Professional Documents

Culture Documents

Life and Financial Planning in The Time of COVID-19

Life and Financial Planning in The Time of COVID-19

Uploaded by

Rodrigo GROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life and Financial Planning in The Time of COVID-19

Life and Financial Planning in The Time of COVID-19

Uploaded by

Rodrigo GRCopyright:

Available Formats

Life and Financial Planning

in the Time of COVID-19

by Marc R. Belletsky, JD, CLU, ChFC, RICP

Christina Anstett, JD

Mark A. Teitelbaum, JD, LLM, CLU, ChFC

inancial professionals are often placed in

ABSTRACT

F a difficult predicament when faced with

anxious clients who are struggling through

With passage of the Coronavirus Aid, Relief, challenging times. They are trained to say “yes” when

and Economic Security Act of 2020 (CARES sometimes “no, and here is why” is the better answer.

Act), and the subsequent Paycheck Protec- As is known, some client decisions are made out of

tion Program and Health Care Enhancement necessity, others out of fear, and still others out of

Act, the U.S. government has committed sheer lack of knowledge and guidance. The financial

to transferring nearly $2.7 trillion dollars professional must walk a tightrope when deciding

to individuals and businesses to weath-

when to say “yes” or “no” to a client.

With passage of the Coronavirus Aid, Relief, and

er COVID-19-related issues. Proper advice

Economic Security Act of 2020 (CARES Act or the

and guidance during these turbulent times

Act), and the subsequent Paycheck Protection Pro-

can assist clients with their overall financial

gram and Health Care Enhancement Act, the U.S.

plans. This article will offer an overview of

government has committed to transferring nearly

the CARES Act provisions, first covering the

$2.7 trillion dollars to individuals and businesses to

individual provisions and followed by a re- weather COVID-19-related issues. Proper advice and

view of business provisions. It will then offer guidance during these turbulent times can assist cli-

planning advice that might be appropriate ents with their overall financial plans. What follows is

for clients, again first from a personal plan- an overview of the CARES Act, as well as educational

ning perspective and followed by an assess- opportunities and planning ideas for individuals and

ment from a business owner’s perspective. business owners alike. Adding life insurance or taking

advantage of existing life insurance cash values can

sometimes make for smoother sailing through the

turbulent waters of retirement income planning.

Vol. 74, No. 4 | pp. 41-53

This issue of the Journal went to press in June 2020. CARES Act Basics

Copyright © 2020, Society of Financial Service Professionals. In response to the current COVID-19 pandem-

All rights reserved.

ic, the President signed the CARES Act into law on

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

41

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

Friday, March 27, 2020. Under the CARES Act, based on the 2018 return.

individuals are expected to benefit by roughly $560 The phaseout is $5 for every additional $100

billion; large corporations/employers by $500 billion; above the phaseout threshold:

small businesses by $377 billion; state and local gov- • Single Earner: Phase out begins above $75,000

ernments by $339.8 billion; public health by $153.5 through $99,000

billion; and educational/other public institutions by • Married Couple: Phase out begins above

$43.7 billion—plus, there are safety net provisions of $150,000 through $198,000

approximately $26 billion. • Head of Household: Phase out begins above

With the additional funding of the Paycheck $112,500 through $136,000

Protection Program and Health Care Enhancement It is important to remember that the payments

Act, another $484 billion designed to increase fund- clients receive, while not income taxable, are advanc-

ing for the Paycheck Protection Program (PPP) has es of anticipated refunds or refunds of taxes paid into

been authorized. It is expected to provide a $310 bil- the system. The cash stimulus payments are techni-

lion boost, plus a separate Small Business Adminis- cally an advance tax credit meant to offset taxes on

tration (SBA) emergency grant and loan program of an individual’s 2020 return. As a result, for 2020, it

$60 billion, and to direct $75 billion to hospitals and is possible that client’s taxes will be under-withheld if

$25 billion toward new coronavirus testing. an individual’s taxable income in 2020 is going to be

The key components of the CARES Act are de- higher than the year used to determine the cash pay-

scribed below. ment. If a client’s income is higher in 2020 so as to

render the client ineligible for all or part of the CARES

Individual Relief and Assistance Act credit, or they are otherwise under-withheld, taxes

Income Tax and Payments Delayed may be due on these advances. Advisors should remind

The deadline for filing of personal income taxes taxpayers to check their W-2s for withholding, and to

(1040) and payment of taxes is delayed until July 15, 2020. adjust withholding or make estimated tax payments

Subsequent guidance by the IRS under Revenue Notice for 2020, if necessary. This is also an excellent time to

2020-23 delayed the deadline for filing all other returns review coverage and possibly the IRS Form 1040.

(Corporate Form 1120, S Corporation Form 1120S, and

Partnership Form 1065) and associated payments. Extra Unemployment Benefits

State-run unemployment programs will continue

Cash Payments to pay benefits, but eligibility is expanded, and ben-

Most single individuals earning less than $75,000 efits have been broadened. The Act adds $600 per

are eligible to receive a one-time $1,200 payment that week from the federal government on top of whatever

was sent out beginning in the second week of April. the recipient is currently receiving in state benefits to

Married couples qualify to receive $500 per eligible help bolster consumer spending among the ranks of

dependent child. An average family of four, earning the suddenly unemployed. This amount will contin-

less than $150,000, might receive up to $3,400. The ue through July 31, 2020. If a person is currently un-

benefits are fully phased out for individuals making employed and is receiving $300 per week, that person

greater than $99,000; married couples making more will receive $900 per week through July 31.

than $198,000; or a head of household earning great- The total number of regular payments under

er than $136,000. Payments will be based on the last state unemployment has been increased by 13 weeks.

filed income tax return. Generally, if a 2019 return If a person receiving unemployment had 20 weeks of

has not been filed, the IRS will determine eligibility benefits, they will now have 33 weeks. Extensions are

