Professional Documents

Culture Documents

Bonds Payable Review

Bonds Payable Review

Uploaded by

Jyasmine Aura V. AgustinCopyright:

Available Formats

You might also like

- f9 FormulasDocument16 pagesf9 FormulasLesh Galeonne100% (1)

- Full Download Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Test BankDocument36 pagesFull Download Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Test Bankadugbatacainb100% (36)

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Document21 pagesProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)

- Partnership Dissolution and Liquidation - 497916619Document4 pagesPartnership Dissolution and Liquidation - 497916619Carl Yry BitengNo ratings yet

- BA213 Test3 Review AnswersDocument27 pagesBA213 Test3 Review AnswersnwuodiopdNo ratings yet

- Final Examination Financial Management 2018Document4 pagesFinal Examination Financial Management 2018Caryl Arciete100% (2)

- Chesterfield WanderersDocument2 pagesChesterfield WanderersYenJangNo ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- CGT Drill Answers and ExplanationsDocument4 pagesCGT Drill Answers and ExplanationsMarianne Portia SumabatNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Financial Analysis Statement Solution IncompleteDocument9 pagesFinancial Analysis Statement Solution IncompleteJerome BaluseroNo ratings yet

- IntAcc 3 Non-Financial LiabilitiesDocument10 pagesIntAcc 3 Non-Financial LiabilitiesKim EllaNo ratings yet

- Accounting For Income Tax-1Document4 pagesAccounting For Income Tax-1CAINo ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument44 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet

- Chap 8 Responsibility AccountingDocument51 pagesChap 8 Responsibility AccountingXel Joe BahianNo ratings yet

- Prelims - ACCA111Document7 pagesPrelims - ACCA111Boa HancockNo ratings yet

- Kingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021Document5 pagesKingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021NCTNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Migriño - Quizzer 2 - Employee Benefits Part 1Document13 pagesMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNo ratings yet

- Process Costing ProblemDocument7 pagesProcess Costing ProblemAnonymous Ehv4lpsJ100% (1)

- Construction ContractDocument17 pagesConstruction ContractYvonne Gam-oyNo ratings yet

- HO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFDocument7 pagesHO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFPATRICIA PEREZNo ratings yet

- Short-Term Budgeting: (Problem 1)Document18 pagesShort-Term Budgeting: (Problem 1)princess bubblegumNo ratings yet

- ECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsDocument4 pagesECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsCassie LyeNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Divide by Average Number of Shares OutstandingDocument11 pagesDivide by Average Number of Shares OutstandingJo FenNo ratings yet

- THEORIESDocument15 pagesTHEORIES123No ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- Managerial EconomicsDocument6 pagesManagerial EconomicsSmartblogzNo ratings yet

- Chapter 14Document4 pagesChapter 14Richard Jay CamaNo ratings yet

- 8 Process CostingDocument4 pages8 Process CostingMaria Cristina A. BarrionNo ratings yet

- Ch5 Operating & Financial LevDocument31 pagesCh5 Operating & Financial LevKristina GarciaNo ratings yet

- Workshop On Management Accounting For Non - Finance ExecutivesDocument67 pagesWorkshop On Management Accounting For Non - Finance ExecutivesPrayogoNo ratings yet

- Activity 5. in What Ways Are The TQM Principles Consistent With The Christian Faith? Discuss How You WillDocument1 pageActivity 5. in What Ways Are The TQM Principles Consistent With The Christian Faith? Discuss How You WillANDI TE'A MARI SIMBALANo ratings yet

- Fund, Which Is Separate From The Reporting Entity For The Purpose ofDocument7 pagesFund, Which Is Separate From The Reporting Entity For The Purpose ofNaddieNo ratings yet

- Activity 1 MAS1 AnswersDocument2 pagesActivity 1 MAS1 Answersangel mae cuevasNo ratings yet

- 1Document1 page1Magsaysay SouthNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocument4 pagesAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Financial Asset at Amortized CostDocument4 pagesFinancial Asset at Amortized Costramir maglangitNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)AdrianBrionesGallardoNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- Self Practice Cost AccountingDocument17 pagesSelf Practice Cost AccountingLara Alyssa GarboNo ratings yet

