Professional Documents

Culture Documents

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Menuka SiwaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

Menuka SiwaCopyright:

Available Formats

Test Series: May, 2020

MOCK TEST PAPER – 1

FINAL (OLD) COURSE: GROUP – I

PAPER 4: CORPORATE AND ALLIED LAWS

Time Allowed – 3 Hours Maximum Marks – 100

DIVISION A: MULTIPLE CHOICE QUESTIONS (TOTAL OF 30 MARKS)

Instructions: All questions are compulsory.

Integrated Case Scenario 1 (8 Marks)

M/s. Sheetal Chemicals Limited (SCL) is a listed public company dealing in petrochemicals which are used

in numerous household products like wax, detergents, dyes, carpeting, safety glasses, etc.

As per the latest audited balance sheet as at 31st March, 2019, company have following financial position-

Paid up share capital Rs. 40 crore

Authorised capital Rs. 50 crore

Turnover for FY 2018-2019 Rs. 300 crore

Composition of Board

The company has thirteen directors on its Board namely, A1, B2, C3, D4, E5, F6, G7, H8, I9, J10, K11, L12

and M13 of which A1, B2, C3, D4 and E5 are the independent directors. The Articles of Association of the

company restrict the maximum number of directors to fifteen.

SCL remains ever-conscious to corporate governance and ensures compliance to legal provisions in both

letter and spirit. L12 is the Managing Director of the company whereas M13 is the only woman director. The

company has constituted requisite committees as per the requirements of law. The Audit Committee

consists of seven directors as members i.e. A1, B2, C3, D4, E5, I9, J10 and K11.

Earlier, for the financial year ending 31st March, 2018, the company successfully convened and held Annual

General Meeting (AGM) on 25th September, 2018 at its registered office at Pune. On the fateful day of

AGM, while returning to Mumbai from Pune by road after her re-appointment at AGM, a fatal accident

claimed the life of M13 thus snatching an efficient and trustworthy director from the hands of the company.

Later on, a Board Meeting was held on 09-01-2019 and N14, a finance professional and daughter of

deceased woman director M13 was appointed as director to fill the vacancy of woman director so created

due to the death of M13. It may be noted that before 09-01-2019, a Board Meeting was held on 15-09-2018.

SCL is a growing company which wants to diversify its business into the sphere of agrochemicals also and

therefore, desires to bring on its Board O15 who is a chemical engineer with hands-on experience of about

twenty years post his qualification in the field of agrochemicals and other petroleum products. Besides

production, he is well versed in marketing of agrochemicals both in India and abroad. It is hoped that he

shall prove to be a valuable asset to the company. Accordingly, a Board Meeting was held on 14 th April,

2019 to appoint O15 as additional director. As the total strength of directors was well within the limit

prescribed by the Articles, there was no need to alter the Articles.

© The Institute of Chartered Accountants of India

Multiple Choice Questions (MCQs)

1. After the appointment of O15 as additional director on 14-04-2019, another Board Meeting of SCL was held

on 17-05-2019. From the given options, choose the correct one which indicates the quorum for the current

Board meeting.

(a) Nine directors

(b) Five directors

(c) Four directors

(d) Two directors

2. For the purpose of meeting of the Audit Committee of SCL, how many members should be present at such

meeting in order to constitute the quorum.

(a) All the seven members

(b) Only five members of which minimum two should be independent members

(c) Only three members of which minimum two should be independent members

(d) Only two members of which minimum one should be independent member

3. From the case scenario, it is observed that after the death of M13, her daughter N14 was appointed at a

Board Meeting held on 09-01-2019 to fill the vacancy of woman director. Is the appointment of N14 on 09-

01-2019 justified?

(a) No. The appointment of N14 should have been made within three months from 25-09-2018.

(b) No. The appointment of N14 should have been made within two months from 25-09-2018.

(c) No.The appointment of N14 should have been made within one month from 25-09-2018.

(d) Yes. The appointment of N14 made on 09-01-2019 is justified.

4. In the above case scenario, L12 is the Managing Director of SCL. If it is assumed that there is no managing

or whole-time director, then in such a situation, how much remuneration the company can pay to all the

directors for the Financial Year 2019-20.

