Professional Documents

Culture Documents

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Uploaded by

خاءيمي خالدCopyright:

Available Formats

You might also like

- My - Bill - 16 Nov, 2023 - 15 Dec, 2023 - 778610258881Document1 pageMy - Bill - 16 Nov, 2023 - 15 Dec, 2023 - 778610258881Ravi RanjanNo ratings yet

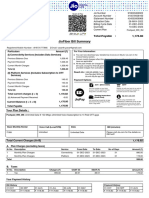

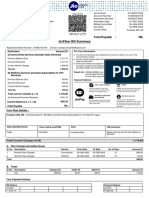

- Jiofiber Bill Summary: Total Payable 1,178.82Document1 pageJiofiber Bill Summary: Total Payable 1,178.82Dharma kurra100% (1)

- Workday Compensation OverviewDocument11 pagesWorkday Compensation OverviewHaritha100% (1)

- Connectors Linking Words - 61564Document2 pagesConnectors Linking Words - 61564ElisabeteRibeiro100% (1)

- Proof Submission User Manual 2023-24 1Document28 pagesProof Submission User Manual 2023-24 1Arun APNo ratings yet

- Actax 3254: Business Taxation: Business Taxes/Business TransactionsDocument2 pagesActax 3254: Business Taxation: Business Taxes/Business TransactionsJhon Ray RabaraNo ratings yet

- Seminar 2 - Heads of ChargeDocument8 pagesSeminar 2 - Heads of ChargeYong Kwang HanNo ratings yet

- CH4 EditedDocument56 pagesCH4 EditedMukemil AbrarNo ratings yet

- Accounts Theory 21 Marks CTC ClassesDocument8 pagesAccounts Theory 21 Marks CTC Classeskhushalpareek8584No ratings yet

- ACCT 504 MART Perfect EducationDocument63 pagesACCT 504 MART Perfect Educationdavi.dwNo ratings yet

- BMS - Human Resource Management zNC4xtSDocument3 pagesBMS - Human Resource Management zNC4xtSishaNo ratings yet

- InterNet Bill Mar 2024Document2 pagesInterNet Bill Mar 2024dhinu8502No ratings yet

- Advanced Taxation - Study TextDocument286 pagesAdvanced Taxation - Study Textmulika99No ratings yet

- changeDocument1 pagechangesubham220915No ratings yet

- Employer Direct Guide WebDocument12 pagesEmployer Direct Guide WebSunnyNo ratings yet

- 17 Spring 2018 - BT SADocument9 pages17 Spring 2018 - BT SApabloescobar11yNo ratings yet

- A Study of Remuneration SystemlatestDocument28 pagesA Study of Remuneration SystemlatestyogisawantNo ratings yet

- How To Manage Payroll Processes at Your Organization: An Introductory Guide OnDocument13 pagesHow To Manage Payroll Processes at Your Organization: An Introductory Guide OnsamNo ratings yet

- Jmiopsjtpca - Resume - Simrat KaurDocument12 pagesJmiopsjtpca - Resume - Simrat KaurAnkur YewalekarNo ratings yet

- Payroll ESS Manual PDFDocument39 pagesPayroll ESS Manual PDFbandonaNo ratings yet

- As 15 - Employee BenefitsDocument22 pagesAs 15 - Employee BenefitsSHRADDHA RAUTNo ratings yet

- Company Setup ChecklistDocument3 pagesCompany Setup ChecklistnjorojoseNo ratings yet

- My - Bill - 04 Jan 2023 - 05 Jan 2023 - 778690066413Document2 pagesMy - Bill - 04 Jan 2023 - 05 Jan 2023 - 778690066413Ahmed mufeedNo ratings yet

- James A. Hall, AIS 6 EditionDocument57 pagesJames A. Hall, AIS 6 EditionNicah AcojonNo ratings yet

