Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

19 viewsTheory in Audit

Theory in Audit

Uploaded by

Raymundo Eirahtheories chapter

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Crash and Boom StrategyDocument12 pagesCrash and Boom StrategyCarla Banessa Jimenez Reyes94% (31)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Far-1 13Document3 pagesFar-1 13Raymundo EirahNo ratings yet

- Far-1 14Document3 pagesFar-1 14Raymundo EirahNo ratings yet

- Far-1 1Document4 pagesFar-1 1Raymundo EirahNo ratings yet

- Far-1 4Document3 pagesFar-1 4Raymundo Eirah100% (1)

- Far 1Document3 pagesFar 1Raymundo EirahNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Aud 2Document7 pagesAud 2Raymundo EirahNo ratings yet

- 1 Sample Confirmation Letter 1Document1 page1 Sample Confirmation Letter 1Raymundo EirahNo ratings yet

- Far-1 3Document2 pagesFar-1 3Raymundo EirahNo ratings yet

- Sample Invitation LetterDocument1 pageSample Invitation LetterRaymundo EirahNo ratings yet

- Scanned With CamscannerDocument31 pagesScanned With CamscannerRaymundo EirahNo ratings yet

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- 244585723Document41 pages244585723Raymundo EirahNo ratings yet

- ScheduleDocument1 pageScheduleRaymundo EirahNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- Food PreservationDocument37 pagesFood PreservationCrisanta Tablizo Orendain GaviolaNo ratings yet

- Purchase Date # of Shares Amount Per Share Total Release Amount Release DateDocument4 pagesPurchase Date # of Shares Amount Per Share Total Release Amount Release DateAlyssa Pinar AñanaNo ratings yet

- ACH Credit / GIRO: Payment DetailsDocument2 pagesACH Credit / GIRO: Payment Detailsmelvin taurianusNo ratings yet

- Pay Slip For August 2017: Nuvoco Vistas Corporation LimitedDocument1 pagePay Slip For August 2017: Nuvoco Vistas Corporation LimitedkamalNo ratings yet

- Qazi Naseem Attendence OctDocument11 pagesQazi Naseem Attendence OctnajamNo ratings yet

- JLMS Access Floor For 590-22Document10 pagesJLMS Access Floor For 590-22Christine TanNo ratings yet

- Intermediate Accounting 9Th Edition Spiceland Solutions Manual Full Chapter PDFDocument36 pagesIntermediate Accounting 9Th Edition Spiceland Solutions Manual Full Chapter PDFnorman.ketcham702100% (20)

- "A Parcel of Land Situated in Sitio Sangab, Municipality of Tanay, Province of Rizal.Document2 pages"A Parcel of Land Situated in Sitio Sangab, Municipality of Tanay, Province of Rizal.Mark RuzNo ratings yet

- Balance of Payments AUSDocument36 pagesBalance of Payments AUSKoushik SenNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- Purchase Agreement TemplateDocument3 pagesPurchase Agreement TemplatesaadNo ratings yet

- td675 Mixed Flow Pump Datasheetr1Document2 pagestd675 Mixed Flow Pump Datasheetr1Carlos CastañedaNo ratings yet

- Analisis Efektifitas Dan Efisiensi Pajak DaerahDocument12 pagesAnalisis Efektifitas Dan Efisiensi Pajak DaerahSabastian Leonardo100% (1)

- Assignment 1Document3 pagesAssignment 1Vasu GuptaNo ratings yet

- Factoring / Distributive Property Worksheet: Factor The ExpressionsDocument2 pagesFactoring / Distributive Property Worksheet: Factor The Expressionssubir216No ratings yet

- Intro To Engineering EconomicsDocument12 pagesIntro To Engineering EconomicsShayan AmjadNo ratings yet

- ECON7180Document3 pagesECON7180t tNo ratings yet

- Acceptable Physicochemical Properties Thin-Walled Large & Special Hand-MadeDocument4 pagesAcceptable Physicochemical Properties Thin-Walled Large & Special Hand-MadeMuhammad TayyabNo ratings yet