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

42

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

available for the longer period. Self-employed people • scheduled to start a new job and do not have an

are eligible for unemployment benefits if they were in existing job or are unable to reach the job as a

business prior to February 15, 2020. Unemployment direct result of the COVID-19 pandemic

benefits are taxable income and many states either • have become the breadwinner/major supporter

may not withhold adequately or they may allow indi- for a household because the head of household

viduals to opt out of withholding. has died as a direct result of COVID-19

• had to quit job due to being diagnosed with

Pandemic Unemployment Assistance Act COVID-19 and being unable to perform work duties

A similar program for temporary, or so-called • place of employment is closed as a direct result of

gig workers, was also created. The Pandemic Unem- the COVID-19 pandemic

ployment Assistance Program (PUA) will assist those

who lost contracts due to the crisis. Clients eligible Retirement Plans—

for PUA include those who were self-employed, did Funding Relief for Employers and

not have a sufficient work history to qualify for reg- Expanded Access for Individuals

ular unemployment compensation, or who have ex- Funding Relief for Employers

hausted their rights to regular or extended benefits. The CARES Act temporarily relaxes employer

PUA provides up to 39 weeks of benefits to covered retirement plan funding requirements.

individuals who are not eligible for regular unem- • First, the funding grace period for deductible

ployment compensation and who are otherwise able contributions to defined-contribution (DC)

and available to work, except that they became un- plans otherwise due between April 1 and July 15

employed or partially employed because of any one has been extended until July 15, 2020.

of the following COVID-19-related reasons: • In addition, defined-benefit (DB) plan required

• diagnosed with or are experiencing symptoms of contributions for 2020 have been delayed until

COVID-19 and are seeking a medical diagnosis January 1, 2021. This means that businesses that

• a member of their household has been diagnosed have DB plans will not have to meet minimum

with COVID-19 funding requirements for 2020. Moreover, DB

• providing care for a family member or a member plans may use 2019 funded percentages to deter-

of the household who has been diagnosed with mine whether benefit restrictions are necessary.

COVID-19 o A consequence of this relief is that life insurance

• a child or other person in the household for whom contracts within those plans may or may not

the individual is the primary caregiver is unable to have the necessary premium amounts. While

attend school or another facility that is closed due many companies are utilizing these extended

to the COVID-19 pandemic, and that school or contribution due dates, existing qualified plans

facility care is required for the individual to work with life insurance need to be reviewed to see if

• unable to reach place of employment because of additional premiums are needed and what effect

a quarantine or stay-at-home order due to the a nonpayment might have. While true of DB

COVID-19 pandemic plans, it is equally true for DC plans where life

• unable to reach place of employment because insurance is provided as an “incidental benefit.”

they have been advised by a health care provider

to self-isolate or quarantine because they are pos- Coronavirus-Related Distributions (CRDs)

itive for, or may have had exposure to, someone The Act allows qualified individuals to with-

who has or is suspected of having COVID-19 draw up to $100,000 from their qualified DC plan

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

43

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

or IRA before age 59½ without the 10 percent early This RMD waiver applies to DC plans, including:

withdrawal penalty or the mandatory 20 percent fed- 1. qualified 401(a) plans, such as profit sharing and

eral tax withholding.1 CRDs are permitted without money-purchase pension plans

regard to the typical restrictions on in-service with- 2. 401(k) plans

drawals in DC plans. Federal taxation on a CRD can 3. 403(a) and 403(b) plans

be spread ratably over 3 years and the CRD may be 4. governmental 457(b) plans

recontributed within the same 3-year timeframe to 5. individual retirement accounts (IRAs)

an eligible retirement plan or arrangement. Normal If all or any part of an RMD has already been

state taxation and withholding will apply, as appli- made in 2020 that would have qualified for the waiv-

cable. A participant’s total withdrawal across all DC er, and it is still within the 60-day time period from

plans and IRAs may not exceed a total of $100,000. the date of the RMD, that payment can be rolled

CRDs are available through December 30, 2020. back into a qualified plan or IRA to avoid taxation in

2020. IRS relief is anticipated for those individuals

Participant Loans who may be beyond the 60-day time period. Not-

The CARES Act also permits a plan to tempo- withstanding the 2020 RMD waiver, most plans will

rarily increase the limit on plan loans to qualified likely provide participants with the opportunity to

individuals from the lesser of 50 percent of the par- receive distribution of the equivalent RMD amount

ticipant’s vested account balance, or $50,000, to the should it be necessary to meet current expenses.

lesser of 100 percent of the participant’s vested ac-

count balance, or $100,000. This increase is permit- Student Loan Relief

ted for loans granted during the 180-day period after Effective April 10, 2020, for federal student loans

the date of enactment of the Act, i.e., until September owned by the U.S. Department of Education (includ-

22, 2020. The limit on 401(k) loans was raised from ing Federal Family Education Loans (FFEL), Federal

$50,000 to $100,000, which is double the current Direct Loans, and Federal Perkins Loans), payments

limit. Participant loans must normally be repaid over and interest accrual through September 30, 2020, are

a maximum of 5 years. However, under the Act, prin- automatically suspended. During the suspension peri-

cipal and interest payments are suspended for one od, borrowers are protected from any involuntary col-

year for loans granted through December 31, 2020. lections, wage garnishment, reduction of tax refunds

At the end of the suspension period, loans must be or federal benefit payments, and interest penalties. Bor-

reamortized to include accumulated interest during rowers may request a refund of payments made since

the suspension period. Additionally, the length of the March 13, 2020. Additionally, the payment-waiver

suspension period is added to the remaining term of period will be credited toward federal forgiveness and

the loan, essentially disregarding the suspension peri- cancellation programs (e.g., Teacher Loan Forgiveness,

od and maintaining the 5-year repayment term. TEACH Grants, and Public Service Loan Forgiveness).

