Professional Documents

Culture Documents

Case Analysis 1 Write Up Revised

Case Analysis 1 Write Up Revised

Uploaded by

Abda Alif PrasidyaCopyright:

Available Formats

You might also like

- FA DCF Modelling Test 1Document17 pagesFA DCF Modelling Test 1honeymakrani220% (1)

- Ebook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFDocument34 pagesEbook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFwarren.beltran184100% (43)

- Time Value of Money The Buy Versus Rent Decision - SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- Time Value of Money The Buy Versus Rent Decision SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision SolutionNida KhanNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Tutorial 4 Chapter 5: Time Value of Money P5-5 Time Value: 2. 6 YearsDocument11 pagesTutorial 4 Chapter 5: Time Value of Money P5-5 Time Value: 2. 6 YearsrizqighaniNo ratings yet

- SPECIAL REVIEWER Part 3Document55 pagesSPECIAL REVIEWER Part 3Keiah CailaoNo ratings yet

- TVM Buy DecisionDocument5 pagesTVM Buy DecisionGulfam Murtaza100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case Study SpreadsheetDocument17 pagesCase Study SpreadsheetExpert Answers100% (1)

- Course Outline FINA 320 WINTER 2022Document6 pagesCourse Outline FINA 320 WINTER 2022ChrisNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- PDFDocument50 pagesPDFM Ali RazaNo ratings yet

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringNo ratings yet

- Buy Vs Rent Decision - Case ExerciseDocument6 pagesBuy Vs Rent Decision - Case ExerciseLife saver100% (2)

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadNo ratings yet

- 07 Time Value of Money - BE ExercisesDocument26 pages07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNo ratings yet

- GCFGFDocument10 pagesGCFGFankushNo ratings yet

- td02 2019 2020 Composc3a9s CorrectionDocument2 pagestd02 2019 2020 Composc3a9s CorrectionMohamed EL AtassiNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual67% (3)

- Solutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsDocument11 pagesSolutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsJonnabeth BondeNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- Case Questions Excel SheetDocument8 pagesCase Questions Excel SheetMustafa MahmoodNo ratings yet

- Case Study ReportDocument13 pagesCase Study ReportHOPE MAKAUNo ratings yet

- Week 2 Assignment FNCE UCWDocument14 pagesWeek 2 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Exercise - Income ApproachDocument2 pagesExercise - Income ApproachanhxxxtuanxxxNo ratings yet

- Solution Key To Problem Set 3Document8 pagesSolution Key To Problem Set 3Ayush RaiNo ratings yet

- Buy Vs Rent Decision Assignment Given DataDocument4 pagesBuy Vs Rent Decision Assignment Given DataMOVIES SHOPNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- A3.3 Annuities SolutionsDocument2 pagesA3.3 Annuities Solutionsrahimjeelani.07No ratings yet

- MidtermDocument12 pagesMidtermFelipe PinedaNo ratings yet

- PGPM 2021 Time Value Problem SetDocument20 pagesPGPM 2021 Time Value Problem SetPRONOY ROYNo ratings yet

- Binder 1Document105 pagesBinder 1prineetu143No ratings yet

- Format of Bond RefundingDocument9 pagesFormat of Bond RefundingvanvunNo ratings yet

- Excel Assignment 4.1 - 4.28Document96 pagesExcel Assignment 4.1 - 4.28ARPIT GILRA0% (1)

- Time Value of Money-Answer KeyDocument12 pagesTime Value of Money-Answer KeyBrianNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Math Class 6 (Homework)Document10 pagesMath Class 6 (Homework)gurpreettagger23No ratings yet

- Module 4 Exercises - JFCDocument10 pagesModule 4 Exercises - JFCJARED DARREN ONGNo ratings yet

- Financial Management Assignment (Final) : C02 Due Date: December 17, 2020, by 2:30 PM SharpDocument2 pagesFinancial Management Assignment (Final) : C02 Due Date: December 17, 2020, by 2:30 PM SharpTasirul IslamNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- Tutorial 9 AnswersDocument5 pagesTutorial 9 AnswersPhụng KimNo ratings yet

