Professional Documents

Culture Documents

April Manjares - Cash and Ar Quiz

April Manjares - Cash and Ar Quiz

Uploaded by

April Manjares0 ratings0% found this document useful (0 votes)

24 views2 pagesThis document summarizes the solutions to two accounting problems. For problem 1, it provides bank and book reconciliation details for November and December, including petty cash amounts, deposits, checks, and outstanding amounts. For problem 2, it details the calculation of accounts receivable and allowance for doubtful accounts for the year ending December 31, 2003. Key figures include a required adjustment to increase the allowance for doubtful accounts by $157,500.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the solutions to two accounting problems. For problem 1, it provides bank and book reconciliation details for November and December, including petty cash amounts, deposits, checks, and outstanding amounts. For problem 2, it details the calculation of accounts receivable and allowance for doubtful accounts for the year ending December 31, 2003. Key figures include a required adjustment to increase the allowance for doubtful accounts by $157,500.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views2 pagesApril Manjares - Cash and Ar Quiz

April Manjares - Cash and Ar Quiz

Uploaded by

April ManjaresThis document summarizes the solutions to two accounting problems. For problem 1, it provides bank and book reconciliation details for November and December, including petty cash amounts, deposits, checks, and outstanding amounts. For problem 2, it details the calculation of accounts receivable and allowance for doubtful accounts for the year ending December 31, 2003. Key figures include a required adjustment to increase the allowance for doubtful accounts by $157,500.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

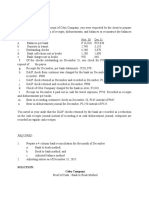

SOLUTION PROBLEM 1

1 Currency and coins (given) C. 152.00

2 Petty cash accounted (152 + 400 + 340 + 2043.50) 2935.5

Accountability - per ledger 3,000

Petty cash shortage D. 64.50

3 December deposits per bank 82,800.00

Note collected by bank in December 10150

Total receipts in Dec. C. 92950

4 December checks per bank 92,200

December service charge 150

Total bank disbursements in Dec. A. 92350

5 December checks per books 94,100

November service charge recorded in December 100

Total book disbursement in Dec. A. 94,200

6 November deposits - per books 73,600

November deposits - per bank 71,100

Deposit in transit, Nov. 30 B. 2500

7 Deposits in transit, Nov 30 2,500

December deposits - collections 82,200

Total 84,700

December deposits per bank -82,800

Deposits in transit, Dec 31 C. 1,900

8 November checks per books 62,900

November checks per bank 61,300

Outstanding checks, Nov 30 D. 1,600

9 Outstanding checks, Nov. 30 1,600

Dec. checks per books 94,100

Total 95,700

Dec. checks per bank -92,200

Outstanding checks, Dec 31 A. 3,500

10 Correct cash in bank balance at November 30 D. 50600

11 Correct cash in bank balance at Dec 31 B. 48,700

12 Correct book receipts in December A. 92,350

13 Correct bank disbursements in December C. 94,250

14 A. Bad debts expense 90,000

Allowance for bad debts 90,000

15 D. No entry

16 Allowance for bad debts - per books 108,500

2003 bad debts provision (6,000,000 x 1.5%) 90,000

Allowance for bad debts, Dec 31, 2003 B. 198,500

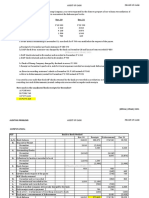

SOLUTION PROBLEM 2

17 Accounts receivable Dec. 31, 2002 900,000

Sales for 2003 75,000,000

Recovery of accounts written off 15,000

Total 8,415,000

Collections from customers 6,540,000

Accounts written off 75,000

Accounts settled by issuance of note 300,000

Accounts receivable Dec. 31, 2003 A. 1500000

18 Allowance for doubtful accounts Dec. 31, 2002 45,000

Recovery of account written off 15,000

Total 60,000

Accounts written off -75,000

Allowance for doubtful accounts Dec. 31, 2003 before adjustment A. -15,000 (debit)

19 On past due accounts (P450,000 x 0.20) 90,000

On current accounts (1,500,000 -450,000) x 0.05 52,500

Required allowance D. 142,500

20 Required allowance 142,500

Debit balance of allowance before adjustment 15,000

Increase in allowance B. 157,500

21 D. Doubtful accounts expense 157,500

Allowance for doubtful accounts 157,500

You might also like

- RESA - AP-702S (MCQs Solutions To Problems)Document12 pagesRESA - AP-702S (MCQs Solutions To Problems)Mellani100% (1)

- Harmeet Singh Cover PDFDocument2 pagesHarmeet Singh Cover PDFDr. FilaNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument1 pageBank Statement Template 1 - TemplateLabViktoria DenisenkoNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo71% (7)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- Bank Reconciliation Dollar CompDocument5 pagesBank Reconciliation Dollar CompCJ alandy100% (2)

- Proof of Cash Cebu CompanyDocument6 pagesProof of Cash Cebu CompanyCJ alandyNo ratings yet

