Professional Documents

Culture Documents

Bank Credit Management CAT (Marking)

Bank Credit Management CAT (Marking)

Uploaded by

Wesley0 ratings0% found this document useful (0 votes)

63 views3 pagesThe document discusses various aspects of bank credit management. It addresses principles of sound lending, types of collateral used to secure credit facilities, different forms of advances provided by banks, and the evaluating procedure for commercial loan requests. The five principles of sound lending are liquidity, purpose, profitability, security, and national interest. The four types of collateral discussed are real estate, cash secured loans, inventory financing, and invoice collateral. The evaluating procedure for commercial loans is a multi-step process that includes an initial application, minimum criteria check, documentation review, analysis, third party checks, further information requests, credit committee review if needed, and a final loan offer if approved.

Original Description:

Bank credit management cat

Original Title

Bank credit management CAT (marking)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses various aspects of bank credit management. It addresses principles of sound lending, types of collateral used to secure credit facilities, different forms of advances provided by banks, and the evaluating procedure for commercial loan requests. The five principles of sound lending are liquidity, purpose, profitability, security, and national interest. The four types of collateral discussed are real estate, cash secured loans, inventory financing, and invoice collateral. The evaluating procedure for commercial loans is a multi-step process that includes an initial application, minimum criteria check, documentation review, analysis, third party checks, further information requests, credit committee review if needed, and a final loan offer if approved.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

63 views3 pagesBank Credit Management CAT (Marking)

Bank Credit Management CAT (Marking)

Uploaded by

WesleyThe document discusses various aspects of bank credit management. It addresses principles of sound lending, types of collateral used to secure credit facilities, different forms of advances provided by banks, and the evaluating procedure for commercial loan requests. The five principles of sound lending are liquidity, purpose, profitability, security, and national interest. The four types of collateral discussed are real estate, cash secured loans, inventory financing, and invoice collateral. The evaluating procedure for commercial loans is a multi-step process that includes an initial application, minimum criteria check, documentation review, analysis, third party checks, further information requests, credit committee review if needed, and a final loan offer if approved.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Bank credit management

CAT

Question one

a) What are the Principles of sound lending? (5 Marks)

● Liquidity

● Purpose

● Profitability

● Security

● National interest

b) State and explain(five (5) different types of collateral used by banks to secure credit

facilities (10 marks)

● Real estate-The most common type of collateral used by borrowers is real

estate, such as one’s home or a parcel of land.

● Cash secured loan Cash is another common type of collateral because it

works very simply..

● Inventory financing- This involves inventory that serves as the collateral for

a loan.

● Invoice collateral Invoices are one of the types of collateral used by small

businesses, wherein invoices to customers of the business that are still

outstanding – unpaid – are used as collateral.

Question two

a) Discuss five (5) different Forms of advances? (5 Marks)[

● Cash credit,

● Overdraft,

● Loans,

● Demand loan vs term loan,

● Secured vs unsecured loan,

● Participation loan or consortium loan

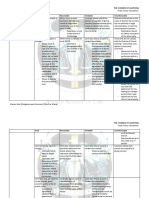

b) Explain in detail evaluating procedure of commercial loan requests (10 Marks)

o Initial Application: This process usually starts with a business owner

completing a 2-minute form online or talking to a member of our team

o Minimum Criteria: On receipt, we check that the business meets our minimum

criteria for turnover levels and the numbers of years trading.

o Documentation: If the business ticks the necessary boxes, we ask the business

owner to provide the most recent set of financial accounts, the last 6 months

bank statements, and the most recent tax clearance certificate – this is what we

call the Initial Information.

o Initial Analysis: The Initial Information is then input into our credit template.

o Scoring and Pricing the Credit Risk: The score is weighted heavily towards the

debt servicing ability of the business, which is measured using a combination of

standard credit scoring metrics such as the level of existing debt or financial

obligations laying claim to the cash flows of the business (either secured or

unsecured), but also a detailed analysis of the credit balances within the bank

account, other monthly creditor payments and monthly and seasonal cash

balances etc

o 3rd Party Checks: We will also use third-party resources to verify personal

information, the ownership structure of the business, the credit history and to

check for any previous judgements or liquidiations, which are also factored in to

the final score.

