Professional Documents

Culture Documents

HKDSE Economics Notes SAMPLE

HKDSE Economics Notes SAMPLE

Uploaded by

Tsz Shun FungCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 - Investment Banking and BrokerageDocument152 pages1 - Investment Banking and BrokerageLordie BlueNo ratings yet

- Bachelor Degree TimetableDocument20 pagesBachelor Degree Timetablebite meNo ratings yet

- Porcelain Club - Letter To HarvardDocument2 pagesPorcelain Club - Letter To HarvardEvanNo ratings yet

- Escovilla 4qmath3aa2 - Patterns in The World I Live inDocument7 pagesEscovilla 4qmath3aa2 - Patterns in The World I Live inapi-743665882No ratings yet

- Atis SentencesDocument3 pagesAtis Sentences이지수(사범대학 교육공학과)No ratings yet

- PURELL® Hand Sanitizer Gel: Safety Data SheetDocument14 pagesPURELL® Hand Sanitizer Gel: Safety Data SheetOmid BeygiNo ratings yet

- CPN-CSPC Protocol 26nov2014Document136 pagesCPN-CSPC Protocol 26nov2014John J. MacasioNo ratings yet

- Test Bank For Biology The Unity and Diversity of Life 14Th Edition by Starr Taggart and Evers Isbn 1305073959 978130507395 Full Chapter PDFDocument36 pagesTest Bank For Biology The Unity and Diversity of Life 14Th Edition by Starr Taggart and Evers Isbn 1305073959 978130507395 Full Chapter PDFjoan.derrick732100% (10)

- Use of Almond Our and Stevia in Rice-Based Gluten-Free Cookie ProductionDocument13 pagesUse of Almond Our and Stevia in Rice-Based Gluten-Free Cookie ProductionLoredana Veronica ZalischiNo ratings yet

- Hard TimesDocument3 pagesHard TimesPaola LamannaNo ratings yet

- Bush Foundation - Communications Program Manager(s)Document2 pagesBush Foundation - Communications Program Manager(s)Lars LeafbladNo ratings yet

- Chapter Vii - Ethics For CriminologistsDocument6 pagesChapter Vii - Ethics For CriminologistsMarlboro BlackNo ratings yet

- Literature Review of Water Level SensorDocument4 pagesLiterature Review of Water Level Sensorc5mr3mxf100% (1)

- Self Affirmation ScaleDocument19 pagesSelf Affirmation ScaleQonitah Arya SulthanahNo ratings yet

- A. H. M. Jones - Studies in Roman Government and Law-Basil Blackwell (1960)Document260 pagesA. H. M. Jones - Studies in Roman Government and Law-Basil Blackwell (1960)L V100% (1)

- Lec 6 Technology of OperativeDocument8 pagesLec 6 Technology of OperativeHassan TantawyNo ratings yet

- Python Arsenal For RE 1.1Document65 pagesPython Arsenal For RE 1.1uhilianNo ratings yet

- Life in The Universe 3rd Edition Bennett Test BankDocument35 pagesLife in The Universe 3rd Edition Bennett Test Bankjaundicecrincum05ba2100% (29)

- Manoj Bhargava: From Billionaire Monk To Ground-Breaking Change MakerDocument5 pagesManoj Bhargava: From Billionaire Monk To Ground-Breaking Change MakerAdilAdNo ratings yet

- EagleBurgmann - Fluachem Expansion Joints - ENDocument5 pagesEagleBurgmann - Fluachem Expansion Joints - ENRoberta PugnettiNo ratings yet

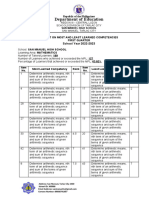

- Most and LEast LEarned Competencies 2022 2023 NUNAGDocument3 pagesMost and LEast LEarned Competencies 2022 2023 NUNAGJONATHAN NUNAGNo ratings yet

- Toym and TofilDocument19 pagesToym and TofilJohn Rey CempronNo ratings yet

- Reading PracticeDocument1 pageReading Practicejemimahluyando8No ratings yet

- Philosophical Elements in Thomas Kuhn's Historiography of ScienceDocument12 pagesPhilosophical Elements in Thomas Kuhn's Historiography of ScienceMartín IraniNo ratings yet

