Professional Documents

Culture Documents

Company Law LAW2450 - Topic Notes - Topic 1

Company Law LAW2450 - Topic Notes - Topic 1

Uploaded by

KimCopyright:

Available Formats

You might also like

- Exercise Chapter 11Document3 pagesExercise Chapter 11nguyễnthùy dươngNo ratings yet

- Sbi Mutual Fund PDFDocument94 pagesSbi Mutual Fund PDFhemal dhuri100% (1)

- Overview On The Companies Act, 1994Document44 pagesOverview On The Companies Act, 1994Tawsif MahbubNo ratings yet

- BMGT 323 Company Law/Business Law IiDocument19 pagesBMGT 323 Company Law/Business Law Iilil kidNo ratings yet

- Session 2 - Entities DIFCDocument17 pagesSession 2 - Entities DIFCZviagin & CoNo ratings yet

- Unit IDocument13 pagesUnit IJ.SreenivasanNo ratings yet

- Nature of CompanyDocument9 pagesNature of CompanyNaing AungNo ratings yet

- Assignment: Submitted by Navami K.V Roll No: 54 CLASS 5Document13 pagesAssignment: Submitted by Navami K.V Roll No: 54 CLASS 5sanjanaNo ratings yet

- Busy Association BeckyDocument11 pagesBusy Association BeckySamuel L ENo ratings yet

- Nature and Types of CompanyDocument20 pagesNature and Types of CompanyAshutosh PandeyNo ratings yet

- Limited V Unlimited CompanyDocument16 pagesLimited V Unlimited CompanyAbhinavNo ratings yet

- Unit Nature andDocument20 pagesUnit Nature andPriyanka SinghNo ratings yet

- What Is A CompanyDocument6 pagesWhat Is A CompanyAayushman SharmaNo ratings yet

- 4 TH ChapterDocument15 pages4 TH ChapterKodi NadarNo ratings yet

- Black BookDocument89 pagesBlack BookdhwaniNo ratings yet

- Assignment On CompanyDocument11 pagesAssignment On CompanyHossainmoajjemNo ratings yet

- Lifting The Corporate VeilDocument12 pagesLifting The Corporate VeilShubham singh kirarNo ratings yet

- Principles of Law and TaxationDocument140 pagesPrinciples of Law and TaxationAyomide Matthew100% (1)

- Cia 2 4703 MaterialDocument16 pagesCia 2 4703 MaterialMadhan RajaNo ratings yet

- Company Law AssignmentDocument8 pagesCompany Law Assignmentইফতেখার আলম মুন্নাNo ratings yet

- Unit Objectives Learning OutcomesDocument16 pagesUnit Objectives Learning OutcomesAkash BaratheNo ratings yet

- Answer 1.: Irani Expert Committee Recommended The Formation of OPC. It Had Suggested That Such AnDocument7 pagesAnswer 1.: Irani Expert Committee Recommended The Formation of OPC. It Had Suggested That Such AnZoha khanamNo ratings yet

- Unit 1Document23 pagesUnit 1Nikhilesh RanaNo ratings yet

- Business LawDocument19 pagesBusiness LawShailesh AsampallyNo ratings yet

- All About Principle of Lifting of Corporate Veil Under Companies ActDocument10 pagesAll About Principle of Lifting of Corporate Veil Under Companies ActPria MakandaNo ratings yet

- Defining Company - Bangladesh LawDocument8 pagesDefining Company - Bangladesh LawSazzad FerdousNo ratings yet

- Introduction To Research Regarding Corporate VeilDocument12 pagesIntroduction To Research Regarding Corporate VeilFaisal AshfaqNo ratings yet

- Company Law Unit - 1Document22 pagesCompany Law Unit - 1Anjali ShuklaNo ratings yet

- Corporate Leagal Framework 3Document553 pagesCorporate Leagal Framework 3Gurpreet SainiNo ratings yet

- Commercial TransactionsDocument191 pagesCommercial TransactionsDavid MunyuaNo ratings yet

- Module-3 3Document8 pagesModule-3 3MAUANAY, MICHAELA, P.No ratings yet

- Assignment On Company LawDocument15 pagesAssignment On Company Lawতাসমুন ইসলাম প্রান্তNo ratings yet