- Notes in Fi4Document1 pageNotes in Fi4Gray JavierNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- 01 Task Performance 1 - SBADocument6 pages01 Task Performance 1 - SBAPrincess AletreNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- WC Management Sample ProblemsDocument2 pagesWC Management Sample ProblemsGreys Maddawat MasulaNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- Bonds Payable 1Document2 pagesBonds Payable 1els emsNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- Seminar 10 PrepQDocument6 pagesSeminar 10 PrepQAlim OsmanNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- Classify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsDocument3 pagesClassify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsJyasmine Aura V. AgustinNo ratings yet

- 1 To 111 Thories 1 57Document34 pages1 To 111 Thories 1 57Jyasmine Aura V. AgustinNo ratings yet

- MINI PERFORMANCE TSKDocument5 pagesMINI PERFORMANCE TSKJyasmine Aura V. AgustinNo ratings yet

- What Are The Techniques For Job SimplificationsDocument2 pagesWhat Are The Techniques For Job SimplificationsJyasmine Aura V. AgustinNo ratings yet

- How To Boost Job SatisfactionDocument3 pagesHow To Boost Job SatisfactionJyasmine Aura V. AgustinNo ratings yet

- The 19th Century World of Jose RizalDocument3 pagesThe 19th Century World of Jose RizalJyasmine Aura V. AgustinNo ratings yet

- How Can We Apply Work Simplification Techniques For Household TasksDocument1 pageHow Can We Apply Work Simplification Techniques For Household TasksJyasmine Aura V. AgustinNo ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument5 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceJyasmine Aura V. AgustinNo ratings yet

- This Study Resource Was: Use The Following Information For Questions 40 To 43Document9 pagesThis Study Resource Was: Use The Following Information For Questions 40 To 43Jyasmine Aura V. AgustinNo ratings yet

- Quiz 8Document3 pagesQuiz 8Jyasmine Aura V. AgustinNo ratings yet

- Quiz 6Document8 pagesQuiz 6Jyasmine Aura V. AgustinNo ratings yet

- Quiz 6Document6 pagesQuiz 6Jyasmine Aura V. AgustinNo ratings yet

- Quiz 7Document6 pagesQuiz 7Jyasmine Aura V. AgustinNo ratings yet

- Partnership Liquidation: Skip To Main ContentDocument3 pagesPartnership Liquidation: Skip To Main ContentJyasmine Aura V. AgustinNo ratings yet

- Quiz 15Document10 pagesQuiz 15Jyasmine Aura V. AgustinNo ratings yet

- Examining Berkshire Hathaway's Purchase of GEICODocument18 pagesExamining Berkshire Hathaway's Purchase of GEICOJaya Kaushish DhawanNo ratings yet

- 0 20211022170211S3 - (Part-1) PPT-Understanding of Loans and BondsDocument22 pages0 20211022170211S3 - (Part-1) PPT-Understanding of Loans and BondsParthVanjaraNo ratings yet

- Types of DebtDocument5 pagesTypes of Debtayesha1985100% (2)

- CH 12Document39 pagesCH 12Allen KateNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionDaniella mae ElipNo ratings yet

- Sumaiya - Financial Management Assignment 1 - 80201190060Document5 pagesSumaiya - Financial Management Assignment 1 - 80201190060Sumaiya SayeediNo ratings yet

- Week 2 Chapter 9Document8 pagesWeek 2 Chapter 9Sahaja SarvaNo ratings yet

- Engineering Economics and Finance For Transportation InfrastructureDocument223 pagesEngineering Economics and Finance For Transportation InfrastructureDinesh RawalNo ratings yet

- Discount Rate (R) Periods: Present Value TableDocument2 pagesDiscount Rate (R) Periods: Present Value TableKumads LaptopNo ratings yet

- Revised RV - Draft Valuation Report - Hakuna MatataDocument11 pagesRevised RV - Draft Valuation Report - Hakuna MatataBhavin SagarNo ratings yet

