Professional Documents

Culture Documents

As-2 Inventory Valuation: 1) Introduction

As-2 Inventory Valuation: 1) Introduction

Uploaded by

Dipen AdhikariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As-2 Inventory Valuation: 1) Introduction

As-2 Inventory Valuation: 1) Introduction

Uploaded by

Dipen AdhikariCopyright:

Available Formats

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

AS-2 INVENTORY VALUATION

Date of Issue - 1/4/1999

Applicable For All Corporate and Non Corporate Entities

Corresponding IND AS/IFRS IND AS 2 IFRS 2

1) iNTRODUCTiON

AS 2 (Revised) ‘Valuation of Inventories’, prescribe the accounting treatment which provides the

guidance for determining the value of Inventories to be shown in financial statements. It also

provides guidance on the cost formulas that are used to assign costs to inventories and any write-

down thereof to net realisable value.

2) meaNiNg

AS 2 (Revised) defines inventories as assets held

• For sale in the ordinary course of business, or

• In the process of production for such sale, or

•For consumption in the production of goods or services for sale, including maintenance

supplies and consumables other than machinery spares, servicing equipment and standby

equipment meeting the definition of Property, plant and equipment.

3. exClUDeD fROm The sCOpe Of as 2 (ReviseD):

(a) Work in progress arising under construction contracts, i.e. cost of part construction, including

directly related service contracts, being covered under AS 7, Accounting for Construction

Contracts; Inventory held for use in construction, e.g. cement lying at the site should however be

covered by AS 2 (Revised).

(b) Work in progress arising in the ordinary course of business of service providers i.e. cost of

providing a part of service. For example, for a shipping company, fuel and stores not consumed

at the end of accounting period is inventory but not costs for voyage-in-progress. Work-in-

progress may arise for different other services e.g. software development, consultancy, medical

services, merchant banking and so on.

(c) Shares, debentures and other financial instruments held as stock-in-trade.

(d) Producers’ inventories of livestock, agricultural and forest products, and mineral oils, ores

and gases.

JTC CA JITIN TYAGI (B COM CA CS) Page 42

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

4. TReaTmeNT Of spaRe paRTs, sTaND by eqUipmeNT aND

seRviCiNg eqUipmeNT

Case 1 If they meet the definition of PPE as per AS 10

Recognised as PPE as per AS 10.

Case 2 If they do not meet the definition of PPE as per AS 10

Such items are classified as Inventory as per AS 2

5. valUaTiON Of iNveNTORies

NRv Of Raw maTeRials helD fOR Use OR DispOsal

Materials and other supplies held for use in the production of inventories are not written down

below cost if the selling price of finished product containing the material exceeds the cost of the

finished product. The reason is, as long as these conditions hold the material realises more than

its cost as shown below.

JTC CA JITIN TYAGI (B COM CA CS) Page 43

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Que.1 The company deals in three products, A, B & C, which are neither similar nor

interchangeable. 'At the time of closing of its account for the year 2010

2010-11, the Historical Cost

and Net Realizable Value of the items of closing stock are determined as follows:

Items Historical Cost ((₹ in lakhs) Net Realisable Value (₹

( in

lakhs)

A 40 28

B 32 32

C 16 24

What will be the value of closing stock?

Ans 1: As per para 5 of AS 2 on ‘Valuation of Inventories’, inventories should be valued at the

lower of cost and net realizable value.

Inventories should be written down to net realizable value on an item

item--by-item basis in the given

case.

Items Historical Cost (₹ in Net Realisable Value (₹ in Valuation of closing stock

lakhs) lakhs) (₹ in lakhs)

A 40 28 28

B 32 32 32

C 16 24 16

88 84 76

Hence, closing stock will be valued at ₹ 76 lakhs.

JTC CA JITIN TYAGI (B COM CA CS) Page 44

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Que.2 On 31st March 2013 a business firm finds that cost of a partly finished unit on that date is ₹

530. The unit can be finished in 2013-14 by an additional expenditure of ₹ 310. The finished unit

can be sold for ₹ 750 subject to payment of 4% brokerage on selling price. The firm seeks your

advice regarding the amount at which the unfinished unit should be valued as at 31st March,

2013 for preparation of final accounts.

Ans:2 Valuation of unfinished unit

₹

Net selling price 750

Less: Estimated cost of completion (310)

440

Less: Brokerage (4% of 750) 30

Net Realisable Value 410

Cost of inventory 530

Value of inventory (Lower of cost and net realisable value) 410

Note: The above answer is given on the assumption that partly finished unit cannot be sold in

semi finished form and its NRV is zero without processing it further.

Que 3 Cost of a partly finished unit at the end of 2009-10 is ₹ 150. The unit can be finished next year by a

further expenditure of ₹ 100.

The finished unit can be sold at ₹ 250, subject to payment of 4% brokerage on selling price. The value of

inventory is determined below:

Ans 3: ₹

Net selling price 250

Less: Estimated cost of completion 100

150

Less: Brokerage (4% of 250) (10)

Net Realisable Value 140

Cost of inventory 150

Value of inventory (Lower of cost and net realisable value) 140

Que 4 X Co. Limited purchased goods at the cost of ₹40 lakhs in October, 2010. Till March, 2011, 75% of

the stocks were sold. The company wants to disclose closing stock at ₹10 lakhs. The expected sale value is

₹11 lakhs and a commission at 10% on sale is payable to the agent. Advise, what is the correct closing

stock to be disclosed as at 31.3.2011.