- FGC - Revenues-A BillingDocument3 pagesFGC - Revenues-A BillingJoyneil GamboaNo ratings yet

- My Bill 778690089643Document2 pagesMy Bill 778690089643uva.laysNo ratings yet

- My - Bill - 01 Dec, 2022 - 31 Dec, 2022 - 300888486889Document1 pageMy - Bill - 01 Dec, 2022 - 31 Dec, 2022 - 300888486889somnathpatil20386No ratings yet

- IND As 115 - Bhavik Chokshi - FR ShieldDocument18 pagesIND As 115 - Bhavik Chokshi - FR ShieldESWAR REDDY Chintam ReddyNo ratings yet

- Labour CostingDocument21 pagesLabour CostingCarry KelvinsNo ratings yet

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Document13 pagesBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsNo ratings yet

- Capital and Revenue Business Case Approval Process November 2016Document10 pagesCapital and Revenue Business Case Approval Process November 2016oscarormeNo ratings yet

- My - Bill - 04 Nov, 2023 - 05 Nov, 2023 - 778540587540Document2 pagesMy - Bill - 04 Nov, 2023 - 05 Nov, 2023 - 778540587540ankitsx2020No ratings yet

- Audit NotesDocument11 pagesAudit NotesNavjyoti SinghNo ratings yet

- 5.ITBA-ASST. Instru. No.9 DT 07.05.2018Document6 pages5.ITBA-ASST. Instru. No.9 DT 07.05.2018Madhura Venkateswara SarmaNo ratings yet

- Internet BillsDocument36 pagesInternet Billssomnathpatil20386No ratings yet

- InterNet Bill Sep 2023Document1 pageInterNet Bill Sep 2023lalitarathodvasNo ratings yet

- LBC Express Holdings, Inc. (LBCDocument7 pagesLBC Express Holdings, Inc. (LBCAllyza RenoballesNo ratings yet

- InterNet Bill Aug 2023Document1 pageInterNet Bill Aug 2023lalitarathodvasNo ratings yet

- Jio Fiber Dec'23Document1 pageJio Fiber Dec'23girishhemnani1No ratings yet

- Creating Pay Component in One Time Portlet Using Integration CenterDocument16 pagesCreating Pay Component in One Time Portlet Using Integration Centerwahid.hcmNo ratings yet

- NZ en Tax Alert May 2017 FinalDocument26 pagesNZ en Tax Alert May 2017 FinalJanice Barbasa BiduaNo ratings yet

- Jio BillDocument1 pageJio BilllalitarathodvasNo ratings yet

- IT Declaration - User ManualDocument43 pagesIT Declaration - User Manuallenkapradipta2011No ratings yet

- My - Bill - 01 Jan, 2023 - 31 Jan, 2023 - 300888486889Document1 pageMy - Bill - 01 Jan, 2023 - 31 Jan, 2023 - 300888486889somnathpatil20386No ratings yet

- Jio Bill AprilgffDocument2 pagesJio Bill AprilgffNaina BiswakarmaNo ratings yet

- My - Bill - 21 Apr, 2024 - 20 May, 2024 - 300589123272Document1 pageMy - Bill - 21 Apr, 2024 - 20 May, 2024 - 300589123272Subrat NandaNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- SUM 410594021878 432002276691 20230126-UnlockedDocument1 pageSUM 410594021878 432002276691 20230126-UnlockedArun PriyaNo ratings yet

- Sreelekshmi 82667-February 2024Document2 pagesSreelekshmi 82667-February 2024sreelekshmis266No ratings yet

- My Bill DecDocument1 pageMy Bill DecRavi RanjanNo ratings yet

- Implementing and Using Tax Recovery in R12 E-Business Tax (EBTax) PDFDocument14 pagesImplementing and Using Tax Recovery in R12 E-Business Tax (EBTax) PDFMustafa SLlamNo ratings yet

