Professional Documents

Culture Documents

The Problem of Creating and Capturing Va

The Problem of Creating and Capturing Va

Uploaded by

Zulfiqar Ahmed AbbasiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Problem of Creating and Capturing Va

The Problem of Creating and Capturing Va

Uploaded by

Zulfiqar Ahmed AbbasiCopyright:

Available Formats

Strategic Organization

http://soq.sagepub.com

The `problem' of creating and capturing value

Jackson A. Nickerson, Brian S. Silverman and Todd R. Zenger

Strategic Organization 2007; 5; 211

DOI: 10.1177/1476127007079969

The online version of this article can be found at:

http://soq.sagepub.com

Published by:

http://www.sagepublications.com

Additional services and information for Strategic Organization can be found at:

Email Alerts: http://soq.sagepub.com/cgi/alerts

Subscriptions: http://soq.sagepub.com/subscriptions

Reprints: http://www.sagepub.com/journalsReprints.nav

Permissions: http://www.sagepub.co.uk/journalsPermissions.nav

Citations http://soq.sagepub.com/cgi/content/refs/5/3/211

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 211

STRATEGIC ORGANIZATION Vol 5(3): 211–225

DOI: 10.1177/1476127007079969

Copyright ©2007 Sage Publications (Los Angeles, London, New Delhi and Singapore)

http://so.sagepub.com

The ‘problem’ of creating and

capturing value

Jackson A. Nickerson Washington University in St Louis, USA

Brian S. Silverman University of Toronto, Canada

Todd R. Zenger Washington University in St Louis, USA

Introduction

Although the strategy field encompasses myriad research interests, perhaps the

most frequently voiced motivating question has been: ‘What are the sources of

a firm’s sustainable competitive advantage?’ In recent years, this has been trans-

formed into ‘How can a firm create and capture value?’, which reflects the

understanding that competitive advantage stems from two distinct (albeit

related) activities: value creation and value capture. If we reflect on the field of

strategy today, however, little research seems directly focused on these broad,

fundamental questions.

Strategy research departs from these questions in two ways. First, although

strategy scholars pay lip service to the notion of value creation, the vast majority

of strategy research has focused on value capture and underemphasized the chal-

lenge of crafting organizations and strategies that continuously create value. In

lieu of systematic understanding, ‘luck’ is regarded as a primary source of value

creation in much of the literature. Second, the typical study in strategy focuses

on a ‘strategic tactic’ – a single input to the process of strategy development.

How should the firm manage its network of relationships? Where should the

firm locate activity X? How should the firm organize activity Y? In essence,

strategy research has moved away from the field’s foundational questions to

focus on tactical decisions to be made under definable circumstances.

Re-emphasizing the strategic question of value creation highlights the

unique and central role that organization plays in crafting strategy. If the object-

ive of the firm is to create or increase value, then effective strategy and organiza-

tion cannot merely entail establishing a competitive advantage (Porter, 1996),

but rather must entail a constant search for entirely new rent streams – in

essence, a steady stream of competitive advantages. Hence, strategic manage-

ment is as much about crafting an organization that can readily identify new

value opportunities (and build strategies to appropriate that value), as it is about

211

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 212

212 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

discovering a singular strategic position that delivers sustained competitive

advantage. Firms that are effective at creating value make their own luck, by

crafting strategies and organizations that provide paths for new value creation.

More precisely, value-creating firms relentlessly uncover ‘strategic problems’ to

solve, whether embedded with customers (or potential customers), with sup-

pliers or within their own firms. For us, this agenda of relentless and deliberate

value creation is the unique contribution of strategic organization.

In this essay, we hope to plant the seeds for a new approach to research in

strategic organization. Our agenda is three pronged. First, we propose that the

problem-solving perspective (PSP) offers a particularly effective lens for an

emphasis on value creation. The PSP takes elements of the ‘problem’ as the unit

of analysis for the study of strategic and organizational questions, and decom-

poses managerial challenges into problem identification, search for problem

solution and creation of strategies for appropriating returns accruing to the

solution. To the extent that problem identification overlaps with value creation,

the PSP can fruitfully guide research in this area. Second, we lay out our assess-

ment of the key theoretical elements necessary to understand problem identifi-

cation. The primary requirement is that strategy scholars pay more heed to

processes that enable actors to deliberately find new sources of value instead of

relying on luck to do so. Central to the perspective is recognition of organiza-

tional processes that overcome biases – cognitive, motivational and informa-

tional – that contaminate the finding of new sources of value. Third, we make

some initial steps at developing a research roadmap by categorizing various

problem identification processes and proposing guideposts for systematic

research on this question.

Identifying a problem occurs in ways other than the deliberate approach

described. For instance, serendipity can occur. Alternatively, some problems are

identified collectively through a process of social construction (Schneider,

1985). In other instances solutions may be in search of or may even create prob-

lems (Cohen et al., 1972). While we acknowledge these and other alternative

mechanisms for identifying problems, our focus is on the deliberate category

described in the following.

We first introduce our perspective on deliberate value creation, drawing on

the PSP. We focus primarily on problem identification because, similar to value

creation, it has been relatively underemphasized in the extant literature. We pro-

vide an overview of the importance of decision-making processes that underlie

problem identification as well as the link between problem identification and

rent generation. We next note commonalities between this approach and organ-

izational learning, elements of Austrian economics and dynamic capabilities,

but argue that the PSP lens offers a more comprehensive approach to value cre-

ation than the alternatives. Finally, we introduce a set of questions that could

give rise to a new research program to advance the study of value creation from

a strategic organization perspective.

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 213

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 213

A problem-solving perspective on value creation

Deliberate value creation

The PSP (Nickerson and Zenger, 2004) shares the assumption of the know-

ledge-based view that the key managerial objective is to create valuable new

knowledge (Barney, 1984; Conner and Prahalad, 1996; Kogut and Zander,

1992; Teece et al., 1997; Wernerfelt, 1984). By creating new knowledge, firms

uncover new means to convert inputs into valued outputs (Arrow and Hahn,

1971; Nelson and Winter, 1982). Consequently, the manager’s organizational

task is to craft an organization that efficiently generates and protects knowledge

(Conner and Prahalad, 1996; Kogut and Zander, 1992; Madhok, 1996). The

manager, however, cannot specify a priori the knowledge she or he wishes to

obtain because, more often than not, this knowledge does not yet exist. What

the manager can instead do is identify valuable problems – those which, if suc-

cessfully solved, yield knowledge that will significantly improve the organiza-

tion’s performance. Once a problem is identified, the manager then organizes a

search for solutions that optimizes the likelihood, speed and cost with which

valuable solutions are discovered. Finally, the manager seeks to appropriate a

portion of the solution’s value. Central to the PSP is an attempt to understand

the characteristics of problems, and of organizational structures and policies,

that facilitate successful problem selection and solution. Specifically, the PSP

seeks to identify a discriminating alignment between organizational forms and

problem characteristics to optimally manage value creation and capture.

