Professional Documents

Culture Documents

Comparison of COMPANY PAR - FUND

Comparison of COMPANY PAR - FUND

Uploaded by

Phebe Minghui YeoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison of COMPANY PAR - FUND

Comparison of COMPANY PAR - FUND

Uploaded by

Phebe Minghui YeoCopyright:

Available Formats

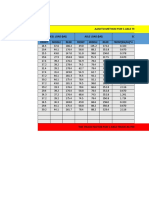

Who's who in the top quartile

Geometric average net investment returns of par funds TOP QUARTILE

LIFE 12-YR AVG 11-YR AVG 10-YR AVG 9-YR AVG 8-YR AVG 7-YR AVG 6-YR AVG 5-YR AVG 4-YR AVG 3-YR AVG 2-YR AVG 1 YEAR NO OF

INSURER (2006-17) (2007-17) (2008-17) (2009-17) (2010-17) (2011-17) (2012-17) (2013-17) (2014-17) (2015-17) (2016-17) 2017 TOP

(%) QUARTILES

AIA 4.78 4.65 4.52 6.44 5.57 5.36 5.74 4.93 6.02 5.54 7.57 9.59 10

Aviva 4.51 4.04 3.66 5.26 4.46 4.24 4.83 3.76 4.60 4.57 7.10 10.04 1

Axa Life 3.80 3.41 3.18 4.29 4.42 4.44 4.54 3.49 5.21 4.24 7.42 9.82 1

GE Life 4.48 4.21 3.67 5.35 4.97 4.80 5.38 4.67 5.00 4.48 5.73 7.99 3

HSBC Insurance 3.72 3.57 3.52 3.72 4.06 3.94 4.08 3.63 4.51 3.97 5.81 7.59 0

Manulife 5.40 4.55 3.97 5.49 4.20 3.76 4.55 3.40 4.50 4.31 7.83 11.50 5

NTUC Income 4.72 4.22 3.62 5.38 4.55 4.36 5.22 4.56 5.16 5.06 6.73 9.03 1

Prudential 5.13 4.50 4.11 7.24 5.53 5.38 6.20 5.50 5.77 5.93 8.97 9.99 11

Tokio Marine LIfe 5.34 4.49 3.76 6.35 4.78 4.52 5.42 4.43 4.96 4.48 6.88 10.38 4

Group average 4.65 4.18 3.78 5.50 4.73 4.53 5.11 4.26 5.08 4.73 7.12 9.55 4.00

Note: Net investment return = (investment revenue - investment expenses) / [[ Total assets (boy) + total assets (eoy) - (investment revenue - investment expenses] /2]

Source: Compiled by Wen Research

You might also like

- Assignment 7.2 Chocolat Cordon Rouge SolutionDocument20 pagesAssignment 7.2 Chocolat Cordon Rouge Solutionspotify2018 gmNo ratings yet

- Mostrade Compliance Information SheetDocument13 pagesMostrade Compliance Information SheetFRANCISCORAFAELPARRA5738No ratings yet

- CPPDSM4006A Establish and Manage Agency Trust Accounts Written AssessmentDocument10 pagesCPPDSM4006A Establish and Manage Agency Trust Accounts Written AssessmentYasir Abdul Karim suriyaNo ratings yet

- Chapter 4 Report Problems 1 4Document8 pagesChapter 4 Report Problems 1 4Nyster Ann Rebenito100% (1)

- Introduction To Risk Management and Insurance 10th Edition Dorfman Test BankDocument11 pagesIntroduction To Risk Management and Insurance 10th Edition Dorfman Test Bankbrittanywilliamsonxpmzdnebgt100% (33)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- Serrano Legal Services Exercise ProblemDocument5 pagesSerrano Legal Services Exercise Problemshanane loteria100% (2)

- Table A.12 Studentized Range Distribution Upper Percentage Points - Values of Q (0.05 K, V)Document1 pageTable A.12 Studentized Range Distribution Upper Percentage Points - Values of Q (0.05 K, V)Chris CahillNo ratings yet

- Deformasi PavementDocument24 pagesDeformasi PavementRaja EngineerNo ratings yet

- Global Competitiveness Index 2013 No Pillar Country Australia Brunei Cambodia China IndiaDocument9 pagesGlobal Competitiveness Index 2013 No Pillar Country Australia Brunei Cambodia China IndiawindiantyshaNo ratings yet

- Designing Control ChartDocument1 pageDesigning Control ChartBwalya ChibutaNo ratings yet

- Control Chart DataDocument16 pagesControl Chart Datavu tuan anhNo ratings yet

- International Postnatal Growth Standards 21Document32 pagesInternational Postnatal Growth Standards 21Nancy LealNo ratings yet

- Summary Table For Metabolic Calculations For Treadmill ExerciseDocument1 pageSummary Table For Metabolic Calculations For Treadmill ExercisePhuong le DinhNo ratings yet

