Professional Documents

Culture Documents

Employee Tax Calculation Report

Employee Tax Calculation Report

Uploaded by

FawazilHamdalahCopyright:

Available Formats

You might also like

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- MAR - 2024 - PaySlip (1) - UnlockedDocument1 pageMAR - 2024 - PaySlip (1) - Unlockednaveen.rawat.10420No ratings yet

- Remuneration Statement: Personal InformationDocument1 pageRemuneration Statement: Personal InformationFeliciaSetiawanNo ratings yet

- Remuneration Statement: Personal InformationDocument1 pageRemuneration Statement: Personal InformationDika HombingNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- Oct2023 PayslipDocument1 pageOct2023 PayslipTKSVELNo ratings yet

- Nov2023 PayslipDocument1 pageNov2023 PayslipTKSVELNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupAnjas AdeputNo ratings yet

- C Statment - Ivan Maleakhi - Aug 2020Document4 pagesC Statment - Ivan Maleakhi - Aug 2020Budi ArtantoNo ratings yet

- PremCal - 03-06-2021 23 - 28 - 02 PMDocument6 pagesPremCal - 03-06-2021 23 - 28 - 02 PMaman khatriNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- PT Prudential Life Assurance Payslip September 2021: ConfidentialDocument1 pagePT Prudential Life Assurance Payslip September 2021: ConfidentialVenysunny KusnadiNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupSintyaa100% (1)

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- SKP Retno MaharaniDocument3 pagesSKP Retno MaharaniJavantara AdvNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- SLIPDocument1 pageSLIPnadyla1212No ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Payslips 00437165 20230816Document2 pagesPayslips 00437165 20230816Nathaniel MasonNo ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- PayslipAstalika (14032024)Document6 pagesPayslipAstalika (14032024)FIZ FOTOCOPYNo ratings yet

- 2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateDocument2 pages2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateLance PazNo ratings yet

- Sheila Mae Platon: Company AIG Shared Services - Business Processing, IncDocument1 pageSheila Mae Platon: Company AIG Shared Services - Business Processing, IncHazel Ann AgacerNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- Oracle Fusion Payroll ReportingDocument2 pagesOracle Fusion Payroll ReportingALYNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Simulasi Tax Current PayDocument81 pagesSimulasi Tax Current PayDebiLianaLestariNo ratings yet

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- Salary Slip 1700531238397241Document1 pageSalary Slip 1700531238397241nirasahu7894No ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- PremCal - 06-08-2021 14 - 08 - 29 PMDocument6 pagesPremCal - 06-08-2021 14 - 08 - 29 PMsuresh kumarNo ratings yet

- PremCal - 18-06-2020 184836 PMDocument7 pagesPremCal - 18-06-2020 184836 PMLeenaNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- Payslip MeiDocument1 pagePayslip MeialyaNo ratings yet

- Capital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836Document1 pageCapital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836AmaryNo ratings yet

- Assignment 01, HRM 412Document3 pagesAssignment 01, HRM 412Nur Nahar LimaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Andaya, A History of Malaysia.Document24 pagesAndaya, A History of Malaysia.CQOT92No ratings yet

- Revised E-Tickets With Seat NumberDocument1 pageRevised E-Tickets With Seat NumberMohiminul KhanNo ratings yet

- Assessment Toolkit: Health InequalitiesDocument30 pagesAssessment Toolkit: Health InequalitiesAlejandro CardonaNo ratings yet

- Solar Cell Presentation Py4jccDocument13 pagesSolar Cell Presentation Py4jccTaufique aliNo ratings yet

- Outcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesDocument8 pagesOutcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesAriel BobisNo ratings yet

- Science Writing Exercise 09-2014Document2 pagesScience Writing Exercise 09-2014Chris Cesar Berdin Lagrio25% (4)

- Mission of The Order of Malta As Subject of Int LawDocument23 pagesMission of The Order of Malta As Subject of Int LawHazra FebriyantiNo ratings yet