Focusing on value creation components of PSP, we first introduce the issues sur-

rounding problem-solving and then devote the rest of our effort to a discussion

of problem identification.

The key question for problem-solving is: how can managers organize an effi-

cient search for high-value solutions to an identified problem? The efficient

approach to solution search depends on the complexity or non-decomposability

of the problem, the extent to which non-decomposability generates knowledge-

formation hazards, and the efficacy of various governance mechanisms for

encouraging searches appropriate for the level of problem complexity. Some

problems can be solved through the combination of independent, modular

searches, and consequently require minimal organizational control. Other prob-

lems require knowledge sharing across actors as well as coordinated search; for

such problems, various forms or hierarchy are optimal to manage efficiently the

attendant knowledge-formation hazards.

The key question for problem identification is: how can managers organize a

search to identify and select a problem whose resolution can be expected to gener-

ate significant value? Although not yet fully formed, the PSP approach to problem

identification examines organizational characteristics that facilitate or impede

problem identification, with a strong focus on processes. It seeks to understand

how various processes affect the discovery of various kinds of problems. As we

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 214

214 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

describe later, in many instances organizational structures and their attendant

processes have profound implications for the identification of problems. Thus, we

choose problem search as an appropriate unit of analysis and study how and why

processes shape the width, depth and speed of the resulting stream of problems

discovered and identified.

Of course, deliberately identifying a problem involves forethought about

the firm’s ability to assemble knowledge sets to solve the problem and hence cre-

ate value, as well as its ability to capture value from the solution. Thus, man-

agers should not want to select problems for which they have little chance of

cost effectively discovering a solution or for which their firm has little chance of

capturing value. Problem choice therefore should be influenced by solution

search and value capture possibilities. However, since prior research in the PSP

has focused on the organization of knowledge for problem-solving (Nickerson

and Zenger, 2004; also see Macher, 2006), and much of the extant strategy lit-

erature focuses on issues of value capture, in the sections that follow we suppress

detailed discussion of these influences.

Problem identification: contexts and domains

Why is it so difficult to identify novel problems? Put differently, why can’t a

manager simply organize the search for a problem according to the same pre-

scription by which she or he organizes the search for a solution to an identified

problem? At first glance, the two search processes may appear quite similar.

However, searching for a novel question or identifying a novel problem can

entail far more uncertainty than searching for a solution. Searching for an

unknown solution to a formulated problem provides at least a benchmark

against which various solution attempts can be evaluated. In contrast, when

searching for a problem and its formulation there exists no analogous bench-

mark against which to evaluate alternative problem formulations. It is not sur-

prising, then, that Einstein and Infeld (1938: 92) claim that ‘The formulation

of a problem is often more essential than its solution. … To raise new questions,

new possibilities, to regard old questions from a new angle, requires creative

imagination and marks real advance in science.’

The nature of searching for a problem thus frequently resembles a search

for an ‘unknown unknown’. Using the metaphor of knowledge landscapes

(Hsieh et al., forthcoming; Nickerson and Zenger, 2004), solving a problem

involves searching on a largely unseen knowledge landscape while searching for

a potentially valuable problem involves searching for potentially valuable and

largely unseen landscapes.

Such uncertainty does not merely increase the amount of resources necessary

to search, but also qualitatively alters the type of effort required. In our view, it is

precisely in such unconstrained-search contexts that biases are likely to be par-

ticularly severe impediments – impediments that contaminate efforts to discover

and identify problems. These include the well-known biases of anchoring,

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 215

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 215

perceptual bias, information distortion, dominance, groupthink, primacy, satis-

ficing and conflicts of interest, among others. Such biases, whether cognitive,

motivational or informational, if not counteracted, can contaminate problem

discovery and identification by narrowing, slowing and making shallow the

stream of problems found. Put in common business vernacular, these impedi-

ments may diminish the identification of growth opportunities and increase

competitive threats. If not counteracted, these biases hamper problem identifica-

tion processes and hinder if not halt the discovery of new problems.

Although our logic is not fully worked out, we envision that the salience of

impediments with respect to problem identification varies with the nature and

context of problems being sought. For instance, the search for value-creating

problems that involve a reduction in manufacturing cost occurs in a context in

which the type of problems sought may be more modular and local, on average,

thus requiring fewer but deeper knowledge sets for their solution. In such situ-

ations, anchoring, conflict of interest and dominance may represent the principal

biases contaminating and limiting search for value-creating problems because

these biases may be more likely to be present among individuals with deep but

differing knowledge sets that collectively are trying to identify problems. For

instance, one possibility is that in such a domain individuals with differing deep

knowledge sets are likely to possess different mental models along with strong

identities that lead to anchoring, conflicts of interest and the use of dominance

to identify problems. In other contexts in which the problems sought are novel

and, if solved, could lead to entrepreneurial opportunities or radical innov-

ations, perceptual bias, information distortion, groupthink, primacy and satisfic-

ing are likely to be the principal impediments that contaminate the search. We

imagine that the salience of these biases arises because individuals with broad

knowledge sets may not be able to fully comprehend deep information and

therefore distort it, happy to discover any problem and therefore latch onto the

first acceptable one. At this point, these categorizations are hypothetical – no

taxonomy of the relationship between the nature and context of problem iden-

tification domain and type of impediments that contaminate the search has yet

been fully fleshed out. Nonetheless, our reading of a variety of literatures

encourages us to believe that a taxonomy is within reach. In turn, such a tax-

onomy will support future research that comprehensively informs our under-

standing of problem identification.

Problem identification: processes

Just as particular contexts may be especially susceptible to particular biases, we

believe that particular biases may be especially remediable through the applica-

tion of particular processes. If so, then this suggests a motivating question for the

study of value creation in strategic management: What processes enable the iden-

tification and selection of problems that ultimately reveal value-creating solutions

for the firm? Put differently, when and under what conditions will specific

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 216

216 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

processes mitigate specific impediments to effective problem identification?

These questions are relatively new to strategy, although they have been raised in

other fields such as the study of creativity.

