Professional Documents

Culture Documents

Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015

Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015

Uploaded by

Doan Chan PhongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015

Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015

Uploaded by

Doan Chan PhongCopyright:

Available Formats

Chapter 7

Exercise 7.1

a

1 Tickets should be issued whenever money is received from customers.

2 Employees should not count their own takings.

3 Employees should not also write entries in the cash records.

4 Money should not be kept in the desk drawer.

5 The accuracy of Nick’s records must be questioned.

6 The amount of cash actually received may never be known.

b

1 Customers should buy tickets from a central area.

2 Tickets should be colour coded for particular rides.

3 Each employee working on a ride should tear the tickets in half and deposit the stubs

into a sealed container to prevent re-use of tickets.

4 All tickets should be pre-printed with sequential numbers.

5 Ticket numbers for all rides should be listed at the start and end of each day’s trading.

6 Cash received by the ticket box should be removed periodically during the day’s

trading and stored under lock and key (perhaps a safe?).

7 Nick should reconcile the money received with the number of tickets issued each day.

8 Cash takings should be banked intact each working day.

By following these steps, Nick will still be able to identify both the popular and unpopular

rides. However, with the built-in control devices, the money received by the business

should all be banked and Nick will have better control over the firm generally.

Exercise 7.2

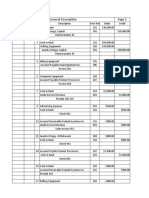

S.O. Heater Installations: Bank reconciliation statement as at 31 July 2015

$

Balance as per bank statement 400 CR

plus Deposits not yet credited 80

480

less Unpresented cheques

Chq. No. Amount

4561 180

4562 225 405

Balance as per cash records of business 75

Permission is granted for this page to be printed by the purchasing institution. 1

Copyright Macmillan Education Australia 2011.

Exercise 7.3

G.T. Car Detailing: Bank reconciliation statement as at 31 August 2015

$

Balance as per bank statement 625 CR

plus Deposits not yet credited 145

770

less Unpresented cheques

Chq. No. Amount

347827 122

347831 340 462

Balance as per cash records of business 308

Adjustments to cash records of business

$

Balance as per business records 220

plus Additional receipt

Interest 110

330

less Additional payments

Bank charges 22

Adjusted balance as per business records 308

Exercise 7.4

a Doncaster Glaziers: Update the cash journals

Cash receipts journal Cash payments journal

Total receipts already 494

recorded 3168 Total payments already recorded 3

Additional

plus Additional receipts 0 plus payments

Total cash receipts for

month 3168 Bank charges 13

495

Total cash payments for month 6

b Doncaster Glaziers: Calculation of cash balance according to the firm’s

records

$

Balance as at 1-Mar-15 2400

plus Cash receipts

journal 3168

5568

less Cash payments

journal 4956

Balance as at 31-Mar-15 612

Permission is granted for this page to be printed by the purchasing institution. 2

Copyright Macmillan Education Australia 2011.

c Doncaster Glaziers: Bank reconciliation statement as at 31 March 2015

$

Balance as per bank statement 821 CR

plus Deposits not yet credited 198

1019

less Unpresented cheques

Chq. No. Amount

24140 154

24141 253 407

Balance as per cash records of business 612

Exercise 7.5

a Snorter and Snorter: Update the cash journals

Cash receipts journal Cash payments journal

$ $

Total receipts already recorded 2761 Total payments already recorded 7341

plus Additional receipts 0 plus Additional payments

Amoun

Total cash receipts for month 2761 Item t

Loan r/p 100

Bank charges 14 114

Total cash payments for month 7455

Calculation of cash balance according to the firm’s records:

$

Balance as at 1-Jun-15 5000

plus Cash receipts for month 2761

7761

less Cash payments for month 7455

Balance as at 30-Jun-15 306

b Snorter and Snorter: Bank reconciliation statement as at 30 June 2015

$

Balance as per bank statement 295 CR

plus Deposits not yet credited 363

658

less Unpresented cheques

Chq. No.

65418 352

Balance as per cash records of business 306

Permission is granted for this page to be printed by the purchasing institution. 3

Copyright Macmillan Education Australia 2011.