(a) 11% of the net profits available for the Financial Year 2019-20

(b) 5% of the net profits available for the Financial Year 2019-20

(c) 3% of the net profits available for the Financial Year 2019-20

(d) 1% of the net profits available for the Financial Year 2019-20

Integrated Case Scenario 2 (10 Marks)

Hiwaves Private Ltd. for expansion of its business took the financial debt of Rs. 50 crore from the GBC

Bank Ltd. in 2017. Hiwaves Private Ltd. in its initial one year paid the instalments of the amount of debt

timely. However from mid of 2018, Hiwaves Private Ltd. started omission in the payments of instalments.

Despite of repeated reminders, Hiwaves Private Ltd. continued with default in payments of instalments.

GBC Bank Ltd. filed an application under Insolvency and Bankruptcy Code, 2016 for initiating Corporate

Insolvency Resolution Process (CIRP) against Hiwaves Private Ltd., alleging default in payments of debt,

interest and other charges on 18th November, 2018.

The application was admitted in the NCLT on 1st December, 2018.

The Ex-directors and shareholders of Hiwaves Private Ltd. preferred an appeal against the said admission

of application under section 7 of the IBC. Appellant submitted that name of Hiwaves Private Ltd. was struck

off from the Register of Companies under Section 248 of the Companies Act, 2013. Also, asserted that

2

© The Institute of Chartered Accountants of India

application under section 7 of IBC was preferred by GBC Bank Ltd., is barred by limitation and against a

non-existent company (i.e. Hiwaves Private Ltd.). So, they alleged that no such application is maintainable.

However, the appeal was set aside.

During the CIRP, Resolution Professional (RP), “Mr. Amar” was appointed to manage the estate of the

Hiwaves Private Ltd.

During the pendency of the CIRP, the Enforcement Directorate (ED) provisionally attached the assets

belonging to the Hiwaves Private Ltd. Mr. Amar (RP) intimated the ED about initiation of the CIRP and

imposition of moratorium on the property and assets of the Hiwaves Private Ltd. as the resolution

professional was required to take charge and custody of the same. ED submitted that moratorium declared

by the Adjudicating Authority would not be applicable to the criminal case initiated under the Prevention of

Money Laundering Act, 2002.

Multiple Choice Questions

1. Comments upon attachment order of Enforcement Directorate under PML Act during moratorium in the

given case:

(a) Attachment order is valid and resolution professional cannot take charge of property.

(b) Attachment order is not valid.

(c) Attachment order is valid but Resolution Professional can proceed to take charge of property and deal

under IBC.

(d) Attachment order is nullity and Resolution Professional can proceed to take charge of the property

and deal under the IBC, as if no attachment orders.

2. In the given case, Hiwaves Private Ltd. was struck off from Register of Companies under the Companies

Act, 2013. State whether GBC Bank Ltd. can file an application under section 7 of the Code-

(a) No. Application cannot be filed as the Hiwaves Private Ltd. is no more in the existence as it is struck

off from Register of Companies.

(b) No. Application cannot be filed under the Code but under the Companies Act be filed within 2 years

from the date of notice notified in Official Gazette on struck off from Register of Companies.

(c) Yes. Application can be filed under both the laws by the GBC Bank Ltd, being under the two different

jurisdictions.

(d) Yes. Application can be filed on an appeal of GBC bank Ltd. (being a creditor) before Tribunal under

the Companies Act for taking Hiwaves Private Ltd. into register of companies, and then may file an

application of initiation of CIRP under the capacity financial creditor, under the Code.

3. As given in the case, GBC Bank Ltd. files an application for initiation of CIRP on 18th November, 2018

which was admitted on 1st December, 2018. Suppose, if later Hiwaves Private Ltd. pays off the outstanding

debt amount and request the GBC Bank Ltd. to withdraw the application. Specify which amongst the

following is the correct statement:

(a) No withdrawal can be done, as the application has been admitted.

(b) Yes, withdrawal is possible by approval of 66% of voting shares of the CoC.

(c) No withdrawal is applicable here as application of CIRP is not maintainable as Hiwaves Private Ltd. is

struck off.

(d) Yes, withdrawal is possible by approval of 90% of voting shares of the CoC.

© The Institute of Chartered Accountants of India

4. Within how many days application for initiation of CIRP can be admitted by NCLT, as it was filed on 18th

November, 2018 by GBC Bank Ltd.?