By processes, we mean individual, group, or organizational activities and

efforts that aid in discovering problems that, if solved, create value. Processes, by

definition, comprise a set of facts, circumstances or experiences that are

observed and described or that can be observed and described and are marked

by gradual changes through a series of states. This technical definition of process

highlights several important elements. The facts, circumstances or experiences

are, or can be, observed and described, which implies that they can be verified

and monitored by participants or observers. Observability suggests that most,

strictly cognitive processes, are not under consideration. Moreover, observability

of the process states implies that the process can be designed, evaluated and

improved upon – important features that can give rise to creating organizational

advantages. Second, a process involves a series of changes, which implies that

one step in a process is differentiated from another by some type of state

change. A series of changes may also have implications for the cost of reaching a

particular state – costs may vary depending on where in the process you start.1

From a behavioral standpoint, most organization theorists have not considered

how problems are discovered and chosen. For instance, the behavioral theory of the

firm (Cyert and March, 1963), which adopts a process-oriented perspective,

assumes the existence of a problem. Similarly, processes found in the literature on

organizational behavior such as nominal group technique, brainstorming, the

Delphi process and dialectic process all assume that the problem is a given and pro-

vide detailed processes about how groups search for and choose solutions. Processes

for discovering and choosing problems are much less studied. To advance the con-

versation, it may be useful to offer a few illustrations of broad types of processes for

identifying and choosing problems. In doing so, we segment processes for identify-

ing problems into two broad classifications: analytic and synthetic processes.

Analytic processes

An analytic process is a sequence of steps – what might also be described as a struc-

tured set of steps – that an individual or organization takes to produce stimuli help-

ful in identifying problems. For instance, the statistical quality control revolution

launched the discovery of numerous processes that stimulate the identification of

deviations or waste, uncover their root cause or causes, and search for solutions to

eliminate them. The quality revolution over the past 20 years has generated a var-

iety of such processes under a variety of labels, including statistical process control,

total quality, lean manufacturing, Six Sigma and quality function deployment.

Each describes a set of specific and detailed process steps through which organiza-

tions discover and identify problems to solve. We use the term analytic to describe

these processes because the process steps disassemble and decompose the value

chain to quantitatively evaluate each step. The net result is that analytic processes

identify problems that, if solved, incrementally reduce cost or enhance quality

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 217

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 217

through variance or waste reduction in particular steps of value chain. To the extent

that analytic processes are outwardly focused on satisfying customers, the customer

preferences being considered are familiar and clearly defined. Thus, analytic

processes focus on reducing defects, lowering cost or increasing well-defined qual-

ity metrics. The typical result of analytic processes, therefore, is value creation

through incremental innovation of an existing business model. These processes

normally depend on an environment in which production is repeated, the produc-

tion process can be defined and characterized, and customers have experience with

the product or service. Obviously, these processes are useful – otherwise they would

not be so widely applied. However, these processes typically generate problems for

which solutions represent incremental advances within an established paradigm.

They typically rely on easily obtained metrics where ‘better’ is uncontroversial –

lower cost, fewer defects, etc. In some ways, analytic processes search on a landscape

to find a higher peak rather than searching for landscapes.

The degree to which analytic processes generate strategic rents is tightly

linked to the firm’s skill in identifying a steady stream of problems and then

rapidly generating valuable solutions. While identifying and solving a single

problem is unlikely to deliver strategic rents, strategic rents are likely to flow to

those firms that develop a sustained capability at problem identification and

problem-solving. For instance, it is undeniable that Toyota’s lean manufacturing

process enables it to earn strategic rents because no other assembler has been

able to match its sustained ability to continually identify and solve manufactur-

ing problems associated with reducing waste. Motorola, credited with first

implementing if not inventing Six Sigma processes, is claimed to have saved

more than US$17 billion in production costs by 2006. It is widely accepted

that General Electric generated competitive advantage in many of its business

units through its commitment to Six Sigma processes. The early development,

adoption and thorough execution of analytic processes have provided Toyota,

Motorola and GE with a stream of problems and solutions that have generated

enormous value for these firms. The inability of many of their competitors to

generate an equivalent stream of problems and solutions has contributed to sus-

taining their competitive advantages.

While some of these analytic processes are well known and have been trans-

ferred between firms, we believe that the theoretical micro-foundations of these

analytic processes remain understudied by strategy scholars. For instance, what

aspects of these processes enable firms to identify a stream of problems and

solutions? Why do some processes and their implementation lead to a superior

ability to create and capture value? Put differently, we can ask why aren’t problems

identified and chosen with similar frequency without these processes? One plaus-

ible explanation is that the cognitive and other biases mentioned earlier act

as important impediments. That is, biases such as anchoring, perceptual bias,

information distortion, dominance, groupthink, primacy, satisficing and conflicts

of interest, unless counteracted, inhibit the discovery and solution of problems.

If processes provide mechanisms for overcoming these biases then we need to

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 218

218 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

understand from an organizational point of view what kinds of processes and

when these processes enable a stream value creation and capture. We also need to

know from a strategic view how some firms’ implementations of these processes

generate a wider, faster, deeper stream of problems and solutions than competitors’

implementations. We know of little specific research that assesses alternative

processes for their bias-reducing benefits and the linkage between analytic

processes and strategy. The consideration of individual and group biases may be

even more relevant to our second class of processes: synthetic processes.

Synthetic processes

Our second classification we call synthetic processes. Similar to analytic processes,

synthetic processes represent sequences of steps that produce stimuli that can lead

to problem identification. We define synthetic processes differently from analytic

processes by suggesting that they generate inductive, exploratory synthesis in

identifying novel problems in contrast to the deductive approaches of analytic

processes. While analytic processes disassemble and decompose, synthetic processes

are designed to actively combine and integrate. Synthetic processes have much

more to do with asking novel and what might be called catalytic questions2 in

response to ambiguity, even creating ambiguity, than with relying on deviations

from repeated activities. Processes that focus on discovering novel customer

problems and that ultimately lead to the identification of entrepreneurial oppor-

tunities or radical innovations fall under this category.

An essential difference between analytic and synthetic processes is the

nature of stimuli that launch problem identification. For instance, whereas ana-

lytic processes commonly rely on deviations and waste from repeated activities

to stimulate the finding of problems, synthetic processes involve stimuli from

less structured environments. Entrepreneurs seeking new questions and man-

agers seeking new growth opportunities represent situations where individuals

are seeking stimuli for the identification of new problems. Alternatively, one

might differentiate synthetic from analytic processes by suggesting that the for-

mer seeks out interesting and catalytic questions where analytic processes gener-

ate questions through deviations generated by repeated activities either in the

firm or between the firm and its environment.

Another essential difference between analytic and synthetic processes involves

the choice of problem to solve. As noted earlier, analytic processes engage stimuli

from deviations and excess waste, and consequently tend to identify problems that

are well structured: eliminating a bottleneck, reducing work in process or reducing

output variability of a machine. Synthetic processes are less constrained and prob-

lem identification less certain and more ill-structured. Synthetic processes may gen-

erate a wide range of alternative problems, many of which are substitutes, while

others are complements, and still others are quite independent from one another.