Exercise 7.6

a Prahran Plumbing: Update the cash journals

Cash receipts journal Cash payments journal

$ $

Total receipts already recorded 11370 Total payments already recorded 11490

plus Additional receipts 0 plus Additional payments

Total cash receipts for month 11370 Item Amount

Misc. Dr. 340

Qtly fee 20

Bank charges 6 366

Total cash payments for month 11856

b Prahran Plumbing: Calculation of cash balance according to the firm’s records

$

Balance as at 1-Sep-15 1350

plus Cash receipts for month 11370

12720

less Cash payments for month 11856

Balance as at 30-Sep-15 864

c Prahran Plumbing: Bank reconciliation statement as at 30 September

2015

$

Balance as per bank statement 5884 CR

plus Deposits not yet credited 3000

8884

less Unpresented cheques

Chq. No. Amount

18094 220

18097 6000

18101 1800 8020

Balance as per cash records of business 864

d Explanation of entry on 26 September:

‘Misc Dr’ is used to denote a miscellaneous debit and is often used when a cheque is

dishonoured (that is, when a cheque ‘bounces’). In this case it appears that the deposit

made on 24 September for $340 has not been honoured. Therefore the bank has

cancelled this amount by the ‘Misc. Dr.’ entry.

Permission is granted for this page to be printed by the purchasing institution. 4

Copyright Macmillan Education Australia 2011.

Exercise 7.7

a Rogers Gym Hire: Update the cash journals

Cash receipts journal Cash payments journal

$ $

Total receipts already recorded 6540 Total payments already recorded 6660

plus Additional receipts 0 plus Additional payments

Total cash receipts for month 6540 Item

Bank charges 15

Total cash payments for month 6675

b Rogers Gym Hire: Calculation of cash balance according to the firm’s records

$

Balance as at 1-Nov-15 140

plus Cash receipts for month 6540

6680

less Cash payments for month 6675

Balance as at 30-Nov-15 5

c Rogers Gym Hire: Bank reconciliation statement as at 30 November 2015

$

Balance as per bank statement 325 CR

plus Deposits not yet credited 1960

2285

less Unpresented cheques

Chq. No. Amount

58248 120

58254 60

58255 2100 2280

Balance as per cash records of business 5

d Explanation: possible suggestions could include:

1 The deposit may not have been processed by the bank before the statement was

issued on that day.

2 The deposit may have been made via a night safe and has therefore not yet been

processed.

3 The statement may have been issued at the start of the day and the deposit was made

towards the end of the business day.

Permission is granted for this page to be printed by the purchasing institution. 5

Copyright Macmillan Education Australia 2011.

Exercise 7.8

a Ken Barbie: Electrical Contractor: Update of cash journals

$ $

Balance as per business records on 1-Jul-15 1400

Plus Cash receipts journal 5900

7300

less Cash payments

Total from the cash payments journal 3270

plus Additional items

Item

Loan repayment 350

Loan fee 10

Misc. Dr. 1820

Bank charge 16 5466

Adjusted balance as per business records as at 31-Jul-15 1834

b Ken Barbie: Electrical Contractor: Bank reconciliation statement as at 31 July

2015

$

Balance as per bank statement 404 CR

plus Deposits not yet credited 1920

2324

less Unpresented cheques

Chq. No. Amount

12456 250

12458 240 490

Balance as per firm's cash book 1834

Exercise 7.9

a Bendigo Computers: Update the cash journals

Cash receipts journal Cash payments journal

$ $

Total receipts already Total payments already 5292

recorded 45795 recorded 7

Additional

plus Additional receipts plus payments

0 Overdraft fee 20

Total cash receipts for month 45795 Bank charges 10

Total cash payments for 5295

month 7

b Bendigo Computers: Calculation of cash balance according to the firm’s

records

$

Balance as at 1-Jul-15 0

plus Cash receipts journal 45795

45795

less Cash payments journal 52957

Balance as at 31-Jul-15 (7162)

c Bendigo Computers: Bank reconciliation statement as at 31 July

2015

$

Permission is granted for this page to be printed by the purchasing institution. 6

Copyright Macmillan Education Australia 2011.