- Corporate Veil:: Concept of Limited LiabilityDocument9 pagesCorporate Veil:: Concept of Limited LiabilityRohan PatelNo ratings yet

- The Companies Act, 2013: Learning OutcomesDocument40 pagesThe Companies Act, 2013: Learning Outcomesmap solutionsNo ratings yet

- Company Law Notes KenyaDocument37 pagesCompany Law Notes KenyaKimberly OdumbeNo ratings yet

- Company Law (1) - 1Document66 pagesCompany Law (1) - 1nivesuresh30604No ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationPragati PrajapatiNo ratings yet

- Meaning of Company:: Definition of Company: The Main Definition of A Company Are Given BelowDocument61 pagesMeaning of Company:: Definition of Company: The Main Definition of A Company Are Given BelowaanyaNo ratings yet

- Company Under The Companies Act 2013Document14 pagesCompany Under The Companies Act 2013Shubham saxenaNo ratings yet

- Company Law NotesDocument7 pagesCompany Law NotesRaja RizwanNo ratings yet

- Company Law - RCL ExamsDocument6 pagesCompany Law - RCL ExamsDisha GuptaNo ratings yet

- The Companies Act, 2013: Learning OutcomesDocument40 pagesThe Companies Act, 2013: Learning OutcomesYogesh sharmaNo ratings yet

- Share & Stocks - Sharia VerdictDocument21 pagesShare & Stocks - Sharia VerdictbibekindriolochonNo ratings yet

- Corporate Law ModuleDocument140 pagesCorporate Law ModulePhebieon MukwenhaNo ratings yet

- ATP 108 Company Law Notes - Incorporation Part 2ADocument15 pagesATP 108 Company Law Notes - Incorporation Part 2ADan JudgeNo ratings yet

- LBA Compiled NotesDocument172 pagesLBA Compiled NotesGladys OpondoNo ratings yet

- Company Law - Assignment by Simon (BUBT)Document22 pagesCompany Law - Assignment by Simon (BUBT)Simon Haque67% (3)

- Malaysia Company LawDocument30 pagesMalaysia Company LawTan Cheng Ying100% (4)

- Bank Agricultural University BangladeshDocument6 pagesBank Agricultural University BangladeshHasanul ShawonNo ratings yet

- Introduction To CompanyDocument15 pagesIntroduction To CompanyShalu ThakurNo ratings yet

- Introduction To Company PDFDocument8 pagesIntroduction To Company PDFhasan alNo ratings yet

- Lectures On Company Law-FullDocument73 pagesLectures On Company Law-FullshakilhmNo ratings yet

- I. Corporation LawDocument8 pagesI. Corporation LawaeriNo ratings yet

- Unit 01 Introduction To Company: New Alliance First Grade College, CrpatnaDocument86 pagesUnit 01 Introduction To Company: New Alliance First Grade College, CrpatnaningegowdaNo ratings yet

- Company LawDocument42 pagesCompany Lawaboood al7tamyNo ratings yet

- FSRE 2022-23 Topic 4Document22 pagesFSRE 2022-23 Topic 4Ali Al RostamaniNo ratings yet

- Nature and Classification of CompaniesDocument9 pagesNature and Classification of CompaniesAntonia SemweyaNo ratings yet

- Companies LawDocument13 pagesCompanies LawNirvana OshoNo ratings yet

- Company Law & Secretarial PracticeDocument69 pagesCompany Law & Secretarial PracticeKarthika ViswanathNo ratings yet

- Dividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeFrom EverandDividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Nifty Trading ProposalDocument9 pagesNifty Trading ProposalmmyemailNo ratings yet

- ASSESSMENT OF VARIOUS ENTITIES - TaxDocument20 pagesASSESSMENT OF VARIOUS ENTITIES - TaxKhushi MultaniNo ratings yet

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- Accounting: Cambridge International Examinations International General Certificate of Secondary EducationDocument12 pagesAccounting: Cambridge International Examinations International General Certificate of Secondary EducationOmar BilalNo ratings yet

