Professional Documents

Culture Documents

Week 2 Tutorial Problems

Week 2 Tutorial Problems

Uploaded by

WOP INVESTOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 2 Tutorial Problems

Week 2 Tutorial Problems

Uploaded by

WOP INVESTCopyright:

Available Formats

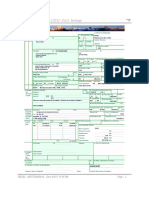

Problem 5.

1 Anne Dietz in Changi #3 (Singapore)

Anne Dietz lives in Singapore, but is making her first business trip to Sydney,

Australia. Standing in Singapore's new terminal #3 at Changi Airport, she looks at the

foreign exchange quotes posted over the FX trader's booth. She wishes to exchange

1,000 Singapore dollars (S$ or SGD) for Australian dollars (A$ or AUD).

a. What is the Singapore dollar to Australian dollar cross rate?

b. How many Australian dollars will Anne get for her Singapore dollars?

Assumptions Values

Singapore dollars to be exchanged SGD 1,000.00

Spot rate (SGD = 1.00 USD) 1.3400

Spot rate (USD = 1.00 AUD) 0.7640

a. What is the SGD per AUD cross rate?

1.0238

SGD per AUD = SGD/USD x USD/SGD

b. How many Australian dollars will Anne get?

AUD 977

Converting SGD to AUD at the calculated cross rate.

Problem 5.4 Andreas Broszio (Geneva)

Andreas Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following

quotes for Swiss francs against the dollar for spot, one-month forward, 3-months forward, and 6-months forward.

Spot exchange rate:

Bid rate SF 1.2575/$

Ask rate SF 1.2585/S

One-month forward 10 to 15

3-months forward 14 to 22

6-months forward 20 to 30

a. Calculate outright quotes for bid and ask, and the number of points spread between each.

b. What do you notice about the spread as quotes evolve from spot toward six months?

c. What is the 6-month Swiss bill rate?

Assumptions Values

Spot exchange rate:

Bid rate (SF/$) 1.2575

Ask rate (SF/$) 1.2585

One-month forward 10 to 15

3-months forward 14 to 22

6-months forward 20 to 30

a. Calculate outright quotes Bid Ask Spread

One-month forward 1.2585 1.2600 0.0015

3-months forward 1.2589 1.2607 0.0018

6-months forward 1.2595 1.2615 0.0020

b. What do you notice about the spread?

It widens, most likely a result of thinner and thinner trading volume.

c. Added/optional question: What is the 6-month Swiss bill rate?

Spot rate, midrate (SF/$) 1.2580

Six-month forward rate, midrate (SF/$) 1.2605

Maturity (days) 180

6-month US dollar treasury rate (yield) 4.200%

Solving for implied SF interest rate 6.450%

Check calculation: the six-month forward 1.2719

Problem 5.10 Swissie Triangular Arbitrage

The following exchange rates are available to you. (You can buy or sell at the stated rates.)

Mt. Fuji Bank ¥92.00/$

Mt. Rushmore Bank SF1.02/$

Mt Blanc Bank ¥90.00/SF

Assume you have an initial SF12,000,000. Can you make a profit via triangular arbitrage?

If so, show the steps and calculate the amount of profit in Swiss francs (Swissies).

Assumptions Values

Beginning funds in Swiss francs (SF) 12,000,000.00

Mt. Fuji Bank (yen/$) 92.00

Mt. Rushmore Bank (SF/$) 1.0200

Matterhorn Bank (yen/SF) 90.00

Try Number 1: Start with SF to $

Step 1: SF to $ 11,764,705.88

Step 2: $ to yen 1,082,352,941.18

Step 3: yen to SF 12,026,143.79

Profit? 26,143.79

A profit.

Try Number 2: Start with SF to yen

Step 1: SF to yen 1,080,000,000.00

Step 2: yen to $ 11,739,130.43

Step 3: $ to SF 11,973,913.04

Profit? (26,086.96)

A loss.

Problem 5.13 Venezuelan Bolivar (A)

The Venezuelan government officially floated the Venezuelan bolivar (Bs) in February of 2002.

Within weeks, its value had moved from the pre-float fix of BS778/$ to Bs1025/$.

a. Is this a devaluation or depreciation?

b. By what percentage did its value change?

Assumptions Values

Fixed rate of exchange, Bs/$ 778

New freely floating rate (2 weeks later), Bs/$ 1,025

a. Is this a devaluation or depreciation?

Devaluation

then

This is a case in which a government has changed its currency from a

Depreciation

governmentally determined fixed rate, to a regime in which the currency

is allowed to change in value based on supply and demand forces in the

market. As a result of the move, the currency's value in this case was a

"depreciation" against the U.S. dollar.

b. By what percentage did its value change?