The CARES Act also modified Internal Revenue

Required Minimum Distributions Code Section 127 to allow employers who provide

Required minimum distributions (RMDs) that tuition reimbursement programs to include student

would otherwise be required from DC plans or IRAs loan payments up to a maximum of $5,250 income

are suspended for 2020. These amounts can therefore tax free to the employee until January 1, 2021.

continue to accumulate tax free under the applicable Small-business owner clients may choose to go this

plan or account. This also means that future RMD route, in lieu of compensation, if they employ people

amounts will likely be different than anticipated. who are studying for degrees.

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

44

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

Charitable Giving Opportunity What Is the Paycheck Protection Program?

As many clients during turbulent times like The PPP provides cash-flow assistance through

to give back, the following CARES Act provisions federally guaranteed loans as an incentive to em-

should be brought to their attention. The Act pro- ployers who maintain their payroll during this

vides a $300 qualified cash charitable deduction for emergency. Up to 2.5 times an employer’s eligible

nonitemizers. Qualified contributions must be made payroll was allowed as a loan to assist toward payroll

to IRC Section 501(c)(3) charities. This deduction continuation. In addition to payroll (75 percent),

can be taken on 2020 taxes filed in 2021. Therefore, the PPP money is permitted to be used for insur-

a couple that files jointly can take a $600 deduction ance premiums, retirement plan contributions, rent,

even if they do not itemize. mortgage interest, and utilities. If employers main-

Additionally, the Tax Cuts and Jobs Act of 2017 tain their payroll, the loan principal will be forgiv-

(TCJA) limitation of 60 percent for cash contribu- en. The loan forgiveness is calculated by using the

tions has been increased to 100 percent for 2020. following formula:

Contributions to donor-advised funds (DAFs) or Forgivable portion (FP) = Payroll costs (PC)

private foundations are not eligible. Qualified char- (both cash and certain noncash)/52 + any ap-

itable deductions of up to $100,000 are allowed for plicable mortgage interest payments (MIP) +

persons over the age of 70½. Both itemizers and any covered utility payment (UP) × 8 weeks,

nonitemizers therefore have additional capacity for or:

charitable gifts in 2020. FP = PC / 52 + (MIP + UP × 8)

Corporations can contribute up to 25 percent of

taxable income to IRC Section 501(c)(3) charities. However, it is important to note that the payroll

This is up from 10 percent in 2019. So, clients should costs are over an average 52 weeks while utilities and

be encouraged to seek employer matching grants if mortgage interest are based on the 8 weeks after the

those programs are available. loan had been granted. It is important for advisors

to stay on top of any developments. It took just 13

Relief for Small-Business Owners days for the first PPP program to run out of funds,

Small-Business Relief for Employee Retention so a second round was authorized which will also be

Approximately $350 billion of the CARES Act was tapped quickly.

dedicated to preventing layoffs and business closures

while workers must stay home during the outbreak. Delayed Payment of Employer Payroll Taxes

Later in April, subsequent relief known as the Paycheck This allows taxpayers to defer paying the em-

Protection Program and Health Care Enhancement Act ployer portion of certain payroll taxes through the

was passed by Congress and signed into law. It commit- end of 2020, with all 2020 deferred amounts due in

ted an additional $310 billion of funds to this pool. two equal installments—one at the end of 2021 and

A range of programs are offered and detailed the other at the end of 2022.

below. The one that has received the most press is If small-business owners avail themselves of the

the Paycheck Protection Program or PPP. Companies payroll tax delay, they foreclose themselves to the PPP.

with 500 employees or fewer that maintain their pay- They remain eligible for:

roll during coronavirus could receive up to 8 weeks of • Economic Injury Disaster Loans (EIDL) and

cash-flow assistance via a forgivable interest-free note. Loan Advance

However, there are other programs and each is sum- • SBA Express Bridge loans

marized below. • SBA Debt Relief

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

45

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

What Are Economic Injury Disaster Loans economic relief as they make critical decisions during

and Emergency Injury Grants? these extraordinary circumstances that will im-

An emergency advance of up to $10,000 to pact their retirement futures. The following should

small businesses and private nonprofits harmed by be considered a general discussion of overall plan-

COVID-19 is available within 3 days of applying ning considerations resulting from provisions in the

for an SBA EIDL. Grants and loans may be used to CARES Act. The actual planning for clients would

keep employees on payroll; pay for sick leave; meet in- be highly customized based on their own facts and

creased production costs due to supply chain disrup- circumstances. It is also important to highlight other

tions; or pay business obligations, including debts, tax, legacy, and business planning opportunities.

rent, and mortgage payments. Planning for individual clients cannot be gener-

alized or routinized. Each individual client will have

What Does the SBA Bridge Loan Program different needs and time horizons. However, the time

Allow for Small Businesses? horizons for client retirement needs can be segregated

The SBA Bridge Loan Program allows small busi- and viewed independently. For example:

nesses who currently have a business relationship with • Younger clients who are in an accumulation mode

an SBA Express Lender to access up to $25,000 with may have the longest time horizon. They should

less paperwork. These loans can provide vital eco- be encouraged to continue saving and take ad-

nomic support to small businesses to help overcome vantage of current market volatility. Because of

the temporary loss of revenue they are experiencing. their longer time horizon, they have an opportu-

The loans can be used to bridge the gap while apply- nity to accumulate now, at potentially lower val-

ing for a direct SBA Economic Injury Disaster Loan. uations. Concepts such as dollar-cost averaging

(DCA) might work very well for them, as well as

Can the Small Business Debt Relief Program a continued systematic investment plan.

Help with Previously Secured SBA Loans? • On the opposite end of the planning spectrum,

The Small Business Debt Relief Program pro- older clients that are in a wealth preservation

vides immediate relief to small businesses with nondi- mode, at or nearer to retirement, will be very

saster SBA loans, in particular Sections 7(a), 504, and concerned with their shorter time horizons for

microloans. Under this program, the SBA will cover economic recovery. For them, there is the realiza-

all loan payments on previously secured SBA loans, tion that market volatility is a new normal they’ll

including principal, interest, and fees, for 6 months. need to deal with throughout their retirement.