- IJTK SupplementaryDocument9 pagesIJTK SupplementaryNastySon FootNimbusNo ratings yet

- Interview With Uns MuftiDocument3 pagesInterview With Uns MuftiNabeel Aejaz100% (1)

- 2017 Carryall 500-550 (ERIC and EX-40 EFI)Document442 pages2017 Carryall 500-550 (ERIC and EX-40 EFI)bartolomealmacenNo ratings yet

- Question Paper Code:: (10×2 20 Marks)Document2 pagesQuestion Paper Code:: (10×2 20 Marks)GOJAN ECENo ratings yet

- Tree Plantation Strategy - GTRDocument37 pagesTree Plantation Strategy - GTRPapa RajuNo ratings yet

- Unit 7 7.2 Key ConceptsDocument3 pagesUnit 7 7.2 Key ConceptsCésar RubioNo ratings yet

HKDSE Economics Notes SAMPLE

HKDSE Economics Notes SAMPLE

Uploaded by

Tsz Shun FungOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HKDSE Economics Notes SAMPLE

HKDSE Economics Notes SAMPLE

Uploaded by

Tsz Shun FungCopyright:

Available Formats

© 2019 M.T.

Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

CONTENT

2019 3 –

• /

• /

•

• 220

CONTENT.................................................................................. 1

Ch.1 Basic Economic Concepts.................................................. 3

Ch. 2 Basic economic problems ............................................... 10

Ch. 3 Ownership of Firms ........................................................ 12

Ch. 4 Production & Division of Labour ................................... 18

Ch. 5 Factors of Production ...................................................... 22

Ch. 6 Production & costs in the Short Run and Long Run ....... 30

Ch. 7 Objectives and expansion of firms .................................. 39

Ch. 8 Determination of Market Price ....................................... 43

Ch. 9 Change in Market Price................................................... 46

Ch. 10 Price Elasticity .............................................................. 49

Ch. 11 Market intervention ....................................................... 53

Ch.12 Market Structure ............................................................ 69

Ch.13 Efficiency, equity and role of government..................... 73

Ch.13 Efficiency, Equity & Role of Government (I) –

Government intervention .......................................................... 75

Ch.13 Efficiency, Equity & Role of Government (I) –

Externalities .............................................................................. 78

Ch. 14 Efficiency, Equity & Role of Government (II) ............. 88

Ch. 15 - 16 National Income accounting ................................ 101

Ch.17 Aggregate Demand & aggregate supply ...................... 124

2019 3 1 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Ch. 18 Determination of Output and Prices............................ 133

Ch.21 Business cycle, changes in general price level and

unemployment ........................................................................ 171

Ch.22 Fiscal Policy & Monetary Policy ................................. 178

Ch.23 Absolute and Comparative Advantage ........................ 196

Ch.24 Trade Barriers .............................................................. 206

Ch.25 Balance of Payments & Exchange rate ........................ 215

Ch.26 Monopoly Pricing ........................................................ 224

Ch.27 Anti-competitive Behaviors ......................................... 229

2019 3 2 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Ch.1 Basic Economic Concepts

☆Overview

Limited resources Limited resources

scarcity

choice

competition opportunity cost

discrimination

☆Scarcity

= resources available are not enough to satisfy all people’s

wants

☆Opportunity cost

= Highest valued option forgone

= Money cost + non-money cost (e.g. time cost)

☆Sunk cost

= Cost which has been incurred, cannot be recovered

☆Interest

- To borrowers: Cost of earlier availability of resources

(positive time preference)

2019 3 3 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

- To lenders: compensation for deferred consumption

*Also exists in barter economy (not necessarily calculated in

money)

☆Free/Economic goods

Free goods Economic goods

Sufficient to satisfy all human not enough to satisfy all human

wants wants

People do not prefer more of it People prefer more of it

No cost involved in production Cost involved in production.

* Free-of-charge goods ≠ free goods

• e.g. free newspaper

① People want more of it

② Not enough to satisfy all human wants

(scarce production resources without any use)

③ Cost involved on production (e.g. printing)

• Free goods = Free of charge (MUST)

9 No one needs to incur a cost

☆Specialization & Exchange

* Specialization

2019 3 4 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

= increase output of an economy

= person only produces the good at a lower opportunity cost

*Exchange

= Necessary condition for specialization

⸪ Without possibility to exchange, you have to produce

everything by yourself.

