Professional Documents

Culture Documents

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

Uploaded by

Kristia AnagapCopyright:

Available Formats

You might also like

- ACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FDocument3 pagesACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FebadbaddevNo ratings yet

- Aws B2.1-1 - 8-228Document18 pagesAws B2.1-1 - 8-228Gio Silva100% (3)

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal89% (9)

- Target Market Project: Itsbobatime Sharetea Simplici-TeaDocument55 pagesTarget Market Project: Itsbobatime Sharetea Simplici-TeaKristia AnagapNo ratings yet

- Chapter 6Document17 pagesChapter 6RB100% (1)

- Intercompany Sales of InventoriesDocument3 pagesIntercompany Sales of InventoriesRoldan Arca Pagapos100% (1)

- Chapter 11Document11 pagesChapter 11Joan LeonorNo ratings yet

- Inventory Valuation C10Document5 pagesInventory Valuation C10music niNo ratings yet

- Problem 1Document3 pagesProblem 1Zyrah Manalo50% (2)

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- Chapter 14 - InventoriesDocument5 pagesChapter 14 - InventoriesFerb CruzadaNo ratings yet

- Classroom Exercises On Inventories: Problem 1Document4 pagesClassroom Exercises On Inventories: Problem 1Amy SpencerNo ratings yet

- MQ 1 Inventories Ak PDFDocument4 pagesMQ 1 Inventories Ak PDFJuliana ChengNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- Inventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inDocument6 pagesInventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inleare ruazaNo ratings yet

- Chapter 4 ExplanationDocument21 pagesChapter 4 ExplanationCatherine OrdoNo ratings yet

- Ia Inventories Practice-ProblemsDocument10 pagesIa Inventories Practice-ProblemsDiana AcostaNo ratings yet

- Activity 1 IaDocument4 pagesActivity 1 IaRikka TakanashiNo ratings yet

- Chapter 10 InventoriesDocument7 pagesChapter 10 InventoriesEllen MaskariñoNo ratings yet

- Chapter One InventoryDocument76 pagesChapter One Inventorykenenisagetachew856No ratings yet

- Chapter - 1-InventoriesDocument36 pagesChapter - 1-Inventoriesrmdn32529732No ratings yet

- FAR-03-Inventories-2nd Sem AY2324Document5 pagesFAR-03-Inventories-2nd Sem AY2324Nanase SenpaiNo ratings yet

- Chapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageDocument7 pagesChapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageYami HeatherNo ratings yet

- Accounting For InventoryDocument35 pagesAccounting For InventorythebestNo ratings yet

- Accounting Test Bank 6Document32 pagesAccounting Test Bank 6likesNo ratings yet

- Auditing Problems Midterm Exam - Inventory Problem 1Document7 pagesAuditing Problems Midterm Exam - Inventory Problem 1Larpii MonameNo ratings yet

- Inventory Cost Flow LCNRVDocument8 pagesInventory Cost Flow LCNRVliesly buticNo ratings yet

- Practice Set Inventories Inventory EstimationDocument4 pagesPractice Set Inventories Inventory EstimationChristine De LeonNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- 7 Cost Formulas and LCNRVDocument6 pages7 Cost Formulas and LCNRVJorufel PapasinNo ratings yet

- Accounting Excercises 2Document13 pagesAccounting Excercises 2Abdallah HassanNo ratings yet

- Financial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HDocument11 pagesFinancial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HJohn Mark FolienteNo ratings yet

- Accounting 2 DR Selim Chapter 4Document23 pagesAccounting 2 DR Selim Chapter 4Souliman MuhammadNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Ifa CH 4Document20 pagesIfa CH 4Nigussie BerhanuNo ratings yet

- QUIZ 3 Inventories and InvestmentsDocument2 pagesQUIZ 3 Inventories and InvestmentsViky Rose EballeNo ratings yet

- P Average Cost MethodDocument11 pagesP Average Cost MethodKirk CarmelotesNo ratings yet

- Final Term Product (Q)Document3 pagesFinal Term Product (Q)Rosendo Bisnar Jr.No ratings yet

