Professional Documents

Culture Documents

704

704

Uploaded by

Bhoomi GhariwalaCopyright:

Available Formats

You might also like

- 704Document8 pages704Bhoomi GhariwalaNo ratings yet

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document10 pages704Bhoomi Ghariwala0% (1)

- AHM13e - Chapter 01 - Key To EOC Problems and CasesDocument14 pagesAHM13e - Chapter 01 - Key To EOC Problems and CasesArunesh SN100% (1)

- Music Mart SolutionDocument6 pagesMusic Mart SolutionStranger Sinha50% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Abbott Workers Requisitioned Out The Following MaterialsDocument10 pagesAbbott Workers Requisitioned Out The Following MaterialsBhoomi GhariwalaNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Ac491 Mock Exam Solution Revised (4891) PDFDocument23 pagesAc491 Mock Exam Solution Revised (4891) PDFLuisito Quispe MarcosNo ratings yet

- Uts AklDocument4 pagesUts AklathifaNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Financial Statement Construction ExercisesDocument14 pagesFinancial Statement Construction ExercisesScribdTranslationsNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- Light Anti-Theft Wallet Lock Financial Plan DraftDocument8 pagesLight Anti-Theft Wallet Lock Financial Plan DraftKyle TimonNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Group Assignment: Financial AccountingDocument4 pagesGroup Assignment: Financial AccountingNguyen HuongNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- 1 Chapter 1 Partnership FormationDocument16 pages1 Chapter 1 Partnership FormationJymldy EnclnNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Cash Flows and Financial Analysis: © 2003 South-Western/Thomson LearningDocument45 pagesCash Flows and Financial Analysis: © 2003 South-Western/Thomson LearningshawnmarionetteNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- ISEM 530 ManagementDocument6 pagesISEM 530 ManagementNaren ReddyNo ratings yet

- Assignment FA IIDocument5 pagesAssignment FA IIdiprajbarua1234No ratings yet

- HW6 CameronCatesDocument2 pagesHW6 CameronCatesCALISTA VANIA MAHARANI Mahasiswa PNJNo ratings yet

- Practical Evaluation Week 7Document8 pagesPractical Evaluation Week 7ScribdTranslationsNo ratings yet

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- El Buho Work ClothesDocument5 pagesEl Buho Work ClothesScribdTranslationsNo ratings yet

- Partnership Testbank Part 1Document17 pagesPartnership Testbank Part 1Klay LuisNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- BizCafe Team6 A3 DeliverableB CSBA1010 S4Document6 pagesBizCafe Team6 A3 DeliverableB CSBA1010 S4Ivneet KaurNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Mokoagouw, Angie Lisy (Advance Problem Chapter 1)Document14 pagesMokoagouw, Angie Lisy (Advance Problem Chapter 1)AngieNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- 4355913Document2 pages4355913mohitgaba19No ratings yet

- Fundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)Document8 pagesFundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)MarielLee Ramos VillarealNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- AC4301 FinalExam 2020-21 SemA QuestionsDocument12 pagesAC4301 FinalExam 2020-21 SemA QuestionslawlokyiNo ratings yet

- The Balance Sheet and Profit and Loss StatementDocument28 pagesThe Balance Sheet and Profit and Loss StatementNguyễn DũngNo ratings yet

- Accounting for Special TransactionsDocument7 pagesAccounting for Special TransactionsReign Christel EstefanioNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Anr 2008-12-13 063245Document5 pagesAnr 2008-12-13 063245Swati VijayNo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Case Solutions CH (1-8) II PDFDocument21 pagesCase Solutions CH (1-8) II PDFMajed MansourNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- High Low High LowDocument4 pagesHigh Low High LowBhoomi GhariwalaNo ratings yet

- Made A Big Difference For A Garment Makers Bottom LineDocument2 pagesMade A Big Difference For A Garment Makers Bottom LineBhoomi GhariwalaNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document7 pages704Bhoomi GhariwalaNo ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Tesda Sample ExaminationDocument83 pagesTesda Sample ExaminationJane JacalaNo ratings yet

- IPCA Ratio Analysis TemplateDocument6 pagesIPCA Ratio Analysis TemplatehimavalluriNo ratings yet

- Unit 4 Preparation of Trial Balance and PDFDocument21 pagesUnit 4 Preparation of Trial Balance and PDFMargarete DelvalleNo ratings yet

- ACTIVITY 5 (Completed)Document50 pagesACTIVITY 5 (Completed)Angeline Gonzales PaneloNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet

- 02 Bergeron7e PPTDocument32 pages02 Bergeron7e PPTIryna VerbovaNo ratings yet

- E22 3Document2 pagesE22 3bellaNo ratings yet

- Accountancy HND ContentDocument9 pagesAccountancy HND ContentPenn Ernest NelsonNo ratings yet

- 5capital and Revenue ConceptDocument4 pages5capital and Revenue ConceptRojesh BasnetNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Dabur Consolidated Balance Sheet PDFDocument1 pageDabur Consolidated Balance Sheet PDFRupasingh33% (3)

- Accounting 2 - FinalDocument4 pagesAccounting 2 - FinalJon Dumagil Inocentes, CPANo ratings yet

- IA1 Financial Assets at Fair ValueDocument11 pagesIA1 Financial Assets at Fair ValueSteffanie OlivarNo ratings yet

- Problem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundDocument17 pagesProblem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundNCTNo ratings yet

- Tutorial 2 (Q) A201Document6 pagesTutorial 2 (Q) A201H4NG325No ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- F7 Exercise To SendDocument34 pagesF7 Exercise To SendHằng LêNo ratings yet

- Creative Teaching PlatformDocument36 pagesCreative Teaching PlatformHannah CaparasNo ratings yet

- Orca Share Media1583315619577Document13 pagesOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNo ratings yet

- Ocean Manufacturing, LNC.: The New Client Acceptance DecisionDocument8 pagesOcean Manufacturing, LNC.: The New Client Acceptance DecisionSilvia SucelyNo ratings yet

- Basic Accounting by Win Ballada Solution Manual 2018Document11 pagesBasic Accounting by Win Ballada Solution Manual 2018John Lucky MacalaladNo ratings yet

- The Statement of Cash Flows: Short Exercises S 14-1Document119 pagesThe Statement of Cash Flows: Short Exercises S 14-1Syed Huzayfah FaisalNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Intangible Asset (Pas 38) : Introduction, Scope and DefinitionsDocument20 pagesIntangible Asset (Pas 38) : Introduction, Scope and Definitionskeithy joshuaNo ratings yet

- Diploma in International Financial Reporting: Thursday 6 December 2007Document9 pagesDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument1 pageQuiz 1 - Statement of Financial PositionFrancez Anne GuanzonNo ratings yet

704

704

Uploaded by

Bhoomi GhariwalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

704

704

Uploaded by

Bhoomi GhariwalaCopyright:

Available Formats

Abbott Shoe Corporation is a RETAILER of shoes.

1. On 1/1/18, ASC begins doing business by obtaining CASH from three principal

owners: Lawrence J. Abbott for $100,000, Don Majkowsky for $50,000 and Brett

Favreau for $50,000. All 3 principals pay in CASH (for a total of $200,000).

Please give the journal entry to describe this transaction (please simply denote this

as ‘contributed capital’).

Cash $200,000

Contributed Capital $200,000

2. On 1/1/18, ASC obtains a cash register for $12,000 – on account. It has a 0

salvage value and a useful life of 5 years. Please give the journal entry to

describe this transaction.

Equipment $12,000

Accounts Payable $12,000

3. On 1/1/18, ASC obtains bank financing by procuring a 10-year loan for $20,000

(i.e. the principal of $20,000 is due in 1/1/2028) with an annual interest rate of 5%

with payments DUE in CASH at 12/31 of each year. Give the journal entry to

describe this transaction.

Cash $20,000

Loans Payable $20,000

4. On 1/1/18, ASC purchases – on account – 100 Air Abbotts for $15,000. It also

purchases – on account – 200 Air Smunts for $32,000. Please give the journal

entry to record this transaction.

Inventory- Air Abbotts $15,000

Accounts Payable $15,000

Inventory-Air Smunts $32,000

Accounts Payable $32,000

5. During the year, ASC paid IN CASH the following to its workers:

Administrative Salaries to CEO, accountant, etc.. $2,000

Salaries to retail workers $4,000

Please give the journal entry to describe this transaction.

Salaries & Wages expenses $2,000

Cash $2,000

Payroll expenses $4,000

Cash $4,000

6. During the year, ASC sold 50 Air Abbotts to Dr. Paul Fischer ON ACCOUNT for

$1,000/Air Abbott. Give the journal entry to describe this transaction.

