Professional Documents

Culture Documents

Quiz 1 (Answer)

Quiz 1 (Answer)

Uploaded by

Ali SaeedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1 (Answer)

Quiz 1 (Answer)

Uploaded by

Ali SaeedCopyright:

Available Formats

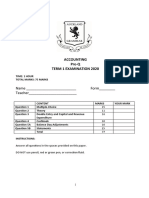

Accounting Principles &

Quiz 1 The Double-Entry System

Name: ________________________________________________________ Batch: EMBA2K19

Max Marks: 40 Time Allowed: 60 minutes

Clearly encircle or tick the right option

1. Which of the following statements is incorrect? (1 mark) 9. This accounting principle assumes that a company will continue

A. Assets – Capital = Liabilities to exist long enough to carry out its objectives and commitments

B. Liabilities + Assets = Capital and will not liquidate in the foreseeable future. Foreseeable

C. Liabilities + Capital = Assets future here is considered to be: (2 marks)

D. Assets – Liabilities = Capital A. a period of not less than 3 months

B. a period of not less than 3 years

2. Which of the following is not an asset? (1 mark) C. a period of not less than 12 months

A. Buildings D. a period of not less than 12 years

B. Cash balance

C. Goods sold on credit 10. Materiality principle states that errors or mistakes in accounting

D. Goods bought on credit procedures, that which involves immaterial or small amount,

may be ignored and are not worth rectifying unless straight-

3. Which of the following is a liability? (1 mark) forward. (2 marks)

A. Machinery ❑ True ❑ False

B. Creditors for goods

C. Motor Vehicles 11. All business resources acquired should be valued and recorded

D. Cash at Bank based on the actual cash equivalent or original cost of acquisition

and not the prevailing market value or future value. (2 marks)

4. Which of the following best describes the meaning of ❑ True ❑ False

‘Purchases’? (1 mark)

A. Items bought 12. Which of the following accounting concepts require the

B. Goods bought for resale recorded amounts to have some form of impartial supporting

C. Goods bought on credit evidence or documentation? (2 marks)

D. Goods paid for A. Matching

B. Prudence

5. Which of the following best describes a trial balance? (1 mark) C. Independence

A. Shows the financial position of a business D. Objectivity

B. Shows all the entries in the books

C. It is a list of balances on the books 13. Given the following, what is the amount of Capital? Assets:

D. It is a special account Premises £20,000; Stock £8,500; Cash £100. Creditors £3,000;

Loan from A Adams £5,000 (2 marks)

6. Profit is: (1 mark) A. £21,100

A. Sales less Purchases B. £21,600

B. Excess of sales over cost C. £20,600

C. Cost of goods sold + Opening stock D. £21,400

D. Net profit less expenses of the period.

14. Which of the following is correct? (1 mark)

7. Capital is a type of liability. This is the amount that is due to the A. Profit does not alter capital

owner(s) of the business and can only increase by any new B. Profit increases capital

capital injected into the business. (1 mark) C. Profit reduces capital

❑ True ❑ False D. Capital can only come from profit

8. Any personal transactions of its owner should not be recorded in 15. What best describes fixed/non-current assets? (1 mark)

the business accounting book unless the owner’s personal A. Bought to be used in the business

transaction involves adding and/or withdrawing resources from B. Items which will not wear out quickly

the business. (1 mark) C. Long life and are not bought specifically for resale.

❑ True ❑ False D. Expensive items bought for the business

Business Accounting Page 1 of 3

16. If Sales (during the period) were £8,200; Opening stock (at year 20. Which accounting concept states that omitting or misstating this

start) was £1,300; Closing stock (at year end) is £900; Purchases information could influence users of the financial statements?