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoNo ratings yet

- Project Finance Study: MembersDocument4 pagesProject Finance Study: MembersjoseNo ratings yet

- FM301 CaseDocument23 pagesFM301 CaseSIDDHART BHANSALINo ratings yet

- Tutorial 7 - QuestionsDocument3 pagesTutorial 7 - QuestionsSweethaa ArumugamNo ratings yet

- BUSI331 PROJECT 1 - Jatinderpal Gill - 3005301Document23 pagesBUSI331 PROJECT 1 - Jatinderpal Gill - 3005301sunnygilliganNo ratings yet

- 20-8-2020-Financial Math Virtual Workshop OneDocument16 pages20-8-2020-Financial Math Virtual Workshop OneAdriana MartinezNo ratings yet

- BA 540 (Homework-1)Document6 pagesBA 540 (Homework-1)MariaNo ratings yet

- Ba 540 (HW1) Osuid 934268766Document6 pagesBa 540 (HW1) Osuid 934268766MariaNo ratings yet

- Present Value Basics - StudentDocument22 pagesPresent Value Basics - Studentsaumil shahNo ratings yet

- Own A HomeDocument2 pagesOwn A HomehelpmewinNo ratings yet

- FIN SolutionDocument5 pagesFIN SolutionAyman FergeionNo ratings yet

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDocument8 pagesACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiNo ratings yet

- Time Value of Money and Net Present ValueDocument9 pagesTime Value of Money and Net Present ValueYashrajsing LuckkanaNo ratings yet

- TVMDocument5 pagesTVMHannah Ma Ya LiNo ratings yet

- Assignment IIDocument4 pagesAssignment IIUtsav PathakNo ratings yet

- Wait or Buy CondoDocument5 pagesWait or Buy CondoNeedster100% (3)

- Financial Analyst G&M - Real Estate Test & Case StudyDocument19 pagesFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahNo ratings yet

- Discounted Cash Flow Valuation Section Worksheet-2Document7 pagesDiscounted Cash Flow Valuation Section Worksheet-2Yehia ElmasryNo ratings yet

- Finance NotesDocument64 pagesFinance NotesRubén Darío AragónNo ratings yet

- Fin440 Final Project PDFDocument30 pagesFin440 Final Project PDFAnwar Hosen OntorNo ratings yet

- Sanction LetterDocument16 pagesSanction LetterKiran Kumar DevajjiNo ratings yet

- Finspeed Round 1 - Individuals FDocument7 pagesFinspeed Round 1 - Individuals FBảo Hân VũNo ratings yet

- A Study On Credit Information Bureau (India) Limited (Cibil)Document6 pagesA Study On Credit Information Bureau (India) Limited (Cibil)sums siNo ratings yet

- In Depth: IFRS 16 Implications For Lessors in The Real Estate IndustryDocument15 pagesIn Depth: IFRS 16 Implications For Lessors in The Real Estate Industrytjiendradjaja yaminNo ratings yet

- Allied Bank V MateoDocument3 pagesAllied Bank V MateoLeo Angelo MenguitoNo ratings yet

- Money Market Instruments in PakistanDocument48 pagesMoney Market Instruments in Pakistanaamna12345689% (45)

- Housing Our Future - LISC Cincinnati Report May 2020 (12283)Document28 pagesHousing Our Future - LISC Cincinnati Report May 2020 (12283)WVXU NewsNo ratings yet

- LOC Draft Rapid Response Oklahoma Housing Finance AgencyDocument88 pagesLOC Draft Rapid Response Oklahoma Housing Finance AgencyOKCFOXNo ratings yet

- Gaboya V Cui DigestDocument2 pagesGaboya V Cui DigestDonvidachiye Liwag CenaNo ratings yet

- Customer Survey Report On Demat Account: Submitted ToDocument15 pagesCustomer Survey Report On Demat Account: Submitted ToSoumik ParuaNo ratings yet

