Professional Documents

Culture Documents

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Uploaded by

ameer HamzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021

Uploaded by

ameer HamzaCopyright:

Available Formats

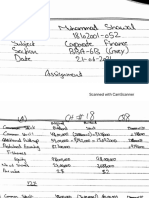

Ameer Hamza Butt 18102001-094 Submitted to: Ma’am Nimra Sohail

Osama Ahsan 18102001-087 Assignment # 1

Abubaker Shafique 18102001-129 08-04-2021

Vertical Analysis Horizontal Analysis

Analysis

2018 2017 2016 2018 2017 2016

51.2% 46.4% 58.6% 117.8% 107.5% 100%

0.02% - - - - -

5.53% 2.8% 3.9% 192% 97.3% 100%

0.04% 0.033% 0.056% 99% 82% 100%

0.03% 0.06% 0.05% 87% 155% 100%

57% 49.27% 62.6% 122.3% 107% 100%

3.41% 3.37% 4.3% 105% 104.6% 100%

23.5% 41.3% 28% 113% 200% 100%

4% 2.15% 0.9% 599% 328% 100%

0.73% 0.63% 1% 97.3% 85% 100%

0.2% 0.17% 0.08% 362% 299% 100%

8.3% 0.43% 0.6% 1945% 100.4 100%

1.35% 0.26% 0.22% 829% 162% 100%

0.53% 1.09% 0.13% 533% 1078% 100%

1% 1.35% 2% 68% 94.4% 100%

43% 50.72 37.3 155% 185% 100%

100% 100% 100% 135% 136% 100%

5.3% 5.25% 7.13% 100% 100% 100%

2.2% 2.15% 3% 100% 100% 100%

10.6% 10.5% 14.2% 100% 100% 100%

2.8% 3.56% 5.7% 68.3% 85.2% 100%

(0.028) % (0.022) % (0.03) % (133) % (103.5) % (100) %

16.2% 11.11% 15.9% 137.5% 95.1% 100%

31.8% 27.3% 39% 111% 96% 100%

22.2% 23.1% 23% 131% 137% 100%

3.77% 5.7% 9.1% 55.5% 85% 100%

26% 29% 32.1% 109% 122% 100%

14.8% 6.6% 12.3% 161.2% 73.2% 100%

0.6% 0.76% 0.7% 125% 154% 100%

20.4% 33.5% 10% 280% 461% 100%

0.054% 0.054% 0.06% 122.2% 123% 100%

6.32% 2.9% 6.3% 136% 63.2% 100%

42.16% 43.7% 29.1% 195% 204.3% 100%

100% 100% 100% 135% 136% 100%

From vertical analysis of (2018), we can oversee that Similarly, From the vertical analysis of (2017,2016), with disastrous change, like trade amount doubled the base year

the majorly part (57 %) of the whole assets (100%)is the situation of contribution of non-current assets and 13% in the 2018. Their trade debts increase with 228% in 2017

contributed by the company’s non-current assets, and current assets with respect to whole asset is off and 499% in 2018. Trade deposits also increases with 199%, and

and in non-current assets about (90%) of the part is same nature, and the equity and liability section is 262% with respective years. The receivables which are left to

contributed by the Al Noor mills property, plants and also similar to the (2018) balance sheet, all the collected increases with a margin of 1845% increase compared to

equipment’s. And current assets hold about (43%) of entities and their nature of contribution is similar. base year in 2018 and 0.4 increase in 2017. Similarly, income tax

the whole assets, furthermore in which stock in refund increase with 62 percent and 729 percent w.r.t base year.

trade contributes about (50%) of the current assets Horizontal Analysis, horizontal analysis gives us the And income refundable (NOP) increase with 978% in 2017 and

and respectively (19.5%) by receivables and (9.2%) trend of growth/decline with respect to base year, if 433% w.r.t base year. And in the equity and liability section un

by trade debts. In equity section capital reserves we compare the balance sheet, we come to know appropriate profit decrease with a margin of 14.8% and 31.7 with

contributes about (50%) of total share equity and that Al Noor mills Property/equipment’s increases 2017 and 2018. Their capital reserves decrease with 4.9 percent in

general reserves about 3rd half. In non- liabilities, (7.5%in 2017, and 17.8% w.r.t Base year), it’s long 2017 and increase with the margin of 37.5 percent. Long term

long term financing take part of (85%) and in current term investment decreases with a lower margin of financing also increases, but deferred liability decreased for about

liabilities. Majority part is taken by short term 2.7% in 2017, but increases with a margin of 92%. half compared to the base year. Trade payable decreases in 2017

borrowing (48%), then payables (35%) and then But if we were to compare the whole non-current but increases in 2018. Accrued finance cost also increases in both

current portion of financing (15%). asset entity then if increases with a margin of 7% in years, short term borrowing also increases in both years. Unclaimed

2017 and 22.3% in 2018. In current assets there are dividend firstly decreases with a margin of 36.8% but increases with

some assets 36% next year. Overall change w.r.t base year is increase in 36

CONT percent in 2017 and 35% in 2018.