(during the period) were £6,400, the profit figure is: (2 marks) (1 mark)

A. £6,800 A. The consistency concept

B. £6,200 B. The accruals concept

C. £7,000 C. The materiality concept

D. Another figure D. The going concern concept

17. A business can make a profit and yet have a reduction in its 21. Which of the following accounting concepts means that similar

bank balance. Which ONE of the following might cause this to items should receive a similar accounting treatment? (1 mark)

happen? (2 marks) A. Going concern

A. Sale of an assets at a loss B. Accruals

B. Overcharging expenses C. Substance over form

C. Lengthening of the period of credit given to customers D. Consistency

D. Lengthening of the period of credit taken from suppliers

22. Which of the following is incorrect? (2 marks)

Assets Liabilities Capital

18. A trial balance is made up of a list of debit balances and credit £ £ £

balances. Which of the following statements is correct? A. 7,850 1,250 6,600

(1 mark) B. 8,200 2,800 5,400

A. Every debit balance represents an expense. C. 6,540 1,120 5,420

B. Assets are represented by debit balances. D. 9,550 1,150 8,200

C. Liabilities are represented by debit balances.

D. Income is included in the list of debit balances.

19. Which accounting concept should be considered if the owner of

a business takes goods from inventory for his own personal use?

A. The substance over form concept (1 mark)

B. The accruals concept

C. The going concern concept

D. The business entity concept

23. Which of the following statements about accounting concepts are correct? (2 marks)

1. Prudence concept means that understating of assets and overstating of liabilities is desirable in preparing financial statements.

2. Reliability concept means that even if information is relevant, if it is very unreliable, it may be misleading to recognize it in the financial

statements.

3. Accruals concept requires that revenue earned must be matched against the expenditure incurred in earning it.

4. Substance over form convention is that, whenever legally possible, the economic substance of a transaction should be reflected in financial

statements rather than simply its legal form.

A. 1, 2 and 3 C. 1, 3 and 4

B. 1, 2 and 4 D. 2, 3 and 4

24. Bert has extracted the following list of balances from his general ledger at 31 October 20X9:

$

Sales 258,542

Stock 9,649

Purchases 142,958

Expenses 34,835

Premises 63,960

Receivables 31,746

Payables 13,864

Cash at bank 1,783

Capital 12,525

What is the total of the debit balances in Bert's trial balance at 31 October 20X9? (2 marks)

A. $267,049 C. $283,148

B. $275,282 D. $284,931

Business Accounting Page 2 of 3

25. Which of the following are correct? (2 marks)

Account to be debited Account to be credited

(i) Bought office furniture for cash Office furniture Cash

(ii) A debtor, P Sangster, pays us by cheque Bank P Sangster

(iii) Introduced capital by cheque Capital Bank

(iv) Paid a creditor, B Lee, by cash B Lee Cash

A. (i), (ii) and (iii) only C. (i) and (iv) only

B. (ii), (iii) and (iv) only D. (i), (ii) and (iv) only

26. Which of the following are incorrect? (2 marks)

Account to be debited Account to be credited

(i) Goods sold for cash Cash Sales

(ii) Goods bought on credit from T Carter Purchases T Carter

(iii) Goods returned by us to C Barry C Barry Returns outwards

(iv) Van bought for cash Purchases Cash

A. (i) and (iii) only C. (ii) and (iv) only

B. (iv) only D. (iii) only

27. Which of the following are correct? (2 marks)

Account to be debited Account to be credited

(i) Received commission by cheque Bank Commission received

(ii) Paid rates by cash Rates Cash

(iii) Paid motor expenses by cheque Motor expenses Bank

(iv) Received refund of insurance by cheque Insurance Bank

A. (i) and (ii) only C. (ii), (iii) and (iv) only

B. (i), (ii) and (iv) only D. (i), (ii) and (iii) only

- - - End of Quiz - - -

Business Accounting Page 3 of 3

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- ACC 3rd QuizDocument12 pagesACC 3rd QuizJazzy Mercado55% (11)

- Wadhwani Activity 2Document4 pagesWadhwani Activity 2Emman IsipNo ratings yet

- Quiz 1Document4 pagesQuiz 1jenylyn acostaNo ratings yet

- Case Study A Profile of Toyota's Production SystemDocument1 pageCase Study A Profile of Toyota's Production SystemZhen WuNo ratings yet

- HH Poll 2009Document6 pagesHH Poll 2009Venky VenkateshNo ratings yet

- Accounting Process MCQDocument11 pagesAccounting Process MCQAce Hulsey TevesNo ratings yet