- DTC Final Sample 2023 - MalaysiaDocument12 pagesDTC Final Sample 2023 - Malaysianguyen ngochaNo ratings yet

- Bpls and BpcoDocument2 pagesBpls and BpcoJoeren EvardoneNo ratings yet

- ZimyoHRMS For - Careers InternationalDocument5 pagesZimyoHRMS For - Careers InternationaldevikaNo ratings yet

- My Bill 778540483425Document1 pageMy Bill 778540483425bhavanireddy1604No ratings yet

- FAR.2832 Employee Benefits YT PDFDocument4 pagesFAR.2832 Employee Benefits YT PDFJames ScoldNo ratings yet

- AIS Chapter 6Document23 pagesAIS Chapter 6Hasan AbirNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- Investment Declaration Submission User Manual 2023-24Document24 pagesInvestment Declaration Submission User Manual 2023-24Y.v. SandeepNo ratings yet

- Siebel Incentive Compensation Management ( ICM ) GuideFrom EverandSiebel Incentive Compensation Management ( ICM ) GuideNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Sample Records Request LetterDocument1 pageSample Records Request LetterFermin James ErosidoNo ratings yet

- Certification ElectionDocument4 pagesCertification ElectionLindsay MillsNo ratings yet

- 2008 Pre-Bar Review in LaborDocument354 pages2008 Pre-Bar Review in LaborRussian RoulletteNo ratings yet

- Graeccoroman SlaveryDocument10 pagesGraeccoroman SlaverySonia KhileriNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- Job DesignDocument34 pagesJob DesignRupakshi Saurabh GaurNo ratings yet

- Models and Techniques of Manpower Demand and Supply Forecasting - Kanchan Pandey)Document27 pagesModels and Techniques of Manpower Demand and Supply Forecasting - Kanchan Pandey)Kanchan Pandey86% (7)

- Labor and Employment Intake Questionnaire-NEWDocument7 pagesLabor and Employment Intake Questionnaire-NEWYisrael Ezekiel Yahweh'sNo ratings yet

- Mar 21 17 Media Release - Town and Unionized Workers Reach 5 Year AgreementDocument1 pageMar 21 17 Media Release - Town and Unionized Workers Reach 5 Year Agreementapi-243632953No ratings yet

- PF Form 3ADocument5 pagesPF Form 3Amaria khanNo ratings yet

- Fundamentals of Management 10th Edition Robbins Test Bank DownloadDocument48 pagesFundamentals of Management 10th Edition Robbins Test Bank DownloadTawanda Medved100% (23)

- Everlane Case StudyDocument3 pagesEverlane Case Studylinh kieu haNo ratings yet

- Resource Manager Resource Manager: EconomicsDocument16 pagesResource Manager Resource Manager: EconomicsPLAYVONo ratings yet

- None - MSE - Muster Roll-Cum-Wageregister - Form IIDocument1 pageNone - MSE - Muster Roll-Cum-Wageregister - Form IIJitendra JagtapNo ratings yet

- Unfair Labor Practices in Nutri Asia Post Pandemic RemediesDocument24 pagesUnfair Labor Practices in Nutri Asia Post Pandemic RemediesGiella MagnayeNo ratings yet

- BBA 605C Labour - LawDocument58 pagesBBA 605C Labour - LawRia DeshpandeNo ratings yet

- A Propose Research Thesis On Employees' Motivation and Organizational Performance in The Banking SectorDocument2 pagesA Propose Research Thesis On Employees' Motivation and Organizational Performance in The Banking SectorEghosa EriboNo ratings yet

- Labour Q &aDocument18 pagesLabour Q &aAma Akpor AdjeiNo ratings yet

- HHJJDocument103 pagesHHJJjuana dela cruzzNo ratings yet

- International School Alliance of Educators vs. Quisumbing, Et. Al. G.R. No. 128845 DIGESTDocument2 pagesInternational School Alliance of Educators vs. Quisumbing, Et. Al. G.R. No. 128845 DIGESTLyna GayasNo ratings yet