- STA408 AppendixDocument2 pagesSTA408 AppendixMUHAMMAD SYAZWAN MOHD SUKRINo ratings yet

- SSG 07Document15 pagesSSG 07bassim amrallaNo ratings yet

- Catálogo StraumannDocument372 pagesCatálogo StraumannEva Maria Perez MonteroNo ratings yet

- Applied Economics: Quarter 1 - Module 2 Application of EconomicsDocument8 pagesApplied Economics: Quarter 1 - Module 2 Application of EconomicsLimar Anasco EscasoNo ratings yet

- Appendix 44: Liquidation ReportDocument16 pagesAppendix 44: Liquidation ReportRendrey MacaraegNo ratings yet

- BNBR Q1 2019 PDFDocument129 pagesBNBR Q1 2019 PDFetud3clNo ratings yet

- Full Design Report For Digester SlabDocument7 pagesFull Design Report For Digester SlabFrederick BruceNo ratings yet

- Chapter I.Document4 pagesChapter I.keith tambaNo ratings yet

- Standard Costing Set 1 - 35f0e748 E5df 44db b107 5c3908d27f33Document3 pagesStandard Costing Set 1 - 35f0e748 E5df 44db b107 5c3908d27f33kolidishant692No ratings yet

- Innovative Equipments - 2023Document6 pagesInnovative Equipments - 2023imranNo ratings yet

- Insurance Project FinalDocument17 pagesInsurance Project Finalamitkmara0% (1)

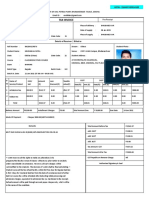

Theory in Audit

Theory in Audit

Uploaded by

Raymundo Eirah0 ratings0% found this document useful (0 votes)

19 views3 pagestheories chapter

Original Title

theory in audit

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttheories chapter

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views3 pagesTheory in Audit

Theory in Audit

Uploaded by

Raymundo Eirahtheories chapter

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Which of the following circumstances most likely would cause the auditor to suspect that there

are material misstatements in the entity's financial statements?

1) The entity's management places no emphasis on meeting publicized earnings projections

2) Significant differences between the physical inventory count and the accounting records are

not investigated

3) Monthly bank reconciliations ordinarily include several large outstanding checks

4) Cash transactions are electronically processed and recorded, leaving no paper audit trail

2) Significant differences between the physical inventory count and the accounting records are

not investigated

Which of the following statements describes why a properly designed and executed audit may

not detect a material misstatement in the financial statements resulting from fraud?

1) Audit procedures that are effective for detecting an unintentional misstatements may be

ineffective for an intentional misstatement that is concealed through collusion

2) An audit is designed to provide reasonable assurance of detecting material errors, but there is

no similar responsibility concerning fraud

3) the factors considered in assessing control risk indicated an increased risk of intentional

misstatements, but only a low risk of unintentional errors in the financial statements

4) The auditor did not consider factors influencing audit risk for account balances that have

effects pervasive to the financial statements as a whole

1) Audit procedures that are effective for detecting an unintentional misstatements may be

ineffective for an intentional misstatement that is concealed through collusion

Prior to, or in conjunction with, the information-gathering procedures for an audit, audit team

members should discuss the potential for material misstatement due to fraud. Which of the

following best characterizes the mindset that the audit team should maintain during this

discussion?

1) Presumptive

2) Judgmental

3) Criticizing

4) Questioning

4) Questioning

Some account balances, such as those for pensions and leases, are the result of complex

calculations. The susceptibility to material misstatements in these types of accounts is defined as

1) audit risk

2) detection risk

3) inherent risk

4) sampling risk

3) inherent risk

As the acceptable level of detection risk decreases, the auditor may do one or more of the

following except change the

1) nature of audit procedures to more effective procedures

2) timing of audit procedures, by perhaps performing them at year-end rather than an interim

date

3) extent of audit procedures, by perhaps using larger sample sizes

4) assurances provided by audit procedures to a lower level

4) assurances provided by audit procedures to a lower level

Inherent risk and control risk differ from planned detection risk in that they

1) arise from the misapplication of auditing procedures

2) may be assessed in either quantitative or nonquantitative terms

3) exist independently of the financial statement audit

4) can be changed at the auditor's discretion

3) exist independently of the financial statement audit

Which of the following does not increase the need for sufficient appropriate audit evidence?