- 11 Chapter 11 Payment Legal ConsiderationsDocument17 pages11 Chapter 11 Payment Legal ConsiderationsTanya JainNo ratings yet

- Finance Sample MidtermDocument21 pagesFinance Sample MidtermbillyNo ratings yet

- Valuation of Cash Flowless High Risk VenturesDocument6 pagesValuation of Cash Flowless High Risk VenturesKarya BangunanNo ratings yet

- Using LEAPS in A Covered Call WriteDocument4 pagesUsing LEAPS in A Covered Call WriteJonhmark AniñonNo ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- DAIBB Management of AccountingDocument4 pagesDAIBB Management of AccountingMuhammad Akmal HossainNo ratings yet

- Roth IRA Investing Starter KitDocument17 pagesRoth IRA Investing Starter KitHuliaNo ratings yet

- Law MCQDocument70 pagesLaw MCQAkshay TapariaNo ratings yet

- Capital and Revenue ExpenditureDocument6 pagesCapital and Revenue ExpenditureTinomudaisheNo ratings yet

- BankUSA - Forecasting Help Desk Demand by Day Forecasting & Demand Planning 9Document5 pagesBankUSA - Forecasting Help Desk Demand by Day Forecasting & Demand Planning 9Nancy MalagonNo ratings yet

- FM Unit 5Document26 pagesFM Unit 5KarishmaNo ratings yet

- A SyllabusDocument11 pagesA SyllabusebbamorkNo ratings yet

- Anglo American Model - PPT 1Document34 pagesAnglo American Model - PPT 1Aprajita Sharma0% (1)

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- I. Call To OrderDocument5 pagesI. Call To OrderNico Rivera CallangNo ratings yet

- Fabm2 - Q2 - M8Document12 pagesFabm2 - Q2 - M8Earl Christian BonaobraNo ratings yet

- Conso FSDocument60 pagesConso FSAldrinNo ratings yet

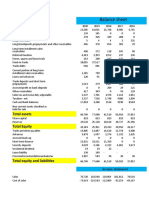

- Balance Sheet: Total Assets Total EquityDocument6 pagesBalance Sheet: Total Assets Total EquityDeepak MatlaniNo ratings yet

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyNo ratings yet

- Law Questions RTPDocument45 pagesLaw Questions RTPamrita tamangNo ratings yet

- Course: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? AnswerDocument20 pagesCourse: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? Answergemixon120No ratings yet

- Week 6-7 Info Sheets - Financial Planning Tools and ConceptsDocument21 pagesWeek 6-7 Info Sheets - Financial Planning Tools and ConceptsCK BarretoNo ratings yet

- Madhucon Projects: Performance HighlightsDocument12 pagesMadhucon Projects: Performance HighlightsAngel BrokingNo ratings yet

- SerialDocument153 pagesSerialnedjad91No ratings yet

Company Law LAW2450 - Topic Notes - Topic 1

Company Law LAW2450 - Topic Notes - Topic 1

Uploaded by

KimOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Law LAW2450 - Topic Notes - Topic 1

Company Law LAW2450 - Topic Notes - Topic 1

Uploaded by

KimCopyright:

Available Formats

COMPANY LAW

LAW2450

TOPIC NOTES

TOPIC 1: Introduction to Company Law

Topic 1: Introduction to Company Law 1

Disclaimer

This subject material is issued by RMIT on the understanding that:

1. RMIT, its directors, author(s), or any other persons involved in the preparation of

this publication expressly disclaim all and any contractual, tortious, or other form of

liability to any person (purchaser of this publication or not) in respect of the

publication and any consequences arising from its use, including any omission

made, by any person in reliance upon the whole or any part of the contents of this

publication.

2. RMIT expressly disclaims all and any liability to any person in respect of anything

and of the consequences of anything done or omitted to be done by any such person

in reliance, whether whole or partial, upon the whole or any part of the contents of

this subject material.

3. No person should act on the basis of the material contained in the publication

without considering and taking professional advice.

4. No correspondence will be entered into in relation to this publication by the

distributors, publisher, editor(s) or author(s) or any other person on their behalf or

otherwise.