You might also like

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document1 pageAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document3 pagesAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Colombia Calendario Lunar: WWW - Vercalendario.infoDocument3 pagesColombia Calendario Lunar: WWW - Vercalendario.infoEduardo MarinoNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Blackjack Excel Zen vs. Omega ComparisonDocument2 pagesBlackjack Excel Zen vs. Omega ComparisonKarthik S. IyerNo ratings yet

- Red Line Mix ChartDocument1 pageRed Line Mix ChartOrlandoNo ratings yet

- Discount RatesDocument2 pagesDiscount RatesabeerNo ratings yet

- Pencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Document1 pagePencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Johari AbdullahNo ratings yet

- 06 - Uas Pai - Ida Ayu Made Dwi PuspitaDocument7 pages06 - Uas Pai - Ida Ayu Made Dwi PuspitaGus TutNo ratings yet

- Tugas Diskusi Sesi 2 Statistika Irmawaty Tulus Apriana SitompulDocument2 pagesTugas Diskusi Sesi 2 Statistika Irmawaty Tulus Apriana SitompulirmawatytulussitompulNo ratings yet

- Porcentaje de ObraDocument3 pagesPorcentaje de ObraCesar E. RodriguezNo ratings yet

- Y Frequency Cumulative % Y Frequency Cumulative %Document3 pagesY Frequency Cumulative % Y Frequency Cumulative %Boy MicroNo ratings yet

- Updated Incentives Plan - Sheet1Document1 pageUpdated Incentives Plan - Sheet1Shashank RaiNo ratings yet

- Simulation Statistics Simulation Statistics: Average STD Dev STD Err Max Min PercentilesDocument4 pagesSimulation Statistics Simulation Statistics: Average STD Dev STD Err Max Min PercentilesEdward WeaverNo ratings yet

- Anexo Tablas Asistente de Servicios Tabla de Variables: Cumplimiento Comercial Satisfacción ClienteDocument2 pagesAnexo Tablas Asistente de Servicios Tabla de Variables: Cumplimiento Comercial Satisfacción ClienteIsrael AguilarNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument2 pagesNuevo Hoja de Cálculo de Microsoft ExcelcokfloyNo ratings yet

- Bengkel Kepimpinan Unit Beruniform KokurikulumDocument11 pagesBengkel Kepimpinan Unit Beruniform KokurikulumSyamimSohaniNo ratings yet

- IC Email Marketing Dashboard Template 8673Document7 pagesIC Email Marketing Dashboard Template 8673Haytham NasefNo ratings yet

- Columna1 Columna2 Columna3 Tasa de Desempleo Tasa de InflacionDocument7 pagesColumna1 Columna2 Columna3 Tasa de Desempleo Tasa de Inflacionjorge eliecer ibarguen palaciosNo ratings yet

- Informe de Situación Del País Al 2022 - CEPLANDocument46 pagesInforme de Situación Del País Al 2022 - CEPLANAlbert GamboaNo ratings yet

- hsc2011 Alevel Subjectwise PDFDocument3 pageshsc2011 Alevel Subjectwise PDFYuviraj PuttenNo ratings yet

- Truoc Thang 6 Tuoi 36 60Document1 pageTruoc Thang 6 Tuoi 36 60Phan Huy HoangNo ratings yet

- Grafica de Materiales de Construccion G#1Document2 pagesGrafica de Materiales de Construccion G#1Eleazar Ocón LópezNo ratings yet

- Single Machine - Multi Part OEE TemplateDocument3 pagesSingle Machine - Multi Part OEE Templaterkhadke1No ratings yet

- Excel de T4 - Project DayanyDocument54 pagesExcel de T4 - Project DayanyLozanoNo ratings yet

- Silkolene Mix ChartDocument1 pageSilkolene Mix ChartOrlandoNo ratings yet

- Cmat AssignmentDocument7 pagesCmat AssignmentJulia FlorencioNo ratings yet

- (Reference) : OEE (NAT / Total NAT) A (NAT / Total NAT) P% (NOT / Total NOT)Document4 pages(Reference) : OEE (NAT / Total NAT) A (NAT / Total NAT) P% (NOT / Total NOT)oborda2769No ratings yet

- Pyq Jul 2022Document13 pagesPyq Jul 2022Nurdiana AzwaNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Analysis BAB 1-6Document8 pagesAnalysis BAB 1-6Jeremi RicardoNo ratings yet