- Accounting For InventoriesDocument29 pagesAccounting For InventoriesLakachew GetasewNo ratings yet

- Miljane Perdizo - Inventory QuizDocument3 pagesMiljane Perdizo - Inventory Quizmiljane perdizoNo ratings yet

- Funamentals of Acct - II - Chapter 1 InventoriesDocument47 pagesFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaNo ratings yet

- M4.1-M4.5 Exercise ProblemsDocument5 pagesM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNo ratings yet

- Government Accounting MidtermDocument8 pagesGovernment Accounting MidtermTan RoncalNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Far Quiz Nov. 20, 2020Document7 pagesFar Quiz Nov. 20, 2020Yanna AlquisolaNo ratings yet

- Accounting For Merchandising Operations Chapter SummaryDocument8 pagesAccounting For Merchandising Operations Chapter SummaryMondy MondyNo ratings yet

- Exercise Chap 8Document6 pagesExercise Chap 8hangbg2k3No ratings yet

- CH 1 Funamentals of Acct - II - InventoriesDocument35 pagesCH 1 Funamentals of Acct - II - InventoriesNatnael AsfawNo ratings yet

- FAR1 MaterialsDocument3 pagesFAR1 MaterialsMitshelle Mae PeraltaNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- Inventory ExerciseDocument2 pagesInventory Exercisenewaybeyene5100% (1)

- Drills Acc 106Document2 pagesDrills Acc 106brmo.amatorio.uiNo ratings yet

- Fundamentals of Acc II Chapter 1 - InventoryDocument11 pagesFundamentals of Acc II Chapter 1 - Inventoryceerbe tubeNo ratings yet

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- FA2 Inventories - QDocument8 pagesFA2 Inventories - Qmiss ainaNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- Chapter 4 Inventorie Ifa 4 NewDocument62 pagesChapter 4 Inventorie Ifa 4 NewNigussie BerhanuNo ratings yet

- The Buyer's Inventory BalanceDocument4 pagesThe Buyer's Inventory BalanceAerielle De GuzmanNo ratings yet

- Review For MidtermI 1092Document40 pagesReview For MidtermI 1092C14041159王莫堯No ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Notes Receivable DiscountingDocument33 pagesNotes Receivable DiscountingKristia AnagapNo ratings yet

- IPCC (Intergovernmental Panel On Climate Change) : SpeechDocument2 pagesIPCC (Intergovernmental Panel On Climate Change) : SpeechKristia AnagapNo ratings yet

- Merchandising and InventoryDocument12 pagesMerchandising and InventoryKristia AnagapNo ratings yet

- 1.0 The Rhetorical Situation: 1.1 ExigenceDocument6 pages1.0 The Rhetorical Situation: 1.1 ExigenceKristia AnagapNo ratings yet

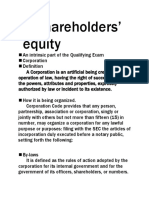

- Shareholders' EquityDocument18 pagesShareholders' EquityKristia AnagapNo ratings yet

- Liquidation by InstallmentDocument6 pagesLiquidation by InstallmentKristia AnagapNo ratings yet

- Inventory Estimation: GP Method: 2 ProceduresDocument4 pagesInventory Estimation: GP Method: 2 ProceduresKristia AnagapNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationKristia AnagapNo ratings yet

- Depreciation' NatureDocument21 pagesDepreciation' NatureKristia AnagapNo ratings yet

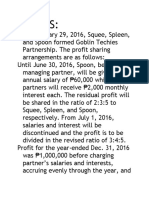

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- Depreciation 1Document17 pagesDepreciation 1Kristia AnagapNo ratings yet

- AConceptual Frameworkfor Environmental Analysisof Social Issuesand Evaluationof Business ResponDocument14 pagesAConceptual Frameworkfor Environmental Analysisof Social Issuesand Evaluationof Business ResponKristia AnagapNo ratings yet

- Common Frameworks For Evaluating The Business EnvironmentDocument10 pagesCommon Frameworks For Evaluating The Business EnvironmentKristia AnagapNo ratings yet