☆Circular Flow Model

Factor market Product market

real flow

money flow

☆Positive vs normative statements

Positive Normative

① What is /was /will be ① What should be

② No value judgement ② With value judgement

③ Can be tested with evidence ③ Cannot be tested (irrefutable)

2019 3 5 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

☆ Ch.1 Questions Remarks

Scarcity implies

(1) limited resources

(2) people need to make choices

(3) unlimited wants

Soln: Only (1) and (2) are correct. Scarcity can still exist when

wants are limited, as long as resources available cannot

satisfy all human wants.

(a) Explain how an increase in traffic congestion in the Cross

Harbour Tunnel would effect the opportunity cost to its

users of crossing the harbour.

(b) Explain whether the opportunity cost of crossing the

harbour would definitely be the same to every tunnel user.

Soln: (a) -Opportunity cost increases.

-They have to spend more time in crossing the tunnel

which has alternative uses. The value of highest-valued

option forgone increases.

(b) -No.

-Different users have different highest-valued

alternative use of time.

2019 3 6 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

David wants to spend $8 to buy a pack of sandwiches or a

bowl of noodle. Explain the sandwiches if a cockroach is found

inside the noodle soup.

Soln: - The opportunity cost of buying sandwiches is noodles.

- Opportunity cost decreases (value of the noodle with a

cockroach decreases)

☆The existence of scarcity implies that

A. there is no such thing as free goods

B. human wants are unlimited

C. each and every economic good has a positive money price.

D. there is a cost in obtaining some goods.

Soln: When there is scarcity, there are not enough resources to

satisfy all human wants. They have to make choices and it

involves a cost.

∴The answer is D.

9 A is incorrect because there are both economic goods and

free goods. The existence of scarcity does not imply that

there are no free goods.

☆May invites Mary to have high tea together in the afternoon.

Mary will NOT have opportunity cost if

A. May pays the fee for him.

2019 3 7 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

B. Mary has nothing more worthwhile to do in the afternoon.

C. Mary likes to play tennis with May.

D. None of the above is a correct answer.

Soln: A is incorrect. Mary still has time cost.

B is incorrect. She has ‘nothing more worthwhile to do’

doesn’t mean ‘she has nothing to do’

C is incorrect. She still has time cost /$$ cost.

∴D is the answer.

☆Good X is a ‘free good’ when

A. there is no opportunity cost involved in using it.

B. its quantity supplied is greater than what consumers are

willing to purchase in the market.

C. nobody wants more of it.

D. its supply is so abundant that consumers place no value on it.

Soln: A free good is a good whose quantity is sufficient to

satisfy all human wants, so nobody wants more of it.

∴ The answer is C.

* A is wrong because although there is no O.C. in using the

good, there may be a cost in obtaining it.

☆A department store reduced the price of its television sets but

there was still unsold stock. These television sets are

2019 3 8 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

A. free goods because the quantity supplied is greater than the

quantity demanded.

B. consumer goods because they are sold at a department of

store.

C. Capital goods because they are man-made.

D. economic good because people have to pay a price for

them.

Soln: Economic goods cannot satisfy all wants so people need to

pay a price to get it.

*C is wrong. Capital ≠ capital goods.

☆In a one-man economy, which of the following may exist?

(1) free good

(2) market price

(3) competition

(4) discrimination

Soln: -Only free good may exist.

9 satisfy all the wants of the person.

-no exchange

∴No Market price

-no other people

9 no competition / discrimination

2019 3 9 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Ch. 3 Ownership of Firms

☆Limited Company

① Legal entity:

- Can sue / can be sued

- Can buy properties / sign contracts

- Owner does not have to bear legal responsibilities

② Limited liability: Liability of shareholders is limited to the

amount of investment in the company

③ Lasting continuity

④ Higher Profits tax rate

⑤ Wider source of capital: issuing shares / bonds

⑥ More complicated Set-up procedures

⑦ Separation of ownership / management

Private Public

-owners < 50 -owners: unlimited

-cannot issue shares and bonds -can issue shares and bonds to

to public public

-shares have to be transferred -shares can be transferred freely

under consent of all

shareholders

-need not disclose financial info -need to disclose financial into

2019 3 12 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

regularly

☆Partnership / Sole proprietorship

① Not a legal entity:

- Owners have to bear responsibilities

- Cannot sue / be sued

② Unlimited liability: Liability is not limited to the amount of

investment in the company

③ Lack of continuity

④ Lower profits tax rate

⑤ Simple set-up procedures

⑥ Financial into kept secret

no upper limit of shareholders.

