Professional Documents

Culture Documents

Straight Problem Merchandising.

Straight Problem Merchandising.

Uploaded by

Kristine SandovalCopyright:

Available Formats

You might also like

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- Chapter 5Document53 pagesChapter 5Kylie BatitisNo ratings yet

- Buenaventura Problem 1 10Document16 pagesBuenaventura Problem 1 10Anonn100% (3)

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- Alternate Demonstration Problem MerchandisingDocument5 pagesAlternate Demonstration Problem MerchandisingmoNo ratings yet

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- NIAT Review 3Document7 pagesNIAT Review 3April Joy InductaNo ratings yet

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- Merchandising Handout - Perpetual Vs PeriodicDocument1 pageMerchandising Handout - Perpetual Vs PeriodicTineNo ratings yet

- Merchandising 105 Answer Key PeriodicDocument38 pagesMerchandising 105 Answer Key PeriodicPrincess Heart MacadatNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- MerchandisingDocument13 pagesMerchandisingairanicolebrugada08No ratings yet

- Accounts ReceivableDocument3 pagesAccounts ReceivableMikhaela TorresNo ratings yet

- CH 6 - SolutionDocument78 pagesCH 6 - SolutionMuhammad RehmanNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- Practice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Document5 pagesPractice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Kieht catcherNo ratings yet

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- Merchandising QuizzerDocument1 pageMerchandising QuizzerjadeNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Chapter 5 - Perpetual Vs Periodic SystemDocument4 pagesChapter 5 - Perpetual Vs Periodic SystemkanyaNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Lecture On Merchandising OperationDocument44 pagesLecture On Merchandising OperationJean Paula SequiñoNo ratings yet

- Intacc NotesDocument11 pagesIntacc NotesKeith SalesNo ratings yet

- Assignment Merchandising AnswerDocument5 pagesAssignment Merchandising AnswerReighjon Ashley C. TolentinoNo ratings yet

- CHAPTER 10 Intermediate AccountingDocument133 pagesCHAPTER 10 Intermediate AccountingWynpha PodiotanNo ratings yet

- CH 10 Merchandising BusinessDocument65 pagesCH 10 Merchandising BusinessKYLA RENZ DE LEONNo ratings yet

- Illustrative Example Journal Entries For New AccountsDocument4 pagesIllustrative Example Journal Entries For New AccountsJoshua SolayaoNo ratings yet

- Merchadising LectureDocument12 pagesMerchadising Lecturejeonlei02No ratings yet

- Accounts ReceivableDocument54 pagesAccounts ReceivableFrancine Thea M. LantayaNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Module 5Document45 pagesModule 5Rafael100% (1)

- Practice 1 ReceivablesDocument7 pagesPractice 1 ReceivablesCeline Therese BuNo ratings yet

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Accounting For Merchandising BusinessDocument21 pagesAccounting For Merchandising BusinessJunel PlanosNo ratings yet

- Practice To Chapter 6 Part 1-4Document22 pagesPractice To Chapter 6 Part 1-4Gulzhan AmanbaikyzyNo ratings yet

- Merchandising AccountingDocument6 pagesMerchandising AccountingchrstncstlljNo ratings yet

- Accounting For MerchandisingDocument45 pagesAccounting For Merchandisingcristin l. viloriaNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument3 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Chapter 7 AlcaparasDocument7 pagesChapter 7 AlcaparasChristian AlcaparasNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- CH 5 - Returns, Discounts and Sales Tax - UpdatedDocument31 pagesCH 5 - Returns, Discounts and Sales Tax - Updatedgolooz43No ratings yet

- 4 Accounts ReceivableDocument10 pages4 Accounts ReceivableAYEZZA SAMSONNo ratings yet

- 1&2p Accounting For Merchandising BusinessDocument36 pages1&2p Accounting For Merchandising Businessمحمد محمد جارالله جاراللهNo ratings yet

- SDocument18 pagesSdebate dd0% (1)

- Answers Part 2Document23 pagesAnswers Part 2YUE LIE PALANCANo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- CHAPTER 7 (Merchandising Operations)Document7 pagesCHAPTER 7 (Merchandising Operations)Karyl FailmaNo ratings yet

- Exercise Set-Intro For Merchandising BusinessDocument10 pagesExercise Set-Intro For Merchandising BusinessCha Eun WooNo ratings yet

