Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsQs List

Qs List

Uploaded by

XINGSHI CHIENThe document provides a summary of past exam questions related to senior financial advisor roles and responsibilities. It covers three main parts: 1) the role of the senior financial advisor in capital structure and financial strategy formulation, 2) ethical and governance issues, and 3) trading and planning in multinational environments. The summary includes over 50 past questions from 2009 to 2020 related to these topics and the requirements of each question, such as to discuss, calculate, advise, or evaluate. The marks allocated for each question range from 4 to 28.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Original PDF Contemporary Financial Management 14th Edition PDFDocument41 pagesOriginal PDF Contemporary Financial Management 14th Edition PDFpaul.shropshire768100% (43)

- NPT-Pathfinder Course Chart - v2Document19 pagesNPT-Pathfinder Course Chart - v2divaamy4No ratings yet

- ICAI Aatmanirbhar Question Bank - by CA Shivam Palan V1-1Document293 pagesICAI Aatmanirbhar Question Bank - by CA Shivam Palan V1-1Shivanand MuleNo ratings yet

- Manual Vilter 440 and 450xlDocument41 pagesManual Vilter 440 and 450xlJose Antonio Yupa MedinaNo ratings yet

- Good Procurement Papua New GuineaDocument177 pagesGood Procurement Papua New GuineaMaaki MIAN100% (4)

- The Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government AccountingDocument14 pagesThe Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government Accountingjohn francisNo ratings yet

- Caiib Study PlanDocument17 pagesCaiib Study PlanPrabhat KrNo ratings yet

- Financial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestDocument89 pagesFinancial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestfelipeNo ratings yet

- Revision 2 - Investment AppraisalDocument27 pagesRevision 2 - Investment AppraisalVishal PrasadNo ratings yet

- V2 Plant PPT 22052023Document20 pagesV2 Plant PPT 22052023Laxmikant JoshiNo ratings yet

- List of Project TopicsDocument1 pageList of Project TopicsASHISH PATILNo ratings yet

- Atmanirbhar QNADocument501 pagesAtmanirbhar QNAsrushti thoratNo ratings yet

- Ok JnjjnjuntitledDocument1 pageOk Jnjjnjuntitledqy55685tzrNo ratings yet

- Topical Past Papers AnalysisDocument2 pagesTopical Past Papers AnalysisabdullahNo ratings yet

- Revision3 WCMGTDocument40 pagesRevision3 WCMGTlidibarvNo ratings yet

- Corporate Finance (Ross) ChaptersDocument1 pageCorporate Finance (Ross) ChaptersJayedNo ratings yet

- Study Plan JAIIB March 2019Document13 pagesStudy Plan JAIIB March 2019anand ShingadeNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Group Math AnalysisDocument2 pagesGroup Math AnalysisMD SAIFUL ISLAMNo ratings yet

- At Notes (Sir Brad's Lecture)Document31 pagesAt Notes (Sir Brad's Lecture)Alessandra CieloNo ratings yet

- BFD Past Paper AnalysisDocument8 pagesBFD Past Paper AnalysisAqib SheikhNo ratings yet

- Changes in Adv. AccountsDocument1 pageChanges in Adv. AccountsantiquehindustaniNo ratings yet

- Company Name: Financial Follow Up Report (FFR - I)Document4 pagesCompany Name: Financial Follow Up Report (FFR - I)Ravikanth MehtaNo ratings yet

- CF Unit GuideDocument3 pagesCF Unit GuideLinh Vo KhanhNo ratings yet

- Study Plan - JAIIB DEC 2019 Updated-1Document15 pagesStudy Plan - JAIIB DEC 2019 Updated-1ThulasiNo ratings yet

- Capital Adequacy Ratio - Class IIIDocument167 pagesCapital Adequacy Ratio - Class IIISachin PangeniNo ratings yet

- Topic Wise Summary FSCMDocument4 pagesTopic Wise Summary FSCMMadhvendra PandeyNo ratings yet

- MAC Past Paper AnalysisDocument6 pagesMAC Past Paper AnalysisAbdulAzeemNo ratings yet

- Slides FSA&SVDocument445 pagesSlides FSA&SVmatthias.vl.1204No ratings yet

- Exam+Question+AnalysisDocument6 pagesExam+Question+Analysissimran jeswaniNo ratings yet

- System TTM Section 10Document1 pageSystem TTM Section 10nizzam aminuddinNo ratings yet

- Full Download PDF of (Original PDF) Contemporary Financial Management 14th Edition All ChapterDocument43 pagesFull Download PDF of (Original PDF) Contemporary Financial Management 14th Edition All Chapterraeemhariss100% (3)

- Specialisation - Finance Management Batch Name - July 2017 (PG)Document1 pageSpecialisation - Finance Management Batch Name - July 2017 (PG)adi19_143No ratings yet

- Master of Finance Curriculum Overview: Intake 2018 / Class of 2020Document1 pageMaster of Finance Curriculum Overview: Intake 2018 / Class of 2020Pussy DestroyerNo ratings yet

- Accounting Principles (Theory) CMA Questions & SolutionsDocument32 pagesAccounting Principles (Theory) CMA Questions & SolutionsKamrul HassanNo ratings yet

- Axis Bluechip Fund (G) - Direct PlanDocument22 pagesAxis Bluechip Fund (G) - Direct PlanParag ChaudhariNo ratings yet

- Course Outline: Program: BBA Course Code: FIN 404 Course Title: Corporate FinanceDocument2 pagesCourse Outline: Program: BBA Course Code: FIN 404 Course Title: Corporate FinanceMd. Amin MiaNo ratings yet

- Emailing SPM PAST PAPER ANALYSIS W-22Document7 pagesEmailing SPM PAST PAPER ANALYSIS W-22Muhammad HamizNo ratings yet

- S4H - 315 F2S - Finance OverviewDocument11 pagesS4H - 315 F2S - Finance OverviewVidya PrasannaNo ratings yet