© RMIT University 2018

Topic 1: Introduction to Company Law 2

Contents

Learning Outcomes

1. Introduction

2. Defining main types of legal structure for business in Australia

a. Company

b. Sole trader

c. Partnership

d. Joint venture

e. Trust

3. Corporations

a. Proprietary Companies

b. Public Companies

4. Separate Legal Entity / Corporate Veil

Learning Outcomes

• Understand how to determine the correct structure for a client

• Understand why a company is the appropriate structure

• Understand the types of companies available in Australia

• Understand the legal consequences of incorporating a company

Readings Topic 1

Modules 1 & 2 of the Highly Recommended Text

Topic 1: Introduction to Company Law 3

1. Introduction

This week we will first look broadly at the operation of organizational structures in

the social sphere, and analyze the way those organizations are treated at law. Most

importantly, this topic introduces the organizational structure called the ‘company’,

and the main legal organisations that we will consider in this course.

The legally recognized organisations on which we will focus in the introductory

component of this subject include the sole proprietor, unincorporated associations,

incorporated associations, partnerships, trusts and, corporations.

2. Business Structures

a. Company

The company is the most common business structure for organisations in Australia.

A company or corporation is a separate legal entity formed under the Corporations

Act 2001 (Cth). As a separate legal entity, a company can enter in contracts, sue and

be sued in its own name.

Further details about a company can be found on page 7 of the Text Book

b. Sole Trader

A sole trader or sole proprietorship is a business that is owned by one person and

that has no legal existence separate from that person. Because the business has no

separate legal existence from its owner, a sole trader is personally responsible for

the debt of the business.

Further details about sole trader can be found on pages 6-7 of the Text Book.

c. Partnership

A partnership is a relationship or association between two or more entities, carrying

on a business in common with a view to making a profit. Each partner in a

partnership is personally liable for all the debts of the partnership, even in they are

caused by decision or acts by other partners.

Topic 1: Introduction to Company Law 4

Further details about partnership can be found on pages 6, 10 - 17 of the Text Book.

d. Joint Venture

A joint venture is another way to structure a business involving multiple people,

particularly where two or more people or parties come together in business. The

parties are only responsible for their respective obligations, not for the obligation of

any of their joint venture partners.

Further details about joint venture can be found on pages 6, 18 -23 of the Text Book.

e. Trust

A trust is referred to in this course as a legal organisation because it involves an

arrangement of things and people; however, it does not mean that a trust is

recognised at law as an organisation. A trust is relationship or association between

two or more parties, whereby one party holds property in trust for the other. The

parties to an express trust are the settlor, the trustee and the beneficiary.

Further details about trusts can be found on pages 6, 20-28 of the Text Book.

3. Corporations

The Corporations Act governs the registration and use of different types of

companies, classified by reference to the basis and the extent of the members’

liability and according to whether they are public companies or proprietary

companies.

In this course we will use The Corporations Act as tool of reference as we look at

topics such as directors’ duties & liabilities, shareholders’ rights & remedies,

financial reporting provisions; and requirements for company meetings in more

detail.

a. Proprietary Company

Under section 113 of the Corporations Act, a Proprietary Company (also known as

Private Company) is a company with no more than 50 non-employee members.

Proprietary companies can be small or large, depending on the amount of revenue

Topic 1: Introduction to Company Law 5

they make, how many assets they hold, and how many employees they have.

See section 45A of the Corporations Act and pages 44-45 of the Text Book for more

details.

b. Public Companies

Under section 9 of the Corporations Ac, a public company is a company is a company

that has more than 50 non-employee shareholders and engages in public

fundraisings. For a public company to engage in public fund raising it must be listed

on the Australian Securities Exchange (ASX). See section 113 Corporations Act for

more details.

Public Companies can be categorized by their listing status; listed or unlisted. A

listed company is a public company that participates on a public securities

exchange such as ASX, where as an unlisted company is a public company that does

not participate on a public securities exchange.

The main classes of a public company are: companies limited by shares,

companies limited by guarantee, unlimited companies and no liability

companies. See section 112 of the Corporations Act and pages 47 – 49 of the Text

Book for more details.

