Professional Documents

Culture Documents

Weekly Financial Market Review - Week Ending 04-06-2021

Weekly Financial Market Review - Week Ending 04-06-2021

Uploaded by

Fuaad DodooOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Financial Market Review - Week Ending 04-06-2021

Weekly Financial Market Review - Week Ending 04-06-2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

Analyst:

Francis Kofi Oduro

Godwin Kojo Odoom

Tel: +233 (0)30 225 1137

WEEKLY MARKETS UPDATE Email: stockbrokers@umbcapital.com

Week ending 04th June, 2021

Indicator GSE Composite Index GSE Financial Index Market Cap (GH¢ M) Value Traded (GH¢ M) Volume Traded (M)

EQUITY MARKET This Week 2,602.76 1,912.30 61,234.21 6.13 4.59

PERFORMANCE Previous Week 2,421.11 1,902.90 59,333.16 19.34 20.32

Change 181.64 9.39 1,901.05 -13.21 -15.73

YTD 34.05% 7.27%

INVESTMENT TERM OF THE WEEK

Dividend: Dividend refers to a reward, cash or otherwise, that a JUSTIFICATION FOR INCLUDING STOCKS IN

AN INVESTMENT PORTFOLIO

company gives to its shareholders. Dividends can be issued in

-Typically,stocks outperform all other investment

various forms, such as cash payment, stocks or any other form. It is

options over any ten-year period making them a

usually a part of the profit that the company shares with its must for long-term portfolio.

shareholders.

-They are excellent vehicles for retirement plans.

EQUITY MARKET FLASH: The GSE Composite Index

-Except for a few short periods, stocks have

trends upward; returns 34.05% (YtD)

consistently outpaced the rate of inflation.

Trading activity during the week saw the market indices extend

MOVING AVERAGES OF ACTIVELY TRADED

gains registered in the previous week due to appreciations in the

STOCKS

prices of five (5) equities. Current Prices Vs. 200, 100 & 50 Days Moving Averages

Indicator Price (GH¢) 200 Days 100 Days 50 Days

At the closing bell, the Year-to-Date return of the GSE Composite

CAL 0.73 0.72 0.75 0.74

Index improved to 34.05%. SOGEGH 0.88 0.70 0.76 0.80

MTNGH 1.15 0.74 0.88 1.00

Trade turnover however was low compared to previous week. EGH 7.00 6.67 7.12 7.04

SCB 18.57 16.43 18.00 18.21

A total volume of 4.59 million shares valued at GH¢6.13 million

GOIL 1.55 1.51 1.51 1.52

exchanged hands in seventeen (17) equities. TOTAL 3.30 2.77 3.11 3.21

GCB 5.22 4.19 4.59 4.77

ETI 0.07 0.07 0.07 0.07

TOP TRADERS

Ticker Volume Value (GH¢)

GAINERS

MTNGH 3,722,970 4,169,737 Ticker Price (GH¢) Change Y-t-D Change

MTNGH 1.15 15.00% 79.69%

EGL 549,172 953,511

EGL 1.75 14.38% 25.00%

SOGEGH 116,318 101,834 SOGEGH 0.88 1.15% 37.50%

EGH 75,655 529,585 TOTAL 3.30 0.92% 16.61%

SCB 18.50 1.65% 13.86%

CAL 36,319 26,513

GSE Composite Index: Monthly Return (%) : May 2020 - May 2021

15.73

8.57

6.76

4.41

0.54 0.56

May'20 Jun'20 Jul'20 Aug'20 Sep'20 Oct'20 Nov'20 Dec'20 Jan'21 Feb'21 Mar'21 Apr'21 May'21

-2.12 -1.17 -1.65 -1.04 -1.01

-5.48

-7.60

MONEY MARKET HIGHLIGHTS

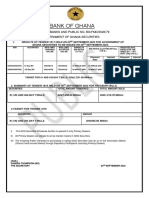

Treasury rates yield (31st May - 04th June 2021)