- 61684bos48086 50222bDocument214 pages61684bos48086 50222bDhanalakshmi BoorlagaddaNo ratings yet

- Course Outline Ba 111A - Strategic Management Wee K Dates ContentDocument2 pagesCourse Outline Ba 111A - Strategic Management Wee K Dates ContentMariane AmancioNo ratings yet

- Scope of Work V04 - Sample 26-06-2020Document2 pagesScope of Work V04 - Sample 26-06-2020arunjoshi12345No ratings yet

- As 2019Document161 pagesAs 2019John Ray RonaNo ratings yet

- Strategic Planning Session 7 - Rev0Document18 pagesStrategic Planning Session 7 - Rev0Mulan FridaNo ratings yet

- Fixed Income Investor PresentationDocument26 pagesFixed Income Investor PresentationsaxobobNo ratings yet

- Part B Water Row Appendices Full Spreads FinalDocument91 pagesPart B Water Row Appendices Full Spreads FinalasdNo ratings yet

- CA CPT Fast Track Revision Notes - CaCmaCsGuru PDFDocument111 pagesCA CPT Fast Track Revision Notes - CaCmaCsGuru PDFSatish Kumar SahuNo ratings yet

- Curmap 2020 ENTDocument4 pagesCurmap 2020 ENTNice BawiNo ratings yet

- CHP 12 - Practice Question List (By Sir Hasan Dossani)Document7 pagesCHP 12 - Practice Question List (By Sir Hasan Dossani)aditi shenoyNo ratings yet

- ACCA AAA - Monthly Study Plan: Introduction and Course InformationDocument3 pagesACCA AAA - Monthly Study Plan: Introduction and Course InformationMuyinda EricNo ratings yet

- MELC BusinessDocument5 pagesMELC BusinessRicyclops SummersNo ratings yet

- CMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleDocument1 pageCMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleNARAYANNo ratings yet

- PRA - Stefan Claus and Giorgis HadzilacosDocument11 pagesPRA - Stefan Claus and Giorgis HadzilacosValerio ScaccoNo ratings yet

- Accountancy 4Document3 pagesAccountancy 4Vinayak NegiNo ratings yet

- Cole Park CLO LimitedDocument22 pagesCole Park CLO Limitedeimg20041333No ratings yet

- Bus 251 D1 & D2 (19-2) : Financial Statement AnalysisDocument18 pagesBus 251 D1 & D2 (19-2) : Financial Statement AnalysisDinesh SunthareswaranNo ratings yet

- 17 Training CalendarDocument4 pages17 Training CalendarVijay GaikwadNo ratings yet

- De Fe Nse: Selected Acquisition Report (SAR)Document35 pagesDe Fe Nse: Selected Acquisition Report (SAR)bring it on100% (1)

- BLP - Fabm 2Document2 pagesBLP - Fabm 2Glaiza Dalayoan FloresNo ratings yet

- AFM (Week 5) (Q1) (1) REAL OPTION EXCELDocument2 pagesAFM (Week 5) (Q1) (1) REAL OPTION EXCELXINGSHI CHIENNo ratings yet

- CasasophiaDocument5 pagesCasasophiaXINGSHI CHIENNo ratings yet

- Tutorial 1 BMIT2703 Information and IT SecurityDocument3 pagesTutorial 1 BMIT2703 Information and IT SecurityXINGSHI CHIENNo ratings yet

- Guidance For Students - Google Doc and Run Originality Checking 202005Document6 pagesGuidance For Students - Google Doc and Run Originality Checking 202005XINGSHI CHIENNo ratings yet

- Case Study 3 2Document30 pagesCase Study 3 2XINGSHI CHIENNo ratings yet

- Kelantan. (Government of Malaysia V Government of The State of KELANTAN (1900) 1 MLJ 129)Document6 pagesKelantan. (Government of Malaysia V Government of The State of KELANTAN (1900) 1 MLJ 129)XINGSHI CHIENNo ratings yet

- Subordinate Courts in Malaysia: Have Jurisdiction in Both Civil and Criminal MattersDocument5 pagesSubordinate Courts in Malaysia: Have Jurisdiction in Both Civil and Criminal MattersXINGSHI CHIENNo ratings yet

- Aplicacion Corto 3Document5 pagesAplicacion Corto 3Garbel LemusNo ratings yet

- CSR Policy KsfeDocument6 pagesCSR Policy KsfeOhari NikshepamNo ratings yet

- Berklee Drum Notation FinaleDocument25 pagesBerklee Drum Notation Finalenbelane100% (2)

- Revenue and Treasury Management Offices in The PhilippinesDocument73 pagesRevenue and Treasury Management Offices in The Philippinesmarj berting67% (3)

- Caterpillar D6Document3 pagesCaterpillar D6RasoolKhadibi100% (1)

- SPG 3 - Afire LoveDocument281 pagesSPG 3 - Afire LoveMicheleNo ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- National: Cadet CorpsDocument6 pagesNational: Cadet CorpsVikesh NautiyalNo ratings yet

- Comm 318 OutlineDocument6 pagesComm 318 Outlineapi-657143147No ratings yet

- Renal Vegetarian NutritionDocument2 pagesRenal Vegetarian NutritionSg Balaji100% (1)

- Physics Part 2 Class Xii PDF FreeDocument263 pagesPhysics Part 2 Class Xii PDF FreeibbuarmNo ratings yet

- The Causative Fun Activities Games 1086Document2 pagesThe Causative Fun Activities Games 1086lemonbusNo ratings yet

- Branches of Medicine & Wards and Departements - EditkuDocument31 pagesBranches of Medicine & Wards and Departements - EditkuGigih Sanjaya PutraNo ratings yet

- ALSTOM Fuse Failure Relay VAPM31 High ResDocument4 pagesALSTOM Fuse Failure Relay VAPM31 High ResThirumalNo ratings yet