- Florida Bar V David Stern, Trent Motion Intervene, FL Supreme Court Case No. SC13-643, Sept. 27, 2013Document50 pagesFlorida Bar V David Stern, Trent Motion Intervene, FL Supreme Court Case No. SC13-643, Sept. 27, 2013larry-612445No ratings yet

- Land & Revenue Records Terms Used in IndiaDocument10 pagesLand & Revenue Records Terms Used in IndiaradhaNo ratings yet

- MLRH 2004 5 576Document4 pagesMLRH 2004 5 576Shidah RafiqeNo ratings yet

- Comparison..pledge, Mortgage, AntichresisDocument2 pagesComparison..pledge, Mortgage, AntichresisElfin Kenneth Puentespina0% (1)

- 2014 - Real Estates - Roberta Marcaccio PDFDocument5 pages2014 - Real Estates - Roberta Marcaccio PDFRoberta MarcaccioNo ratings yet

- Factors For Financial EngineeringDocument8 pagesFactors For Financial EngineeringMuhaiminul IslamNo ratings yet

- Beyond The Indian Act Restoring Aboriginal Property RightsDocument241 pagesBeyond The Indian Act Restoring Aboriginal Property RightsMark BrownNo ratings yet

- PPSA-Registry, Priority, Prior Interests and Transitory ProvisionsDocument59 pagesPPSA-Registry, Priority, Prior Interests and Transitory ProvisionsFederico Dipay Jr.No ratings yet

- What Is The Meaning of Share?: in Other WordsDocument27 pagesWhat Is The Meaning of Share?: in Other WordsSIddharth CHoudhary0% (1)

- Accounting LeaseDocument18 pagesAccounting LeaseNune SabanalNo ratings yet

- Chanakya National Law University, Patna: Law Relating To Finance and Corporate Finance, Securities and CompetitionDocument18 pagesChanakya National Law University, Patna: Law Relating To Finance and Corporate Finance, Securities and CompetitionKhyati ShreeNo ratings yet

- Credit & Collection: Midterm Quiz 1Document5 pagesCredit & Collection: Midterm Quiz 1geofrey gepitulanNo ratings yet

- Lecture Notes 3 - Unpaid Seller To Consumer - S ActDocument106 pagesLecture Notes 3 - Unpaid Seller To Consumer - S ActIan Pol FiestaNo ratings yet

- Finman Module 8Document42 pagesFinman Module 8Jennyveive RiveraNo ratings yet

- G EnglishDocument23 pagesG EnglishChouaib Ben BoubakerNo ratings yet

- Spouses Eduardo and Lydia Silos Vs Philippine National Bank CaseDocument27 pagesSpouses Eduardo and Lydia Silos Vs Philippine National Bank CaseMina AgarNo ratings yet

- Chap 027-LeasingDocument19 pagesChap 027-LeasingChotto MateNo ratings yet

Case Analysis 1 Write Up Revised

Case Analysis 1 Write Up Revised

Uploaded by

Abda Alif PrasidyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Analysis 1 Write Up Revised

Case Analysis 1 Write Up Revised

Uploaded by

Abda Alif PrasidyaCopyright:

Available Formats

lOMoARcPSD|5648297

Case Analysis 1 Write-Up revised

Financial Management (Howard University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

Case Analysis

Time Value of Money: The Buy Versus Rent Decision

Write-Up

Andre' Diggs

Kamesia Hawkins

Wesley Jackson

Natasia Kennedy

Brooke Thomas

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

Overview

The case describes Rebecca Young, who completed her MBA in May 2013 and moved to

Toronto to start a new job in investment banking She rented a two-bedroom condo for $3,000 per

month that included parking but not utilities or cable television. In July 2014, an identical unit

next door became available for sale, and Rebecca could purchase it for $500,000.00. Even

though she liked the condo, Rebecca planned to move to a house or larger penthouse condo

within 5 to 10 years. She's facing a tough dilemma on whether to continue renting or purchase a

new house or condo according to her future plans. While friends and family make compelling

arguments to both perspectives, Rebecca will have to perform a time value of money analysis to

support and confirm her decision to buy or rent.