In selecting problems managers must decide not only which questions represent

design challenges to create value but also which problems their organizations have

a reasonable likelihood of solving at a low enough cost to create and capture value.

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 219

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 219

We view new business strategies as primarily shaped and created through these

synthetic processes. Such processes are much more likely to look outwardly toward

customers and explore the fundamental ‘problems’ customers face in their efforts to

create value. A key outcome of such processes is identifying which customer prob-

lems to solve. Or, perhaps after sorting through various customers’ problems and the

related opportunities, synthetic processes may help decide upon which customers to

focus. Alternatively, if internally focused, these synthetic processes may explore the

broad interconnection of activities within the firm and thereby identify systemic

‘problems’, which if solved, could generate significant breakthroughs in the value

created for customers or in the costs incurred in serving them.

While we are unaware of research on synthetic processes for problem iden-

tification with respect to organizations, a few synthetic processes have been

introduced into related literatures. For instance, the evolving literature on cre-

ativity suggests that creativity is hard work and commonly social and collabora-

tive; seldom do breakthrough innovations occur as a ‘burst of creativity from a

lone genius’ (Sawyer, 2006: 258). One such process encompasses four stages:

these are preparation, incubation, insight and verification (Sawyer, 2006: 59).

While some researchers suggest the creative process is not linear, others have

argued by analyzing sketches and notebooks leading up to the insight that each

innovation resulted from a connected, directed, rational process (Weisberg,

1986, 1993). A variety of processes for creativity have been identified and these

processes may provide an interesting and useful foundation for the development

of processes for problem identification in strategic management. We also might

think of the tools in strategic management such as industry analysis, capability

analysis or activity analysis as inputs to a synthetic process. While the tools of

strategic management are relatively well specified, the processes by which man-

agers discover new questions are much less studied.

Alternative approaches to value creation … and

why they fall short

The perspective described in the preceding section has obvious links to several

other literatures. Perhaps reflecting our own biases, we comment here on only a

few of these relationships, notably organizational learning, Austrian economics

and the entrepreneurship literature and dynamic capabilities.

Organizational learning

Our terminology of analytic and synthetic processes has obvious parallels with

the literature on exploration and exploitation and the study of organizational

learning. A significant topic in the organizational learning literature explores the

problem of balancing exploration and exploitation as exhibited in distinctions

made between refinement of an existing technology and the invention of a new

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 220

220 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

one (see March, 1991: 72). Analytical and synthetic processes do parallel

exploitation and exploration but with specific and important differences. Perhaps

the most significant difference is that the latter tend to focus on the tradeoff

between processes at the organizational level whereas the former focuses on the

identification and solving of specific problems. These different units of analysis

have important implication for the types of questions that are answered. Rather

than focusing on the balance between processes, which is a focus in the explor-

ation–exploitation literature without ever delving into the details of these, the

PSP’s objective is to explore in a deep and detailed way processes as mechanisms

for overcoming various individual and group biases. As such, we are interested in

discerning the full sets of alternative analytic or synthetic processes and when a

particular analytic or synthetic alternative might be the most efficacious.

Austrian economics and entrepreneurship

Much of the entrepreneurship literature resonates with, if not directly builds off

of, the Austrian Economics perspective (e.g. Roberts and Eisenhardt, 2003).

Austrian economists and entrepreneurship scholars assume that humans are ra-

tional but ignorant about unseen opportunities, which is consistent with the

notion of Knightian uncertainty. This literature claims that discovering these

unseen opportunities fundamentally involves alertness, as the entrepreneur

through alertness uncovers opportunities for arbitrage – opportunities where cer-

tain factors of production are under-priced. The PSP adopts this baseline model

of humans but recognizes crucial and additional dimensions not embedded in the

Austrian perspective. In our perspective we assume that humans are boundedly

rational and can suffer from a variety of biases. These assumptions give rise to our

discussion of process and organization as ways to overcome bias impediments to

problem identification, which are not relevant in the Austrian perspective.

Our perspective assumes that such synthetic processes can and do exist to

enable the identification of novel problems. The entrepreneurship literature,

particularly the Austrian perspective, also asserts the existence of processes of

opportunity recognition but does not yet offer rich descriptions or comparative

analyses of synthetic processes. Instead, this literature focuses on individual fac-

tors such as life experience, information search, social ties, absorptive capacity,

cognitive processes and a heavy dose of luck as the primary factors driving

opportunity discovery. In particular, the notion that successful entrepreneurs are

those whose synthetic processes and theories are superior is absent not only

from the strategic management literature but from other literatures as well.

The PSP also differs from Austrian economics in its unit of analysis and its

core terminology. Austrians assume the ‘opportunity’ is the unit of analysis where

the PSP distinguishes problem identification from problem-solving. Although

some may view the distinction as a semantic difference, we believe that an oppor-

tunity consists of a problem ultimately matched with a solution that creates value.

Processes are helpful in both identifying problems and guiding solution search,

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 221

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 221

theory crafting and the exploration of new ‘means–ends’ combinations (Casson,

1982; Shane and Venkataraman, 2000). Therefore, any focus by us on problem

identification explicitly deals with only one half of the concept of opportunity dis-

cussed by Austrians and entrepreneurship scholars. Put differently, we think we

have a better chance of developing new insights by segmenting the search for new

means–ends combinations into two component processes – one for problem dis-

covery and identification and the other for problem-solving. Indeed, new research

in entrepreneurship is beginning to pursue this path. McMullen and Shepherd

(2006) introduce a new model of entrepreneurial action that is concerned with

issues of stimulus, motivation and knowledge.

Dynamic capabilities

The PSP shares with the dynamic capabilities perspective a focus on the process

by which firms continually create and sustain competitive advantage. Teece et al.

(1997) define dynamic capabilities as ‘the ability to integrate, build, and recon-

figure internal and external competencies to address rapidly-changing environ-

ments’. Thus, while the resource-based view focuses on the selection and analysis

of rather static resources, the dynamic capabilities literature emphasizes the

development and renewal of resources that deliver competitive advantage. In this

regard, the theory is more organizational in its focus than the resource-based

view, highlighting the ways in which firms create value through constant capabil-

ity development and redevelopment.

This dynamic capabilities perspective, however, offers little theory surrounding

the processes by which capabilities are formed, or around which capabilities are

most appropriate for the changing environment. Moreover, this perspective is

entirely reactive – firms assess changing environments and then develop capabilities

isomorphic to that environment. Within the PSP, while the environment certainly

plays an important role in shaping problem choice and solution search, managers

within the PSP are actively shaping their environments as they seek to create value

through their selection of problems and search for solutions. Moreover, this per-

spective aims to define the organizational attributes and processes that support the

successful selection of problems and search for solutions. That said, recent work by

Eisenhardt and colleagues bridges some of the distinction between dynamic cap-

abilities and the PSP, by incorporating a focus on the process as the unit of analysis

(Eisenhardt and Martin, 2000) and by proposing a relationship between process

structure and innovative performance (Brown and Eisenhardt, 1997).