- Technicall Specification of 630 KVA, 11-0.415 KV Dry Type Outdoor Transformers.......... Dated. 31.08.2015Document25 pagesTechnicall Specification of 630 KVA, 11-0.415 KV Dry Type Outdoor Transformers.......... Dated. 31.08.2015spidervinoNo ratings yet

- ACCA P1 Study Guide OpenTuitionDocument4 pagesACCA P1 Study Guide OpenTuitionalauddinaloNo ratings yet

- 6yc Multifunction Meter: Operation ManualDocument46 pages6yc Multifunction Meter: Operation ManualHamish JosephNo ratings yet

- Math Manipulatives HandoutDocument38 pagesMath Manipulatives HandoutKeshav KundanNo ratings yet

- Tumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesDocument26 pagesTumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesStella NoviaNo ratings yet

- Anita Longley's LegacyDocument4 pagesAnita Longley's LegacyJill TietjenNo ratings yet

- Project Final Report TemplateDocument14 pagesProject Final Report Templatemonparaashvin0% (1)

- A Call For A Temporary Moratorium On "The DAO"Document13 pagesA Call For A Temporary Moratorium On "The DAO"SoftpediaNo ratings yet

- Samsung LN46D550K1FXZA Fast Track Guide (SM)Document4 pagesSamsung LN46D550K1FXZA Fast Track Guide (SM)Carlos OdilonNo ratings yet

- Alter IndexDocument64 pagesAlter IndexPiyush MandalNo ratings yet

- Fundamentals in Computer Investigations - General Digital ForensicsDocument60 pagesFundamentals in Computer Investigations - General Digital ForensicsMick YoNo ratings yet

- Astm d5453Document9 pagesAstm d5453aqmar aqeemNo ratings yet

- Aristo Alhakim IndonesiaDocument2 pagesAristo Alhakim Indonesiaaristo anadyaNo ratings yet

- Baku - Group - TourDocument4 pagesBaku - Group - TourZara Farooq SahiNo ratings yet

- CAPM in Capital BudgetingDocument2 pagesCAPM in Capital BudgetingNaga PraveenNo ratings yet

Qs List

Qs List

Uploaded by

XINGSHI CHIEN0 ratings0% found this document useful (0 votes)

15 views7 pagesThe document provides a summary of past exam questions related to senior financial advisor roles and responsibilities. It covers three main parts: 1) the role of the senior financial advisor in capital structure and financial strategy formulation, 2) ethical and governance issues, and 3) trading and planning in multinational environments. The summary includes over 50 past questions from 2009 to 2020 related to these topics and the requirements of each question, such as to discuss, calculate, advise, or evaluate. The marks allocated for each question range from 4 to 28.

Original Description:

Original Title

qs list

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a summary of past exam questions related to senior financial advisor roles and responsibilities. It covers three main parts: 1) the role of the senior financial advisor in capital structure and financial strategy formulation, 2) ethical and governance issues, and 3) trading and planning in multinational environments. The summary includes over 50 past questions from 2009 to 2020 related to these topics and the requirements of each question, such as to discuss, calculate, advise, or evaluate. The marks allocated for each question range from 4 to 28.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views7 pagesQs List

Qs List

Uploaded by

XINGSHI CHIENThe document provides a summary of past exam questions related to senior financial advisor roles and responsibilities. It covers three main parts: 1) the role of the senior financial advisor in capital structure and financial strategy formulation, 2) ethical and governance issues, and 3) trading and planning in multinational environments. The summary includes over 50 past questions from 2009 to 2020 related to these topics and the requirements of each question, such as to discuss, calculate, advise, or evaluate. The marks allocated for each question range from 4 to 28.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

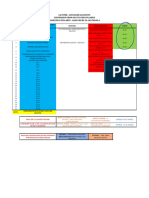

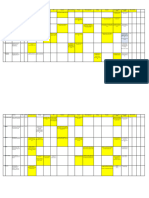

Part Knowledge point Past Paper Question Requirement Marks

Jun-12 Q3(c) - capital structure Discuss 9

1 The role of the senior

Sep/Dec-17 Q1(a) - capital structure - benefit of debt financing Discuss 7

financial advisor

Mar/Jun-18 Q2(b) - shareholders, convertible loan notes Discuss 8

Dec-09 Q2(a)(b) - risks, EVA, ratios Outline, Summarise 18

Dec-10 Q4 - dividend capacity Calculate, comment and suggest 20

Jun-11 Q5 - issue to commercialise new products and mitigation Discuss 17

Dec-11 Q4(b)(c) - gearing Calculate and discuss 14

Jun-12 Q2(a) - EPS,gearing Estimate, discuss 20

Jun-12 Q5(a) - risks and mitigation Discuss 15

Jun-13 Q1(a)(iv) - issuing shares and listing Advise, discuss, explain and assess 12

Jun-13 Q4 - dividend, financing, risk management policy, share buyback Discuss, evaluate, calculate 25

Dec-13 Q1(b)(iii) - business risk Discuss 14

Dec-14 Q4 - EVA, ratio analysis Discuss, evaluate 25

Jun-15 Q3(b) - ratio,gearing Estimate 12

2 Financial strategy

Mar/Jun-16 Q1(b)(i)(iii)(iv) - dividend capacity, financing Estimate 26

formulation

Sep/Dec-16 Q1(a)(c) - bizz & fin risk, risk mitigation & diversification, risk mgmt Explain 13

Sep/Dec-16 Q3(a) - dividend policies Calculate, discuss 15

Mar/Jun-17 Q1(c) - listing Discuss 4

Mar/Jun-17 Q2 - source of finance, risk and mitigation, behavioural finance Discuss, describe, explain, assess 25

Sep/Dec-17 Q3 - Financial performance, ratios and trends, financing decision Evaluate, calculate, discuss 25

Mar/Jun-18 Q3(a) Dividend capacity and policies Estimate, discuss 25

Sep-18 Q2(a) - performance evaluation (ratios and trend), behavioural factors Evaluate 25