- Inventories (Financial Accounting)Document2 pagesInventories (Financial Accounting)Herlyn QuintoNo ratings yet

- CH 5Document35 pagesCH 5Mohamed DiabNo ratings yet

- (IFA 8) - Rendy Filiang - 1402210324Document15 pages(IFA 8) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Dividend Investing with a Splash of Options Trading: Financial Freedom, #224From EverandDividend Investing with a Splash of Options Trading: Financial Freedom, #224No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Geographical Division Organizational StructureDocument2 pagesGeographical Division Organizational StructureMaria Sienna LegaspiNo ratings yet

- Emirates Airline Case Study: Khalil Ullah TO: ADNAN KHER CMS: 121-17-0017Document17 pagesEmirates Airline Case Study: Khalil Ullah TO: ADNAN KHER CMS: 121-17-0017AliNo ratings yet

- Business Model Canvas: Existing Alternative SolutionDocument2 pagesBusiness Model Canvas: Existing Alternative SolutionPRINCESS DIANNE DUG-ANo ratings yet

- Assignment 1Document2 pagesAssignment 1Umar GondalNo ratings yet

- Admas University School of Postgraduate Studies MBA Financial Management AssignmentDocument17 pagesAdmas University School of Postgraduate Studies MBA Financial Management AssignmentAbnet BeleteNo ratings yet

- Annual Report 2019-20 PDFDocument272 pagesAnnual Report 2019-20 PDFpushpraj rastogiNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Introduction To Human Resource Employee Staffing and DevelopmentDocument4 pagesIntroduction To Human Resource Employee Staffing and DevelopmentJezza Mae BravoNo ratings yet

- Clear Path To Sustainable Growth: Investor Presentation FY18 ResultsDocument14 pagesClear Path To Sustainable Growth: Investor Presentation FY18 ResultsDiego O CuevasNo ratings yet

- Tata Steel 2015 16 PDFDocument300 pagesTata Steel 2015 16 PDFAman PrasasdNo ratings yet

- Chapter 7: Segmentation, Targeting, and Pos... : How To Use The VocabularyDocument4 pagesChapter 7: Segmentation, Targeting, and Pos... : How To Use The VocabularySavannah Simone PetrachenkoNo ratings yet

- CH 02Document20 pagesCH 02nahlaNo ratings yet

- America+Canada Les HorswillDocument15 pagesAmerica+Canada Les Horswillbrent4327No ratings yet

- Creating A Strong Future For South Koreas Chemicals Companies v3Document9 pagesCreating A Strong Future For South Koreas Chemicals Companies v3Luca EgidiNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- HO Inventory-EstimationDocument1 pageHO Inventory-EstimationAl Francis GuillermoNo ratings yet

- Indonesia Road Freight Transport Market 1676607775209Document90 pagesIndonesia Road Freight Transport Market 1676607775209cindyNo ratings yet

- A Critical Review of NPA in Indian Banking IndustryDocument12 pagesA Critical Review of NPA in Indian Banking IndustryNavneet NandaNo ratings yet

- Gujarat PDFDocument13 pagesGujarat PDFmsulgadle100% (1)

- Forex Salary Journal by CMA Kulwant RanaDocument3 pagesForex Salary Journal by CMA Kulwant RanaGovind SinghNo ratings yet

- Management of Strategy Concepts International Edition 10Th Edition Ireland Solutions Manual Full Chapter PDFDocument54 pagesManagement of Strategy Concepts International Edition 10Th Edition Ireland Solutions Manual Full Chapter PDFveneratedemesnew1klx100% (10)

- Agriculture: Background: Industry CompositionDocument3 pagesAgriculture: Background: Industry CompositionRosebelle GocoNo ratings yet

- Marxism and "The Doll's House"Document2 pagesMarxism and "The Doll's House"FaizanAzizNo ratings yet

- Ms WijerathnaDocument4 pagesMs WijerathnaSunshine SmilyNo ratings yet

- Slide Chapter 1Document42 pagesSlide Chapter 1daoviethung29No ratings yet

- Quality Service Management in Hospitality and Tourism: Taguig City UniversityDocument10 pagesQuality Service Management in Hospitality and Tourism: Taguig City UniversityRenz John Louie PullarcaNo ratings yet

- Summer Internship: "Comparison Between Religare and Stock Trading Service"Document9 pagesSummer Internship: "Comparison Between Religare and Stock Trading Service"Mohammed SaadNo ratings yet

- Oracle Accounts Receivables 1Document431 pagesOracle Accounts Receivables 1gangadhar1310100% (1)

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Economy of JapanDocument44 pagesEconomy of JapanasmiNo ratings yet

Straight Problem Merchandising.

