Professional Documents

Culture Documents

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Uploaded by

Praise and worshipCopyright:

Available Formats

You might also like

- Philosophical Foundations of EducationDocument38 pagesPhilosophical Foundations of EducationSherwin Soroten80% (5)

- Home Buyers Guide Standard BankDocument32 pagesHome Buyers Guide Standard Bank07961056320% (1)

- Business Policy and Strategy ExamDocument3 pagesBusiness Policy and Strategy ExamMARITONI MEDALLANo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50solankisanjay2875No ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSongs TrendsettersNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50Sakshi SharmaNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesPrashant DalviNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicessuraj PatilNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSyed ZaheerNo ratings yet

- Ind Nifty Private BankDocument2 pagesInd Nifty Private BankJackNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50Prabhakar DalviNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankSatish RajkumarNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesKevinSuriyanNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicesswaroopr8No ratings yet

- Nifty Bank Weightage 2022Document2 pagesNifty Bank Weightage 2022Latnekar VNo ratings yet

- Factsheet NiftyMidSmallFinancialSevicesDocument2 pagesFactsheet NiftyMidSmallFinancialSevicesKrishna GoyalNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVishal GandhleNo ratings yet

- Factsheet NiftyFinancialServicesExBankDocument2 pagesFactsheet NiftyFinancialServicesExBankpatsan007No ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50patsan007No ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Anil KumarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankEshaan ChadhaNo ratings yet

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- Ind Nifty BankDocument2 pagesInd Nifty Bankdata manageNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFMinal PatilNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Banksandeep jainNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFLee leeNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankJessy JainNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFAJAY KUMAR TALATHOTANo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFHandi BiryaniNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)arjunasahu1986No ratings yet

- March 29, 2019: Portfolio CharacteristicsDocument2 pagesMarch 29, 2019: Portfolio Characteristicsprem sagarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankIndustry Standard Structural DesignNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20swaroopr8No ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50RajneeshNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Natasha SNo ratings yet

- BN ComponentsDocument2 pagesBN ComponentsAshwani PatelNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankalrickbarwa2006No ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankBharat BajoriaNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVikas GowdaNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoJackNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFÄñîRûddhâ JâdHäv ÂjNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankAhmedNasirNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketthankyouji12345No ratings yet

- Ind Nifty50Document2 pagesInd Nifty50NNo ratings yet

- New Imp VV ImpvDocument2 pagesNew Imp VV ImpvNeeraj KohliNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankAshish SinghNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Aswin PoomangalathNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30namharidwarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankDharmendra Singh GondNo ratings yet

- January 31, 2020: Portfolio CharacteristicsDocument2 pagesJanuary 31, 2020: Portfolio Characteristicskishore kumarNo ratings yet

- Balance Sheet StructuresFrom EverandBalance Sheet StructuresAnthony N BirtsNo ratings yet

- Consignee: (Ek487) Al Ashrafi Metal Coating Co. LLC P.O BOX 33031 Dubai - U.A.E Plant No. 1 Al Qusais - DubaiDocument3 pagesConsignee: (Ek487) Al Ashrafi Metal Coating Co. LLC P.O BOX 33031 Dubai - U.A.E Plant No. 1 Al Qusais - DubaiPraise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Chemical Stock UpdatedDocument21 pagesChemical Stock UpdatedPraise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Ashrafi CA Table R1Document10 pagesAshrafi CA Table R1Praise and worshipNo ratings yet

- Goodsclassification Cas Un Hs Nameofproduct Goodsunit: Maximumquantitystored Currentquantitystored ChemicalcompositionDocument3 pagesGoodsclassification Cas Un Hs Nameofproduct Goodsunit: Maximumquantitystored Currentquantitystored ChemicalcompositionPraise and worshipNo ratings yet

- MR - MD Samiullah: Page 1 of 1 M-2263937Document1 pageMR - MD Samiullah: Page 1 of 1 M-2263937Notty AmreshNo ratings yet