Processes and strategy

For strategy scholars, studying the identification and development of analytic and

synthetic processes is important to the understanding of creating and capturing

value. To generate a stream of rents, a firm must develop processes that generate

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 222

222 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

problems (and solutions) faster, more frequently and of higher quality than their

competitors. Shaping the nature of this stream of problems is a vital competitive

concern and deserves a detailed micro-analytic understanding of underlying

mechanisms. Firms fundamentally compete based on the quality of the analytic

and synthetic processes in which they engage. More effective processes deliver

greater opportunities for and success in value creation and capture. If all firms

embed identical or equivalent processes within their organizations and implement

these processes with similar consistency and efficacy, then the likelihood of firms

identifying truly unique problems with truly unique solutions is compromised.

While two firms with identically efficacious processes may identify unique prob-

lems and solutions and deliver competitive advantage to each, these unique com-

petitive advantages are more likely to accompany firms with unique and more

developed processes, particularly synthetic processes. Of course, developing

unique synthetic processes may be more difficult than analytic processes given

that we know much less about the former. That said, a firm that successfully

builds effective synthetic processes may possess an unusually valuable and sustain-

able source of competitive advantages, in part because these processes are so poorly

understood and thus exceptionally difficult to copy.

We believe that in most cases, processes, whether analytic or synthetic, are

developed, introduced and managed by organizations as opposed to being

introduced across market interfaces. We further believe that by managing

processes, organizations craft strategies that create and, ultimately, capture

value. An effective strategically focused organization generates a steady stream of

competitive advantages. These advantages begin by first identifying a steady

stream of valuable problems. We argue that processes specific to a firm for iden-

tifying and choosing problems may be at the root of such effective strategy and

organization.

Implications for research in strategic organization

Our preliminary conclusion is that much opportunity exists in the literature on

strategic organization to better explore and understand value creation. Based on

the problem-solving perspective of value creation articulated herein, we identify

several voids in the strategic organization literature and offer our thoughts on

how to advance the field. To do so, in this essay we have suppressed discussion

of governance-related issues to emphasize the need to develop a theoretical

apparatus for identifying, comparing and evaluating processes.

Perhaps the most obvious opportunity arises from the fact that few strategy

scholars have taken seriously the problem identification process (as opposed to

opportunity recognition) as the unit of analysis for studying value creation.

Moreover, few have conceptualized studying processes as mechanisms for at-

tenuating problem identification impediments. Most studies of process in strategic

management and organization investigate how problems are solved rather than

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 223

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 223

how they are identified and chosen, or study processes from a perspective of

organizational change. Those areas of management and operations that do offer

descriptions of highly structured problem-identification processes, such as lean

manufacturing and Six Sigma, provide neither a behavioral theory about when

and why these processes are beneficial nor a theoretical apparatus for assessing

the benefits of alternative processes. If such processes create value (and ul-

timately lead to the capture of value), why do they do so? What problem iden-

tification impediments do these processes overcome? How can we identify and

assess new processes that might be sources of strategic advantage? From a per-

spective of creating and capturing value, can firms develop problem identifica-

tion processes that provide them with unique streams of problems – and rents?

If so, how can these streams be made wider, faster, deeper?

If alternative analytic or synthetic processes exist, as we strongly suspect,

then what are the alternatives and when will alternative processes be superior in

various contexts? What attributes of the problem identification contexts are rele-

vant for choosing among alternative processes? What contextual attributes

influence the design and choice of processes for problem identification?

Even though we recommend problem identification search as a useful unit

of analysis, the desire of bundling multiple processes within an organization – say

an analytic process as well as a synthetic process – raises additional questions

about organization. Can a single organization sustain multiple types of processes

within the same organization? Under what conditions are processes comple-

ments vs substitutes? Does the adoption of one process impair the adoption and

application of another process? Can a single organization sustain multiple and

different analytic processes or synthetic processes? If so, under what conditions

will processes conflict as mechanisms? The answers to these questions may have

broad implications not only for the study of creating and capturing value but

also may have a profound influence on the practice of management. Moreover,

answering these questions may allow scholars to better integrate various perspec-

tives such as organizational learning, dynamic capabilities and transaction cost

economics into a more comprehensive science of organization.

Acknowledgements

The authors wish to thank Markus Baer, Stuart Bunderson and Kurt Dirks for their helpful con-

versations.

Notes

1 We generally view processes as a specific class of routines. The key differentiator between

processes and routines, more generally, is that the former are specific, observable and, there-

fore, improvable.

2 We thank Jeff Dyer for introducing us to the terminology of catalytic questions.

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 224

224 S T R AT E G I C O R G A N I Z AT I O N 5 ( 3 )

References

Arrow, K. J. and Hahn, F. H. (1971) General Competitive Analysis. San Francisco: Holden-Day.

Barney, J. B. (1984) ‘Strategic Factor Markets: Expectations, Luck, and Business Strategy’,

Management Science 32(10): 1231–41.

Brown, S. L. and Eisenhardt, K. M. (1997) ‘The Art of Continuous Change: Linking

Complexity Theory and Time-Paced Evolution in Relentlessly Shifting Organizations’,

Administrative Science Quarterly 42(1): 1–34.

Casson, M. (1982) The Entrepreneur. Totawa, NJ: Barnes and Noble Books.

Cohen, M. D., March, J. G. and Olsen, J. P. (1972) ‘A Garbage Can Model of Organizational

Choice’, Administrative Science Quarterly 17(1): 1–25.

Conner, K. R. and Prahalad, C. K. (1996) ‘A Resource-Based Theory of the Firm: Knowledge

versus Opportunism’, Organization Science 7(5): 477–501.

Cyert, R. M. and March, J. G. (1963) A Behavioral Theory of the Firm. Englewood Cliffs, NJ:

Prentice-Hall.

Einstein, A. and Infeld, L. (1938) The Evolution of Physics. New York: Simon and Shuster.

Eisenhardt, K. M. and Martin, J. A. (2000) ‘Dynamic Capabilities: What Are They?’, Strategic

Management Journal 12(10/11): 1105–21.

Hsieh, C., Nickerson, J. A. and Zenger, T. R. (forthcoming) ‘Opportunity Discovery, Problem

Solving, and the Entrepreneurial Theory of the Firm’, Journal of Management Studies.