- List of Favourite SFM Examination QuestionsDocument12 pagesList of Favourite SFM Examination QuestionsAnkit RastogiNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Western Money Management Inc PDFDocument12 pagesWestern Money Management Inc PDFMariaAngelicaMargenApe100% (1)

- Agec 343 - Farm Management PrinciplesDocument38 pagesAgec 343 - Farm Management PrinciplesKenani WycliffeNo ratings yet

- Future Rewards Valuation ModelDocument2 pagesFuture Rewards Valuation ModelWelcome 1995No ratings yet

- Problem 5-1, 5-2, 5-6, 5-7 AnswerDocument3 pagesProblem 5-1, 5-2, 5-6, 5-7 AnswerNINIO B. MANIALAGNo ratings yet

- Brooks 3e PPT 04Document59 pagesBrooks 3e PPT 04Vy HoàngNo ratings yet

- 2 Time Value of Money - StudDocument36 pages2 Time Value of Money - StudAshwamedhNo ratings yet

- Perpetual Help: Calculate Future Value and Present Value of Money andDocument8 pagesPerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNo ratings yet

- DeVry BUSN 379 Complete Course - LatestDocument8 pagesDeVry BUSN 379 Complete Course - Latestdhol112No ratings yet

- MMW Finals ReviewerDocument4 pagesMMW Finals ReviewerChicken PizzaNo ratings yet

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- 4 - Notes ReceivableDocument10 pages4 - Notes Receivablejoneth.duenasNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch06Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch06Kevin Molly KamrathNo ratings yet

Bonds Payable Review

Bonds Payable Review

Uploaded by

Jyasmine Aura V. AgustinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonds Payable Review

Bonds Payable Review

Uploaded by

Jyasmine Aura V. AgustinCopyright:

Available Formats

lOMoARcPSD|5677109

82503837 Reviewer in Prac 2 Prefi

Accountancy (Pamantasan ng Lungsod ng Maynila)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

lOMoARcPSD|5677109

BONDS PAYABLE

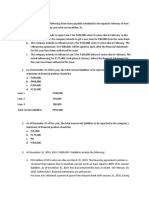

On April 1, 2010, Greg Company issued at 99 plus accrued interest, 2000 of its 8% P1000 face

value bonds. The bonds are dated January 1, 2010, mature on January 1, 2020, and pay interest

on January 1 and July 1. Greg paid bond issue cost of P70,000. From the bond issuance, what is

the net cash received by Greg Company?

Issue Price (2,000,000 x 99%) P1,980,000

Accrued Interest from January 1 to April 1

(2,000,000 x 8% x 3/12) 40,000

Total 2,020,000

Less: bond issue cost 70,000

Net cash received P 1,950,000

On November 1, 2010, Mason Company issued P8, 000,000 of its 10-year, 8% term bonds dated

October 1, 2010. The bonds were sold to yield 10% with total proceeds of P7, 000,000 plus

accrued interest. Interest is paid every April and October 1. What should Mason report for

accrued interest payable in its December 31, 2010 statement of financial position?

Accrued interest from October 1 to December 31

(8,000,000 x 8% x 3/12) P160,000

On June 30, 2010, Huff Company issued at 99, 5000 of its 8%, P1, 000 face value bonds. The

bonds were issued through an underwriter to whom Huff paid bond issue cost of P425, 000. On

June 30, 2010, what should be reported as bond liability?

Issue price (P5, 000,000 x 99%) 4,950,000

Bonds payable (5,000 x 1,000) 5,000,000

Discount on B/P (50,000)

Bond issue cost (425,000)

Carrying amount of bonds payable P4, 535,000

Note: kapag premium i-add siya sa bonds payable

Kapag hinahanap ang carrying amount ng bonds payable wag ng i-add ang accrued

Interest payable. Iaadd lang siya sa issue price kapag hinahanap ang net cash received.