(a) Within 7 days from receipt of application

(b) Within 10 days from receipt of application

(c) Within 14 days from receipt of application

(d) Within 21 days from receipt of application

5. Suppose, NCLT rejects application of GBC Bank Ltd. on account of incomplete application submitted before

it. Within how many days, the applicant can rectify the defect in the application?

(a) Within 7 days of receipt of such notice from NCLT

(b) Within 10 days of receipt of such notice from NCLT

(c) Within 14 days of receipt of such notice from NCLT

(d) Within 30 days of receipt of such notice from NCLT

Multiple choice questions (Total 10 marks)

3. Infra Ltd. was winded up by an order of Tribunal dated 10th March, 2019 by the Tribunal. The appointed

official liquidator of the company noticed that the MD of the Infra Ltd. had sold certain properties belonging

to the company to a Supra Pvt. Ltd. in which his brother was interested on 15th October, 2018. This caused

loss to the Infra Ltd. to the extent of INR 60 lakhs. Examine the course of action, the official liquidator can

take in this matter.

(1) The official liquidator can recover the sale of assets of the company as per the Section 328 of the

Companies Act, 2013

(2) The transaction made will be regarded as invalid and restore the position of the company.

(3) This transaction made will be regarded as valid as being made under ordinary course of its

business.

(a) Only statement (1) is correct

(b) Only statement (2) is correct

(c) Only statement (3) is correct

(d) Statements (1) & (2) are correct (2 Marks)

4. Nanny Marcons Private Limited was incorporated on 9th June, 2017. For the financial year 2017-2018,

it did not file its financial statements and annual returns. For the time being the company desires to be

treated as ‘inactive company’ since it does not intend to carry on any business permitted by its

Memorandum. As to when ROC can issue certificate of status of dormant company to ‘Nanny Marcons’

on the basis of non-submission of financial statements if the company makes an application to the

Registrar in this respect.

(a) After non-submission of financial statements for the two financial years i.e. 2018-19 and 2019-20.

(b) After non-submission of financial statements for the next financial year i.e. 2018-19.

(c) After non-submission of financial statements for the three financial years i.e. 2018-19, 2019-20

and 2020-21.

(d) After non-submission of financial statements for the four financial years i.e. 2018-19, 2019-20,

2020-21 and 2021-22 (2Marks)

© The Institute of Chartered Accountants of India

5. Ruby Diamonds Limited is required to establish ‘Vigil Mechanism’ though it is neither a listed company

nor a company which has accepted deposits from the public. Name the third criterion because of

which it is necessitated that the company needs to create ‘Vigil Mechanism’

(a) As per the last audited statements, the subscribed capital of the company is in excess of Rs. 50

crore.

(b) As per the last audited statements, the paid up capital of the company is in excess of Rs. 50

crore.

(c) As per the last audited statements, the turnover of the company is in excess of Rs. 50 crore.

(d) None of the above (1 Mark)

6. Ram and Shyam, two brothers, are professionally qualified Chartered Accountants. They are engaged

in working as recovery agents for different types of loans and advances given by banks to different

customers. They were also involved in arrangement of short terms funds for their client’s. Their

business was doing well and they were making a good amount of money. While dealing with banks

they came to know about Asset reconstruction Companies (ARC’S). Both the brothers wanted to

expand their business, so they decided to register themselves as an ARC. From the following tick the

correct option; which is incorrect in respect of their beginning of ARC business---

(a) Chartered Accountants are not eligible to commence on the business of securitisation or asset

reconstruction.

(b) The requirement of minimum of net owned fund of One hundred crore rupees

(c) After registered as an ARC they will no longer be eligible to continue their business of arranging

short term funds for their clients.

(d) They will be required to raise funds only from qualified buyers. (2 Marks)

7. Videshi. Ltd, a foreign company established with a principal place of business at Kolkata, West

Bengal. The company delivered various documents to Registrar of Companies. State the number of

days and place where the said company shall deliver such documents:

(a) Within 15 days to the Central Government

(b) Within 15 days to the Registrar having jurisdiction over New Delhi

(c) Within 30 days to the Registrar having jurisdiction over West Bengal

(d) Within 30 days to the Registrar having jurisdiction over New Delhi (1 Mark)

8. Mr. Z was appointed as representative of ABC Company for a 10 days corporate programme organized in

USA. During the said period in USA, he was diagnosed with the severe kidney disease, so decided to have

a treatment done in USA. State the maximum amount that can be drawn by Mr. Z as foreign exchange for

the medical treatment abroad.