Straight Problem Merchandising.

Uploaded by

Kristine SandovalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Straight Problem Merchandising.

Straight Problem Merchandising.

Uploaded by

Kristine SandovalCopyright:

Available Formats

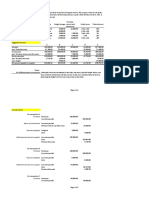

MEKE-MI CO.

NUKO TRADING

Buyer’s Point of View Seller’s Point of View

a. Purchased merchandise for ₱ 55,000 a. Sold merchandise for cash ₱ 55,000

Purchases 55,000 Cash 55,000

Cash 55,000 Sales 55,000

b. Purchased merchandise ₱ 150,000 b. Sold merchandise on account ₱ 150,000

on account. Terms: 2/n, n/60 on account. Terms: 2/n, n/60

Purchases 150,000 Accounts Receivable 150,000

Accounts Payable 150,000 Sales 150,000

c. Returned ₱5,000 defective merchandise c. Received ₱5,000 defective merchandise sold

bought on account, on account.

Accounts Payable 5,000 Sales Return and Allowances 5,000

Purchase Return and Allowances Accounts receivable 5,000

5,000

d. Received ₱ 300 cash refund for returned d. Paid ₱ 300 cash refund for returned

merchandise. merchandise.

Cash 300 Sales Return and Allowances 300

Purchase Return and Allowances Cash 300

300

e. Paid transportation charges ₱ 1,000 e. Paid transportation charges ₱ 1,000

(Assumption: Freight charges to be shouldered (Assumption: Freight charges to be shouldered

by the buyer) by the seller)

Freight In 1000 Freight out or Delivery Expense 1,000

Cash or Accounts Payable Cash or Accounts Payable 1,000

1000

f. Payment of Accounts Payable within the f. Collection within the discount period arising

discount period arising from the purchase of from the sale of merchandise

merchandise Cash 142,100

Accounts Payable 145,000 Sales 2,900

Purchase Discount 2,900 Accounts Receivable 145,000

Cash 142,100

Computation: Computation:

Purchase Price ₱ 150,000 Purchase Price ₱ 150,000

Less: Purchase Less: Purchase

Return and Allowances 5,000 Return and Allowances 5,000

Net Purchases ₱ 145,000 Net Purchases ₱ 145,000

Less: Purchase Less: Purchase

Discount(145,000 x 2%) 2,900 Discount(145,000 x 2%) 2,900

Cash Paid ₱ 142,100 Cash Paid ₱ 142,100

g. Purchase merchandise ₱ 14,000 on account g. Sold merchandise ₱ 14,000 on account Terms:

Terms: 3/n, n/60 3/n, n/60

Purchases 14,000 Accounts Receivable 14,000

Accounts Payable 14,000 Sales 14,000

h. Pay ment after the discount period h. Collection after the discount period

Accounts Payable 14,000 Cash 14,000

Cash 14,000 Accounts Receivable 14,000

NOTE : If you want a straight problem solving consider the following . Changing the value from 155,00 0

to 150,000

How to compute for purchases / purchase price

Look at your letter b and c transaction :

Purchases is 150,000

Purchase returns 5,000

Total Purchases = 145,000

This 145,000 is subject for a 2 % discount (2/n,n/60) . Assuming that the payment will be made within

the discount period.

The purchase discount will be 145,000 x 2 % = 2900.

Question: Where did you get the 2 %, look at the transaction letter b (2/n, n/60) .

Hehe clear?

Follow the color nalang po. Matetrace niyo na kung san nanggaling yung amounts.