o Further Information: Credit team may request additional information (such as

an accountant’s reference, recent management accounts, copies of key

contracts etc.) and/or discuss queries from the initial analysis with the borrower,

their accountant or their financial advisor, so as to complete the credit template

and generate a final credit score.

o Credit Commitee: Depending on the final score or any other exceptional aspect

to the business, the loan application may be brought to the LF Credit

Committee. The credit committee meets daily to discuss any loan requests

which warrant additional discussion.

o Loan Offer: Following the final analysis, or the decision of the Credit Commitee

as required, if the application gets a sufficient score then a loan offer is made.

o Continuous Upgrading/management: the current credit template is the

seventh iteration of the original model used by Linked Finance in 2013, and it is

constantly being amended and upgraded due to macroeconomic factors and

changing market conditions.

Question three

The five Cs of credit is a system used by lenders to gauge the creditworthiness of potential

borrowers. The system weighs five characteristics of the borrower and conditions of the loan,

attempting to estimate the chance of default and, consequently, the risk of a financial loss for the

lender. State and explain the 5 Cs of Credit (10 marks)

a) Character

b) Capacity/Cash flow

c) Capital

d) Conditions

e) Collateral

You might also like

- Types of Borrowers-Lending ProcessDocument39 pagesTypes of Borrowers-Lending ProcessEr Yogendra100% (1)

- Cost Accounting Progress AssignmentsDocument6 pagesCost Accounting Progress AssignmentsWesleyNo ratings yet

- Garcia vs. ThioDocument1 pageGarcia vs. ThioOM MolinsNo ratings yet

- Credit AwarenessDocument62 pagesCredit AwarenessHimanshu Mishra100% (1)

- Report On Working Capital Loan (Prime Bank)Document29 pagesReport On Working Capital Loan (Prime Bank)rrashadatt100% (3)

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- 1 Bank LendingDocument56 pages1 Bank Lendingparthasarathi_inNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Principles of LendingDocument37 pagesPrinciples of LendingRohit BaralNo ratings yet

- Mortgage Loans in IndiaDocument11 pagesMortgage Loans in IndiaDebobrata MajumdarNo ratings yet

- Create A Pictorial Representation On The Five C Principles of Lendi - 20240401 - 110846 - 0000Document11 pagesCreate A Pictorial Representation On The Five C Principles of Lendi - 20240401 - 110846 - 0000mohankumar12tha1No ratings yet

- Note On Bank Loans-SummaryDocument7 pagesNote On Bank Loans-Summaryscbihari1186No ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- Bank Lending: Policies & Procedures: M. Morshed 1Document26 pagesBank Lending: Policies & Procedures: M. Morshed 1musansuNo ratings yet

- C. Credit AnalysisDocument4 pagesC. Credit AnalysisArif HossainNo ratings yet

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Credit Management Overview and Principles of LendingDocument55 pagesCredit Management Overview and Principles of LendingShilpa Grover100% (4)

- Sanction, Documentation and Disbursement of CreditDocument32 pagesSanction, Documentation and Disbursement of Creditrajin_rammstein100% (1)

- Bank LendingDocument14 pagesBank LendingNadia VirkNo ratings yet

- Final Coverage PageDocument5 pagesFinal Coverage Pageanilmourya5No ratings yet

- Sanaul - CECM 4th - Assignment 1Document6 pagesSanaul - CECM 4th - Assignment 1Sanaul Faisal100% (1)

- Bank Lending and Credit A DministrationDocument5 pagesBank Lending and Credit A Dministrationolikagu patrickNo ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Unit 8Document8 pagesUnit 8rtrsujaladhikariNo ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- Process of Retail LendingDocument26 pagesProcess of Retail Lendingkaren sunil100% (1)

- Credit Report On MCBDocument16 pagesCredit Report On MCBuzmabhatti34No ratings yet

- Commercial and Industrial LoansDocument36 pagesCommercial and Industrial LoansAngela ChuaNo ratings yet

- Credit Mgt. - WEBILT - DeckDocument287 pagesCredit Mgt. - WEBILT - Decksimran kaur100% (1)

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- CHAP - 3 - Lending Policies and ProceduresDocument74 pagesCHAP - 3 - Lending Policies and Procedureskhanhlmao25252No ratings yet

- Pamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020 - 2021 First Semester Fin 3104: Credit Management and Collection PoliciesDocument29 pagesPamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020 - 2021 First Semester Fin 3104: Credit Management and Collection PoliciesHarlene BulaongNo ratings yet

- CREDIT Service TRAINING SLIDESDocument92 pagesCREDIT Service TRAINING SLIDESsiinqeecreditNo ratings yet

- Unit 5 Credit Analysis & RatingDocument29 pagesUnit 5 Credit Analysis & Ratingsaurabh thakurNo ratings yet

- Credit AnalysisDocument43 pagesCredit AnalysisAan OkeNo ratings yet

- 9new - 471233 - Learning Material - SMEDocument28 pages9new - 471233 - Learning Material - SMERavi KumarNo ratings yet

- Chapter 1: The Principles of Lending and Lending BasicsDocument5 pagesChapter 1: The Principles of Lending and Lending Basicshesham zakiNo ratings yet

- S 14 - Short-Term Finance and PlanningDocument18 pagesS 14 - Short-Term Finance and PlanningAninda DuttaNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementAmit RoyNo ratings yet

- Credit AppraisalDocument6 pagesCredit AppraisalAnjali Angel ThakurNo ratings yet

- A Study On Credit Management at District CoDocument86 pagesA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- Credit ManagementDocument83 pagesCredit ManagementPrashamsa RijalNo ratings yet

- Unit 4 Receivables - ManagementDocument27 pagesUnit 4 Receivables - ManagementrehaarocksNo ratings yet

- Financial Credit Analysis-1Document33 pagesFinancial Credit Analysis-1sudhu1606No ratings yet

- Sample of Handing Over NoteDocument4 pagesSample of Handing Over Notebarima075705100% (3)

- Dashka Zulfiqar 18910 Fasiha Sagheer 18911Document5 pagesDashka Zulfiqar 18910 Fasiha Sagheer 18911samreenNo ratings yet

- Credit Management - Reading MaterialsDocument10 pagesCredit Management - Reading Materialsmesba_17No ratings yet

- Bank of IndiaDocument15 pagesBank of Indiashreyaasharmaa100% (1)

- Credit Guarantee CorporationDocument24 pagesCredit Guarantee Corporationsweet5458No ratings yet

- Term LoanDocument8 pagesTerm LoanDarshan PatilNo ratings yet

- UNIT-5Financial Credit Risk AnalyticsDocument27 pagesUNIT-5Financial Credit Risk Analyticsblack canvasNo ratings yet

- Credit Analysis and Distress Prediction Credit Analysis and Distress PredictionDocument10 pagesCredit Analysis and Distress Prediction Credit Analysis and Distress PredictionEster Oshin AritonangNo ratings yet

- UNIT3Document37 pagesUNIT3lokesh palNo ratings yet

- 1 1meaningDocument21 pages1 1meaningadtyshkhrNo ratings yet

- SCFS Cooperative Bank LTDDocument64 pagesSCFS Cooperative Bank LTDLïkïth RäjNo ratings yet

- Term Loans: Assets and WC MarginsDocument11 pagesTerm Loans: Assets and WC MarginsSrinidhi RangarajanNo ratings yet

- 5cs CreditDocument6 pages5cs CreditiftikharchughtaiNo ratings yet

- Introduction To Community Development 1Document40 pagesIntroduction To Community Development 1WesleyNo ratings yet

- Economics R.kitDocument227 pagesEconomics R.kitWesleyNo ratings yet

- Introduction To Community DevelopmentDocument72 pagesIntroduction To Community DevelopmentWesleyNo ratings yet

- BML 211 Money & BankingDocument103 pagesBML 211 Money & BankingWesleyNo ratings yet

- Fundamentals of Commercial BanksDocument3 pagesFundamentals of Commercial BanksWesleyNo ratings yet

- CML 102 Foundations of Accounting (Notes)Document170 pagesCML 102 Foundations of Accounting (Notes)Wesley100% (2)

- Sociology of AdolescenceDocument18 pagesSociology of AdolescenceWesleyNo ratings yet

- CP11 Credit Management 8Document2 pagesCP11 Credit Management 8WesleyNo ratings yet