- Section ADocument9 pagesSection Ahanh123miumiuNo ratings yet

- Compilation of Test ACC106 For StudentsDocument15 pagesCompilation of Test ACC106 For StudentsKamarul Adha0% (1)

- QP XI AccountancyDocument13 pagesQP XI AccountancySanjay Panicker100% (1)

- Xi - Acc - Sample P-QP - 21-22Document8 pagesXi - Acc - Sample P-QP - 21-22karanNo ratings yet

- Last Assignment of PRC-04 December 2022Document94 pagesLast Assignment of PRC-04 December 2022mudassar saeedNo ratings yet

- Luyong - Fabm1 - 4thQDocument4 pagesLuyong - Fabm1 - 4thQJonavi Luyong0% (1)

- ABM 2 SummativeDocument3 pagesABM 2 SummativeDindin Oromedlav LoricaNo ratings yet

- Prudence Final ExamDocument5 pagesPrudence Final ExamBhumi NavtiaNo ratings yet

- SET B Class 11th Accountancy WPT - I 3Document5 pagesSET B Class 11th Accountancy WPT - I 3Shakshi ShudhNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Haridas OngallurNo ratings yet

- Grade 10 Edexcel Accounting IDocument15 pagesGrade 10 Edexcel Accounting IKeven MothaNo ratings yet

- AccountingDocument18 pagesAccountingnirosha pereraNo ratings yet

- Revision Accountancy XI Term II 8.12.2022 FinalDocument15 pagesRevision Accountancy XI Term II 8.12.2022 FinalNIRMALA COMMERCE DEPTNo ratings yet

- Mtp-T2-Accuntancy-11 202324Document8 pagesMtp-T2-Accuntancy-11 202324aasthakalamkarlpsNo ratings yet

- JULLIE CARMELLE H. CHATTO - APE 1 - Final Exam AnswersDocument5 pagesJULLIE CARMELLE H. CHATTO - APE 1 - Final Exam AnswersJULLIE CARMELLE H. CHATTONo ratings yet

- MCQ Class 11 On 25th Septembar 2021Document3 pagesMCQ Class 11 On 25th Septembar 2021sunnybgs25No ratings yet

- Practice 5 - Accounting For Merchandising - Theories and Problem SolvingDocument7 pagesPractice 5 - Accounting For Merchandising - Theories and Problem SolvingAeron RamirexNo ratings yet

- Acc 211 Continuous Assessment Test12Document25 pagesAcc 211 Continuous Assessment Test12Emmanuel OdukoyaNo ratings yet

- Question 684609Document11 pagesQuestion 684609Kishan VithalaniNo ratings yet

- Entrep-With AnswersDocument2 pagesEntrep-With AnswersMaskter ArcheryNo ratings yet

- Accounting ObjectiveDocument2 pagesAccounting ObjectiveAbdul MoidNo ratings yet

- BFAR Practice Exercise QuestionnaireDocument3 pagesBFAR Practice Exercise QuestionnairePARBO Alessandra KateNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument7 pagesElementsBookKeepingAccountancy SQPKanya PrakashNo ratings yet

- C. Allowance B. No: Mcqs/page/2Document5 pagesC. Allowance B. No: Mcqs/page/2Javed IqbalNo ratings yet

- Reviewer in Basic Accounting 2 KeyDocument6 pagesReviewer in Basic Accounting 2 KeyLala BoraNo ratings yet

- Accts U1Document9 pagesAccts U1Avriella BlakeNo ratings yet

- Worksheet 03Document4 pagesWorksheet 03LuckyNo ratings yet

- Pre-Q Term 1 School Exam 2020Document14 pagesPre-Q Term 1 School Exam 2020Rafael Marco ManubayNo ratings yet

- Commerce MCQs Practice Test 1Document8 pagesCommerce MCQs Practice Test 1Nirakar GoudaNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- t8 - Abfa1153 Fa I (Tutor)Document3 pagest8 - Abfa1153 Fa I (Tutor)Wu kai AngNo ratings yet