Ans: As per Para 5 of AS 2 “Valuation of Inventories”, the inventories are to be valued at lower of cost

and net realizable value.

In this case, the cost of inventory is ₹10 lakhs. The net realizable value is 11,00,000 × 90%= ₹9,90,000. So,

the stock should be valued at ₹9,90,000.

Que.5 How do you deal with the following?

On 31.3.2012, the closing stock of Gourav Ltd. includes 10,000 units costing @ ₹ 10 i.e., ₹ 1,00,000.

But the current market price as on that date was @ ₹ 9 i.e., ₹ 90,000.

Ans:5 According to AS 2, Valuation of Inventories, an assessment is made of net realisable value

as at each Balance Sheet date.

Hence , the value of stock should be ₹ 90,000 (i.e. @ 9 per unit).

JTC CA JITIN TYAGI (B COM CA CS) Page 45

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Que.6 Sonar Bhandar deals in old colour TVs. It has 4 TVs the particulars of which are given

below :

You are asked to compute the value of stock to be included, in Balance Sheet for the year ended

31st March, 2009.

TVs Onida(₹) Philips(₹) EC (₹) Sony(₹) Total(₹)

Cost Price 10,000 20,000 35,000 50,000 1,15,000

(Expenses incurred to bring into saleable 3,000 2,000 5,000 - 10,000

conditions)

Net Realisable Value 18,000 30000 36,000 55,000 1,39,000

Ans:6 As per para 5, AS 2, Valuation of Inventories, inventories should be valued at the lower of

cost or net realisable value, which are:

TVs Onida(₹) Philips(₹) EC (₹) Sony(₹) Total(₹)

Cost Price (including expenses) 13,000 22,000 40,000 50,000 1,25,000

Net Realisable Value 18,000 30,000 36,000 55,000 1,39,000

Value of Stock 13,000 22,000 36,000 50,000 1,21,000

Value of stock to be included in the Balance Sheet will be ₹ 1,21,000 (i.e. Lower of cost (₹ 1,25,000)

and net realisable value ₹ 1,21,000).

Que.7 The following particulars are presented by M Ltd. (deals in clothing) as on 31.3.2012:

Compute the value of stock as per AS 2.

Stock held by M Ltd. ₹

(Cost Price) 10,550

(Net Realisable Value) 11,500

The details of such stocks were:

Cost Price Net Realisable Value

Cotton 5,600 4,960

Woolen 3,450 4,540

Synthetic 1,500 2,000

10,550 11,500

Ans:7 Valuation of Stock as per AS 2

As per AS 2, para 21, inventories are usually written-down to net realisable value on an item-by-

item basis:

Cost Price Net Realisable Value of Closing Stock

Value (₹)

Cotton 5,600 4,960 4,960

Woolen 3,450 4,540 3,450

Synthetic 1,500 2,000 1,500

10,550 11,500 9,910

Hence, value of stock will be considered for ₹ 9,910 as per AS 2.

Que.8 The total stock of A Ltd. as on 31.3.2012 was ₹ 5,00,000 of which stock amounting to ₹

31,000 were not ascertained as per AS 2. Compute the value of the said stocks as per AS 2 for

inclusion in financial statements as on that date.

JTC CA JITIN TYAGI (B COM CA CS) Page 46

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Type of Product Cost of Materials Productive Selling and Estimated

(₹) Expenses Distribution Selling

incurred (₹) expense to be Price (₹)

incurred (₹)

P 10,000 2,000 1,000 15,000

S 5,000 - 500 4,500

T 12,000 3,000 2,000 18,000

27,000 5,000 3,500 37,500

Ans.8 As per para 21, AS 2, inventories are usually written-down to net realisable value on an

item-by-item basis. Thus, value of stock will be computed as:

Type of Cost Price (including Net Realisable Value Value of Stock to be

Product Production Exp.) (excluding Selling & taken (lower of Cost

Distribution Expenses Price & Net

from Selling Price) (₹) Realisable Value) (₹)

P 12,000 (₹ 10,000 + ₹ 2,000) 14,000 (₹ 15,000- ₹ 1,000) 12,000

S 5,000 (-) 4,000 (₹ 4,500- ₹ 500) 4,000

T 15,000 (₹ 12,000 + ₹ 3,000) 16,000 (₹ 18,000- ₹ 2,000) 15,000

31,000

So, Value of Stock will be ₹ 31,000 for inclusion in financial statements as per AS 2.

COsTs Of iNveNTORy

Costs of inventories comprise all costs of purchase, costs of conversion and other costs incurred

in bringing the inventories to their present location and condition.

COsTs Of pURChase Of maTeRial

Purchase Price of Inventories XXX

+Duties & Taxes (not Recoverable) XXX

+ Freight Inward XXX

+Other Expenses directly related to acquisition of Inventory XXX

(-) Trade Discount (XXX)

(-) Rebates (XXX)

(-) Duty Drawbacks (XXX)

XXX

COsT fORmUla

Mostly inventories are purchased / made in different lots and unit cost of each lot frequently

differs. In all such circumstances, determination of closing inventory cost requires identification

of units in stock to have come from a particular lot. This specific identification is best wherever

possible. In all other cases, the cost of inventory should be determined by the First-In First-Out

(FIFO), or Weighted Average cost formula. The formula used should reflect the fairest possible

approximation to the cost incurred in bringing the items of inventory to their present location

and condition.