- CBSE Class 8 Revision Worksheets and Sample PapersDocument43 pagesCBSE Class 8 Revision Worksheets and Sample PapersAanya PariharNo ratings yet

- The Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentDocument2 pagesThe Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentPR.comNo ratings yet

- Flap T - The American TDocument18 pagesFlap T - The American TrrrgbfjjNo ratings yet

- Chapter 4 - Quiz EnglishDocument2 pagesChapter 4 - Quiz EnglishFitri-ssiNo ratings yet

- Unit 4Document2 pagesUnit 4LaraNo ratings yet

- Garthoff, Cuban Missile Crisis - The Soviet StoryDocument21 pagesGarthoff, Cuban Missile Crisis - The Soviet StoryJoseNo ratings yet

- Early AdulthoodDocument30 pagesEarly AdulthoodJovita Calista100% (1)

- Evolutionary Psychology PDFDocument2 pagesEvolutionary Psychology PDFChelseaNo ratings yet

- Govt 2226 2014.finalDocument24 pagesGovt 2226 2014.finalHarrisonLochtenbergNo ratings yet

- Samsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDocument1 pageSamsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDhruv GohelNo ratings yet

- LIST OF CANDIDATES FOR INTERVIEW - DEPUTY MANAGER F&A - RFCL - 2018 PDFDocument4 pagesLIST OF CANDIDATES FOR INTERVIEW - DEPUTY MANAGER F&A - RFCL - 2018 PDFSwarup NayakNo ratings yet

- Rivera Iii V Comelec (1991) : Term Limits - Sandoval-Gutierrez, J. - G.R. No. 167591, G.R. No. 170577Document2 pagesRivera Iii V Comelec (1991) : Term Limits - Sandoval-Gutierrez, J. - G.R. No. 167591, G.R. No. 170577Chelle BelenzoNo ratings yet

- Read-and-Interpret Pie-ChartsDocument19 pagesRead-and-Interpret Pie-ChartsMANILYN C. CARCALLASNo ratings yet

- Shelter Island Reporter Classifieds: Sept. 11, 2014Document2 pagesShelter Island Reporter Classifieds: Sept. 11, 2014TimesreviewNo ratings yet

- SC CircularsDocument65 pagesSC CircularskaiNo ratings yet

- Voiceless IndiaDocument2 pagesVoiceless Indiasantosh kumarNo ratings yet

- CUATRIZ - My Three Acts of GoodnessDocument2 pagesCUATRIZ - My Three Acts of GoodnessJacqueline HarleNo ratings yet

- Dhanushvasudevan ResumeDocument1 pageDhanushvasudevan Resumeapi-318807442No ratings yet

- Vocab 27 NewDocument2 pagesVocab 27 Newapi-359741140No ratings yet

- Oracle Hospitality OPERA 5 Property ManagementDocument4 pagesOracle Hospitality OPERA 5 Property ManagementnisheednairNo ratings yet

- Tailor-Made Flights: Electronic Ticket ReceiptDocument2 pagesTailor-Made Flights: Electronic Ticket ReceiptJavierNo ratings yet

- Lopez Edilbert B. Back Up Power System For Water Supply Station FinalDocument32 pagesLopez Edilbert B. Back Up Power System For Water Supply Station Finalalvin castroNo ratings yet

- Miguel Perez Rubio vs. Hon. Samuel Reyes, Et Al.Document3 pagesMiguel Perez Rubio vs. Hon. Samuel Reyes, Et Al.ZsazsaNo ratings yet

- Cadet Handbook: Itizenchip Dvancement RainingDocument17 pagesCadet Handbook: Itizenchip Dvancement RainingManu Emelon McBulosNo ratings yet

- Mobil Bible School FinalDocument7 pagesMobil Bible School FinalHassan KoromaNo ratings yet

- 10i-Rosal-Macbeth IiDocument4 pages10i-Rosal-Macbeth IiMatthew RosalNo ratings yet

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Uploaded by

Praise and worshipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)

Uploaded by

Praise and worshipCopyright:

Available Formats

May 31, 2021

Nifty Financial Services 25/50 is a new capped version of Nifty Financial Services index, where 25 refers to the maximum value for

the % weight of a single stock and 50 refers to maximum value for the aggregate % weight for all stocks with individual weight more

than 5%.