- Appendix 13 - Harrow Pay Policy Statement 2022-23Document8 pagesAppendix 13 - Harrow Pay Policy Statement 2022-23shantanu.deo.photos1No ratings yet

- Bagong Pagkakaisa NG Manggagawa Sa Triumph International V SOLEDocument2 pagesBagong Pagkakaisa NG Manggagawa Sa Triumph International V SOLEGlory Grace Obenza-NodadoNo ratings yet

- Employee Development and Talent ManagementDocument12 pagesEmployee Development and Talent ManagementAnkita Dey GroverNo ratings yet

- RAFI Micro-Finance, Inc. Unit: From: Salaries and Wages Date Description Debit Credit T oDocument12 pagesRAFI Micro-Finance, Inc. Unit: From: Salaries and Wages Date Description Debit Credit T oRoland Manuel AladoNo ratings yet

- Labour Economics: Petri Böckerman, Per Skedinger, Roope UusitaloDocument15 pagesLabour Economics: Petri Böckerman, Per Skedinger, Roope UusitaloAzizan RamlyNo ratings yet

- 2 IloDocument4 pages2 Ilojuwel KabirNo ratings yet

- Tutorial 2.1 Accident Loss StatisticsDocument3 pagesTutorial 2.1 Accident Loss StatisticsOnee chanNo ratings yet

- Hiring Process at Sui Southern Gas CompanyDocument26 pagesHiring Process at Sui Southern Gas CompanyWarda Soomro100% (2)

- Leave of Absence Form (Rev. 02 072017)Document1 pageLeave of Absence Form (Rev. 02 072017)KIMBERLY BALISACANNo ratings yet

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Uploaded by

خاءيمي خالدOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Payment-Bulk-Payroll & Stat Payment Guide-LITE

Uploaded by

خاءيمي خالدCopyright:

Available Formats

BizChannel@CIMB LITE Package

Payroll and Statutory Payments Guide

Getting Started:

• First time performing payroll payments, please contact Business Call Centre at 1300 888 828 or email to mybusinesscare@cimb.com

to enable payroll and statutory payments.

• Please note that the first EPF and SOCSO submission is a test file and must be approved by the respective statutory bodies (usually

takes up to 3 working days) before you can submit a payment. To check the approval status, please refer to Section 2 (ii) below.

• Fields marked with asterisk (*) in the sections below are mandatory fields.

• For further guidance on the fields, kindly refer to the Appendix section.

Section 1: Transaction initiation

i) Click ‘Payroll’ from the left

ii

side menu. Select ‘Payroll’

iii to create new transaction/

template or select ‘Payroll

Template’ to retrieve saved

templates.

ii) Select ‘New’ to create a

new transaction. Select

i ‘Template’ if using the earlier

saved template.

iii) Click ‘Continue’ to proceed.

Section 2: Company details

i) Click to select the type of

i payment, i.e. Payroll, Zakat,

SOCSO,LHDN or EPF. Enter

i the details into the template.

Example:

a) Employees contributing to

i Zakat - select only Payroll

and Zakat and save as

ii template A.

b) Employees contributing to

i

LHDN and EPF – select

Payroll, LHDN and EPF and

save as template B.

ii) For EPF or SOCSO payments,

the first submission is a test file

and it must be approved by the

i

respective statutory bodies

before you can proceed to make

ii the payment. Click here to check

iii the status of your test file. Once

approved, you may proceed to

submit the payment.

iii) Select ‘Test’ for the first EPF

submission. Else, select ‘Live’

for payment once the test status

iv is approved.

iv) Click ‘Continue’ to proceed to

Section 3.