- Item Preguntas Aciertos Promedio Incorrectas Porsentaje Suma de PorcentajesDocument2 pagesItem Preguntas Aciertos Promedio Incorrectas Porsentaje Suma de PorcentajesAnonymous CvOBouNo ratings yet

- Analysis BAB 1-6Document8 pagesAnalysis BAB 1-6Jeremi Ricardo100% (1)

- Statistik CobaDocument10 pagesStatistik CobaShela AuliyahNo ratings yet

- Kejutan Dimulai SegeraDocument29 pagesKejutan Dimulai SegeraIna BerkatNo ratings yet

- MCRSDocument9 pagesMCRSMercedes Isla VertizNo ratings yet

- Promkes: Grafik Capaian Program Ukm EsensialDocument21 pagesPromkes: Grafik Capaian Program Ukm Esensialeyun k firdausNo ratings yet

- Nutritional Status Report of Cabiao National High SchoolDocument4 pagesNutritional Status Report of Cabiao National High SchoolLorraine VenzonNo ratings yet

- Ramirez Lopez Francisco JohanDocument3 pagesRamirez Lopez Francisco Johan196P1379No ratings yet

- Summary StatisticsDocument3 pagesSummary StatisticsNguyenNo ratings yet

- Chart Title: Valor de KDocument9 pagesChart Title: Valor de KNatalia BordaNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- F23 - OEE DashboardDocument10 pagesF23 - OEE DashboardAnand RNo ratings yet

- Stock Price: Dividend YieldDocument21 pagesStock Price: Dividend YieldEmre UzunogluNo ratings yet

- Statistikadimasbagus 2Document2 pagesStatistikadimasbagus 2dimasizha75No ratings yet

- SNS OddsDocument1 pageSNS OddsRomaric VERDONCKNo ratings yet

- 01 Stats Introduction ANSWERSDocument7 pages01 Stats Introduction ANSWERSGilang PamungkasNo ratings yet

- Análises de DadosDocument8 pagesAnálises de DadosGabriel ZuanettiNo ratings yet

- m1 Safetystockminmax ExaDocument6 pagesm1 Safetystockminmax ExaAslam SoniNo ratings yet

- Garnish FLR Console UpperDocument2 pagesGarnish FLR Console UpperMarketing TanajawaNo ratings yet

- Calculation Saving Ipl 16.6.2017Document3 pagesCalculation Saving Ipl 16.6.2017Jal Ley HaaNo ratings yet

- Rendimientos Diarios - Amazon (2023)Document1 pageRendimientos Diarios - Amazon (2023)Pro God1293No ratings yet

- Porcentaje de Ocupacion Hospitalaria 26 Junio 2023Document1 pagePorcentaje de Ocupacion Hospitalaria 26 Junio 2023Ashley CastañedaNo ratings yet

- Investor Presentation & FAQ For ReorganisationDocument61 pagesInvestor Presentation & FAQ For ReorganisationManish KhakhraNo ratings yet

- Vix Hedges: Institute of Trading & Portfolio ManagementDocument9 pagesVix Hedges: Institute of Trading & Portfolio ManagementHakam DaoudNo ratings yet

- Get The Training You Need!: Excel PR ODocument10 pagesGet The Training You Need!: Excel PR OKhurram AliNo ratings yet

- Dia Fecha Peso Diario Avance (TN)Document8 pagesDia Fecha Peso Diario Avance (TN)Anonymous xI91T7GjSNo ratings yet

- Statistika Dimas Bagus 2Document2 pagesStatistika Dimas Bagus 2dimasizha75No ratings yet

- Saim Imtiaz 186 Corporate Finance Assignment 1Document7 pagesSaim Imtiaz 186 Corporate Finance Assignment 1ameer HamzaNo ratings yet

- CF-Assignmnt 01Document4 pagesCF-Assignmnt 01ameer HamzaNo ratings yet

- Book Review: SubjectDocument6 pagesBook Review: Subjectameer Hamza0% (4)

- Shawal Corporate Finance AssignmentDocument4 pagesShawal Corporate Finance Assignmentameer HamzaNo ratings yet

- CF - Assignment #01 HiraDocument2 pagesCF - Assignment #01 Hiraameer HamzaNo ratings yet

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document1 pageAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Ameer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021Document3 pagesAmeer Hamza Butt 18102001-094 Submitted To: Ma'am Nimra Sohail Osama Ahsan 18102001-087 Assignment # 1 Abubaker Shafique 18102001-129 08-04-2021ameer HamzaNo ratings yet

- Identifying and Analyzing Domestic and International OpportunitiesDocument16 pagesIdentifying and Analyzing Domestic and International Opportunitiesameer HamzaNo ratings yet

- Week 3Document18 pagesWeek 3ameer HamzaNo ratings yet

- Tentative Mid Term Datesheet Spring-2021Document17 pagesTentative Mid Term Datesheet Spring-2021ameer HamzaNo ratings yet