(a) USD 1,25,000

(b) USD 2,25,000

(c) USD 2,50,000

(d) As estimated by a medical institute offering treatment (1 Mark)

9. An agreement which restricts competition in the relevant market is known as:

(a) Fair-competitive agreement;

(b) Competitive agreement;

(c) Pro-competitive agreement;

(d) Anti-competitive agreement (1 Mark)

5

© The Institute of Chartered Accountants of India

10. Prohibited current account transactions find place in:

(a) Schedule I of the FEM (Current Account Transactions) Rules, 2000.

(b) Schedule II of the FEM (Current Account Transactions) Rules, 2000.

(c) Schedule III of the FEM (Current Account Transactions) Rules, 2000.

(d) All of the above (1 Mark)

11. Any property found to be involved in money laundering cannot be provisionally attached by the

Director, ED for more than ---------------.

(a) 30 days

(b) 60 days

(c) 90 days

(d) 180 days (1 Mark)

DIVISION B: Descriptive questions (70 Marks)

Question No. 1 is compulsory. Out of remaining five questions attempt any four.

1. (a) Prince Ltd. desires to appoint an additional director on its Board of directors. The Articles of the

company confer upon the Board to exercise the power to appoint such a director. As such Mr.

Mantri is appointed as an additional director. In the light of the provisions of the Companies Act,

2013, examine:

(i) Whether Mr. Mantri can continue as director if the annual general meeting of the company is

not held within the stipulated period and is adjourned to a later date?

(ii) Can the power of appointing additional director be exercised at the Annual General Meeting

by the members?

(iii) As the Company Secretary of the company what checks would you make after Mr. Mantri is

appointed as an additional director? (6 Marks)

(b) The Board of Directors of Future Fashions Limited at its meeting recommended a dividend on its

paid-up equity share capital which was later on approved by the shareholders at the Annual

General Meeting. In the meantime, the directors at another meeting of the Board decided by

passing a board resolution to divert the total dividend to be paid to the shareholders for purchase

of certain short-term investments in the name of the company. As a result, dividend was paid to

shareholders after 45 days.

Examining the provisions of the Companies Act, 2013, statewhether the act of directors is in

violation of the provisions of the Act and if so, state the consequences that shall follow for the

above act. (8 Marks)

2. (a) (i) A group of members of XYZ Limited has filed a petition before the Tribunal alleging various

acts of oppression and mismanagement by the majority shareholders of the company. The

Petitioner group holds 12% of the issued share capital of the company. During the pendancy

of the petition, some of the petitioner group holding about 5% of the issued share capital of

the company wish to disassociate themselves from the petition and they along with the other

majority shareholders have submitted before the Tribunal that the petition may be dismissed

on the ground of non-maintainability. Examine their contention having regard to the

provisions of the Companies Act, 2013. (3 Marks)

© The Institute of Chartered Accountants of India

(ii) ABC Limited is a wholly owned subsidiary company of XYZ Limited. The Company wants to

make application for merger of Holding and Subsidiary Companies under Section 232. The

Company Secretary of the XYZ Limited is of the opinion that company cannot apply for

merger as per section 232. The company shall have to apply for merger as per section 233

i.e. Fast Track Merger. Examine on the validity of the contention made by Company

Secretary as per law? (5 Marks)

(b) Examine the given situations in the light of the respective laws:

(i) Mr. Veer is having 400 shares of Travel Everywhere Limited and the current price of these

shares in the market is Rs. 100. Veer’s goal is to sell these shares in 6 months’ time.

However, is worried that the price of these shares could fall considerably, by then. At the

same time, Veer doesn’t want to sell off these shares today, as he conjectured that the

share price might appreciate in the near future. Determine how should Mr. Veer protect his

security and reduce the risk of loss on the share price under the Securities Contract

(Regulation) Act, 1956? (4 Marks)

(ii) SEBI received complaints from some investors alleging that ABC Ltd. and some brokers are

indulging in price manipulation in the shares of ABC Ltd. Explain the powers that can be

exercised by SEBI under the Securities and Exchange Board of India Act, 1992 in case the

allegations are found to be correct. (2 Marks)

3. (a) Leading Ltd. filed an application to the registrar for removal of the name of company from the

register of companies after passing special resolution. On the complaint of certain members,

Registrar came to know that already an application is pending before the Tribunal for the

approval of proposed compromise or arrangement scheme. The application of compromise or

arrangement was filed two months before the filing of this application to the Registrar.

