Professional Documents

Culture Documents

2019 Medical Mutual HSA - Group Official Flier

2019 Medical Mutual HSA - Group Official Flier

Uploaded by

MayurRumalwala0 ratings0% found this document useful (0 votes)

6 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views2 pages2019 Medical Mutual HSA - Group Official Flier

2019 Medical Mutual HSA - Group Official Flier

Uploaded by

MayurRumalwalaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Medical Mutual Health Savings Account (HSA)

Savings for you and your employees

Complete Employer Administration Enrollment Made Easy

Now you can offer your employees healthcare Once your employees are enrolled in their health

benefits and an HSA together from Medical plan, they can quickly enroll in the HSA online

Mutual. We provide full HSA support to both you though My Health Plan.

and your employees via our Ohio-based team

and administration tools that allow you to: Full Access 24/7

• Manage employee enrollment Once enrolled, your employees will have 24/7

• Change employer/employee online access to their HSA and their health

contributions benefits through My Health Plan. After logging in,

• Verify employee participation they’ll be able to:

• Manage all HSA reporting • Track HSA and investment balances

• Pay for qualified medical expenses

Medical Mutual’s HSA • Invest in mutual fund options

Used in conjunction with a Medical Mutual • Report and reissue a lost or stolen debit

qualified high-deductible health plan, our HSA card

gives your employees three great tax

• Use all the health benefits resources on

advantages:

My Health Plan, including My Care

1. Money goes in tax-free. Employee HSA Compare and Find a Provider

contributions are made on a pre-tax

basis, making savings immediate. AccountLink Mobile App

2. Money comes out tax-free. Eligible Your employees can access their Medical Mutual

healthcare purchases can be made tax- HSA on the go with Medical Mutual’s AccountLink

free when the HSA is used. Purchases mobile app. AccountLink lets employees view

can be made directly from the HSA account balance and profile information; submit a

account, either by using the Medical claim; and much more from a mobile device.

Mutual debit card, ACH, online bill-pay;

or, your employees can pay out of pocket AccountLink app is available for free from the

and then be reimbursed yourself from Apple App Store® or Google Play™ by searching

their HSA. for AccountLink.

3. Earn interest, tax-free. The interest on

HSA funds grows on a tax-free basis. Medical Mutual Debit Card

Unlike most savings accounts, interest The Medical Mutual debit card can be used to

earned on an HSA is not considered pay for qualified medical expenses, including

taxable income when the funds are used doctor’s visits, prescriptions and more.

for eligible medical expenses.

For more information on the Medical

Healthcare and Savings in One Location Mutual HSA, please contact your Medical

Your employees can easily manage their HSA Mutual Sales Representative or broker.

through My Health Plan, our secure member

website. They will have access to both their

Medical Mutual health benefits and HSA from one

location and with one password.

© 2018 Medical Mutual of Ohio

C2958-GHP rev 10/18

Medical Mutual Health Savings Account (HSA)

General Information

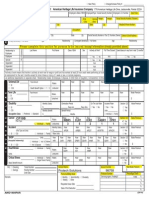

What is an HSA? IRS Contribution Information

An HSA is a tax-advantaged personal savings • 2019 IRS contribution limits for HSAs:

account that can be used to pay for medical, o $3,500 for single

dental, vision and other qualified healthcare o $7,000 for family

expenses now or later in life.

Account holders 55 or older are allowed to make

HSA Advantages: an additional $1,000 contribution each year. The

• Contributions are made tax free full catch-up contribution can be made in the

• Qualified medical expense payments year of the 55th birthday. Members may not

from the account are tax free make catch-up contributions for spouses turning

• The HSA balance earns interest tax free 55, as only the account holder’s age is taken

into consideration.

What is a High Deductible Health Plan?

A high-deductible health plan (HDHP) is health Contribution Options

insurance with deductible amounts that are • Direct deposit

greater than standard insurance plans. • Pre or post-tax payroll deductions

• Funds transfer

2019 IRS HDHP Requirements • Schedule one-time or recurring electronic

Deductibles are at least: transfers from a checking/savings

• $1,350 for individual coverage account

• $2,700 for family coverage • Account transfer

Maximum out of pocket does not exceed: • Existing health benefit accounts or IRAs

• $6,750 for individual coverage may be eligible to rollover or transfer

• $13,500 for family coverage • Send a check by mail

Who is Eligible to Participate in an HSA? Qualified Healthcare Expenses

Members can contribute to an HSA so long as HSAs cover a list of eligible, reimbursable

they are: expenses, as defined by IRS Code Section

• Covered by a qualified HDHP 213(d). Qualified medical expenses are

• Not covered by another first-dollar expenses for healthcare services for the

coverage health insurance participant and his or her spouse and

dependents that are not paid by insurance.