Percentage devaluation is: -24.10%

% Chg = (S1 - S2) / (S2)

Problem 5.15 Indirect Forward Premium on the Australian dollar

Calculate the forward premium on the Australian dollar (the Australian dollar is the home currency) if the spot rate is

€0.6151/A$ and the 3-month forward rate is €0.6216/A$.

Quoted 90-day Percent premium

Assumptions Spot rate Forward rate or discount on euro

Days forward 90

European euro (€ per A$) € 0.6151 € 0.6216

Calculation formula for the indirect quote on the dollar:

Percent premium = (S-F)/(F) x (360/90) -4.1828%

The euro would be selling forward at a premium against the Australian dollar, or equivalently, the Australian dollar is selling

forward against the euro at a discount.

In a way, the terminology is a bit tricky. One might say that the "forward premium is a premium."

Check calculation

One way to check percentage change calculations is to invert each of the currency

quotes (1/(€/A$)), and recalculate the quote using the direct quotation formula.

Australian dollar (A$ per €) $1.6258 $1.6088

Percent discount = (F-S)/(S) x (360/90) -4.1828%

Problem 5.16 Direct Forward Discount on the Dollar

Calculate the forward discount on the dollar (the dollar is the home currency) if the spot rate is spot rate is $1.5800/£ and

the 6-month forward rate is $1.5550/£

Quoted 180-day Percent premium

Assumptions Spot rate Forward rate or discount

Days forward 180

Exchange rate, US$/£ $ 1.5800 $ 1.5550

Calculation formula for the direct quote on the dollar:

Percent premium = ( Forward - Spot ) / ( Spot ) x ( 360 / 180 ) -3.1646%

The forward rate requires fewer US dollars in exchange for pounds than the current spot rate. The dollar is therefore

selling forward at a premium against the pound (and the pound is simultaneously selling forward at a discount versus the

US dollar).

Check calculation

Inverting the quotes (£/US$) £0.6329 £0.6431

Percent forward premium = ( Spot - Forward ) / ( Forward ) x ( 360 / 180 ) -3.1646%

Problem 5.17 Mexican Peso - European Euro Cross Rate

Calculate the cross rate between the Mexican peso (Ps) and the euro (€ ) from the

following two spot rates: Ps12.45/$ and € 0.7550/$.

Assumptions Exchange rate

Mexican peso, pesos/dollar (Ps/$) 12.45

European euro, euros/dollar (€/$) 0.7550

Calculated cross rate, pesos/euro 16.4901

pesos/euro = (Ps/$) / (€/$)

or equivalently, euros/peso (€/Ps) 0.0606

You might also like

- Central Bank Digital Currency - PPTDocument13 pagesCentral Bank Digital Currency - PPTSachin ChauhanNo ratings yet

- Week 3 Tutorial ProblemsDocument6 pagesWeek 3 Tutorial ProblemsWOP INVESTNo ratings yet

- Week 3 Tutorial ProblemsDocument6 pagesWeek 3 Tutorial ProblemsWOP INVESTNo ratings yet

- Soalan Webex 3Document2 pagesSoalan Webex 3lenakaNo ratings yet

- MBF13e Chap10 Pbms - FinalDocument17 pagesMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- MBF14e Chap10 Transaction PbmsDocument19 pagesMBF14e Chap10 Transaction PbmsQurratul Asmawi100% (2)

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Problem 11.3Document1 pageProblem 11.3SamerNo ratings yet

- Ch3 7Document61 pagesCh3 7katie0204100% (1)

- 6.18 East Asiatic CompanyDocument2 pages6.18 East Asiatic Companydummy yummyNo ratings yet

- Chap07 Pbms MBF12eDocument22 pagesChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- Chapter 14 HW SolutionDocument10 pagesChapter 14 HW SolutionIsmail Özdemir100% (1)

- Chapter 6 Excel - CIA1Document10 pagesChapter 6 Excel - CIA1tableroof100% (1)

- Blades Inc Case Solution CH 2Document3 pagesBlades Inc Case Solution CH 2MUZNA100% (3)

- Chapter 5Document1 pageChapter 5abcNo ratings yet

- Madura IFM10e IM Ch04Document11 pagesMadura IFM10e IM Ch04waqar hattarNo ratings yet

- Spot Exchange Markets. Quiz QuestionsDocument14 pagesSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Exercises Topic 2 With AnswersDocument2 pagesExercises Topic 2 With AnswersfatehahNo ratings yet

- A Case Study On Final)Document1 pageA Case Study On Final)Dipayan_luNo ratings yet

- Philippine Derivative Market, A StudyDocument15 pagesPhilippine Derivative Market, A Studybookworm_1550% (6)