Balance as per bank

statement 5402 OD

plus Unpresented cheques

Chq. No. Amount

009 1540

012 297 1837

7239

less Deposits not credited 77

Balance as per cash records of business 7162 OD

Exercise 7.10

a L.P.'s Music Hire

Calculation of bank balance according to business records:

$ $

Balance as at 1 August 1860

plus Cash receipts journal 9262

Additional receipts

Interest on bonds 100 9362

11222

less Cash payments journal 16325

Additional payments

Loan repayment 1600

Bank charges 25 17950

Adjusted balance of business records (6728)

b L.P.'s Music Hire: Bank reconciliation statement as at 31 August

2015

$

Balance as per bank statement 4713 OD

plus Unpresented cheques

Chq. No. Amount

83847 640

83851 1540

83853 770 2950

7663

less Deposits not credited 935

Balance as per cash records of business 6728 OD

c Comment on the cash position:

The owner needs to do something very quickly. The overdraft limit is $5000 and the

balance according to the bank is an overdraft of $4713. When the unpresented cheques

are presented for payment, they will drag the balance past the overdraft limit. Therefore,

the owner may have to contribute some additional cash or make arrangements for

alternative finance (perhaps increase the overdraft limit or arrange a loan).

Permission is granted for this page to be printed by the purchasing institution. 7

Copyright Macmillan Education Australia 2011.

Exercise 7.11

a Windy Hill Laundry Services

Adjustments to cash records of business

$ $

Balance as per business records 350

less Additional payments

Loan repayment 550

Bank charges 35 585

(235)

Adjustment

Error in receipts journal 9

Adjusted balance of business records (226)

b Windy Hill Laundry Services: Bank reconciliation statement as at 30 November 2015

$ $

Balance as per bank statement 581 OD

plus Unpresented cheques

Chq. No. Amount

298111 95

298117 120 215

796

less Deposits not credited 570

Balance as per cash records of business 226 OD

c Explanation:

Timing differences between the two entities cause the discrepancy in the bank balance.

There are two major reasons why Cheryl's balance is different to that shown on the bank

statement. Firstly, she is aware of the $570 deposited on 30 November but this hasn't

been recorded by the bank as yet. Secondly, the loan repayment has been paid as a direct

debit and Cheryl's books do not include this payment. These two items combined cause

the bank's records to show a much worse situation than that shown in Cheryl's records.

Exercise 7.12

a John's Landscaping Services

Adjustments to cash records of business

$ $

Balance as per business records 4424 OD

plus Additional payments

Bank charges 32

Loan service fee 25 57

4481

less Additional receipts

Interest—term deposit 120

Adjusted balance of business records 4361 OD

Permission is granted for this page to be printed by the purchasing institution. 8

Copyright Macmillan Education Australia 2011.

b John's Landscaping Services: Bank reconciliation statement as at 31 October 2015

$ $

Balance as per bank statement 3434 OD

plus Unpresented cheques

Chq. No. Amount

13962 210

13968 430

13976 132

13982 245

13987 360 1377

4811

less Deposits not credited 450

Balance as per cash records of business 4361 OD

c Explanation—two reasons the cheques have not yet been presented:

1 they may be lost in the mail

2 they may have been sent to the wrong address, or

3 they may have been sent correctly, but the payee has not yet banked them.

Exercise 7.13

a Burlak's DVD Hire

Adjustments to cash records of business

$ $

Balance as per business records 1220 OD

plus Additional payments

Bank charges 28

Misc. debit 200

Interest 22

Loan repayment 650 900

2120

less Additional receipts

0

Adjusted balance of business records 2120 OD

b Burlak's DVD Hire: Bank reconciliation statement as at 31 July

2015

$ $

Balance as per bank statement 120 CR

plus Deposits not credited 500

620

less Unpresented cheques

Chq. No. Amount

699027 1940

699042 350

699051 450 2740

Balance as per cash records of business (2120) OD

c Reasons for doing a bank reconciliation monthly (choose any two of the following):

1 To update the firm's records with 'unknown' items.

2 To check the accuracy of the firm's records.

3 To ensure that the bank has recorded everything accurately.

4 To reduce the likelihood of fraud or theft.

5 To identify cheques that are unpresented for an extended period of time.

Permission is granted for this page to be printed by the purchasing institution. 9

Copyright Macmillan Education Australia 2011.

