Professional Documents

Culture Documents

Corpo 1983

Corpo 1983

Uploaded by

Isay JimenezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corpo 1983

Corpo 1983

Uploaded by

Isay JimenezCopyright:

Available Formats

1. ABC Corporation is engaged in the business of manufacturing soft drinks.

For the past 10

years, it has bought all its bottles from XYZ Corporation. Considering the volume of its

production, it now finds that it will be more economical to manufacture its own bottles.

The Board of Directors, after studying and discussing the matter thoroughly, decides to set

aside the amount of 1 Million for this project. Most of this amount will go to the cost of

equipment and materials.

M is a stockholder of ABC Corporation and is against this investment in the bottling project

and would like to withdraw from the corporation by exercising his appraisal right if the

project goes through. He therefore demands that the project be submitted to the

stockholders for approval, but the board refuses to do so on the ground that there is no

need for such approval and that the calling of a special stockholder’s meeting would entail

too much expenses.

M thus cannot have the opportunity to exercise his appraisal right. He wants to sue the

board to compel it to submit the matter to the stockholders and to enjoin it from pursuing

the project until the stockholders shall have approved it.

a) Before whom should M file his suit? Why?

b) Do you think the matter needs the stockholders’ approval or is the action of the Board of

Directors sufficient? Explain.

Answer:

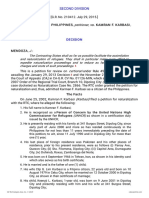

a) A should bring his case before the Regional Trial Court.

According to Section 5.2 of the Securities Regulation Code, the jurisdiction of the SEC

over all cases enumerated under Section 5 of PD 902-A has been transferred to the

courts of general jurisdiction or the appropriate RTC.

In the case at bar, it involves a controversy which arose from the intra-corporate relation

between a stockholders and the corporation. Under the law, jurisdiction over this kind of

case has been transferred to the RTC and the SEC does not have jurisdiction over it.

Thus, the RTC have jurisdiction over the case and A should bring his case before the

RTC.

b) No, it does not need the approval of the stockholders, and the action of the Board is

sufficient.

According to Section 41 of the Revised Corporation Code, a corporation may invest its

funds in another business or in any purpose other than the primary purpose for which it

was organized, when approved by the Board of Directors and by 2/3 of the outstanding

capital stock in a meeting called for the purpose. Any dissenting stockholder shall have

the appraisal right. However, where the investment is reasonably necessary to

accomplish its primary purpose, the approval of the stockholders is not necessary.

In the case at bar, the manufacture of bottles is reasonably necessary for the

corporation’s primary business of manufacturing soft drinks. Thus, it does not need the

approval of the stockholders.

Therefore, the action of the board is sufficient.

2. X Corporation is in need of land on which to construct an additional factory to be used in

the expansion of its business Jose Cruz owns a piece of land in Tagaytay, Rizal, which is

ideal for the purpose, and the corporation offers to buy it at a fair price. Jose is willing to

part with the land on condition that he be paid in shares of stocks of the corporation. The

Board of Directors decides to accept the terms of Jose, but since the authorized capital

stock of the corporation has been fully subscribed, it proposes to increase the capital stock

so that it can consummate the sale of the land. The proposal, including the purchase of

Jose’s land in exchange for the new shares was submitted to the stockholders in a meeting

called for the purpose.

Pedro Reyes, who has 100 shares in the corporation, alleging that he and all other

stockholders have a preemptive right to the new shares, insists that the corporation issue to

him his proportionate quota of the new shares which he offers to buy in cash. Holders of

80% of the outstanding capital stock are in favor of the proposal to increase the capital

stock, including the exchange of Jose’s land for new shares of stock.

Is Pedro Reyes within his rights in claiming a preemptive right? Explain.

Answer:

No, Pedro Reyes’ preemptive right is not available and thus he cannot claim the same.

According to Section 38 of the Revised Corporation Code, all stockholders of a stock

corporation shall enjoy preemptive right to subscribe to all issues or disposition of shares of

any class, in proportion to their respective shareholdings, unless such right is denied by the

articles of incorporation or an amendment thereto. However, such preemptive right shall not

be available to shares issued in compliance with laws requiring stock offerings or minimum

stock ownership by the public; or to shares issued in good faith, with the stockholders

representing 2/3 of the outstanding capital stock, in exchange for property needed for

corporate purposes.

In the case at bar, 80% of the stockholders representing the outstanding capital stock are in

favor of the proposal to increase the capital stock, including the exchange of Jose’s land for

new shares of stock. Since shares are issued in exchange for property needed for

corporate purposes and 80% or more than 2/3 of the stockholders favored the proposal,

pre-emptive right is not available.

Therefore, Pedro Reyes cannot insist on the preemptive right as his pre-emptive right is not

available in this case.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- Short Form LLC Member Admission AgreementDocument3 pagesShort Form LLC Member Admission AgreementJPF100% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ST Jude Novena BCJ 2018Document1 pageST Jude Novena BCJ 2018annNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bar Questions and Answers (Conflict of Laws)Document15 pagesBar Questions and Answers (Conflict of Laws)Kristine De Los Santos100% (2)

- Topic: Common Carrier Breach of Contract Damages (2003)Document3 pagesTopic: Common Carrier Breach of Contract Damages (2003)Isay JimenezNo ratings yet

- NEA Vs Maguindanao Electric CooperativeDocument2 pagesNEA Vs Maguindanao Electric CooperativeIsay JimenezNo ratings yet

- Nego Case Patrimonio Vs GutierrezDocument2 pagesNego Case Patrimonio Vs GutierrezIsay JimenezNo ratings yet