Nifty Financial Services 25/50 Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index

funds, ETFs and structured products.

Index Variant: NIFTY Financial Services 25/50 Total Returns Index

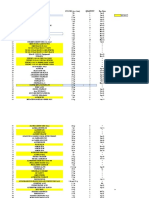

Portfolio Characteristics

Methodology Periodic capped free-float Index Since

QTD YTD 1 Year 5 Years

Returns (%) Inception

No. of Constituents 20

Price Return 6.21 11.90 77.77 17.70 17.43

Launch Date May 20, 2020 Total Return 6.40 12.18 78.66 18.75 19.11

Base Date January 01, 2004

Since

Base Value 1000 Statistics ## 1 Year 5 Years

Inception

Calculation Frequency Online Daily Std. Deviation * 24.53 23.98 28.41

Index Rebalancing Semi - Annually Beta (NIFTY 50) 1.27 1.21 1.13

Correlation (NIFTY 50) 0.91 0.93 0.91

1 Year Performance Comparison of Sector Indices

Fundamentals

P/E P/B Dividend Yield

21.74 4.01 0.59

Top constituents by weightage

Company’s Name Weight(%)

HDFC Bank Ltd. 16.88

Housing Development Finance Corporation 13.81

ICICI Bank Ltd. 13.77

Bajaj Finserv Ltd. 5.41

State Bank of India 4.96

SBI Life Insurance Company Ltd. 4.60

Bajaj Finance Ltd. 4.56

Axis Bank Ltd. 4.49

Kotak Mahindra Bank Ltd. 4.26

HDFC Life Insurance Company Ltd. 4.15

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy

and reliability of the above information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of

the information contained herein and disclaim any and all liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information

provided herein. The information contained in this document is not intended to provide any professional advice.

1

May 31, 2021

Index Methodology

• Nifty Financial Services is the base index for this index where all stocks forming part of Nifty Financial Services shall form part of

this index.

• Weight of stocks in the Index is based on free-float market capitalization method subject to following weight caps.

• Weight of stocks within this index are capped to achieve the following:

• Weight of the individual stock should not exceed 25%

• Aggregate weight of all the stocks with individual weight above 5% should not exceed 50%

• A buffer of 10% of the value of each cap limit is used in order to reduce the probability of passive breach of above mentioned

capping limits due to stock price movements between two quarterly rebalancing.

• Accordingly, at the time of quarterly rebalancing of Nifty Financial Services 25/50 Index,

• Weight of each stock is capped at 22.5%

• Sum of the top 3 stocks is capped at 45% subject to individual stock floored at 4.6% Stocks below top 3 are individually capped at

4.5%

• The index will follow the composition of Nifty Financial Services Index at every point in time.

Index Weight Re-Balancing:

Index weight will be rebalanced on a quarterly basis.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

NIFTY 50 NIFTY Bank NIFTY CPSE NIFTY100 Equal Weight NIFTY 10 yr Benchmark G-Sec

NIFTY Next 50 NIFTY IT NIFTY Commodities NIFTY50 PR 1x Inverse NIFTY 8-13 yr G-Sec

NIFTY 100 NIFTY PSU Bank NIFTY Energy NIFTY50 PR 2x Leverage NIFTY 4-8 yr G-Sec

NIFTY 200 NIFTY FMCG NIFTY Shariah 25 NIFTY50 Value 20 NIFTY 11-15 yr G-Sec

NIFTY 500 NIFTY Private Bank NIFTY 100 Liquid15 NIFTY100 Quality 30 NIFTY 15 yr and above G-Sec

NIFTY Midcap 50 NIFTY Metal NIFTY Infrastructure NIFTY Low Volatility 50 NIFTY Composite G-Sec