JTC CA JITIN TYAGI (B COM CA CS) Page 47

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

COsTs Of CONveRsiON

The costs of conversion include costs directly related to production, e.g. direct labour. They also

include overheads, both fixed and variable that are incurred in converting raw material to

finished goods. The fixed production overheads should be absorbed systematically to units of

production over normal capacity. Normal capacity is the production the enterprise expects to

achieve on an average over a number of periods or seasons under normal circumstances, taking

into account the loss of capacity resulting from planned maintenance.

The actual level of production may be used if it approximates the normal capacity. The amount

of fixed production overheads allocated to each unit of production should not be increased as a

consequence of low production or idle plant. Unallocated overheads (i.e. under recovery) are

recognised as an expense in the period in which they are incurred. In periods

period of abnormally high

production, the amount of fixed production overheads allocated to each unit of production is

decreased so that inventories are no

not measured above cost. Variable production overheads are

assigned to each unit of production on the basis of the actual use of the production facilities.

JTC CA JITIN TYAGI (B COM CA CS) Page 48

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Que 9 ABC Ltd. has a plant with the capacity to produce 1 lac unit of a product per annum and

the expected fixed overhead is ₹ 18 lacs. Fixed overhead on the basis of normal capacity is ₹ 18

(18 lacs/1 lac).

Case 1: Actual production is 1 lac units. Fixed overhead on the basis of normal capacity and

actual overhead will lead to same figure of ₹ 18 lacs. Therefore it is advisable to include this on

normal capacity.

Case 2: Actual production is 90,000 units. Fixed overhead is not going to change with the change

in output and will remain constant at ₹ 18 lacs, therefore, overheads on actual basis is ₹ 20 per

unit (18 lacs/ 90 thousands). Hence by valuing inventory at ₹ 20 each for fixed overhead

purpose, it will be overvalued and the losses of ₹ 1.8 lacs will also be included in closing

inventory leading to a higher gross profit then actually earned. Therefore, it is advisable to

include fixed overhead per unit on normal capacity to actual production (90,000 x 18) ₹ 16.2 lacs

and rest ₹ 1.8 lacs should be transferred to Profit & Loss Account.

Case 3: Actual production is 1.2 lacs units. Fixed overhead is not going to change with the change

in output and will remain constant at ₹ 188 lacs, therefore, overheads on actual basis is ₹ 15 (18

lacs/ 1.2 lacs). Hence by valuing inventory at ₹ 18 each for fixed overhead purpose, we will be

adding the element of cost to inventory which actually has not been incurred. At ₹ 18 per unit,

total fixed overhead comes to ₹ 21.6 lacs whereas, actual fixed overhead expense is only ₹ 18 lacs.

Therefore, it is advisable to include fixed overhead on actual basis (1.2 lacs x 15) ₹ 18 lacs.

Que 10

JTC CA JITIN TYAGI (B COM CA CS) Page 49

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Material 1,00,000 Kg @ Rs 20 per Kg

Labour Cost Rs. 25 per piece

Variable Overheads Rs. 5 per piece

Fixed Overhead Rs. 5,00,000

Actual production 90,000 pieces

Normal Production 1,00,000 pieces

Calculate Value of stock for 5,000 pieces?

Ans: Rs. 2,86,111

Que.11 You are required to value the inventory per kg of finished goods consisting of:

₹ per kg.

Material cost 200

Direct labour 40

Direct variable overhead 20

Fixed production charges for the year on normal working capacity of 2 lakh kgs is ₹20 lakhs.

4,000 kgs of finished goods are in stock at the year end.

Ans:11 In accordance with paras 8 & 9 of AS 2, the cost of conversion include a systematic

allocation of fixed & variable overheads that are incurred in converting materials into finished

goods. The allocation of fixed overheads for the purpose of their inclusion in the cost of

conversion is based on normal capacity of the production facilities. Cost per kg. of finished

goods:

₹

Material Cost 200

Direct Labour 40

Direct Variable Production Overhead 20

Fixed Production Overhead (20,00,000/2,00,000) 10 70

270

Hence the value of 4,000 kgs. of finished goods = 4,000 kgs x ₹ 270 = ₹ 10,80,000

Que.12 In a production process, normal waste is 5% of input. 5,000 MT of input were put in

process resulting in wastage of 300 MT.

Cost per MT of input is ₹1,000. The entire quantity of waste is on stock at the year end. State

with reference to Accounting Standard, how will you value the inventories in this case?

Ans: As per para 13 of AS 2 (Revised), abnormal amounts of wasted materials, labour and other

production costs are excluded from cost of inventories and such costs are recognized as

expenses in the period in which they are incurred. In this case, normal waste is 250 MT and

abnormal waste is 50 MT.

The cost of 250 MT will be included in determining the cost of inventories (finished goods) at the

year end. The cost of abnormal waste amounting to ₹50,000 (50 MT × ₹1,000) will be charged to

the profit and loss statement.

JOiNT OR by-pRODUCTs

In case of joint or by products, the costs incurred up to the stage of split off should be allocated

on a rational and consistent basis. The basis of allocation may be sale value at split off point, for

example, value of by products, scraps and wastes are usually not material. These are therefore

JTC CA JITIN TYAGI (B COM CA CS) Page 50

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

valued at net realisable value. The cost of main product is then valued as joint cost minus net

realisable value of by-products, scraps or waste.

Que.13 From the following information presented by P Ltd. ascertain the value of stock to be

included in Balance Sheet:

Cost Price of certain stock amounted to ₹ 60,000; being obsolete, it can be used for production

purposes after incurring ₹ 10,000 for modification. The same could be used as a by-product for an

existing product, the purchase price for the same amounts to ₹ 40,000.

Ans: Cost price of the product (given) ₹ 60,000.