Kogut, B. and Zander, U. (1992) ‘Knowledge of the Firm, Combinative Capabilities and the

Replication of Technology’, Organization Science 3(August): 383–97.

McMullen, J. S. and Shepherd, D. A. (2006) ‘Entrepreneurial Action and the Role of Uncertainty

in the Theory of the Entrepreneur’, Academy of Management Review 31(1): 132–52.

Macher, J. T. (2006) ‘Technological Development and the Boundaries of the Firm: A Knowledge-

Based Examination in Semiconductor Manufacturing’, Management Science 52(6):

826–43.

Madhok, A. (1996) ‘The Organization of Economic Activity: Transaction Costs, Firm

Capabilities, and the Nature of Governance’, Organization Science 7(5): 577–90.

March, J. G. (1991) ‘Exploration and Exploitation in Organizational Learning’, Organization

Science 2: 71–87.

Nelson, R. R. and Winter, S. G. (1982) An Evolutionary Theory of Economic Change. Cambridge,

MA: Belknap Press.

Nickerson, J. and Zenger, T. (2004) ‘A Knowledge-Based Theory of Governance Choice’,

Organization Science 15(6): 617–32.

Porter, M. (1996) ‘What is Strategy’, Harvard Business Review November/December.

Roberts, P. W. and Eisenhardt, K. M. (2003) ‘Austrian Insights on Strategic Organization: From

Market Insights to Implications for Firms’, Strategic Organization 8(1): 345–52.

Sawyer, K. (2006) Explaining Creativity. New York: Oxford University Press.

Shane, S. and Venkataraman, S. (2000) ‘The Promise of Entrepreneurship as a Field of Research’,

Academy of Management Review 26(1): 13–27.

Schneider, J. W. (1985) ‘Social Problems Theory: The Constructionist View’, Annual Review of

Sociology 11: 209–29.

Teece, D., Pisano, G. and Shuen, A. (1997) ‘Dynamic Capabilities and Strategic Management’,

Strategic Management Journal 18(7): 509–33.

Weisberg, R. (1986) Creativity: Genius and Other Myths. New York: Freeman.

Weisberg, R. (1993) Creativity: Beyond the Myth of Genius. New York: Freeman.

Wernerfelt, B. (1984) ‘A Resource-Based View of the Firm,’ Strategic Management Journal 5(2):

171–80.

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

211-226 SOQ-079969.qxd 31/7/07 8:56 PM Page 225

N I C K E R S O N E T A L . : C R E AT I N G A N D C A P T U R I N G VA L U E 225

Jackson A. Nickerson is the Frahm Family Professor of Organization and Strategy at the

John M. Olin School of Business at Washington University in St Louis. Jackson’s research

explores the antecedents and performance implications of organizational choice and how

these relationships apply to business strategy. His current interests include the problem-

solving perspective, knowledge and organizational choice, pharmaceutical manufacturing regula-

tion and performance, and R&D projects selection rules. He has published in a number of

journals including Administrative Science Quarterly, Journal of Political Economy, Strategic

Management Journal, Journal of Economics, Management and Strategy, Organization Science and

Strategic Organization. Address: Campus Box 1133, 1 Brookings Drive, St Louis, MO 63130,

USA. [email: nickerson@wustl.edu]

Brian S. Silverman is the J. R. S. Prichard and Ann Wilson Chair in Management at the

University of Toronto’s Rotman School of Management. His research focuses on the ways

that firms’ strategies and organizational structures interact to affect their performance – in

particular, their ability to access and exploit technological capabilities. His research has

appeared in numerous journals including, most recently, Administrative Science Quarterly, Journal

of Law and Economics, Management Science, Research Policy and Strategic Management Journal.

He is currently on the editorial boards of Administrative Science Quarterly, Organization Science

and Strategic Organization, and is an advisory editor for Research Policy. Address: Rotman

School of Management, University of Toronto, 105 St George Street,Toronto, ON, Canada,

M6S 2A7. [email: silverman@rotman.utoronto.ca]

Todd R. Zenger is the Robert and Barbara Frick Professor of Business Strategy at the Olin

School of Business at Washington University in St Louis. Professor Zenger’s research focuses

on organizational design and incentives, organizational boundaries and corporate strategy. His

research has explored the advantages of small firm size in crafting high-powered incentives,

the relationship between formal contracts and trust, and patterns of oscillating centralization

and decentralization within organizations. Professor Zenger’s work has appeared in Strategic

Management Journal,Administrative Science Quarterly,Academy of Management Journal,Academy of

Management Review, Organization Science and Management Science. He currently serves as an

associate editor of Management Science and on the editorial boards of Academy of Management

Review, Strategic Management Journal and Strategic Organization. Address: Campus Box 1133,

1 Brookings Drive, St Louis, MO 63130. [email: zenger@wustl.edu]

Downloaded from http://soq.sagepub.com at SAGE Publications on April 30, 2009

You might also like

- Staff Analysis of The 2023-2024 Executive BudgetDocument212 pagesStaff Analysis of The 2023-2024 Executive BudgetNew York SenateNo ratings yet

- Veeam Certified Engineer 2021 VMCE2021 Exam DumpsDocument11 pagesVeeam Certified Engineer 2021 VMCE2021 Exam DumpskaronbillNo ratings yet

- A Critical Application of Strategy DichotomiesDocument5 pagesA Critical Application of Strategy DichotomiesDerek RealeNo ratings yet

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Theory of FirmDocument10 pagesTheory of FirmPrashanth CGNo ratings yet

- Literature Review On The Nature of Strategic ManagementDocument7 pagesLiterature Review On The Nature of Strategic Managementc5qp53eeNo ratings yet

- Shared Valuex CreationDocument29 pagesShared Valuex CreationDancan OnyangoNo ratings yet

- 194-Article Text-521-1-10-20170929Document19 pages194-Article Text-521-1-10-20170929Kathryn Krystal R LanuzaNo ratings yet

- Innovation ReviewDocument6 pagesInnovation ReviewMuhammad Usama NaseerNo ratings yet

- Strategy and Competitive AdvantageDocument6 pagesStrategy and Competitive AdvantageUtsav SarkarNo ratings yet

- Thesis Business StrategyDocument4 pagesThesis Business StrategySandra Long100% (2)

- How The Balanced Scorecard Complements The McKinsey 7 S Model PDFDocument6 pagesHow The Balanced Scorecard Complements The McKinsey 7 S Model PDFDumitru Cosmin ChindrisNo ratings yet

- Business Policy and Strategy As A Professional Field: January 2001Document16 pagesBusiness Policy and Strategy As A Professional Field: January 2001ij EducationNo ratings yet

- Strategy Management ImplementationDocument52 pagesStrategy Management ImplementationrandainzeroNo ratings yet

