Professional Documents

Culture Documents

Brief Description Ex: The Doctor Opens The Business and Practices His License

Brief Description Ex: The Doctor Opens The Business and Practices His License

Uploaded by

henry0 ratings0% found this document useful (0 votes)

12 views4 pagesThis document provides information on different types of business entities: sole proprietorship, general partnership, corporation, and limited liability company (LLC). A sole proprietorship is a business owned and operated by one individual for their own benefit. A general partnership involves two or more individuals joining together to carry on a business endeavor and sharing responsibilities and profits. A corporation is a legal entity separate from its owners that provides liability protection but involves more complex setup and potential double taxation. An LLC is a hybrid that provides liability protection like a corporation but tax flexibility like a sole proprietorship or partnership.

Original Description:

finance

Original Title

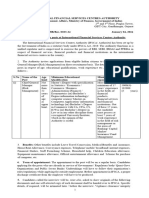

Chart 1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information on different types of business entities: sole proprietorship, general partnership, corporation, and limited liability company (LLC). A sole proprietorship is a business owned and operated by one individual for their own benefit. A general partnership involves two or more individuals joining together to carry on a business endeavor and sharing responsibilities and profits. A corporation is a legal entity separate from its owners that provides liability protection but involves more complex setup and potential double taxation. An LLC is a hybrid that provides liability protection like a corporation but tax flexibility like a sole proprietorship or partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views4 pagesBrief Description Ex: The Doctor Opens The Business and Practices His License

Brief Description Ex: The Doctor Opens The Business and Practices His License

Uploaded by

henryThis document provides information on different types of business entities: sole proprietorship, general partnership, corporation, and limited liability company (LLC). A sole proprietorship is a business owned and operated by one individual for their own benefit. A general partnership involves two or more individuals joining together to carry on a business endeavor and sharing responsibilities and profits. A corporation is a legal entity separate from its owners that provides liability protection but involves more complex setup and potential double taxation. An LLC is a hybrid that provides liability protection like a corporation but tax flexibility like a sole proprietorship or partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

Sole-Proprietorship

The business run by one individual

for his/her own benefit and the owner and the proprietorship

Brief

are the same.

Description

Ex: The doctor opens the business and practices his license.

• Easy to set-up since it does not need to fill of any paper.

• It does not require the registration of proprietorships from

States.

• Revenue is only taxed once on the owner's personal tax

returns.

Advantages

• The owner makes all decisions and has complete control of

the business.

• Tax forms are simple.

• It is easy to liquidate assets when the owner is passed away.

• The only responsibility for unlimited legal liabilities is the

owner who may lose his/her home, car, and other personal

assets if he/she loses a lawsuit.

• Duration is short. The business will be liquidated upon the

Disadvantages death of owner.

• It can not be transferred to someone else.

• It can not accept capital from outside investors.

• It is more difficult to borrow money from the bank.

General Partnership

It is an agreement between two or more people who

join together to carry on a business endeavor for profit.

• It is easy to form.

• This set-up can bring together a group of individuals

with different talents. Since they are all equal and share

in the responsibilities of everything within the company,

they can monitor each others closely to bring out the

best of them.

• The partnership can still exist when one of the

partners dies if the partnership agreement is permitted.

• It can be transfered ownership.

• All partners are responsible for unlimited liabilities.

• There will be a problem in making decisions since they

will not always agree with each others. It will lead to

management conflicts.

• Partners will not feel they are being adequately

compensated for their contributions and services in

sharing profits at all times.

Corporation

•A corporation is a legal entity separate from its owners and

managers.

•File papers of incorporation with state.

Charter

Bylaws

•The rights of stockholders are very limited.

•The Corporation can sue their parties and can also be sued.

• Debts of the corporation are separated from owners' personal

liability. Shareholders may only lose the amount of their

investment in the company.

• The company has more access to financial resources including

selling stock to praise capital, applying for loans from the bank

easier, and issuing bonds for long-term financing.

• It can be transfered ownership easily.

• It is better able to attract more talented and skilled employees

than proprietorships.

• Duration can be long as long as the owner and shareholders

want.

• The business structure is complex and required a lawyer for

setting-up.

• Double taxation can be applied to earnings.

• Costs of organizing this business are higher.

• The corporate charter restricts operation to the state where it

was issued, unless there is permission from other states.

Limited Liability Company (LLC).

LLC is a mixture between a corporation and a partnership.

All members of an LLC have operational flexibility and

income benefits similar to a partnership and limited

liability exposure.

• There is limited liability for owners. Judgments and

defaults on company debts do not affect the owners'

personal assets.