• Not enrolled in Medicare

• Medical expenses paid with HSA dollars

• Not able to be claimed as a dependent

cannot be claimed as a deduction on a

on someone else’s tax return

tax return

• Medical or other insurance premiums

are not qualified expenses

© 2018 Medical Mutual of Ohio

You might also like

- Complete Material SRI 111 CCPDocument51 pagesComplete Material SRI 111 CCPAnimesh Sen50% (2)

- Horton CH 3 Test AnswersDocument4 pagesHorton CH 3 Test Answersscribddommini88% (8)

- Policy - Co-2-034 Independent Double Check High Alert MedicationsDocument8 pagesPolicy - Co-2-034 Independent Double Check High Alert MedicationsTravel JunkyNo ratings yet

- 2019 Medical Mutual HSA - Group Member FlierDocument2 pages2019 Medical Mutual HSA - Group Member FlierMayurRumalwalaNo ratings yet

- Nara Introduction To Hsa SC Al 1Document11 pagesNara Introduction To Hsa SC Al 1api-293251883No ratings yet

- Chrysler Retirees - FAQDocument7 pagesChrysler Retirees - FAQAlex RobertsNo ratings yet

- Tower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsDocument32 pagesTower Club Legal Lunch Forum January 10, 2014 Tax Update On Selected TopicsPeter Rudolph, CPANo ratings yet

- p969 PDFDocument22 pagesp969 PDFstalker1841No ratings yet

- HSA Sample SetupDocument16 pagesHSA Sample Setupleninapps33No ratings yet

- March 2009 Nyscaa Hra Hsa CobraDocument18 pagesMarch 2009 Nyscaa Hra Hsa CobraKristieNo ratings yet

- Health InsuranceDocument10 pagesHealth InsuranceBindu ShreeNo ratings yet

- 2021 Benefits Summary - ReadDocument12 pages2021 Benefits Summary - Readapi-544195419No ratings yet

- Health Savings Accounts HSAs 2021Document2 pagesHealth Savings Accounts HSAs 2021Finn KevinNo ratings yet

- HSA GuideDocument4 pagesHSA GuideTininNo ratings yet

- 2013 Benefits SummaryDocument0 pages2013 Benefits SummarybalajisaireddyNo ratings yet

- CharterOak HSA E-BrochureDocument1 pageCharterOak HSA E-BrochureRhoads ClemmieNo ratings yet

- Health Savings Accounts: Do The Critics Have A Point?, Cato Policy Analysis No. 569Document28 pagesHealth Savings Accounts: Do The Critics Have A Point?, Cato Policy Analysis No. 569Cato InstituteNo ratings yet

- Flexible Spending AccountDocument22 pagesFlexible Spending AccountRajkumarNo ratings yet

- Nawelcomeletter 549100Document1 pageNawelcomeletter 549100Leah MaggardNo ratings yet

- 2024 Chapters Benefit Guide - Final PDFDocument36 pages2024 Chapters Benefit Guide - Final PDFvcfigueroa1973No ratings yet

- Insurance GlossaryDocument4 pagesInsurance Glossaryapi-273325813No ratings yet

- HSA SunAdvantageHSA Guide May07Document8 pagesHSA SunAdvantageHSA Guide May07jaxNo ratings yet

- Health Savings Account 2013 - 2014 FINALDocument2 pagesHealth Savings Account 2013 - 2014 FINALMattress Firm BenefitsNo ratings yet

- Section 125 Flexible Spending Account: Employee Enrollment InformationDocument7 pagesSection 125 Flexible Spending Account: Employee Enrollment InformationDavidNo ratings yet

- Hpe Leavingsite Benefits LeavingDocument5 pagesHpe Leavingsite Benefits Leavingmanuvrat23No ratings yet

- FSA Introduction PPTDocument15 pagesFSA Introduction PPTSarah VillanuevaNo ratings yet

- Announcing New Partnership For Free Hsas, Triple Tax AdvantagesDocument2 pagesAnnouncing New Partnership For Free Hsas, Triple Tax AdvantagesAnonymous VA3KeEwzNo ratings yet

