Professional Documents

Culture Documents

What Is Technical Analysis?

What Is Technical Analysis?

Uploaded by

Jonhmark AniñonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Technical Analysis?

What Is Technical Analysis?

Uploaded by

Jonhmark AniñonCopyright:

Available Formats

Technical Analysis

By

ADAM HAYES

Reviewed by

THOMAS BROCK

Updated Apr 25, 2021

TABLE OF CONTENTS

What Is Technical Analysis?

Understanding Technical Analysis

Underlying Assumptions of Technical Analysis

Fundamental Analysis

Limitations

Frequently Asked Questions

What Is Technical Analysis?

Technical analysis is a trading discipline employed to evaluate investments

and identify trading opportunities by analyzing statistical trends gathered from

trading activity, such as price movement and volume.

KEY TAKEAWAYS

Technical analysis is a trading discipline employed to evaluate investments

and identify trading opportunities in price trends and patterns seen on

charts.

Technical analysts believe past trading activity and price changes of a

security can be valuable indicators of the security's future price

movements.

Technical analysis may be contrasted with fundamental analysis, which

focuses on a company's financials rather than historical price patterns or

stock trends.

Volume 75%

1:20

Understanding Fundamental Vs. Technical Analysis

Understanding Technical Analysis

Unlike fundamental analysis, which attempts to evaluate a security's value based

on business results such as sales and earnings, technical analysis focuses on

the study of price and volume. Technical analysis tools are used to scrutinize the

ways supply and demand for a security will affect changes in price, volume and

implied volatility. Technical analysis is often used to generate short-term trading

signals from various charting tools, but can also help improve the evaluation of a

security's strength or weakness relative to the broader market or one of its

sectors. This information helps analysts improve there overall valuation estimate.

Technical analysis can be used on any security with historical trading data. This

includes stocks, futures, commodities, fixed-income, currencies, and other

securities. In this tutorial, we’ll usually analyze stocks in our examples, but keep

in mind that these concepts can be applied to any type of security. In fact,

technical analysis is far more prevalent in commodities and forex markets

where traders focus on short-term price movements.

Technical analysis as we know it today was first introduced by Charles Dow and

the Dow Theory in the late 1800s.1 Several noteworthy researchers including

William P. Hamilton, Robert Rhea, Edson Gould, and John Magee further

contributed to Dow Theory concepts helping to form its basis. In modern day,

technical analysis has evolved to included hundreds of patterns and signals

developed through years of research.

Technical analysis operates from the assumption that past trading activity and

price changes of a security can be valuable indicators of the security's future

price movements when paired with appropriate investing or trading rules.

Professional analysts often use technical analysis in conjunction with other forms

of research. Retail traders may make decisions based solely on the price charts

of a security and similar statistics, but practicing equity analysts rarely limit their

research to fundamental or technical analysis alone.

Among professional analysts, the CMT Association supports the largest

collection of chartered or certified analysts using technical analysis professionally

around the world. The association's Chartered Market Technician (CMT)

designation can be obtained after three levels of exams that cover both a broad

and deep look at technical analysis tools. Nearly one third of CMT charter

holders are also Certified Financial Analyst (CFA) charter holders. This

demonstrates how well the two disciplines reinforce each other.2

Technical analysis attempts to forecast the price movement of virtually any

tradable instrument that is generally subject to forces of supply and demand,

including stocks, bonds, futures and currency pairs. In fact, some view technical

analysis as simply the study of supply and demand forces as reflected in the

market price movements of a security. Technical analysis most commonly

applies to price changes, but some analysts track numbers other than just price,

such as trading volume or open interest figures.

Across the industry there are hundreds of patterns and signals that have been

developed by researchers to support technical analysis trading. Technical

analysts have also developed numerous types of trading systems to help them

forecast and trade on price movements. Some indicators are focused primarily

on identifying the current market trend, including support and resistance areas,

while others are focused on determining the strength of a trend and the likelihood

of its continuation. Commonly used technical indicators and charting patterns

include trendlines, channels, moving averages and momentum indicators.