Determine the given situations in the lights of the given facts as per the Companies Act, 2013:

(i) Legality of filing an application by Leading Ltd. before the Registrar.

(ii) Consequences if Leading Ltd. files an application in the above given situation.

(iii) In case Registrar notifies Leading Ltd as dissolved under section 248 in compliances to the

required provisions, what remedy will be available to the aggrieved party? (8 Marks)

(b) ABCRubber Limited and Syntax Tyres Limited marketing their products in India proposes to be

amalgamated. The enterprise created as a result of the said amalgamation will have assets of

value of Rs. 950 crore and a turnover of Rs. 6500 crore. Advise on the validity of proposed

amalgamation in the light of the provisions of the Competition Act, 2002. (6 Marks)

4. (a) ABZ Ltd. an unlisted company with total assets of Rs. one crore as per financial statement as on

31st March, 2018, defaulted in the payment of the financial debt against the financial creditor Mr.

X. Mr. An application for initiation of insolvency process was filed by Mr. X, against ABZ Ltd.

under the fast track corporate insolvency resolution process on 31st May, 2019. Discuss the

relevancy for disposal through the mechanism of the fast track corporate insolvency resolution

process and the legal position of holding of fast track corporate insolvency resolution process by

Mr. X in the term of the IBC, 2016. Compute the time period for completion of fast track process

in the said situation. (8 Marks)

(b) Apex Limited failed to repay the amount borrowed from the banker, ACE Bank Limited, which is

holding a charge on all the assets of the company. The Bank took over management of the

company in accordance with the provisions of the Securitization and Reconstruction of Financial

Assets and Enforcement of Security Interest Act, 2002 by appointing four persons as directors for

7

© The Institute of Chartered Accountants of India

management of the business of the Apex Ltd. The company business before take over, was

managed by a Managing Director, Mr. X. Referring to the provisions of the said Act, examine,

whether Mr. X is entitled to compensation for loss of office in the given circumstances. (6 Marks)

5. (a) Determine the legal positions in the given situations.

(i) Excel Ltd. committed an offence under the Companies Act, 2013. The offences fall within

the jurisdiction of a special court of Bundi district in which the registered office of Excel Ltd

was situated. However in that Bundi district, there were two special courts one in X place

and other in Y place. Identify the jurisdiction of special court for trial of an offences

committed by Excel Ltd. (3 Marks)

(ii) As per provisions of the Companies Act, 2013, what is the status of XYZ Ltd., a Company

incorporated in London, U.K., which has a share transfer office at Mumbai? (2 Marks)

(iii) Abroad Ltd.a foreign company without establishing a place of business in India,issued

prospectus for subscription of securities in India. Being a consultant of the company, advise

on the validity of such an issue of prospectus by Abroad Ltd. (3 Marks)

(b) Mr. Fraudulent, 16 years old, has been arrested for a cognizable and non-bailable offence

punishable under the Prevention of Money Laundering Act, 2002 for money laundering of amount

of 70 lakh. Advise, in the given situation whether Mr. Fraudulent can be released on bail in this

case? (6 Marks)

6. (a) State the procedure for the following, explaining the relevant provisions of the Companies Act,

2013:

(i) Appointment of First Auditor, when the Board of directors did not appoint the First Auditor

within one month from the date of registration of the company.

(ii) Removal of Statutory Auditor (appointed in last Annual General Meeting) before the expiry

of his term. (8 Marks)

(b) (i) Mr. P has won a big lottery and wants to remit US Dollar 20,000 out of his winnings to his

son who is in USA. Advise whether such remittance is possible under the Foreign Exchange

Management Act, 1999. (3 Marks)

(ii) Differentiate Mandatory Provision from a Directory Provision. What factors decide whether a

provision is directory or mandatory? (3 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Intermediate Accounting 1 Review MaterialsDocument24 pagesIntermediate Accounting 1 Review MaterialsGIRLNo ratings yet