Here, emphasizing preservation of principal and

What Other Provisions Are Available to Help minimizing sequence of returns risk might be

Small-Business Owners? more appropriate.

The Employee Retention Credit for Employers • In the middle, some clients may be unaffected by

Subject to Closure or Experiencing Economic Hard- this crisis or may have significant remaining net

ship is a refundable payroll tax credit for 50 percent worth, presenting different planning opportuni-

of wages paid by eligible employers to certain em- ties with depressed asset values. Here, the advi-

ployees during the COVID-19 crisis. sor may want to talk about repositioning assets,

possibly into a different tax structure, to benefit

Planning Considerations for Individuals from the recovery.

It is important for financial professionals to take Financial professionals may want to use a differ-

the lead and educate clients about potential sources of ent focus for each of these clients, also based on their

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

46

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

individual needs and reaction to the recent market such a move have on a client’s ultimate 401(k) ac-

volatility. Each of the items below is intended to fo- count and their funds available for retirement?

cus on some of the common planning questions that Sometimes a picture is worth a thousand words.

may come up, due both to the CARES Act and re- Figures 1-3 demonstrate the potential results of with-

cent economic trends. drawals and/or loans being taken from retirement

plans. These results are estimates and individuals will

The Cost of Retirement Plan experience differing results based on their actual sit-

Withdrawals and Loans uations. No specific conclusions can be drawn from

One common question will be whether clients these examples. Using the assumption of a 50-year-old

should take advantage of the cash withdrawal or loan client and a hypothetical 7 percent rate of return, in

provisions offered by the CARES Act. The following 15 years, the potential plan account value without the

is an analysis of the efficacy of withdrawals and loans withdrawal would be approximately $2,759,032. That

from retirement savings plans. When working with would produce roughly an income stream of $137,952

a client who is thinking of accessing funds from a per year for 20 years (assuming no additional growth).

retirement plan, two critical questions which need to What is the effect of a $100,000 withdrawal,

be addressed are: assuming the same 7 percent rate of return? The

1. What is the market opportunity lost by a client CARES Act allows this size withdrawal and allows

who takes a withdrawal or loan? the tax to be spread ratably over the next 3 years.

2. How much will it cost that client to have money In a 37 percent tax bracket, that would be roughly

taken out of the plan? $12,333.33 per year for a total tax of $37,000. In the

The following scenario can be considered. If a end, that nets an individual $67,000 although they

client withdrew or borrowed $100,000 today, from will have been able to spread the tax bill. The po-

a $1 million 401(k) plan account, how much would tential gain would be approximately $2,483,128 for a

that account have been worth for retirement in 5 total projected income stream of $124,156. In short,

years? In 10 years? In 15 years? What effect would $275,904 is lost that translates to a reduced $13,796

FIGURE 1

Effect of a $100,000 Withdrawal, 7 Percent Growth, No Repayment

$3,000,000 $2,759,032

$2,483,128

$2,500,000

$2,000,000

Taking $100,000 withdrawal

with no repayment has a Almost $14,000 per

$1,500,000 cost of $275,904 year for 20 years

$1,000,000

$500,000 $275,904 $137,952 $124,156 $13,796

None @7% With $100,000 Difference 65-85 65-85 Difference

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

47

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

per distribution for 20 years (Figure 1). making contributions is helpful.

For people wondering if they should continue to Finally, by way of example, if the client took a

make contributions to the plan, Figure 2 demonstrates loan from the plan, the results are more positive as

a similar result. The contribution amount was increased funds are being restored to the plan, interest is be-

annually at $500 per year and a 4 percent company ing paid to the plan, and the client is not required to

match was assumed on the entire contribution amount. pay taxes unless they fail to repay the loan. However,

This is typical of a standard 401(k) plan. Once again, the client would have to repay the loan from outside

assuming a 50-year-old client and a 7 percent hypothet- sources with after-tax dollars.

ical rate of return, in 15 years, the potential plan account Considering the same 50-year-old and the same

value without the withdrawal and assuming regular 7 percent rate of return, in 15 years, the potential plan

401(k) contributions (increasing at $500 per year plus value without the loan and assuming regular 401(k)

a 4 percent employer match on the contribution) would contributions, which increases at $500 per year plus

be approximately $3,384,833. That would produce an a 4 percent employer match would be approximately

income stream of roughly $169,242 per year for 20 years $3,384,833. That would, again, produce an income

(assuming no growth once retirement begins). stream of roughly $169,242 per year for 20 years (as-

Now, that same 7 percent rate of return is as- suming no growth starting at retirement).

sumed, but with a $100,000 withdrawal taken this Now, that same 7 percent rate of return is again

year. The CARES Act allows this and allows the assumed, but a $100,000 loan is taken this year. The

tax to be spread ratably over the next 3 years. In a CARES Act allows this size withdrawal or loan and

37 percent tax bracket, that would again be roughly allows the loan to delay repayment and accumulate

$12,333.33 per year. The potential gain would be ap- interest for one year, with repayment in 5 years. The

proximately $3,126,979 for a total projected income potential gain would be approximately $3,305,921 for

stream of $156,349. In short, $257,854 is lost, and a total projected income stream of $165,296. The in-

that translates to a reduced $12,893 per distribution terest rate is projected to be current U.S. prime rate +

for 20 years. This shows that staying the course and 2 (3.25% +2% =5.25%). Accrued interest over the loan

FIGURE 2

Effect of a $100,000 Withdrawal, No Repayment, with Ongoing Contributions and Match