Financial Background/Details

If Rebecca decided to purchase a new condo, she would have to consider the following financial

expenses:

1) $1,055.00 per month in condo fees

2) $300.00 per month in property taxes

3) $600.00 a year in maintenance and repairs ($50.00 per month)

4) $100,000.00 in a 20% cash down payment

5) $1,500.00 in 3.0% combined 1.5% local and 1.5% provincial deed-transfer taxes

6) $2,000.00 closing fees

In order to finance the remaining 80.0% of the purchase price, Rebecca contacted lenders

who would offer a 3.75% annual rate locked in for a 10-year terms, and she would amortize the

mortgage over 30 years with monthly payments. The money Rebecca planned to use for her

down payment and closing costs was invested and earning the same effective monthly rate of

return as she would be paying for her mortgage. She assumed that if she were to sell her condo in

the next 2 to 10 years, Rebecca would pay 5.0% of the selling price to realtor fees plus $2,000.00

in other closing fees.

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

Scenario Analysis Background/Details

To complete a financial analysis of the buy-versus-rent decision, Rebecca would have to

perform the following steps:

1) Determine the required monthly payments.

2) Determine the opportunity costs (on a monthly basis) of using the lump-sum required funds

for the condominium purchase rather than leaving those funds invested and earning the effective

monthly rate.

3) Determine additional monthly payments required to purchase the condo compared to renting,

including opportunity cost.

Rebecca also wanted to consider what might happen if she chose to sell at a future date,

which would not transpire for at least two years but could in 5 or 10 years. She would model the

amount of the outstanding principal at various points in the future - two, five, or 10 years from

now and then determine the future gain or loss after 2, 5, and 10 years under the following

scenarios:

A) The condo price remains unchanged.

B) The condo price drops 10.0% over the next 2 years, then increases back to its purchase price

by the end of five years, then increases by a total of 10.0% from the original purchase price by

the end of 10 years.

C) The condo price increases annually by the annual rate of inflation of 2.0% per year over the

next 10 years.

D) The condo price increases annually by an annual rate of 5.0% per year over the next 10 years.

Although the majority of her decision would be based on a quantitative analysis, Rebecca

would also have to factor qualitative scenarios that would aid her in her decision to buy or rent.

Financial Analysis

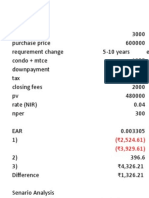

With a purchase price of $500,000.00, an annual rate of 3.75%, 20.0% down payment of

$100,000.00, and amortization period of 30 years, Rebecca's monthly payment is $1,845.89. If

she decided to buy the identical condo, she would have to add monthly condo fees at $1,055.00,

taxes at $300.00, and repairs at $50.00, which would result in $3,250.89 per month. Compared to

monthly rent of $3,000.00, Rebecca's net additional payments are $250.89 per month. Her

monthly opportunity costs (down payment and closing costs) would be $362.80 if the

$117,000.00 was invested at the same rate of return. The total additional monthly cash flow cost

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

is $613.69. Rebecca's principal outstanding after 2, 5, and 10 years is the following:

$384,936.59, $360,135.11, and $312,132.28. if Rebecca stopped her analysis at this point, it

would best for her to rent than buy because she would have to pay $250.89 more per month in

additional payments, and the total additional monthly cash flow cost would be $613.69. however,

we would have to include the scenario analysis for Rebecca to either rent or buy.

Financial Scenario Analysis

Scenario A) No Change in Price

2 years 5 years 10 years

Selling Price 500000 500000 500000

Realtor Fees (@5%) 25000 25000 25000

Other Selling fees 2000 2000 2000

Princ OS $384,936.59 $360,135.11 $312,132.28

Net Proceeds $88,063.41 $112,864.89 $160,867.72

Funds at Closing 117000 117000 117000

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing $15,266.04 $40,401.14 $89,049.69

Net FV -$44,202.63 -$44,536.25 -$45,181.97

PV of Future Net (NPV) -$41,037.19 -$36,986.01 -$31,161.10

In this scenario, Rebecca's NPV would be in the negative after 2 (-$41,037.19), 5 (-$36,986.01),

and 10 years (-$31,161.10). Even though the NPV increases after 5 or 10 years, it still remains in

the negative. Rebecca would have to remain in the condo longer than 10 years based on the

model in this scenario in hopes of receiving a positive NPV; however, we're not confident that if

she remained longer than 10 years that there would be a positive NPV.