- BaumgartnerDocument8 pagesBaumgartnermhalkot11No ratings yet

- 01 Grant 1996 SMJ Knowledge Based TheoryDocument15 pages01 Grant 1996 SMJ Knowledge Based TheoryRuey-Der TwuNo ratings yet

- Strategic ManagementDocument82 pagesStrategic ManagementrandainzeroNo ratings yet

- Johnson Chap4Document28 pagesJohnson Chap4Sachin BansalNo ratings yet

- "Doing" StrategyDocument10 pages"Doing" StrategyHendra PoltakNo ratings yet

- Meta SWOTDocument11 pagesMeta SWOTMohammed Mohammed Shoukry NaiemNo ratings yet

- Chapter 1Document26 pagesChapter 1CharleneKronstedtNo ratings yet

- Proposal To Implement The Balanced Scorecard in ADocument27 pagesProposal To Implement The Balanced Scorecard in ADuarte SilvaNo ratings yet

- Bowen MissionDocument10 pagesBowen MissionDaniel NóbregaNo ratings yet

- Tplus en 4397Document9 pagesTplus en 4397Klara MalinovaNo ratings yet

- BSC Met Rode MadridDocument16 pagesBSC Met Rode MadridAndres Fernando Cortes JaramilloNo ratings yet

- Human Capital Analytics: Why Aren't We There? Introduction To The Special IssueDocument19 pagesHuman Capital Analytics: Why Aren't We There? Introduction To The Special IssueSaleiha SharifNo ratings yet

- 7 Step Guide For The IaDocument11 pages7 Step Guide For The Iahmurillo-stNo ratings yet

- Strategic Management Sessions 21 - 30Document22 pagesStrategic Management Sessions 21 - 30SHEETAL SINGHNo ratings yet

- Strategic Management PaperDocument15 pagesStrategic Management Paperelagamy_2000No ratings yet

- Handbookfinal BergDocument19 pagesHandbookfinal BergamyouanNo ratings yet

- DisneyDocument2 pagesDisneyKaran NagpalNo ratings yet

- Swot Strategic Planning ToolDocument10 pagesSwot Strategic Planning ToolEdu Rubio MorenoNo ratings yet

- Summary of "Contemporary Strategy"Document12 pagesSummary of "Contemporary Strategy"MostakNo ratings yet

- Scaling Capacities: Supports For Growing Impact: Topic: Expanding Social ImpactDocument20 pagesScaling Capacities: Supports For Growing Impact: Topic: Expanding Social ImpactMahendra A-Gil KusumaNo ratings yet

- Entrepreneurship & StrategyDocument11 pagesEntrepreneurship & StrategyRajan KumarNo ratings yet

- Lecture 3 (17sep13)Document64 pagesLecture 3 (17sep13)Ifzal AhmadNo ratings yet

- U4 Valor Agregado ProspectivaDocument29 pagesU4 Valor Agregado ProspectivaRobert PosliguaNo ratings yet

- Running Head: Strategic Management Analysis Tools 1Document23 pagesRunning Head: Strategic Management Analysis Tools 1Suraj KumarNo ratings yet

- Managing Innovation Chapter 3Document67 pagesManaging Innovation Chapter 3cutadeNo ratings yet

- Week 1 - Lecture PDFDocument14 pagesWeek 1 - Lecture PDFYuan LiNo ratings yet

- Strategic Thinking: Can It Be Taught?: Jeanne M. LiedtkaDocument10 pagesStrategic Thinking: Can It Be Taught?: Jeanne M. LiedtkaMuhammad Imtiyazuddin Mohd KhairuddinNo ratings yet

- Organisation Development-Kotak MahindraDocument88 pagesOrganisation Development-Kotak MahindraDasari Anilkumar0% (1)

- 09 Ch.05 Strategic Governance - Part02Document35 pages09 Ch.05 Strategic Governance - Part02idbtiewNo ratings yet

- 1 Liedka - The Rise of Strategic ThinkingDocument16 pages1 Liedka - The Rise of Strategic ThinkingMichael PuertoNo ratings yet

- Strategic Alignment ThesisDocument7 pagesStrategic Alignment Thesisashleyfishererie100% (1)

- Wuba LemDocument12 pagesWuba LemdanigeletaNo ratings yet

- Strategic Management Literature ReviewDocument8 pagesStrategic Management Literature Reviewafdtrajxq100% (1)

- Creativity, Innovation and DesignDocument7 pagesCreativity, Innovation and DesignDylan HansenNo ratings yet

- Strategy As Evolution With Design: The Foundations of Dynamic Capabilities and The Role of Managers in The Economic SystemDocument22 pagesStrategy As Evolution With Design: The Foundations of Dynamic Capabilities and The Role of Managers in The Economic SystemThiagoNo ratings yet

- Final PaperDocument9 pagesFinal PaperSama TanveerNo ratings yet

- Understandingcreatingsharedvaluep.513 525 ISBN978 9963 711-56-7 ISSN2547 8516Document14 pagesUnderstandingcreatingsharedvaluep.513 525 ISBN978 9963 711-56-7 ISSN2547 8516Bony BonyNo ratings yet

- Strategic InnovationDocument45 pagesStrategic InnovationChristine HermawanNo ratings yet

- Balanced Scorecard: A) Balanced Scorecard B) Balanced Scorecard-The Four Techniques To Be MasteredDocument18 pagesBalanced Scorecard: A) Balanced Scorecard B) Balanced Scorecard-The Four Techniques To Be Masteredillona.chertsey632No ratings yet

- Resource Based View DissertationDocument4 pagesResource Based View DissertationOnlinePaperWritersCanada100% (1)

- Analytical Approach To Develop Strategic Roadmap Guiding Org Dev - Norawat (2018)Document39 pagesAnalytical Approach To Develop Strategic Roadmap Guiding Org Dev - Norawat (2018)Yapp TzeNo ratings yet

- Chapter 2 Strategic ThinkingDocument25 pagesChapter 2 Strategic ThinkingNaimNo ratings yet

- LDR 660 Strategic Thinking Swot PaperDocument8 pagesLDR 660 Strategic Thinking Swot Paperapi-341100125No ratings yet

- Session 6 Leadership in ContextDocument32 pagesSession 6 Leadership in ContextCsec helper1No ratings yet

- Getting to Innovation: How Asking the Right Questions Generates the Great Ideas Your Company NeedsFrom EverandGetting to Innovation: How Asking the Right Questions Generates the Great Ideas Your Company NeedsNo ratings yet

- A BUM's Strategic Planning And Critical Thinking ApproachFrom EverandA BUM's Strategic Planning And Critical Thinking ApproachNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Finance for Strategic Decision-Making: What Non-Financial Managers Need to KnowFrom EverandFinance for Strategic Decision-Making: What Non-Financial Managers Need to KnowNo ratings yet