NIFTY Midcap 100 NIFTY Financial Services NIFTY Corporate Group NIFTY Alpha 50 NIFTY 1D Rate

Contact Us:

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com

2

You might also like

- Philosophical Foundations of EducationDocument38 pagesPhilosophical Foundations of EducationSherwin Soroten80% (5)

- Home Buyers Guide Standard BankDocument32 pagesHome Buyers Guide Standard Bank07961056320% (1)

- Business Policy and Strategy ExamDocument3 pagesBusiness Policy and Strategy ExamMARITONI MEDALLANo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50solankisanjay2875No ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSongs TrendsettersNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50Sakshi SharmaNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesPrashant DalviNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicessuraj PatilNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesSyed ZaheerNo ratings yet

- Ind Nifty Private BankDocument2 pagesInd Nifty Private BankJackNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50Prabhakar DalviNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankSatish RajkumarNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesKevinSuriyanNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial Servicesswaroopr8No ratings yet

- Nifty Bank Weightage 2022Document2 pagesNifty Bank Weightage 2022Latnekar VNo ratings yet

- Factsheet NiftyMidSmallFinancialSevicesDocument2 pagesFactsheet NiftyMidSmallFinancialSevicesKrishna GoyalNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVishal GandhleNo ratings yet

- Factsheet NiftyFinancialServicesExBankDocument2 pagesFactsheet NiftyFinancialServicesExBankpatsan007No ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50patsan007No ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Anil KumarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankEshaan ChadhaNo ratings yet

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- Ind Nifty BankDocument2 pagesInd Nifty Bankdata manageNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFMinal PatilNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Banksandeep jainNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFLee leeNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankJessy JainNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFAJAY KUMAR TALATHOTANo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFHandi BiryaniNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)arjunasahu1986No ratings yet

- March 29, 2019: Portfolio CharacteristicsDocument2 pagesMarch 29, 2019: Portfolio Characteristicsprem sagarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankIndustry Standard Structural DesignNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20swaroopr8No ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50RajneeshNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Natasha SNo ratings yet

- BN ComponentsDocument2 pagesBN ComponentsAshwani PatelNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankalrickbarwa2006No ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankBharat BajoriaNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVikas GowdaNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoJackNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFÄñîRûddhâ JâdHäv ÂjNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankAhmedNasirNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketthankyouji12345No ratings yet

- Ind Nifty50Document2 pagesInd Nifty50NNo ratings yet

- New Imp VV ImpvDocument2 pagesNew Imp VV ImpvNeeraj KohliNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankAshish SinghNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Aswin PoomangalathNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30namharidwarNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankDharmendra Singh GondNo ratings yet

- January 31, 2020: Portfolio CharacteristicsDocument2 pagesJanuary 31, 2020: Portfolio Characteristicskishore kumarNo ratings yet

- Balance Sheet StructuresFrom EverandBalance Sheet StructuresAnthony N BirtsNo ratings yet

- Consignee: (Ek487) Al Ashrafi Metal Coating Co. LLC P.O BOX 33031 Dubai - U.A.E Plant No. 1 Al Qusais - DubaiDocument3 pagesConsignee: (Ek487) Al Ashrafi Metal Coating Co. LLC P.O BOX 33031 Dubai - U.A.E Plant No. 1 Al Qusais - DubaiPraise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Chemical Stock UpdatedDocument21 pagesChemical Stock UpdatedPraise and worshipNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Ashrafi CA Table R1Document10 pagesAshrafi CA Table R1Praise and worshipNo ratings yet

- Goodsclassification Cas Un Hs Nameofproduct Goodsunit: Maximumquantitystored Currentquantitystored ChemicalcompositionDocument3 pagesGoodsclassification Cas Un Hs Nameofproduct Goodsunit: Maximumquantitystored Currentquantitystored ChemicalcompositionPraise and worshipNo ratings yet

- MR - MD Samiullah: Page 1 of 1 M-2263937Document1 pageMR - MD Samiullah: Page 1 of 1 M-2263937Notty AmreshNo ratings yet