- The Entrepreneurial and Entrepreneurial Mind: Week #2Document21 pagesThe Entrepreneurial and Entrepreneurial Mind: Week #2ameer HamzaNo ratings yet

- FSA BBA 6th-Finance (Attendance)Document12 pagesFSA BBA 6th-Finance (Attendance)ameer HamzaNo ratings yet

- Tugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Document2 pagesTugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Ester SabatiniNo ratings yet

- WBG Presentation DAEPDocument39 pagesWBG Presentation DAEPhrhhamadaNo ratings yet

- Employees Training & Development Process of Grameen BankDocument37 pagesEmployees Training & Development Process of Grameen BankBoby PodderNo ratings yet

- Buildium Outstanding BalancesDocument34 pagesBuildium Outstanding BalancesJulian KurtNo ratings yet

- Account For MaterialDocument25 pagesAccount For Materialshrestha.aryxnNo ratings yet

- Activity 2 Merino Designs SolutionDocument2 pagesActivity 2 Merino Designs SolutionTran NguyenNo ratings yet

- Ey Business Responsibility and Sustainability ReportingDocument28 pagesEy Business Responsibility and Sustainability ReportingdinuindiaNo ratings yet

- Resume Now ReviewDocument9 pagesResume Now Reviewafjwrcqmzuxzxg100% (2)

- Seo PricingDocument2 pagesSeo Pricingfarman aliNo ratings yet

- Financial Accounting Reporting - Partnership DissolutionDocument3 pagesFinancial Accounting Reporting - Partnership DissolutionlcNo ratings yet

- Internal Scanning: Organizational Analysis: Session 3Document40 pagesInternal Scanning: Organizational Analysis: Session 3YOLAPOHANNo ratings yet

- Chapter 8Document31 pagesChapter 8Shirah CoolNo ratings yet

- VISA Latam Travel Trends 2024Document20 pagesVISA Latam Travel Trends 2024email4400No ratings yet

- Embassy Techvillage Acquisition Key Transaction ParametersDocument1 pageEmbassy Techvillage Acquisition Key Transaction ParametersYash RathiNo ratings yet

- Befa 1Document23 pagesBefa 121WH1A6634 NALLAMOTHU HIMA SRINo ratings yet

- Eco415 - Chapter 4 Market EquillibriumDocument13 pagesEco415 - Chapter 4 Market EquillibriumIRDINA 'ALIAH MAZLANNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Fussy INVESTMENT - NOTEDocument3 pagesFussy INVESTMENT - NOTEAmitshah84No ratings yet

- Full Ebook of Principles and Practice of Marketing 9Th Edition David Jobber Online PDF All ChapterDocument65 pagesFull Ebook of Principles and Practice of Marketing 9Th Edition David Jobber Online PDF All Chapterjoeeeenhaeeey945100% (5)

- Group 11: Abhishek Singh DM22204 Maitreyi Yadav DM22188 Talea Khan DM22175 Ankita Bhuniya DM22215 Rohan Paul Philip DM22261Document3 pagesGroup 11: Abhishek Singh DM22204 Maitreyi Yadav DM22188 Talea Khan DM22175 Ankita Bhuniya DM22215 Rohan Paul Philip DM22261ABHISHEK SINGHNo ratings yet

- Forklift Driver ResumeDocument6 pagesForklift Driver Resumejcipchajd100% (2)

- Weathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaDocument21 pagesWeathering The Economic Impact of COVID-19 Challenges Faced by Microentrepreneurs and Their Coping Strategies During Movement Control Order (MCO) in MalaysiaJeslyn TanNo ratings yet

- Thermal Control Magazine January 2023 PreviewDocument5 pagesThermal Control Magazine January 2023 PreviewABHISHEK KUMAR SHARMANo ratings yet

- Eoi AssamDocument8 pagesEoi AssamBinu PrakashNo ratings yet

- Kisan FoodsDocument7 pagesKisan FoodsKhanzada Wajahat100% (1)

- Chapter 7 - Innovation and TechnologyDocument5 pagesChapter 7 - Innovation and TechnologyMuse ManiaNo ratings yet

- CBC-Final ExamDocument4 pagesCBC-Final ExamKanbiro OrkaidoNo ratings yet

- PT Sumber Alfaria Trijaya TBK: Branch Toko TanggalDocument3 pagesPT Sumber Alfaria Trijaya TBK: Branch Toko TanggalArdiaNo ratings yet

- Q2 LAS Organization & Mgt. 11 Week 9 MELC 10Document11 pagesQ2 LAS Organization & Mgt. 11 Week 9 MELC 10andyNo ratings yet

- Ecological BricksDocument3 pagesEcological BricksSebastian Tovar GarciaNo ratings yet