Net Realisable Value of the product ₹ 40,000 - ₹ 10,000 = ₹ 30,000. Hence, ₹ 30,000 should be

treated as the Value of Stock to be included in Balance Sheet.

OTheR COsTs

(a) These may be included in cost of inventory provided they are incurred to bring the inventory

to their present location and condition. Cost of design, for example, for a custom made unit may

be taken as part of inventory cost.

(b) Interest and other borrowing costs are usually considered as not relating to bringing the

inventories to their present location and condition. These costs are therefore not usually included

in cost of inventory. Interests and other borrowing costs however are taken as part of inventory

costs, where the inventory necessarily takes substantial period of time for getting ready for

intended sale. Example of such inventory is wine.

(c) The standard is silent on treatment of amortisation of intangibles for ascertaining inventory

costs. It nevertheless appears that amortisation of intangibles related to production, e.g. patents

right of production or copyright for a publisher should be taken as part of inventory costs.

(d) Exchange differences are not taken in inventory costs.

exClUsiONs fROm The COsT Of iNveNTORies

In determining the cost of inventories, it is appropriate to exclude certain costs and recognise

them as expenses in the period in which they are incurred. Examples of such costs are:

(a) Abnormal amounts of wasted materials, labour, or other production costs;

(b) Storage costs, unless the production process requires such storage;

(c) Administrative overheads that do not contribute to bringing the inventories to their present

location and condition;

(d) Selling and distribution costs.

Que.14 “In determining the cost of inventories, it is appropriate to exclude certain costs and

recognize them as expenses in the period in which they are incurred”. Provide examples of such

costs as per AS 2 'Valuation of Inventories'.

Ans:14 As per AS 2 ‘Valuation of Inventories’, certain costs are excluded from the cost of the

inventories and are recognised as expenses in the period in which incurred. Examples of such

costs are:

(a) abnormal amount of wasted materials, labour, or other production costs;

JTC CA JITIN TYAGI (B COM CA CS) Page 51

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

(b) storage costs, unless those costs are necessary in the production process prior to a further

production stage;

(c) administrative overheads that do not contribute to bringing the inventories to their present

location and condition; and

(d) selling and distribution costs

Que.15 The Company X Ltd., has to pay for delay in cotton clearing charges. The company up to

31.3.2010 has included such charges in the valuation of closing stock. This being in the nature of

interest, X Ltd. decided to exclude such charges from closing stock for the year 2010-11. This

would result in decrease in profit by ₹5 lakhs. Comment.

Ans:15 As per para 12 of AS 2 (revised), interest and other borrowing costs are usually

considered as not relating to bringing the inventories to their present location and condition and

are therefore, usually not included in the cost of inventories. However, X Ltd. was in practice to

charge the cost for delay in cotton clearing in the closing stock. As X Ltd. decided to change this

valuation procedure of closing stock, this treatment will be considered as a change in accounting

policy and such fact to be disclosed as per AS 1. Therefore, any change in amount mentioned in

financial statement, which will affect the financial position of the company should be disclosed

properly as per AS 1, AS 2 and AS 5.

Also a note should be given in the annual accounts that, had the company followed earlier

system of valuation of closing stock, the profit before tax would have been higher by ₹ 5 lakhs.

Que.16 How will you deal with the following situation?

“A company deals in purchase and sale of timber and has included notional interest charges

calculated (on the paid-up share capital and free reserves) in the value of stock of timber as at the

Balance Sheet date as part of cost of holding the timber”.

Ans:16 According to the para 12 of AS 2, Valuation of Inventories, interest and other borrowing

costs are usually considered as not relating to bringing the inventories to their present location

and condition and are, therefore, usually not included in the cost of inventories. Hence, the

valuation of closing stock of timber cannot be considered as it is not in conformity with AS 2.

Que.17 How would you deal with the following in the annual accounts of a company for the

year ended 31.3.2012?

“The company has to pay delayed cotton clearing charges over and above the negotiated price

for asking delayed delivery of cotton from the supplier’s godown. Up to 2010-11, the company

has regularly included such charges in the valuation of closing stock. This being in the nature of

interest the company has decided to exclude it from closing stock valuation for the year 2011-12.

This would result into decrease in profit by ₹ 7.60 lakhs.”

Ans: As per para 12, AS 2, Valuation of Inventories, interest and other borrowing costs are

usually considered as not relating to bringing the inventories to their present location and

condition and are, therefore, usually not included in the cost of inventories. Thus, it becomes

quite clear that delayed cotton clearing charges which were treated in the nature of interest must

not be included while valuing closing stock as per the provision of AS 2 and it is not in

compliance with AS 2 which was done upto 2010-11. But from year 2011-12, the company

decided to change the earlier view i.e. they decided to exclude the same from the valuation of

closing stock which is, no doubt, in compliance with AS 2.

JTC CA JITIN TYAGI (B COM CA CS) Page 52

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

As a result of change in accounting policy regarding valuation of stock the profit was reduced by

is ₹ 7.60 lakhs which must be disclosed in the financial statement or per AS 1 as Notes to

Account.

Que.18 Capital Cables Ltd., has a normal wastage of 4% in the production process. During the

year 2013-14 the Company used 12,000 MT of raw material costing ₹ 150 per MT. At the end of

the year 630 MT of wastage was in stock. The accountant wants to know how this wastage is to

be treated in the books. Explain in the context of AS 2 the treatment of normal loss and abnormal

loss and also find out the amount of abnormal loss if any.