• The owners can choose how to pay taxes either the same

as a proprietorship, a partnership, or a corporation.

• LLC is not required to have Anual Meetings by most

states.

• LLCs' structure are not required to have a board of

directors.

•There is unlimited in the number of shaholders.

• It is easy to form.

•Comparing with proprietorships and partnerships, the

Legal and accounting costs are much higher.

• Owners have to create an operating agreement that

defines management authority and limits to making

decisions.

• When there is a death of a member within LLC, the

business will be stopped unless otherwise specified in the

operating agreement.

• It can not make a public stock offering.

• Ownership transfer is more difficult than the corporation.

You might also like

- TRINSEY V PAGLIARO Statements of Counsel Insufficient 1964Document2 pagesTRINSEY V PAGLIARO Statements of Counsel Insufficient 1964Martin Petrosky100% (6)

- The Karnataka Maternity Benefit Rules, 1966Document9 pagesThe Karnataka Maternity Benefit Rules, 1966kartik100% (1)

- Chapter 8 Forms of Small Business OwnershipDocument22 pagesChapter 8 Forms of Small Business OwnershipRoxanna Mhae Agarin VidamoNo ratings yet

- C7-Types of Business Ownership-FDocument27 pagesC7-Types of Business Ownership-FMaria Evelyn WonNo ratings yet

- Types of Business OwnershipDocument26 pagesTypes of Business OwnershipAkshat AgarwalNo ratings yet

- 3.00 Acquire Knowledge of Business Ownership To Establish & Continue Business OperationsDocument26 pages3.00 Acquire Knowledge of Business Ownership To Establish & Continue Business OperationsIssa ChavezNo ratings yet

- Forms of OwnershipDocument45 pagesForms of OwnershipAvanishNo ratings yet

- Types of Business OwnershipDocument26 pagesTypes of Business OwnershipMartinLNo ratings yet

- Business Incorporation UsDocument21 pagesBusiness Incorporation UsMARIANA CRISTINA ANAYA QUINTERONo ratings yet

- Types of Business Organisations For ArchitectsDocument14 pagesTypes of Business Organisations For ArchitectsANSLEM ALBERTNo ratings yet

- Innovation As An Entrepreneur and Different Types of Enterprises and CompaniesDocument51 pagesInnovation As An Entrepreneur and Different Types of Enterprises and Companiespaulkhor74No ratings yet

- Business Structures in OntarioDocument7 pagesBusiness Structures in OntariocorecorpNo ratings yet

- Dis and AdvantagesDocument9 pagesDis and Advantagesapi-264550290No ratings yet

- Chapter - 3: Industrial OwnershipDocument11 pagesChapter - 3: Industrial Ownershipashish.nigam120893No ratings yet

- Busi Law Ch15-1Document52 pagesBusi Law Ch15-1chuacasNo ratings yet

- Types of Businesses PT1Document14 pagesTypes of Businesses PT1NoN -NaNo ratings yet

- Sole ProprietorshipDocument3 pagesSole ProprietorshipjeromeencioNo ratings yet

- Business Organisations Yr 10Document23 pagesBusiness Organisations Yr 10David KariukiNo ratings yet

- Types of Ownerships: Advantages and DisadvantagesDocument17 pagesTypes of Ownerships: Advantages and Disadvantagesj ā dNo ratings yet

- Business ManagementDocument45 pagesBusiness Managementbit-027-19No ratings yet

- Commercial Law in UsDocument19 pagesCommercial Law in Usg.petryszak1No ratings yet

- Forms of Business UnitsDocument115 pagesForms of Business UnitsJaseme OtoyoNo ratings yet

- Forms of BusinessDocument13 pagesForms of BusinessA.B SathyaNo ratings yet

- Business OrganizationDocument26 pagesBusiness OrganizationAhmad NisarNo ratings yet

- Forms of Business OrganizationDocument12 pagesForms of Business OrganizationAshik MahmudNo ratings yet

- FABM 1 Lesson 4Document58 pagesFABM 1 Lesson 4althearozs.grijaldoNo ratings yet

- UET Entrepreneurship 5Document16 pagesUET Entrepreneurship 5Zain GhummanNo ratings yet

- Tax Considerations:: Factors Affecting The ChoiceDocument26 pagesTax Considerations:: Factors Affecting The ChoiceAnonymous jrIMYSz9No ratings yet

- Forms of Business & Recommendation MemoDocument14 pagesForms of Business & Recommendation MemoLollipopLouiseNo ratings yet

- L-04 Industrial ManagementDocument12 pagesL-04 Industrial ManagementTanyaMathurNo ratings yet