Exercise 7.14

a Seoud's Suit Hire

Adjustments to cash records of business

$

Balance as at 1 August 2015 (2750)

plus Adjusted receipts journal 4422

1672

less Adjusted payments journal (8495)

Balance as at 31 August 2015 (6823)

b Seoud's Suit Hire: Bank reconciliation statement as at 31 August

2015

$ $

Balance as per bank statement 1552 OD

plus Unpresented cheques

Chq. No. Amount

315423 1190

315435 2530

315440 198

315441 1650

315443 385 5953

7505

less Deposits not credited 682

Balance as per business records (6823)

Exercise 7.15

a Easy Equipment Hire: Reconciliation of records for September

Adjustments to cash records of business

$ $

Balance as per business records 594

less Additional payments

Loan repayment 500

Bank charges 30 530

64

plus Additional receipts

nil 0

Adjusted balance of business records 64

Easy Equipment Hire: Bank reconciliation statement as at 30 September 2015

$ $

Balance as per bank statement 930

plus Deposits not credited 290

1220

less Unpresented cheques

Chq. No. Amount

20039 386

20051 480

20052 290 1156

Balance as per business records 64

b Easy Equipment Hire: Reconciliation of records for October

Permission is granted for this page to be printed by the purchasing institution. 10

Copyright Macmillan Education Australia 2011.

Adjustments to cash records of business

$ $

Balance as per business records (52) OD

plus Additional payments

Loan repayment 500

Misc. debit 365

Bank charges 38 903

(955)

less Additional receipts

Interest on bonds 95

Adjusted balance of business records (860) OD

Easy Equipment Hire: Bank reconciliation statement as at 31 October 2015

$ $

Balance as per bank statement 120 DR

plus Deposits not credited 320

440

less Unpresented cheques

Chq. No. Amount

20039 386

20061 450

20072 464 1300

Balance as per business records (860) OD

Exercise 7.16

a Brunswick Catering Supplies: Update the cash journals

Cash receipts journal for October Cash payments journal for October

$ $

Total receipts already recorded 7690 Total payments already recorded 11490

plus Additional receipts plus Additional payments

Interest 40 Bank charges 25

Total cash receipts for month 7730 Loan fee 100

Total cash payments for month 11615

Calculation of cash balance according to the firm’s records:

$

Balance as at 1-Oct-15 (200) OD

plus Cash receipts journal 7730

7530

less Cash payments journal 11615

Balance as at 31-Oct-15 (4085) OD

b Brunswick Catering Supplies: Bank reconciliation statement as at 31 October 2015

$ $

Permission is granted for this page to be printed by the purchasing institution. 11

Copyright Macmillan Education Australia 2011.

Balance as per bank statement 3085 OD

plus Unpresented cheques

Chq. No. Amount

493461 1000

493463 960 1960

5045

less Deposits not credited 960

Balance as per business records 4085 OD

c Brunswick Catering Supplies: Update the cash journals

Cash receipts journal for November Cash payments journal for November

$ $

926

Total receipts already recorded 11680 Total payments already recorded 0

plu

plus Additional receipts s Additional payments

0 Bank charges 30

929

Total cash receipts for month 11680 Total cash payments for month 0

Calculation of cash balance according to the firm’s records:

Balance as at 1-Nov-15 (4085) OD

plus Cash receipts journal 11680

7595

less Cash payments journal 9290

Balance as at 30-Nov-15 (1695) OD

d Brunswick Catering Supplies: Bank reconciliation statement as at 30 Novmber 2015

$ $

Balance as per bank statement 985 CR

plus Deposits not credited 670

1655

less Unpresented cheques

Chq. No. Amount

493461 1000

493474 550

493475 1800 3350

Balance as per business records (1695) OD

e Comment on the cash position:

At quick glance at the bank statements may indicate that the cash position appears to be

in a much better state. The bank statements show that the overdraft has disappeared and

the firm now has a positive balance of $985. However, this does not reveal the true

situation. The business started October with an overdraft of $200 and this has deteriorated

to an overdrawn balance of $1695.Three cheques remain unpresented and when these

are presented the account will once again be in overdraft. The firm's cash position should

continue to be of concern to the owner of this business.