- Bersa TPR9 Threaded BarrelDocument2 pagesBersa TPR9 Threaded BarrelDicko Perdana PutraNo ratings yet

- Breathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UkDocument5 pagesBreathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UksahraahmedaliNo ratings yet

- 2016-06-30 Flanges Petition Volume IDocument144 pages2016-06-30 Flanges Petition Volume ICapitalTradeNo ratings yet

- 5 GRADE ENGLISH (2019-2020) : Examination Questions 1Document7 pages5 GRADE ENGLISH (2019-2020) : Examination Questions 1didarseyitjanowNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Green BeltDocument149 pagesGreen BeltSUVADIP BHOWMIK100% (2)

- NSTP 2 Chapter 3 Community ImmersionDocument23 pagesNSTP 2 Chapter 3 Community ImmersionDaniel Corpus AntonioNo ratings yet

- PNP Memorandum Circular No 2021-16Document5 pagesPNP Memorandum Circular No 2021-16Dong Lupz100% (2)

- Welcome To Cambridge ClubDocument4 pagesWelcome To Cambridge ClubZhanna ZhannaNo ratings yet

- Describe A JourneyDocument15 pagesDescribe A JourneyEmma NguyenNo ratings yet

- Paul Andrew Mitchell Criminal ComplaiantDocument10 pagesPaul Andrew Mitchell Criminal Complaiantremenant2006No ratings yet

- Disaster Preparedness IntroDocument10 pagesDisaster Preparedness IntroBernadette-Mkandawire MandolomaNo ratings yet

- How To Be Courageous & BraveDocument1 pageHow To Be Courageous & BraveElias FungNo ratings yet

- Computeractive - Issue 636, 20 July 2022Document76 pagesComputeractive - Issue 636, 20 July 2022Joy BeltranNo ratings yet

- M W Patterson - The Church of EnglandDocument464 pagesM W Patterson - The Church of Englandds1112225198No ratings yet

- Implementing ERP in OrganizationsDocument12 pagesImplementing ERP in Organizationsprachi_rane_4No ratings yet

- Chapter 11Document6 pagesChapter 11Mian SajjadNo ratings yet

- Thematic Classification of ModuleDocument6 pagesThematic Classification of Modulehabtu2006No ratings yet

- Psychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah StringerDocument53 pagesPsychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah Stringermarsha.beaver589100% (5)

- Business Lessons I Learned From Steve Jobs PDFDocument6 pagesBusiness Lessons I Learned From Steve Jobs PDFKhởi NguyênNo ratings yet

- SIMP Model Catch Certificates PDFDocument9 pagesSIMP Model Catch Certificates PDFElvita RizkyNo ratings yet

- QATAR: Major ChangesDocument11 pagesQATAR: Major ChangesVivekanandNo ratings yet

- Clements Interview Transcript - PCSD Maricopa County Jail 8-15-17 (00626285-3xCDD05)Document40 pagesClements Interview Transcript - PCSD Maricopa County Jail 8-15-17 (00626285-3xCDD05)KOLD News 13No ratings yet

Employee Tax Calculation Report

Employee Tax Calculation Report

Uploaded by

FawazilHamdalahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Tax Calculation Report

Employee Tax Calculation Report

Uploaded by

FawazilHamdalahCopyright:

Available Formats

Employee Tax Calculation Report

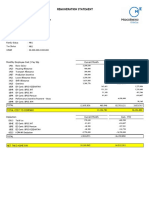

Name of Employee : Michael Gunawan PLANT002

Department :

