Professional Documents

Culture Documents

Managerial Economics: Problem Set 1

Managerial Economics: Problem Set 1

Uploaded by

Asfawosen DingamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Economics: Problem Set 1

Managerial Economics: Problem Set 1

Uploaded by

Asfawosen DingamaCopyright:

Available Formats

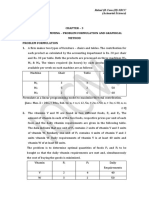

Managerial Economics

Problem Set 1

Submission Date: Nov. 26, 2016

1. Suppose there are 120 identical buyers and 100 similar sellers in the market for teff and the annual

demand (for a quintal of teff) and supply functions of typical representative buyer and seller are Qd

= 45 – 0.25P and Qs = 0.1P – 6 respectively. What is the market equilibrium price? And how many

quintals of teff are transacted during a year?

2. Suppose that a household demands 50 units of oranges at the price 40 cents per piece. If the price

falls to the price 30 cents per piece, 100 oranges are demanded. What is the elasticity of demand

for Oranges? And interpret it. If the inverse supply function of a representative supplier in a market

of 20 similar

a. Suppliers of jeans is P= 0.1Qs + 0.5, then

b. What is the market supply function

c. What is the quantity supplied in the market if the price is Br 100?

d. What is equilibrium price if market supply function is Qs=5P-20?

3. With an 8% rise in the price of a commodity, the quantities demanded falls from 10 to 2 units.

a. Determines the price elasticity of demand and Interpret the result

4. Consider the following demand and supply equation. P = 20-0.5 Q and P = 16+0.5Q

a. Determine price elasticity of demand at the equilibrium point and interpret the result

5. Vik and Fleet produce trainers in the sports-shoe market. For one of their main products they have

the following demand curves:

Vik: PV =¼ 175- 1.2QV

Fleet: Pf= ¼ 125 - 0.8Qf,

Where P is in US$ and Q is in pairs per week. The firms are currently selling 80 and 75 pairs of their

products per week respectively.

a. What are the current price elasticities for the products?

b. Assume that Vik reduces its price and increases its sales to 90 pairs and that this causes a fall in Fleet’s

sales to 70 pairs per week. What is the cross-elasticity between the two products?

You might also like

- Sample Econometrics Research PaperDocument14 pagesSample Econometrics Research PaperAnuska JayswalNo ratings yet

- Harambee University Faculty of Business and Economics Master of Business Administration (MBA)Document11 pagesHarambee University Faculty of Business and Economics Master of Business Administration (MBA)Getu WeyessaNo ratings yet

- History of Economic Thought Midterm - ReviewDocument7 pagesHistory of Economic Thought Midterm - ReviewUDeconNo ratings yet

- Demand NumericalsDocument2 pagesDemand Numericalsmahesh kumar0% (1)

- Tutorial Chapter 11 SolDocument7 pagesTutorial Chapter 11 SolMadina SuleimenovaNo ratings yet

- Econometrics - Basic 1-8Document58 pagesEconometrics - Basic 1-8Saket RathiNo ratings yet

- Operations ResearchDocument2 pagesOperations Researchced_mosbyNo ratings yet

- Alpha University College Mba Program Worksheet (Practice Questions) For The Course Quantitative Analysis For Management DecisionDocument3 pagesAlpha University College Mba Program Worksheet (Practice Questions) For The Course Quantitative Analysis For Management DecisionAmanuel Mitiku100% (1)

- Leontief Paradox.f01Document2 pagesLeontief Paradox.f01Payel ChakrabortyNo ratings yet

- Chapter 3: Number System: Summary of Number SystemsDocument9 pagesChapter 3: Number System: Summary of Number SystemsdagneNo ratings yet

- Impact Assessment of Small Scale Pump Irrigation in The Somali Region of EthiopiaDocument58 pagesImpact Assessment of Small Scale Pump Irrigation in The Somali Region of EthiopiaFeinstein International Center100% (1)

- Arba Minch UniversityDocument51 pagesArba Minch UniversitybezawitwubshetNo ratings yet

- MC090204957 Project ProposalDocument10 pagesMC090204957 Project ProposalWaleed Meer0% (1)

- Exercise Chapter 1 and 2Document2 pagesExercise Chapter 1 and 2Emellda MANo ratings yet

- Monopolistically CompetitiveDocument26 pagesMonopolistically Competitivebeth el100% (1)