- BONUSDocument16 pagesBONUSKristia AnagapNo ratings yet

- Mgtnotes Week 8-9Document21 pagesMgtnotes Week 8-9Kristia AnagapNo ratings yet

- Accounting Is The - Of: - , - and - EconomicDocument48 pagesAccounting Is The - Of: - , - and - EconomicKristia AnagapNo ratings yet

- What Is Leadership?: Two Related But Distinct IdeasDocument13 pagesWhat Is Leadership?: Two Related But Distinct IdeasKristia AnagapNo ratings yet

- Mgtnotes Week 2-3Document13 pagesMgtnotes Week 2-3Kristia AnagapNo ratings yet

- Mgtnotes Week 6-7Document17 pagesMgtnotes Week 6-7Kristia AnagapNo ratings yet

- Officiating Basketball and Referee Signals: There Are "Fouls" and There Are "Violations"Document8 pagesOfficiating Basketball and Referee Signals: There Are "Fouls" and There Are "Violations"Kristia Anagap100% (1)

- A Business Plan of Teahouse in Helsinki, Finland: Xu ZeluDocument49 pagesA Business Plan of Teahouse in Helsinki, Finland: Xu ZeluKristia AnagapNo ratings yet

- 4 PillarsDocument25 pages4 PillarsMarina CholakovaNo ratings yet

- PomDocument3 pagesPomMa. Alexandra Teddy BuenNo ratings yet

- Financing A Car Loan WorksheetDocument3 pagesFinancing A Car Loan WorksheetDestiney GriffinNo ratings yet

- AC Installation Offer - Jan Till Mar 2024Document7 pagesAC Installation Offer - Jan Till Mar 2024SakthiRaj MuralidharanNo ratings yet

- Relief For Contractor Developers of Road Sector in View of Covid-19Document2 pagesRelief For Contractor Developers of Road Sector in View of Covid-19peterNo ratings yet

- Modern Management: Concepts and Skills: Fifteenth Edition, Global EditionDocument29 pagesModern Management: Concepts and Skills: Fifteenth Edition, Global EditionnotsaudNo ratings yet

- Class Exercises - Accounting Errors - AnswersDocument4 pagesClass Exercises - Accounting Errors - Answerseshakaur100% (2)

- Legal Reasearch CaseDocument5 pagesLegal Reasearch Casewenny capplemanNo ratings yet

- The Amazon Logo, Its Meaning and The History Behind ItDocument11 pagesThe Amazon Logo, Its Meaning and The History Behind ItVăn Nghi NguyễnNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- DESM#11 Agile Organization ManagementDocument44 pagesDESM#11 Agile Organization Managementz god luckNo ratings yet

- Tender Enquiry Document: Medical Gas Pipe Line SystemDocument108 pagesTender Enquiry Document: Medical Gas Pipe Line SystemVikas PatidarNo ratings yet

- Tatung Rice Cooker ManualDocument5 pagesTatung Rice Cooker ManualtheintrepiddodgerNo ratings yet

- Abhishek Ghetiya (Hi - Bond)Document77 pagesAbhishek Ghetiya (Hi - Bond)Sardar Patel0% (1)

- KeTTHA SIRIM 002 - PrePDFDocument4 pagesKeTTHA SIRIM 002 - PrePDFtangNo ratings yet

- BPI vs. IACDocument2 pagesBPI vs. IACkelbingeNo ratings yet

- Full Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter ChapterDocument23 pagesFull Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter Chaptersuavefiltermyr62100% (31)

- Paperboat - PPT FinalDocument11 pagesPaperboat - PPT Finalriddhi.atreNo ratings yet

- Bank Alfalah and Chevron Alliance ProposalDocument7 pagesBank Alfalah and Chevron Alliance ProposalasimNo ratings yet

- HIM SubmittedDocument6 pagesHIM SubmittedmanidipNo ratings yet

- Bancassurance: Problems and Challenges in India: Journal of Management June 2012Document13 pagesBancassurance: Problems and Challenges in India: Journal of Management June 2012Rahat SorathiyaNo ratings yet