- CBSE Class 8 Revision Worksheets and Sample PapersDocument43 pagesCBSE Class 8 Revision Worksheets and Sample PapersAanya PariharNo ratings yet

- The Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentDocument2 pagesThe Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentPR.comNo ratings yet

- Flap T - The American TDocument18 pagesFlap T - The American TrrrgbfjjNo ratings yet

- Chapter 4 - Quiz EnglishDocument2 pagesChapter 4 - Quiz EnglishFitri-ssiNo ratings yet

- Unit 4Document2 pagesUnit 4LaraNo ratings yet

- Garthoff, Cuban Missile Crisis - The Soviet StoryDocument21 pagesGarthoff, Cuban Missile Crisis - The Soviet StoryJoseNo ratings yet

- Early AdulthoodDocument30 pagesEarly AdulthoodJovita Calista100% (1)

- Evolutionary Psychology PDFDocument2 pagesEvolutionary Psychology PDFChelseaNo ratings yet

- Govt 2226 2014.finalDocument24 pagesGovt 2226 2014.finalHarrisonLochtenbergNo ratings yet

- Samsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDocument1 pageSamsung 6.2 KG With Monsoon Feature Fully Automatic Top Load GreyDhruv GohelNo ratings yet

- LIST OF CANDIDATES FOR INTERVIEW - DEPUTY MANAGER F&A - RFCL - 2018 PDFDocument4 pagesLIST OF CANDIDATES FOR INTERVIEW - DEPUTY MANAGER F&A - RFCL - 2018 PDFSwarup NayakNo ratings yet

- Rivera Iii V Comelec (1991) : Term Limits - Sandoval-Gutierrez, J. - G.R. No. 167591, G.R. No. 170577Document2 pagesRivera Iii V Comelec (1991) : Term Limits - Sandoval-Gutierrez, J. - G.R. No. 167591, G.R. No. 170577Chelle BelenzoNo ratings yet

- Read-and-Interpret Pie-ChartsDocument19 pagesRead-and-Interpret Pie-ChartsMANILYN C. CARCALLASNo ratings yet

- Shelter Island Reporter Classifieds: Sept. 11, 2014Document2 pagesShelter Island Reporter Classifieds: Sept. 11, 2014TimesreviewNo ratings yet

- SC CircularsDocument65 pagesSC CircularskaiNo ratings yet

- Voiceless IndiaDocument2 pagesVoiceless Indiasantosh kumarNo ratings yet

- CUATRIZ - My Three Acts of GoodnessDocument2 pagesCUATRIZ - My Three Acts of GoodnessJacqueline HarleNo ratings yet

- Dhanushvasudevan ResumeDocument1 pageDhanushvasudevan Resumeapi-318807442No ratings yet

- Vocab 27 NewDocument2 pagesVocab 27 Newapi-359741140No ratings yet

- Oracle Hospitality OPERA 5 Property ManagementDocument4 pagesOracle Hospitality OPERA 5 Property ManagementnisheednairNo ratings yet

- Tailor-Made Flights: Electronic Ticket ReceiptDocument2 pagesTailor-Made Flights: Electronic Ticket ReceiptJavierNo ratings yet

- Lopez Edilbert B. Back Up Power System For Water Supply Station FinalDocument32 pagesLopez Edilbert B. Back Up Power System For Water Supply Station Finalalvin castroNo ratings yet

- Miguel Perez Rubio vs. Hon. Samuel Reyes, Et Al.Document3 pagesMiguel Perez Rubio vs. Hon. Samuel Reyes, Et Al.ZsazsaNo ratings yet

- Cadet Handbook: Itizenchip Dvancement RainingDocument17 pagesCadet Handbook: Itizenchip Dvancement RainingManu Emelon McBulosNo ratings yet

- Mobil Bible School FinalDocument7 pagesMobil Bible School FinalHassan KoromaNo ratings yet

- 10i-Rosal-Macbeth IiDocument4 pages10i-Rosal-Macbeth IiMatthew RosalNo ratings yet