Professional Documents

Culture Documents

April-22 - Louise Peralta - 11 - Fairness

April-22 - Louise Peralta - 11 - Fairness

Uploaded by

Louise Joseph PeraltaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April-22 - Louise Peralta - 11 - Fairness

April-22 - Louise Peralta - 11 - Fairness

Uploaded by

Louise Joseph PeraltaCopyright:

Available Formats

Asynchronous Activity

3

Sorsogon National High School April 22, 2021

SENIOR HIGH SCHOOL DEPARTMENT

FABM 2

Name: __________________________________________________________________________________________

Louise Joseph G. Peralta

Grade & Section: __________________________________,

11 - Fairness Date Accomplished: _________________________

Modality: ONLINE Type: Synchronous and Asynchronous Platform: Google Meet/Classroom G-Meet Link: meet.google.com/pad-ybnu-bcn

FABM 2 – April,22

1st Quarter; School Year 2020-2021

Practice Task 1: Let’s Identify

Joana had the following expense accounts for the year ended December 1, 2016:

General and Administrative Expense 1. Salaries of admin personnel

General and Administrative Expense 2. Salaries of Janitors

Selling Expense 3. Salaries of sales agents

General and Administrative Expense 4. Utilities of home office

General and Administrative Expense 5. Rent of office building

General and Administrative Expense 6. Depreciation of office equipment

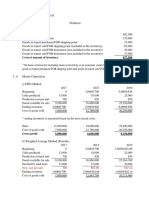

Sales P 500,000

Sales returns (P 30,000)

Sales discounts (P 10,000) P 40,000

Net Sales P 460,000

Purchases P 100,000

Purchase returns (P 20,000)

Purchase discounts (P 10,000) P 30,000

Net Purchases P 130,000

Selling Expense 7. Depreciation of delivery van

Selling Expense 8. Advertising Practice Task 2: Solve

for the Following:

1. Alpha Merchandising’s Sales amounted to P 500,000. Sales returns and sales discounts amounted to P

30,000 and P 10,000 respectively. Purchases of the company totaled P 100,000 while purchase returns

and purchase discounts amounted to P 20,000 and P 10,000 respectively. How much is the company’s

Net Sales? Net purchases?

Sales = P 500,000

Sales returns = P 30,000

Sales discounts = P 10,000

Purchases = P 100,000

Purchase returns = P 20,000

Purchase discounts = P 10,000

2. Gross profit of Tripe Star Trading amounted to P 175,000. Beginning Inventory totaled P 250,000.

Ending Inventory amounted to P 50,000 while Net Cost of Purchases totaled P 85,000. Compute for the

Net Sales.

Gross Profit = P 175,000

Beginning Inventory = P 250,000

Ending Inventory = P 50,000

Net Cost of Purchases = P 85,000

Net Sales =?

Beginning Inventory P 250,000

Net Cost of Purchases P 85,000

P 335,000

Ending Inventory (P 50,000) (P 285,000)

P 175,000

Net Sales P 285,000 + P 175,000 = P 460,000

3. Compute for the Cost of Goods Sold using the following:

Sales – 15,000

Purchases – 2,000

Purchase returns – 200

Purchase discounts – 200

Freight in – 100

Beginning inventory – 1,000

Ending inventory – 500

Purchases 2,000

Purchase returns (200)

Purchase discounts

Net Purchases

-COGS-

Beginning inventory 1,000

Net purchases 1,600

Freight In 100

Goods Available for Sale 2,700

Cost of Goods Sold 2,200

*The Cost of Goods Sold is P 2,200

Practice Task 3: Prepare a multistep Statement of Comprehensive Income using the following:

Sales – 20,000

Cost of Goods Sold – 10,000

General and Administrative expenses – 4,000

Selling expenses – 2,000

*You can use any business name and the end of the current year for the heading.

NACARIO’S COMPANY

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR AUGUST 31, 2021

Sales P 20,000

Cost of Goods Sold P 10,000

Gross Profit P 10,000

General and Administrative Expenses P 4,000

Selling Expenses P 2,000 2,000

Net Income P 8,000

You might also like

- John Deere 4055 4255 4455 4555 4755 4955 Shopmanual Sec WatDocument20 pagesJohn Deere 4055 4255 4455 4555 4755 4955 Shopmanual Sec Watdoris97% (32)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Home Office and Branch AccountingDocument12 pagesHome Office and Branch AccountingKrizia Mae FloresNo ratings yet

- Laravel Admin TemplateDocument35 pagesLaravel Admin TemplateLaravel0% (1)