NOTE : PURCHASE ON ACCOUNT VS, RETURN OF MERCHANDISE ON ACCOUNT

PURCHASE MERCHANDISE FOR CASH VS. RETURN OF MERCHANDISE BOUGHT FOR CASH,

Huwag pong pagsasama samahin

You might also like

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- Chapter 5Document53 pagesChapter 5Kylie BatitisNo ratings yet

- Buenaventura Problem 1 10Document16 pagesBuenaventura Problem 1 10Anonn100% (3)

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- Alternate Demonstration Problem MerchandisingDocument5 pagesAlternate Demonstration Problem MerchandisingmoNo ratings yet

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- NIAT Review 3Document7 pagesNIAT Review 3April Joy InductaNo ratings yet

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- Merchandising Handout - Perpetual Vs PeriodicDocument1 pageMerchandising Handout - Perpetual Vs PeriodicTineNo ratings yet

- Merchandising 105 Answer Key PeriodicDocument38 pagesMerchandising 105 Answer Key PeriodicPrincess Heart MacadatNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- MerchandisingDocument13 pagesMerchandisingairanicolebrugada08No ratings yet

- Accounts ReceivableDocument3 pagesAccounts ReceivableMikhaela TorresNo ratings yet

- CH 6 - SolutionDocument78 pagesCH 6 - SolutionMuhammad RehmanNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- Practice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Document5 pagesPractice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Kieht catcherNo ratings yet

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- Merchandising QuizzerDocument1 pageMerchandising QuizzerjadeNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Chapter 5 - Perpetual Vs Periodic SystemDocument4 pagesChapter 5 - Perpetual Vs Periodic SystemkanyaNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument8 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Lecture On Merchandising OperationDocument44 pagesLecture On Merchandising OperationJean Paula SequiñoNo ratings yet

- Intacc NotesDocument11 pagesIntacc NotesKeith SalesNo ratings yet

- Assignment Merchandising AnswerDocument5 pagesAssignment Merchandising AnswerReighjon Ashley C. TolentinoNo ratings yet

- CHAPTER 10 Intermediate AccountingDocument133 pagesCHAPTER 10 Intermediate AccountingWynpha PodiotanNo ratings yet

- CH 10 Merchandising BusinessDocument65 pagesCH 10 Merchandising BusinessKYLA RENZ DE LEONNo ratings yet

- Illustrative Example Journal Entries For New AccountsDocument4 pagesIllustrative Example Journal Entries For New AccountsJoshua SolayaoNo ratings yet

- Merchadising LectureDocument12 pagesMerchadising Lecturejeonlei02No ratings yet

- Accounts ReceivableDocument54 pagesAccounts ReceivableFrancine Thea M. LantayaNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Module 5Document45 pagesModule 5Rafael100% (1)

- Practice 1 ReceivablesDocument7 pagesPractice 1 ReceivablesCeline Therese BuNo ratings yet

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Accounting For Merchandising BusinessDocument21 pagesAccounting For Merchandising BusinessJunel PlanosNo ratings yet

- Practice To Chapter 6 Part 1-4Document22 pagesPractice To Chapter 6 Part 1-4Gulzhan AmanbaikyzyNo ratings yet

- Merchandising AccountingDocument6 pagesMerchandising AccountingchrstncstlljNo ratings yet

- Accounting For MerchandisingDocument45 pagesAccounting For Merchandisingcristin l. viloriaNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocument3 pagesExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNo ratings yet

- Chapter 7 AlcaparasDocument7 pagesChapter 7 AlcaparasChristian AlcaparasNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- CH 5 - Returns, Discounts and Sales Tax - UpdatedDocument31 pagesCH 5 - Returns, Discounts and Sales Tax - Updatedgolooz43No ratings yet

- 4 Accounts ReceivableDocument10 pages4 Accounts ReceivableAYEZZA SAMSONNo ratings yet

- 1&2p Accounting For Merchandising BusinessDocument36 pages1&2p Accounting For Merchandising Businessمحمد محمد جارالله جاراللهNo ratings yet

- SDocument18 pagesSdebate dd0% (1)

- Answers Part 2Document23 pagesAnswers Part 2YUE LIE PALANCANo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- CHAPTER 7 (Merchandising Operations)Document7 pagesCHAPTER 7 (Merchandising Operations)Karyl FailmaNo ratings yet

- Exercise Set-Intro For Merchandising BusinessDocument10 pagesExercise Set-Intro For Merchandising BusinessCha Eun WooNo ratings yet

- Inventories (Financial Accounting)Document2 pagesInventories (Financial Accounting)Herlyn QuintoNo ratings yet

