Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsAuditing The

Auditing The

Uploaded by

Raymundo Eirahchap 1 audit

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Auditing Summary NotesDocument23 pagesAuditing Summary NotesTuryamureeba Julius100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Far-1 13Document3 pagesFar-1 13Raymundo EirahNo ratings yet

- Far-1 14Document3 pagesFar-1 14Raymundo EirahNo ratings yet

- Far-1 1Document4 pagesFar-1 1Raymundo EirahNo ratings yet

- Far-1 4Document3 pagesFar-1 4Raymundo Eirah100% (1)

- Far 1Document3 pagesFar 1Raymundo EirahNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Aud 2Document7 pagesAud 2Raymundo EirahNo ratings yet

- 1 Sample Confirmation Letter 1Document1 page1 Sample Confirmation Letter 1Raymundo EirahNo ratings yet

- Far-1 3Document2 pagesFar-1 3Raymundo EirahNo ratings yet

- Sample Invitation LetterDocument1 pageSample Invitation LetterRaymundo EirahNo ratings yet

- Scanned With CamscannerDocument31 pagesScanned With CamscannerRaymundo EirahNo ratings yet

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- 244585723Document41 pages244585723Raymundo EirahNo ratings yet

- ScheduleDocument1 pageScheduleRaymundo EirahNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- Executive Agencies Act, Cap 245Document10 pagesExecutive Agencies Act, Cap 245Jeremia MtobesyaNo ratings yet

- Sarbanes Oxley ActDocument6 pagesSarbanes Oxley ActBiggun554No ratings yet

- This Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewDocument5 pagesThis Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewNhel AlvaroNo ratings yet

- Module Two Planning - Course NotesDocument25 pagesModule Two Planning - Course NotesZwivhuya MaimelaNo ratings yet

- Financial Disclosures Checklist: General InstructionsDocument35 pagesFinancial Disclosures Checklist: General InstructionsPaulineBiroselNo ratings yet

- CA Final Audit Revision MarkedDocument4 pagesCA Final Audit Revision MarkedSARASWATHI SNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Management Representation Letter IAS 580Document20 pagesManagement Representation Letter IAS 580Mehdi LombardoNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Audit Chapter 3Document18 pagesAudit Chapter 3Nur ShahiraNo ratings yet

- Principles and Practice of AuditingDocument80 pagesPrinciples and Practice of AuditingManoj KumarNo ratings yet

- Bank of Kigali Limited: Financially Transforming LivesDocument3 pagesBank of Kigali Limited: Financially Transforming LivesBank of KigaliNo ratings yet

- Auditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFDocument51 pagesAuditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (16)

- Aprish 2019 - 22589 (Rev)Document5 pagesAprish 2019 - 22589 (Rev)In InNo ratings yet

- Chapter 2 Risk Assessments and Internal ControlDocument16 pagesChapter 2 Risk Assessments and Internal ControlSteffany RoqueNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument8 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestNithyashree RajagopalanNo ratings yet

- Principles of Auditing Lecture 5Document4 pagesPrinciples of Auditing Lecture 5Isaac PortelliNo ratings yet

- Chapter 5 Audit Planning and Documentation: Answer 1Document7 pagesChapter 5 Audit Planning and Documentation: Answer 1AhmadYaseenNo ratings yet

- Auditing, Kabucho MwangiDocument22 pagesAuditing, Kabucho MwangiKafonyi JohnNo ratings yet

- Aud Theory CompiledDocument495 pagesAud Theory Compiledaperez1105100% (1)

- ICICI Bank FinancialDocument175 pagesICICI Bank FinancialRahul NishadNo ratings yet

- Part B-Professional Accountant in Public PracticeDocument58 pagesPart B-Professional Accountant in Public PracticeAlliahDataNo ratings yet

- External Auditing As A Supporting Tool For ManagementDocument54 pagesExternal Auditing As A Supporting Tool For ManagementTasmiaNo ratings yet

- Presentation 1 Auditing TheoDocument21 pagesPresentation 1 Auditing TheoMhegan ManarangNo ratings yet

- AAA Student Book (2021)Document122 pagesAAA Student Book (2021)Nam Nguyễn AnhNo ratings yet

- Financials InfosysDocument155 pagesFinancials InfosysvishnuNo ratings yet

- Activity Sheet - Module 7Document10 pagesActivity Sheet - Module 7Chris JacksonNo ratings yet

- Cadmn e PDFDocument420 pagesCadmn e PDFRajesh BabuNo ratings yet

Auditing The

Auditing The

Uploaded by

Raymundo Eirah0 ratings0% found this document useful (0 votes)

12 views3 pageschap 1 audit

Original Title

auditing the

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentchap 1 audit

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesAuditing The

Auditing The

Uploaded by

Raymundo Eirahchap 1 audit

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

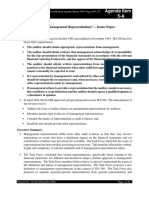

Which of the following will most likely indicate the existence of related parties?