Accounts receivable $50,000

Sales revenue $50,000

Cost of goods sold $7,500

Inventory $7,500

7. During the year, ASC sold 80 Air Smunts for $2,000/Air Smunt in CASH. Give

the journal entry to describe this transaction.

Cash $160,000

Sales revenue $160,000

Cost of goods sold $12,800

Inventory $12,800

8. During the year, ASC paid CASH the following bills:

Utilities for office building $5,000

Rent for building $2,000

Give the journal entry to describe this transaction.

Utilities expense $5,000

Rent expense $2,000

Cash $7,000

9. Dr. Paul Fischer pays $10,000 of his account balance. Give the journal entry to

describe this transaction.

Cash $10,000

Accounts receivable $10,000

10. Give any adjusting journal entries needed on 12/31/18.

Depreciation expense – cash register $2,400

Accumulated depreciation – cash register $2,400

Interest expense $1,000

Cash $1,000

11. Please prepare the CLOSING journal entry for 12/31/18.

Sales $210,000

Cost of goods sold $20,300

SG & A expenses $16,400

Retained earnings $173,300

12. Based upon 1above, PREPARE AN INCOME STATEMENT for 2018.

Sales (50,000 + 160,000) $210,000

Less: Cost of goods sold (7500 + 12,800) $20,300

Gross Margin $189,700

Less: SG & A $16,400

Net income $173,300

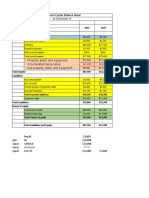

13. Based on the above, prepare a BALANCE SHEET for 2018

Assets

Current Assets

Cash $376,000

Accounts receivable $40,000

Inventory $26,700

Total current assets $442,700

Property, plant & equipment

Equipment – Cash register $12,000

Less: Accumulated depreciation $2,400 $9,600

Total assets $452,300

Liabilities & Stockholder’s Equity

Current liability

Accounts payable $59,000

Total current assets $59,000

Long-term liabilities

Loans payable $20,000

Total liabilities $20,000

Stockholder’s equity

Contributed capital $200,000

Retained earnings $173,300

Total stockholder’s equity $373,300

Total liabilities & stockholder’s equity $452,300

You might also like

- 704Document8 pages704Bhoomi GhariwalaNo ratings yet

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document10 pages704Bhoomi Ghariwala0% (1)

- AHM13e - Chapter 01 - Key To EOC Problems and CasesDocument14 pagesAHM13e - Chapter 01 - Key To EOC Problems and CasesArunesh SN100% (1)

- Music Mart SolutionDocument6 pagesMusic Mart SolutionStranger Sinha50% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Abbott Workers Requisitioned Out The Following MaterialsDocument10 pagesAbbott Workers Requisitioned Out The Following MaterialsBhoomi GhariwalaNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Ac491 Mock Exam Solution Revised (4891) PDFDocument23 pagesAc491 Mock Exam Solution Revised (4891) PDFLuisito Quispe MarcosNo ratings yet

- Uts AklDocument4 pagesUts AklathifaNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Financial Statement Construction ExercisesDocument14 pagesFinancial Statement Construction ExercisesScribdTranslationsNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- Light Anti-Theft Wallet Lock Financial Plan DraftDocument8 pagesLight Anti-Theft Wallet Lock Financial Plan DraftKyle TimonNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Group Assignment: Financial AccountingDocument4 pagesGroup Assignment: Financial AccountingNguyen HuongNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- 1 Chapter 1 Partnership FormationDocument16 pages1 Chapter 1 Partnership FormationJymldy EnclnNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Cash Flows and Financial Analysis: © 2003 South-Western/Thomson LearningDocument45 pagesCash Flows and Financial Analysis: © 2003 South-Western/Thomson LearningshawnmarionetteNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- ISEM 530 ManagementDocument6 pagesISEM 530 ManagementNaren ReddyNo ratings yet

- Assignment FA IIDocument5 pagesAssignment FA IIdiprajbarua1234No ratings yet

- HW6 CameronCatesDocument2 pagesHW6 CameronCatesCALISTA VANIA MAHARANI Mahasiswa PNJNo ratings yet

- Practical Evaluation Week 7Document8 pagesPractical Evaluation Week 7ScribdTranslationsNo ratings yet

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- Translation QuestionsDocument6 pagesTranslation QuestionsVeenal BansalNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- El Buho Work ClothesDocument5 pagesEl Buho Work ClothesScribdTranslationsNo ratings yet