- E Patrick Assignment 1 4Document3 pagesE Patrick Assignment 1 4MarlenaNo ratings yet

- Sars V Wiese - Asset DissipationDocument354 pagesSars V Wiese - Asset DissipationTiso Blackstar Group100% (1)

- © The Institute of Chartered Accountants of IndiaDocument16 pages© The Institute of Chartered Accountants of IndiaFentorNo ratings yet

- Practice Questions Company LawDocument8 pagesPractice Questions Company LawAditi SinghNo ratings yet

- Paper 4: Corporate and Allied Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 4: Corporate and Allied Laws (Old Course) : © The Institute of Chartered Accountants of IndiaShyam virsinghNo ratings yet

- Super Test-2Document6 pagesSuper Test-2RitikaNo ratings yet

- All Mcqs Are Compulsory. Question No. 1 Is Compulsory. Attempt Any Four Questions From The RemainingDocument8 pagesAll Mcqs Are Compulsory. Question No. 1 Is Compulsory. Attempt Any Four Questions From The RemainingSanthosh SivaramalingamNo ratings yet

- Ep Module 1 Dec18 OsDocument81 pagesEp Module 1 Dec18 OsHeena MistryNo ratings yet

- CA Inter Law Test 1Document6 pagesCA Inter Law Test 1SwAti KiNiNo ratings yet

- Corporate and Other Laws: CA Inter Law Test Marathon - Test 3Document4 pagesCorporate and Other Laws: CA Inter Law Test Marathon - Test 3Ca FinalsNo ratings yet

- Guideline Answers: Professional Programme (New Syllabus)Document71 pagesGuideline Answers: Professional Programme (New Syllabus)Lekshminarayanan KrishnanNo ratings yet

- 5 6176943427335225437Document46 pages5 6176943427335225437JINENDRA JAINNo ratings yet

- 52592bos42131 Finalold p7Document13 pages52592bos42131 Finalold p7sourabhNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument30 pagesDisclaimer: © The Institute of Chartered Accountants of Indiakunal kumarNo ratings yet

- CL Test Unit 3Document4 pagesCL Test Unit 3VbNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestMehul JainNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShivanshu sethiaNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestShrwan SinghNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestAditya MaheshwariNo ratings yet

- In LW Ut3 QPDocument7 pagesIn LW Ut3 QPFIRST OPINIONNo ratings yet

- Prospectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Document2 pagesProspectus, Meetings & Dividend Question Paper - 1223261 - 2024 - 01 - 22 - 00 - 53Anjali SomaniNo ratings yet

- Ca Final New Course Law MCQDocument5 pagesCa Final New Course Law MCQJayendrakumar KatariyaNo ratings yet

- MCQ Booklet Question DiscussionDocument214 pagesMCQ Booklet Question DiscussionSwAti KiNi100% (1)

- Company Law-Ii, Mid Term Examination, Only QuestionDocument2 pagesCompany Law-Ii, Mid Term Examination, Only QuestionSittu RajNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- CA Inter Law Q MTP 2 May 2024 Castudynotes ComDocument11 pagesCA Inter Law Q MTP 2 May 2024 Castudynotes ComthegodslayyerNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- P13 Corporate Laws ComplianceDocument3 pagesP13 Corporate Laws Compliancekiran babuNo ratings yet

- Corporate & Other Laws Question PaperDocument8 pagesCorporate & Other Laws Question Paperpradhiba meenakshisundaramNo ratings yet

- MTP Law IiDocument11 pagesMTP Law IiAbhishant KapahiNo ratings yet

- RTP May 2021 Law EnglishDocument14 pagesRTP May 2021 Law EnglishVISHALNo ratings yet

- Company Law New Syllabus Question PaperDocument6 pagesCompany Law New Syllabus Question PaperCma Sankaraiah100% (1)

- Corporate and Economic Laws Test 4 May Test 1609311095Document9 pagesCorporate and Economic Laws Test 4 May Test 1609311095CAtestseriesNo ratings yet

- CA Final Law Solution Nov 2015 by CS Tejpal ShethDocument9 pagesCA Final Law Solution Nov 2015 by CS Tejpal ShethAnjana AvoodaiappanNo ratings yet

- SP Case Study PDFDocument4 pagesSP Case Study PDFTanya SinghNo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- Company Law - Test IVDocument5 pagesCompany Law - Test IVArundhati PawarNo ratings yet