- Chapter 3Document24 pagesChapter 3Amit RaiNo ratings yet

- Business Entities 3Document13 pagesBusiness Entities 3PetrinaNo ratings yet

- Type of Ventures PDFDocument81 pagesType of Ventures PDFJevonny AndersonNo ratings yet

- BSP PPT 333333Document15 pagesBSP PPT 333333Anjan Kumar SmitNo ratings yet

- Chapter 4 Forms of Business OrganizationDocument19 pagesChapter 4 Forms of Business OrganizationJoy BeronioNo ratings yet

- The Organizational PlanDocument32 pagesThe Organizational PlanSrishti Vasdev50% (4)

- Economic Sectors and Legal StructuresDocument21 pagesEconomic Sectors and Legal Structuresdanielwilo100% (1)

- Form of Business OrganizationDocument31 pagesForm of Business OrganizationRudy Hope V. TuraNo ratings yet

- Forms of Ownership: Sole ProprietorshipDocument3 pagesForms of Ownership: Sole ProprietorshipAjay KaundalNo ratings yet

- Forms of Business OrganizationsDocument15 pagesForms of Business OrganizationsReiner MagdadaroNo ratings yet

- Forms of BusinessDocument41 pagesForms of BusinessJAYLORD SANTOSNo ratings yet

- Types of Commercial Enterprises: Sole Traders, Cooperatives and PartnershipsDocument3 pagesTypes of Commercial Enterprises: Sole Traders, Cooperatives and Partnershipsnohoe abdiNo ratings yet

- Chapter 2Document3 pagesChapter 2ali goharNo ratings yet

- Week 6Document11 pagesWeek 6Zybel RosalesNo ratings yet

- Chapter 3 Forms of OwnershipDocument22 pagesChapter 3 Forms of OwnershipFaizan ShahzadNo ratings yet

- Company Law: Shortened Version For Mba StudentsDocument134 pagesCompany Law: Shortened Version For Mba Studentsgaurav bishtNo ratings yet

- Functions of Business FinanceDocument6 pagesFunctions of Business FinancePrincess AudreyNo ratings yet

- Chapter 1 Types of OrganizationDocument33 pagesChapter 1 Types of OrganizationHsu Lae NandarNo ratings yet

- Incorporation GuideDocument28 pagesIncorporation GuideSandeep BellapuNo ratings yet

- Forms of Business OrganizationDocument1 pageForms of Business OrganizationElla Simone100% (3)

- Types of Business Sole Proprietorship Parntership Corporation Types of PartnershipDocument22 pagesTypes of Business Sole Proprietorship Parntership Corporation Types of PartnershipRoberta Gonzales Sison100% (1)

- Forms of BusinessDocument21 pagesForms of Businessmagesty tamayoNo ratings yet

- 2023 BSTD Grade 10 Chaptert 10 Week 6 Forms of Ownership NotesDocument8 pages2023 BSTD Grade 10 Chaptert 10 Week 6 Forms of Ownership Notestshireletsoseloane2No ratings yet

- Forms of Business OrganisationsDocument39 pagesForms of Business OrganisationsTushar TyagiNo ratings yet

- Business OwnershipDocument23 pagesBusiness OwnershipIra OrenciaNo ratings yet

- The Legal Forms of BusinessDocument76 pagesThe Legal Forms of BusinessAbdou DarboeNo ratings yet

- Types of OwnershipDocument7 pagesTypes of Ownershiphjpa2023-7388-23616No ratings yet

- Forms of Business OwnershipDocument30 pagesForms of Business OwnershipByun Boy50% (2)

- Task 4 - Business CatergoriesDocument5 pagesTask 4 - Business CatergoriesYashmi BhanderiNo ratings yet

- Forms of Business Ownership and Buying An Existing BusinessDocument66 pagesForms of Business Ownership and Buying An Existing BusinessAmr MohamedNo ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- International Students Asoke Campus Learning Center Master of Business Administration (Mba)Document2 pagesInternational Students Asoke Campus Learning Center Master of Business Administration (Mba)henryNo ratings yet

- Stamford International University - Postgraduate BrochureDocument11 pagesStamford International University - Postgraduate BrochurehenryNo ratings yet

- Tax Planning MBA 2021Document21 pagesTax Planning MBA 2021henryNo ratings yet

- Ch01 ShowDocument49 pagesCh01 ShowhenryNo ratings yet

- Complainants vs. vs. Respondent: First DivisionDocument4 pagesComplainants vs. vs. Respondent: First DivisionKNo ratings yet