1) Writing down obsolete inventory prior to year end

2) Failing to correct deficiencies in the client's internal control

3) An unexplained increase in gross margin

4) Borrowing money at a rate significantly below the market rate

4) Borrowing money at a rate significantly below the market rate

Which of the following is least likely to be included in the auditor's engagement letter?

1) Details about the preliminary audit strategy

2) Overview of the objectives of the engagement

3) Statement that management is responsible for the financial statements

4) Description of the level of assurance obtained when conducting the audit

1) Details about the preliminary audit strategy

Analytical procedures used in planning an audit should focus on identifying

1) Material weaknesses in internal control

2) The predictability of financial data from individual transactions

3) The various assertions that are embodied in the financial statements

4) Areas that may represent specific risks relevant to the audit

4) Areas that may represent specific risks relevant to the audit

When approached to perform an audit for the first time, the CPA should make inquires

of the predecessor auditor. This is a necessary procedure because the predecessor

may be able to provide the successor with information that will assist the successor in

determining whether

1) the predecessor's work should be used

2) the company follows the policy of rotating its auditors

3) in the predecessor's opinion, internal control of the company has been satisfactory

4) the engagement should be accepted

4) the engagement should be accepted

A successor would most likely make specific inquiries of the predecessor auditor

regarding

1) specialized accounting principles of the client's industry

2) the competency of the client's internal audit staff

3) the uncertainty inherent in applying sampling procedures

4) disagreements with management as to auditing procedures

4) disagreements with management as to auditing procedures

Which of the following circumstances would most likely pose the greatest risk in

accepting a new audit engagement?

1) staff will need to be rescheduled to cover this client

2) There will be a client-imposed scope limitation

3) The firm will have to hire a specialist in one audit area

4) The client's financial reporting system has been in place for 10 years

2) There will be a client-imposed scope limitation

Which one of the following statements is correct concerning the concept of materiality?

1) Materiality is determined by reference to guidelines established by the AICPA

2) Materiality depends only on the dollar amount of an item relative to other items in the

financial statements

3) Materiality depends on the nature of an item rather than the dollar amount

4) Materiality is a matter of professional judgement

4) Materiality is a matter of professional judgement

In considering materiality for planning purposes, an auditor believes that misstatements

aggregating $10,000 will have a material effect on an entity's income statement, but the

misstatements will have to aggregate $20,000 to materially affect the balance sheet.

Ordinarily, it is appropriate to design audit procedures that are expected to detect

misstatements that aggregate

1) $10,000

2) $15,000

3) $20,000

4) $30,000

1) $10,000

A client decides not to record an auditor's proposed adjustments that collectively are not

material and wants the auditor to issue the report based on the unadjusted numbers.

Which of the following statements is correct regarding the financial statement

presentation?

1) The financial statements are free from material misstatement, and no disclosure is

required in the notes to the financial statements

2) The financial statements so not conform with GAAP

3) The financial statements contain unadjusted misstatements that should result in a

qualified opinion

4) The financial statements are free from material misstatement, but disclosure of the

proposed adjustment is required in the notes to the financial statements

1) The financial statements are free from material misstatement, and no disclosure is

required in the notes to the financial statements

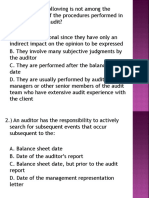

Which of the following procedures would a CPA least likely perform during the planning

stage of an audit?

1) Determine the timing of testing

2) Take a tour of the client's facilities

3) Perform inquiries of outside legal counsel regarding pending litigation

4) Determine the effect of information technology on the audit

3) Perform inquiries of outside legal counsel regarding pending litigation

A successor auditor's inquiries of the predecessor auditor should include questions

regarding

1) the number of engagement personnel the predecessor assigned to the engagement

2) the assessment of the objectivity of the client's internal audit staff

3) communications to management and those charged with governance regarding

significant deficiencies in internal control

4) the response rate for confirmations of accounts receivable

3) communications to management and those charged with governance regarding

significant deficiencies in internal control

In which of the following circumstances would an auditor of an issuer be least likely to

reevaluate established materiality levels?