- FS PrivateInsuranceDocument2 pagesFS PrivateInsuranceIndiana Family to FamilyNo ratings yet

- Flexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govDocument2 pagesFlexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govRobinhoodNo ratings yet

- OHLA USA 2024 Benefits GuideDocument21 pagesOHLA USA 2024 Benefits GuideAbhijnaRao MedavarapuNo ratings yet

- 2023.05.17 - Hsa Benefits That May Surprise YouDocument1 page2023.05.17 - Hsa Benefits That May Surprise YouJay AnnNo ratings yet

- The Complete HSA GuidebookDocument229 pagesThe Complete HSA GuidebookMichelle LumNo ratings yet

- Cliff Notes - PM RetirementDocument5 pagesCliff Notes - PM RetirementJohnathan JohnsonNo ratings yet

- Healthcare Calculator 07-22-2010Document13 pagesHealthcare Calculator 07-22-2010dumpuuNo ratings yet

- Flexible Spending Account FINALDocument2 pagesFlexible Spending Account FINALMattress Firm BenefitsNo ratings yet

- State ManualDocument31 pagesState ManualKEILYBNo ratings yet

- Medical Mutual HSA Enrollment GuideC2924GHP 1218rDocument23 pagesMedical Mutual HSA Enrollment GuideC2924GHP 1218rMayurRumalwalaNo ratings yet

- What Is Health InsuranceDocument1 pageWhat Is Health InsuranceFiona SuzenneNo ratings yet

- Onboarding Process: Accept The OfferDocument9 pagesOnboarding Process: Accept The Offerrnj1230No ratings yet

- Health Savings Account (Hsa) : Fifth ThirdDocument2 pagesHealth Savings Account (Hsa) : Fifth ThirdMuhammad Akmal HossainNo ratings yet

- Guide For Deferred MembersDocument6 pagesGuide For Deferred MembersPeter BeattieNo ratings yet

- Benefits, Compensation and RetirementDocument59 pagesBenefits, Compensation and RetirementAndrew NeuberNo ratings yet

- Benefits at A Glance 2018Document2 pagesBenefits at A Glance 2018JeffNo ratings yet

- 2019 BenefitSummaryDocument8 pages2019 BenefitSummaryRob LenderNo ratings yet

- 2018 Contractor Benefit GuideDocument38 pages2018 Contractor Benefit GuidepseudoanonNo ratings yet

- Sen Rand Paul Obamacare Replacement ActDocument4 pagesSen Rand Paul Obamacare Replacement ActKevinBattsllNo ratings yet

- The Complete Hsa Guidebook: Sixth EditionDocument230 pagesThe Complete Hsa Guidebook: Sixth EditionullikeitNo ratings yet

- Contractor Benefit Guide 2012-2013Document42 pagesContractor Benefit Guide 2012-2013roseguy7No ratings yet

- 2023 New Hire GuideDocument22 pages2023 New Hire GuideKelle SuttonNo ratings yet

- Infosys Infosys 2014Document45 pagesInfosys Infosys 2014Basant KumarNo ratings yet

- JBT 2020 Enrollment Guide - Airport Services LPDocument31 pagesJBT 2020 Enrollment Guide - Airport Services LPErick BurgosNo ratings yet

- US HealthCare BasicsDocument9 pagesUS HealthCare Basicsgumma krishNo ratings yet

- 407 HESTA-super-PDS - 6Document26 pages407 HESTA-super-PDS - 6Ryan CabralNo ratings yet

- 17 Benefits For Seniors at NYDocument24 pages17 Benefits For Seniors at NYAbu HudaNo ratings yet

- Section 80d of Income TaxDocument7 pagesSection 80d of Income TaxBAJRANG LAL AgrawalNo ratings yet

- 2024 Non SCA Benefits Open Enrollment DetailsDocument4 pages2024 Non SCA Benefits Open Enrollment Detailsliljenncreech5No ratings yet

- TCS India FAQs - Health Insurance SchemeDocument7 pagesTCS India FAQs - Health Insurance SchemeVipul KulshreshthaNo ratings yet

- More Information About Tax Credits: R T - L 8 - HDocument1 pageMore Information About Tax Credits: R T - L 8 - HKevin MangumNo ratings yet