Position : 00 Financial Analyst

Family Status : S/ 0 N.P.W.P. : 84.520.689.5-043.000

Date of hire : 01/03/19

Month of : October 2020

Base Salary 35,416,667

Tax Allowance 266,562

BPJS-TK JKK Allowance 0.24% 850 N

BPJS-TK JKK Allowance 0.30% 1,063 N

BPJS-TK JP Allowance 1% 89,397 N

BPJS-TK Allowance 2% 708,333 N

36,482,872

Monthly Income 36,482,872

Upto current period 366,584,288

Income per Year (360/300) 439,901,146

Bonus /non regular income 7,055,001

Total 446,956,147

Functional Cost 6,000,000

Jamsostek 8,499,996

Pension 1,062,509

Non Taxable Income (S/0) 54,000,000

Taxable Income 377,393,642

Tax calculation per year

5 %x 50,000,000 = 2,500,000

15 % x 200,000,000 = 30,000,000

25 % x 127,393,000 = 31,848,250

30 % x =

377,393,000 64,348,250

Non Reguler Reguler

Tax due up to current period 1,763,750 52,153,750

Tax payment 1,763,750 46,982,438

Tax due on current period 5,171,312

Gross Salary 36,482,872

TAX 5,171,312

Net Salary 31,311,560

BPJS-TK JKK Deduction 0.24% 850

BPJS-TK JKM Deduction 0.30% 1,063

BPJS-TK JHT Deduction 2% 708,333

BPJS-TK JHT Deduction 3.7% 1,310,417

BPJS-TK JHT Additional -3.7% -1,310,417

BPJS-TK JP Deduction 2% 178,794

BPJS-TK JP Additional -2% -178,794

BPJS-TK JP Deduction 1% 89,397

Total Deduction 799,643

Prepared by Verified by Approved by

Employee Tax Calculation Report

Name of Employee : Michael Gunawan PLANT002

Department :

Position : 00 Financial Analyst

Family Status : S/ 0 N.P.W.P. : 84.520.689.5-043.000

Date of hire : 01/03/19

Month of : October 2020

Transfered to Bank 30,511,917

Bank name :

Account No. : 1021528672

Account Name : MICHAEL GUNAWAN

Prepared by Verified by Approved by

xOperator xSupervisor Signer name ABC

Employee Tax Calculation Report

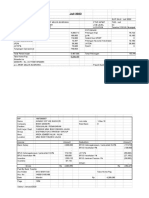

Name of Employee : Erik Gordon PLANT003

Department :

Position : 09 Employee

Family Status : M/ 1 N.P.W.P. : 26.468.085.1-036.000

Date of hire : 01/04/19

Month of : October 2020

Base Salary 52,236,800

Tax Allowance 487,200

BPJS-TK JKK Allowance 0.24% 1,254 N

BPJS-TK JKK Allowance 0.30% 1,567 N

BPJS-TK JP Allowance 1% 89,397 N

BPJS-TK Allowance 2% 1,044,736 N

Commission 7,302,705

61,163,659

Monthly Income 53,860,954

Upto current period 541,390,550

Income per Year (360/300) 649,668,660

Bonus /non regular income 103,993,682

Total 753,662,342

Functional Cost 6,000,000

Jamsostek 12,536,832

Pension 1,062,509

Non Taxable Income (M/1) 63,000,000

Taxable Income 671,063,001

Tax calculation per year

5 %x 50,000,000 = 2,500,000

15 % x 200,000,000 = 30,000,000

25 % x 250,000,000 = 62,500,000

30 % x 171,063,000 = 51,318,900

671,063,000 146,318,900

Non Reguler Reguler

Tax due up to current period 31,198,200 95,933,917

Tax payment 29,007,300 86,424,225

Tax due on current period 2,190,900 9,509,692

Gross Salary 61,163,659

TAX 11,700,592

Net Salary 49,463,067

Overpayment 16,537,708

BPJS-TK JKK Deduction 0.24% 1,254

BPJS-TK JKM Deduction 0.30% 1,567

BPJS-TK JHT Deduction 2% 1,044,736

BPJS-TK JHT Deduction 3.7% 1,932,762

BPJS-TK JHT Additional -3.7% -1,932,762

BPJS-TK JP Deduction 2% 178,794

BPJS-TK JP Additional -2% -178,794

Prepared by Verified by Approved by

Employee Tax Calculation Report

Name of Employee : Erik Gordon PLANT003

Department :