Ans: 22 As per para 13 of AS 2 (Revised) ‘Valuation of Inventories’, abnormal amounts of wasted

materials, labour and other production costs are excluded from cost of inventories and such costs

are recognized as expenses in the period in which they are incurred.

The normal loss will be included in determining the cost of inventories (finished goods) at the

year end.

Amount of Abnormal Loss:

Material used 12,000 MT @ ₹150 = ₹18,00,000

Normal Loss (4% of 12,000 MT) 480 MT

Net quantity of material 11,520 MT

Abnormal Loss in quantity 150 MT

Abnormal Loss ₹ 23,437.50

[150 units @ ₹ 156.25 (₹ 18,00,000/11,520)]

Amount ₹ 23,437.50 will be charged to the Profit and Loss statement

OTheR TeChNiqUes Of COsT measURemeNT

(a) Instead of actual, the standard costs may be taken as cost of inventory provided standards

fairly approximate the actual. Such standards (for finished or partly finished units) should be set

in the light of normal levels of material consumption, labour efficiency and capacity utilisation.

The standards so set should be regularly reviewed and if necessary, be revised to reflect current

conditions.

(b) In retail business, where a large number of rapidly changing items are traded, the actual costs

of items may be difficult to determine. The units dealt by a retailer however, are usually sold for

similar gross margins and a retail method to determine cost in such retail trades makes use of the

fact. By this method, cost of inventory is determined by reducing sale value of unsold stock by

appropriate average percentage of gross margin.

Que 19 A trader purchased certain articles for ₹ 85,000. He sold some of articles for ₹ 1,05,000. The

average percentage of gross margin is 25% on cost. Opening stock of inventory at cost was ₹ 15,000. Cost

of closing inventory is shown below:

₹

Sale value of opening stock and purchase (₹ 85,000 + ₹ 15,000) x 1.25 1,25,000

Sales (1,05,000)

Sale value of unsold stock 20,000

Less: Gross Margin (₹ 20,000 / 1.25) x 0.25 (4,000)

Cost of inventory 16,000

JTC CA JITIN TYAGI (B COM CA CS) Page 53

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

DisClOsURes

The financial statements should disclose:

(a) The accounting policies adopted in measuring inventories, including the cost formula used;

and

(b) The total carrying amount of inventories together with a classification appropriate to the

enterprise.

Information about the carrying amounts held in different classifications of inventories and the

extent of the changes in these assets is useful to financial statement users.

Common classifications of inventories are:

(1) raw materials and components,

(2) work in progress,

(3) finished goods,

(4) Stock-in-trade (in respect of goods acquired for trading),

(5) stores and spares,

(6) loose tools, and

(7) Others (specify nature).

Que 20 In a production process, normal waste is 5% of input. 5,000 MT of input were put in

process resulting in wastage of 300 MT. Cost per MT of input is ` 1,000. The entire quantity of

waste is on stock at the year end. State with reference to Accounting Standard, how will you

value the inventories in this case?

Solution

As per AS 2 (Revised), abnormal amounts of wasted materials, labour and other production costs

are excluded from cost of inventories and such costs are recognised as expenses in the period in

which they are incurred.

In this case, normal waste is 250 MT and abnormal waste is 50 MT. The cost of 250 MT will be

included in determining the cost of inventories (finished goods) at the year end. The cost of

abnormal waste (50 MT x 1,052.6315 = ` 52,632) will be charged to the profit and loss statement.

Cost per MT (Normal Quantity of 4,750 MT) = 50,00,000 / 4,750 = ` 1,052.6315

Total value of inventory = 4,700 MT x ` 1,052.6315 = ` 49,47,368.

Que.21 Find out the value of stock to be included in the Balance Sheet:

Cost Price of stock amounts to ₹ 1,00,000 which is considered as an obsolete item. It can be sold

as scrap for ₹ 55,000, or the same can be sold for ₹ 70,000 after allowing a trade discount of @

10%, Cash discount of ₹ 3,000 and expenses to be incurred for disposal amounted to ₹ 3,000.

Ans: Cost Price ₹ 1,00,000

Computation of Net Realisable Value

₹

Sale proceeds 70,000

Less: Trade Discount @ 10% 7,000

63,000

Less: Disposal Expenses 3,000

60,000

JTC CA JITIN TYAGI (B COM CA CS) Page 54

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Stock should be valued as per cost price or net realisable value, whichever is lower. So, value of

stock will be ₹ 55,000.

It must be remembered that, while calculating net realisable value, cash discounts will be

excluded.

Que.22 X Ltd. presented the following particular as on 31.3.2012: Compute the value of stock as on

31.3.2012.

The total cost of product:

Cost per unit (₹)

Cost of materials (₹12 each) 50

Manufacturing inputs 30

Total Cost 80

Profit 20

Selling Price 100

On 31.3.2012, selling price has gone down suddenly from ₹ 100 to ₹ 70. Price of raw material has also

gone down to ₹ 8 each. X Ltd. had in its stock 6,000, units of materials which was bought as per the above

rate on the same date.

Ans.22 According to para 24, AS 2, when there has been a decline in the price of materials and it is

estimated that the cost of the finished products will exceed net realisable value, the materials are written-

down to net realisable value. In such circumstances, the replacement cost of the materials may be the best

available measure of their net realisable value. In this case, the total cost of ₹ 80 exceeds the net realisable

value, i.e., selling price, of ₹ 70 (as the price of raw materials had gone down from ₹ 12 to ₹ 8). So,

inventories should be valued @ ₹ 70 each and as such, the total value of stock would be ₹ 4,20,000 (i.e., ₹

6,000 units × ₹ 70).

