Professional Documents

Culture Documents

Tax File Number - Application or Enquiry For Individuals: Section A

Tax File Number - Application or Enquiry For Individuals: Section A

Uploaded by

Rebecca BakerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax File Number - Application or Enquiry For Individuals: Section A

Tax File Number - Application or Enquiry For Individuals: Section A

Uploaded by

Rebecca BakerCopyright:

Available Formats

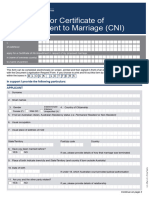

Tax file number – application

or enquiry for individuals

14321214

WHEN COMPLETING THIS FORM n Sign next to any corrections.

n Refer to the instructions to help you complete this application. n Make sure you read the privacy statement and

n Answer all the questions, otherwise we may need to contact sign the declaration at the end of the form.

you for further information. n Provide acceptable proof of identity

n Print clearly, using a black or dark blue pen only. documents – see section E.

n Use BLOCK LETTERS and print one character in each box.

S M I T H S T

n Place X in all applicable boxes.

ATO USE ONLY

n Do not use correction fluid or covering stickers.

Section A: Applicant information See instructions page 4.

The answer to these questions will help us establish whether you are already on our records or not.

Provide the details of the applicant.

1 Have you ever: (Place X in one box only.)

n had a TFN

n applied for a TFN before

n lodged a tax return in Australia?

No Go to question 3.

Yes Go to question 2.

2 If you know the details of when you last dealt with us, provide them below.

When did you last deal with us?

Year Details (eg tax return)

Were your personal details the same as they are now?

No Provide your details as they were when you last dealt with us.

Yes Go to question 3.

Family name at that time

First given name

Other given names

Postal address for tax matters at that time

Suburb/town/locality State/territory Postcode

Name of your registered tax agent at that time (if applicable)

NAT 1432-12.2014 Sensitive (when completed) Page 1

3 Why do you need a TFN? (Place X in one box only.)

Select one reason only that best describes why you are applying for a TFN.

To give to your employer or payer To lodge an income tax return

To give to your bank or financial institution To claim family tax benefit

To apply for a loan under the Higher

Education Loan Program (HELP) For child support payments

To apply for an Australian business number

(ABN) or register for another business account

– for example, goods and services tax (GST)

To give to Centrelink I have authorised Centrelink to receive my TFN from the ATO

Provide your Centrelink Customer Reference

No Yes Number (CRN)

Other reason Describe below

Other reason (describe)

4 What is your full name?

Title: Mr Mrs Miss Ms Other

Family name

First given name

Other given names

5 Have you ever had another name?

No Go to question 6.

Yes Provide details below.

Type of name? (Place X in one box only.)

The name on your A shortened version

Your previous married name birth certificate of your name Your name before marriage

An assumed name

An anglicised name (known as) Your skin name

Other

Other name

Title: Mr Mrs Miss Ms Other

Family name

First given name

Other given names

If you have more names, provide details on a separate sheet of paper and include with your application.

Make sure you provide full names and indicate type of name.

OFFICE USE ONLY

6 What is your sex? Male Female

Day Month Year Day Month Year

7 What is your date of birth?

Page 2 Sensitive (when completed)

8 Were you born in Australia?

Yes

No Which country were you born in?

Day Month Year

What date did you arrive in Australia?

If you have a foreign passport, you may be eligible to apply for a TFN online at iar.ato.gov.au

(see instructions on page 3 for more information).

9 Do you have a spouse? See instructions page 4.

No Go to question 10.

Yes Provide details below.

Spouse’s family name

Spouse’s first given name

Spouse’s other given names

Day Month Year

Spouse’s date of birth

Check that you have given your name before marriage or

previous married name at question 5, if applicable.

14321314

Section B: Address details See instructions page 4.

We may use these details to send notices and correspondence about your taxation affairs.

10 What is your postal address in Australia? (Your TFN will be sent to this address.)

This could be your home address, your post office box, or your registered tax agent’s postal address.