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

Scenario B) 10.0% Down After 2 Years, Back to $500,000.00 After 5 Years, Up 10.0%

After 10 Years

2 years 5 years 10 years

Selling Price 450000 500000 550000

Realtor Fees (@5%) 22500 25000 27500

Other Selling fees 2000 2000 2000

Princ OS $384,936.59 $360,135.11 $312,132.28

Net Proceeds $40,563.41 $112,864.89 $208,367.72

Funds at Closing 117000 117000 117000

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing $15,266.04 $40,401.14 $89,049.69

Net FV -$91,702.63 -$44,536.25 $2,318.03

PV of Future Net (NPV) -$85,135.62 -$36,986.01 $1,598.70

In this scenario, Rebecca's NPV would remain in the negative after 2 (-$85,135.62) and 5 (-

$36,986.01) years. Even though it significantly increases when you compare the NPVs after 2

and 5 years; however, they still remain negative. The NPV becomes positive after 10 years still

the amount is $1,598.70, but it is significantly low.

Scenario C) Condo Price Increases 2.0% Annually

2 years 5 years 10 years

Selling Price 520200 552040 609497

Realtor Fees (@5%) 26010 27602 30475

Other Selling fees 2000 2000 2000

Princ OS $384,936.59 $360,135.11 $312,132.28

Net Proceeds $107,253.41 $162,303.28 $264,890.07

Funds at Closing 117000 117000 117000

Opportunity Cost of Extra Payments Incl. Funds Used at Initial Closing $15,266.04 $40,401.14 $89,049.69

Net FV -$25,012.63 $45,303.28 $147,890.07

PV of Future Net (NPV) -$23,221.42 $37,623.00 $101,996.81

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

In this scenario, if the condo price increases 2.0% annually, Rebecca's NPV is negative

after 2 years; however, it is positive after 5 and 10 years. When you compare the NPVs, there is a

$60,844.42 increase between 2 (-$23,221.42) and 5 years ($37,623.00). If Rebecca decided to

stay in the condo after 10 years, her NPV would increase by 2.71 times when comparing them in

5 years and 10 years. After 5 years, her NPV is $37,623.00, and 10 years, it would be

$101,996.81.

Scenario D) Condo Price Increase 5.0% Annually

2 years 5 years 10 years

Selling Price 551250 638141 814447

Realtor Fees (@5%) 27562.5 31907 40722

Other Selling fees 2000 2000 2000

Princ OS $384,936.59 $360,135.11 $312,132.28

Net Proceeds $136,750.91 $244,098.64 $459,592.67

Funds at Closing 117000 117000 117000

Opportunity Cost of Extra Payments Incl. Funds Used at Initial

Closing $15,266.04 $40,401.14 $89,049.69

Net FV $4,484.87 $86,697.49 $253,542.98

PV of Future Net (NPV) $4,163.70 $71,999.64 $174,863.49

In this scenario, if the condo price increases 5.0% annually, Rebecca's NPV would be positive

after 2, 5, and 10 years. In 2 years, the NPV would be $4,163.70. In 5 years, the NPV would be

$71,999.64, and in 10 years, it would be $174,863.49. The NPV factor would increase by 17.29

times from 2 to 5 years and 42 times from 2 to 10 years.