Section 3: Employee details

i) Click ‘Add/Edit Employee’.

ii) At ‘Payroll’ tab, enter the

i details. The fields available to

be filled are based on the

v selection of payment type

in Section 2 above (Payroll or

Statutory Payments).

v

vi

iii) If Payroll is not selected in

Section 2 above, please enter

ii

‘0’ for ‘Account No’.

iii

iv) Click ‘Save’ to proceed. Repeat

steps (i) to (iii) to create another

employee record.

v) Upon creating all the employee

records, click ‘Add To List’ to

proceed.

vi) Click ‘Confirm’ to proceed for

payment or ‘Save As Template’

for future use (can be retrieved

from ‘Payroll Template’ under

‘Payroll’ menu).

iv

Section 4: Submission of transaction for approval

i) Click ‘Submit’ and ‘OK’.

Result Message: This

transaction is pending for

i

approval.

Important note: The authoriser

i will need to approve/decline the

submitted transaction prior to

processing by the Bank.

For further enquiries, please contact our Business Call Centre at 1300 888 828 between 7AM to 7PM from Monday to Friday or 8AM to 5PM

on Saturday (excluding public holidays) or email to mybusinesscare@cimb.com.

VERSION 1.0 (15042018)

Appendix

Section 2: Company details

EMPLOYER INFORMATION

• Payroll Source Account - CIMB account number to pay from for salary payments.

ZAKAT INFORMATION

• Zakat Source Account - CIMB account number to pay from for zakat payments.

• Region - Select either ‘Selangor’ or ‘Wilayah Persekutuan KL’ from the dropdown list. Not available for other states.

SOCSO INFORMATION

• SOCSO Source Account - CIMB account number to pay from for SOCSO payments.

• MyCo ID - Business registration number.

LHDN INFORMATION

• LHDN Source Account - CIMB account number to pay from for LHDN payments.

• Region - Select ‘LHDNM’.

EPF INFORMATION

• EPF Source Account - CIMB account number to pay from for EPF payments.

• EPF Form Submission - Select ‘Test’ for first EPF submission. Else, select ‘Live’ for actual payment once the test status is

approved. CIMB account number to pay from for salary payments.

Section 3: Employee details

EMPLOYEE PROFILE

• Account No - Employee account number either with CIMB or other bank. Enter ‘0’ if payroll is not selected.

• Old/New IC - Enter ‘0’ for foreign workers.

AMOUNT DETAIL

• Payroll Amount - Net Salary.

PAYROLL DETAIL

• Bank Name - The bank for employee account number.

LHDN DETAIL

• Wife’s Code - The last digit of your employee’s tax reference number.

EPF DETAIL

• Employee Wages - Gross salary.

VERSION 1.0 (15042018)

You might also like

- My - Bill - 16 Nov, 2023 - 15 Dec, 2023 - 778610258881Document1 pageMy - Bill - 16 Nov, 2023 - 15 Dec, 2023 - 778610258881Ravi RanjanNo ratings yet

- Jiofiber Bill Summary: Total Payable 1,178.82Document1 pageJiofiber Bill Summary: Total Payable 1,178.82Dharma kurra100% (1)

- Workday Compensation OverviewDocument11 pagesWorkday Compensation OverviewHaritha100% (1)

- Connectors Linking Words - 61564Document2 pagesConnectors Linking Words - 61564ElisabeteRibeiro100% (1)

- Proof Submission User Manual 2023-24 1Document28 pagesProof Submission User Manual 2023-24 1Arun APNo ratings yet

- Actax 3254: Business Taxation: Business Taxes/Business TransactionsDocument2 pagesActax 3254: Business Taxation: Business Taxes/Business TransactionsJhon Ray RabaraNo ratings yet

- Seminar 2 - Heads of ChargeDocument8 pagesSeminar 2 - Heads of ChargeYong Kwang HanNo ratings yet

- CH4 EditedDocument56 pagesCH4 EditedMukemil AbrarNo ratings yet

- Accounts Theory 21 Marks CTC ClassesDocument8 pagesAccounts Theory 21 Marks CTC Classeskhushalpareek8584No ratings yet