3. The ‘Separate Legal Entity’ concept & the Corporate Veil

A company, once registered, is a separate legal entity, distinct from its members

and those that manage its operations. A company can:

incur debts in its own name;

holds property, and undertake; and

sue and be sued.

See section 119 of the Corporations Act for further details.

The legal principle of the corporate veil comes from the case Salomon v Salomon &

Co Ltd [1897] AC 22, the leading case on the establishment of the doctrine of

separate legal personality. The corporate veil concept is an expression used to

describe the legal rules that keep participants separate from the company in a legal

Topic 1: Introduction to Company Law 6

sense. In essence it means that no-one can claim that the company’s obligations,

liabilities, rights or property are the participants.

However, there are a few circumstances where the law will ‘lift the corporate veil’.

Under the Corporations Act, this mainly occurs where there are dealings between a

director and the company and the director attempts to get a benefit over a third

party or creditor. Other statutes (e.g. Tax, OHS, Fair Work) will operate to hold

directors personally liable in certain situations.

A related concept to the company being a separate legal entity is that members of

‘limited’ companies have limited liability. This means that Liability is limited to the

amount of any unpaid share capital or guarantees given. Members are legally

responsible for the debts of a company only to the extent of the unpaid amount on

the nominal value of their shares. See section 516 of the Corporations Act for further

details.

Another related concept to the company being a separate legal entity is that

contracts entered into before the company was registered (called ‘pre-incorporation

contracts’) require further steps to be taken for the company to be bound by those

contracts. See sections 131-133 of the Corporations Act for further details.

Topic 1: Introduction to Company Law 7

You might also like

- Exercise Chapter 11Document3 pagesExercise Chapter 11nguyễnthùy dươngNo ratings yet

- Sbi Mutual Fund PDFDocument94 pagesSbi Mutual Fund PDFhemal dhuri100% (1)

- Overview On The Companies Act, 1994Document44 pagesOverview On The Companies Act, 1994Tawsif MahbubNo ratings yet

- BMGT 323 Company Law/Business Law IiDocument19 pagesBMGT 323 Company Law/Business Law Iilil kidNo ratings yet

- Session 2 - Entities DIFCDocument17 pagesSession 2 - Entities DIFCZviagin & CoNo ratings yet

- Unit IDocument13 pagesUnit IJ.SreenivasanNo ratings yet

- Nature of CompanyDocument9 pagesNature of CompanyNaing AungNo ratings yet

- Assignment: Submitted by Navami K.V Roll No: 54 CLASS 5Document13 pagesAssignment: Submitted by Navami K.V Roll No: 54 CLASS 5sanjanaNo ratings yet

- Busy Association BeckyDocument11 pagesBusy Association BeckySamuel L ENo ratings yet

- Nature and Types of CompanyDocument20 pagesNature and Types of CompanyAshutosh PandeyNo ratings yet

- Limited V Unlimited CompanyDocument16 pagesLimited V Unlimited CompanyAbhinavNo ratings yet

- Unit Nature andDocument20 pagesUnit Nature andPriyanka SinghNo ratings yet

- What Is A CompanyDocument6 pagesWhat Is A CompanyAayushman SharmaNo ratings yet

- 4 TH ChapterDocument15 pages4 TH ChapterKodi NadarNo ratings yet

- Black BookDocument89 pagesBlack BookdhwaniNo ratings yet

- Assignment On CompanyDocument11 pagesAssignment On CompanyHossainmoajjemNo ratings yet

- Lifting The Corporate VeilDocument12 pagesLifting The Corporate VeilShubham singh kirarNo ratings yet

- Principles of Law and TaxationDocument140 pagesPrinciples of Law and TaxationAyomide Matthew100% (1)

- Cia 2 4703 MaterialDocument16 pagesCia 2 4703 MaterialMadhan RajaNo ratings yet

- Company Law AssignmentDocument8 pagesCompany Law Assignmentইফতেখার আলম মুন্নাNo ratings yet

- Unit Objectives Learning OutcomesDocument16 pagesUnit Objectives Learning OutcomesAkash BaratheNo ratings yet