Permission is granted for this page to be printed by the purchasing institution. 12

Copyright Macmillan Education Australia 2011.

You might also like

- Assignmet For Practice Session StudentsDocument5 pagesAssignmet For Practice Session StudentsYasir Ahmed Siddiqui0% (1)

- Voucher Entry & Practical Problem - TallyDocument7 pagesVoucher Entry & Practical Problem - TallyBackiyalakshmi Venkatraman92% (12)

- Simply Jordan TD Bank Statement Andrew Jun 2020Document2 pagesSimply Jordan TD Bank Statement Andrew Jun 2020MD Masum0% (1)

- Payment Information Account Summary: March 9 20Document3 pagesPayment Information Account Summary: March 9 20Mark Williams100% (2)

- Sample Board of Director SurveyDocument5 pagesSample Board of Director SurveyChris DaleNo ratings yet

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- Bank Recon DiscussionDocument6 pagesBank Recon DiscussionKrigfordNo ratings yet

- BUSI 1043 Unit 3 ExerciseDocument4 pagesBUSI 1043 Unit 3 ExerciseRichard MamisNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Acc Chapter 09Document39 pagesAcc Chapter 09Nicholas J W LeeNo ratings yet

- Financial Accounting ADocument137 pagesFinancial Accounting AlordNo ratings yet

- C02 Financial Accounting Fundamentals - Control AccountsDocument7 pagesC02 Financial Accounting Fundamentals - Control AccountsAlfred MakonaNo ratings yet

- Solutions To More SAC 1 Revision 2021Document5 pagesSolutions To More SAC 1 Revision 2021anshsinghsoniNo ratings yet

- General DescriptionDocument7 pagesGeneral Description11A Ol MonorothNo ratings yet

- Topic 7 Cash Management & ControlDocument25 pagesTopic 7 Cash Management & ControlMd Jahid HossainNo ratings yet

- Solution Aassignments CH 7Document5 pagesSolution Aassignments CH 7RuturajPatilNo ratings yet

- Summary of Account Activity Payment InformationDocument6 pagesSummary of Account Activity Payment InformationNeil BreenNo ratings yet

- UntitledDocument6 pagesUntitledÂn LyNo ratings yet

- Bcfa 1: Fundamentals of Accounting 1Document14 pagesBcfa 1: Fundamentals of Accounting 1Arlene PerlasNo ratings yet

- Special Journals Accounting)Document15 pagesSpecial Journals Accounting)Ardialyn100% (3)

- Financial Accounting BMBA 140 Assignment #5 Name (First and Last Name)Document3 pagesFinancial Accounting BMBA 140 Assignment #5 Name (First and Last Name)Ednalyn PascualNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- Cash Additional ProblemsDocument2 pagesCash Additional ProblemsRed TigerNo ratings yet

- Tutorial 1 and 2 Tutor Accy 112Document7 pagesTutorial 1 and 2 Tutor Accy 112mei100% (1)

- Wells Fargo Business Card: Current Payment Due $15.00 Current Payment Due Date 02/14/19Document4 pagesWells Fargo Business Card: Current Payment Due $15.00 Current Payment Due Date 02/14/19MLBB Phil.No ratings yet

- Bài-tập-bank-reconciliation MLDocument6 pagesBài-tập-bank-reconciliation MLMai Lâm LêNo ratings yet

- Bookkeeping FinalExam - Answers2022 - GG1712Document8 pagesBookkeeping FinalExam - Answers2022 - GG1712Karan KhannaNo ratings yet

- Accounting,: 21 Edition Warren Reeve FessDocument40 pagesAccounting,: 21 Edition Warren Reeve FesskitrasNo ratings yet