- Business Studies Notes Form 1 4Document275 pagesBusiness Studies Notes Form 1 4Tinodaishe NziraNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Exhibit13 SAPReadinessCheckforSAPS4HANAConversionDocument117 pagesExhibit13 SAPReadinessCheckforSAPS4HANAConversionThao TranNo ratings yet

- Business Case About Agile Transformation @me PDFDocument4 pagesBusiness Case About Agile Transformation @me PDFSara Lucia CárdenasNo ratings yet

- MacalalagDocument1 pageMacalalagChristian Nehru ValeraNo ratings yet

- Hazard Analysis Critical Control PointDocument5 pagesHazard Analysis Critical Control PointPardeep SinghNo ratings yet

- Learning Outcome TaxDocument2 pagesLearning Outcome TaxNiño Mendoza MabatoNo ratings yet

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

Uploaded by

Kristia AnagapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The Same

Uploaded by

Kristia AnagapCopyright:

Available Formats

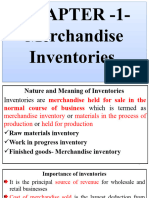

Beginning inventory xx

Purchases xx

Add: Freight-in xx

Less: Purchase return xx

Purchase allowance xx

Purchase discount xx

Net Purchases xx

Goods available for sale xx

Less: Ending Inventory xx

Cost of sales xx

“first purchased, first sold…”

Note well that under FIFO-periodic and

FIFO perpetual, the inventory costs are

the same.

On April 1, 2011, Toronto Company had 6,000 units of

merchandise on hand that cost P120 per unit. During the

month, Toronto had the following entries with regard to

the merchandise:

April 5 Purchased on account 15,000 units at P140

per unit

April 8 Returned 1,000 units from the April 5

purchase

April 29 Sold on account 16,000 units at P200

per unit

Toronto Company uses a perpetual inventory system and

a FIFO cost flow. What is the cost of goods sold for

April?

A. 2,120,000

B. 2,200,000

C. 2,144,000

D. 2,080,000

Note:

o The average unit cost is multiplied to ending inventory

units to get the cost of ending inventory

o In order to get the cost of goods sold, cost of ending

inventory is deducted from cost of goods available for sale

The following information was taken from the inventory records of

Fairie Company for January of the current year:

Units Unit Cost Total Cost

Balance, Jan 1 50,000 8.024

401,200

Purchases:

Jan 10 20,000 8.500

170,000

Jan 25 48,000 8.750

420,000

Sales:

Jan 12 30,000

Jan 30 53,000

Fairie Company does not maintain perpetual inventory records.

What is the inventory on January 31 under the weighted average

method?

A. 294,000 C. 297,850

B. 294,700 D. 301,880

Note:

o Popularly known as “Moving Average” method

o The moving average unit cost changes every time

there is a new purchase or a purchase return

o The moving average unit cost is not affected by a sale

or a sale return

Anders Company uses the moving average method to

determine the cost of its inventory. During January of

the current year, Anders recorded the following

information pertaining to its inventory:

Units Unit cost Total Cost

Balance, Jan 1 40,000 50 2,000,000

Sold on Jan 17 35,000

Purchased on Jan 28 20,000 80

1,600,000

What amount of inventory should Anders report on

January 31?

2,000,000

1,850,000

1,625,000

1,500,000

o The standard provides that this method is appropriate

for inventories that are segregated for a specific project

and inventories that are not ordinarily interchangeable.

o May be used in either periodic or perpetual inventory

system.

o Involves keeping track of the purchase price of each

unit available for sale and pricing the ending inventory at

the actual prices of the specific units not sold

You might also like

- ACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FDocument3 pagesACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FebadbaddevNo ratings yet

- Aws B2.1-1 - 8-228Document18 pagesAws B2.1-1 - 8-228Gio Silva100% (3)

- ACT112.QS2 With AnswersDocument6 pagesACT112.QS2 With AnswersGinie Lyn Rosal89% (9)

- Target Market Project: Itsbobatime Sharetea Simplici-TeaDocument55 pagesTarget Market Project: Itsbobatime Sharetea Simplici-TeaKristia AnagapNo ratings yet

- Chapter 6Document17 pagesChapter 6RB100% (1)