- Plate Load Test: Sr. No. Dial Gauge D1 Dial Gauge D2 Dial Gauge D3 Dial Gauge D4 Avg Dial GaugeDocument4 pagesPlate Load Test: Sr. No. Dial Gauge D1 Dial Gauge D2 Dial Gauge D3 Dial Gauge D4 Avg Dial GaugeDeepak100% (1)

- Clase ConfiabilidadDocument22 pagesClase Confiabilidadandrea pertuzNo ratings yet

- Annuity TableDocument1 pageAnnuity TableDivvya DarshiniNo ratings yet

- Ipn-Esia-Tecamachalco 1 de 1: Ing. Arq. Adolfo Barranco VargasDocument1 pageIpn-Esia-Tecamachalco 1 de 1: Ing. Arq. Adolfo Barranco VargasIvaan ContrerasNo ratings yet

- Best Performer of January, 2024Document5 pagesBest Performer of January, 2024mohammeddubale06No ratings yet

- Lampiran 1Document23 pagesLampiran 1tegar ilhamNo ratings yet

- Name: Reyes, Agnes O. Section: BSF 3-2 Activity 4: Length-Weight Relationship and Condition FactorDocument2 pagesName: Reyes, Agnes O. Section: BSF 3-2 Activity 4: Length-Weight Relationship and Condition Factordiana valdezNo ratings yet

- Wheel Load (KN) Axle Load (KN) Equivalency Factor Front Middle Rear Front Middle Rear FRONT (kN/65) 4Document10 pagesWheel Load (KN) Axle Load (KN) Equivalency Factor Front Middle Rear Front Middle Rear FRONT (kN/65) 4jhonnyNo ratings yet

- Stat ReportDocument4 pagesStat ReportJawaria GillNo ratings yet

- Case StudyDocument5 pagesCase StudybadshaahhamanNo ratings yet

- Raw Data Activity 1 StatisticDocument43 pagesRaw Data Activity 1 StatisticFelicity de GuzmanNo ratings yet

- Mall Monitoring Tool Joint 02-02-24Document12 pagesMall Monitoring Tool Joint 02-02-24srbce.servicesNo ratings yet

- Stansa OutputDocument2 pagesStansa OutputJenniveve ocenaNo ratings yet

- 5T 30faf28eDocument2 pages5T 30faf28eManjot KohliNo ratings yet

- CometgearchartDocument1 pageCometgearchartAnonymous RbxuQvkNo ratings yet

- Filozofski Fakultet Novi Sad Preliminarna Lista 2018 PedagogijaDocument4 pagesFilozofski Fakultet Novi Sad Preliminarna Lista 2018 PedagogijaIgor IlićNo ratings yet

- AlldataDocument5 pagesAlldataAyush SharmaNo ratings yet

- Cuadro de Amortizacion de Un Leasing FinancieroDocument4 pagesCuadro de Amortizacion de Un Leasing FinancieroRoberto Renato Castro VergaraNo ratings yet

- Univariate Analysis of Variance: NotesDocument23 pagesUnivariate Analysis of Variance: NotesHizkia SebayangNo ratings yet

- Table B.5-The Studentized Range Statistic (Q) The Critical Values For Q Corresponding To Alpha .05 (Top) and Alpha .01 (Bottom)Document2 pagesTable B.5-The Studentized Range Statistic (Q) The Critical Values For Q Corresponding To Alpha .05 (Top) and Alpha .01 (Bottom)Nareswara TitisNo ratings yet

- Parcial1 Parcial2: Notaparciales Final ActividadesDocument2 pagesParcial1 Parcial2: Notaparciales Final ActividadesAndres DominguezNo ratings yet

- Brewed Beverage Alcohol ChartDocument1 pageBrewed Beverage Alcohol ChartJohnRykerNo ratings yet

- Walt DisneyDocument40 pagesWalt DisneyRahil VermaNo ratings yet

- Convertible Whole Life Assurance PlanDocument8 pagesConvertible Whole Life Assurance PlanNaveenNo ratings yet

- Tabla 8: Cuantiles de La Distribuci On de Tukey Q (N, M)Document4 pagesTabla 8: Cuantiles de La Distribuci On de Tukey Q (N, M)Pedroza Mendiola K exul YumtsilNo ratings yet

- Distribution of Cholesterol Level in A Healthy Malaysian Population (Mmol/l)Document3 pagesDistribution of Cholesterol Level in A Healthy Malaysian Population (Mmol/l)gan0No ratings yet

- SAS Computer BerhadDocument13 pagesSAS Computer BerhadizzieNo ratings yet

- Market Repositionning CorrectionDocument10 pagesMarket Repositionning CorrectionHaiLin WangNo ratings yet

- Sección 1 - HPE 2021-10Document6 pagesSección 1 - HPE 2021-10Juan Sebastian Peña DelgadoNo ratings yet

- Time Drop Off ChartDocument4 pagesTime Drop Off ChartAmogh PanditNo ratings yet

- Ipl Monitoring MallDocument16 pagesIpl Monitoring Mallsrbce.servicesNo ratings yet