GOG 31st – 04th 24th – 28th Change 01st – 05th

Treasuries Jun. 2021 May, 2021 (%) Jun. 2020 25.00%

91-Day T-Bill 12.71% 12.78% -0.074% 13.95% 19.80% 19.75%

20.00% 18.50% 17.70% 19.25%

182-Day T-Bill 13.43% 13.51% -0.076% 14.06% 16.49% 16.25%

364-Day T-Bill 16.49% 16.49% 0.000% 16.88%

3-Year Bond 17.70% 17.70% 0.000% 18.85% 15.00% 12.71% 13.43%

BOG Offer 1,281.00 1,177.00 875.00

10.00%

(GH¢ MN)

Dealers Tender 1,241.76 1,852.67 925.23

5.00%

(GH¢ MN)

Amount Raised 1,241.76 1,817.56 921.23

0.00%

(GH¢ MN)

91-Day 182-Day 364-Day 2-Year 3-Year 6-Year 7-Year 10-Year 15-Year

Source: Bank of Ghana Bill Bill Bill Note Bond Bond Bond Bond Bond

CURRENCY MARKET UMBS PICKS

Interbank Average Rates Ticker Price (GH¢) Reason

Currency Closing Previous Y-t-D MTNGH 1.15 Improving Bids

Week Week Change

GOIL 1.55 Has upside price potential

(GH¢) (GH¢) %

DOLLAR 5.7470 5.7416 0.23 GCB 5.22 Improving Bids

SCB 18.57 Has upside price potential

POUND 8.1427 8.1408 -3.30

TOTAL 3.30 Has upside price potential

EURO 6.9927 6.9947 1.02

YEN 0.0525 0.0523 6.48

RENMINBI 0.8988 0.9016 -1.82 OTHER ECONOMIC DATA

Source: Bank of Ghana Indicator

Monetary Policy Rate May 2021 13.50%

Real GDP Growth Q4 2020 3.30%

Inflation April 2021 8.50%

Reference rate June 2021 13.80%

Source: GSS, BOG, GBA

Disclaimer: This document is not intended to be an offer, or a solicitation of an offer for the sale or purchase of any security. The information and opinions contained in this document have been compiled from

or arrived at in good faith from sources believed to be reliable. Whilst care has been taken in preparing this document, no representation is given and no responsibility or liability by UMB Stockbrokers (UMBS),

any member of UMBS or UMB Capital as to the accuracy of the information contained herein. All opinions and estimates contained in this report may be changed after publication at any time without notice.

Stock Brokerage Equity Research Issuing House Services Retirement Planning Investment Advisory

You might also like

- HDFC ERGO SummeerIntern Ship Project ReportDocument70 pagesHDFC ERGO SummeerIntern Ship Project Reportskaushik040260% (5)

- Develop Strategic Marketing Plan For Sampath BankDocument33 pagesDevelop Strategic Marketing Plan For Sampath BankJeyachandrika Piragalathan60% (10)

- Rodriguez-Luna vs. Intermediate Appellate CourtDocument7 pagesRodriguez-Luna vs. Intermediate Appellate Courtvince005No ratings yet

- Weekly Financial Market Review - Week Ending 04-06-2021Document2 pagesWeekly Financial Market Review - Week Ending 04-06-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 01-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 01-04-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 26-03-2021Document2 pagesWeekly Financial Market Review - Week Ending 26-03-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 16-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 16-04-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 09-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 09-04-2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.09.2021Document1 pageDaily Equity Market Report - 07.09.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 20.08.2021Document2 pagesWeekly Capital Market Recap Week Ending 20.08.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 27.06.2022 2022-06-27Document1 pageDaily Equity Market Report 27.06.2022 2022-06-27Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 25.07.2022 2022-07-25Document1 pageDaily Equity Market Report 25.07.2022 2022-07-25Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.11.2021Document1 pageDaily Equity Market Report - 17.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.03.2022Document1 pageDaily Equity Market Report - 30.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.09.2022Document1 pageDaily Equity Market Report - 05.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 05.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 05.08.2022Fuaad DodooNo ratings yet

- 06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICDocument2 pages06 JANUARY 2022 Weekly Capital Market Report: MTNGH PBC CAL ETI SICFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.07.2022Document1 pageDaily Equity Market Report - 19.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.06.2022Document1 pageDaily Equity Market Report - 29.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.11.2021Document1 pageDaily Equity Market Report - 30.11.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 21.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 21.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.07.2022Document1 pageDaily Equity Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Cash Flow.Document39 pagesCash Flow.JAPNo ratings yet