1) A lower acceptable level of detection risk

2) An increase in the assessed control risk

3) A lower acceptable audit risk

4) A decrease in the assessed inherent risk

4) A decrease in the assessed inherent risk

As lower acceptable levels of both audit risk and materiality are established, the auditor should

plan more work on individual accounts to

1) find smaller misstatements

2) find larger misstatements

3) increase the performance materiality in the accounts

4) increase inherent risk in the accounts

1) find smaller misstatements

Based on the evidence gathered and evaluated, an auditor decides to increase the assessed level

of control risk from that originally planned. To achieve an overall audi risk that is substantially

the same as planned audit risk level, the auditor could

1) decrease detection risk

2) increase materiality levels

3) decrease substantive testing

4) increase inherent risk

1) decrease detection risk

Which of the following procedures would a CPA most likely perform during the planning stage

of the audit?

1) Evaluate the reasonableness of management's allowance for doubtful accounts

2) Determine areas where there is a higher risk of material misstatements

3) Evaluate the significance of uncorrected misstatements

4) Confirm a sample of accounts receivable

2) Determine areas where there is a higher risk of material misstatements

Dan, CPA. has been engaged to audit Modern Home, a manufacturing company that specialized

in furniture. Which of the following matters related to the year under audit would most likely

result in an increase of inherent risk?

1) The furniture industry has experienced an overall increase in demand

2) Modern Home recently engaged in a complex derivative transaction

3) Modern Home experienced an increase in working capital

4) Modern Home purchased expensive new equipment in the current year

2) Modern Home recently engaged in a complex derivative transaction

After making a preliminary assessment of the risk of material misstatement during planning and

beginning t apply audit procedures, an auditor determines that this risk is actually higher than

anticipated. Which would be the most likely effect of this finding on the auditor's desired level of

detection risk and the overall level of audit risk, as compared to the levels originally planned?

1) increase/decrease/same - Auditor's desired level of detection risk

2) lower/higher/same - Overall level of audit risk

Decrease auditor's desired level of detection risk

Lower overall level of audit risk

Which of the following would not be considered an inherent limitation of the potential

effectiveness of an entity's internal control structure?

1) Incompatible duties

2) Management override

3) Mistakes in judgement

4) Collusion among employees

1) Incompatible duties

Actions, policies, and procedures that reflect the overall attitude of management,

directors, and owners of an entity about internal control relate to which of the following

internal control components?

1) Control environment

2) Information and communication

3) Risk assessment

4) Monitoring

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Crash and Boom StrategyDocument12 pagesCrash and Boom StrategyCarla Banessa Jimenez Reyes94% (31)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Far-1 13Document3 pagesFar-1 13Raymundo EirahNo ratings yet

- Far-1 14Document3 pagesFar-1 14Raymundo EirahNo ratings yet

- Far-1 1Document4 pagesFar-1 1Raymundo EirahNo ratings yet

- Far-1 4Document3 pagesFar-1 4Raymundo Eirah100% (1)

- Far 1Document3 pagesFar 1Raymundo EirahNo ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Aud 2Document7 pagesAud 2Raymundo EirahNo ratings yet

- 1 Sample Confirmation Letter 1Document1 page1 Sample Confirmation Letter 1Raymundo EirahNo ratings yet

- Far-1 3Document2 pagesFar-1 3Raymundo EirahNo ratings yet

- Sample Invitation LetterDocument1 pageSample Invitation LetterRaymundo EirahNo ratings yet

- Scanned With CamscannerDocument31 pagesScanned With CamscannerRaymundo EirahNo ratings yet

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- 244585723Document41 pages244585723Raymundo EirahNo ratings yet

- ScheduleDocument1 pageScheduleRaymundo EirahNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Structural Change Model PDFDocument10 pagesStructural Change Model PDFRaymundo EirahNo ratings yet

- Food PreservationDocument37 pagesFood PreservationCrisanta Tablizo Orendain GaviolaNo ratings yet