Position : 09 Employee

Family Status : M/ 1 N.P.W.P. : 26.468.085.1-036.000

Date of hire : 01/04/19

Month of : October 2020

BPJS-TK JP Deduction 1% 89,397

Total Deduction 17,674,662

Transfered to Bank 31,788,405

Bank name :

Account No. :

Account Name : Erik Gordon,

Prepared by Verified by Approved by

xOperator xSupervisor Signer name ABC

Employee Tax Calculation Report

Name of Employee : Christian Budisusetia PLANT005

Department :

Position :

Family Status : M/ 2 N.P.W.P. : 09.669.124.1-036.000

Date of hire : 01/05/19

Month of : October 2020

Base Salary 87,500,000

Tax Allowance 790,350

BPJS-TK JKK Allowance 0.24% 2,100 N

BPJS-TK JKK Allowance 0.30% 2,625 N

BPJS-TK JP Allowance 1% 89,397 N

BPJS-TK Allowance 2% 1,750,000 N

Commission 32,783,100

122,917,572

Monthly Income 90,134,472

Upto current period 906,010,099

Income per Year (360/300) 1,087,212,119

Bonus /non regular income 620,826,021

Total 1,708,038,140

Functional Cost 6,000,000

Jamsostek 21,000,000

Pension 1,062,509

Non Taxable Income (M/2) 67,500,000

Taxable Income 1,612,475,631

Tax calculation per year

5 %x 50,000,000 = 2,500,000

15 % x 200,000,000 = 30,000,000

25 % x 250,000,000 = 62,500,000

30 % x 1,112,475,000 = 333,742,500

1,612,475,000 428,742,500

Non Reguler Reguler

Tax due up to current period 186,247,800 202,078,917

Tax payment 176,412,900 182,011,200

Tax due on current period 9,834,900 20,067,717

Gross Salary 122,917,572

TAX 29,902,617

Net Salary 93,014,955

BPJS-TK JKK Deduction 0.24% 2,100

BPJS-TK JKM Deduction 0.30% 2,625

BPJS-TK JHT Deduction 2% 1,750,000

BPJS-TK JHT Deduction 3.7% 3,237,500

BPJS-TK JHT Additional -3.7% -3,237,500

BPJS-TK JP Deduction 2% 178,794

BPJS-TK JP Additional -2% -178,794

BPJS-TK JP Deduction 1% 89,397

Prepared by Verified by Approved by

Employee Tax Calculation Report

Name of Employee : Christian Budisusetia PLANT005

Department :

Position :

Family Status : M/ 2 N.P.W.P. : 09.669.124.1-036.000

Date of hire : 01/05/19

Month of : October 2020

Total Deduction 1,844,122

Transfered to Bank 91,170,833

Bank name :

Account No. :

Account Name : Christian Budisusetia,

Prepared by Verified by Approved by

xOperator xSupervisor Signer name ABC

Employee Tax Calculation Report

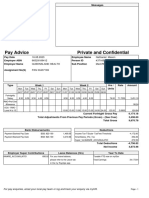

Name of Employee : Depi Rahayu PLANT006

Department :

Position :