- Petitioner vs. vs. Respondent.: Second DivisionDocument16 pagesPetitioner vs. vs. Respondent.: Second DivisionIsay JimenezNo ratings yet

- 169333-2014-Spouses Lanier v. PeopleDocument9 pages169333-2014-Spouses Lanier v. PeopleIsay JimenezNo ratings yet

- In Re Suspension of Atty Rogelio Z. BagabuyoDocument1 pageIn Re Suspension of Atty Rogelio Z. BagabuyoIsay Jimenez100% (2)

- Consti 1 - Chapter 3 CasesDocument190 pagesConsti 1 - Chapter 3 CasesIsay JimenezNo ratings yet

- Jimenez Vs FranciscoDocument2 pagesJimenez Vs FranciscoIsay JimenezNo ratings yet

- Jimenez Vs FranciscoDocument2 pagesJimenez Vs FranciscoIsay JimenezNo ratings yet

- Petitioners Vs Vs Respondents: First DivisionDocument13 pagesPetitioners Vs Vs Respondents: First DivisionIsay JimenezNo ratings yet

- Duty of Care NotesDocument4 pagesDuty of Care NotesIvan LeeNo ratings yet

- Agreement For Sale Day of April 2021. Between, (1) Mrs.S.VIJAYALAKSHMI, Wife of Late S.Sampath, AgedDocument7 pagesAgreement For Sale Day of April 2021. Between, (1) Mrs.S.VIJAYALAKSHMI, Wife of Late S.Sampath, AgedKamal KannanNo ratings yet

- Acko Bike InsuranceDocument1 pageAcko Bike InsuranceMahesh BabuNo ratings yet

- Rafael Reyes Trucking Corporation v. People G.R. 129029Document2 pagesRafael Reyes Trucking Corporation v. People G.R. 129029KattNo ratings yet

- JAPRL DEVELOPMENT CORP. v. SECURITY BANK CORPORATIONDocument8 pagesJAPRL DEVELOPMENT CORP. v. SECURITY BANK CORPORATIONEj CalaorNo ratings yet

- All Year Participation Agreement and Medical Release FormDocument2 pagesAll Year Participation Agreement and Medical Release Formofthelogos0% (1)

- Draft Reply To UG1 Letter # 9838Document2 pagesDraft Reply To UG1 Letter # 9838Arindam HaldarNo ratings yet

- Declaration - Home Loan (Section 80EE) - 1Document2 pagesDeclaration - Home Loan (Section 80EE) - 1palanivelNo ratings yet

- Property, Marriage, DivorceDocument5 pagesProperty, Marriage, DivorceLemuel Angelo M. EleccionNo ratings yet

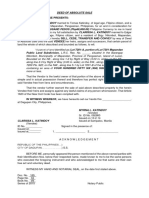

- Know All Men by These Presents:: Deed of Absolute SaleDocument1 pageKnow All Men by These Presents:: Deed of Absolute SaleMaria Florida ParaanNo ratings yet

- Organisational StructuresDocument7 pagesOrganisational StructuresjackNo ratings yet

- TAI TONG CHUACHE v. Insurance CommissionDocument2 pagesTAI TONG CHUACHE v. Insurance CommissionAngelette BulacanNo ratings yet

- Civil Law Review Finals Possession Up To Donation - 201021 - 205729Document10 pagesCivil Law Review Finals Possession Up To Donation - 201021 - 205729Gladys Bustria OrlinoNo ratings yet

- Eagle Star Insurance Vs Chia Yu March 31, 1955Document1 pageEagle Star Insurance Vs Chia Yu March 31, 1955Alvin-Evelyn GuloyNo ratings yet

- Contractual Ouster of JurisdictionDocument20 pagesContractual Ouster of JurisdictionEmmanuel O.100% (1)

- Annexure III Market ValueDocument4 pagesAnnexure III Market ValueCHARANYA KUMAR DUVVURUNo ratings yet

- ASSURANCE FUND Report4Document7 pagesASSURANCE FUND Report4Camella AgatepNo ratings yet

- Annex Consolidated SpaDocument2 pagesAnnex Consolidated Spamcjeff32No ratings yet

- LAW 299: Business Law (Offer) : Main Source of ReferenceDocument30 pagesLAW 299: Business Law (Offer) : Main Source of ReferenceNaqi LemanNo ratings yet

- Introduction To DerivatiesDocument37 pagesIntroduction To DerivatiesyopoNo ratings yet

- Credit Trans Cases Nov. 19Document6 pagesCredit Trans Cases Nov. 19JASON BRIAN AVELINONo ratings yet

- Remington & Vernick Engineers II, Inc.-2020 - BE - FormDocument140 pagesRemington & Vernick Engineers II, Inc.-2020 - BE - FormRise Up Ocean CountyNo ratings yet

- Arco Pulp and Paper Co Vs LimDocument2 pagesArco Pulp and Paper Co Vs LimJoey Albert De Guzman100% (1)

- (ARTICLE 299) Lays Provisions: ThereofDocument6 pages(ARTICLE 299) Lays Provisions: ThereofDevesh SawantNo ratings yet

- Business Structures SummaryDocument5 pagesBusiness Structures SummaryMrudula V.100% (2)

- Money Market Group Presentation - FinalDocument41 pagesMoney Market Group Presentation - FinalYibeltal AssefaNo ratings yet

- 110 C PDFDocument35 pages110 C PDFAyushi TripathiNo ratings yet

- Platinum Plans Phils Inc VDocument8 pagesPlatinum Plans Phils Inc VNadine Malaya NadiasanNo ratings yet