- Gibber T 2002Document11 pagesGibber T 2002Zulfiqar Ahmed AbbasiNo ratings yet

- Accelerating Time To Impact: Deconstructing Practices To Achieve Project ValueDocument18 pagesAccelerating Time To Impact: Deconstructing Practices To Achieve Project ValueZulfiqar Ahmed AbbasiNo ratings yet

- Leung 2003Document10 pagesLeung 2003Zulfiqar Ahmed AbbasiNo ratings yet

- Understanding The Meaning of PROJECT SUCDocument7 pagesUnderstanding The Meaning of PROJECT SUCZulfiqar Ahmed AbbasiNo ratings yet

- Sciencedirect: The Relationship Between Project Success and Project EfficiencyDocument10 pagesSciencedirect: The Relationship Between Project Success and Project EfficiencyZulfiqar Ahmed AbbasiNo ratings yet

- Governance of Projects: Generating Value by Linking Projects With Their Permanent OrganisationDocument16 pagesGovernance of Projects: Generating Value by Linking Projects With Their Permanent OrganisationZulfiqar Ahmed AbbasiNo ratings yet

- The Co-Evolution of Organizational Value Capture, Value Creation and Sustainable AdvantageDocument48 pagesThe Co-Evolution of Organizational Value Capture, Value Creation and Sustainable AdvantageZulfiqar Ahmed AbbasiNo ratings yet

- Global Virtual Teams For Value Creation and Project Success: A Case StudyDocument12 pagesGlobal Virtual Teams For Value Creation and Project Success: A Case StudyZulfiqar Ahmed AbbasiNo ratings yet

- Taking Stock of Project Value Creation: A Structured Literature Review With Future Directions For Research and PracticeDocument12 pagesTaking Stock of Project Value Creation: A Structured Literature Review With Future Directions For Research and PracticeZulfiqar Ahmed AbbasiNo ratings yet

- Strategic Corporate Social Responsibility and Value CreationDocument19 pagesStrategic Corporate Social Responsibility and Value CreationZulfiqar Ahmed AbbasiNo ratings yet

- Value Creation in Projects: Towards A Narrative Perspective: SciencedirectDocument16 pagesValue Creation in Projects: Towards A Narrative Perspective: SciencedirectZulfiqar Ahmed AbbasiNo ratings yet

- A Value-Oriented View of StrategyDocument35 pagesA Value-Oriented View of StrategyZulfiqar Ahmed AbbasiNo ratings yet

- Editorial - Delivery of Value - SubmittedDocument8 pagesEditorial - Delivery of Value - SubmittedZulfiqar Ahmed AbbasiNo ratings yet

- Value Management: A Systematic Approach For Improving Time Performance in Construction ProjectsDocument6 pagesValue Management: A Systematic Approach For Improving Time Performance in Construction ProjectsZulfiqar Ahmed AbbasiNo ratings yet

- Job Shop Scheduling SecretDocument9 pagesJob Shop Scheduling SecretVladislav Velikov100% (1)

- Chapter9 OutlineDocument3 pagesChapter9 OutlineMajesty AlfaroNo ratings yet

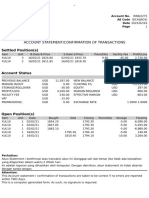

- Account Statement/Confirmation of Transactions: Settled Position(s)Document1 pageAccount Statement/Confirmation of Transactions: Settled Position(s)mohammad qadafiNo ratings yet

- PIM MirzapurDocument6 pagesPIM Mirzapurbaali4No ratings yet

- 7 Principles of Creative Problem SolvingDocument2 pages7 Principles of Creative Problem SolvingDinh TranNo ratings yet

- Cover Letter To IrebDocument6 pagesCover Letter To IrebresearchingNo ratings yet

- Hiru Solar IMSMDocument29 pagesHiru Solar IMSMnil thaeuNo ratings yet

- SEC-Cover - Sheet-for-AFSDocument13 pagesSEC-Cover - Sheet-for-AFSArlene FelicianoNo ratings yet

- Cisco - EMC Migrating To Cisco UCSDocument4 pagesCisco - EMC Migrating To Cisco UCSRoshan KarnaNo ratings yet

- Introduction To Social MediaDocument8 pagesIntroduction To Social MediamaryNo ratings yet

- Business Ethics (PDFDrive - Com) - Trang-4Document1 pageBusiness Ethics (PDFDrive - Com) - Trang-4leethyz1206No ratings yet

- CVWaqquas AkhtarDocument4 pagesCVWaqquas AkhtarAliya HussainNo ratings yet

- 3a - A3 - BMC - Guidelines & TemplateDocument6 pages3a - A3 - BMC - Guidelines & TemplateDoshNo ratings yet

- Bid Evaluation Report - 23H00003Document3 pagesBid Evaluation Report - 23H00003Irish Jane MagnoNo ratings yet

- Resume - Malak Al Abri - Version#6Document4 pagesResume - Malak Al Abri - Version#6malakalabri98No ratings yet

- Soal PAS Bahasa Inggris Kelas XII Semester 1Document4 pagesSoal PAS Bahasa Inggris Kelas XII Semester 1Asepto PamaleloNo ratings yet

- 1870 (EC-7) Spencer v. Harding - Elements of Offer and AcceptanceDocument1 page1870 (EC-7) Spencer v. Harding - Elements of Offer and AcceptanceMehreen Akmal100% (1)

- Marketing Proj Moov FinalDocument26 pagesMarketing Proj Moov FinalAbhi Modak33% (9)

- Accounting Information Systems, 10th Edition: James A. HallDocument35 pagesAccounting Information Systems, 10th Edition: James A. HallAlexis Kaye DayagNo ratings yet

- Zara Literature ReviewDocument8 pagesZara Literature Reviewcmaqqsrif100% (1)

- CSE 405N System Analysis and DesignDocument19 pagesCSE 405N System Analysis and DesignAsfikRahmanNo ratings yet

- Questions: Strong Cloud GovernanceDocument4 pagesQuestions: Strong Cloud GovernanceBrayanNo ratings yet

- Unit 5 Theory QuestionsDocument10 pagesUnit 5 Theory QuestionsFiras AhmadNo ratings yet

- Logitech Wireless Mouse m210 DriverDocument4 pagesLogitech Wireless Mouse m210 DriverKlmcc Klmcc KlmccNo ratings yet

- National CyberDocument40 pagesNational CyberralikdgpNo ratings yet

- Addendum To Services AgreementDocument6 pagesAddendum To Services AgreementRODOLFO MARTINEZNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)