- Introduction of Community Development ProjectDocument35 pagesIntroduction of Community Development ProjectWesleyNo ratings yet

- Financial Accounting Introdution To Accounting A) DefinitionDocument8 pagesFinancial Accounting Introdution To Accounting A) DefinitionWesleyNo ratings yet

- State, Society and Development State, Society and DevelopmentDocument51 pagesState, Society and Development State, Society and DevelopmentWesleyNo ratings yet

- Bank Credit-Management NotesDocument32 pagesBank Credit-Management NotesWesley67% (3)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- WEEK 4-BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. THE MONETARY BOARDDocument3 pagesWEEK 4-BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. THE MONETARY BOARDKrizzle de la PeñaNo ratings yet

- Project ManagementDocument3 pagesProject ManagementSoham BhurkeNo ratings yet

- Introduction To Business Combinations and The Conceptual FrameworkDocument51 pagesIntroduction To Business Combinations and The Conceptual Frameworkw_fibNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- IIM Sambalpur PI KIT 2021Document110 pagesIIM Sambalpur PI KIT 2021Kaushal P.No ratings yet

- Chapter Four Interm P2Document10 pagesChapter Four Interm P2saed cabdiNo ratings yet

- GE1202 Managing Your Personal Finance: Purchasing HomesDocument33 pagesGE1202 Managing Your Personal Finance: Purchasing HomesAiden LANNo ratings yet

- Learning Module 1 Review of The Accounting Cycle of A Service Business MARCH 2022Document37 pagesLearning Module 1 Review of The Accounting Cycle of A Service Business MARCH 2022Kyle Vincent AguilarNo ratings yet

- FM402 Sugar CaseDocument11 pagesFM402 Sugar CaseDEV DUTT VASHIST 22111116No ratings yet

- Kind of Obligations - ExamplesDocument3 pagesKind of Obligations - ExamplesJoana ReyesNo ratings yet

- Balance Sheet - ConsolidatedDocument239 pagesBalance Sheet - ConsolidatedAISHWARYA KUZHIKKATNo ratings yet

- Careers in Banking and Finance 200910Document50 pagesCareers in Banking and Finance 200910Paulo PereiraNo ratings yet

- ICAI How To Grow MoneyDocument358 pagesICAI How To Grow Moneyshank nNo ratings yet

- Blooming Valley Custom Landscaping Provides Landscaping Services To A VarietyDocument1 pageBlooming Valley Custom Landscaping Provides Landscaping Services To A Varietyhassan taimourNo ratings yet

- Seatwork in Audit 2-3Document8 pagesSeatwork in Audit 2-3Shr BnNo ratings yet

- The Cash FlowDocument30 pagesThe Cash Flowafnanmirza106No ratings yet

- Ssa 3105Document2 pagesSsa 3105Joshua Sygnal Gutierrez100% (2)

- Case Digest Chapter 4Document4 pagesCase Digest Chapter 4Marilie TubalinalNo ratings yet

- 12 BK Question Bank Group C 2020 21Document6 pages12 BK Question Bank Group C 2020 21PuranNo ratings yet

- Why Our Course: Banking Important Terms Part 5Document17 pagesWhy Our Course: Banking Important Terms Part 5Vaishali SinghNo ratings yet

- Group 6 Banking Law AssignmentDocument22 pagesGroup 6 Banking Law Assignmentmoses machiraNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- MARIA M Case Study03..Document3 pagesMARIA M Case Study03..Charrie Faye Magbitang HernandezNo ratings yet

- (Marion Kho) Contracts Table - Mel Sta. MariaDocument7 pages(Marion Kho) Contracts Table - Mel Sta. MariaAnthony ChoiNo ratings yet

- Upper Level Vocabulary 2 PDFDocument2 pagesUpper Level Vocabulary 2 PDFCap Mohamed ElmasriNo ratings yet

- The Merchant of VeniceDocument11 pagesThe Merchant of VeniceSergio CastellanosNo ratings yet

- 11 Traders Royal Bank v. CADocument4 pages11 Traders Royal Bank v. CATricia MontoyaNo ratings yet

- 07 Activity 2Document6 pages07 Activity 2Gillai Marie IbardolazaNo ratings yet