- Chapter 8Document14 pagesChapter 8Kanton FernandezNo ratings yet

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Exercise in SCIDocument2 pagesExercise in SCIRizty CabibilNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeMarie FeNo ratings yet

- Amoroso - Inventory MethodDocument6 pagesAmoroso - Inventory MethodRovey JNo ratings yet

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- Intercompany Sales Business CombiDocument26 pagesIntercompany Sales Business CombiElai grace FernandezNo ratings yet

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Answers MerchandisingDocument11 pagesAnswers MerchandisingAltea AroganteNo ratings yet

- AccountingDocument13 pagesAccountingbeshahashenafe20No ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- FABM - SCI Quiz 4Document4 pagesFABM - SCI Quiz 4Raidenhile mae VicenteNo ratings yet

- EL201 Accounting Learning Module Lessons 51Document19 pagesEL201 Accounting Learning Module Lessons 51BabyjoyNo ratings yet

- Information Sheet Financial StatementsDocument6 pagesInformation Sheet Financial StatementsSitti SadalaoNo ratings yet

- Lesson 2 The Statement of Comprehensive Income (Part 2 of 2)Document4 pagesLesson 2 The Statement of Comprehensive Income (Part 2 of 2)Franchesca CalmaNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Notes Business MathDocument8 pagesNotes Business MathgelicametristanNo ratings yet

- Inventories and Cost of Goods CalculationsDocument7 pagesInventories and Cost of Goods CalculationsAvon Jade RamosNo ratings yet

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- FABM 2 3.ACT SCIdocxDocument10 pagesFABM 2 3.ACT SCIdocxMaryPher CadioganNo ratings yet

- MAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Document59 pagesMAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Maria Jeannie CurayNo ratings yet

- NIAT Review 3Document7 pagesNIAT Review 3April Joy InductaNo ratings yet

- Income Statement Problem SolvingDocument12 pagesIncome Statement Problem SolvingMaryjoy CuyosNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Model Exam Work Out FADocument5 pagesModel Exam Work Out FAnewaybeyene5No ratings yet

- Classroom Exercises On Inventories: Problem 1Document4 pagesClassroom Exercises On Inventories: Problem 1Amy SpencerNo ratings yet

- QUIZ 5 MidtermsDocument9 pagesQUIZ 5 MidtermsMa. Clovel MosasoNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- FaldoDocument10 pagesFaldodinda ardiyaniNo ratings yet

- Managrial Accounting (0301211) Assignment 1 On Chapter 1Document5 pagesManagrial Accounting (0301211) Assignment 1 On Chapter 1بشير حيدرNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BAnonn100% (2)

- BuenaventuraEJ BSA1BDocument29 pagesBuenaventuraEJ BSA1BMark Christian BrlNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- Bac4023 W5 Seminar Question - InventoriesDocument5 pagesBac4023 W5 Seminar Question - InventoriesHien NguyenNo ratings yet

- Hà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICEDocument7 pagesHà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICE31231020411No ratings yet

- Solution To Exercise Set Chapter 5Document5 pagesSolution To Exercise Set Chapter 5Nguyễn HuyNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- MerchandisingDocument11 pagesMerchandisingLyca MaeNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie Bocala0% (1)

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaNo ratings yet

- Advanced Accounting Drill ProblemsDocument6 pagesAdvanced Accounting Drill ProblemsiajycNo ratings yet

- Part 1: Net Income For Merchandising Is $168,750. Part 2: Net Income For Manufacturing Is $437,500Document8 pagesPart 1: Net Income For Merchandising Is $168,750. Part 2: Net Income For Manufacturing Is $437,500Jane VillanuevaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- MESP by Peralta L.J.G. and Ubana P.a.D. of SNHSDocument9 pagesMESP by Peralta L.J.G. and Ubana P.a.D. of SNHSLouise Joseph PeraltaNo ratings yet

- Behavioral ETHICS in ORG A ReviewDocument41 pagesBehavioral ETHICS in ORG A ReviewLouise Joseph PeraltaNo ratings yet

- Behavioral Approach To ManagementDocument2 pagesBehavioral Approach To ManagementLouise Joseph Peralta100% (1)

- Chapter 1Document10 pagesChapter 1Louise Joseph PeraltaNo ratings yet

- Cy Robert L. Sale Sketch Notes Module 2 and 3Document1 pageCy Robert L. Sale Sketch Notes Module 2 and 3Louise Joseph PeraltaNo ratings yet