$3,500,000 $3,384,833

$3,126,979

$3,000,000 Taking $100,000 withdrawal with

no repayment, contributions

$2,500,000 increase at $500 per year, with

employer match of 4% of

$2,000,000 contribution amount results in Around $13,000 per

$257,854 less. year for 20 years

$1,500,000

$1,000,000

$500,000 $257,854 $169,242 $156,349 $12,893

None @7% With $100,000 Difference 65-85 65-85 Difference

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

48

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

term (including the suspension period) is estimated to client were to also look at moving existing brokerage

be $16,301. A full loan repayment plus interest ratably assets into an asset that acts as a “tax-wrapper” sim-

by year 6 is illustrated. In short, $84,435 is lost; that ilar to a Roth IRA? Even though a client might be

translates to a reduced $3,946 per distribution for 20 facing losses, where a client has a life insurance need,

years (Figure 3). The power of continuing to make it may be better to recover the gains inside a life in-

contributions to plans shows that retirement income surance accumulation product.

is about staying the course; paying back the loan gen- As diversifying across different asset classes and

erally comes closest to squaring up the plan. asset types is considered, it’s important to note that

clients need safety net sources of income. Clients

Roth Conversions and never know how assets (retirement or otherwise) will

Asset Repositioning perform in any given year. It’s one thing to have fluc-

Because many financial professionals like to po- tuations during a client’s accumulation years because

sition a tax-free bucket in a client’s portfolio, consid- when they retire, they’ll have reached a target goal with

eration of a Roth IRA conversion, while assets are their assets. But what happens to those assets in retire-

depressed and tax rates are somewhat low, might be a ment can be critical. Losses early in retirement can risk

good way to start a client discussion. It’s a great idea depleting one’s retirement assets faster than growth in

for the right client, but it needs to be looked at within the early years followed by losses in later years; it is

the perspective of the client’s larger picture. However, impossible to know what a client will be retiring into.

if a client does a Roth IRA conversion, like the with- This is the classic “sequence of returns risk.” Selective

drawal from a qualified plan seen earlier withdrawals of life insurance cash values at times of

• it accelerates taxes (and care needs to be taken not market drops can cushion a client against those in-

to bump a client into a higher tax bracket), and evitable downturns. What is being suggested is using

• if there’s a family life insurance need, it doesn’t life insurance cash values as a safety net, an alternative

address that need asset, to smooth out the waves a client might see in

This can be taken one step further. What if the their traditional retirement assets. This is not unlike

FIGURE 3

Loan from Plan with Payback

$3,500,000 $3,384,883 $3,305,921

$3,000,000

$2,500,000

Taking $100,000 Loan at

$2,000,000

5.25%, paying back loan Around $4,000

per CARES Act Per year for 20 years

$1,500,000

$1,000,000

$500,000

$84,435 $169,242 $165,296 $3,946

None @7% LOAN of Difference 65-85 65-85 Difference

$100,000

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

49

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

the CARES Act provision that suspends RMDs, so as over 3 years or not, it is an additional cost. Some cli-

to allow IRA assets a chance to recover.2 ents might also have state income taxes. The loan and

Using selective withdrawals and loans of policy repayment would cost nearly that amount. If they had

cash values as a tax-advantaged source of funds in the the option of accessing cash value life insurance via a

kind of environment being experienced allows a cli- loan, it might offer a different set of choices.

ent’s other assets to recover so that the clients are not Finally, for the older baby boomer looking to

forced to sell into, and lock in, a loss. It can make the transfer wealth to their children or grandchildren and

difference from having a client conversation about an concerned as to what might happen if there’s another

eroding pool of retirement assets to a conversation market drop—as in 2000, 2008, and 2020—life in-

about wealth transfer to the next generation. surance can help stabilize wealth transfer. Using the

It is important to remember that loans and with- concept of life insurance as an asset, it may be possi-

drawals reduce the policy’s cash value and death ble for the client to take small portions or percentages

benefit, may cause certain policy benefits or riders to of their portfolio, or a portion of annual growth, and

become unavailable, and increase the chance the pol- purchase a life insurance policy to ultimately protect

icy may lapse. If the policy lapses, is surrendered, or the overall financial and legacy planning.

becomes a modified endowment contract (MEC), the Here, the death benefit of the policy can replace

loan balance at such time would generally be viewed value that was lost to market volatility. This can assure

as distributed and taxable under the general rules for a client some peace of mind that they’ll be able to pass

distribution of policy cash values. death benefit amounts to their family regardless of

Under current federal tax rules, clients general- what the market forces are doing to their other assets

ly may take federal income-tax-free withdrawals up when they pass. Financial professionals can structure

to their basis (total premiums paid) in the policy this in a way that doesn’t disrupt assets under manage-

or loans from a life insurance policy that is not an ment, perhaps by harvesting a small portion of assets

MEC. Certain exceptions may apply for partial with- a year or through some growth. Now that asset values

drawals during the policy’s first 15 years. If the policy are depressed, a client might be looking to regroup, but

is an MEC, all distributions (withdrawals or loans) if they can focus on a reasonable percentage (often low

are taxed as ordinary income to the extent of gain in single digits), the effect on their portfolio won’t be that

the policy and may also be subject to an additional 10 noticeable as asset values recover. This technique also

percent premature distribution penalty prior to age has the effect of allowing financial professionals more

59½, unless certain exceptions are applicable. flexibility with their client planning. For one client,

Clients considering repositioning assets need to be they might be able to go in a more aggressive direction

reminded of the power and flexibility of cash value life knowing the client has an anchor with the life insur-

insurance. Right now, many clients and small-business ance death benefit. For other clients, they might carve

owners are considering borrowing or not funding their out some assets for a series of annuities for income,

qualified plans. They should also be considering pur- knowing other assets will transfer wealth to the family.

chasing more coverage for family or business protec-

tion and utilizing existing cash value life insurance. If Pure Family Protection and Policy Review

a client is weathering this crisis and realizes they need Life insurance reviews and whether a client’s cur-

$100,000, the options are there. Should they access rent insurance is appropriate or adequate for the client’s

or deplete their IRA or qualified plan? If the client needs is a conversation that any financial professional

does need the $100,000, they would have to pay up to should bring to the table during these troubling times.