- Intercompany Sales of InventoriesDocument3 pagesIntercompany Sales of InventoriesRoldan Arca Pagapos100% (1)

- Chapter 11Document11 pagesChapter 11Joan LeonorNo ratings yet

- Inventory Valuation C10Document5 pagesInventory Valuation C10music niNo ratings yet

- Problem 1Document3 pagesProblem 1Zyrah Manalo50% (2)

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- Chapter 14 - InventoriesDocument5 pagesChapter 14 - InventoriesFerb CruzadaNo ratings yet

- Classroom Exercises On Inventories: Problem 1Document4 pagesClassroom Exercises On Inventories: Problem 1Amy SpencerNo ratings yet

- MQ 1 Inventories Ak PDFDocument4 pagesMQ 1 Inventories Ak PDFJuliana ChengNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- Inventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inDocument6 pagesInventories of Manufacturing Concern. A Trading Concern Is One That Buys and Sells Goods inleare ruazaNo ratings yet

- Chapter 4 ExplanationDocument21 pagesChapter 4 ExplanationCatherine OrdoNo ratings yet

- Ia Inventories Practice-ProblemsDocument10 pagesIa Inventories Practice-ProblemsDiana AcostaNo ratings yet

- Activity 1 IaDocument4 pagesActivity 1 IaRikka TakanashiNo ratings yet

- Chapter 10 InventoriesDocument7 pagesChapter 10 InventoriesEllen MaskariñoNo ratings yet

- Chapter One InventoryDocument76 pagesChapter One Inventorykenenisagetachew856No ratings yet

- Chapter - 1-InventoriesDocument36 pagesChapter - 1-Inventoriesrmdn32529732No ratings yet

- FAR-03-Inventories-2nd Sem AY2324Document5 pagesFAR-03-Inventories-2nd Sem AY2324Nanase SenpaiNo ratings yet

- Chapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageDocument7 pagesChapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageYami HeatherNo ratings yet

- Accounting For InventoryDocument35 pagesAccounting For InventorythebestNo ratings yet

- Accounting Test Bank 6Document32 pagesAccounting Test Bank 6likesNo ratings yet

- Auditing Problems Midterm Exam - Inventory Problem 1Document7 pagesAuditing Problems Midterm Exam - Inventory Problem 1Larpii MonameNo ratings yet

- Inventory Cost Flow LCNRVDocument8 pagesInventory Cost Flow LCNRVliesly buticNo ratings yet

- Practice Set Inventories Inventory EstimationDocument4 pagesPractice Set Inventories Inventory EstimationChristine De LeonNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- 7 Cost Formulas and LCNRVDocument6 pages7 Cost Formulas and LCNRVJorufel PapasinNo ratings yet

- Accounting Excercises 2Document13 pagesAccounting Excercises 2Abdallah HassanNo ratings yet

- Financial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HDocument11 pagesFinancial Accounting 1 - Inventory Valuation and Biological assets-REAH M. HJohn Mark FolienteNo ratings yet

- Accounting 2 DR Selim Chapter 4Document23 pagesAccounting 2 DR Selim Chapter 4Souliman MuhammadNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Ifa CH 4Document20 pagesIfa CH 4Nigussie BerhanuNo ratings yet

- QUIZ 3 Inventories and InvestmentsDocument2 pagesQUIZ 3 Inventories and InvestmentsViky Rose EballeNo ratings yet

- P Average Cost MethodDocument11 pagesP Average Cost MethodKirk CarmelotesNo ratings yet

- Final Term Product (Q)Document3 pagesFinal Term Product (Q)Rosendo Bisnar Jr.No ratings yet

- Accounting For InventoriesDocument29 pagesAccounting For InventoriesLakachew GetasewNo ratings yet

- Miljane Perdizo - Inventory QuizDocument3 pagesMiljane Perdizo - Inventory Quizmiljane perdizoNo ratings yet

- Funamentals of Acct - II - Chapter 1 InventoriesDocument47 pagesFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaNo ratings yet

- M4.1-M4.5 Exercise ProblemsDocument5 pagesM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNo ratings yet