- ACCT 504 MART Perfect EducationDocument63 pagesACCT 504 MART Perfect Educationdavi.dwNo ratings yet

- BMS - Human Resource Management zNC4xtSDocument3 pagesBMS - Human Resource Management zNC4xtSishaNo ratings yet

- InterNet Bill Mar 2024Document2 pagesInterNet Bill Mar 2024dhinu8502No ratings yet

- Advanced Taxation - Study TextDocument286 pagesAdvanced Taxation - Study Textmulika99No ratings yet

- changeDocument1 pagechangesubham220915No ratings yet

- Employer Direct Guide WebDocument12 pagesEmployer Direct Guide WebSunnyNo ratings yet

- 17 Spring 2018 - BT SADocument9 pages17 Spring 2018 - BT SApabloescobar11yNo ratings yet

- A Study of Remuneration SystemlatestDocument28 pagesA Study of Remuneration SystemlatestyogisawantNo ratings yet

- How To Manage Payroll Processes at Your Organization: An Introductory Guide OnDocument13 pagesHow To Manage Payroll Processes at Your Organization: An Introductory Guide OnsamNo ratings yet

- Jmiopsjtpca - Resume - Simrat KaurDocument12 pagesJmiopsjtpca - Resume - Simrat KaurAnkur YewalekarNo ratings yet

- Payroll ESS Manual PDFDocument39 pagesPayroll ESS Manual PDFbandonaNo ratings yet

- As 15 - Employee BenefitsDocument22 pagesAs 15 - Employee BenefitsSHRADDHA RAUTNo ratings yet

- Company Setup ChecklistDocument3 pagesCompany Setup ChecklistnjorojoseNo ratings yet

- My - Bill - 04 Jan 2023 - 05 Jan 2023 - 778690066413Document2 pagesMy - Bill - 04 Jan 2023 - 05 Jan 2023 - 778690066413Ahmed mufeedNo ratings yet

- James A. Hall, AIS 6 EditionDocument57 pagesJames A. Hall, AIS 6 EditionNicah AcojonNo ratings yet

- FGC - Revenues-A BillingDocument3 pagesFGC - Revenues-A BillingJoyneil GamboaNo ratings yet

- My Bill 778690089643Document2 pagesMy Bill 778690089643uva.laysNo ratings yet

- My - Bill - 01 Dec, 2022 - 31 Dec, 2022 - 300888486889Document1 pageMy - Bill - 01 Dec, 2022 - 31 Dec, 2022 - 300888486889somnathpatil20386No ratings yet

- IND As 115 - Bhavik Chokshi - FR ShieldDocument18 pagesIND As 115 - Bhavik Chokshi - FR ShieldESWAR REDDY Chintam ReddyNo ratings yet

- Labour CostingDocument21 pagesLabour CostingCarry KelvinsNo ratings yet

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Document13 pagesBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsNo ratings yet

- Capital and Revenue Business Case Approval Process November 2016Document10 pagesCapital and Revenue Business Case Approval Process November 2016oscarormeNo ratings yet

- My - Bill - 04 Nov, 2023 - 05 Nov, 2023 - 778540587540Document2 pagesMy - Bill - 04 Nov, 2023 - 05 Nov, 2023 - 778540587540ankitsx2020No ratings yet

- Audit NotesDocument11 pagesAudit NotesNavjyoti SinghNo ratings yet

- 5.ITBA-ASST. Instru. No.9 DT 07.05.2018Document6 pages5.ITBA-ASST. Instru. No.9 DT 07.05.2018Madhura Venkateswara SarmaNo ratings yet

- Internet BillsDocument36 pagesInternet Billssomnathpatil20386No ratings yet

- InterNet Bill Sep 2023Document1 pageInterNet Bill Sep 2023lalitarathodvasNo ratings yet