- BFC5935 - Tutorial 1 Solutions PDFDocument7 pagesBFC5935 - Tutorial 1 Solutions PDFXue Xu100% (1)

- Blades Case, IncDocument2 pagesBlades Case, IncAhmed Jan Dahri100% (3)

- Multiple ChoiceDocument3 pagesMultiple ChoicePeng GuinNo ratings yet

- Solutions Chapter 5 Balance of PaymentsDocument13 pagesSolutions Chapter 5 Balance of Paymentsfahdly67% (3)

- Foreign Exchange ArithmeticDocument9 pagesForeign Exchange Arithmeticmeghaparekh11No ratings yet

- Week 5 Tutorial ProblemsDocument6 pagesWeek 5 Tutorial ProblemsWOP INVESTNo ratings yet

- Week 5 Tutorial ProblemsDocument6 pagesWeek 5 Tutorial ProblemsWOP INVESTNo ratings yet

- Caobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractDocument4 pagesCaobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractMilica BarjaktarevicNo ratings yet

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- BladesDocument7 pagesBladestausif080604No ratings yet

- Security Market Indicator Series - STDocument36 pagesSecurity Market Indicator Series - STEng Hams100% (1)

- Chapter 8Document22 pagesChapter 8mark leeNo ratings yet

- This Study Resource Was: Blades Inc. Chapter 7Document6 pagesThis Study Resource Was: Blades Inc. Chapter 7rizwan aliNo ratings yet

- Chapter 7 International Arbitrage and IRPDocument11 pagesChapter 7 International Arbitrage and IRPRim RimNo ratings yet

- MBF14e Chap02 Monetary System PbmsDocument13 pagesMBF14e Chap02 Monetary System PbmsKarlNo ratings yet

- Int Finance Practice - SolDocument7 pagesInt Finance Practice - SolAlexisNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Blades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)Document8 pagesBlades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)raihans_dhk337894% (18)

- Chapter 01 Multinational Financial Management An OverviewDocument45 pagesChapter 01 Multinational Financial Management An OverviewGunawan Adi Saputra0% (1)

- Quiz 8Document2 pagesQuiz 8朱潇妤No ratings yet

- International Finance Assignment - SolutionDocument5 pagesInternational Finance Assignment - SolutionFagbola Oluwatobi OmolajaNo ratings yet

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- CH 7Document7 pagesCH 7Asad Ehsan Warraich100% (3)

- Week 4 Tutorial ProblemsDocument5 pagesWeek 4 Tutorial ProblemsWOP INVESTNo ratings yet

- BUS322Tutorial5 SolutionDocument20 pagesBUS322Tutorial5 Solutionjacklee191825% (4)

- Chapter 7 Facility LayoutDocument6 pagesChapter 7 Facility LayoutAndrew Miranda100% (1)

- Exercise Foreign Exchange Market - SOLVEDDocument3 pagesExercise Foreign Exchange Market - SOLVEDamer_wah100% (1)

- Blade's CaseDocument8 pagesBlade's CaseEly HarunoNo ratings yet

- FINMAN Answer KeyDocument7 pagesFINMAN Answer KeyReginald ValenciaNo ratings yet

- 6 International Parity Relationships and Forecasting Foreign Exchange RatesDocument57 pages6 International Parity Relationships and Forecasting Foreign Exchange Ratesreena2412No ratings yet

- Chapter 06 International PaDocument59 pagesChapter 06 International PaLiaNo ratings yet

- FIM CH 03 Non-Depository Financial InstitutionsDocument30 pagesFIM CH 03 Non-Depository Financial InstitutionsMarina KhanNo ratings yet

- Tutorial FIN221 Chapter 2 (Q&A) - Part TwoDocument11 pagesTutorial FIN221 Chapter 2 (Q&A) - Part TwojojojoNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- Chapter 17 Investments ExercisesDocument18 pagesChapter 17 Investments ExercisesAila Marie MovillaNo ratings yet

- Ex - TransExposure SOLDocument5 pagesEx - TransExposure SOLAlexisNo ratings yet

- Chapter 19 Foreign Exchange Risk: 1. ObjectivesDocument31 pagesChapter 19 Foreign Exchange Risk: 1. ObjectivesDerickBrownThe-Gentleman100% (1)

- Chapter9Solutions (Questions)Document14 pagesChapter9Solutions (Questions)ayaNo ratings yet

- MBF14e Chap06 Parity Condition PbmsDocument23 pagesMBF14e Chap06 Parity Condition Pbmsanon_355962815No ratings yet

- MBS12 FeDocument2 pagesMBS12 FewertyuoiuNo ratings yet

- FXSumsDocument5 pagesFXSumsPRANJAL BANSALNo ratings yet

- IfDocument14 pagesIfĐặng Thuỳ HươngNo ratings yet

- Chap06 Pbms MBF12eDocument16 pagesChap06 Pbms MBF12eBeatrice BallabioNo ratings yet