- Purchase Date # of Shares Amount Per Share Total Release Amount Release DateDocument4 pagesPurchase Date # of Shares Amount Per Share Total Release Amount Release DateAlyssa Pinar AñanaNo ratings yet

- ACH Credit / GIRO: Payment DetailsDocument2 pagesACH Credit / GIRO: Payment Detailsmelvin taurianusNo ratings yet

- Pay Slip For August 2017: Nuvoco Vistas Corporation LimitedDocument1 pagePay Slip For August 2017: Nuvoco Vistas Corporation LimitedkamalNo ratings yet

- Qazi Naseem Attendence OctDocument11 pagesQazi Naseem Attendence OctnajamNo ratings yet

- JLMS Access Floor For 590-22Document10 pagesJLMS Access Floor For 590-22Christine TanNo ratings yet

- Intermediate Accounting 9Th Edition Spiceland Solutions Manual Full Chapter PDFDocument36 pagesIntermediate Accounting 9Th Edition Spiceland Solutions Manual Full Chapter PDFnorman.ketcham702100% (20)

- "A Parcel of Land Situated in Sitio Sangab, Municipality of Tanay, Province of Rizal.Document2 pages"A Parcel of Land Situated in Sitio Sangab, Municipality of Tanay, Province of Rizal.Mark RuzNo ratings yet

- Balance of Payments AUSDocument36 pagesBalance of Payments AUSKoushik SenNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- Purchase Agreement TemplateDocument3 pagesPurchase Agreement TemplatesaadNo ratings yet

- td675 Mixed Flow Pump Datasheetr1Document2 pagestd675 Mixed Flow Pump Datasheetr1Carlos CastañedaNo ratings yet

- Analisis Efektifitas Dan Efisiensi Pajak DaerahDocument12 pagesAnalisis Efektifitas Dan Efisiensi Pajak DaerahSabastian Leonardo100% (1)

- Assignment 1Document3 pagesAssignment 1Vasu GuptaNo ratings yet

- Factoring / Distributive Property Worksheet: Factor The ExpressionsDocument2 pagesFactoring / Distributive Property Worksheet: Factor The Expressionssubir216No ratings yet

- Intro To Engineering EconomicsDocument12 pagesIntro To Engineering EconomicsShayan AmjadNo ratings yet

- ECON7180Document3 pagesECON7180t tNo ratings yet

- Acceptable Physicochemical Properties Thin-Walled Large & Special Hand-MadeDocument4 pagesAcceptable Physicochemical Properties Thin-Walled Large & Special Hand-MadeMuhammad TayyabNo ratings yet

- STA408 AppendixDocument2 pagesSTA408 AppendixMUHAMMAD SYAZWAN MOHD SUKRINo ratings yet

- SSG 07Document15 pagesSSG 07bassim amrallaNo ratings yet

- Catálogo StraumannDocument372 pagesCatálogo StraumannEva Maria Perez MonteroNo ratings yet

- Applied Economics: Quarter 1 - Module 2 Application of EconomicsDocument8 pagesApplied Economics: Quarter 1 - Module 2 Application of EconomicsLimar Anasco EscasoNo ratings yet

- Appendix 44: Liquidation ReportDocument16 pagesAppendix 44: Liquidation ReportRendrey MacaraegNo ratings yet

- BNBR Q1 2019 PDFDocument129 pagesBNBR Q1 2019 PDFetud3clNo ratings yet

- Full Design Report For Digester SlabDocument7 pagesFull Design Report For Digester SlabFrederick BruceNo ratings yet

- Chapter I.Document4 pagesChapter I.keith tambaNo ratings yet

- Standard Costing Set 1 - 35f0e748 E5df 44db b107 5c3908d27f33Document3 pagesStandard Costing Set 1 - 35f0e748 E5df 44db b107 5c3908d27f33kolidishant692No ratings yet

- Innovative Equipments - 2023Document6 pagesInnovative Equipments - 2023imranNo ratings yet

- Insurance Project FinalDocument17 pagesInsurance Project Finalamitkmara0% (1)