You might also like

- QuickBooks Desktop Online Student GuideDocument145 pagesQuickBooks Desktop Online Student GuideJonhmark Aniñon100% (2)

- QBO Certification Training Guide - v031122Document308 pagesQBO Certification Training Guide - v031122Jonhmark AniñonNo ratings yet

- PTG Three-Day Cycle PDFDocument6 pagesPTG Three-Day Cycle PDFDraženS100% (3)

- ContinueDocument2 pagesContinuejeyabalguruNo ratings yet

- TD Rei PDFDocument12 pagesTD Rei PDFzameerp73No ratings yet

- Is It Possible To Write A ThinkScript Script To Make Time-Based Buy - Sell Orders - ThinkorswimDocument9 pagesIs It Possible To Write A ThinkScript Script To Make Time-Based Buy - Sell Orders - ThinkorswimAlan PetzoldNo ratings yet

- Target Corporation Financial Accounting Final AssignmentDocument12 pagesTarget Corporation Financial Accounting Final AssignmentFernanda CugolaNo ratings yet

- Boomie Bounce PlaybookDocument9 pagesBoomie Bounce PlaybookJustin LimNo ratings yet

- Developing Your Trading PlaybookDocument5 pagesDeveloping Your Trading PlaybookIan B. YtomNo ratings yet

- Boh Philippines Black Box - 2019.07.31Document289 pagesBoh Philippines Black Box - 2019.07.31Phi Consistent TraderNo ratings yet

- Darvas Box Explained - Trend Following System For Any Time FrameDocument11 pagesDarvas Box Explained - Trend Following System For Any Time FrameMae Jumao-asNo ratings yet

- Live Market Seminar CurriculumDocument33 pagesLive Market Seminar CurriculumRui LopesNo ratings yet

- KKDocument34 pagesKKgoud mahendharNo ratings yet

- Lecture - 028 - Best Trading StrategyDocument9 pagesLecture - 028 - Best Trading StrategyphaerphrmngkhlchayNo ratings yet

- Exit Strategies (Part 1)Document6 pagesExit Strategies (Part 1)pderby1No ratings yet

- MAMA SetupDocument4 pagesMAMA SetupJhomz MartinezNo ratings yet

- Trade Score PDFDocument30 pagesTrade Score PDFvenkat.sqlNo ratings yet

- 01-03-12 Stock Market Trends & ObservationsDocument149 pages01-03-12 Stock Market Trends & ObservationsrkarrowNo ratings yet

- How To Use Multiple Time Frames To Find Trades With The Highest Probabilities of SuccessDocument5 pagesHow To Use Multiple Time Frames To Find Trades With The Highest Probabilities of SuccesssheebheeNo ratings yet

- Chart Patterns Double Tops BottomsDocument9 pagesChart Patterns Double Tops BottomsJeremy NealNo ratings yet

- Stevenson PTTDocument13 pagesStevenson PTTErezwa100% (1)

- Chuck LeBeau - Founder of System Traders ClubDocument2 pagesChuck LeBeau - Founder of System Traders ClubcoachbiznesuNo ratings yet

- NSK Magic 3 System by Nitin Kadam.Document2 pagesNSK Magic 3 System by Nitin Kadam.Raj VasuNo ratings yet

- Suri Duddella - 3 Line Price Break ChartsDocument3 pagesSuri Duddella - 3 Line Price Break ChartsDarkmatter DarkmatterrNo ratings yet

- Ict - Power - of - 3 - Thread - by - Mrstoploss01 - Jan 2, 24 - From - RattibhaDocument17 pagesIct - Power - of - 3 - Thread - by - Mrstoploss01 - Jan 2, 24 - From - RattibhaJuzerNo ratings yet

- WB 1960 WavAdv Relative Strength PDFDocument41 pagesWB 1960 WavAdv Relative Strength PDFLei ChenNo ratings yet

- Long Call Butterfly: Montréal ExchangeDocument2 pagesLong Call Butterfly: Montréal ExchangepkkothariNo ratings yet