- General Provisions: Succession Reviewer 1 SEM 2006-2007Document161 pagesGeneral Provisions: Succession Reviewer 1 SEM 2006-2007jerick16100% (2)

- LA Times' Respondents Brief For anti-SLAPP Motion in Ted Rall v. Ted Rall Et Al.Document125 pagesLA Times' Respondents Brief For anti-SLAPP Motion in Ted Rall v. Ted Rall Et Al.Ted RallNo ratings yet

- A Conceptual View On Companies Act 2013: With Special Reference To Share CapitalDocument12 pagesA Conceptual View On Companies Act 2013: With Special Reference To Share CapitalSameer DhumaleNo ratings yet

- CRIM PEOPLE Vs VILLALONDocument2 pagesCRIM PEOPLE Vs VILLALONBug RancherNo ratings yet

- Moot Propositions-10thsem 2021Document22 pagesMoot Propositions-10thsem 2021janvee0% (1)

- Vacancy Notification For Recruitment of Chief General Manager CGM Grade F at Ifsca04012024105255Document5 pagesVacancy Notification For Recruitment of Chief General Manager CGM Grade F at Ifsca04012024105255Samirkumar P. LakhtariaNo ratings yet

- Unit 2Document6 pagesUnit 2Kian FloresNo ratings yet

- CD - 74. Allied Banking Corp vs. Bpi, G.R. No. 188363, February 27, 2013Document2 pagesCD - 74. Allied Banking Corp vs. Bpi, G.R. No. 188363, February 27, 2013MykaNo ratings yet

- Oliman: The Bill of LadingDocument5 pagesOliman: The Bill of LadingMohd AyoobNo ratings yet

- St. Croix County Property Transfers For Aug. 24-30, 2020Document31 pagesSt. Croix County Property Transfers For Aug. 24-30, 2020Michael BrunNo ratings yet

- Mohammad SavadDocument7 pagesMohammad SavadSavad ChavvaNo ratings yet

- Veronique T. Huibonhoa vs. Angel Concepcion, Et AlDocument7 pagesVeronique T. Huibonhoa vs. Angel Concepcion, Et AljafernandNo ratings yet

- PAB ResolutionDocument27 pagesPAB Resolutionkat perezNo ratings yet

- F002 Admin. PRCDocument24 pagesF002 Admin. PRCLeolaida AragonNo ratings yet

- People vs. LeonorDocument19 pagesPeople vs. LeonorMichael Rentoza0% (1)

- Intervention Programs For Children in Conflict With The Law (Cicl) : Gearing Towards Sustainable DevelopmentDocument6 pagesIntervention Programs For Children in Conflict With The Law (Cicl) : Gearing Towards Sustainable DevelopmentAvel Rivera100% (1)

- 11 Miners Association of The Philippines v. Factoran, 240 SCRA 100, January 16, 1995Document3 pages11 Miners Association of The Philippines v. Factoran, 240 SCRA 100, January 16, 1995mae ann rodolfoNo ratings yet

- Css Essay War On Terrorism İs Contributing Towards Growing Abuse of Human RightsDocument10 pagesCss Essay War On Terrorism İs Contributing Towards Growing Abuse of Human RightsShah JahanNo ratings yet

- Accused State: Section 12 of Art. III of The ConstitutionDocument3 pagesAccused State: Section 12 of Art. III of The ConstitutionMarie Claire T. InductivoNo ratings yet

- Divorce PetitionDocument4 pagesDivorce PetitionSweety JNo ratings yet

- McLaughlin v. CA DigestDocument2 pagesMcLaughlin v. CA DigestSS80% (5)

- Datalift Movers, Inc. vs. Belgravia Realty & Development Corporation, Et AlDocument5 pagesDatalift Movers, Inc. vs. Belgravia Realty & Development Corporation, Et AljafernandNo ratings yet

- Succession Outline Notes Cases2Document117 pagesSuccession Outline Notes Cases2Dianne Medel GumawidNo ratings yet

- Judicial Process Law Courts and Politics in The United States 7th Edition Ebook PDF VersionDocument62 pagesJudicial Process Law Courts and Politics in The United States 7th Edition Ebook PDF Versionhenrietta.hallquist413100% (46)

- Local RulesDocument133 pagesLocal RulesSylvester MooreNo ratings yet

- Abatement of LegaciesDocument8 pagesAbatement of LegaciesSyed Faisal HayatNo ratings yet

- Insurance Cases For WednesdayDocument13 pagesInsurance Cases For WednesdayYolanda Janice Sayan FalingaoNo ratings yet