Suburb/town/locality State/territory Postcode

11 What is your home address?

This must be a street address – for example, 123 Smith St. This cannot be a post office box, RMB, RSD or other

delivery point address. Write ‘AS ABOVE’ if same as postal address at question 10.

If you are a temporary visitor, your home address may be your home country address.

Suburb/town/locality State/territory Postcode

Country if not Australia (Australia only) (Australia only)

Sensitive (when completed) Page 3

Section C: Residency details

The criteria we use to work out your residency status for tax purposes are not the same as those used by other Australian agencies

for other purposes, such as immigration.

See instructions page 4 or visit ato.gov.au/residency to check your Australian residency status for tax purposes.

12 Are you an Australian resident for tax purposes?

No

Yes

Section D: Contact details See instructions page 4.

13 What are your contact details?

Provide all details where you can. We may use these details to contact you as well as send notices

and correspondence about your taxation affairs.

Daytime phone number (include area code) Mobile number

Email address (use BLOCK LETTERS) – such as EXAMPLE@PROVIDER.COM.AU

14 Do you want to provide an alternative contact person?

These details will only be used if we need help to process this form and will not be recorded on our systems.

If you would like to add an authorised contact (nominated representative) on our systems to deal with us on your behalf,

you will need to phone us when you receive your TFN.

No

Yes Provide the details of another person who we can contact for further information about your application below.

Contact person’s name

Daytime phone number (include area code) Mobile number

Email address (use BLOCK LETTERS) – such as EXAMPLE@PROVIDER.COM.AU

15 Do you have a registered tax agent?

No

Yes Provide your registered tax agent’s details below.

Name

Phone number Registration number

Name of person you deal with

Page 4 Sensitive (when completed)

Section E: Supporting documents See instructions page 4.

This section will help you provide the proof of identity documents we need to process your application. If you do not provide all the

documents we ask for, we cannot issue you with a TFN.

We will accept certified copies of original documents. Do not send us original documents. Certified copies of documents

that you mail to us may not be returned to you. Documents that have been corrected or changed and initialled are not acceptable.

We may check the supporting documents you supply with the agencies that issued them.

16 Are you:

You need to provide three documents as listed at question 17,

aged 16 or over one of which must be a primary document.

You need to provide two documents as listed at question 17,

under 16 one of which must be a primary document.

17 Which of the following supporting documents will you provide with your application?

(Place X in all applicable boxes.)

Primary documents

Australian full birth certificate (not an extract)

Australian passport

Australian citizenship certificate, or Extract from Register of Citizenship by Descent

Foreign passport.

Secondary documents

Medicare card

Account statement from an Australian bank, credit union or building society less than one year old, with your name and

your current address matching the details you provide on your application (statements printed off the internet and credit

card statements are not acceptable)

Current Australian firearm licence with your signature and/or photo matching the details you provide on your application

Current student identification card (tertiary or secondary) with your photo issued from an Australian government accredited

education authority

One of the following cards with your photo and signature. Any address on the card must match the details provided on

the application:

n Australian driver’s licence

n Australian learner’s permit

n state or territory government issued proof of age card

n state or territory government issued photo card.

If you are under 16, secondary documents can include one of the following, which must be less than one year old and

issued by an Australian government accredited education authority:

secondary examination certificate

record of achievement

examination report.

Sensitive (when completed) Page 5

18 Are you a parent or guardian signing this application?

See page 5 of the instructions to see if you are eligible to sign the form on behalf of the applicant.

No

Yes If you sign on behalf of the applicant, you must include all of the following with this application:

The applicant’s supporting documents that you have selected at question 17.

One of the ‘Linking documents’ on page 6 of the instructions that shows your relationship to the applicant.

If one of the applicant’s supporting documents that you have selected at question 17 shows your relationship to

the applicant, you do not need to provide another linking document.

If you are signing on behalf of an applicant who is 16 years or older and unable to sign their application, there

are additional requirements. See ‘Protected persons (additional requirements)’ on page 5 of the instructions.