- Total Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inDocument5 pagesTotal Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inFolk BluesNo ratings yet

- Week 1 Tutorial ProblemsDocument7 pagesWeek 1 Tutorial ProblemsWOP INVESTNo ratings yet

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- Week 4 Tutorial ProblemsDocument5 pagesWeek 4 Tutorial ProblemsWOP INVESTNo ratings yet

- Week 5 Tutorial QuestionsDocument2 pagesWeek 5 Tutorial QuestionsWOP INVESTNo ratings yet

- GEP Jan 2024 Regional Highlights LACDocument3 pagesGEP Jan 2024 Regional Highlights LACaoerdannyNo ratings yet

- Market SupplyDocument7 pagesMarket SupplyAnis Syakira BidresNo ratings yet

- For Check RequestDocument6 pagesFor Check RequestPaul LeeNo ratings yet

- Worksheet 2 (Reading) - English XDocument2 pagesWorksheet 2 (Reading) - English XVardaan BajajNo ratings yet

- ContemporaryDocument7 pagesContemporaryMia AstilloNo ratings yet

- Donation Is SolelyDocument2 pagesDonation Is SolelyAnthony Angel Tejares50% (2)

- Nine Tenets of MercantilismDocument2 pagesNine Tenets of Mercantilismftacct5No ratings yet

- Level of Knowledge: Objective:: Syllabus: International Business - Laws and PracticesDocument6 pagesLevel of Knowledge: Objective:: Syllabus: International Business - Laws and PracticesAna Carmela DomingoNo ratings yet

- IBM - Unit - IIDocument38 pagesIBM - Unit - IIKarthikeyan RNo ratings yet

- Chapter 1 - Introduction - Trade Theories (Part 3 of 3)Document22 pagesChapter 1 - Introduction - Trade Theories (Part 3 of 3)kirthi nairNo ratings yet

- Principles of Corporate Finance 10 Ed PDFDocument57 pagesPrinciples of Corporate Finance 10 Ed PDFOlivia BaluNo ratings yet

- SWOT Analysis of Banking IndustryDocument13 pagesSWOT Analysis of Banking IndustryApoorv94% (18)

- Role of Banks in Marine Insurance: Submitted To: Shri.N.Chandra Mohan Submitted By: K.Samhitha ROLL NO-FS10-017Document8 pagesRole of Banks in Marine Insurance: Submitted To: Shri.N.Chandra Mohan Submitted By: K.Samhitha ROLL NO-FS10-017Samhitha KandlakuntaNo ratings yet

- Contact Person Company Name IndustryDocument6 pagesContact Person Company Name IndustryDinesh KumarNo ratings yet

- F6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentDocument16 pagesF6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentAbraham JuleNo ratings yet

- Case Study - GCC Economic Outlook PDFDocument18 pagesCase Study - GCC Economic Outlook PDFMhmd KaramNo ratings yet

- Presentation On Roads & Highways Department Presented By:: Group-2Document10 pagesPresentation On Roads & Highways Department Presented By:: Group-2Golam MostofaNo ratings yet

- Final Guidelines For Payment BanksDocument3 pagesFinal Guidelines For Payment BanksAnkaj MohindrooNo ratings yet

- Auto MobDocument8 pagesAuto Mobdpriyaghosh6269No ratings yet

- Pragyapan Patra For Auditor Dai NewDocument1 pagePragyapan Patra For Auditor Dai NewPL ConsultantsNo ratings yet

- Full International Business 15Th Edition Daniels Test Bank Online PDF All ChapterDocument56 pagesFull International Business 15Th Edition Daniels Test Bank Online PDF All Chapterdebrabourque854313100% (7)

- Wto EssayDocument6 pagesWto Essayapi-272198292No ratings yet

- أثر الاستثمار الأجنبي المباشر على معدلات البطالهDocument5 pagesأثر الاستثمار الأجنبي المباشر على معدلات البطالهpurrrlamNo ratings yet

- Hero Honda A SWOT AnalysisDocument3 pagesHero Honda A SWOT AnalysisKarthik VaratharajanNo ratings yet

- Tutorial 1 Week 3Document2 pagesTutorial 1 Week 3Gaiva MuriNo ratings yet

- International Finance DEC 2023Document3 pagesInternational Finance DEC 2023Sneha DograNo ratings yet

- Macroeconomic Indicators of Nepal 2021 JulyDocument26 pagesMacroeconomic Indicators of Nepal 2021 JulypisabandmutNo ratings yet

- SIA 2024 Factbook 3Document27 pagesSIA 2024 Factbook 3licesa1819No ratings yet