- Exercises - Chapter 3Document6 pagesExercises - Chapter 3Kristine BacaniNo ratings yet

- Calculation of Rebate: Particular Dr. CRDocument12 pagesCalculation of Rebate: Particular Dr. CRDennis BijuNo ratings yet

- Accounted II PRACTICEDocument5 pagesAccounted II PRACTICEScribdTranslationsNo ratings yet

- Acc Clerk Chapter. 6-Control Accounts (Ledgers)Document28 pagesAcc Clerk Chapter. 6-Control Accounts (Ledgers)Ephraim PryceNo ratings yet

- Bank Reconciliation IntroductionDocument7 pagesBank Reconciliation IntroductionLesego HlezaNo ratings yet

- Welcome: Click To Edit Master Title StyleDocument29 pagesWelcome: Click To Edit Master Title StyleMingxNo ratings yet

- Attachment 1SADocument10 pagesAttachment 1SA76xzv4kk5vNo ratings yet

- Exercises - Chapter 3Document5 pagesExercises - Chapter 3Galang, Princess T.No ratings yet

- College Accounting 12th Edition Slater Solutions Manual DownloadDocument35 pagesCollege Accounting 12th Edition Slater Solutions Manual DownloadRicardo Rivera100% (27)

- ACCA F3 Bank Recon and Errors 09 and Fixed AssetsDocument2 pagesACCA F3 Bank Recon and Errors 09 and Fixed AssetsAmos OkechNo ratings yet

- Wang H 56180805 444 Alaska Avenue Suite Torrance Ca 90503Document4 pagesWang H 56180805 444 Alaska Avenue Suite Torrance Ca 90503xrayjackdevNo ratings yet

- Grade 11 Accn June 2023 P2 MGDocument9 pagesGrade 11 Accn June 2023 P2 MGKwakhanya StemelaNo ratings yet

- Cash and ReceivablesDocument97 pagesCash and ReceivablesmengistuNo ratings yet

- Chapter 8Document5 pagesChapter 8Saharin Islam ShakibNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Omaha Bank Statement (Card)Document3 pagesOmaha Bank Statement (Card)ВасилийNo ratings yet

- Bank Reconciliations Credit Memo PDF FormatDocument8 pagesBank Reconciliations Credit Memo PDF FormatGeorge MockNo ratings yet

- Ad Control Accounts Worksheet 1Document2 pagesAd Control Accounts Worksheet 1MUSTHARI KHANNo ratings yet

- Exercises Chapter 3Document5 pagesExercises Chapter 3Galang, Princess T.No ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- Cash and RecievablesDocument60 pagesCash and Recievablesአንተነህ የእናቱ100% (1)

- Accounting For Cash and ReceivableDocument7 pagesAccounting For Cash and ReceivableAbrha GidayNo ratings yet

- Result PDF Watermark Iic7NF6Document4 pagesResult PDF Watermark Iic7NF6mdyafi8084No ratings yet

- Summary of Account Activity Payment InformationDocument4 pagesSummary of Account Activity Payment InformationerikNo ratings yet

- Chapter 08 - Bank and CashDocument13 pagesChapter 08 - Bank and CashMkhonto XuluNo ratings yet

- Lembar Jawaban Kosong Jayatama - OKDocument42 pagesLembar Jawaban Kosong Jayatama - OK21Dwi Athaya SalsabilaNo ratings yet

- Cash Book Bank ColumnBank StatementDocument6 pagesCash Book Bank ColumnBank StatementShaikh Ghassan AbidNo ratings yet

- Initiate Business Checking: August 31, 2022 Page 1 of 4Document5 pagesInitiate Business Checking: August 31, 2022 Page 1 of 4Alexander Barno AlexNo ratings yet

- 03-23-2017 PDFDocument6 pages03-23-2017 PDFal pomerantzNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Analysis Example 2Document2 pagesVisual Analysis Example 2Doan Chan PhongNo ratings yet

- Accounting TOPIC 7 - Accounting For StockDocument38 pagesAccounting TOPIC 7 - Accounting For StockDoan Chan PhongNo ratings yet