$37,000 in federal income tax. Whether that is spread In general, adding life insurance or taking ad-

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

50

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

vantage of existing life insurance cash values can by those assets could both pay a low-interest loan and

sometimes allow smooth sailing through the turbu- excess growth and income can be used to leverage

lent waters of retirement income planning. into premium payments with life insurance.

So, as people begin to feel comfortable with the

Wealth Transfer Planning Techniques “new reality,” the low-interest-rate environment gives

A thorough analysis of wealth transfer techniques in them a chance to really help solve their retirement in-

today’s environment merits a full article and transcends come needs as well. Imagine a person selling a depressed

the CARES Act, but this article wouldn’t be complete stock portfolio to an irrevocable trust, and the assets are

without a brief discussion noting how this is an import- removed from the estate. When the stock appreciates in

ant consideration with clients, regardless of the asset size. value, the appreciation is removed from the estate, but

For high-net-worth clients, there currently ex- a string known as a promissory note is retained back by

ists the highest estate and gift exemption ever at the seller of the property. A promissory note is nego-

$11,580,000 per person, or $23,160,000 for a mar- tiable, so while it may start at a low-interest rate of less

ried couple. Those amounts will be more than halved than one percent, it can be increased when additional

after 2025 when the TCJA provisions in this area are income is needed. This sort of planning flexibility is en-

due to sunset. It remains important to take advantage hanced by cash value life insurance, these transactions

of this high exemption, particularly as the Treasury can be used to purchase policies, and those policies can

has noted there will not be a claw-back for gifts made be utilized in all of the ways discussed.

now even if future exemption amounts are lower.

Additionally, now may be a particularly opportune Planning Considerations for

time to discuss and explore wealth transfer transactions Business Owners

that can take advantage of today’s ultra-low-interest Net-Operating Losses

rates. This can be a valuable discussion for clients re- The recent TCJA net-operating-loss (NOL) rules

gardless of their net worth, but for high-net-worth cli- are modified. The 80 percent rule is removed, and

ents, the low interest rate can be combined with the very losses can now be carried back 5 years. There is also a

high exemption for what may be once in a lifetime plan- 20-year carryforward of NOLs incurred before Janu-

ning. These discussions include grantor retained annu- ary 1, 2019, plus the lesser of: (1) all NOLs after De-

ity trusts (GRATs), loans to trusts or private financing cember 31, 2017, or (2) 80 percent of taxable income

split dollar, and sales of businesses to irrevocable grantor payroll costs, interest on mortgage obligations, rent,

trusts as a means to transfer businesses and investments and utilities would be forgiven.

generationally. GRATs are a particularly attractive

transaction as income from assets given away today will Excess-Loss Limitations

reflect a very low interest rate, yet the retained amount The excess-loss limitation (ELL) rules for pass-

can be increased up to 20 percent annually. through entities are suspended for excess losses in-

Loans may also be a very popular approach in curred in 2018, 2019, and 2020. This will assist

the next few years given the low-interest-rate envi- businesses with cash flow as the limitations lead to

ronment. A simple example can be a business owner more included income.

lending money to a key employee for 9 years. The

interest rate that would need to be charged under the Interest-Expense Limitation

current applicable federal rates (AFRs) is less than one Similar to the excess-loss-limitation rules, the in-

percent. Similarly, a client could contemplate lending terest-expense limitations are temporarily increased

assets to a trust. The growth and income generated to 50 percent from 30 percent for tax years beginning

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

51

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

in 2019 or 2020. Taxpayers can also elect to calcu- been adequately addressed and may be better

late the interest limitation for 2020 using their 2019 handled by a will or trust?

adjusted taxable income as the relevant base, which 11. Are wills and trusts considered in the buy-sell

often will be significantly higher. agreement?

So, when dealing with business-owner clients,

Buy-Sell Planning in Crisis one size does not fit all in times of crisis.

On top of the income tax ramifications of the

CARES Act, many business owner clients have buy- Wills and Trust Planning for

sell agreements in place. A buy-sell agreement can Small-Business Owners

effectively transfer a business to family members Not every business-continuation plan involves the

in the event of a business owner’s death. If a buy- use of a buy-sell agreement. In some cases, especially

sell agreement is incorrectly drafted, it may lead to family situations, the older generation might simply in-

family and business strife, litigation, and unintend- tend to pass the business ownership to one or more adult

ed financial consequences, including the failure of children through a will or trust. Sometimes the children

the business. Small-business owners who take on are of age; other times, they might be minor children.

debt during the COVID-19 crisis could unwitting- In these cases, the advisor should help the cli-

ly affect their existing buy-sell agreements. Further, ent make sure that those testamentary transfer plans

clients who have no buy-sell agreements may be are properly documented by the client’s will or trust.

transferring debt to other owners and family mem- These items will become more and more important

bers. Now is the time for insurance professionals to in times of crisis. Further, the crisis may reveal cracks

review this area with clients. in the plan. An advisor can assist in designing the

Here’s a quick list of the most important things perfect plan on paper, but business-continuation

to visit with business-owner clients when performing plans often times fail because of the person(s) chosen.

a buy-sell review: So, the advisor needs to discover:

1. Is there a buy-sell agreement in place? • Are successor owners prepared with the right

2. Does the buy-sell agreement address the correct skills to take over?

parties? • Are they ready to handle crisis?

3. Is the buy-sell agreement reflective of the current • Do key employees know about the succession

market conditions? plans that the owners have put in place?

4. Is the business worth what it was when the buy- • Have any difficult family or office dynamics

sell agreement was drafted? been properly planned for?