- Welding Electrode Manufacturing Plant. Production of Stick Electrodes, Welding Rods, Weld Rods.-77816 PDFDocument65 pagesWelding Electrode Manufacturing Plant. Production of Stick Electrodes, Welding Rods, Weld Rods.-77816 PDFJatin Shandilya50% (2)

- Bain Report India Venture Capital 2021Document46 pagesBain Report India Venture Capital 2021Ansuka SahuNo ratings yet

- Goodwill and Valuation of GoodwillDocument19 pagesGoodwill and Valuation of GoodwillpranavNo ratings yet

- BUS 630 Week 1 AssignmentDocument5 pagesBUS 630 Week 1 Assignmenttaranisha29No ratings yet

- FMAC227 Financial Analysis and Reporting Midterm Exam PDFDocument12 pagesFMAC227 Financial Analysis and Reporting Midterm Exam PDFEnalyn AldeNo ratings yet

- Sebi Grade A Exam: PHASE (I) Previous PaperDocument52 pagesSebi Grade A Exam: PHASE (I) Previous PaperHuzaifaNo ratings yet

- 25444sm SFM Finalnewvol2 cp12Document72 pages25444sm SFM Finalnewvol2 cp12h.b. akshayaNo ratings yet

- Netflix - EcommerceDocument17 pagesNetflix - Ecommerceitaloyz87No ratings yet

- MF 4Document4 pagesMF 4harish dsNo ratings yet

- Taxation) Remedies) Made 1998 Early Part (Est) ) by UP) 14 PagesDocument13 pagesTaxation) Remedies) Made 1998 Early Part (Est) ) by UP) 14 PagesbubblingbrookNo ratings yet

- How Well Has Berkshire Hathaway Performed? How Well Has It Performed in The Aggregate? What About Its Investment in Midamerican Energy Holdings?Document2 pagesHow Well Has Berkshire Hathaway Performed? How Well Has It Performed in The Aggregate? What About Its Investment in Midamerican Energy Holdings?Kahan ModiNo ratings yet

- IFCDocument15 pagesIFCKartik GuptaNo ratings yet

- Professional Ethics and Corporate Governance Section 1 and Seminar 2Document50 pagesProfessional Ethics and Corporate Governance Section 1 and Seminar 2Trần Đức TàiNo ratings yet

- Swot CastrolDocument4 pagesSwot CastrolDashing KartikNo ratings yet

- Nueva Ecia University of Science and Technology: Prepared By: Alamon, John Leah LDocument3 pagesNueva Ecia University of Science and Technology: Prepared By: Alamon, John Leah LKiyan YunNo ratings yet

- Motilal Oswal Securities LTDDocument2 pagesMotilal Oswal Securities LTDjigarpayalpatelNo ratings yet

- Balance Sheet Prepare and AnalyseDocument9 pagesBalance Sheet Prepare and AnalyseSatyarth GaurNo ratings yet

- Parallel FICCOMSS 2024Document12 pagesParallel FICCOMSS 2024music accousticNo ratings yet

- Pil ProjectDocument14 pagesPil ProjectMonishNo ratings yet

- Concepts & Conventions in AccountingDocument5 pagesConcepts & Conventions in Accountingpratz dhakateNo ratings yet

- Accounting Jan 2008 Mark SchemeDocument20 pagesAccounting Jan 2008 Mark SchemejayedosNo ratings yet

- BF ReviewerDocument5 pagesBF ReviewerAnsel SaldeNo ratings yet

- Chapter 21 International Cash ManagementDocument22 pagesChapter 21 International Cash ManagementmahraNo ratings yet

- The Investment Theories of Kalecki and KeynesDocument18 pagesThe Investment Theories of Kalecki and Keynesfanke16No ratings yet

- Consumer Decision Making For Residential MortgagesDocument10 pagesConsumer Decision Making For Residential MortgagesKevin MNo ratings yet

- The Investable BlueprintDocument5 pagesThe Investable BlueprintDiana KilelNo ratings yet