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

lOMoARcPSD|5677109

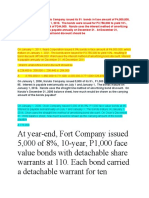

Aye Company is authorized to issue P5, 000,000 of 6%, 10-year bonds dated July 1, 2010 with

interest payments on June 30 and December 31. When the bonds are issued on November 1,

2010, Aye Company received cash of P5, 150,000 including accrued interest. What is the

discount or premium from the issuance of the bonds payable?

Cash received P5, 150,000

Accrued interest from June 30 to November 1, 2010

(5,000,000 x 6% x 4/12) (100,000)

Issue price 5, 050, 000

Face value 5, 000, 000

Premium on bonds payable 50,000

On July 1, 2010, Tara Company issued 4000 of its 8%, P1, 000 face value bonds payable for

P3, 504 ,000. The bonds were issued to yield 10%. The bonds are dated July 1, 2010 and mature

on July 1, 2020. Using the effective interest method, how much of the bond discount should be

amortized for the six months ended December 31, 2010?

On January 1, 2010, Carrow Company issued its 10% bonds in the face amount of P1, 000, 000

that mature on January 1, 2010. The bonds were issued for P 886, 000 to yield 12%, resulting in

bond discount of P114, 000. Carrow uses the interest method of amortizing the bond discount.

Interest is payable on Januaryb1 and July 1. For the year ended December 31, 2010, what

amount should be reported as bond interest expense?

On January 1, 2010, Wolf Company issued its 10% bonds in the face amount of P5, 000, 000,

which mature on January 1, 2020. The bonds were issued for P5, 675, 000 to yield 8%, resulting

in bond premium of P675, 000. Wold uses the interest method of amortizing bond premium.

Interest is payable annually on December 31.

On December 31, 2010, what is the adjusted unamortized bond premium?

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

lOMoARcPSD|5677109

NOTE PAYABALE

On September 1, 2009, Pine Company issued a note payable on National Bank in the amount of

P1, 800,000, bearing interest at 12%, and payable in 3 equal annual principal payments of P600,

000. On this date, the bank’s prime rate was 11%. The first interest and principal payment was

made on September 1, 2010.

On December 31, 2010, what should be reported as accrued interest payable?

Note Payable, September 1, 2009 P1, 800, 000

Payment on September 1, 2010 (600, 000)

Balance, September 1, 2010 1, 200, 000

Accrued interest payable from September 1 to December 31, 2010

(1, 200, 000 x 12% x 4/12) 48,000

January 1 – August 31, 2010 (1, 8000, 000 x 12% X 4/12) 144,000

September 1 – December 31, 2010 48,000

Total interest expense 192, 000

On December 31, 2010, Boston Company purchased a machine from Heliz Company in

exchange for a noninterest bearing note requiring 8 payments of 200,000. The first payment

was made on December 31, 2010 and the others are due annually on December 31. At date of

issuance, the prevailing rate of interest for this type of note was 11%. Present value factors are

as follows:

PV of an ordinary annuity of 1 at 11% for 8 periods 5.146

PV of an annuity of 1 in advance at 11% for 8 periods 5.712

On December 31, 2010, what should be reported as carrying amount of the note payable?

PV of note payable (200, 000 x 5.712) P1, 142, 400

Payment on December 31, 2010 (200,000)

PV of note payable- Dec. 31, 2010 942, 000

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

lOMoARcPSD|5677109

Joshua Company bought a new machine on January present valye of 1 at 12% for five periods is

0.1, 2010 and agreed to pay in equal annual instalment of P600, 000 at the end of each of the

next five years. The prevailing interest rate for this type of transaction is 12%.

The present value of an ordinary annuity of 1 at 12% for five periods is 3.60. the present value

of 1 at 12% for five periods is 0.567.

How much should Joshua report as note payable in the statement of financial position if

financial statements were prepared on January 1, 2010?

PV of note payable on January 1, 2010(600, 000 x 3.60) 2, 160, 000

What is the interest expense on the note payable for 2010?