- Partnership Testbank Part 1Document17 pagesPartnership Testbank Part 1Klay LuisNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- BizCafe Team6 A3 DeliverableB CSBA1010 S4Document6 pagesBizCafe Team6 A3 DeliverableB CSBA1010 S4Ivneet KaurNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Mokoagouw, Angie Lisy (Advance Problem Chapter 1)Document14 pagesMokoagouw, Angie Lisy (Advance Problem Chapter 1)AngieNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- 4355913Document2 pages4355913mohitgaba19No ratings yet

- Fundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)Document8 pagesFundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)MarielLee Ramos VillarealNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- AC4301 FinalExam 2020-21 SemA QuestionsDocument12 pagesAC4301 FinalExam 2020-21 SemA QuestionslawlokyiNo ratings yet

- The Balance Sheet and Profit and Loss StatementDocument28 pagesThe Balance Sheet and Profit and Loss StatementNguyễn DũngNo ratings yet

- Accounting for Special TransactionsDocument7 pagesAccounting for Special TransactionsReign Christel EstefanioNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Anr 2008-12-13 063245Document5 pagesAnr 2008-12-13 063245Swati VijayNo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Case Solutions CH (1-8) II PDFDocument21 pagesCase Solutions CH (1-8) II PDFMajed MansourNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- High Low High LowDocument4 pagesHigh Low High LowBhoomi GhariwalaNo ratings yet

- Made A Big Difference For A Garment Makers Bottom LineDocument2 pagesMade A Big Difference For A Garment Makers Bottom LineBhoomi GhariwalaNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- 704Document7 pages704Bhoomi GhariwalaNo ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Tesda Sample ExaminationDocument83 pagesTesda Sample ExaminationJane JacalaNo ratings yet

- IPCA Ratio Analysis TemplateDocument6 pagesIPCA Ratio Analysis TemplatehimavalluriNo ratings yet

- Unit 4 Preparation of Trial Balance and PDFDocument21 pagesUnit 4 Preparation of Trial Balance and PDFMargarete DelvalleNo ratings yet

- ACTIVITY 5 (Completed)Document50 pagesACTIVITY 5 (Completed)Angeline Gonzales PaneloNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet

- 02 Bergeron7e PPTDocument32 pages02 Bergeron7e PPTIryna VerbovaNo ratings yet

- E22 3Document2 pagesE22 3bellaNo ratings yet

- Accountancy HND ContentDocument9 pagesAccountancy HND ContentPenn Ernest NelsonNo ratings yet

- 5capital and Revenue ConceptDocument4 pages5capital and Revenue ConceptRojesh BasnetNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Dabur Consolidated Balance Sheet PDFDocument1 pageDabur Consolidated Balance Sheet PDFRupasingh33% (3)

- Accounting 2 - FinalDocument4 pagesAccounting 2 - FinalJon Dumagil Inocentes, CPANo ratings yet

- IA1 Financial Assets at Fair ValueDocument11 pagesIA1 Financial Assets at Fair ValueSteffanie OlivarNo ratings yet

- Problem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundDocument17 pagesProblem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundNCTNo ratings yet

- Tutorial 2 (Q) A201Document6 pagesTutorial 2 (Q) A201H4NG325No ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- F7 Exercise To SendDocument34 pagesF7 Exercise To SendHằng LêNo ratings yet

- Creative Teaching PlatformDocument36 pagesCreative Teaching PlatformHannah CaparasNo ratings yet

- Orca Share Media1583315619577Document13 pagesOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNo ratings yet

- Ocean Manufacturing, LNC.: The New Client Acceptance DecisionDocument8 pagesOcean Manufacturing, LNC.: The New Client Acceptance DecisionSilvia SucelyNo ratings yet

- Basic Accounting by Win Ballada Solution Manual 2018Document11 pagesBasic Accounting by Win Ballada Solution Manual 2018John Lucky MacalaladNo ratings yet

- The Statement of Cash Flows: Short Exercises S 14-1Document119 pagesThe Statement of Cash Flows: Short Exercises S 14-1Syed Huzayfah FaisalNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Intangible Asset (Pas 38) : Introduction, Scope and DefinitionsDocument20 pagesIntangible Asset (Pas 38) : Introduction, Scope and Definitionskeithy joshuaNo ratings yet

- Diploma in International Financial Reporting: Thursday 6 December 2007Document9 pagesDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNo ratings yet

- Quiz 1 - Statement of Financial PositionDocument1 pageQuiz 1 - Statement of Financial PositionFrancez Anne GuanzonNo ratings yet