↓

Sole proprietorship Partnership

-bear all risks / responsibility -collective responsibility

-more prompt decision-making -less prompt decision-making

-narrower source of capital -more sources of capital

-better relationships with -Admission / withdrawal needs

employees consent of all shareholders

-wider scope of specialization

☆Public Enterprise

*Govt. Departments / public corporations

2019 3 13 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

① Higher average production costs

② Easy access to into & data

→ better business decisions

③ Adequate & stable capital

④ Reliable supply of goods at lower price

→not profit - maximizing.

☆Partnership / Sole proprietorship

① Not a legal entity:

● owners have to bear responsibilities

● cannot sue / be sued

② Unlimited liability: Liability is not limited to the amount of

investment in the company

③ Lack of continuity

④ Lower profits tax rate

⑤ Simple set-up procedures

⑥ Financial into kept secret

no upper limit of shareholders.

↓

Sole proprietorship Partnership

-bear all risks / responsibility -collective responsibility

-more prompt decision-making -less prompt decision-making

-narrower source of capital -more sources of capital

2019 3 14 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

-better relationships with -Admission / withdrawal needs

employees consent of all shareholders

-wider scope of specialization

☆Public Enterprise

*Govt. Departments / public Advantages of public enterprise

(H-E-A-R) over govt. department:

① Adequate & Stable capital - better control of employees

② Easy access to info data - higher incentive to lower

→better business decisions product cost

③ Reliable supply of goods - more responsive to demand

④ Higher average product - profit - motive

→not profit maximizing. - more flexible operation

- more innovative

☆Bonds vs Shares

Firm’s Perspective:

Bonds Shares

Pros ① Not diluting existing ① No obligation to pay

shareholder’s power of dividend

Control ② No fixed redemption

② No risk of being taken date (no need to buy back

over shares)

Cons ① Obligated to pay fixed ① Dilute existing

2019 3 15 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

interest shareholder’s power of

② Fixed redemption date control

(pay face value upon ② High risk of being taken

maturity) over (shares are freely

transferable)

Investors’ Perspective:

Bonds Shares

Pros ① Lower risk: higher ① Higher potential return

priority in claiming ② Has voting rights (affect

repayment when the firm management of firm)

liquidates

② More stable return

(interest rate is fixed

regardless of loss)

Cons ① No voting rights ① Higher risk: last in

② Fixed rate of return claiming repayment when

(regardless of profit) the firm liquidates

② Less stable return

* Priority of claiming repayment upon liquidation:

1) employees

2) debenture holders

3) preference shareholders

4) ordinary shareholders

2019 3 16 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Ch. 4 Production & Division of Labour

☆Productions vs Consumption

Production = turning inputs into outputs

Consumption = using goods and services to directly satisfy

human wants

☆Types of production

Type Definition Examples

①Primary extracting raw mining, fishery, farming

materials from nature

②Secondary turning raw construction, garment,

materials, in semi - manufacturing

finished / finished

products

③Tertiary providing service transportation, banking,

education

2019 3 18 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

*A firm can engage in more than one production stage

e.g. Bakery

① Secondary: flour → bread

(raw materials à finished product)

② Tertiary: wholesaling service

☆Producer goods vs Consumer goods

Producer Consumer

- used in production process - used for consumption

e.g. TV at karaoke - directly satisfy wants

e.g. TV at home

☆Private goods vs Public goods

Private: Public:

① Not concurrent (rival) ① Concurrent (non-rival)

→one’s consumption will →one’s consumption will not

reduce its availability to others reduces it availability to others

② Excludable ② Non-excludable

→can exclude people from →cannot exclude people from

using it using it

e.g. economics book e.g. economic theory

an apple lighthouse

a place to view the moon a moon

2019 3 19 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

* public goods = too costly to charge

∴ easy to free-ride

*The way to derive the market demand curve is horizontal

summation, while that for public good is not.