EITHER of the following:

Your own tax file number (TFN)

OR

If you do not provide your TFN, you will need to provide three of your own supporting documents, one must be a

primary document. See ‘Acceptable proof of identity documents’ on page 5 of the instructions.

For more information about providing TFNs, see the Privacy note in the Declaration on page 7 of this form.

19 Are any of the supporting documents you will provide in a previous name?

No

You will also need to provide one of the ‘Linking documents’ listed on page 6 of the instructions that shows how

Yes your name was changed.

20 Are the supporting documents you will provide in English?

The documents will need to be translated into English and certified as a true and correct copy by an authorised

No translation service. Details of accredited translators and interpreters can be found at naati.com.au

Yes

Make sure you sign the declaration on the next page.

Page 6 Sensitive (when completed)

Section F: Declaration See instructions page 6.

If you are:

n 16 years or older – you must sign your application

n 13 to 15 years old – you or your parent or guardian can sign

n 12 years old or under – your parent or guardian must sign on your behalf.

If you are signing on behalf of an applicant who is 16 years or older and unable to sign their application,

see ‘Protected persons (additional requirements)’ on page 5 of the instructions.

If you are completing this TFN application on behalf of another person, this does not give you the authority to ask about

their tax matters.

21 Who is the authorised person signing this declaration?

The person applying for the TFN Sign and date the declaration below.

Make sure you have completed questions 14 and 18 and provide your full name

A parent or guardian below before signing and dating the declaration below.

Name of parent or guardian

Penalties may be imposed for giving false or misleading information or for the unauthorised use of a TFN.

Privacy

The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN). We will use your TFN to

identify you in our records. It is not an offence not to provide your TFN. However, if you do not provide your TFN, there may be a

delay in processing this form.

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your

privacy, go to ato.gov.au/privacy

We may check the supporting documents you supply with the agencies that issued them.

I declare that the information given on this application is true and correct.

Signature

Date

Day Month Year

You MUST SIGN here

Lodging your application

Keep a copy of your application for your records.

Send the original application and certified copies of your identity documents to us at

n Australian Taxation Office

PO Box 9942

MOONEE PONDS VIC 3039

Or, you can visit your nearest:

n ATO shopfront – phone 13 28 61 between 8.00am and 6.00pm, Monday to Friday, to make an appointment. You must

provide original identity documents with your application.

n Centrelink Service Centre – if you are applying for a government benefit or pension. You must provide original identity

documents with your application.

We will aim to process this form within 28 days of receiving all the necessary information. If your form is

incomplete, incorrect or needs checking, it may take longer. We will forward your TFN to the postal address

on your application.

We appreciate your patience during the processing period. Do not lodge another application during this time.

Sensitive (when completed) Page 7

OFFICE USE ONLY – Print clearly

Proof of identity certification

Record a birth certificate’s registration date as the date of issue or expiry.

Medicare cards – add the sequence number after the card number.

Centrelink officers can fill out this section only if the applicant is a customer of their agency.

Centrelink officers – you must provide the customer reference number for the applicant, if this is not present or incorrect there will be a delay in

processing the application.

Applicant: Record all primary and secondary documents presented to you.

Document Date of issue

Document number Place of issue

code or expiry

Registration year

ABC AUSTRALIAN STATE OF ISSUE YYYY

Issue date

AAP AUSTRALIA DD/MM/YYYY

Issue date

ACC STOCK NUMBER AUSTRALIA DD/MM/YYYY

Expiry date

AFP COUNTRY CODE DD/MM/YYYY

B

B

B

Link documents:

Document Date of issue

Document number Place of issue

code or expiry

L

L

L

Representative/nominee:

Document Date of issue

Document number Place of issue

code or expiry

A

Electronic Visa class/

travel authority No Yes Visa number sub class

Officer’s signature Officer’s name (please print)

Phone

Day Month Year

CLK customer

Date reference number Office code

DVA customer

reference number Source code

Notes Centrelink use only

Have you used alternative POI?

you must complete the proof of identity

No certification above.

Yes copies of these POI documents must be attached.