Dec-18 Q3(b) - long-term finance policy Discuss 10

Sep/Dec-19 Q1(d) - risk management Discuss 6

Part A Sep/Dec-19 Q2(a)(b) - dividend capacity, dividend policy Calculate, discuss 17

Role of the Mar-20 Q3(b) - capital investment monitoring Explain, suggest 8

senior financial Jun-09 Q4 - ethical issues Advise 20

advisor Dec-11 Q5 - TBL Explain, discuss 18

Jun-13 Q1(b) - ethical issues Discuss 8

3 Ethical and Mar/Jun-16 Q3(b) - stakeholder, ethical issues Discuss 6

governance issues Mar/Jun-19 Q1(c) - sustainability and ethical issues Discuss, advise 10

Mar/Jun-19 Q3(c) - communication to shareholders and stakeholders Discuss 5

Sep/Dec-19 Q2(c) - governance and ethical issues for dividend and remuneration Discuss 8

Sep/Dec-20 Q1(c) - employee remuneration Discuss 8

Dec-09 Q4 - Global debt market, loan syndication vs bond issue, capital investment and global Advise, assess 20

economic cycle

Jun-10 Q3 - tranching, securitisation, sensitivity Calculate, explain and discuss 20

Dec-10 Q5 - Joint venture advantages and disadvantages Discuss 20

Jun-12 Q5(b) - dark pool trading Explain 5

Dec-12 Q5 - IMF, EU,austerity measure,risk Explain, suggest, discuss 20

4a Trading in a

multinational

environment

4a Trading in a Dec-13 Q1(a) - WTO Discuss 9

multinational Dec-14 Q1(b) - EU Discuss 4

environment Dec-14 Q3(a) - EU, free trade area Discuss 5

Jun-15 Q1(a) - subsidiary vs licensing Discuss 5

Jun-15 Q2(a) - dark pool Explain 5

Sep/Dec-15 Q4(a)(b) - tranching,securitisation Calculate, discuss 17

Mar/Jun-16 Q4(c) - World bank, IDA Discuss 4

Jun-14 Q1(d)(ii) - agency issue Discuss 9

4b Planning in a Dec-14 Q3(c) - legal risk Discuss 7

multinational Mar/Jun-18 Q4(c) - transfer price Evaluate 6

environment Specimen exam Q1(d) - risk management and agency issue Discuss 22

(Sep18)

Part Knowledge point Past Paper Question Requirement Marks

Jun-09 Q5 - IRR, Profitability index (single period capital rationing) Calculation, estimate and advise 20

Jun-09 Q1 - NPV, sensitivity analysis, discounted payback period Project evaluation, estimate & recommend 28

Dec-09 Q5(c) - VAR Estimate 6

Jun-10 Q1 - NPV, uncertainties, sensitivity analysis, Monte Carlo simulation Estimate, discuss, explain 28

Jun-12 Q4(b)(c) - IRR, MIRR and VAR Calculate, recommend, estimate 12

5 Discounted cash flow Dec-12 Q4 - sensitivity analysis and Multi- period capital rationing Calculate and comment, explain 20

techniques Dec-13 Q1(b)(i) - NPV and assumption Calculate and recommend 14

Dec-14 Q3(b) - IRR, MIRR, VAR Calculate and recommend 13

Sep/Dec-16 Q2 - NPV and duration, sensitivity analysis Evaluate, calculate, discuss 25

Specimen (Sep18) Q1(c) - modified duration Calculate and explain 7

Mar/Jun-19 Q1(b)(i)(iii) - NPV & assumptions Estimate, assess 22

Mar-20 Q3(a) - NPV, expected value, Evaluate, calculate, recommend 17

Dec-09 Q3 - Option valuation and assumption Estimate and discuss 20

Jun-11 Q4 - option to delay and valuation Estimate and discuss 17

Jun-12 Q1(iii) - option to delay valuation Estimate 8

6 Application of option

Dec-13 Q1(b)(ii) - option to abandon and assumption Calculate and recommend 9

pricing theory in

Jun-14 Q4(a) - option Discuss, explain 11

investment decision

Mar/Jun-16 Q4(a)(b) - option to expand Calculate, assess, explain 21

Mar/Jun-18 Q1(b) - real option Discuss 5

Mar/Jun-19 Q1(a)(b)(ii) - real option Discuss, estimate 14

Dec-10 Q2 - APV, appropriateness and assumptions Evaluate, discuss and explain 25

Jun-11 Q3- Macaulay duration Estimate and discuss 17

Jun-12 Q4(a) - CAPM, geared beta and WACC Calculate 8

Part B Dec-12 Q1(a)(b) - CAPM, geared beta and WACC Calculate and comment, explain 20

Jun-13 Q1(a) (i)- ungeared and regeared Calculate and explain 7

Advanced 7a Impact of financing Dec-13 Q4(c) - Islamic finance (Musharaka,Mudaraba) Discuss 12

investment on investment decisions Jun-14 Q1(c) - modified duration Calculate and explain 7

appraisal and adjusted present Jun-14 Q2 - APV Calculate and comment 25

value Dec-14 Q2(c) - Islamic finance (Salam) Discuss 4

Sep/Dec-15 Q4(c) - Islamic finance (Sukuk,Mudaraba) Discuss 8

Sep/Dec-16 Q1(b) - cost of capital and forecast financial position Estimate, discuss 37

Mar/Jun-17 Q4 - bond valuation, credit rating Calculate, discuss 25

Sep/Dec-17 Q1(b) - bond valuation, Macaulay duration, credit rating, forecast financial position, Estimate, comment and discuss 43

impact on equity holder, debt holder

Mar/Jun-18 Q2(a) - APV Calculate, conclude 17

Specimen (Sep18) Q2 - APV Calculate and comment 25

Dec-18 Q3(a) - APV Calculate, conclude 15

Sep/Dec-19 Q1(a)(b) - APV vs NPV, Estimate APV and discuss the assumptions, Duration Discuss, estimate, evaluate and justify 40