- Become A Market Maven Be Picky When Day Trading Dan Zanger Offers AdviceDocument6 pagesBecome A Market Maven Be Picky When Day Trading Dan Zanger Offers Advicequantum70No ratings yet

- William's %R - Ultilmate OsciallatorDocument2 pagesWilliam's %R - Ultilmate OsciallatorMian Umar RafiqNo ratings yet

- Trading of GapsDocument3 pagesTrading of GapsAnonymous 2HXuAeNo ratings yet

- ValueDocument6 pagesValuemeranaamfakeNo ratings yet

- John Carter - Mastering The Trade (Another Version) - (ForexFinest) PDFDocument213 pagesJohn Carter - Mastering The Trade (Another Version) - (ForexFinest) PDFFara NumeNo ratings yet

- Predicting Stock Market TrendsDocument15 pagesPredicting Stock Market Trendsşafak erdoğduNo ratings yet

- Velez PristineDocument68 pagesVelez PristineMickNo ratings yet

- Imperial Options Ebook 4Document19 pagesImperial Options Ebook 4adminNo ratings yet

- Forecasting Stock Trend Using Technical Indicators With RDocument14 pagesForecasting Stock Trend Using Technical Indicators With Rmohan100% (1)

- Weekly Template Trades Using OR - IB V2Document13 pagesWeekly Template Trades Using OR - IB V2ginblake86100% (1)

- Elliott Wave Short Term UpdateDocument12 pagesElliott Wave Short Term UpdateNazerrul Hazwan KamarudinNo ratings yet

- MTA Symposium - My Notes (Vipul H. Ramaiya)Document12 pagesMTA Symposium - My Notes (Vipul H. Ramaiya)vipulramaiya100% (2)

- Bandy NAAIM PaperDocument30 pagesBandy NAAIM Paperkanteron6443No ratings yet

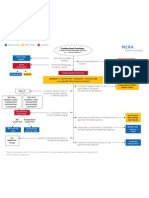

- Market Risk FlowchartDocument1 pageMarket Risk FlowchartlardogiousNo ratings yet

- Raghav - My DayTradingDocument164 pagesRaghav - My DayTradingRam SNo ratings yet

- Technical Analysis: of The Financial MarketsDocument32 pagesTechnical Analysis: of The Financial MarketsSaikatNo ratings yet

- All-Time High Stocks - Why 52-Week and All-Time Highs OutperformDocument3 pagesAll-Time High Stocks - Why 52-Week and All-Time Highs Outperform_karr99100% (1)

- Building A Trading PlanDocument2 pagesBuilding A Trading PlanGeorge KangasNo ratings yet

- 005smo PDFDocument5 pages005smo PDFthelearner16No ratings yet

- Dan Zanger Trader's LogDocument1 pageDan Zanger Trader's LogLNo ratings yet

- Commodity Traders ClassroomDocument0 pagesCommodity Traders ClassroomNick ClarkNo ratings yet

- Hilda SystemDocument6 pagesHilda SystemBudi MulyonoNo ratings yet

- Trading BibleDocument133 pagesTrading BibleLil JLazzyNo ratings yet

- Stock Trading JournalDocument25 pagesStock Trading JournalAmamore PlazaNo ratings yet

- WSJ Barrons Options Insert-NYOT18-LowDocument8 pagesWSJ Barrons Options Insert-NYOT18-LowR@gmailNo ratings yet

- Price Action Tweets From @PAVLeaderDocument4 pagesPrice Action Tweets From @PAVLeaderMana PlanetNo ratings yet

- EPAT Course StructureDocument5 pagesEPAT Course StructureLionel Cayo0% (1)

- Training New TradersDocument3 pagesTraining New TradersLUCKYNo ratings yet

- Zahar Udin PHD ThesisDocument201 pagesZahar Udin PHD ThesisSunny ChaturvediNo ratings yet

- Trading Strategies From Technical Analysis - 6Document19 pagesTrading Strategies From Technical Analysis - 6GEorge StassanNo ratings yet

- Bilz Golden Strategy Checklist (Edited)Document3 pagesBilz Golden Strategy Checklist (Edited)bacreatheNo ratings yet