- Simple Path 5Document40 pagesSimple Path 5goldbudda701No ratings yet

- TCS India FAQsDocument8 pagesTCS India FAQsRaj kishan ShawNo ratings yet

- Leading Causes of MortalityDocument12 pagesLeading Causes of MortalityJayricDepalobosNo ratings yet

- Admision and DischargeDocument30 pagesAdmision and DischargeKetheesaran Lingam100% (2)

- Where Did You Last Spend Your Money? What Kind of Service Did You Last Avail?Document52 pagesWhere Did You Last Spend Your Money? What Kind of Service Did You Last Avail?Who Am I100% (1)

- Comment Submission On Behalf of Ballad Health 8-2-19Document24 pagesComment Submission On Behalf of Ballad Health 8-2-19Anonymous COFJlahNo ratings yet

- Families Caring For An Aging AmericaDocument366 pagesFamilies Caring For An Aging AmericaVladimirNo ratings yet

- Overview of CasemixDocument24 pagesOverview of CasemixJoanne NgimNo ratings yet

- (Perioperative Nursing Clinics 5 No. 3.) Goodman, Terri - Sterilization and Disinfection For The Perioperative Nurse (2010, Saunders) PDFDocument148 pages(Perioperative Nursing Clinics 5 No. 3.) Goodman, Terri - Sterilization and Disinfection For The Perioperative Nurse (2010, Saunders) PDFGokul SivaNo ratings yet

- The Ghosts of PhilhealthDocument11 pagesThe Ghosts of PhilhealthJoel A. Sarza100% (1)

- The Aged - CafsDocument12 pagesThe Aged - CafsAlyshaStanimerosNo ratings yet

- Revised Pediatric Sleep & DisordersDocument43 pagesRevised Pediatric Sleep & DisordersNicolas EvansNo ratings yet

- Where Does The Money Go? Funding For Indigenous HealthDocument2 pagesWhere Does The Money Go? Funding For Indigenous HealthdiamondphoenixNo ratings yet

- Canadas Physician ShortageDocument11 pagesCanadas Physician ShortageFion LamNo ratings yet

- Admission To Hospital: Nama: Aden Amaro B. Wahyu Prihantoro Prodi: S1 Keperawatan Mata Kuliah: English in NursingDocument2 pagesAdmission To Hospital: Nama: Aden Amaro B. Wahyu Prihantoro Prodi: S1 Keperawatan Mata Kuliah: English in NursingkickNo ratings yet

- Allianz HealthCare Individual Medical Plan-1Document2 pagesAllianz HealthCare Individual Medical Plan-1kumaNo ratings yet

- Hand HygieneDocument3 pagesHand Hygieneashlyn0203No ratings yet

- 2011 3-17 Hendrickson Tables and References Re Post-Acute Growth Teaneck NJ Board of AdjustmentDocument7 pages2011 3-17 Hendrickson Tables and References Re Post-Acute Growth Teaneck NJ Board of AdjustmentLeslie HendricksonNo ratings yet

- Aaron - Patnode - Resume For Cover OregonDocument3 pagesAaron - Patnode - Resume For Cover OregonStatesman JournalNo ratings yet

- A Method For Business Model DevelopmentDocument18 pagesA Method For Business Model DevelopmentRiza PrapascatamaNo ratings yet

- BirthDocument11 pagesBirthLini DasanNo ratings yet

- Hospital Planning: Prepared & Presented By-Awantika Diwan MBA (HA&HC)Document32 pagesHospital Planning: Prepared & Presented By-Awantika Diwan MBA (HA&HC)Pooja Jain100% (1)

- IPC Success StoryDocument1 pageIPC Success StoryYammerNo ratings yet

- Hospital Billing ScenariosDocument7 pagesHospital Billing Scenarioskrishna EnagaluruNo ratings yet

- Application For Life and Health Insurance ToDocument5 pagesApplication For Life and Health Insurance Toimi_swimNo ratings yet

- Quality of Care in Nursing HomesDocument432 pagesQuality of Care in Nursing HomesjpavlovaNo ratings yet

- Data Dictionary 201504Document301 pagesData Dictionary 201504john mullerNo ratings yet

- Aetna Group Life ApplicationDocument3 pagesAetna Group Life ApplicationLeslie EchinNo ratings yet

- PharmacistDocument3 pagesPharmacistapi-121451433No ratings yet

- One Pager PCMHDocument1 pageOne Pager PCMHMandy NicosiaNo ratings yet