1) The materiality level was established based on preliminary financial statement

amounts that differ significantly from actual amounts

2) The client disposed of a major portion of the client's business

3) The client released third-quarter results before the SEC-prescribed deadline

4) Significant new contractual arrangements draw attention to a particular aspect of a

client's business that is separately disclosed in the financial statements

3) The client released third-quarter results before the SEC-prescribe

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Auditing Summary NotesDocument23 pagesAuditing Summary NotesTuryamureeba Julius100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- Far-1 13Document3 pagesFar-1 13Raymundo EirahNo ratings yet

- Far-1 14Document3 pagesFar-1 14Raymundo EirahNo ratings yet

- Far-1 1Document4 pagesFar-1 1Raymundo EirahNo ratings yet

- Far-1 4Document3 pagesFar-1 4Raymundo Eirah100% (1)

- Far 1Document3 pagesFar 1Raymundo EirahNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Aud 2Document7 pagesAud 2Raymundo EirahNo ratings yet

- 1 Sample Confirmation Letter 1Document1 page1 Sample Confirmation Letter 1Raymundo EirahNo ratings yet

- Far-1 3Document2 pagesFar-1 3Raymundo EirahNo ratings yet

- Sample Invitation LetterDocument1 pageSample Invitation LetterRaymundo EirahNo ratings yet

- Scanned With CamscannerDocument31 pagesScanned With CamscannerRaymundo EirahNo ratings yet

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- 244585723Document41 pages244585723Raymundo EirahNo ratings yet

- ScheduleDocument1 pageScheduleRaymundo EirahNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- Executive Agencies Act, Cap 245Document10 pagesExecutive Agencies Act, Cap 245Jeremia MtobesyaNo ratings yet

- Sarbanes Oxley ActDocument6 pagesSarbanes Oxley ActBiggun554No ratings yet

- This Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewDocument5 pagesThis Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewNhel AlvaroNo ratings yet

- Module Two Planning - Course NotesDocument25 pagesModule Two Planning - Course NotesZwivhuya MaimelaNo ratings yet

- Financial Disclosures Checklist: General InstructionsDocument35 pagesFinancial Disclosures Checklist: General InstructionsPaulineBiroselNo ratings yet

- CA Final Audit Revision MarkedDocument4 pagesCA Final Audit Revision MarkedSARASWATHI SNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Management Representation Letter IAS 580Document20 pagesManagement Representation Letter IAS 580Mehdi LombardoNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Audit Chapter 3Document18 pagesAudit Chapter 3Nur ShahiraNo ratings yet

- Principles and Practice of AuditingDocument80 pagesPrinciples and Practice of AuditingManoj KumarNo ratings yet

- Bank of Kigali Limited: Financially Transforming LivesDocument3 pagesBank of Kigali Limited: Financially Transforming LivesBank of KigaliNo ratings yet

- Auditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFDocument51 pagesAuditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (16)

- Aprish 2019 - 22589 (Rev)Document5 pagesAprish 2019 - 22589 (Rev)In InNo ratings yet

- Chapter 2 Risk Assessments and Internal ControlDocument16 pagesChapter 2 Risk Assessments and Internal ControlSteffany RoqueNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument8 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestNithyashree RajagopalanNo ratings yet

- Principles of Auditing Lecture 5Document4 pagesPrinciples of Auditing Lecture 5Isaac PortelliNo ratings yet

- Chapter 5 Audit Planning and Documentation: Answer 1Document7 pagesChapter 5 Audit Planning and Documentation: Answer 1AhmadYaseenNo ratings yet

- Auditing, Kabucho MwangiDocument22 pagesAuditing, Kabucho MwangiKafonyi JohnNo ratings yet

- Aud Theory CompiledDocument495 pagesAud Theory Compiledaperez1105100% (1)

- ICICI Bank FinancialDocument175 pagesICICI Bank FinancialRahul NishadNo ratings yet

- Part B-Professional Accountant in Public PracticeDocument58 pagesPart B-Professional Accountant in Public PracticeAlliahDataNo ratings yet

- External Auditing As A Supporting Tool For ManagementDocument54 pagesExternal Auditing As A Supporting Tool For ManagementTasmiaNo ratings yet

- Presentation 1 Auditing TheoDocument21 pagesPresentation 1 Auditing TheoMhegan ManarangNo ratings yet

- AAA Student Book (2021)Document122 pagesAAA Student Book (2021)Nam Nguyễn AnhNo ratings yet

- Financials InfosysDocument155 pagesFinancials InfosysvishnuNo ratings yet

- Activity Sheet - Module 7Document10 pagesActivity Sheet - Module 7Chris JacksonNo ratings yet

- Cadmn e PDFDocument420 pagesCadmn e PDFRajesh BabuNo ratings yet