Office stamp

Page 8 Sensitive (when completed)

You might also like

- Work Visa Form Vaf2Document11 pagesWork Visa Form Vaf2Dilini Tennakoon100% (1)

- Passport Requirements Courtesy LaneDocument1 pagePassport Requirements Courtesy LaneMark VargasNo ratings yet

- Supplementary Join Family Application Form: New Delhi Visa Office, Embassy of IrelandDocument6 pagesSupplementary Join Family Application Form: New Delhi Visa Office, Embassy of Irelandkalligadu_143No ratings yet

- Separation Document - Ss293 1707en PDocument13 pagesSeparation Document - Ss293 1707en PMark LordNo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga83% (6)

- Application For A Permit For Residence or WorkDocument5 pagesApplication For A Permit For Residence or WorkmichnolidjNo ratings yet

- UK State Pension StatementDocument7 pagesUK State Pension StatementElmer LeonardNo ratings yet

- (Cooperative) BOD and Secretary CertificateDocument2 pages(Cooperative) BOD and Secretary CertificateReshel D. BulcaseNo ratings yet

- ISLU Mortgages Buy To Let - Application Form PDFDocument20 pagesISLU Mortgages Buy To Let - Application Form PDFges176No ratings yet

- Tax Change AddressDocument3 pagesTax Change AddressamoszhouNo ratings yet

- 3 - Form 3 Statement of Affairs22re 12042016 - 0Document25 pages3 - Form 3 Statement of Affairs22re 12042016 - 0Hang TuahNo ratings yet

- Application For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesDocument18 pagesApplication For Housing Assistance: Use This Form To Apply For Social Housing Assistance in New South WalesVincent HardyNo ratings yet

- Registration Form: (Private and Confidential Once Completed)Document7 pagesRegistration Form: (Private and Confidential Once Completed)Gideon AffleckNo ratings yet

- Application For Household Support GrantDocument5 pagesApplication For Household Support GrantgbabunetNo ratings yet

- DH3050 Tenancy Assistance Application 03.21Document16 pagesDH3050 Tenancy Assistance Application 03.21Sarah VirziNo ratings yet

- ATO Tax CompensationDocument3 pagesATO Tax CompensationJohnNo ratings yet

- AAT FormDocument10 pagesAAT Formrenniemac100% (2)

- Declaration of Service: Part A - General InformationDocument10 pagesDeclaration of Service: Part A - General InformationmistnehaNo ratings yet

- Application For Departing Australia Superannuation Payment (DASP) From A Super Fund or Retirement Savings AccountDocument6 pagesApplication For Departing Australia Superannuation Payment (DASP) From A Super Fund or Retirement Savings AccountAndrea Dr FanisNo ratings yet

- Inz 1202Document20 pagesInz 1202nad.liveNo ratings yet

- Ato 2011Document8 pagesAto 2011kms1978No ratings yet

- Request For Fee WaiverDocument11 pagesRequest For Fee WaiverWilma OcampoNo ratings yet

- Child Benefit Claim Form: Who Should Fill in This FormDocument9 pagesChild Benefit Claim Form: Who Should Fill in This FormNabeel MerchantNo ratings yet

- Collection Information Statement For Wage Earners and Self-Employed IndividualsDocument7 pagesCollection Information Statement For Wage Earners and Self-Employed IndividualsAnonymous dfLfinUrp60% (5)

- VAF2Document13 pagesVAF2Subin SamuelNo ratings yet

- Supplementary Welfare Allowance: Application Form ForDocument8 pagesSupplementary Welfare Allowance: Application Form ForHysen MashadNo ratings yet

- f8857 PDFDocument7 pagesf8857 PDFAnthony JacobsNo ratings yet

- Child B2Document9 pagesChild B2myscichowski1985No ratings yet

- Foreign Resident Capital Gains Withholding Clearance Certificate ApplicationDocument6 pagesForeign Resident Capital Gains Withholding Clearance Certificate Applicationcutegirl.m8No ratings yet

- CH2 Child Benefit Claim Form Internet 05 17Document9 pagesCH2 Child Benefit Claim Form Internet 05 17i1963877No ratings yet