- Visual Analysis History 140313Document2 pagesVisual Analysis History 140313Doan Chan PhongNo ratings yet

- Psych Unit3 WhatIsConsciousness SlidesDocument10 pagesPsych Unit3 WhatIsConsciousness SlidesDoan Chan PhongNo ratings yet

- What Is HistoriographyDocument36 pagesWhat Is HistoriographyDoan Chan PhongNo ratings yet

- Accounting TOPIC 6 - Recording in LedgersDocument29 pagesAccounting TOPIC 6 - Recording in LedgersDoan Chan PhongNo ratings yet

- What Is Sleep and How Is It MeasuredDocument11 pagesWhat Is Sleep and How Is It MeasuredDoan Chan PhongNo ratings yet

- Theories of SleepDocument6 pagesTheories of SleepDoan Chan PhongNo ratings yet

- Civil and Political RightsDocument6 pagesCivil and Political RightsDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 2 July, 2020Document37 pagesMany-Sorted First-Order Model Theory: 2 July, 2020Doan Chan PhongNo ratings yet

- Sleep and The Sleep Cycle RevisionDocument15 pagesSleep and The Sleep Cycle RevisionDoan Chan PhongNo ratings yet

- U3 Aos 1 - Mind, Brain andDocument11 pagesU3 Aos 1 - Mind, Brain andDoan Chan PhongNo ratings yet

- Sleep Deprivation Powerpoint SlidesDocument9 pagesSleep Deprivation Powerpoint SlidesDoan Chan PhongNo ratings yet

- Sleep DeprivationDocument10 pagesSleep DeprivationDoan Chan PhongNo ratings yet

- Remembering Memory !Document11 pagesRemembering Memory !Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 16 July, 2020Document33 pagesMany-Sorted First-Order Model Theory: 16 July, 2020Doan Chan PhongNo ratings yet

- Inforamtion For Learning SACDocument10 pagesInforamtion For Learning SACDoan Chan PhongNo ratings yet

- Manipulation of MemoryDocument7 pagesManipulation of MemoryDoan Chan PhongNo ratings yet

- Collecting DataDocument18 pagesCollecting DataDoan Chan PhongNo ratings yet

- Era Combined ResultsDocument3 pagesEra Combined ResultsDoan Chan PhongNo ratings yet

- Yr 12 Research Methods - Going Back To BasicsDocument7 pagesYr 12 Research Methods - Going Back To BasicsDoan Chan PhongNo ratings yet

- The Conscious Self - SAC 2 RevisionDocument44 pagesThe Conscious Self - SAC 2 RevisionDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 9 July, 2020Document48 pagesMany-Sorted First-Order Model Theory: 9 July, 2020Doan Chan PhongNo ratings yet

- 7 Plus English Paper SampleDocument12 pages7 Plus English Paper SampleDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 19 June, 2020Document48 pagesMany-Sorted First-Order Model Theory: 19 June, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 25 June, 2020Document31 pagesMany-Sorted First-Order Model Theory: 25 June, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 2 July, 2020Document37 pagesMany-Sorted First-Order Model Theory: 2 July, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model Theory: 2 July, 2020Document56 pagesMany-Sorted First-Order Model Theory: 2 July, 2020Doan Chan PhongNo ratings yet

- Many-Sorted First-Order Model TheoryDocument14 pagesMany-Sorted First-Order Model TheoryDoan Chan PhongNo ratings yet

- Many-Sorted First-Order Model TheoryDocument22 pagesMany-Sorted First-Order Model TheoryDoan Chan PhongNo ratings yet

- Acctg 7 - Problem 3&4Document5 pagesAcctg 7 - Problem 3&4Nyster Ann RebenitoNo ratings yet

- Departemen Akuntansi Fakultas Ekonomi Dan Bisnis Universitas AirlanggaDocument8 pagesDepartemen Akuntansi Fakultas Ekonomi Dan Bisnis Universitas Airlanggatolha ramadhaniNo ratings yet