Family Status : S/ 0 N.P.W.P. : 44.943.688.0-077.000

Date of hire : 01/05/19

Month of : October 2020

Base Salary 13,184,153

Tax Allowance 62,437

Tax Allowance on Bonus 37,650

BPJS-TK JKK Allowance 0.24% 316 N

BPJS-TK JKK Allowance 0.30% 396 N

BPJS-TK JP Allowance 1% 89,397 N

BPJS-TK Allowance 2% 263,683 N

Commission 3,951,702

WOW Bonus 213,461 N

17,803,195

Monthly Income 13,600,382

Upto current period 136,574,153

Income per Year (360/300) 163,888,984

Bonus /non regular income 92,704,443

Total 256,593,427

Functional Cost 6,000,000

Jamsostek 3,164,196

Pension 1,062,509

Non Taxable Income (S/0) 54,000,000

Taxable Income 192,366,722

Tax calculation per year

5 %x 50,000,000 = 2,500,000

15 % x 142,366,000 = 21,354,900

25 % x =

30 % x =

192,366,000 23,854,900

Non Reguler Reguler

Tax due up to current period 13,905,600 8,291,083

Tax payment 13,275,300 7,470,638

Tax due on current period 630,300 820,445

Gross Salary 17,803,195

TAX 1,450,745

Net Salary 16,352,450

Overpayment 5,893,992

Other Deduction 213,461

BPJS-TK JKK Deduction 0.24% 316

BPJS-TK JKM Deduction 0.30% 396

BPJS-TK JHT Deduction 2% 263,683

BPJS-TK JHT Deduction 3.7% 487,814

Prepared by Verified by Approved by

Employee Tax Calculation Report

Name of Employee : Depi Rahayu PLANT006

Department :

Position :

Family Status : S/ 0 N.P.W.P. : 44.943.688.0-077.000

Date of hire : 01/05/19

Month of : October 2020

BPJS-TK JHT Additional -3.7% -487,814

BPJS-TK JP Deduction 2% 178,794

BPJS-TK JP Additional -2% -178,794

BPJS-TK JP Deduction 1% 89,397

Total Deduction 6,461,245

Transfered to Bank 9,891,205

Bank name :

Account No. :

Account Name : Depi Rahayu,

Prepared by Verified by Approved by

xOperator xSupervisor Signer name ABC

Employee Tax Calculation Report

Name of Employee : Erlangga Putra PLANT007

Department :

Position :

Family Status : M/ 3 N.P.W.P. : 0000000000000000000000

Date of hire : 01/11/19

Month of : October 2020

Base Salary 27,456,000

Tax Allowance 144,404

BPJS-TK JKK Allowance 0.24% 659 N

BPJS-TK JKK Allowance 0.30% 824 N

BPJS-TK JP Allowance 1% 89,397 N

BPJS-TK Allowance 2% 549,120 N

Commission 15,353,395

43,593,799

Monthly Income 28,240,404

Upto current period 283,764,949

Income per Year (360/300) 340,517,939

Bonus /non regular income 228,214,561

Total 568,732,500

Functional Cost 6,000,000

Jamsostek 6,589,440

Pension 1,062,509

Non Taxable Income (M/3) 72,000,000

Taxable Income 483,080,551

Tax calculation per year

5 %x 50,000,000 = 2,500,000

15 % x 200,000,000 = 30,000,000

25 % x 233,080,000 = 58,270,000

30 % x =

483,080,000 90,770,000

Non Reguler Reguler

Tax due up to current period 57,053,750 28,096,875

Tax payment 53,215,250 25,321,500

Tax due on current period 3,838,500 2,775,375

Gross Salary 43,593,799

TAX 6,613,875

Net Salary 36,979,924

BPJS-TK JKK Deduction 0.24% 659

BPJS-TK JKM Deduction 0.30% 824

BPJS-TK JHT Deduction 2% 549,120

BPJS-TK JHT Deduction 3.7% 1,015,872

BPJS-TK JHT Additional -3.7% -1,015,872

BPJS-TK JP Deduction 2% 178,794

BPJS-TK JP Additional -2% -178,794

BPJS-TK JP Deduction 1% 89,397

Prepared by Verified by Approved by

Employee Tax Calculation Report

Name of Employee : Erlangga Putra PLANT007

Department :

Position :