Interest expense (2, 160, 000 x 12%) 259, 200

On March 1, 2009, Fine Company borrowed P1, 000, 000 and signed a 2-year note bearing

interest at 12% per annum compounded annually. Interest is payable in full at maturity on

February 28, 2011. What amount should be reported as accrued interest payable on December

31, 2010?

Accrued interest from March 1, 20089 to February 28, 2010

(1,000,000 x 12%) 120,000

Accrued interest from March 1 to December 31, 2010

(1,000,000 + 120,000 x 12% x 10/12) 112,000

Accrued interest payable, December 31, 2010 232,000

NONINTEREST BEARING NOTE IS ISSUED FOR PROPERTY

On January 1, 2012, an entity acquired equipment with a cash price of P350, 000 for P500, 000,

P100, 000 down and the balance payable in 4 equal annual instalments.

Find first the discount on N/P

Equipment 350, 000

Discount 150, 000

Cash 100, 000

Note payable 400, 000

Year N/P Fraction Amortization

2012 400, 000 4/10 60, 000

2013 300, 000 3/10 45, 000

2014 200, 000 2/10 30, 000

2015 100, 000 1/10 15, 000

1, 000, 000 150, 000

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

lOMoARcPSD|5677109

NONINTEREST BEARING NOTE IS ISSUED FOR PROPERTY- no cash price

On January 1, 2012, an entity acquired an equipment for P1, 000, 000 payable in 5

equal annual instalments on every December 31 of each year.

The cost of the equipment is equal to the PV of the P200, 000 annual instalments

in 5 years at an appropriate rate of 10%. The rate of 10% is assumed to be the

prevailing market rate of interest.

Equipment (200, 000 x 3.7908) 758, 160

Discount on N/P 241, 840

Note payable 1, 000,000

NONINTEREST BEARING note payable lump sum

On January 1, 2012, an entity acquired an equipment for P1, 000, 000. The entity paid

P100, 000 down and signed a noninterest bearing note for the balance which is due after three

years on January 1, 2015. The present value of 1 for 3 periods is 0.7513.

Downpayment P100, 000

Present value of note (900, 000 x .7513) 676, 170

Cost of Equipment 776, 170

Face value of N/P 900, 000

Present value of N/P 676, 170

Imputed interest/ discount on NP 223, 830

Downloaded by Elijah Montefalco (jyasmineaura01@gmail.com)

You might also like

- f9 FormulasDocument16 pagesf9 FormulasLesh Galeonne100% (1)

- Full Download Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Test BankDocument36 pagesFull Download Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Test Bankadugbatacainb100% (36)

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Document21 pagesProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)

- Partnership Dissolution and Liquidation - 497916619Document4 pagesPartnership Dissolution and Liquidation - 497916619Carl Yry BitengNo ratings yet

- BA213 Test3 Review AnswersDocument27 pagesBA213 Test3 Review AnswersnwuodiopdNo ratings yet

- Final Examination Financial Management 2018Document4 pagesFinal Examination Financial Management 2018Caryl Arciete100% (2)

- Chesterfield WanderersDocument2 pagesChesterfield WanderersYenJangNo ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- CGT Drill Answers and ExplanationsDocument4 pagesCGT Drill Answers and ExplanationsMarianne Portia SumabatNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Financial Analysis Statement Solution IncompleteDocument9 pagesFinancial Analysis Statement Solution IncompleteJerome BaluseroNo ratings yet

- IntAcc 3 Non-Financial LiabilitiesDocument10 pagesIntAcc 3 Non-Financial LiabilitiesKim EllaNo ratings yet

- Accounting For Income Tax-1Document4 pagesAccounting For Income Tax-1CAINo ratings yet

- Financial Management 2Document6 pagesFinancial Management 2Julie R. UgsodNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument44 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- Fa2prob3 1Document3 pagesFa2prob3 1jayNo ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet

- Chap 8 Responsibility AccountingDocument51 pagesChap 8 Responsibility AccountingXel Joe BahianNo ratings yet

- Prelims - ACCA111Document7 pagesPrelims - ACCA111Boa HancockNo ratings yet

- Kingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021Document5 pagesKingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021NCTNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Migriño - Quizzer 2 - Employee Benefits Part 1Document13 pagesMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNo ratings yet