Sep/Dec-20 Q1(b) - Ba formula, CAPM,WACC,reaction of equity and bondholder Estimate, discuss 24

Dec-11 Q3 - bond yield and valuation Calculate, advise, briefly explain 18

7b Valuation and the

use of free cash flows

Jun-12 Q1(i) - valuation using free cash flow Calculation 7

7b Valuation and the Jun-13 Q1(a)(ii) - valuation Calculation 14

use of free cash flows Jun-14 Q4(b) - Valuation (option pricing) Discuss 9

Sep/Dec-16 Q3(b) - market capitalisation vs dividend valuation Calculate, discuss 10

Sep/Dec-20 Q1(b) - bond yield and valuation Estimate, discuss 7

Dec-11 Q1 - international investment and APV Evaluate and discuss 39

Jun-15 Q1(b) - international project Evaluate, discuss, recommend 45

8 International

Mar/Jun-16 Q1(a) - purchasing power parity Explain 6

investment and

Sep-18 Q1(a)(c)(ii) - international investment Discuss, estimate 14

financing decisions

Sep/Dec-19 Q1(c) - Economic risk and how to manage Discuss 4

Sep/Dec-20 Q2 - international investment Evaluate, explain, discuss

Part Knowledge point Past Paper Question Requirement Marks

Jun-13 Q2(a) - synergy Discuss 9

Jun-14 Q3(a)(b) - organic growth vs Discuss 11

9 Acquisitions and Dec-14 Q1(a) - acquisition strategies Discuss 7

mergers versus other Mar/Jun-16 Q2(a) - acquisition adv.& disadv. Discuss 6

growth strategies Mar/Jun-17 Q1(a) - reverse takeover vs IPO Explain, discuss 9

Dec-18 Q1(d) - reverse takeover vs IPO Distinguish, discuss 8

Sep/Dec-19 Q3(a) - sources of financial synergy, overestimate synergy + action Discuss, comment 8

Dec-09 Q1 - Valuation - FCFE, terminal value, assumptions & uncertainties & option pricing Prepare CF forecast, estimate and advise 28

Jun-10 Q2 - Valuation - FCF, BSOP Estimate, explain, and discuss 32

Jun-11 Q1(i)(ii)(v)- M&A valuation, capital structure, defence strategy Evaluate, discuss, estimate, explain and ass 25

Jun-12 Q1(ii)(iv) - mergers and acquisitions valuation Estimate, discuss 16

Jun-13 Q2(b) - valuation and max acquisition premium Calculate 6

Dec-13 Q3(a)(b) - valuation of M&A (FCF) Estimate, comment, discuss 18

10 Valuation of Jun-14 Q3(c) - valuation of M&A Estimate, explain 14

acquisitions and mergers Dec-14 Q1(c) - valuation of M&A Estimate, evaluate 35

Sep/Dec-15 Q1(b) - valuation of M&A Estimate, assess, advise 30

Part C Mar/Jun-18 Q1(a)(b) - valuation of M&A, Compare, prepare a report, estimate, 37

Acquisitions and Specimen (Sep18) Q3 - synergies, acquisition premium Distinguish, discuss, calculate, explain 25

mergers Sep-18 Q3(a)(b) valuation of M&A and Estimate, evaluate 19

Dec-18 Q1(c)(i) - valuatiion of M&A Estimate 10

Mar-20 Q1(a)(b) - behavioural factors, valuation(P/E), WACC (combined co), value gain from acq Discuss, compare, calculate, estimate, 42

Dec-12 Q3 (b) - global regulatory framework Discuss 4

11 Regulatory

Sep/Dec-15 Q1(d) - takeover regulation Explain 6

framework and

Mar/Jun-18 Q1(d) - mandatory bid rule Discuss 8

processes

Sep/Dec-20 Q1(a) - defence strategies Discuss 7

Jun-11 Q1(iii)(iv) - financing acquisition Estimate and explain 7

Dec-12 Q3(a) - Financing M&A Estimate, comment 16

Jun-13 Q2(c) - acquisition payment method Calculate and justify 10

Dec-13 Q3(c) - financing acquisition Estimate and discuss 7

12 Financing mergers Mar/Jun-16 Q2(b)(c) - P/E ratio and EPS Calculate, comment 19

and acquisitions Sep-18 Q3(c) - source of finance Discuss 6

Dec-18 Q1(c)(ii)(iii) - % gain in value for cash, share-for-share, mixed offer and likely action Estimate, evaluate 19

Q3(b)(c) - share-for-share exchange offer, effect of cash and share-for- share offers on

Sep/Dec-19 Advise, calculate, discuss 17

the shareholders' wealth, and shareholders reaction

Mar-20 Q1(c) - factors determined offer finance and gearing Discuss 8

Part Knowledge point Past Paper Question Requirement Marks

Dec-09 Q2(c)(d) - impact of acquisition on beta and Ke Estimate and evaluate 10

13 Financial

Jun-13 Q1(a)(iii)equity-for-debt Calculate and advise 5

reconstruction

Sep/Dec-15 Q3 - share repurchase, refinancing Prepare projected statement, evaluate 25

Jun-09 Q2 - Unbundling impact - SFP, EPS and WACC Comparative statement, estimate & evalua 32

Jun-10 Q4 - Issues of disposing division, risks involved Outline 20

Part D Dec-10 Q1 -cease, restructuring & MBO, financing and impact on the parties involved Evaluate, discuss and suggest 35

Corporate Dec-11 Q4(a) - MBO Discuss, calculate 4

reconstruction Dec-12 Q1(c) - demerger Explain 8

and Dec-13 Q4(a)(b) - disposal, demerger Calculate, advise, discuss 25

reorganisation Jun-15 Q2(b) - dispose Calculate and discuss 20

14 Business Jun-15 Q3(a)(c) - MBO,MBI Distinguish, discuss 13

reorganisation Sep/Dec-15 Q1(a)(c) - sell-off,MBI,disposing assets as defence strategy Distinguish, discuss 10