- Adyen Payment MethodsDocument17 pagesAdyen Payment MethodsCristián SmithNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanySr. Janet PereyraNo ratings yet

- Proof of Cash MQM ComDocument5 pagesProof of Cash MQM ComCJ alandyNo ratings yet

- Adadasd 2321Document4 pagesAdadasd 2321Prime JavateNo ratings yet

- Loa - Application 1 Quiz 1Document5 pagesLoa - Application 1 Quiz 1Genevieve VargasNo ratings yet

- Unadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Document2 pagesUnadjusted Book Balance (1.) 504,000 (2.) 735,000 (3.) 700,000 (4.) 539,000Quijano GpokskieNo ratings yet

- Problem Set For AR (Ctto)Document16 pagesProblem Set For AR (Ctto)Mariane Jean Guerrero100% (1)

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- End of Chapter Problems 3-1 (Cash Count)Document3 pagesEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- Proof of Cash Syria CompanyDocument4 pagesProof of Cash Syria CompanyCJ alandy100% (1)

- Book To Bank MethodDocument3 pagesBook To Bank Methodelsana philipNo ratings yet

- Accounting Question Petty CashDocument2 pagesAccounting Question Petty Cashelsana philipNo ratings yet

- AdasdDocument4 pagesAdasdPrime JavateNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- November 30 Receipts Disbursements December 31Document4 pagesNovember 30 Receipts Disbursements December 31Jocy DelgadoNo ratings yet

- ELARDO Perp Audit Problem Prelim ExamDocument6 pagesELARDO Perp Audit Problem Prelim ExamArlan Jay GipulanNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- Cash and Cash Equivalents Answers KeyDocument6 pagesCash and Cash Equivalents Answers KeyCyrss BaldemosNo ratings yet

- Bank Recon and CC and PCF ProblemsDocument5 pagesBank Recon and CC and PCF ProblemsCruxzelle BajoNo ratings yet

- Audit: Cash-and-Cash Equivalent: Problem 1Document12 pagesAudit: Cash-and-Cash Equivalent: Problem 1Idh skyNo ratings yet

- Antonio, Ysa Elaine - 3A8Document2 pagesAntonio, Ysa Elaine - 3A8Elaine AntonioNo ratings yet

- Bank Recon and Cash and Cash Equivalent and PCF FA ProblemsDocument5 pagesBank Recon and Cash and Cash Equivalent and PCF FA ProblemsCruxzelle BajoNo ratings yet

- Cash, BNK Recon and AR Answer KeyDocument6 pagesCash, BNK Recon and AR Answer KeyNanya BisnestNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Activity 2-IntaAcc1Document1 pageActivity 2-IntaAcc10322-1975No ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia PartDocument15 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia PartMike Joseph E. Moran100% (3)

- Auditing For Cash SolmanDocument5 pagesAuditing For Cash SolmanJoseph FelipeNo ratings yet

- Adjusting EntryDocument3 pagesAdjusting EntryNo NotreallyNo ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument3 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- SOLUTIONS - Metrobank Etc.Document3 pagesSOLUTIONS - Metrobank Etc.Avarel DPNo ratings yet

- Beehive Company Bank Reconciliation For The Month of OctoberDocument2 pagesBeehive Company Bank Reconciliation For The Month of OctoberGilner PomarNo ratings yet

- Problem 1Document4 pagesProblem 1redassdawnNo ratings yet

- FABMDocument12 pagesFABMJhayn NonNo ratings yet

- 2021 Prelim Exam Auditing Concepts and Applications 1Document15 pages2021 Prelim Exam Auditing Concepts and Applications 1moreNo ratings yet

- Dockers Inc Proof of CashDocument1 pageDockers Inc Proof of CashJoemar LegresoNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- RAMIREZ, BSA CompanyDocument2 pagesRAMIREZ, BSA CompanyMarie Ramirez100% (1)

- Assignment 1Document12 pagesAssignment 1Ira YbanezNo ratings yet

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- Suggested Answers - Audit of Cash AR Liab HandoutsDocument10 pagesSuggested Answers - Audit of Cash AR Liab HandoutsBanna SplitNo ratings yet

- Intacc Test 1Document1 pageIntacc Test 1Gray JavierNo ratings yet

- Quizzes and SolutionsDocument8 pagesQuizzes and Solutionsdzadehh's sp4nkNo ratings yet

- Proof of Cash SolutionsDocument4 pagesProof of Cash SolutionsyowatdafrickNo ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- PLP Government Accounting Final ExamDocument4 pagesPLP Government Accounting Final ExamApril ManjaresNo ratings yet

- 1 Name (Family, Given, Mi.) 2 3 4 5 6 7 8 9 10: de Vera, Kyle CDocument18 pages1 Name (Family, Given, Mi.) 2 3 4 5 6 7 8 9 10: de Vera, Kyle CApril ManjaresNo ratings yet

- Educational Institutions: Santos, Sofia Anne PDocument11 pagesEducational Institutions: Santos, Sofia Anne PApril ManjaresNo ratings yet