Family Status : M/ 3 N.P.W.P. : 0000000000000000000000

Date of hire : 01/11/19

Month of : October 2020

Total Deduction 640,000

Transfered to Bank 36,339,924

Bank name :

Account No. :

Account Name : Erlangga Putra,

Prepared by Verified by Approved by

xOperator xSupervisor Signer name ABC

You might also like

- Workday 1Document1 pageWorkday 1raheemtimo1No ratings yet

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- MAR - 2024 - PaySlip (1) - UnlockedDocument1 pageMAR - 2024 - PaySlip (1) - Unlockednaveen.rawat.10420No ratings yet

- Remuneration Statement: Personal InformationDocument1 pageRemuneration Statement: Personal InformationFeliciaSetiawanNo ratings yet

- Remuneration Statement: Personal InformationDocument1 pageRemuneration Statement: Personal InformationDika HombingNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Payslip-03 10 2023Document1 pagePayslip-03 10 2023wireNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- Oct2023 PayslipDocument1 pageOct2023 PayslipTKSVELNo ratings yet

- Nov2023 PayslipDocument1 pageNov2023 PayslipTKSVELNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupAnjas AdeputNo ratings yet

- C Statment - Ivan Maleakhi - Aug 2020Document4 pagesC Statment - Ivan Maleakhi - Aug 2020Budi ArtantoNo ratings yet

- PremCal - 03-06-2021 23 - 28 - 02 PMDocument6 pagesPremCal - 03-06-2021 23 - 28 - 02 PMaman khatriNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- PT Prudential Life Assurance Payslip September 2021: ConfidentialDocument1 pagePT Prudential Life Assurance Payslip September 2021: ConfidentialVenysunny KusnadiNo ratings yet

- Slip Gaji Kapal Api GroupDocument3 pagesSlip Gaji Kapal Api GroupSintyaa100% (1)

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- SKP Retno MaharaniDocument3 pagesSKP Retno MaharaniJavantara AdvNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- SLIPDocument1 pageSLIPnadyla1212No ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Payslips 00437165 20230816Document2 pagesPayslips 00437165 20230816Nathaniel MasonNo ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- PayslipAstalika (14032024)Document6 pagesPayslipAstalika (14032024)FIZ FOTOCOPYNo ratings yet

- 2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateDocument2 pages2022-Mar Payslip - Purewealth Ebc Corporation: Payroll Break Down Year - To - DateLance PazNo ratings yet

- Sheila Mae Platon: Company AIG Shared Services - Business Processing, IncDocument1 pageSheila Mae Platon: Company AIG Shared Services - Business Processing, IncHazel Ann AgacerNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- Oracle Fusion Payroll ReportingDocument2 pagesOracle Fusion Payroll ReportingALYNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Simulasi Tax Current PayDocument81 pagesSimulasi Tax Current PayDebiLianaLestariNo ratings yet

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- Salary Slip 1700531238397241Document1 pageSalary Slip 1700531238397241nirasahu7894No ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- PremCal - 06-08-2021 14 - 08 - 29 PMDocument6 pagesPremCal - 06-08-2021 14 - 08 - 29 PMsuresh kumarNo ratings yet

- PremCal - 18-06-2020 184836 PMDocument7 pagesPremCal - 18-06-2020 184836 PMLeenaNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- 87 FC 2402Document1 page87 FC 2402AmaryNo ratings yet

- Payslip MeiDocument1 pagePayslip MeialyaNo ratings yet

- Capital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836Document1 pageCapital One Services, LLC 1680 Capital One Drive Mclean, Va 22102-3407 +1 (888) 376-8836AmaryNo ratings yet

- Assignment 01, HRM 412Document3 pagesAssignment 01, HRM 412Nur Nahar LimaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Andaya, A History of Malaysia.Document24 pagesAndaya, A History of Malaysia.CQOT92No ratings yet

- Revised E-Tickets With Seat NumberDocument1 pageRevised E-Tickets With Seat NumberMohiminul KhanNo ratings yet