Mar/Jun-16 Q3(a) - disposing Evaluate 19

Mar/Jun-17 Q1(b) - restructuring - SFP, estimate value, impact on the parties Estimate, explain, discuss 37

Sep/Dec-17 Q2 - divest, impact on financial position, forecast EPS and WACC Calculate and evaluate 25

Dec-18 Q1(a)(b) - MBO vs MBI, portfolio restructuring and org restructuring Distinguish, discuss, explain 9

Mar/Jun-19 Q3(a)(b) - demerger, WACC and FCF valuation Discuss, calculate 20

Part Knowledge point Past Paper Question Requirement Marks

Jun-12 Q2(b) - securitisation Explain 5

Dec-14 Q2(b) - centralised treasury dept Discuss 6

15 The role of the

Sep/Dec-17 Q4(b) - separate treasury function vs single global treasury function Discuss 7

treasury function in

Sep-18 Q1(d) - centralised and decentralised treasury department Discuss 7

multinationals

Mar/Jun-19 Q2(c) - treasury function Criticise 5

Mar-20 Q2(a) - hedging policy and communication to stakeholders Explain 7

Jun-09 Q3 - forward exchange rate, currency swap Estimate, outline 20

Jun-10 Q5 - Netting, advantages and disadvantages Calculate and discuss 20

Jun-11 Q2 - hedging (forward, futures, option), swap Advise and recommend, estimate, calculate 30

Dec-12 Q2 - transaction risk, translation risk, economic risk, hedging Explain, recommend, compute and discuss 27

Jun-13 Q3(a)(b) - hedging (forward, money market, options, netting) Calculate, advise and recommend 22

16 The use of financial Jun-14 Q1(a) - hedging (forward, futures, options) Calculate, advise 15

Jun-14 Q1(d) - management of foreign exchange exposure Discuss 9

derivatives to hedge

Sep/Dec-15 Q2(a) - netting Calculate, discuss 11

against foreign exchange

Mar/Jun-16 Q1(b)(ii) - hedging strategy Advise, recommend 14

risk

Mar/Jun-17 Q3 - currency swap, options Discuss, calculate, evaluate 25

Part E Mar/Jun-18 Q4(a)(b) - hedging (money market, futures, multilateral netting) Advise, calculate, discuss 19

Treasury and Specimen (Sep18) Q1(a) - hedging (forward, futures, options) Advise 15

advanced risk Sep-18 Q1(b)(c)(i)(iii) exchange traded option vs OTC option, forex hedging Discuss, estimate 25

management Dec-18 Q2 - exchange-traded derivatives (futures, option), forward vs OTC option, mark-to- Evaluate, discuss, explain, illustrate 25

techniques Mar-20 Q2(b)(c) - hedging (forward, futures, options), futures mark-to-market Recommend, calculate and explain 18

Dec-09 Q5(a)(b) - interest rate risk hedge, swap Evaluate, recommend and estimate 14

Dec-10 Q3 - hedge ratio Estimate, explain and discuss 20

Dec-11 Q2 - hedging interest rate risk (futures, options, collar), basis risk Discuss, recommend 25

Jun-12 Q3(a)(b)- swap Calculate, explain 11

Jun-13 Q3(d) - gamma Explain 3

Dec-13 Q2 - hedging (forward, futures, options), delta Calculate, recommend, discuss 25

Jun-14 Q1(b)(d) - swap, management of interest rate exposure Demonstrate, discuss 15

17 The use of financial

Jun-14 Q4(c) - vega and option value Explain 5

derivatives to hedge

Dec-14 Q2(a) - hedging (traded options, swaps) Calculate, discuss 15

against interest rate risk

Jun-15 Q4 - hedging (futures, options, collar), mark-to-market Calculate, discuss 25

Sep/Dec-15 Q2(b) - option, collars Calculate, comment 14

Sep/Dec-16 Q4 - estimate forward rates, swap Calculate, comment, advise. Discuss 25

Sep/Dec-17 Q4(a) - hedging - FRA, futures, options on futures Recommend, calculation and discussion 18

Specimen (Sep18) Q1(b) - Swap Demonstrate 6

Mar/Jun-19 Q2(a)(b) - options, swap, Calculation, comment, discuss 20

Sep/Dec-20 Q3 - Swap, Collar, greeks Calculate, comment, discuss, explain 25

You might also like

- Original PDF Contemporary Financial Management 14th Edition PDFDocument41 pagesOriginal PDF Contemporary Financial Management 14th Edition PDFpaul.shropshire768100% (43)

- NPT-Pathfinder Course Chart - v2Document19 pagesNPT-Pathfinder Course Chart - v2divaamy4No ratings yet

- ICAI Aatmanirbhar Question Bank - by CA Shivam Palan V1-1Document293 pagesICAI Aatmanirbhar Question Bank - by CA Shivam Palan V1-1Shivanand MuleNo ratings yet

- Manual Vilter 440 and 450xlDocument41 pagesManual Vilter 440 and 450xlJose Antonio Yupa MedinaNo ratings yet

- Good Procurement Papua New GuineaDocument177 pagesGood Procurement Papua New GuineaMaaki MIAN100% (4)

- The Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government AccountingDocument14 pagesThe Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government Accountingjohn francisNo ratings yet

- Caiib Study PlanDocument17 pagesCaiib Study PlanPrabhat KrNo ratings yet

- Financial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestDocument89 pagesFinancial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestfelipeNo ratings yet

- Revision 2 - Investment AppraisalDocument27 pagesRevision 2 - Investment AppraisalVishal PrasadNo ratings yet

- V2 Plant PPT 22052023Document20 pagesV2 Plant PPT 22052023Laxmikant JoshiNo ratings yet

- List of Project TopicsDocument1 pageList of Project TopicsASHISH PATILNo ratings yet