- Corporate and Economic Laws Test 3 May Test 1609311077Document9 pagesCorporate and Economic Laws Test 3 May Test 1609311077CAtestseriesNo ratings yet

- Paper - 2: Auditing Questions: Accounting Treatment of The Above Receipt of Rs. 50 Lacs?Document20 pagesPaper - 2: Auditing Questions: Accounting Treatment of The Above Receipt of Rs. 50 Lacs?tpsbtpsbtpsbNo ratings yet

- Dec'19 QDocument7 pagesDec'19 QVivek SaraogiNo ratings yet

- Ca Final (Advanced Auditing & Professional Ethics) Mock Test - IDocument18 pagesCa Final (Advanced Auditing & Professional Ethics) Mock Test - ISrinivas RevankarNo ratings yet

- You Are Required To:: Time Allowed - 3.30 Hours Total Marks - 100Document4 pagesYou Are Required To:: Time Allowed - 3.30 Hours Total Marks - 100Bizness Zenius HantNo ratings yet

- Guideline Answers: Professional ProgrammeDocument57 pagesGuideline Answers: Professional ProgrammeLekshminarayanan KrishnanNo ratings yet

- Ca Final LawDocument3 pagesCa Final LawSamNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Audit Question 15Document4 pagesAudit Question 15JINENDRA JAINNo ratings yet

- New Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperDocument14 pagesNew Scheme - May 2022 Ca Inter - Group 1 Paper 2-Syllabus 100A Question PaperPunith KumarNo ratings yet

- Law March MTPDocument16 pagesLaw March MTPritz meshNo ratings yet

- Term Test 1Document3 pagesTerm Test 1Hassan TanveerNo ratings yet

- LAW 2 New Question PaperDocument9 pagesLAW 2 New Question Paperneha manglaniNo ratings yet

- Corporate Laws & Practices: RequirementsDocument3 pagesCorporate Laws & Practices: RequirementsReefat HasanNo ratings yet

- Ep Module 1 Dec19 Os PDFDocument86 pagesEp Module 1 Dec19 Os PDFHIMANSHU NNo ratings yet

- Test 5Document3 pagesTest 5mangla.harsh77No ratings yet

- Solved PaperDocument9 pagesSolved PaperHariram RamlalNo ratings yet

- Corporate Laws & Practices: RequirementDocument4 pagesCorporate Laws & Practices: RequirementShahriarChowdhuryNo ratings yet

- Law Mock QDocument12 pagesLaw Mock QRanjitha GovindaiahNo ratings yet

- Advanced Company Law & Practice: NoteDocument4 pagesAdvanced Company Law & Practice: NoteabhinandNo ratings yet

- Test 1 - 2 All Law PapersDocument26 pagesTest 1 - 2 All Law PapersShrikant RathodNo ratings yet

- Law Q MTP 1 Final May22Document10 pagesLaw Q MTP 1 Final May22Someone 4780No ratings yet

- Synonyms List: Sam Ielts Telegram @ieltsielts @asksamDocument6 pagesSynonyms List: Sam Ielts Telegram @ieltsielts @asksamMenuka SiwaNo ratings yet

- C-108286 2Document36 pagesC-108286 2Menuka SiwaNo ratings yet

- Major Changes in Labour ActDocument1 pageMajor Changes in Labour ActMenuka SiwaNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Fundamental of Applied Chemistry AllDocument6 pagesFundamental of Applied Chemistry AllMenuka SiwaNo ratings yet

- Audit Committee AND Corporate Governance: Learning OutcomesDocument47 pagesAudit Committee AND Corporate Governance: Learning OutcomesMenuka SiwaNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Document12 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Menuka SiwaNo ratings yet

- (Examination Scheme) (Written Examination) X: (Multiple Choice)Document7 pages(Examination Scheme) (Written Examination) X: (Multiple Choice)Menuka SiwaNo ratings yet

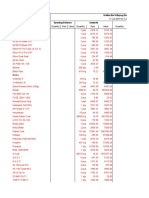

- Kalika Itta Udhyog (Vat) 2076/2077 Particulars Opening Balance Inwards OutwardsDocument5 pagesKalika Itta Udhyog (Vat) 2076/2077 Particulars Opening Balance Inwards OutwardsMenuka SiwaNo ratings yet