☆Types of Division of labour

Type Definition Example

① Simple -specializes in producing a teachers &

particular good doctors

-do not depend on each other

② Complex -specialize in a particular cook & waiter

production stage

-interdependent

③ Regional -a region specializes in HK = finance

producing a particular good Thailand = rice

☆Advantages of division of labour

S-M-S-P-R

① Saves tire in training

② Stimulate Mechanization

③ Saves time in moving around tasks

④ Practice makes perfect

2019 3 20 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

⑤ Right people do the right task

⑥ Efficient use of capital goods (each worker = one set of

capital goods)

⑦ Living standard↑

(output level↑= ↑goods for consumption)

☆Disadvantages of division of labour

M-O-G-E-L

① Monotony

② Over-interdependence

(one stage disrupts = hinders other stages)

③ Greater risk of unemployment

(only specializes in one skill)

④ Excessive standardization

⑤ Loss of craftmanship

☆Limitations of division of labour

① Nature of product

e.g. painting / poetry

→requires creativity

② Size of market

→small amount of output

→small no. of workers

2019 3 21 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

→X large Scale of division of labour

Ch. 5 Factors of Production

☆Summary

Factor Definition Return

Capital Man-made resources in production Interest

Land Natural resources in production Rent

Labour Human effort used in production Wage

Entrepreneurship Human effort provided by owner Profits

of the firm, including risk bearing

+ decision-making

☆Capital

* Man-made resources in production

* Return = interest

* Change in capital stock

= Capital formation (production / purchase of capital) - Capital

depreciation (reduction of value due to capital consumption /

obsolescence)

Remarks for Capital Formation:

- It cannot be negative

2019 3 22 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

- It is an investment (sacrificing capital consumption for

more future consumption)

* Net increase in capital stock = capital accumulation (can be

negative)

→ production capacity

→ output level↑

(gives up present consumption for future consumption)

☆Land

* Natural resources in production

* Return = rent

- Emergence of land: no choice à No opportunity cost

(BUT use of land might have opportunity cost!)

Capital Land

man-made resource natural resources

human effort applied no human effort applied

can be artificially increase can increase but cannot be

artificially increased

can be relocated by human cannot be relocated by human

effort effort

production involves cost emergence involves no cost

☆Labour

2019 3 23 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

* Human effort used in production

* Return = wage

* Labour supply

- (number of worker) × average working hours) × [man-hour]

(unit!!!)

* Factors affecting labour supply

①Size of labour force

-population size

-legal working age

-age and sex distribution

-years of schooling

②Average working hours

-no. of public holidays

-max. legal working hours

*Labour Productivity

= (output) ÷ (man-hour) [output per man-hour]

①Education and training

②Working conditions

③Incentive to work

(e g. bonuses, job prospect)

2019 3 24 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

④Capital good per worker

⑤Management

(division of labour)

⑥Health of workers

*Wage payment menthod

Producti Cost of Quality Cost of Cost of

vity Supervis quality wage

ion control calculati

(to on

employe

rs)

Time ↓ ↑ ↑ ↓ ↓

rate

Piece ↑ ↓ ↓ ↑ ↑

rate

Basic ↑ ↓ ↑ ↓ ↑

salary (commis

plus sion

commiss already

ion reflects

(Maintai quality)

ns a

stable

team of

staff.)

2019 3 25 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

profit- ↑ ↓ ↑ ↓ ↑

sharing

(employ

er shares

risk with

employe

e.)

tips ↑ ↓ ↑ ↓ ↓

Risk of income Reward to better

fluctuation work

Time-rate ↓ ×

Piece-rate ↑ √

Basic salary plus depends √

commission

profit sharing ↑ √

tips ↑ √

Payment Method Suitable when

Time rate - Contribution too costly to measure

- High quality is required

Piece rate - Contribution easily measured

- Product quality easy to control

Basic salary plus - Output easily measured but not

commission standardized

2019 3 26 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Profit-sharing - Decisive to firm’s profits

*Factor mobility

①Occupational mobility (The ease with which a factor moves

from one occupation to another.)