- Government Accounting MidtermDocument8 pagesGovernment Accounting MidtermTan RoncalNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Far Quiz Nov. 20, 2020Document7 pagesFar Quiz Nov. 20, 2020Yanna AlquisolaNo ratings yet

- Accounting For Merchandising Operations Chapter SummaryDocument8 pagesAccounting For Merchandising Operations Chapter SummaryMondy MondyNo ratings yet

- Exercise Chap 8Document6 pagesExercise Chap 8hangbg2k3No ratings yet

- CH 1 Funamentals of Acct - II - InventoriesDocument35 pagesCH 1 Funamentals of Acct - II - InventoriesNatnael AsfawNo ratings yet

- FAR1 MaterialsDocument3 pagesFAR1 MaterialsMitshelle Mae PeraltaNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- Inventory ExerciseDocument2 pagesInventory Exercisenewaybeyene5100% (1)

- Drills Acc 106Document2 pagesDrills Acc 106brmo.amatorio.uiNo ratings yet

- Fundamentals of Acc II Chapter 1 - InventoryDocument11 pagesFundamentals of Acc II Chapter 1 - Inventoryceerbe tubeNo ratings yet

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- FA2 Inventories - QDocument8 pagesFA2 Inventories - Qmiss ainaNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- Chapter 4 Inventorie Ifa 4 NewDocument62 pagesChapter 4 Inventorie Ifa 4 NewNigussie BerhanuNo ratings yet

- The Buyer's Inventory BalanceDocument4 pagesThe Buyer's Inventory BalanceAerielle De GuzmanNo ratings yet

- Review For MidtermI 1092Document40 pagesReview For MidtermI 1092C14041159王莫堯No ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Notes Receivable DiscountingDocument33 pagesNotes Receivable DiscountingKristia AnagapNo ratings yet

- IPCC (Intergovernmental Panel On Climate Change) : SpeechDocument2 pagesIPCC (Intergovernmental Panel On Climate Change) : SpeechKristia AnagapNo ratings yet

- Merchandising and InventoryDocument12 pagesMerchandising and InventoryKristia AnagapNo ratings yet

- 1.0 The Rhetorical Situation: 1.1 ExigenceDocument6 pages1.0 The Rhetorical Situation: 1.1 ExigenceKristia AnagapNo ratings yet

- Shareholders' EquityDocument18 pagesShareholders' EquityKristia AnagapNo ratings yet

- Liquidation by InstallmentDocument6 pagesLiquidation by InstallmentKristia AnagapNo ratings yet

- Inventory Estimation: GP Method: 2 ProceduresDocument4 pagesInventory Estimation: GP Method: 2 ProceduresKristia AnagapNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationKristia AnagapNo ratings yet

- Depreciation' NatureDocument21 pagesDepreciation' NatureKristia AnagapNo ratings yet

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- Depreciation 1Document17 pagesDepreciation 1Kristia AnagapNo ratings yet

- AConceptual Frameworkfor Environmental Analysisof Social Issuesand Evaluationof Business ResponDocument14 pagesAConceptual Frameworkfor Environmental Analysisof Social Issuesand Evaluationof Business ResponKristia AnagapNo ratings yet

- Common Frameworks For Evaluating The Business EnvironmentDocument10 pagesCommon Frameworks For Evaluating The Business EnvironmentKristia AnagapNo ratings yet

- BONUSDocument16 pagesBONUSKristia AnagapNo ratings yet

- Mgtnotes Week 8-9Document21 pagesMgtnotes Week 8-9Kristia AnagapNo ratings yet

- Accounting Is The - Of: - , - and - EconomicDocument48 pagesAccounting Is The - Of: - , - and - EconomicKristia AnagapNo ratings yet

- What Is Leadership?: Two Related But Distinct IdeasDocument13 pagesWhat Is Leadership?: Two Related But Distinct IdeasKristia AnagapNo ratings yet

- Mgtnotes Week 2-3Document13 pagesMgtnotes Week 2-3Kristia AnagapNo ratings yet

- Mgtnotes Week 6-7Document17 pagesMgtnotes Week 6-7Kristia AnagapNo ratings yet

- Officiating Basketball and Referee Signals: There Are "Fouls" and There Are "Violations"Document8 pagesOfficiating Basketball and Referee Signals: There Are "Fouls" and There Are "Violations"Kristia Anagap100% (1)