Conclusion

Based on the financial scenario analysis, we recommend that Rebecca should buy the

condo, which would best fit her plan to move another house after staying in the condo between 5

to 10 years. The scenarios that would maximize her NPV if the condo prices increase 2.0%

(Scenario C) or 5.0% annually (Scenario D). If condo prices increase 2.0% or 5.0% annually,

Rebecca's NPV is maximized if she purchased the condo and stayed there after ten years. We do

understand the risk involved is the condo price could decrease in percentage then increase. Still,

when we review that scenario, which the condo price decreases 10.0% then back to the purchase

price, then increases to 10.0%, Rebecca would have to stay in the condo for 10+ years to receive

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

lOMoARcPSD|5648297

a positive NPV. Unfortunately, the NPV amount is miniscule in comparison to Scenario C or D.

We also recognize there are qualitative considerations that Rebecca would factor in as well such

as moving to another neighborhood in Toronto, moving to another city in Canada, and applying

for another job in her career. If she considers these qualitative factors, it could possibly influence

her to deviate in her decision. We do not recommend purchasing a condo then selling after two

years. In every scenario we analyze, Rebecca's NPV is in the negative except in Scenario D,

which results as positive; however, the amount is under $10,000.00.

Downloaded by Abda Alif Prasidya (abdaalifprasidya@gmail.com)

You might also like

- FA DCF Modelling Test 1Document17 pagesFA DCF Modelling Test 1honeymakrani220% (1)

- Ebook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFDocument34 pagesEbook Ebook PDF Personal Finance 2nd Edition by Vickie L Bajtelsmit PDFwarren.beltran184100% (43)

- Time Value of Money The Buy Versus Rent Decision - SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- Time Value of Money The Buy Versus Rent Decision SolutionDocument5 pagesTime Value of Money The Buy Versus Rent Decision SolutionNida KhanNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Tutorial 4 Chapter 5: Time Value of Money P5-5 Time Value: 2. 6 YearsDocument11 pagesTutorial 4 Chapter 5: Time Value of Money P5-5 Time Value: 2. 6 YearsrizqighaniNo ratings yet

- SPECIAL REVIEWER Part 3Document55 pagesSPECIAL REVIEWER Part 3Keiah CailaoNo ratings yet

- TVM Buy DecisionDocument5 pagesTVM Buy DecisionGulfam Murtaza100% (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case Study SpreadsheetDocument17 pagesCase Study SpreadsheetExpert Answers100% (1)

- Course Outline FINA 320 WINTER 2022Document6 pagesCourse Outline FINA 320 WINTER 2022ChrisNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- PDFDocument50 pagesPDFM Ali RazaNo ratings yet

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringNo ratings yet

- Buy Vs Rent Decision - Case ExerciseDocument6 pagesBuy Vs Rent Decision - Case ExerciseLife saver100% (2)

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadNo ratings yet

- 07 Time Value of Money - BE ExercisesDocument26 pages07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNo ratings yet

- GCFGFDocument10 pagesGCFGFankushNo ratings yet

- td02 2019 2020 Composc3a9s CorrectionDocument2 pagestd02 2019 2020 Composc3a9s CorrectionMohamed EL AtassiNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual67% (3)

- Solutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsDocument11 pagesSolutions To Problems - Chapter 6 Mortgages: Additional Concepts, Analysis, and ApplicationsJonnabeth BondeNo ratings yet

- Time Value of Money The Buy Versus Rent Decision Solution PDFDocument5 pagesTime Value of Money The Buy Versus Rent Decision Solution PDFMuhammad Ibtehash100% (1)

- Case Questions Excel SheetDocument8 pagesCase Questions Excel SheetMustafa MahmoodNo ratings yet

- Case Study ReportDocument13 pagesCase Study ReportHOPE MAKAUNo ratings yet

- Week 2 Assignment FNCE UCWDocument14 pagesWeek 2 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Exercise - Income ApproachDocument2 pagesExercise - Income ApproachanhxxxtuanxxxNo ratings yet

- Solution Key To Problem Set 3Document8 pagesSolution Key To Problem Set 3Ayush RaiNo ratings yet

- Buy Vs Rent Decision Assignment Given DataDocument4 pagesBuy Vs Rent Decision Assignment Given DataMOVIES SHOPNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- A3.3 Annuities SolutionsDocument2 pagesA3.3 Annuities Solutionsrahimjeelani.07No ratings yet