- CH 5Document35 pagesCH 5Mohamed DiabNo ratings yet

- (IFA 8) - Rendy Filiang - 1402210324Document15 pages(IFA 8) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Dividend Investing with a Splash of Options Trading: Financial Freedom, #224From EverandDividend Investing with a Splash of Options Trading: Financial Freedom, #224No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Geographical Division Organizational StructureDocument2 pagesGeographical Division Organizational StructureMaria Sienna LegaspiNo ratings yet

- Emirates Airline Case Study: Khalil Ullah TO: ADNAN KHER CMS: 121-17-0017Document17 pagesEmirates Airline Case Study: Khalil Ullah TO: ADNAN KHER CMS: 121-17-0017AliNo ratings yet

- Business Model Canvas: Existing Alternative SolutionDocument2 pagesBusiness Model Canvas: Existing Alternative SolutionPRINCESS DIANNE DUG-ANo ratings yet

- Assignment 1Document2 pagesAssignment 1Umar GondalNo ratings yet

- Admas University School of Postgraduate Studies MBA Financial Management AssignmentDocument17 pagesAdmas University School of Postgraduate Studies MBA Financial Management AssignmentAbnet BeleteNo ratings yet

- Annual Report 2019-20 PDFDocument272 pagesAnnual Report 2019-20 PDFpushpraj rastogiNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Introduction To Human Resource Employee Staffing and DevelopmentDocument4 pagesIntroduction To Human Resource Employee Staffing and DevelopmentJezza Mae BravoNo ratings yet

- Clear Path To Sustainable Growth: Investor Presentation FY18 ResultsDocument14 pagesClear Path To Sustainable Growth: Investor Presentation FY18 ResultsDiego O CuevasNo ratings yet

- Tata Steel 2015 16 PDFDocument300 pagesTata Steel 2015 16 PDFAman PrasasdNo ratings yet

- Chapter 7: Segmentation, Targeting, and Pos... : How To Use The VocabularyDocument4 pagesChapter 7: Segmentation, Targeting, and Pos... : How To Use The VocabularySavannah Simone PetrachenkoNo ratings yet

- CH 02Document20 pagesCH 02nahlaNo ratings yet

- America+Canada Les HorswillDocument15 pagesAmerica+Canada Les Horswillbrent4327No ratings yet

- Creating A Strong Future For South Koreas Chemicals Companies v3Document9 pagesCreating A Strong Future For South Koreas Chemicals Companies v3Luca EgidiNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- HO Inventory-EstimationDocument1 pageHO Inventory-EstimationAl Francis GuillermoNo ratings yet

- Indonesia Road Freight Transport Market 1676607775209Document90 pagesIndonesia Road Freight Transport Market 1676607775209cindyNo ratings yet

- A Critical Review of NPA in Indian Banking IndustryDocument12 pagesA Critical Review of NPA in Indian Banking IndustryNavneet NandaNo ratings yet

- Gujarat PDFDocument13 pagesGujarat PDFmsulgadle100% (1)

- Forex Salary Journal by CMA Kulwant RanaDocument3 pagesForex Salary Journal by CMA Kulwant RanaGovind SinghNo ratings yet

- Management of Strategy Concepts International Edition 10Th Edition Ireland Solutions Manual Full Chapter PDFDocument54 pagesManagement of Strategy Concepts International Edition 10Th Edition Ireland Solutions Manual Full Chapter PDFveneratedemesnew1klx100% (10)

- Agriculture: Background: Industry CompositionDocument3 pagesAgriculture: Background: Industry CompositionRosebelle GocoNo ratings yet

- Marxism and "The Doll's House"Document2 pagesMarxism and "The Doll's House"FaizanAzizNo ratings yet

- Ms WijerathnaDocument4 pagesMs WijerathnaSunshine SmilyNo ratings yet

- Slide Chapter 1Document42 pagesSlide Chapter 1daoviethung29No ratings yet

- Quality Service Management in Hospitality and Tourism: Taguig City UniversityDocument10 pagesQuality Service Management in Hospitality and Tourism: Taguig City UniversityRenz John Louie PullarcaNo ratings yet

- Summer Internship: "Comparison Between Religare and Stock Trading Service"Document9 pagesSummer Internship: "Comparison Between Religare and Stock Trading Service"Mohammed SaadNo ratings yet

- Oracle Accounts Receivables 1Document431 pagesOracle Accounts Receivables 1gangadhar1310100% (1)

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Economy of JapanDocument44 pagesEconomy of JapanasmiNo ratings yet