- Vaf1 Guidance NotesDocument9 pagesVaf1 Guidance NotesAyatmirzaNo ratings yet

- Child Benefit Claim Form : Who Should Fill in This FormDocument9 pagesChild Benefit Claim Form : Who Should Fill in This Formஅருண் குமார் விNo ratings yet

- OMV Application FormDocument7 pagesOMV Application FormHamzah AhmedNo ratings yet

- VAF1 GuidanceDocument5 pagesVAF1 GuidanceNarcisa OrtizNo ratings yet

- Rent Supplement BenefsssDocument12 pagesRent Supplement Benefsssluizbila11No ratings yet

- CH2 EnglishDocument9 pagesCH2 EnglishamjadbonusNo ratings yet

- Form No Impediment MarriageDocument3 pagesForm No Impediment MarriageE QNo ratings yet

- Supplementary Visit Family /friend Application Form: New Delhi Visa Office, Embassy of IrelandDocument5 pagesSupplementary Visit Family /friend Application Form: New Delhi Visa Office, Embassy of Irelandkalligadu_143No ratings yet

- Inductions - Application For Employment - v1.5Document4 pagesInductions - Application For Employment - v1.5SEBASTIAN PULIDO MOJICANo ratings yet

- Revised GSK Application For Employment - With Criminal DisclosureDocument4 pagesRevised GSK Application For Employment - With Criminal DisclosurePravallika Rao TadepalliNo ratings yet

- Preview: Petition For A Nonimmigrant Worker: H1 ClassificationsDocument17 pagesPreview: Petition For A Nonimmigrant Worker: H1 ClassificationsSai Sunil ChandraaNo ratings yet

- Appendix 1 - Schools Volunteer Application FormDocument4 pagesAppendix 1 - Schools Volunteer Application FormHarry TiwanaNo ratings yet

- Supplementary Employment Application Form NdvoDocument7 pagesSupplementary Employment Application Form NdvoSamuel MutahiNo ratings yet

- Inz1000 PDFDocument32 pagesInz1000 PDFAbisath 0131No ratings yet

- V4.0 Asylum Support Application Form v4.4Document32 pagesV4.0 Asylum Support Application Form v4.4Haji Waseem qarghaiNo ratings yet

- Seasonal NSPDocument14 pagesSeasonal NSPsuzanneyell6No ratings yet

- NWB50014 Add A New Party To An Account 030615Document7 pagesNWB50014 Add A New Party To An Account 030615SumNo ratings yet

- @@@ Family Visitor Visa FormDocument15 pages@@@ Family Visitor Visa FormWIN NAINGNo ratings yet

- Working Family PaymentDocument12 pagesWorking Family PaymentGordonPhillipsNo ratings yet

- Form An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant SocietyDocument16 pagesForm An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant Societyjana a100% (1)

- When To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsDocument10 pagesWhen To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsLyley YAYNo ratings yet

- Register To Vote Anonymously Resident in EnglandDocument6 pagesRegister To Vote Anonymously Resident in EnglandRyan SmithNo ratings yet

- Comp FormDocument5 pagesComp Formsrsyffy9wfNo ratings yet

- Staff-App-form-2 2Document7 pagesStaff-App-form-2 2sarah sajjadNo ratings yet

- Questionnaire For Caregivers (Doc Format)Document9 pagesQuestionnaire For Caregivers (Doc Format)roxanne sarazaNo ratings yet

- Nurse Form 1 Application For Licensure: WWW - Op.nysed - GovDocument4 pagesNurse Form 1 Application For Licensure: WWW - Op.nysed - GovMarlyn BelizarioNo ratings yet

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- Ca5400 Application For A National Insurance NumberDocument4 pagesCa5400 Application For A National Insurance NumberSamuel MutahiNo ratings yet

- Ca 3916Document4 pagesCa 3916Fernando Mochales GutiérrezNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- RGD Deed Poll 11X8.5Document2 pagesRGD Deed Poll 11X8.5SSBaughNo ratings yet