- System Trader 2Document26 pagesSystem Trader 2Aggelos KotsokolosNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Advanced Technical Analysis: Price Action-Based Entries, Exits, and Chart PatternsFrom EverandAdvanced Technical Analysis: Price Action-Based Entries, Exits, and Chart PatternsNo ratings yet

- Sectors and Styles: A New Approach to Outperforming the MarketFrom EverandSectors and Styles: A New Approach to Outperforming the MarketRating: 1 out of 5 stars1/5 (1)

- What Is Diversification?Document4 pagesWhat Is Diversification?Jonhmark AniñonNo ratings yet

- Broad Index Secured Trust OfferingDocument3 pagesBroad Index Secured Trust OfferingJonhmark AniñonNo ratings yet

- What Is Pegging?Document4 pagesWhat Is Pegging?Jonhmark AniñonNo ratings yet

- What Is A Crawling Peg?Document3 pagesWhat Is A Crawling Peg?Jonhmark AniñonNo ratings yet

- What Is The MUR (Mauritius Rupee) ?Document3 pagesWhat Is The MUR (Mauritius Rupee) ?Jonhmark AniñonNo ratings yet

- What Is An All-Cash, All-Stock Offer?Document3 pagesWhat Is An All-Cash, All-Stock Offer?Jonhmark AniñonNo ratings yet

- What Is Synthetic?Document3 pagesWhat Is Synthetic?Jonhmark AniñonNo ratings yet

- What Is Mean Reversion?Document3 pagesWhat Is Mean Reversion?Jonhmark AniñonNo ratings yet

- What Is Smart Beta?Document4 pagesWhat Is Smart Beta?Jonhmark AniñonNo ratings yet

- Bitcoin vs. Litecoin: What's The Difference?Document4 pagesBitcoin vs. Litecoin: What's The Difference?Jonhmark AniñonNo ratings yet

- Autoregressive Integrated Moving AverageDocument4 pagesAutoregressive Integrated Moving AverageJonhmark AniñonNo ratings yet

- Is Bitcoin Mining Still ProfitableDocument4 pagesIs Bitcoin Mining Still ProfitableJonhmark AniñonNo ratings yet

- Generalized AutoRegressive Conditional HeteroskedasticityDocument3 pagesGeneralized AutoRegressive Conditional HeteroskedasticityJonhmark AniñonNo ratings yet

- What Is A Closed Corporation?Document3 pagesWhat Is A Closed Corporation?Jonhmark AniñonNo ratings yet

- Bitcoin vs. Ripple: What's The Difference?Document5 pagesBitcoin vs. Ripple: What's The Difference?Jonhmark AniñonNo ratings yet

- Valuing Startup VenturesDocument4 pagesValuing Startup VenturesJonhmark AniñonNo ratings yet

- Using LEAPS in A Covered Call WriteDocument4 pagesUsing LEAPS in A Covered Call WriteJonhmark AniñonNo ratings yet

- How To Value Private CompaniesDocument5 pagesHow To Value Private CompaniesJonhmark AniñonNo ratings yet

- What Is A Reverse Takeover (RTO) ?Document3 pagesWhat Is A Reverse Takeover (RTO) ?Jonhmark AniñonNo ratings yet

- What Is The Maximum Loss or Profit With A Covered CallDocument3 pagesWhat Is The Maximum Loss or Profit With A Covered CallJonhmark AniñonNo ratings yet

- What Is Voluntary Bankruptcy?Document2 pagesWhat Is Voluntary Bankruptcy?Jonhmark AniñonNo ratings yet

- What Is Technical Bankruptcy?Document3 pagesWhat Is Technical Bankruptcy?Jonhmark AniñonNo ratings yet

- Proof of ClaimDocument3 pagesProof of ClaimJonhmark AniñonNo ratings yet

- Top 5 Reasons Why People Go BankruptDocument3 pagesTop 5 Reasons Why People Go BankruptJonhmark AniñonNo ratings yet