- LBC Express Holdings, Inc. (LBCDocument7 pagesLBC Express Holdings, Inc. (LBCAllyza RenoballesNo ratings yet

- InterNet Bill Aug 2023Document1 pageInterNet Bill Aug 2023lalitarathodvasNo ratings yet

- Jio Fiber Dec'23Document1 pageJio Fiber Dec'23girishhemnani1No ratings yet

- Creating Pay Component in One Time Portlet Using Integration CenterDocument16 pagesCreating Pay Component in One Time Portlet Using Integration Centerwahid.hcmNo ratings yet

- NZ en Tax Alert May 2017 FinalDocument26 pagesNZ en Tax Alert May 2017 FinalJanice Barbasa BiduaNo ratings yet

- Jio BillDocument1 pageJio BilllalitarathodvasNo ratings yet

- IT Declaration - User ManualDocument43 pagesIT Declaration - User Manuallenkapradipta2011No ratings yet

- My - Bill - 01 Jan, 2023 - 31 Jan, 2023 - 300888486889Document1 pageMy - Bill - 01 Jan, 2023 - 31 Jan, 2023 - 300888486889somnathpatil20386No ratings yet

- Jio Bill AprilgffDocument2 pagesJio Bill AprilgffNaina BiswakarmaNo ratings yet

- My - Bill - 21 Apr, 2024 - 20 May, 2024 - 300589123272Document1 pageMy - Bill - 21 Apr, 2024 - 20 May, 2024 - 300589123272Subrat NandaNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- SUM 410594021878 432002276691 20230126-UnlockedDocument1 pageSUM 410594021878 432002276691 20230126-UnlockedArun PriyaNo ratings yet

- Sreelekshmi 82667-February 2024Document2 pagesSreelekshmi 82667-February 2024sreelekshmis266No ratings yet

- My Bill DecDocument1 pageMy Bill DecRavi RanjanNo ratings yet

- Implementing and Using Tax Recovery in R12 E-Business Tax (EBTax) PDFDocument14 pagesImplementing and Using Tax Recovery in R12 E-Business Tax (EBTax) PDFMustafa SLlamNo ratings yet

- DTC Final Sample 2023 - MalaysiaDocument12 pagesDTC Final Sample 2023 - Malaysianguyen ngochaNo ratings yet

- Bpls and BpcoDocument2 pagesBpls and BpcoJoeren EvardoneNo ratings yet

- ZimyoHRMS For - Careers InternationalDocument5 pagesZimyoHRMS For - Careers InternationaldevikaNo ratings yet

- My Bill 778540483425Document1 pageMy Bill 778540483425bhavanireddy1604No ratings yet

- FAR.2832 Employee Benefits YT PDFDocument4 pagesFAR.2832 Employee Benefits YT PDFJames ScoldNo ratings yet

- AIS Chapter 6Document23 pagesAIS Chapter 6Hasan AbirNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- Investment Declaration Submission User Manual 2023-24Document24 pagesInvestment Declaration Submission User Manual 2023-24Y.v. SandeepNo ratings yet

- Siebel Incentive Compensation Management ( ICM ) GuideFrom EverandSiebel Incentive Compensation Management ( ICM ) GuideNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Sample Records Request LetterDocument1 pageSample Records Request LetterFermin James ErosidoNo ratings yet

- Certification ElectionDocument4 pagesCertification ElectionLindsay MillsNo ratings yet

- 2008 Pre-Bar Review in LaborDocument354 pages2008 Pre-Bar Review in LaborRussian RoulletteNo ratings yet

- Graeccoroman SlaveryDocument10 pagesGraeccoroman SlaverySonia KhileriNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- Job DesignDocument34 pagesJob DesignRupakshi Saurabh GaurNo ratings yet

- Models and Techniques of Manpower Demand and Supply Forecasting - Kanchan Pandey)Document27 pagesModels and Techniques of Manpower Demand and Supply Forecasting - Kanchan Pandey)Kanchan Pandey86% (7)