- WORKSHEET wk7 1Document4 pagesWORKSHEET wk7 1Louise Joseph PeraltaNo ratings yet

- Request Letter Interview GuideDocument4 pagesRequest Letter Interview GuideLouise Joseph PeraltaNo ratings yet

- Admission Sec Scholastic RecordDocument1 pageAdmission Sec Scholastic RecordLouise Joseph PeraltaNo ratings yet

- People Vs ObsaniaDocument2 pagesPeople Vs Obsaniaminri721No ratings yet

- 2 Concept Plan - Myanmar Workshop - Final PDFDocument0 pages2 Concept Plan - Myanmar Workshop - Final PDFmaungohsiNo ratings yet

- Chapter 13 Business TaxationDocument5 pagesChapter 13 Business TaxationMaricrisNo ratings yet

- Steel Design 3 Nov 2020Document1 pageSteel Design 3 Nov 2020IaamIiaann100% (1)

- Sabar Group: Three Phase Cooling Tower MotorsDocument2 pagesSabar Group: Three Phase Cooling Tower MotorsHrithik Sai TummalaNo ratings yet

- Afoem Sample Paper Stage B Written Exam Paper 7Document43 pagesAfoem Sample Paper Stage B Written Exam Paper 7Caity YoungNo ratings yet

- Formal Treason Claim (S) Reported To The Office Massachusetts Governor Charlie Baker (R-Ma)Document3 pagesFormal Treason Claim (S) Reported To The Office Massachusetts Governor Charlie Baker (R-Ma)Mohan Harihar100% (1)

- Mindset MattersDocument19 pagesMindset Mattersracer100% (2)

- Сatalogue Dry-Type Current Limiting ReactorsDocument36 pagesСatalogue Dry-Type Current Limiting ReactorsAzis Maxun100% (1)

- Elevation: Section of Approach SlabDocument1 pageElevation: Section of Approach Slabfevahe756No ratings yet

- AGPU Everything-About-PVC enDocument16 pagesAGPU Everything-About-PVC enPierluigi GhioneNo ratings yet

- Think EntrepreneuriallyDocument29 pagesThink EntrepreneuriallyDipali SikandNo ratings yet

- PCUPDocument6 pagesPCUPBonn PustaNo ratings yet

- 11G-Reduce XTTS Downtime Using Cross Platform Incremental BackupDocument16 pages11G-Reduce XTTS Downtime Using Cross Platform Incremental Backupsaidi_mNo ratings yet

- CH 21 Network Layer Address Mapping Error Reporting and Multicasting Multiple Choice Questions and Answers PDFDocument10 pagesCH 21 Network Layer Address Mapping Error Reporting and Multicasting Multiple Choice Questions and Answers PDFGayle LokeshNo ratings yet

- 36 Lansang vs. Court of AppealsDocument1 page36 Lansang vs. Court of AppealsRoushael Cient MontealtoNo ratings yet

- Sample Cover Letter and Resume - Director Public Sector Appeals Grievance ReviewsDocument6 pagesSample Cover Letter and Resume - Director Public Sector Appeals Grievance ReviewsManojNo ratings yet

- United States v. Javar Minott, 4th Cir. (2014)Document3 pagesUnited States v. Javar Minott, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- JP Programme Officer PAK-OxfamNDocument2 pagesJP Programme Officer PAK-OxfamNxtremist2001No ratings yet

- LG 5 Year Promotion Terms and Conditions 2016Document4 pagesLG 5 Year Promotion Terms and Conditions 2016sadlkasdNo ratings yet

- My CV PDFDocument2 pagesMy CV PDFAli ArslanNo ratings yet

- 4976 15636 1 PBDocument26 pages4976 15636 1 PBNoor Ainun CameliyaNo ratings yet

- Keyboard Shortcuts For Windows and MacDocument13 pagesKeyboard Shortcuts For Windows and MacJahirul HaqueNo ratings yet

- Business StudiesDocument13 pagesBusiness StudiesSargam ShahNo ratings yet

- Intercompany Profit Transactions - BondsDocument50 pagesIntercompany Profit Transactions - BondsJeremy JansenNo ratings yet

- L.G. Foods Corp. vs. Pagapong-AgraviadorDocument4 pagesL.G. Foods Corp. vs. Pagapong-AgraviadorGlads SarominezNo ratings yet

- Charotar 9789385039126Document4 pagesCharotar 9789385039126Jayapal Rajan0% (1)

- Solar Dryer IFRJDocument18 pagesSolar Dryer IFRJdzaki ramadhanNo ratings yet