- Market Microstructure: Pamantasan NG Lungsod NG Pasig College of Business and AccountancyDocument10 pagesMarket Microstructure: Pamantasan NG Lungsod NG Pasig College of Business and AccountancyApril ManjaresNo ratings yet

- Intangible Assets and LiabilitiesDocument13 pagesIntangible Assets and LiabilitiesApril ManjaresNo ratings yet

- Liabilities Leases - Group 10Document11 pagesLiabilities Leases - Group 10April ManjaresNo ratings yet

- Property, Plant and Equipment: Group 8 LeaderDocument35 pagesProperty, Plant and Equipment: Group 8 LeaderApril ManjaresNo ratings yet

- By Updated Aug 21, 2019: What Is A Spot Trade?Document3 pagesBy Updated Aug 21, 2019: What Is A Spot Trade?April ManjaresNo ratings yet

- Shareholders Equity - AssignmentDocument2 pagesShareholders Equity - AssignmentApril ManjaresNo ratings yet

- Performance EvaluationDocument5 pagesPerformance EvaluationApril ManjaresNo ratings yet

- Auditing Finance and Accounting FunctionsDocument14 pagesAuditing Finance and Accounting FunctionsApril ManjaresNo ratings yet

- Dbs BankDocument6 pagesDbs Bankvivi_15o689_11272315No ratings yet

- Balance Sheet of Axis Bank: MoneyDocument13 pagesBalance Sheet of Axis Bank: MoneyNaresh KumarNo ratings yet

- BoomerangMichaelLewis NEWDocument5 pagesBoomerangMichaelLewis NEWRJ GutierrezNo ratings yet

- Financial Planning Case StudyDocument1 pageFinancial Planning Case Studythangave2000No ratings yet

- Processed Business 2017 by NatureDocument441 pagesProcessed Business 2017 by NatureJaimelyn ManguerraNo ratings yet

- SBI Life Annual Report 2015-16Document301 pagesSBI Life Annual Report 2015-16Sukanta JanaNo ratings yet

- 241 274Document34 pages241 274Fiona ArellanoNo ratings yet

- The Rockefeller File - The Multi-Billion Dollar MythDocument10 pagesThe Rockefeller File - The Multi-Billion Dollar MythNealratan AgarwalaNo ratings yet

- Law On Nego Sundiang NotesDocument33 pagesLaw On Nego Sundiang NotesAudrey100% (1)

- Energy Efficient Manet ProtocplsDocument7 pagesEnergy Efficient Manet ProtocplsSuhas KapseNo ratings yet

- Chattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawDocument187 pagesChattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawYieMaghirangNo ratings yet

- Credit Digitization For Credit Management Presentation 23jul19Document21 pagesCredit Digitization For Credit Management Presentation 23jul19Chidozie Farsight100% (1)

- Januari - Rek AgusDocument2 pagesJanuari - Rek AgusEdi SetyawanNo ratings yet

- Reserve Bank of IndiaDocument54 pagesReserve Bank of IndiaKrishan PrustyNo ratings yet

- Icar Japan Invoice Rt1 1007104 Micronesia 1Document2 pagesIcar Japan Invoice Rt1 1007104 Micronesia 1semenster03No ratings yet

- Chapter 1 Introduction To FMIDocument56 pagesChapter 1 Introduction To FMIDrehfcieNo ratings yet

- GK Powercapsule For Ibps Po - Iv 2014 ExamDocument45 pagesGK Powercapsule For Ibps Po - Iv 2014 ExamJayapalNo ratings yet

- 3 Golden Rules of AccountancyDocument6 pages3 Golden Rules of Accountancynishu_0001No ratings yet

- S T A T E B A NK of I Ndi A:-: SBI Share in Deposits & AdvancesDocument5 pagesS T A T E B A NK of I Ndi A:-: SBI Share in Deposits & AdvancesRainee KocharNo ratings yet

- Work Stress Management Among Bank EmployeesDocument62 pagesWork Stress Management Among Bank EmployeesPrajjwal KanojiyaNo ratings yet

- ISJ020Document81 pagesISJ0202imediaNo ratings yet

- Loan EMI CalculatorDocument13 pagesLoan EMI CalculatorSameer ThakkarNo ratings yet

- 731 - 740 Fa-6Document17 pages731 - 740 Fa-6738 Lavanya JadhavNo ratings yet

- A Project Report On Smuggling, Money Laundering and HawalaDocument13 pagesA Project Report On Smuggling, Money Laundering and HawalaSpeedie records0% (1)

- BF M U Vksojlht CSSD': D DZ' HRHZ Ijh"K D'K G Iz'U-I (Document22 pagesBF M U Vksojlht CSSD': D DZ' HRHZ Ijh"K D'K G Iz'U-I (Viren BhandariNo ratings yet

- RecommendedDocument1 pageRecommendedBoris KPEGLONo ratings yet

- Lesson in Islamic Economics by Monzer Kahf v-1Document0 pagesLesson in Islamic Economics by Monzer Kahf v-1Etnadia SuhartonoNo ratings yet