- 2021-2022 G-11 AccountancyDocument4 pages2021-2022 G-11 AccountancyAumkarNo ratings yet

- Exam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024Document35 pagesExam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024MUSTHARI KHANNo ratings yet

- CAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestDocument6 pagesCAMPERDOWN HIGH SCHOOL - Accounting Grade 9 TestLatoya SmithNo ratings yet

- Xi AccountingDocument10 pagesXi AccountingTaha KHILARINo ratings yet

- Entrepreneurship q2 Module 5Document12 pagesEntrepreneurship q2 Module 5Arap MamboNo ratings yet

- Accounts (GAP)Document13 pagesAccounts (GAP)abdul gani khanNo ratings yet

- Sample Paper: H.O.: 6, Vidya Sagar Lane, Behind Apex Mall, Indrapuri, Lal Kothi. Tonk Road, JaipurDocument11 pagesSample Paper: H.O.: 6, Vidya Sagar Lane, Behind Apex Mall, Indrapuri, Lal Kothi. Tonk Road, JaipurTanisha GuptaNo ratings yet

- ACCT CH.2 HomeworkDocument13 pagesACCT CH.2 Homeworkj8noelNo ratings yet

- FDNACCT Review Exam-AnsKey-SetADocument7 pagesFDNACCT Review Exam-AnsKey-SetAChyle Sagun100% (1)

- Section A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceDocument9 pagesSection A (Multiple Choice) : A. Extracting Balances From The Ledger Accounts To Produce A Trial BalanceMagnolia KhineNo ratings yet

- 2017 MARCH Financial Accounting Reporting Fundamentals March 2017 English Medium - EnglishDocument12 pages2017 MARCH Financial Accounting Reporting Fundamentals March 2017 English Medium - EnglishJahanzaib ButtNo ratings yet

- Fundamentals of Accountancy, Business & Management 1 Third Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Third Grading ExaminationMc Clent CervantesNo ratings yet

- Quick TestDocument2 pagesQuick TestPraveena RavishankerNo ratings yet

- Quesstionnaire Part 1 Only 1 AutosavedDocument2 pagesQuesstionnaire Part 1 Only 1 AutosavedIdont KnowNo ratings yet

- 11 Accountancy Practice PaperDocument9 pages11 Accountancy Practice PaperPlayer dude65No ratings yet

- AS Accounting: Paper 1 Financial and Management AccountingDocument34 pagesAS Accounting: Paper 1 Financial and Management AccountingkaruneshnNo ratings yet

- Question Paper Financial Accounting (111) - January 2004: Section A: Basic Concepts (40 Marks)Document30 pagesQuestion Paper Financial Accounting (111) - January 2004: Section A: Basic Concepts (40 Marks)api-27548664No ratings yet

- Sample QP For Grade 11 ACC Model Examination 2024Document9 pagesSample QP For Grade 11 ACC Model Examination 2024Suhaim SahebNo ratings yet

- FABM 1 - QuizDocument2 pagesFABM 1 - QuizEdrel ManagaseNo ratings yet

- Easy Round B. Acquisition Cost: When A Corporation Records Less Profit, Less Asset Amount, or A Greater Liability AmountDocument8 pagesEasy Round B. Acquisition Cost: When A Corporation Records Less Profit, Less Asset Amount, or A Greater Liability AmountShaira IwayanNo ratings yet

- Final Exam of WCADocument5 pagesFinal Exam of WCABereket K.ChubetaNo ratings yet

- VCM - Chap 3 & 4 Questions (Midterms)Document9 pagesVCM - Chap 3 & 4 Questions (Midterms)natalie clyde matesNo ratings yet

- Ev 2Document9 pagesEv 2minita sharmaNo ratings yet

- Punjab College Jahanian: A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A)Document2 pagesPunjab College Jahanian: A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A) A)Husnat MaitlaNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- The FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationDocument27 pagesThe FATF Recommendations On Combating Money Laundering and The Financing of Terrorism & ProliferationAli SaeedNo ratings yet