- Labor and Employment Intake Questionnaire-NEWDocument7 pagesLabor and Employment Intake Questionnaire-NEWYisrael Ezekiel Yahweh'sNo ratings yet

- Mar 21 17 Media Release - Town and Unionized Workers Reach 5 Year AgreementDocument1 pageMar 21 17 Media Release - Town and Unionized Workers Reach 5 Year Agreementapi-243632953No ratings yet

- PF Form 3ADocument5 pagesPF Form 3Amaria khanNo ratings yet

- Fundamentals of Management 10th Edition Robbins Test Bank DownloadDocument48 pagesFundamentals of Management 10th Edition Robbins Test Bank DownloadTawanda Medved100% (23)

- Everlane Case StudyDocument3 pagesEverlane Case Studylinh kieu haNo ratings yet

- Resource Manager Resource Manager: EconomicsDocument16 pagesResource Manager Resource Manager: EconomicsPLAYVONo ratings yet

- None - MSE - Muster Roll-Cum-Wageregister - Form IIDocument1 pageNone - MSE - Muster Roll-Cum-Wageregister - Form IIJitendra JagtapNo ratings yet

- Unfair Labor Practices in Nutri Asia Post Pandemic RemediesDocument24 pagesUnfair Labor Practices in Nutri Asia Post Pandemic RemediesGiella MagnayeNo ratings yet

- BBA 605C Labour - LawDocument58 pagesBBA 605C Labour - LawRia DeshpandeNo ratings yet

- A Propose Research Thesis On Employees' Motivation and Organizational Performance in The Banking SectorDocument2 pagesA Propose Research Thesis On Employees' Motivation and Organizational Performance in The Banking SectorEghosa EriboNo ratings yet

- Labour Q &aDocument18 pagesLabour Q &aAma Akpor AdjeiNo ratings yet

- HHJJDocument103 pagesHHJJjuana dela cruzzNo ratings yet

- International School Alliance of Educators vs. Quisumbing, Et. Al. G.R. No. 128845 DIGESTDocument2 pagesInternational School Alliance of Educators vs. Quisumbing, Et. Al. G.R. No. 128845 DIGESTLyna GayasNo ratings yet

- Appendix 13 - Harrow Pay Policy Statement 2022-23Document8 pagesAppendix 13 - Harrow Pay Policy Statement 2022-23shantanu.deo.photos1No ratings yet

- Bagong Pagkakaisa NG Manggagawa Sa Triumph International V SOLEDocument2 pagesBagong Pagkakaisa NG Manggagawa Sa Triumph International V SOLEGlory Grace Obenza-NodadoNo ratings yet

- Employee Development and Talent ManagementDocument12 pagesEmployee Development and Talent ManagementAnkita Dey GroverNo ratings yet

- RAFI Micro-Finance, Inc. Unit: From: Salaries and Wages Date Description Debit Credit T oDocument12 pagesRAFI Micro-Finance, Inc. Unit: From: Salaries and Wages Date Description Debit Credit T oRoland Manuel AladoNo ratings yet

- Labour Economics: Petri Böckerman, Per Skedinger, Roope UusitaloDocument15 pagesLabour Economics: Petri Böckerman, Per Skedinger, Roope UusitaloAzizan RamlyNo ratings yet

- 2 IloDocument4 pages2 Ilojuwel KabirNo ratings yet

- Tutorial 2.1 Accident Loss StatisticsDocument3 pagesTutorial 2.1 Accident Loss StatisticsOnee chanNo ratings yet

- Hiring Process at Sui Southern Gas CompanyDocument26 pagesHiring Process at Sui Southern Gas CompanyWarda Soomro100% (2)

- Leave of Absence Form (Rev. 02 072017)Document1 pageLeave of Absence Form (Rev. 02 072017)KIMBERLY BALISACANNo ratings yet