- Professional Ethics: After Studying This Chapter, You Will Be Able ToDocument161 pagesProfessional Ethics: After Studying This Chapter, You Will Be Able ToMenuka SiwaNo ratings yet

- Audit OF Public Sector Undertakings: Learning OutcomesDocument36 pagesAudit OF Public Sector Undertakings: Learning OutcomesMenuka SiwaNo ratings yet

- Jan 21Document87 pagesJan 21Menuka SiwaNo ratings yet

- Product Development: MBS-2 Semester (Evening Shift) Group-ADocument11 pagesProduct Development: MBS-2 Semester (Evening Shift) Group-AMenuka SiwaNo ratings yet

- Liabilities of AuditorDocument39 pagesLiabilities of AuditorMenuka SiwaNo ratings yet

- Power 15Document1 pagePower 15Menuka SiwaNo ratings yet

- Alliance Holdings Limited: Credit Rating ReportDocument5 pagesAlliance Holdings Limited: Credit Rating ReportrontterNo ratings yet

- Rathi Steel and Power Ltd. REPORT DATED 7th JUNE 2008Document5 pagesRathi Steel and Power Ltd. REPORT DATED 7th JUNE 2008Niftyviews BlogspotNo ratings yet

- Annual Report - Nesco Limited - 2019-20 PDFDocument170 pagesAnnual Report - Nesco Limited - 2019-20 PDFAvinash PatraNo ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Document6 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Shubham KuberkarNo ratings yet

- Accounting 504 - Chapter 02 AnswersDocument19 pagesAccounting 504 - Chapter 02 AnswerspicassaaNo ratings yet

- Chapter 04Document79 pagesChapter 04Amylia AmirNo ratings yet

- 05 GL Head ReportSultanpur Lodhi PADB19082019021855PMDocument15 pages05 GL Head ReportSultanpur Lodhi PADB19082019021855PMsandeepNo ratings yet

- 1st Mock Bar Tax Review February 27 20211Document9 pages1st Mock Bar Tax Review February 27 20211Francis Louie Allera HumawidNo ratings yet

- Accounting ExamsDocument56 pagesAccounting Examsjhie boterNo ratings yet

- IPCC Capital Budgeting and FFS ScannerDocument27 pagesIPCC Capital Budgeting and FFS ScannerMadan SharmaNo ratings yet

- 25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)Document11 pages25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)LucioJr AvergonzadoNo ratings yet

- 12th AccountancyDocument34 pages12th AccountancyDYNAMIC VERMA100% (1)

- Lesson 1 RIGHT OF APPRAISALDocument6 pagesLesson 1 RIGHT OF APPRAISALDi CanNo ratings yet

- Asset Allocation and Security Selection: AcknowledgementDocument11 pagesAsset Allocation and Security Selection: AcknowledgementyayomakNo ratings yet

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocument10 pagesAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNo ratings yet

- Rajesh SharmaDocument120 pagesRajesh SharmaCreating EraNo ratings yet

- Investment Portfolio of BanksDocument3 pagesInvestment Portfolio of BanksMirza Farhan BegNo ratings yet

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisRaijo PhilipNo ratings yet

- ACC 401 Week 7 QuizDocument8 pagesACC 401 Week 7 QuizEMLNo ratings yet

- DC024 TutorialDocument105 pagesDC024 TutorialazmiahNo ratings yet

- Investment in Associates ProblemsDocument4 pagesInvestment in Associates ProblemsLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- Business Finance Reviewer For Summative TestDocument8 pagesBusiness Finance Reviewer For Summative TestMia Abegail ChuaNo ratings yet

- Illustrative Ifrs Hkfrs Dec2014Document317 pagesIllustrative Ifrs Hkfrs Dec2014petitfm100% (1)

- AP Lecture SW SheDocument23 pagesAP Lecture SW SheMary Dale Joie BocalaNo ratings yet

- AuditDocument11 pagesAuditÂbdül ÃhādNo ratings yet

- Tania Maharani - C1C019071 - Tugas AKL 4Document8 pagesTania Maharani - C1C019071 - Tugas AKL 4Tania MaharaniNo ratings yet

- Mat Adjustments Table (Ay 2021-22)Document4 pagesMat Adjustments Table (Ay 2021-22)priyal shahNo ratings yet