- What Is LiquidationDocument2 pagesWhat Is LiquidationJonhmark AniñonNo ratings yet

- What Is A Quick-Rinse Bankruptcy?Document2 pagesWhat Is A Quick-Rinse Bankruptcy?Jonhmark AniñonNo ratings yet

- Discount: What Is A Discount?Document3 pagesDiscount: What Is A Discount?Jonhmark AniñonNo ratings yet

- Par ValueDocument3 pagesPar ValueJonhmark AniñonNo ratings yet

- VA Tech Wabag Limited: Summary of Rated InstrumentsDocument8 pagesVA Tech Wabag Limited: Summary of Rated InstrumentsPower of Stock MarketNo ratings yet

- Practice Macro Economics Multiple Choice QuestionsDocument6 pagesPractice Macro Economics Multiple Choice Questionsashwin1804No ratings yet

- Funding SMEs in The PhilippinesDocument4 pagesFunding SMEs in The PhilippinesJR GabrielNo ratings yet

- FEU Financial ReportDocument183 pagesFEU Financial ReportEdgar L. BajamundiNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Chapter 8 - An Intro To Asset Pricing ModelsDocument42 pagesChapter 8 - An Intro To Asset Pricing ModelsImam SetiawanNo ratings yet

- Goldman CaseDocument25 pagesGoldman CaseUrmilaAnantNo ratings yet

- General Information Sheet (Gis) : Non-Stock Corporation FOR THE YEAR - 2020Document6 pagesGeneral Information Sheet (Gis) : Non-Stock Corporation FOR THE YEAR - 2020Rafael ObusanNo ratings yet

- Test Paper Deduction From GtiDocument2 pagesTest Paper Deduction From GtiAkshit GuptaNo ratings yet

- Law of Contract & Special Contract: Lecture By: Saadat Ullah KhanDocument67 pagesLaw of Contract & Special Contract: Lecture By: Saadat Ullah KhanSyed DeXter ShahNo ratings yet

- Microequities Deep Value Microcap Fund IMDocument28 pagesMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdNo ratings yet

- Moore, Brian - Brian S Moore For State Senate District 13 - 1905 - DR2 - SummaryDocument1 pageMoore, Brian - Brian S Moore For State Senate District 13 - 1905 - DR2 - SummaryZach EdwardsNo ratings yet

- Impact of Liquidity Transformation To Vietnamese Commercial Banks Capital Adequacy RatioDocument18 pagesImpact of Liquidity Transformation To Vietnamese Commercial Banks Capital Adequacy Ratioyen294No ratings yet

- FIN 3331 Managerial Finance: Time Value of MoneyDocument23 pagesFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenNo ratings yet

- JuneCS 2014 PDFDocument156 pagesJuneCS 2014 PDFAamir AliNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- CH - 10 7-16-11Document58 pagesCH - 10 7-16-11Myla GellicaNo ratings yet

- Surat Perjanjian FounderDocument10 pagesSurat Perjanjian FounderAndy PermanaNo ratings yet

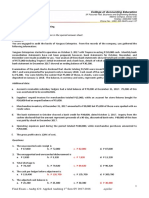

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- Types of Divedend PolicyDocument5 pagesTypes of Divedend PolicyPrajakta BhideNo ratings yet

- How To Register A Startup in IndiaDocument4 pagesHow To Register A Startup in IndiaManoj Kumar MannepalliNo ratings yet

- Insurance: Malaybalay Polymedic General Hospital IncDocument6 pagesInsurance: Malaybalay Polymedic General Hospital IncNaj QuitaNo ratings yet

- Tutorial 2Document3 pagesTutorial 2Godiraönê RamogwëraNo ratings yet

- Dayarayan - RSM ProfileDocument14 pagesDayarayan - RSM ProfileDayarayan CanadaNo ratings yet

- Motilal 9th WealthDocument40 pagesMotilal 9th WealthDhritimanDasNo ratings yet

- Earning Per Shares 1Document45 pagesEarning Per Shares 1kaviyapriyaNo ratings yet

- 20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Document3 pages20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Dustar Ali HaideriNo ratings yet