-monetary / non-monetary rewards

-skill and education requirements

(requirement↑= harder to enter industry)

-trade union restriction

-availability of retraining programmes

-market information

②Geographical mobility

-transportation network & cost

-economic / political / social condition

-immigration / emigration policies

-market information

☆Entrepreneurship

* Human effort provided by owner of the firm, including risk

bearing + decision-making

* Return = profits

- Labour = stable wage / known in advance

- Entrepreneurship = fluctuating (can be negative)

2019 3 27 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

* Basic salary + commission is better than commission only

→ maintain a team of staff more easily

2019 3 28 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

☆Question Remarks for Ch. 5

Which of the followings are correct?

(1) The supply of both capital and land can be reduced by

human effort.

(2) There is no cost in producing and using land for production.

(3) Both capital and land can increase the wealth of a society.

(4) Capital formation can be negative.

Soln: (1) and (3) are correct.

(1): Correct. The supply of both capital and land can be reduced

by human effort. For example, the killing of whale and the

demolition of old buildings of humans.

(2): Incorrect. A piece of land has alternative way to be used.

The use of land in one way implies giving up of its use in

another way.

(3): Correct. As factors of production, both capital and land

increase output and help humans accumulate wealth.

(4): Incorrect. Both capital formation and capital consumption

can be either positive or zero. They cannot be negative. Only

capital accumulation can be negative.

2019 3 29 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

☆Question Remarks – Demand & Supply

☆Point out the difference between ‘quantity demanded’ and

‘quantity bought’.

Soln: ‘Quantity demanded’ is the amount that a consumer is

willing and able to buy. It only shows the consumer’s plan and

does not imply what will be actually bought.

‘Quantity bought’ is the actual amount consumers buy at the

ongoing price. It is determined only after the act of purchase.

☆When the tax on commodity X is doubled, its tax revenue is

also doubled. This indicates that

A. The demand for X is perfectly elastic.

B. The demand for X is unitarily elastic.

C. The supply of X is perfectly elastic.

D. The supply of X is perfectly inelastic.

Soln:

When the supply is perfectly inelastic, the supply curve will not

shift upwards. When per-unit tax doubles, tax revenue doubles.

2019 3 59 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

☆People tend to consume less live poultry but more canned

food. As a result, the price of the canned food changed by 50%

and its quantity transacted rose from 1000 cans to 1350 cans per

month we can conclude it had

A. an elastic demand

B. An inelastic demand

C. An elastic supply

D. An inelastic supply

Soln: Demand increases.

∴Must be movement along supply curve.

∴A and B are wrong.

Elasticity of supply

∴The answer is D.

☆ Price Qd Qs

$6 60 40

$9 55 45

$12 50 50

$15 45 55

$18 40 60

2019 3 60 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

(a) If the govt. fixes the production quota at 45 units, the market

price will be

A. $9

B. $12

C. $15

D. $18

(b) If the govt. uses a unit tax instead to fix the output at 45

units, the unit tax imposed will be

A. $3

B. $6

C. $9

D. $12

Soln: (a)

The answer is C.

(b) To make the seller only receive $9 when the price is at $15

(so that the output is 45), an unit tax of $6 should be imposed.

∴The answer is B.

2019 3 61 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

☆ Price $20 $25 $30 $35 $40

Qd 120 100 80 75 60

Qs 80 80 80 80 80

If the govt. impose a tax of $5, the new equilibrium price

inclusive of tax will be

A. $25

B. $30

C. $35

D. $40

Soln: The supply is perfectly inelastic.

∴Supply curve won’t shift.

∴Equilibrium price remains at $30.

∴The answer is B.

☆The housing authority has offered to sell rental flats in public

housing to the public tenants. However, not many tenants have

expressed a desire to buy the flats they are living in. Which of

the following would make the tenants more willing to buy them?

A. increasing the supply of flats in the private sector.

B. increasing the rents of public housing units.

C. increasing the interest rate on home mortgage loan.

D. increasing the quantity of Home Ownership Scheme flats

allocated to tenants.

2019 3 62 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

Soln: Renting and buying the flats are substitutes.

When price of rent↑, Qd for rent↓, D of buy↑

∴The answer is B.

☆Suppose there is a technological advancement in the

production of a normal good. In which of the following

situations may the market price of the good remain unchanged?

A. The income of consumers decreases.

B. The government raises the unit sales tax on the good.

C. The demand for the good is perfectly inelastic.

D. The supply of the good is perfectly inelastic.

Soln: Supply increases due to technological advancement.