- Atmanirbhar QNADocument501 pagesAtmanirbhar QNAsrushti thoratNo ratings yet

- Ok JnjjnjuntitledDocument1 pageOk Jnjjnjuntitledqy55685tzrNo ratings yet

- Topical Past Papers AnalysisDocument2 pagesTopical Past Papers AnalysisabdullahNo ratings yet

- Revision3 WCMGTDocument40 pagesRevision3 WCMGTlidibarvNo ratings yet

- Corporate Finance (Ross) ChaptersDocument1 pageCorporate Finance (Ross) ChaptersJayedNo ratings yet

- Study Plan JAIIB March 2019Document13 pagesStudy Plan JAIIB March 2019anand ShingadeNo ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Group Math AnalysisDocument2 pagesGroup Math AnalysisMD SAIFUL ISLAMNo ratings yet

- At Notes (Sir Brad's Lecture)Document31 pagesAt Notes (Sir Brad's Lecture)Alessandra CieloNo ratings yet

- BFD Past Paper AnalysisDocument8 pagesBFD Past Paper AnalysisAqib SheikhNo ratings yet

- Changes in Adv. AccountsDocument1 pageChanges in Adv. AccountsantiquehindustaniNo ratings yet

- Company Name: Financial Follow Up Report (FFR - I)Document4 pagesCompany Name: Financial Follow Up Report (FFR - I)Ravikanth MehtaNo ratings yet

- CF Unit GuideDocument3 pagesCF Unit GuideLinh Vo KhanhNo ratings yet

- Study Plan - JAIIB DEC 2019 Updated-1Document15 pagesStudy Plan - JAIIB DEC 2019 Updated-1ThulasiNo ratings yet

- Capital Adequacy Ratio - Class IIIDocument167 pagesCapital Adequacy Ratio - Class IIISachin PangeniNo ratings yet

- Topic Wise Summary FSCMDocument4 pagesTopic Wise Summary FSCMMadhvendra PandeyNo ratings yet

- MAC Past Paper AnalysisDocument6 pagesMAC Past Paper AnalysisAbdulAzeemNo ratings yet

- Slides FSA&SVDocument445 pagesSlides FSA&SVmatthias.vl.1204No ratings yet

- Exam+Question+AnalysisDocument6 pagesExam+Question+Analysissimran jeswaniNo ratings yet

- System TTM Section 10Document1 pageSystem TTM Section 10nizzam aminuddinNo ratings yet

- Full Download PDF of (Original PDF) Contemporary Financial Management 14th Edition All ChapterDocument43 pagesFull Download PDF of (Original PDF) Contemporary Financial Management 14th Edition All Chapterraeemhariss100% (3)

- Specialisation - Finance Management Batch Name - July 2017 (PG)Document1 pageSpecialisation - Finance Management Batch Name - July 2017 (PG)adi19_143No ratings yet

- Master of Finance Curriculum Overview: Intake 2018 / Class of 2020Document1 pageMaster of Finance Curriculum Overview: Intake 2018 / Class of 2020Pussy DestroyerNo ratings yet

- Accounting Principles (Theory) CMA Questions & SolutionsDocument32 pagesAccounting Principles (Theory) CMA Questions & SolutionsKamrul HassanNo ratings yet

- Axis Bluechip Fund (G) - Direct PlanDocument22 pagesAxis Bluechip Fund (G) - Direct PlanParag ChaudhariNo ratings yet

- Course Outline: Program: BBA Course Code: FIN 404 Course Title: Corporate FinanceDocument2 pagesCourse Outline: Program: BBA Course Code: FIN 404 Course Title: Corporate FinanceMd. Amin MiaNo ratings yet

- Emailing SPM PAST PAPER ANALYSIS W-22Document7 pagesEmailing SPM PAST PAPER ANALYSIS W-22Muhammad HamizNo ratings yet

- S4H - 315 F2S - Finance OverviewDocument11 pagesS4H - 315 F2S - Finance OverviewVidya PrasannaNo ratings yet

- 61684bos48086 50222bDocument214 pages61684bos48086 50222bDhanalakshmi BoorlagaddaNo ratings yet

- Course Outline Ba 111A - Strategic Management Wee K Dates ContentDocument2 pagesCourse Outline Ba 111A - Strategic Management Wee K Dates ContentMariane AmancioNo ratings yet

- Scope of Work V04 - Sample 26-06-2020Document2 pagesScope of Work V04 - Sample 26-06-2020arunjoshi12345No ratings yet

- As 2019Document161 pagesAs 2019John Ray RonaNo ratings yet

- Strategic Planning Session 7 - Rev0Document18 pagesStrategic Planning Session 7 - Rev0Mulan FridaNo ratings yet

- Fixed Income Investor PresentationDocument26 pagesFixed Income Investor PresentationsaxobobNo ratings yet

- Part B Water Row Appendices Full Spreads FinalDocument91 pagesPart B Water Row Appendices Full Spreads FinalasdNo ratings yet

- CA CPT Fast Track Revision Notes - CaCmaCsGuru PDFDocument111 pagesCA CPT Fast Track Revision Notes - CaCmaCsGuru PDFSatish Kumar SahuNo ratings yet

- Curmap 2020 ENTDocument4 pagesCurmap 2020 ENTNice BawiNo ratings yet

- CHP 12 - Practice Question List (By Sir Hasan Dossani)Document7 pagesCHP 12 - Practice Question List (By Sir Hasan Dossani)aditi shenoyNo ratings yet

- ACCA AAA - Monthly Study Plan: Introduction and Course InformationDocument3 pagesACCA AAA - Monthly Study Plan: Introduction and Course InformationMuyinda EricNo ratings yet

- MELC BusinessDocument5 pagesMELC BusinessRicyclops SummersNo ratings yet

- CMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleDocument1 pageCMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleNARAYANNo ratings yet

- PRA - Stefan Claus and Giorgis HadzilacosDocument11 pagesPRA - Stefan Claus and Giorgis HadzilacosValerio ScaccoNo ratings yet