- Chap1 EconometricsDocument36 pagesChap1 EconometricsLidiya wodajenehNo ratings yet

- Zambian Open University: Bba 313 - Operations ResearchDocument6 pagesZambian Open University: Bba 313 - Operations ResearchMASMO SHIYALANo ratings yet

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımNo ratings yet

- Tme 601Document14 pagesTme 601dearsaswatNo ratings yet

- LT 2 EconometricsDocument94 pagesLT 2 EconometricsumerNo ratings yet

- Problems in CVP Set ADocument5 pagesProblems in CVP Set AArtee GuptaNo ratings yet

- MGMT 221 Ch. 1Document13 pagesMGMT 221 Ch. 1kebron100% (1)

- Chapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForDocument11 pagesChapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForYamica ChopraNo ratings yet

- Managerial Economics Assignment Biruk TesfaDocument13 pagesManagerial Economics Assignment Biruk TesfaBirukee ManNo ratings yet

- Ambo University Woliso Campus School of Business and EconomicsDocument23 pagesAmbo University Woliso Campus School of Business and EconomicsDagim Fekadu100% (1)

- Unit 3 - Ethics and Environmental EthicsDocument11 pagesUnit 3 - Ethics and Environmental Ethics088jay IsamaliyaNo ratings yet

- LP Sample Model Formulation, Duality, Sensitivity Analysis Product MixDocument8 pagesLP Sample Model Formulation, Duality, Sensitivity Analysis Product MixZed Alemayehu100% (1)

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Document67 pagesThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayNo ratings yet

- Quantitative AssignmentDocument6 pagesQuantitative AssignmentAlemu Muleta KebedeNo ratings yet

- Krugman2e Solutions CH13Document12 pagesKrugman2e Solutions CH13amw4011100% (1)

- Demand and Supply Analysis (Aychew and Amsale Bakery)Document5 pagesDemand and Supply Analysis (Aychew and Amsale Bakery)Eshete GetawaNo ratings yet

- Quantitative Techniques - Paper 2 PDFDocument11 pagesQuantitative Techniques - Paper 2 PDFTuryamureeba JuliusNo ratings yet

- Problems: Week Crew Size Yards InstalledDocument2 pagesProblems: Week Crew Size Yards Installedfarnaz afshariNo ratings yet

- Introduction To Econometrics 12-09-2019Document232 pagesIntroduction To Econometrics 12-09-2019huynNo ratings yet

- Introduction To Linear ProgrammingDocument27 pagesIntroduction To Linear Programmingmuskaan bhadada100% (1)

- UM04CBBA04 - 09 - Statistics For Management IIDocument2 pagesUM04CBBA04 - 09 - Statistics For Management IIDrRitesh PatelNo ratings yet

- Assignment PDFDocument4 pagesAssignment PDFDark LightNo ratings yet

- Exam History of Economic ThoughtDocument3 pagesExam History of Economic ThoughtLeonardo VidaNo ratings yet

- Queens' College MBA Students Exercise:: 1 + 40x 2 1 + 120x 2 0Document2 pagesQueens' College MBA Students Exercise:: 1 + 40x 2 1 + 120x 2 0Tahir Kasim0% (1)

- CH 4 - ProblemsDocument72 pagesCH 4 - Problemstemesgen yohannesNo ratings yet

- Statistics Module IDocument94 pagesStatistics Module ILove Is100% (1)

- Questions: Temesgen - Worku@aau - Edu.etDocument3 pagesQuestions: Temesgen - Worku@aau - Edu.etHoney HoneyNo ratings yet

- Micro Economics IIDocument237 pagesMicro Economics IImillionyohannis.studNo ratings yet

- Econometrics I Lecture NotesDocument74 pagesEconometrics I Lecture NotesMahamad Foos AhmadNo ratings yet

- INTRODUCTIONDocument44 pagesINTRODUCTIONpadm0% (1)

- Chapter FiveDocument8 pagesChapter FiveyimenueyassuNo ratings yet

- Assignment I: Work Center Product Cutting Machine Packing Profit Per Unit ($) A B Total CapacityDocument4 pagesAssignment I: Work Center Product Cutting Machine Packing Profit Per Unit ($) A B Total CapacityShimeles TsegayeNo ratings yet