☆Producer A goes bankrupt and closes down at the beginning of

the year. The price of ball pens of producer B increases from $6

to $8 while the quantity transacted increases by 50%. We can

conclude

A. the price elasticity of demand is greater than 1.

B. the price elasticity of demand is smaller than 1

C. the price elasticity of supply is greater than 1

D. the price elasticity of supply is smaller than 1

Soln: P↑, Q↑ Þdemand increases.

Þmovement along supply curve.

2019 3 63 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

elasticity=

∴The answer is C.

☆The imposition of a per-unit sales tax on a good will reduce its

equilibrium quantity if

A. the demand is inelastic.

B. the demand is elastic.

C. the demand is unitarily elastic.

D. All of the above is correct.

Soln: The upward shift of the supply curve will reduce the

equilibrium quantity unless there is a perfectly inelastic demand.

∴The answer is D.

A. B. C.

☆HK’s recent economic recession has caused a decline in

people’s income. In view of this, the government decided to

lower the effective minimum wage level of Filipino maids. As a

result of these two changes,

(1) the demand for Filipino maids showed decrease.

(2) the quantity supplied of Filipinos maids should decrease.

2019 3 64 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

(3) the excess supply of Filipino maids should decrease.

(4) the total expenditure on the employment of Filipino maids

should drop.

Soln: (1) is correct. Income↓ so D↓.

(2) is correct. P↓ So Qs↓.

(3) is incorrect. It depends on the extent of decrease in demand.

(4) is incorrect because TE may ↑/↓/ remains unchanged,

depending on the extent of decrease in demand & decrease in

minimum wage.

☆ If price decreases

from $3 to P, the total

revenue will be

A. equal to $30

B. greater than $30

C. smaller than $30

Soln: it is a movement along lower part of the demand curve, the

demand is inelastic

2019 3 65 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

∴%decrease in price > % increase in quantity

∴TR↓

∴The answer is C.

☆Suppose the government provides a subsidy to vegetable

suppliers in order to encourage the consumption of vegetables.

In which of the following situations will the subsidy have no

effect on the quantity transacted?

(1) The price elasticity of demand is equal to zero.

(2) The price elasticity of demand is equal to infinity.

(3) The price elasticity of supply is equal to zero.

(4) The price elasticity of supply is equal to infinity.

Soln: elasticity = 0, perfectly inelastic supply/ demand

∴The answer is (1) and (3) only.

☆ Price ($) 9 8 7 6 5 4 3 2 1

Qs 17 16 15 14 13 12 11 10 9

Qd 7 8 9 10 11 12 13 14 15

Suppose a per-unit fax of $4 is imposed on the supply of Good

X. The total social surplus is maximized without the tax. After

the tax, the deadweight loss is

A. $2

B. $4

C. $6

2019 3 66 BACK TO CONTENT

© 2019 M.T. Education (Hong Kong) Company Limited All Rights Reserved

SAMPLE

D. $8

Soln: -before the tax, price is $4 and quantity is 12

-after the tax, price is $6 and quantity is 10

∴The 11th and 12th output are not produced after the tax.

① For the 12th unit, MB=$4, MC=$4

9 loss in TSS=$0

For the 11th unit, MB=$5, MC=$3

9 loss in TSS=$2

∴The answer is A.

② -Before the tax, marginal costs of 11th and 12th units are $3

and $4 respectively. Total cost = $7.

-Total benefit=MB of 11th & 12th units

=$5+$4

=$9

∴Loss in TSS=$9–$7=$2#

☆ The original market price is at $6 per unit. Suppose the

government imposes an effective price floor at $9 per unit. How

does the consumer surplus change?

Unit price ($) Quantity demanded (unit)

12 0

9 1

6 2

2019 3 67 BACK TO CONTENT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 - Investment Banking and BrokerageDocument152 pages1 - Investment Banking and BrokerageLordie BlueNo ratings yet

- Bachelor Degree TimetableDocument20 pagesBachelor Degree Timetablebite meNo ratings yet

- Porcelain Club - Letter To HarvardDocument2 pagesPorcelain Club - Letter To HarvardEvanNo ratings yet

- Escovilla 4qmath3aa2 - Patterns in The World I Live inDocument7 pagesEscovilla 4qmath3aa2 - Patterns in The World I Live inapi-743665882No ratings yet