- Assessment Toolkit: Health InequalitiesDocument30 pagesAssessment Toolkit: Health InequalitiesAlejandro CardonaNo ratings yet

- Solar Cell Presentation Py4jccDocument13 pagesSolar Cell Presentation Py4jccTaufique aliNo ratings yet

- Outcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesDocument8 pagesOutcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesAriel BobisNo ratings yet

- Science Writing Exercise 09-2014Document2 pagesScience Writing Exercise 09-2014Chris Cesar Berdin Lagrio25% (4)

- Mission of The Order of Malta As Subject of Int LawDocument23 pagesMission of The Order of Malta As Subject of Int LawHazra FebriyantiNo ratings yet

- Bersa TPR9 Threaded BarrelDocument2 pagesBersa TPR9 Threaded BarrelDicko Perdana PutraNo ratings yet

- Breathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UkDocument5 pagesBreathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UksahraahmedaliNo ratings yet

- 2016-06-30 Flanges Petition Volume IDocument144 pages2016-06-30 Flanges Petition Volume ICapitalTradeNo ratings yet

- 5 GRADE ENGLISH (2019-2020) : Examination Questions 1Document7 pages5 GRADE ENGLISH (2019-2020) : Examination Questions 1didarseyitjanowNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Green BeltDocument149 pagesGreen BeltSUVADIP BHOWMIK100% (2)

- NSTP 2 Chapter 3 Community ImmersionDocument23 pagesNSTP 2 Chapter 3 Community ImmersionDaniel Corpus AntonioNo ratings yet

- PNP Memorandum Circular No 2021-16Document5 pagesPNP Memorandum Circular No 2021-16Dong Lupz100% (2)

- Welcome To Cambridge ClubDocument4 pagesWelcome To Cambridge ClubZhanna ZhannaNo ratings yet

- Describe A JourneyDocument15 pagesDescribe A JourneyEmma NguyenNo ratings yet

- Paul Andrew Mitchell Criminal ComplaiantDocument10 pagesPaul Andrew Mitchell Criminal Complaiantremenant2006No ratings yet

- Disaster Preparedness IntroDocument10 pagesDisaster Preparedness IntroBernadette-Mkandawire MandolomaNo ratings yet

- How To Be Courageous & BraveDocument1 pageHow To Be Courageous & BraveElias FungNo ratings yet

- Computeractive - Issue 636, 20 July 2022Document76 pagesComputeractive - Issue 636, 20 July 2022Joy BeltranNo ratings yet

- M W Patterson - The Church of EnglandDocument464 pagesM W Patterson - The Church of Englandds1112225198No ratings yet

- Implementing ERP in OrganizationsDocument12 pagesImplementing ERP in Organizationsprachi_rane_4No ratings yet

- Chapter 11Document6 pagesChapter 11Mian SajjadNo ratings yet

- Thematic Classification of ModuleDocument6 pagesThematic Classification of Modulehabtu2006No ratings yet

- Psychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah StringerDocument53 pagesPsychiatry P R N Principles Reality Next Steps Juliet Hurn Laurence Church Roxanne Keynejad Sarah Stringermarsha.beaver589100% (5)

- Business Lessons I Learned From Steve Jobs PDFDocument6 pagesBusiness Lessons I Learned From Steve Jobs PDFKhởi NguyênNo ratings yet

- SIMP Model Catch Certificates PDFDocument9 pagesSIMP Model Catch Certificates PDFElvita RizkyNo ratings yet

- QATAR: Major ChangesDocument11 pagesQATAR: Major ChangesVivekanandNo ratings yet

- Clements Interview Transcript - PCSD Maricopa County Jail 8-15-17 (00626285-3xCDD05)Document40 pagesClements Interview Transcript - PCSD Maricopa County Jail 8-15-17 (00626285-3xCDD05)KOLD News 13No ratings yet