- Process Costing ProblemDocument7 pagesProcess Costing ProblemAnonymous Ehv4lpsJ100% (1)

- Construction ContractDocument17 pagesConstruction ContractYvonne Gam-oyNo ratings yet

- HO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFDocument7 pagesHO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFPATRICIA PEREZNo ratings yet

- Short-Term Budgeting: (Problem 1)Document18 pagesShort-Term Budgeting: (Problem 1)princess bubblegumNo ratings yet

- ECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsDocument4 pagesECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsCassie LyeNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- P 1Document4 pagesP 1Kenneth Bryan Tegerero TegioNo ratings yet

- Divide by Average Number of Shares OutstandingDocument11 pagesDivide by Average Number of Shares OutstandingJo FenNo ratings yet

- THEORIESDocument15 pagesTHEORIES123No ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- Managerial EconomicsDocument6 pagesManagerial EconomicsSmartblogzNo ratings yet

- Chapter 14Document4 pagesChapter 14Richard Jay CamaNo ratings yet

- 8 Process CostingDocument4 pages8 Process CostingMaria Cristina A. BarrionNo ratings yet

- Ch5 Operating & Financial LevDocument31 pagesCh5 Operating & Financial LevKristina GarciaNo ratings yet

- Workshop On Management Accounting For Non - Finance ExecutivesDocument67 pagesWorkshop On Management Accounting For Non - Finance ExecutivesPrayogoNo ratings yet

- Activity 5. in What Ways Are The TQM Principles Consistent With The Christian Faith? Discuss How You WillDocument1 pageActivity 5. in What Ways Are The TQM Principles Consistent With The Christian Faith? Discuss How You WillANDI TE'A MARI SIMBALANo ratings yet

- Fund, Which Is Separate From The Reporting Entity For The Purpose ofDocument7 pagesFund, Which Is Separate From The Reporting Entity For The Purpose ofNaddieNo ratings yet

- Activity 1 MAS1 AnswersDocument2 pagesActivity 1 MAS1 Answersangel mae cuevasNo ratings yet

- 1Document1 page1Magsaysay SouthNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocument4 pagesAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Financial Asset at Amortized CostDocument4 pagesFinancial Asset at Amortized Costramir maglangitNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)AdrianBrionesGallardoNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- Self Practice Cost AccountingDocument17 pagesSelf Practice Cost AccountingLara Alyssa GarboNo ratings yet

- Notes in Fi4Document1 pageNotes in Fi4Gray JavierNo ratings yet

- A. The Machine's Final Recorded Value Was P1,558,000Document7 pagesA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- 01 Task Performance 1 - SBADocument6 pages01 Task Performance 1 - SBAPrincess AletreNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- WC Management Sample ProblemsDocument2 pagesWC Management Sample ProblemsGreys Maddawat MasulaNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- Bonds Payable 1Document2 pagesBonds Payable 1els emsNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- Seminar 10 PrepQDocument6 pagesSeminar 10 PrepQAlim OsmanNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- Classify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsDocument3 pagesClassify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsJyasmine Aura V. AgustinNo ratings yet

- 1 To 111 Thories 1 57Document34 pages1 To 111 Thories 1 57Jyasmine Aura V. AgustinNo ratings yet

- MINI PERFORMANCE TSKDocument5 pagesMINI PERFORMANCE TSKJyasmine Aura V. AgustinNo ratings yet

- What Are The Techniques For Job SimplificationsDocument2 pagesWhat Are The Techniques For Job SimplificationsJyasmine Aura V. AgustinNo ratings yet

- How To Boost Job SatisfactionDocument3 pagesHow To Boost Job SatisfactionJyasmine Aura V. AgustinNo ratings yet

- The 19th Century World of Jose RizalDocument3 pagesThe 19th Century World of Jose RizalJyasmine Aura V. AgustinNo ratings yet