Que.23 State with reference to accounting standards how you will value the inventories in the following

case:

Raw materials were purchased at ₹ 100 per kilo. Prices of raw materials are on the decline. The finished

goods in which the raw materials is incorporated is expected to be sold at below cost. 10,000 Kgs. of raw

materials is on stock at the year end. Replacement cost is ₹ 80 per kg.

Ans.23 As per para 24, AS 2, materials and other supplies held for use in the production of inventories

are not written-down cost if the finished products in which they will be incorporated are expected to be

sold at or above cost. However, when there has been a decline in the price of materials and it is estimated

that the cost of the finished products will exceed net realisable value,the materials are written down to

net realisable value. In this case, cost of raw material was ₹ 100 per kg. But the finished goods (which are

produced from the said raw materials) are expected to realise at below the cost price. So, the value of

10,000 kg of raw materials will be @ 80 per kg (i.e. On the basisof replacement cost) ₹ 8,00,000.

Que.24 Calculate the value of raw materials and closing stock based on the following

information:

Raw material X

Closing balance 500 units

₹ per unit

Cost price including excise duty 200

Excise duty (Cenvat credit is receivable on the excise duty paid) 10

Freight inward 20

Unloading charges 10

Replacement cost 150

JTC CA JITIN TYAGI (B COM CA CS) Page 55

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Finished goods Y

Closing Balance 1,200

₹ per unit

Material consumed 220

Direct labour 60

Direct overhead 40

Total Fixed overhead for the year was ₹ 2,00,000 on normal capacity of 20,000 units.

Calculate the value of the closing stock, when

(i) Net Realizable Value of the Finished Goods Y is ₹ 400.

(ii) Net Realizable Value of the Finished Goods Y is ₹ 300.

Ans.24 Situation (i)

When Net Realisable Value of the Finished Goods Y is ₹ 400

NRV is greater than the cost of Finished Goods Y i.e. ₹ 330

Hence, Raw Material and Finished Goods are to be valued at cost

Value of Closing Stock:

Qty Rate Amount (₹)

Raw Material X 500 220 1,10,000

Finished Goods Y 1,200 330 3,96,000

Total Cost of Closing Stock 5,06,000

Situation (ii)

When Net Realisable Value of the Finished Goods Y is ₹ 300

NRV is less than the cost of Finished Goods Y i.e. ₹ 330

Hence, Raw Material is to be valued at replacement cost and

Finished Goods are to be valued at NRV since NRV is less than the cost

Value of Closing Stock:

Qty Rate Amount (₹)

Raw Material X 500 150 75,000

Finished Goods Y 1,200 300 3,60,000

Total Cost of Closing Stock 4,35,000

Working Notes:

Raw Material X ₹

Cost Price 200

Less: Cenvat Credit -10

190

Add: Freight Inward 20

Unloading charges 10

Cost 220

Finished goods Y ₹

Materials consumed 220

Direct Labour 60

Direct overhead 40

JTC CA JITIN TYAGI (B COM CA CS) Page 56

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

Fixed overheads (₹ 2,00,000/20,000 units) 10

Cost 330

Note: It has been considered that Raw Material X is used for the production of Finished Goods Y.

Que.25 Mr. Mehul gives the following information relating to items forming part of inventory as on 31-3-

2015. His factory produces Product X using Raw material A.

(i) 600 units of Raw material A (purchased @ ₹ 120). Replacement cost of raw material A as on 31-3-2015

is ₹ 90 per unit.

(ii) 500 units of partly finished goods in the process of producing X and cost incurred till date ₹ 260 per

unit. These units can be finished next year by incurring additional cost of ₹ 60 per unit.

(iii) 1500 units of finished Product X and total cost incurred ₹ 320 per unit. Expected selling price of

Product X is ₹ 300 per unit.

Determine how each item of inventory will be valued as on 31-3-2015. Also calculate the value of total

inventory as on 31-3-2015.

Ans:25 As per AS 2 “Valuation of Inventories”, materials and other supplies held for use in the

production of inventories are not written down below cost if the finished products in which they will be

incorporated are expected to be sold at cost or above cost. However, when there has been a decline in the

price of materials and it is estimated that the cost of the finished products will exceed net realizable

value, the materials are written down to net realizable value. In such circumstances, the replacement cost

of the materials may be the best available measure of their net realizable value. In the given case, selling

price of product X is ₹ 300 and total cost per unit for production is ₹ 320.

Hence the valuation will be done as under:

(i) 600 units of raw material will be written down to replacement cost as market value of finished product

is less than its cost, hence valued at ₹ 90 per unit.

(ii) 500 units of partly finished goods will be valued at 240 per unit i.e. lower of cost ₹ 320 (₹ 260 +

additional cost ₹ 60) or Net estimated selling price ₹ 240 (Estimated selling price ₹ 300 per unit less

additional cost of ₹ 60).

(iii) 1500 units of finished product X will be valued at NRV of ₹ 300 per unit since it is lower than cost ₹

320 of product X

Valuation of Total Inventory as on 31.03.2015:

Units Cost(₹) NRV/Replacement Cost Value = units x cost Or NRV

whichever is less (₹)

Raw material A 600 120 90 54000

Partly finished goods 500 260 240 120000

Finished goods X 1500 320 300 450000

Value of Inventory 624000

Que26 An enterprise ordered 13,000 Kg. of certain material at ₹ 90 per unit. The purchase price

includes excise duty ₹ 5 per Kg., in respect of which full CENVAT credit is admissible. Freight

incurred amounted to ₹ 80,600. Normal transit loss is 4%. The enterprise actually received 12,400

Kg and consumed 10,000 Kg.