- MidtermDocument12 pagesMidtermFelipe PinedaNo ratings yet

- PGPM 2021 Time Value Problem SetDocument20 pagesPGPM 2021 Time Value Problem SetPRONOY ROYNo ratings yet

- Binder 1Document105 pagesBinder 1prineetu143No ratings yet

- Format of Bond RefundingDocument9 pagesFormat of Bond RefundingvanvunNo ratings yet

- Excel Assignment 4.1 - 4.28Document96 pagesExcel Assignment 4.1 - 4.28ARPIT GILRA0% (1)

- Time Value of Money-Answer KeyDocument12 pagesTime Value of Money-Answer KeyBrianNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Math Class 6 (Homework)Document10 pagesMath Class 6 (Homework)gurpreettagger23No ratings yet

- Module 4 Exercises - JFCDocument10 pagesModule 4 Exercises - JFCJARED DARREN ONGNo ratings yet

- Financial Management Assignment (Final) : C02 Due Date: December 17, 2020, by 2:30 PM SharpDocument2 pagesFinancial Management Assignment (Final) : C02 Due Date: December 17, 2020, by 2:30 PM SharpTasirul IslamNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- Tutorial 9 AnswersDocument5 pagesTutorial 9 AnswersPhụng KimNo ratings yet

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoNo ratings yet

- Project Finance Study: MembersDocument4 pagesProject Finance Study: MembersjoseNo ratings yet

- FM301 CaseDocument23 pagesFM301 CaseSIDDHART BHANSALINo ratings yet

- Tutorial 7 - QuestionsDocument3 pagesTutorial 7 - QuestionsSweethaa ArumugamNo ratings yet

- BUSI331 PROJECT 1 - Jatinderpal Gill - 3005301Document23 pagesBUSI331 PROJECT 1 - Jatinderpal Gill - 3005301sunnygilliganNo ratings yet

- 20-8-2020-Financial Math Virtual Workshop OneDocument16 pages20-8-2020-Financial Math Virtual Workshop OneAdriana MartinezNo ratings yet

- BA 540 (Homework-1)Document6 pagesBA 540 (Homework-1)MariaNo ratings yet

- Ba 540 (HW1) Osuid 934268766Document6 pagesBa 540 (HW1) Osuid 934268766MariaNo ratings yet

- Present Value Basics - StudentDocument22 pagesPresent Value Basics - Studentsaumil shahNo ratings yet

- Own A HomeDocument2 pagesOwn A HomehelpmewinNo ratings yet

- FIN SolutionDocument5 pagesFIN SolutionAyman FergeionNo ratings yet

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDocument8 pagesACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiNo ratings yet

- Time Value of Money and Net Present ValueDocument9 pagesTime Value of Money and Net Present ValueYashrajsing LuckkanaNo ratings yet

- TVMDocument5 pagesTVMHannah Ma Ya LiNo ratings yet

- Assignment IIDocument4 pagesAssignment IIUtsav PathakNo ratings yet

- Wait or Buy CondoDocument5 pagesWait or Buy CondoNeedster100% (3)

- Financial Analyst G&M - Real Estate Test & Case StudyDocument19 pagesFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahNo ratings yet

- Discounted Cash Flow Valuation Section Worksheet-2Document7 pagesDiscounted Cash Flow Valuation Section Worksheet-2Yehia ElmasryNo ratings yet

- Finance NotesDocument64 pagesFinance NotesRubén Darío AragónNo ratings yet

- Fin440 Final Project PDFDocument30 pagesFin440 Final Project PDFAnwar Hosen OntorNo ratings yet

- Sanction LetterDocument16 pagesSanction LetterKiran Kumar DevajjiNo ratings yet

- Finspeed Round 1 - Individuals FDocument7 pagesFinspeed Round 1 - Individuals FBảo Hân VũNo ratings yet

- A Study On Credit Information Bureau (India) Limited (Cibil)Document6 pagesA Study On Credit Information Bureau (India) Limited (Cibil)sums siNo ratings yet