- How Can We Apply Work Simplification Techniques For Household TasksDocument1 pageHow Can We Apply Work Simplification Techniques For Household TasksJyasmine Aura V. AgustinNo ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument5 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceJyasmine Aura V. AgustinNo ratings yet

- This Study Resource Was: Use The Following Information For Questions 40 To 43Document9 pagesThis Study Resource Was: Use The Following Information For Questions 40 To 43Jyasmine Aura V. AgustinNo ratings yet

- Quiz 8Document3 pagesQuiz 8Jyasmine Aura V. AgustinNo ratings yet

- Quiz 6Document8 pagesQuiz 6Jyasmine Aura V. AgustinNo ratings yet

- Quiz 6Document6 pagesQuiz 6Jyasmine Aura V. AgustinNo ratings yet

- Quiz 7Document6 pagesQuiz 7Jyasmine Aura V. AgustinNo ratings yet

- Partnership Liquidation: Skip To Main ContentDocument3 pagesPartnership Liquidation: Skip To Main ContentJyasmine Aura V. AgustinNo ratings yet

- Quiz 15Document10 pagesQuiz 15Jyasmine Aura V. AgustinNo ratings yet

- Examining Berkshire Hathaway's Purchase of GEICODocument18 pagesExamining Berkshire Hathaway's Purchase of GEICOJaya Kaushish DhawanNo ratings yet

- 0 20211022170211S3 - (Part-1) PPT-Understanding of Loans and BondsDocument22 pages0 20211022170211S3 - (Part-1) PPT-Understanding of Loans and BondsParthVanjaraNo ratings yet

- Types of DebtDocument5 pagesTypes of Debtayesha1985100% (2)

- CH 12Document39 pagesCH 12Allen KateNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionDaniella mae ElipNo ratings yet

- Sumaiya - Financial Management Assignment 1 - 80201190060Document5 pagesSumaiya - Financial Management Assignment 1 - 80201190060Sumaiya SayeediNo ratings yet

- Week 2 Chapter 9Document8 pagesWeek 2 Chapter 9Sahaja SarvaNo ratings yet

- Engineering Economics and Finance For Transportation InfrastructureDocument223 pagesEngineering Economics and Finance For Transportation InfrastructureDinesh RawalNo ratings yet

- Discount Rate (R) Periods: Present Value TableDocument2 pagesDiscount Rate (R) Periods: Present Value TableKumads LaptopNo ratings yet

- Revised RV - Draft Valuation Report - Hakuna MatataDocument11 pagesRevised RV - Draft Valuation Report - Hakuna MatataBhavin SagarNo ratings yet

- List of Favourite SFM Examination QuestionsDocument12 pagesList of Favourite SFM Examination QuestionsAnkit RastogiNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Western Money Management Inc PDFDocument12 pagesWestern Money Management Inc PDFMariaAngelicaMargenApe100% (1)

- Agec 343 - Farm Management PrinciplesDocument38 pagesAgec 343 - Farm Management PrinciplesKenani WycliffeNo ratings yet

- Future Rewards Valuation ModelDocument2 pagesFuture Rewards Valuation ModelWelcome 1995No ratings yet

- Problem 5-1, 5-2, 5-6, 5-7 AnswerDocument3 pagesProblem 5-1, 5-2, 5-6, 5-7 AnswerNINIO B. MANIALAGNo ratings yet

- Brooks 3e PPT 04Document59 pagesBrooks 3e PPT 04Vy HoàngNo ratings yet

- 2 Time Value of Money - StudDocument36 pages2 Time Value of Money - StudAshwamedhNo ratings yet

- Perpetual Help: Calculate Future Value and Present Value of Money andDocument8 pagesPerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNo ratings yet

- DeVry BUSN 379 Complete Course - LatestDocument8 pagesDeVry BUSN 379 Complete Course - Latestdhol112No ratings yet

- MMW Finals ReviewerDocument4 pagesMMW Finals ReviewerChicken PizzaNo ratings yet

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- 4 - Notes ReceivableDocument10 pages4 - Notes Receivablejoneth.duenasNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch06Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch06Kevin Molly KamrathNo ratings yet