- Answer 1.: Irani Expert Committee Recommended The Formation of OPC. It Had Suggested That Such AnDocument7 pagesAnswer 1.: Irani Expert Committee Recommended The Formation of OPC. It Had Suggested That Such AnZoha khanamNo ratings yet

- Unit 1Document23 pagesUnit 1Nikhilesh RanaNo ratings yet

- Business LawDocument19 pagesBusiness LawShailesh AsampallyNo ratings yet

- All About Principle of Lifting of Corporate Veil Under Companies ActDocument10 pagesAll About Principle of Lifting of Corporate Veil Under Companies ActPria MakandaNo ratings yet

- Defining Company - Bangladesh LawDocument8 pagesDefining Company - Bangladesh LawSazzad FerdousNo ratings yet

- Introduction To Research Regarding Corporate VeilDocument12 pagesIntroduction To Research Regarding Corporate VeilFaisal AshfaqNo ratings yet

- Company Law Unit - 1Document22 pagesCompany Law Unit - 1Anjali ShuklaNo ratings yet

- Corporate Leagal Framework 3Document553 pagesCorporate Leagal Framework 3Gurpreet SainiNo ratings yet

- Commercial TransactionsDocument191 pagesCommercial TransactionsDavid MunyuaNo ratings yet

- Module-3 3Document8 pagesModule-3 3MAUANAY, MICHAELA, P.No ratings yet

- Assignment On Company LawDocument15 pagesAssignment On Company Lawতাসমুন ইসলাম প্রান্তNo ratings yet

- Corporate Veil:: Concept of Limited LiabilityDocument9 pagesCorporate Veil:: Concept of Limited LiabilityRohan PatelNo ratings yet

- The Companies Act, 2013: Learning OutcomesDocument40 pagesThe Companies Act, 2013: Learning Outcomesmap solutionsNo ratings yet

- Company Law Notes KenyaDocument37 pagesCompany Law Notes KenyaKimberly OdumbeNo ratings yet

- Company Law (1) - 1Document66 pagesCompany Law (1) - 1nivesuresh30604No ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationPragati PrajapatiNo ratings yet

- Meaning of Company:: Definition of Company: The Main Definition of A Company Are Given BelowDocument61 pagesMeaning of Company:: Definition of Company: The Main Definition of A Company Are Given BelowaanyaNo ratings yet

- Company Under The Companies Act 2013Document14 pagesCompany Under The Companies Act 2013Shubham saxenaNo ratings yet

- Company Law NotesDocument7 pagesCompany Law NotesRaja RizwanNo ratings yet

- Company Law - RCL ExamsDocument6 pagesCompany Law - RCL ExamsDisha GuptaNo ratings yet

- The Companies Act, 2013: Learning OutcomesDocument40 pagesThe Companies Act, 2013: Learning OutcomesYogesh sharmaNo ratings yet

- Share & Stocks - Sharia VerdictDocument21 pagesShare & Stocks - Sharia VerdictbibekindriolochonNo ratings yet

- Corporate Law ModuleDocument140 pagesCorporate Law ModulePhebieon MukwenhaNo ratings yet

- ATP 108 Company Law Notes - Incorporation Part 2ADocument15 pagesATP 108 Company Law Notes - Incorporation Part 2ADan JudgeNo ratings yet

- LBA Compiled NotesDocument172 pagesLBA Compiled NotesGladys OpondoNo ratings yet

- Company Law - Assignment by Simon (BUBT)Document22 pagesCompany Law - Assignment by Simon (BUBT)Simon Haque67% (3)

- Malaysia Company LawDocument30 pagesMalaysia Company LawTan Cheng Ying100% (4)

- Bank Agricultural University BangladeshDocument6 pagesBank Agricultural University BangladeshHasanul ShawonNo ratings yet

- Introduction To CompanyDocument15 pagesIntroduction To CompanyShalu ThakurNo ratings yet

- Introduction To Company PDFDocument8 pagesIntroduction To Company PDFhasan alNo ratings yet

- Lectures On Company Law-FullDocument73 pagesLectures On Company Law-FullshakilhmNo ratings yet