Cost of inventory and allocation of material cost is shown below:

Ans : 26

(Normal cost per Kg.)

₹

Purchase price (13,000 Kg. x ₹ 90) 11,70,000

Less: CENVAT Credit (13,000 Kg. x ₹ 5) -65,000

JTC CA JITIN TYAGI (B COM CA CS) Page 57

CA INTERMEDIATE JITIN TYAGI CLASSES AS -2

11,05,000

Add: Freight 80,600

A. Total material cost 11,85,600

B. Number units normally received = 96% of 13,000 Kg. Kg.12480

C. Normal cost per Kg. (A/B) 95

Allocation of material cost

Kg. ₹ /Kg. ₹

Materials consumed 10,000 95 9,50,000

Cost of inventory 2,400 9 2,28,000

Abnormal loss 80 95 7,600

Total material cost 12,480 95 11,85,600

Note: Abnormal losses are recognised as separate expense.

JTC CA JITIN TYAGI (B COM CA CS) Page 58

You might also like

- Paper 6A Business CommunicationDocument261 pagesPaper 6A Business CommunicationDipen AdhikariNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Cost Accs Reconciliation Extra SumsDocument7 pagesCost Accs Reconciliation Extra Sumspurvi doshiNo ratings yet

- 6 - As-16 Borrowing CostsDocument15 pages6 - As-16 Borrowing CostsKrishna JhaNo ratings yet

- As 11 Question 12 SolutionDocument3 pagesAs 11 Question 12 SolutionDebjit Raha100% (1)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- NpoDocument30 pagesNpoSaurabh AdakNo ratings yet

- Sdathn Ripsryd@r@ea@pis - Unit) : - SolutionDocument16 pagesSdathn Ripsryd@r@ea@pis - Unit) : - SolutionAnimesh VoraNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Ch.4 Redemption of DebenturesDocument14 pagesCh.4 Redemption of DebenturesNidhi LathNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- Chapter 11 Hire Purchase and Instalment Sale Transactions PDFDocument52 pagesChapter 11 Hire Purchase and Instalment Sale Transactions PDFEswari GkNo ratings yet

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- 19732ipcc CA Vol2 Cp3Document43 pages19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANo ratings yet

- Branch AccountingDocument44 pagesBranch Accountingaruna2707100% (1)

- 35 Resource 11Document16 pages35 Resource 11Anonymous bf1cFDuepPNo ratings yet

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- Process Operation CostingDocument71 pagesProcess Operation CostingMansi IndurkarNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Incomplete Records (Single Entry)Document15 pagesIncomplete Records (Single Entry)Kabiir RathodNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Joint Venture Accounts Hr-5Document11 pagesJoint Venture Accounts Hr-5meenasarathaNo ratings yet

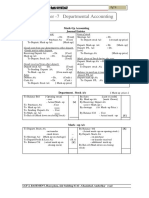

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Contarct CostingDocument13 pagesContarct CostingBuddhadev NathNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PMDocument48 pagesChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- Amalgamation of CompaniesDocument22 pagesAmalgamation of CompaniesSmit Shah0% (1)

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- CA Intermediate Paper-8A PDFDocument282 pagesCA Intermediate Paper-8A PDFAnand_Agrawal19100% (2)

- Accounting Round 1 Ans KeyDocument21 pagesAccounting Round 1 Ans KeyMalhar ShahNo ratings yet

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Unit 2: Sale of Goods On Approval or Return Basis: Learning OutcomesDocument17 pagesUnit 2: Sale of Goods On Approval or Return Basis: Learning OutcomessajedulNo ratings yet

- Unit2: Treatment of Goodwill in Partnership AccountsDocument27 pagesUnit2: Treatment of Goodwill in Partnership AccountsJavid QuadirNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- (Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)Document20 pages(Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)razorNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- UM PPT Process CostDocument92 pagesUM PPT Process CostRahul ShendeNo ratings yet

- Chapter 12 Service CostingDocument3 pagesChapter 12 Service CostingMS Raju100% (1)

- Paper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 3: Cost and Management Accounting: © The Institute of Chartered Accountants of IndiaUdaykiran BheemaganiNo ratings yet

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- FR ConsolidationDocument31 pagesFR Consolidationvignesh_vikiNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- MTP May I 22Document17 pagesMTP May I 22SAM and Co0% (1)

- Chapter 8 Operating CostingDocument13 pagesChapter 8 Operating CostingDerrick LewisNo ratings yet

- 20 - Ind As 115 (R)Document82 pages20 - Ind As 115 (R)S Bharhath kumarNo ratings yet

- Accounts Ans Jan 2021Document25 pagesAccounts Ans Jan 2021Hemant AherNo ratings yet

- Extra Questions For AsDocument35 pagesExtra Questions For AsAmish DebNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Pankaj Garg Audit Main Book May 21Document730 pagesPankaj Garg Audit Main Book May 21Dipen AdhikariNo ratings yet

- Capii - Corporatelaw - June12 4Document14 pagesCapii - Corporatelaw - June12 4Dipen AdhikariNo ratings yet

- Suggested - Answer - CAP - II - June - 2016 6Document75 pagesSuggested - Answer - CAP - II - June - 2016 6Dipen AdhikariNo ratings yet

- Chapter 8 CARO 2016Document58 pagesChapter 8 CARO 2016Dipen AdhikariNo ratings yet