- Economic Systems & Intro To Econ-Multiple ChoiceDocument3 pagesEconomic Systems & Intro To Econ-Multiple Choicechanese jean-pierre100% (1)

- Chapter 1 Over ViewDocument25 pagesChapter 1 Over ViewAgatNo ratings yet

- ExercisesDocument9 pagesExercisesArzum EserNo ratings yet

- Assignment IDocument2 pagesAssignment IGu100% (1)

- Productivity Problems 1 3 AnsDocument1 pageProductivity Problems 1 3 Anssami damtewNo ratings yet

- Group Assignment QAFMDM Bedelle 2Document16 pagesGroup Assignment QAFMDM Bedelle 2Dejen TagelewNo ratings yet

- Engineering Economics and Financial AccountingDocument5 pagesEngineering Economics and Financial AccountingAkvijayNo ratings yet

- 1 Logit Probit and Tobit ModelDocument51 pages1 Logit Probit and Tobit ModelPrabin Ghimire100% (2)

- BOOKFE Kalot14Document217 pagesBOOKFE Kalot14AhmedNo ratings yet

- Haramaya University College of Agriculture and Environmental Sciences School of Agricultural Economics and AgribusinessDocument62 pagesHaramaya University College of Agriculture and Environmental Sciences School of Agricultural Economics and AgribusinessLyricsVideo ZoneNo ratings yet

- Assingment BEDocument3 pagesAssingment BERavi Prakash VermaNo ratings yet

- Problem Set V (PGP Micro)Document2 pagesProblem Set V (PGP Micro)RohitKumarNo ratings yet

- Ifrs Iyoha F (Acct) 3Document10 pagesIfrs Iyoha F (Acct) 3Asfawosen DingamaNo ratings yet

- Benefits and Challenges of International FinancialDocument25 pagesBenefits and Challenges of International FinancialAsfawosen DingamaNo ratings yet

- HabteDocument5 pagesHabteAsfawosen DingamaNo ratings yet

- Ifrs The Challenges and Prospects of IFRS Adoption in Ethiopian Commercial BanksDocument20 pagesIfrs The Challenges and Prospects of IFRS Adoption in Ethiopian Commercial BanksAsfawosen DingamaNo ratings yet

- Charles W. L. Hill / Gareth R. JonesDocument24 pagesCharles W. L. Hill / Gareth R. JonesAsfawosen DingamaNo ratings yet

- Ifrs MSL - 2019 - 277Document14 pagesIfrs MSL - 2019 - 277Asfawosen DingamaNo ratings yet

- Ifrs Article 9463Document6 pagesIfrs Article 9463Asfawosen DingamaNo ratings yet

- Ifrs D7105118419Document7 pagesIfrs D7105118419Asfawosen DingamaNo ratings yet

- Ifrs AFC 2017 02 ParvathyDocument7 pagesIfrs AFC 2017 02 ParvathyAsfawosen DingamaNo ratings yet

- Meta Analysis On Buisness Process Reengineering Approaches and ApplicationDocument12 pagesMeta Analysis On Buisness Process Reengineering Approaches and ApplicationAsfawosen DingamaNo ratings yet

- Ifrs Literature ReviewDocument4 pagesIfrs Literature ReviewAsfawosen DingamaNo ratings yet

- Problem Set IIIDocument2 pagesProblem Set IIIAsfawosen DingamaNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Asfawosen DingamaNo ratings yet

- A UN Treaty Now Under Discussion Looks PromisingDocument3 pagesA UN Treaty Now Under Discussion Looks PromisingAsfawosen DingamaNo ratings yet

- Case Application 1Document10 pagesCase Application 1Asfawosen DingamaNo ratings yet

- Bank Service Quality, Customer Satisfaction and Loyalty in Ethiopian Banking SectorDocument10 pagesBank Service Quality, Customer Satisfaction and Loyalty in Ethiopian Banking SectorAsfawosen DingamaNo ratings yet

- Meta Anaysis AssignmentDocument17 pagesMeta Anaysis AssignmentAsfawosen DingamaNo ratings yet

- Habte HabtishDocument83 pagesHabte HabtishAsfawosen DingamaNo ratings yet

- Unit-2 Capital Budgeting: Value, Size by Influencing Its Growth, Profitability and RiskDocument26 pagesUnit-2 Capital Budgeting: Value, Size by Influencing Its Growth, Profitability and RiskAsfawosen DingamaNo ratings yet