- A Business Plan of Teahouse in Helsinki, Finland: Xu ZeluDocument49 pagesA Business Plan of Teahouse in Helsinki, Finland: Xu ZeluKristia AnagapNo ratings yet

- 4 PillarsDocument25 pages4 PillarsMarina CholakovaNo ratings yet

- PomDocument3 pagesPomMa. Alexandra Teddy BuenNo ratings yet

- Financing A Car Loan WorksheetDocument3 pagesFinancing A Car Loan WorksheetDestiney GriffinNo ratings yet

- AC Installation Offer - Jan Till Mar 2024Document7 pagesAC Installation Offer - Jan Till Mar 2024SakthiRaj MuralidharanNo ratings yet

- Relief For Contractor Developers of Road Sector in View of Covid-19Document2 pagesRelief For Contractor Developers of Road Sector in View of Covid-19peterNo ratings yet

- Modern Management: Concepts and Skills: Fifteenth Edition, Global EditionDocument29 pagesModern Management: Concepts and Skills: Fifteenth Edition, Global EditionnotsaudNo ratings yet

- Class Exercises - Accounting Errors - AnswersDocument4 pagesClass Exercises - Accounting Errors - Answerseshakaur100% (2)

- Legal Reasearch CaseDocument5 pagesLegal Reasearch Casewenny capplemanNo ratings yet

- The Amazon Logo, Its Meaning and The History Behind ItDocument11 pagesThe Amazon Logo, Its Meaning and The History Behind ItVăn Nghi NguyễnNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- DESM#11 Agile Organization ManagementDocument44 pagesDESM#11 Agile Organization Managementz god luckNo ratings yet

- Tender Enquiry Document: Medical Gas Pipe Line SystemDocument108 pagesTender Enquiry Document: Medical Gas Pipe Line SystemVikas PatidarNo ratings yet

- Tatung Rice Cooker ManualDocument5 pagesTatung Rice Cooker ManualtheintrepiddodgerNo ratings yet

- Abhishek Ghetiya (Hi - Bond)Document77 pagesAbhishek Ghetiya (Hi - Bond)Sardar Patel0% (1)

- KeTTHA SIRIM 002 - PrePDFDocument4 pagesKeTTHA SIRIM 002 - PrePDFtangNo ratings yet

- BPI vs. IACDocument2 pagesBPI vs. IACkelbingeNo ratings yet

- Full Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter ChapterDocument23 pagesFull Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter Chaptersuavefiltermyr62100% (31)

- Paperboat - PPT FinalDocument11 pagesPaperboat - PPT Finalriddhi.atreNo ratings yet

- Bank Alfalah and Chevron Alliance ProposalDocument7 pagesBank Alfalah and Chevron Alliance ProposalasimNo ratings yet

- HIM SubmittedDocument6 pagesHIM SubmittedmanidipNo ratings yet

- Bancassurance: Problems and Challenges in India: Journal of Management June 2012Document13 pagesBancassurance: Problems and Challenges in India: Journal of Management June 2012Rahat SorathiyaNo ratings yet

- Business Studies Notes Form 1 4Document275 pagesBusiness Studies Notes Form 1 4Tinodaishe NziraNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Exhibit13 SAPReadinessCheckforSAPS4HANAConversionDocument117 pagesExhibit13 SAPReadinessCheckforSAPS4HANAConversionThao TranNo ratings yet

- Business Case About Agile Transformation @me PDFDocument4 pagesBusiness Case About Agile Transformation @me PDFSara Lucia CárdenasNo ratings yet

- MacalalagDocument1 pageMacalalagChristian Nehru ValeraNo ratings yet

- Hazard Analysis Critical Control PointDocument5 pagesHazard Analysis Critical Control PointPardeep SinghNo ratings yet

- Learning Outcome TaxDocument2 pagesLearning Outcome TaxNiño Mendoza MabatoNo ratings yet