- In Depth: IFRS 16 Implications For Lessors in The Real Estate IndustryDocument15 pagesIn Depth: IFRS 16 Implications For Lessors in The Real Estate Industrytjiendradjaja yaminNo ratings yet

- Allied Bank V MateoDocument3 pagesAllied Bank V MateoLeo Angelo MenguitoNo ratings yet

- Money Market Instruments in PakistanDocument48 pagesMoney Market Instruments in Pakistanaamna12345689% (45)

- Housing Our Future - LISC Cincinnati Report May 2020 (12283)Document28 pagesHousing Our Future - LISC Cincinnati Report May 2020 (12283)WVXU NewsNo ratings yet

- LOC Draft Rapid Response Oklahoma Housing Finance AgencyDocument88 pagesLOC Draft Rapid Response Oklahoma Housing Finance AgencyOKCFOXNo ratings yet

- Gaboya V Cui DigestDocument2 pagesGaboya V Cui DigestDonvidachiye Liwag CenaNo ratings yet

- Customer Survey Report On Demat Account: Submitted ToDocument15 pagesCustomer Survey Report On Demat Account: Submitted ToSoumik ParuaNo ratings yet

- Florida Bar V David Stern, Trent Motion Intervene, FL Supreme Court Case No. SC13-643, Sept. 27, 2013Document50 pagesFlorida Bar V David Stern, Trent Motion Intervene, FL Supreme Court Case No. SC13-643, Sept. 27, 2013larry-612445No ratings yet

- Land & Revenue Records Terms Used in IndiaDocument10 pagesLand & Revenue Records Terms Used in IndiaradhaNo ratings yet

- MLRH 2004 5 576Document4 pagesMLRH 2004 5 576Shidah RafiqeNo ratings yet

- Comparison..pledge, Mortgage, AntichresisDocument2 pagesComparison..pledge, Mortgage, AntichresisElfin Kenneth Puentespina0% (1)

- 2014 - Real Estates - Roberta Marcaccio PDFDocument5 pages2014 - Real Estates - Roberta Marcaccio PDFRoberta MarcaccioNo ratings yet

- Factors For Financial EngineeringDocument8 pagesFactors For Financial EngineeringMuhaiminul IslamNo ratings yet

- Beyond The Indian Act Restoring Aboriginal Property RightsDocument241 pagesBeyond The Indian Act Restoring Aboriginal Property RightsMark BrownNo ratings yet

- PPSA-Registry, Priority, Prior Interests and Transitory ProvisionsDocument59 pagesPPSA-Registry, Priority, Prior Interests and Transitory ProvisionsFederico Dipay Jr.No ratings yet

- What Is The Meaning of Share?: in Other WordsDocument27 pagesWhat Is The Meaning of Share?: in Other WordsSIddharth CHoudhary0% (1)

- Accounting LeaseDocument18 pagesAccounting LeaseNune SabanalNo ratings yet

- Chanakya National Law University, Patna: Law Relating To Finance and Corporate Finance, Securities and CompetitionDocument18 pagesChanakya National Law University, Patna: Law Relating To Finance and Corporate Finance, Securities and CompetitionKhyati ShreeNo ratings yet

- Credit & Collection: Midterm Quiz 1Document5 pagesCredit & Collection: Midterm Quiz 1geofrey gepitulanNo ratings yet

- Lecture Notes 3 - Unpaid Seller To Consumer - S ActDocument106 pagesLecture Notes 3 - Unpaid Seller To Consumer - S ActIan Pol FiestaNo ratings yet

- Finman Module 8Document42 pagesFinman Module 8Jennyveive RiveraNo ratings yet

- G EnglishDocument23 pagesG EnglishChouaib Ben BoubakerNo ratings yet

- Spouses Eduardo and Lydia Silos Vs Philippine National Bank CaseDocument27 pagesSpouses Eduardo and Lydia Silos Vs Philippine National Bank CaseMina AgarNo ratings yet

- Chap 027-LeasingDocument19 pagesChap 027-LeasingChotto MateNo ratings yet