- TX NotesDocument157 pagesTX Notessahalacca123No ratings yet

- Ravat Laxman CVVDocument1 pageRavat Laxman CVVthakurnarendra8077No ratings yet

- Identifikasi Saluran Pemasaran Kopi Arabika Gayo Pada Cv. Gayo Mandiri Coffee Kabupaten Bener Meriah Riyandhi PrazaDocument7 pagesIdentifikasi Saluran Pemasaran Kopi Arabika Gayo Pada Cv. Gayo Mandiri Coffee Kabupaten Bener Meriah Riyandhi Prazaferi gustiNo ratings yet

- Groww Stock Account Opening FormDocument21 pagesGroww Stock Account Opening FormPranjal RanaNo ratings yet

- Difference Between QA and QCDocument6 pagesDifference Between QA and QCGajendra Singh Raghav100% (1)

- Aggressive Corporation Approaches Matt Taylor A Loan Officer For OklahomaDocument1 pageAggressive Corporation Approaches Matt Taylor A Loan Officer For OklahomaMiroslav GegoskiNo ratings yet

- 02 Therason - Sourcing Recommendation Paper Answer TemplateDocument10 pages02 Therason - Sourcing Recommendation Paper Answer Templatephiphungho2002No ratings yet

- AB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskDocument12 pagesAB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskSirak AynalemNo ratings yet

- Urban Ladder Vs Pepperfry 2Document10 pagesUrban Ladder Vs Pepperfry 2Sabhay ChoudharyNo ratings yet

- Page 63 BIR Inclusion Non-IndividualDocument1 pagePage 63 BIR Inclusion Non-IndividualHans LeeNo ratings yet

- Seatwork in PSA 240Document2 pagesSeatwork in PSA 240Everlyn YuNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Maharashtra Tourism 2003Document284 pagesMaharashtra Tourism 2003Mehmood SheikhNo ratings yet

- FILE - 20220513 - 151826 - Chapter 5 Protection - DoneDocument40 pagesFILE - 20220513 - 151826 - Chapter 5 Protection - DoneHuyền TràNo ratings yet

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- Deloitte Uk Global Mobility Trends 2021 Report LatestDocument16 pagesDeloitte Uk Global Mobility Trends 2021 Report LatestNguyễn Hoàng NhânNo ratings yet

- Chapter 22 QuizDocument10 pagesChapter 22 Quizمنیر ساداتNo ratings yet

- دور إدارة المعرفة التسويقية في تحقيق التفوق التنافسي للمؤسسة الاقتصادية الجزائرية دراسة حالة مؤسسة فرتيال (Fertial) بعنابة- الجزائرDocument20 pagesدور إدارة المعرفة التسويقية في تحقيق التفوق التنافسي للمؤسسة الاقتصادية الجزائرية دراسة حالة مؤسسة فرتيال (Fertial) بعنابة- الجزائرKheira BourassiNo ratings yet

- The Corporate Form of Organization: Ordinary Shares Represent The Residual Corporate Interest That Bears The UltimateDocument3 pagesThe Corporate Form of Organization: Ordinary Shares Represent The Residual Corporate Interest That Bears The UltimateJihan Rahma IrianaNo ratings yet

- Pp-Dole-Ncr August 29Document20 pagesPp-Dole-Ncr August 29Mcel PadiernosNo ratings yet

- Certificate of Business Name Registration: MGTV Sari Sari StoreDocument2 pagesCertificate of Business Name Registration: MGTV Sari Sari StoreMaria MalangNo ratings yet

- Blackbook TybmsDocument68 pagesBlackbook TybmsDharmil Topiwala0% (1)

- ISPM Assignment 1Document5 pagesISPM Assignment 1Azmr Ed100% (1)

- Russian Cultural Values and Workplace Communication PatternsDocument15 pagesRussian Cultural Values and Workplace Communication PatternsdanielNo ratings yet

- Consulting On Human CapitalDocument2 pagesConsulting On Human CapitalVaibhav AggarwalNo ratings yet

- Grade 12 Task 1 Activity 2 MGDocument6 pagesGrade 12 Task 1 Activity 2 MGBohlale MakhuraNo ratings yet