- Loan Annexure WorkingsDocument74 pagesLoan Annexure WorkingsDipen AdhikariNo ratings yet

- 11 As 4 Event Occuring After The Balance Sheet DateDocument14 pages11 As 4 Event Occuring After The Balance Sheet DateDipen AdhikariNo ratings yet

- Paper 5: Advanced AccountingDocument31 pagesPaper 5: Advanced AccountingDipen AdhikariNo ratings yet

- MTP20MAY201420GROUP20120SERIES202.pdf 3Document85 pagesMTP20MAY201420GROUP20120SERIES202.pdf 3Dipen AdhikariNo ratings yet

- Httpsmanagement - Ind.inforumattachmentsf225408d1451274756 Accounting 1 Ca Inter Ipc Group I Accounting Exam Answer Key PDFDocument16 pagesHttpsmanagement - Ind.inforumattachmentsf225408d1451274756 Accounting 1 Ca Inter Ipc Group I Accounting Exam Answer Key PDFDipen AdhikariNo ratings yet

- Attachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDocument25 pagesAttachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDipen AdhikariNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDocument8 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Chapter - 5 Marginal CostingDocument9 pagesChapter - 5 Marginal CostingDipen AdhikariNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Amalgamation of Companies 2Document19 pagesAmalgamation of Companies 2Dipen Adhikari0% (1)

- Cost and Management Accounting (VJuly 2016)Document629 pagesCost and Management Accounting (VJuly 2016)Dipen Adhikari100% (1)

- FAR JA-2023 QuestionDocument4 pagesFAR JA-2023 QuestionMd HasanNo ratings yet

- Analisis Kelayakan Finansial Usahatani Jagung Di Sumari Kecematan Sindue Kabupaten DonggalaDocument7 pagesAnalisis Kelayakan Finansial Usahatani Jagung Di Sumari Kecematan Sindue Kabupaten DonggalaMika Daniel NNo ratings yet

- Using Multiples For ValuationDocument26 pagesUsing Multiples For ValuationGuillermo LyNo ratings yet

- 2020 LBG q1 Ims Pillar 3 DisclosuresDocument8 pages2020 LBG q1 Ims Pillar 3 DisclosuressaxobobNo ratings yet

- Problems On Income StatementDocument3 pagesProblems On Income Statementcnagadeepa100% (2)

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- 10 - Getting Financing or FundingDocument29 pages10 - Getting Financing or FundingAzeem SubhaniNo ratings yet

- Funding The Business TACN 2 HVTCDocument10 pagesFunding The Business TACN 2 HVTCNguyễn Lương Minh ChâuNo ratings yet

- Restructuring Investment Banking - How To Get in and What You DoDocument18 pagesRestructuring Investment Banking - How To Get in and What You DoAditya Goel100% (1)

- Business Report - Myer Holdings LTDDocument9 pagesBusiness Report - Myer Holdings LTDSimon100% (1)

- Baf 1201 Fa2Document3 pagesBaf 1201 Fa2ReginaNo ratings yet

- Pearsons Federal Taxation 2018 Comprehensive 31st Edition Rupert Test BankDocument45 pagesPearsons Federal Taxation 2018 Comprehensive 31st Edition Rupert Test Bankloanazura7k6bl100% (32)

- ZAFRA Hannah Mae S. Income Statement and Balance Sheet Ferna CompanyDocument2 pagesZAFRA Hannah Mae S. Income Statement and Balance Sheet Ferna CompanyAngeliePanerioGonzagaNo ratings yet

- SOAL 1 - Break Even AnalysisDocument3 pagesSOAL 1 - Break Even AnalysisRifqi RinaldiNo ratings yet

- MBA AgribusinessDocument52 pagesMBA AgribusinessNihal PatilNo ratings yet

- Laporan Tahunan 2013Document152 pagesLaporan Tahunan 2013NadineNo ratings yet

- Atswa: Financial AccountingDocument344 pagesAtswa: Financial AccountingOyedola Gafar BabatundeNo ratings yet

- Lecture7 WorkingCapitalManagementDocument91 pagesLecture7 WorkingCapitalManagementduncan100% (4)

- Career Paths Accounting SB-20 PDFDocument1 pageCareer Paths Accounting SB-20 PDFYanetNo ratings yet

- GPB Capital: Massachusetts ComplaintDocument47 pagesGPB Capital: Massachusetts ComplaintTony OrtegaNo ratings yet

- CH 7 Vol 1 2012 AnswersDocument18 pagesCH 7 Vol 1 2012 Answersprince karlNo ratings yet

- Accounting Policies - Study Group 4IDocument24 pagesAccounting Policies - Study Group 4ISatish Ranjan PradhanNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sam THUNGANo ratings yet

- Answer Key Midterm Acct 201 Financial AccountingDocument9 pagesAnswer Key Midterm Acct 201 Financial AccountingJammy DeNo ratings yet

- Introduction To AccountingDocument3 pagesIntroduction To AccountingDamith Piumal Perera100% (1)

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Mini Case Excel TemplateDocument5 pagesMini Case Excel TemplateHoang Thi Thanh TamNo ratings yet

- 2020 - GATI - Gatron Industries Limited-55-56Document2 pages2020 - GATI - Gatron Industries Limited-55-56Muhammad Noman MehboobNo ratings yet

- Sample Practice Questions - Module-01 To Module-09Document30 pagesSample Practice Questions - Module-01 To Module-09المائدہNo ratings yet

- Accounting Question BankDocument217 pagesAccounting Question BankFaiza TahreemNo ratings yet