- Atis SentencesDocument3 pagesAtis Sentences이지수(사범대학 교육공학과)No ratings yet

- PURELL® Hand Sanitizer Gel: Safety Data SheetDocument14 pagesPURELL® Hand Sanitizer Gel: Safety Data SheetOmid BeygiNo ratings yet

- CPN-CSPC Protocol 26nov2014Document136 pagesCPN-CSPC Protocol 26nov2014John J. MacasioNo ratings yet

- Test Bank For Biology The Unity and Diversity of Life 14Th Edition by Starr Taggart and Evers Isbn 1305073959 978130507395 Full Chapter PDFDocument36 pagesTest Bank For Biology The Unity and Diversity of Life 14Th Edition by Starr Taggart and Evers Isbn 1305073959 978130507395 Full Chapter PDFjoan.derrick732100% (10)

- Use of Almond Our and Stevia in Rice-Based Gluten-Free Cookie ProductionDocument13 pagesUse of Almond Our and Stevia in Rice-Based Gluten-Free Cookie ProductionLoredana Veronica ZalischiNo ratings yet

- Hard TimesDocument3 pagesHard TimesPaola LamannaNo ratings yet

- Bush Foundation - Communications Program Manager(s)Document2 pagesBush Foundation - Communications Program Manager(s)Lars LeafbladNo ratings yet

- Chapter Vii - Ethics For CriminologistsDocument6 pagesChapter Vii - Ethics For CriminologistsMarlboro BlackNo ratings yet

- Literature Review of Water Level SensorDocument4 pagesLiterature Review of Water Level Sensorc5mr3mxf100% (1)

- Self Affirmation ScaleDocument19 pagesSelf Affirmation ScaleQonitah Arya SulthanahNo ratings yet

- A. H. M. Jones - Studies in Roman Government and Law-Basil Blackwell (1960)Document260 pagesA. H. M. Jones - Studies in Roman Government and Law-Basil Blackwell (1960)L V100% (1)

- Lec 6 Technology of OperativeDocument8 pagesLec 6 Technology of OperativeHassan TantawyNo ratings yet

- Python Arsenal For RE 1.1Document65 pagesPython Arsenal For RE 1.1uhilianNo ratings yet

- Life in The Universe 3rd Edition Bennett Test BankDocument35 pagesLife in The Universe 3rd Edition Bennett Test Bankjaundicecrincum05ba2100% (29)

- Manoj Bhargava: From Billionaire Monk To Ground-Breaking Change MakerDocument5 pagesManoj Bhargava: From Billionaire Monk To Ground-Breaking Change MakerAdilAdNo ratings yet

- EagleBurgmann - Fluachem Expansion Joints - ENDocument5 pagesEagleBurgmann - Fluachem Expansion Joints - ENRoberta PugnettiNo ratings yet

- Most and LEast LEarned Competencies 2022 2023 NUNAGDocument3 pagesMost and LEast LEarned Competencies 2022 2023 NUNAGJONATHAN NUNAGNo ratings yet

- Toym and TofilDocument19 pagesToym and TofilJohn Rey CempronNo ratings yet

- Reading PracticeDocument1 pageReading Practicejemimahluyando8No ratings yet

- Philosophical Elements in Thomas Kuhn's Historiography of ScienceDocument12 pagesPhilosophical Elements in Thomas Kuhn's Historiography of ScienceMartín IraniNo ratings yet

- IJTK SupplementaryDocument9 pagesIJTK SupplementaryNastySon FootNimbusNo ratings yet

- Interview With Uns MuftiDocument3 pagesInterview With Uns MuftiNabeel Aejaz100% (1)

- 2017 Carryall 500-550 (ERIC and EX-40 EFI)Document442 pages2017 Carryall 500-550 (ERIC and EX-40 EFI)bartolomealmacenNo ratings yet

- Question Paper Code:: (10×2 20 Marks)Document2 pagesQuestion Paper Code:: (10×2 20 Marks)GOJAN ECENo ratings yet

- Tree Plantation Strategy - GTRDocument37 pagesTree Plantation Strategy - GTRPapa RajuNo ratings yet

- Unit 7 7.2 Key ConceptsDocument3 pagesUnit 7 7.2 Key ConceptsCésar RubioNo ratings yet