5. Is there a formula clause for the business valua- While engaging in a review of a client’s busi-

tion in the buy-sell agreement? ness-continuation plan may be difficult to do well,

6. Is the buy-sell agreement adequately funded with the conversation is one that can produce significant

life insurance? results for clients during these difficult times.

7. Does the structure of the insurance funding

match the buy-sell obligations? Conclusion

8. Is the structure of the buy-sell agreement opti- In this time of economic and social crisis, life in-

mized for tax and practical objectives? surance and financial planning advice is more valuable

9. Are all the relevant buyout triggers included in than ever. The tough economic news of the past few

the agreement? months affects clients in many ways. Review of life in-

10. Are there any special family issues that have not surance needs and planning strategies, retirement sav-

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

52

Life and Financial Planning in the Time of COVID-19

Marc R. Belletsky et al.

ings, asset allocation, tax efficiency, and general wealth

Christina Anstett, JD, is an ERISA attorney with over 25

planning have never been more important. Now is a

years of retirement plan industry experience specializing in

good time to consider proactively reaching out to cli- the design, implementation, and ongoing administration of

ents and informing them of the potential ramifications employee retirement programs. Prior to joining Equitable in

of the current economic upheaval. Social distancing 2013, she was senior vice president and chief legal officer for

should not keep us from what financial professionals do a national retirement plan consulting firm. Tinas is a frequent

speaker at industry conferences and a presenter of seminars,

best—advising clients on the impact of laws such as the

webinars, and training programs. She holds a BA from New

CARES Act. Financial professionals have an obligation York University, a JD from Western New England University

to engage in the review activities described and a duty School of Law and is a member of the Connecticut bar. Tina

to provide what is in the clients’ best interest. n is also a member of the American Society of Pension Profes-

Variable products are co-distributed by AXA Ad- sionals and Actuaries, the National Association of Plan Ad-

visors, and the National Tax-Deferred Savings Association.

visors, LLC (Member FINRA, SIPC) and AXA Dis-

She holds FINRA Series 6 and 63 licenses and a variable an-

tributors, LLC. When sold by New York based (i.e., nuity, life, and variable life producer license. Christina can be

domiciled) financial professionals life insurance is issued reached at Christina.Anstett@equitable.com.

by AXA Equitable Life Insurance Company.

Equitable is the brand name of Equitable Hold Mark A. Teitelbaum, JD, LLM, CLU, ChFC, is vice president,

ings, Inc. and its family of companies, including AXA Advanced Markets, at Equitable Life Insurance Company.

Mark joined Equitable in June 2006 to manage Advanced

Equitable Life Insurance Company (NY, NY) (AXA

Markets. He is currently head of Life Advanced Markets Strat-

Equitable) MONY Life Insurance Company of America egy & Governance. Prior to joining Equitable, Mark worked at

(Arizona stock corporation, main administrative office several other life insurance carriers. He has also performed

Jersey City, NJ); AXA Advisors, LLC (member FINRA, tax and business planning work for a Boston area firm that

SIPC); and AXA Distributors, LLC. The obligations of specialized in executive stock option planning and a CPA firm

that specialized in estate planning for business owners. Mark

AXA Equitable and MONY Life Insurance Company of

is an assistant editor of the Journal of Financial Service Profes-

America are backed solely by their claims paying ability. sionals and was previously the editor of the Society of Finan-

cial Service Professionals’ Business & Compensation Plan-

Marc R. Belletsky, JD, CLU, ChFC, RICP, is assistant vice pres- ning Section newsletter. Mark actively participates with the

ident, Advanced Markets, at Equitable Life Insurance Compa- Association for Advanced Life Underwriting (AALU). He has

ny. Marc is an advanced sales consultant who has worked at published articles in several professional journals. Mark is a

several insurance carriers and has been assisting agents for graduate of Kenyon College and obtained his law degree and

over 35 years in the areas of estate and business planning, LLM at both Ohio Northern University and Boston University.

nonqualified-deferred compensation, foreign nationals, cor- He can be reached at Mark.Teitelbaum@equitable.com.

porate and bank-owned life insurance (COLI/BOLI), and pri-

vate-placement insurance. He is a former bank trust officer (1) For CRD and participant loan purposes, the Act defines a quali-

and was the president of a broker dealer that specialized in fied individual as an individual who has been diagnosed, or individual

nonqualified-deferred compensation and COLI/BOLI/private with a spouse or dependent who has been diagnosed, with COVID-19

placement insurance. A noted author and speaker, he has by a test approved by the Centers for Disease Control and Prevention;

spoken at numerous professional meetings and has been or an individual who experiences adverse financial consequences as a

quoted by many major news outlets. An adjunct professor of result of being quarantined, being furloughed, or laid off, or having

law at Western New England University School of Law LLM work hours reduced due to COVID-19; being unable to work due to

program in Springfield, Massachusetts, he is also a member lack of child care due to COVID-19; closing or reducing hours of a

of the Connecticut bar and holder of FINRA Series 6, 63, and business owned or operated by the individual due to COVID-19; or

26 licenses. His JD is from the New England School of Law other factors as determined by the secretary of the Treasury.

and he is an honors graduate from the University of Connecti- (2) This recognizes that in normal years RMDs do need to be taken

cut. He can be reached at marc.belletsky@equitable.com. and that the contingency assets, discussed here, are not a source of

funds to access in lieu of RMDs during normal distribution years.