- Bangladesh: Government EconomyDocument1 pageBangladesh: Government EconomyAli SaeedNo ratings yet

- BOP BanglaDocument184 pagesBOP BanglaAli SaeedNo ratings yet

- Sih Ar 2015Document230 pagesSih Ar 2015Ali SaeedNo ratings yet

- Quiz 3 (Answers Highlighted)Document2 pagesQuiz 3 (Answers Highlighted)Ali SaeedNo ratings yet

- Presentation On Negotiable InstrumentDocument38 pagesPresentation On Negotiable Instrumentacidreign0% (1)

- 03 - Mental Accounting - HANDOUTDocument8 pages03 - Mental Accounting - HANDOUTtkkt1015No ratings yet

- Export ProceduresDocument13 pagesExport ProceduresghirenvNo ratings yet

- San Miguel Corp. v. InciongDocument4 pagesSan Miguel Corp. v. InciongBianca BNo ratings yet

- CRM and E-Crm: Abhinav SharmaDocument23 pagesCRM and E-Crm: Abhinav Sharmalekhajj100% (2)

- Chapter 19 GUI TestingDocument38 pagesChapter 19 GUI Testingavuma22No ratings yet

- SOP Work Flow-BR Black & Prepaid (2nd Option) - EXTERNALDocument5 pagesSOP Work Flow-BR Black & Prepaid (2nd Option) - EXTERNALSITI HAJAR MOHD RAISNo ratings yet

- Managing Change and InnovationDocument26 pagesManaging Change and InnovationMarlowe June AmilerNo ratings yet

- BY-Vijaya Lakshmi KambhampatiDocument35 pagesBY-Vijaya Lakshmi KambhampatiAritra Ravenor JanaNo ratings yet

- Ip Due DiligenceDocument13 pagesIp Due DiligenceyoshimgamtNo ratings yet

- Global Toluene ConsumptionDocument2 pagesGlobal Toluene ConsumptiontotpityiNo ratings yet

- Business Plan MDS - EngDocument41 pagesBusiness Plan MDS - Engusher9000No ratings yet

- ECON 300 Practice Quiz TwoDocument12 pagesECON 300 Practice Quiz Twosam lissenNo ratings yet

- Functions of National Small Industries Corporation (NSIC)Document14 pagesFunctions of National Small Industries Corporation (NSIC)Naveen Jacob JohnNo ratings yet

- What Is The Difference Between Book Value and Market ValueDocument12 pagesWhat Is The Difference Between Book Value and Market ValueAinie Intwines100% (1)

- Whirlpool Project ReportDocument45 pagesWhirlpool Project ReportAnkur Singh67% (6)

- Supply Chain DynamicsDocument48 pagesSupply Chain Dynamicsvinny vaswaniNo ratings yet

- BRICSDocument20 pagesBRICSShahid Khan50% (4)

- 50,364.48 Korea, Republic of Korea, Republic Of: 803 Paredes ST - Brgy.289 Zone 27Document3 pages50,364.48 Korea, Republic of Korea, Republic Of: 803 Paredes ST - Brgy.289 Zone 27Marjorie TWTCINo ratings yet

- Web Designing, SEO, Digital Marketing Company Vadodara - JeenwebDocument14 pagesWeb Designing, SEO, Digital Marketing Company Vadodara - JeenwebTatvam ShahNo ratings yet

- Guide Conflict Minerals AIAGDocument35 pagesGuide Conflict Minerals AIAGErnesto SanzNo ratings yet

- June 2018Document244 pagesJune 2018Muhammad HaroonNo ratings yet

- Fusion HCM IntroductionDocument27 pagesFusion HCM IntroductionmanojNo ratings yet

- XBXBXBXBXBXBXBXBXB LandasanDocument13 pagesXBXBXBXBXBXBXBXBXB LandasanArnol_Inyo_9526No ratings yet

- Brand AssociationDocument16 pagesBrand AssociationPeermithaNo ratings yet

- RM VS ErmDocument2 pagesRM VS ErmHew Jhet NungNo ratings yet

- F 8849Document4 pagesF 8849IRSNo ratings yet