- Important Notes:: Professional Regulation Commission Action Sheet For AuthenticationDocument1 pageImportant Notes:: Professional Regulation Commission Action Sheet For AuthenticationJessalyn RadaNo ratings yet

- Semi Detailed Lesson PlanDocument5 pagesSemi Detailed Lesson PlanJose MagalongNo ratings yet

- Affidavit of SINGLENESSDocument3 pagesAffidavit of SINGLENESSGrace MapaNo ratings yet

- Giron v. COMELEC G.R. No. 188179 (January 22, 2013)Document1 pageGiron v. COMELEC G.R. No. 188179 (January 22, 2013)carol anneNo ratings yet

- Constitutional LawDocument7 pagesConstitutional LawAqiel NaidooNo ratings yet

- Bus TCKTDocument1 pageBus TCKTajdubeyNo ratings yet

- Online Taiwanese Entry-Permit Application for Hong Kong and Macau Residents K05213708 S105595 男 Male 香港/HK 09 Oct 2006 107640984220 30 Jan 2018 30 Apr 2018 30日 / 30 daysDocument1 pageOnline Taiwanese Entry-Permit Application for Hong Kong and Macau Residents K05213708 S105595 男 Male 香港/HK 09 Oct 2006 107640984220 30 Jan 2018 30 Apr 2018 30日 / 30 daysKelvn KelvinNo ratings yet

- Law Making The Legislative Process in Wales and The UKDocument15 pagesLaw Making The Legislative Process in Wales and The UKjkjahkjahd987981723No ratings yet

- Crew List MV Big Horn RiverDocument1 pageCrew List MV Big Horn RiverEdwien Arif WicaksonoNo ratings yet

- Security CouncilDocument3 pagesSecurity CouncilPopular Youtube VideosNo ratings yet

- File PDFDocument1 pageFile PDFRaja RajanNo ratings yet

- Affidavit For Change in Appearance: Your Kids NameDocument1 pageAffidavit For Change in Appearance: Your Kids NameAmbicaMohanNo ratings yet

- Checklist - For JoiningDocument1 pageChecklist - For JoiningSabi SatharNo ratings yet

- LOD For HLDocument2 pagesLOD For HLPratik KapadiaNo ratings yet

- Garautha Batch 3Document3 pagesGarautha Batch 3DIAL SISNo ratings yet

- Biometric Letter BhartiDocument3 pagesBiometric Letter BhartiajayNo ratings yet

- MVV Issue FormDocument2 pagesMVV Issue FormSayNever100% (1)

- Composition of DPC - Dt. 07.07.2020Document5 pagesComposition of DPC - Dt. 07.07.2020Vanlal MuanpuiaNo ratings yet

- Salient Features of Indian ConstitutionDocument10 pagesSalient Features of Indian ConstitutionManvendra Shah (B18EE026)No ratings yet

- Torralba vs. Municipality of SibagatDocument3 pagesTorralba vs. Municipality of SibagatPam MiraflorNo ratings yet

- Uk Tier 4 Visa Checklist: Following Documents For Student Visa FilingDocument3 pagesUk Tier 4 Visa Checklist: Following Documents For Student Visa FilingWaleed ShafiqNo ratings yet

- 1 - Legal Basis RA 7077 & RA 9163Document1 page1 - Legal Basis RA 7077 & RA 9163Grace06 LabinNo ratings yet

- PDFDocument2 pagesPDFForam Patel0% (1)

- Fact Sheet Mba Pt@Esb 2024Document2 pagesFact Sheet Mba Pt@Esb 2024Tomislav VreskNo ratings yet

- (Application Form For Refugees) : For Official Use OnlyDocument1 page(Application Form For Refugees) : For Official Use OnlyManoj KhatriNo ratings yet

- Birth SHDocument1 pageBirth SHSan100% (1)

- Oprita Marius FR 2024-04-08 2024-04-09Document1 pageOprita Marius FR 2024-04-08 2024-04-09Dumitru IftodeNo ratings yet