- I. Corporation LawDocument8 pagesI. Corporation LawaeriNo ratings yet

- Unit 01 Introduction To Company: New Alliance First Grade College, CrpatnaDocument86 pagesUnit 01 Introduction To Company: New Alliance First Grade College, CrpatnaningegowdaNo ratings yet

- Company LawDocument42 pagesCompany Lawaboood al7tamyNo ratings yet

- FSRE 2022-23 Topic 4Document22 pagesFSRE 2022-23 Topic 4Ali Al RostamaniNo ratings yet

- Nature and Classification of CompaniesDocument9 pagesNature and Classification of CompaniesAntonia SemweyaNo ratings yet

- Companies LawDocument13 pagesCompanies LawNirvana OshoNo ratings yet

- Company Law & Secretarial PracticeDocument69 pagesCompany Law & Secretarial PracticeKarthika ViswanathNo ratings yet

- Dividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeFrom EverandDividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Nifty Trading ProposalDocument9 pagesNifty Trading ProposalmmyemailNo ratings yet

- ASSESSMENT OF VARIOUS ENTITIES - TaxDocument20 pagesASSESSMENT OF VARIOUS ENTITIES - TaxKhushi MultaniNo ratings yet

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- Accounting: Cambridge International Examinations International General Certificate of Secondary EducationDocument12 pagesAccounting: Cambridge International Examinations International General Certificate of Secondary EducationOmar BilalNo ratings yet

- 11 Chapter 11 Payment Legal ConsiderationsDocument17 pages11 Chapter 11 Payment Legal ConsiderationsTanya JainNo ratings yet

- Finance Sample MidtermDocument21 pagesFinance Sample MidtermbillyNo ratings yet

- Valuation of Cash Flowless High Risk VenturesDocument6 pagesValuation of Cash Flowless High Risk VenturesKarya BangunanNo ratings yet

- Using LEAPS in A Covered Call WriteDocument4 pagesUsing LEAPS in A Covered Call WriteJonhmark AniñonNo ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- DAIBB Management of AccountingDocument4 pagesDAIBB Management of AccountingMuhammad Akmal HossainNo ratings yet

- Roth IRA Investing Starter KitDocument17 pagesRoth IRA Investing Starter KitHuliaNo ratings yet

- Law MCQDocument70 pagesLaw MCQAkshay TapariaNo ratings yet

- Capital and Revenue ExpenditureDocument6 pagesCapital and Revenue ExpenditureTinomudaisheNo ratings yet

- BankUSA - Forecasting Help Desk Demand by Day Forecasting & Demand Planning 9Document5 pagesBankUSA - Forecasting Help Desk Demand by Day Forecasting & Demand Planning 9Nancy MalagonNo ratings yet

- FM Unit 5Document26 pagesFM Unit 5KarishmaNo ratings yet

- A SyllabusDocument11 pagesA SyllabusebbamorkNo ratings yet

- Anglo American Model - PPT 1Document34 pagesAnglo American Model - PPT 1Aprajita Sharma0% (1)

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- I. Call To OrderDocument5 pagesI. Call To OrderNico Rivera CallangNo ratings yet

- Fabm2 - Q2 - M8Document12 pagesFabm2 - Q2 - M8Earl Christian BonaobraNo ratings yet

- Conso FSDocument60 pagesConso FSAldrinNo ratings yet

- Balance Sheet: Total Assets Total EquityDocument6 pagesBalance Sheet: Total Assets Total EquityDeepak MatlaniNo ratings yet

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyNo ratings yet

- Law Questions RTPDocument45 pagesLaw Questions RTPamrita tamangNo ratings yet

- Course: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? AnswerDocument20 pagesCourse: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? Answergemixon120No ratings yet

- Week 6-7 Info Sheets - Financial Planning Tools and ConceptsDocument21 pagesWeek 6-7 Info Sheets - Financial Planning Tools and ConceptsCK BarretoNo ratings yet

- Madhucon Projects: Performance HighlightsDocument12 pagesMadhucon Projects: Performance HighlightsAngel BrokingNo ratings yet

- SerialDocument153 pagesSerialnedjad91No ratings yet