- Accountancy 4Document3 pagesAccountancy 4Vinayak NegiNo ratings yet

- Cole Park CLO LimitedDocument22 pagesCole Park CLO Limitedeimg20041333No ratings yet

- Bus 251 D1 & D2 (19-2) : Financial Statement AnalysisDocument18 pagesBus 251 D1 & D2 (19-2) : Financial Statement AnalysisDinesh SunthareswaranNo ratings yet

- 17 Training CalendarDocument4 pages17 Training CalendarVijay GaikwadNo ratings yet

- De Fe Nse: Selected Acquisition Report (SAR)Document35 pagesDe Fe Nse: Selected Acquisition Report (SAR)bring it on100% (1)

- BLP - Fabm 2Document2 pagesBLP - Fabm 2Glaiza Dalayoan FloresNo ratings yet

- AFM (Week 5) (Q1) (1) REAL OPTION EXCELDocument2 pagesAFM (Week 5) (Q1) (1) REAL OPTION EXCELXINGSHI CHIENNo ratings yet

- CasasophiaDocument5 pagesCasasophiaXINGSHI CHIENNo ratings yet

- Tutorial 1 BMIT2703 Information and IT SecurityDocument3 pagesTutorial 1 BMIT2703 Information and IT SecurityXINGSHI CHIENNo ratings yet

- Guidance For Students - Google Doc and Run Originality Checking 202005Document6 pagesGuidance For Students - Google Doc and Run Originality Checking 202005XINGSHI CHIENNo ratings yet

- Case Study 3 2Document30 pagesCase Study 3 2XINGSHI CHIENNo ratings yet

- Kelantan. (Government of Malaysia V Government of The State of KELANTAN (1900) 1 MLJ 129)Document6 pagesKelantan. (Government of Malaysia V Government of The State of KELANTAN (1900) 1 MLJ 129)XINGSHI CHIENNo ratings yet

- Subordinate Courts in Malaysia: Have Jurisdiction in Both Civil and Criminal MattersDocument5 pagesSubordinate Courts in Malaysia: Have Jurisdiction in Both Civil and Criminal MattersXINGSHI CHIENNo ratings yet

- Aplicacion Corto 3Document5 pagesAplicacion Corto 3Garbel LemusNo ratings yet

- CSR Policy KsfeDocument6 pagesCSR Policy KsfeOhari NikshepamNo ratings yet

- Berklee Drum Notation FinaleDocument25 pagesBerklee Drum Notation Finalenbelane100% (2)

- Revenue and Treasury Management Offices in The PhilippinesDocument73 pagesRevenue and Treasury Management Offices in The Philippinesmarj berting67% (3)

- Caterpillar D6Document3 pagesCaterpillar D6RasoolKhadibi100% (1)

- SPG 3 - Afire LoveDocument281 pagesSPG 3 - Afire LoveMicheleNo ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- National: Cadet CorpsDocument6 pagesNational: Cadet CorpsVikesh NautiyalNo ratings yet

- Comm 318 OutlineDocument6 pagesComm 318 Outlineapi-657143147No ratings yet

- Renal Vegetarian NutritionDocument2 pagesRenal Vegetarian NutritionSg Balaji100% (1)

- Physics Part 2 Class Xii PDF FreeDocument263 pagesPhysics Part 2 Class Xii PDF FreeibbuarmNo ratings yet

- The Causative Fun Activities Games 1086Document2 pagesThe Causative Fun Activities Games 1086lemonbusNo ratings yet

- Branches of Medicine & Wards and Departements - EditkuDocument31 pagesBranches of Medicine & Wards and Departements - EditkuGigih Sanjaya PutraNo ratings yet

- ALSTOM Fuse Failure Relay VAPM31 High ResDocument4 pagesALSTOM Fuse Failure Relay VAPM31 High ResThirumalNo ratings yet

- Technicall Specification of 630 KVA, 11-0.415 KV Dry Type Outdoor Transformers.......... Dated. 31.08.2015Document25 pagesTechnicall Specification of 630 KVA, 11-0.415 KV Dry Type Outdoor Transformers.......... Dated. 31.08.2015spidervinoNo ratings yet

- ACCA P1 Study Guide OpenTuitionDocument4 pagesACCA P1 Study Guide OpenTuitionalauddinaloNo ratings yet

- 6yc Multifunction Meter: Operation ManualDocument46 pages6yc Multifunction Meter: Operation ManualHamish JosephNo ratings yet

- Math Manipulatives HandoutDocument38 pagesMath Manipulatives HandoutKeshav KundanNo ratings yet

- Tumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesDocument26 pagesTumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesStella NoviaNo ratings yet

- Anita Longley's LegacyDocument4 pagesAnita Longley's LegacyJill TietjenNo ratings yet

- Project Final Report TemplateDocument14 pagesProject Final Report Templatemonparaashvin0% (1)

- A Call For A Temporary Moratorium On "The DAO"Document13 pagesA Call For A Temporary Moratorium On "The DAO"SoftpediaNo ratings yet

- Samsung LN46D550K1FXZA Fast Track Guide (SM)Document4 pagesSamsung LN46D550K1FXZA Fast Track Guide (SM)Carlos OdilonNo ratings yet

- Alter IndexDocument64 pagesAlter IndexPiyush MandalNo ratings yet

- Fundamentals in Computer Investigations - General Digital ForensicsDocument60 pagesFundamentals in Computer Investigations - General Digital ForensicsMick YoNo ratings yet

- Astm d5453Document9 pagesAstm d5453aqmar aqeemNo ratings yet

- Aristo Alhakim IndonesiaDocument2 pagesAristo Alhakim Indonesiaaristo anadyaNo ratings yet

- Baku - Group - TourDocument4 pagesBaku - Group - TourZara Farooq SahiNo ratings yet

- CAPM in Capital BudgetingDocument2 pagesCAPM in Capital BudgetingNaga PraveenNo ratings yet