JOURNAL OF FINANCIAL SERVICE PROFESSIONALS | JULY 2020

53

Copyright of Journal of Financial Service Professionals is the property of Society of Financial

Service Professionals and its content may not be copied or emailed to multiple sites or posted

to a listserv without the copyright holder's express written permission. However, users may

print, download, or email articles for individual use.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Comparing Credit Card Offers Fcs 340Document2 pagesComparing Credit Card Offers Fcs 340api-350693115No ratings yet

- Market Corrections, Panics, and COVID-19Document5 pagesMarket Corrections, Panics, and COVID-19Rodrigo GRNo ratings yet

- The Salt Tolerance of The Freshwater Snail Melanoides Tuberculata (Mollusca, Gastropoda), A Bioinvader GastropodDocument11 pagesThe Salt Tolerance of The Freshwater Snail Melanoides Tuberculata (Mollusca, Gastropoda), A Bioinvader GastropodRodrigo GRNo ratings yet

- Animals in A Bacterial World. McFall-Ngai, Et Al. 2013Document8 pagesAnimals in A Bacterial World. McFall-Ngai, Et Al. 2013Rodrigo GRNo ratings yet

- Ascent of The Mammals: Scientific American May 2016Document9 pagesAscent of The Mammals: Scientific American May 2016Rodrigo GRNo ratings yet

- Insectivorous Bats As Biomonitor of Metal Exposure in The Megalopolis of Mexico and Rural Environments in Central MexicoDocument10 pagesInsectivorous Bats As Biomonitor of Metal Exposure in The Megalopolis of Mexico and Rural Environments in Central MexicoRodrigo GRNo ratings yet

- From The Origin of Species To The Origin of Bacterial FlagellaDocument8 pagesFrom The Origin of Species To The Origin of Bacterial FlagellaRodrigo GRNo ratings yet

- Modeling Distribution and Population Vibility of Ateles HybridusDocument1 pageModeling Distribution and Population Vibility of Ateles HybridusRodrigo GRNo ratings yet

- Hostplants and ClassificationsDocument109 pagesHostplants and ClassificationsRodrigo GRNo ratings yet

- Predation by Rainbow Trout Oncorhynchus Mykiss On A Western Australian Icon Marron Cherax CainiiDocument9 pagesPredation by Rainbow Trout Oncorhynchus Mykiss On A Western Australian Icon Marron Cherax CainiiRodrigo GRNo ratings yet

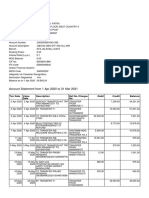

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancesayanNo ratings yet

- COST To COMPANY (CTC) For MR Hitesh Tomar Email: Tomar - Soft@Document1 pageCOST To COMPANY (CTC) For MR Hitesh Tomar Email: Tomar - Soft@tomar_softNo ratings yet

- Hc-Si22110190 Db-JeelytonDocument1 pageHc-Si22110190 Db-JeelytonHanh Nguyen KhacNo ratings yet

- Terengo AsmareDocument43 pagesTerengo Asmaretadesse beyeneNo ratings yet

- Huhu 105Document1 pageHuhu 105Mikko Gabrielle LangbidNo ratings yet

- Commerce General 1st SemesterDocument4 pagesCommerce General 1st SemestertNo ratings yet

- Krishna HSBC 20-21 StatementDocument175 pagesKrishna HSBC 20-21 StatementSumit VermaNo ratings yet

- Crypto Yield Farm Watcher DeFi Dashboard Apps OngcgstDocument4 pagesCrypto Yield Farm Watcher DeFi Dashboard Apps Ongcgstcablechive7100% (1)

- Lecture Notes Employee Benefits: Page 1 of 16Document16 pagesLecture Notes Employee Benefits: Page 1 of 16fastslowerNo ratings yet

- Ceylom Biscuit LimitedDocument24 pagesCeylom Biscuit LimitedLakshani fernandoNo ratings yet

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Document9 pagesRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasNo ratings yet

- Ruis LK TW Iv 2022Document157 pagesRuis LK TW Iv 2022Ragil ArdianNo ratings yet

- Financial Management Live Project: A Study of Ratio Analysis of Axis BankDocument14 pagesFinancial Management Live Project: A Study of Ratio Analysis of Axis BankKreator's BlogNo ratings yet

- 3-PDIC-LAW' With YouDocument15 pages3-PDIC-LAW' With YoubeachyliarahNo ratings yet

- Paper6 Syl22 Dec23 Set1Document7 pagesPaper6 Syl22 Dec23 Set1koteshdarshanala82No ratings yet

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikNo ratings yet

- Financial Statements: College of Business Management and AccountancyDocument6 pagesFinancial Statements: College of Business Management and AccountancyJamie Rose AragonesNo ratings yet

- Sean Darby - JefferiesDocument18 pagesSean Darby - JefferiesKurnia NindyoNo ratings yet

- Topic 1 - Overview of Financial SystemsDocument23 pagesTopic 1 - Overview of Financial SystemsĐinh PhươngNo ratings yet

- 5010 XXXXXX 3202Document4 pages5010 XXXXXX 3202SHIVALAYA CONSTRUCTIONNo ratings yet

- Daibb - Mfi: Default Risk PremiumDocument14 pagesDaibb - Mfi: Default Risk Premiumanon_904021637No ratings yet

- Islamic Treasury Risk Management ProductsDocument4 pagesIslamic Treasury Risk Management ProductsjjangguNo ratings yet

- Chapter 10. Preparation Review of Night Audit 1Document36 pagesChapter 10. Preparation Review of Night Audit 1Cảnh DươngNo ratings yet

- Sss Salary Loan QuizDocument4 pagesSss Salary Loan QuizMeireen AnnNo ratings yet

- Unit 3 Risk Management Part 3Document8 pagesUnit 3 Risk Management Part 3Lylegwyneth SuperticiosoNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument14 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSanthosh Naik BhukyaNo ratings yet

- Acct Statement - XX3852 - 11012024Document5 pagesAcct Statement - XX3852 - 11012024Praveen SainiNo ratings yet

- 2.trial Balance-Hans Lee-9-6-2021Document5 pages2.trial Balance-Hans Lee-9-6-2021Dhairya AilaniNo ratings yet

- Gerrard Construction Co Is An Excavation Contractor The Following SummarizedDocument3 pagesGerrard Construction Co Is An Excavation Contractor The Following SummarizedCharlotteNo ratings yet