- Nilai-Nilai Untuk Distribusi F Baris Atas Untuk 5% Baris Bawah Untuk 1%Document3 pagesNilai-Nilai Untuk Distribusi F Baris Atas Untuk 5% Baris Bawah Untuk 1%Anonymous mcBbb9bAiUNo ratings yet

- Putting SpeedsDocument452 pagesPutting SpeedsNaqi AbbasNo ratings yet

- NOMINAL PIPE SIZE CHART - Nominal Pipe DimensionDocument1 pageNOMINAL PIPE SIZE CHART - Nominal Pipe DimensionHager ElsasserNo ratings yet

- Pure Equity Fact SheetDocument3 pagesPure Equity Fact Sheetbhavinsavalia1808No ratings yet

- HY Vs IG DurationDocument1 pageHY Vs IG DurationCreditTraderNo ratings yet

- Tabla Dunnet Fmax RangosDocument7 pagesTabla Dunnet Fmax Rangosm36610232No ratings yet

- GLOBE Phase 2 Aggregated Societal Culture DataDocument58 pagesGLOBE Phase 2 Aggregated Societal Culture DataVaibhav BahlNo ratings yet

- WRC Data-ModifiedDocument40 pagesWRC Data-ModifiedGovindan KrishnamoorthybashyamNo ratings yet

- CanadaDocument10 pagesCanadaSheldon D'souzaNo ratings yet

- Lampiran 3 Distribusi FrekwensiDocument14 pagesLampiran 3 Distribusi FrekwensithityasfaNo ratings yet

- UntitledDocument4 pagesUntitledXiaolin SuNo ratings yet

- Shyamlal CaseDocument7 pagesShyamlal CaseDhagash SanghaviNo ratings yet

- Sección 1 - HPE 2021-10Document6 pagesSección 1 - HPE 2021-10Juan Sebastian Peña DelgadoNo ratings yet

- Alejandre Cruz Giovanny Act 5Document3 pagesAlejandre Cruz Giovanny Act 5gatobeso28No ratings yet

- Solution 1 CDocument3 pagesSolution 1 CMohammadNo ratings yet

- Statistics: (C) Calculate The Frequency Distribution and A Relative Frequency Distribution For The Age of WorkersDocument3 pagesStatistics: (C) Calculate The Frequency Distribution and A Relative Frequency Distribution For The Age of WorkersMohammadNo ratings yet

- Statistics: (C) Calculate The Frequency Distribution and A Relative Frequency Distribution For The Age of WorkersDocument3 pagesStatistics: (C) Calculate The Frequency Distribution and A Relative Frequency Distribution For The Age of WorkersMohammadNo ratings yet

- IncomeDocument20 pagesIncomeJane Imperial LitcherNo ratings yet

- (LINA) Assignment Data AnalysisDocument8 pages(LINA) Assignment Data AnalysislynaAPPLESNo ratings yet

- Appendix 1. Statistical ResultsDocument17 pagesAppendix 1. Statistical ResultsMark Nel VenusNo ratings yet

- Make Your Own Perfume FLYERDocument1 pageMake Your Own Perfume FLYERPhebe Minghui YeoNo ratings yet

- Make Your Own Perfume FLYERDocument1 pageMake Your Own Perfume FLYERPhebe Minghui YeoNo ratings yet

- 6 Steps For Women To Take Charge of Their FinancesDocument26 pages6 Steps For Women To Take Charge of Their FinancesPhebe Minghui YeoNo ratings yet

- Cute Paper Dolls Printable Free For KidsDocument16 pagesCute Paper Dolls Printable Free For KidsPhebe Minghui YeoNo ratings yet

- White and Gold Inspirational Quote Instagram PostDocument1 pageWhite and Gold Inspirational Quote Instagram PostPhebe Minghui YeoNo ratings yet

- Interview With A Covid Survivor: CC: Phebe YeoDocument1 pageInterview With A Covid Survivor: CC: Phebe YeoPhebe Minghui YeoNo ratings yet

- 6 Dec WorshipDocument2 pages6 Dec WorshipPhebe Minghui YeoNo ratings yet

- EOP Completion CertificationDocument1 pageEOP Completion CertificationPhebe Minghui YeoNo ratings yet

- To The Fullest.: Do LifeDocument3 pagesTo The Fullest.: Do LifePhebe Minghui YeoNo ratings yet

- TheMinstrel SongDocument1 pageTheMinstrel SongPhebe Minghui YeoNo ratings yet

- Chapter 01 TestbankDocument24 pagesChapter 01 Testbank张思雨No ratings yet

- AccountStatement HRFDocument14 pagesAccountStatement HRFshikhil665No ratings yet

- Fidelityvs Surety BondsDocument4 pagesFidelityvs Surety BondsBelteshazzarL.CabacangNo ratings yet

- Vijay El MbfsDocument2 pagesVijay El MbfsPraveen KumarNo ratings yet

- ViewSoa PDFDocument6 pagesViewSoa PDFIan DelesNo ratings yet

- Loans Notes and ExamplesDocument7 pagesLoans Notes and ExamplesJennifer PitterleNo ratings yet

- Be Forward Co., LTD.: BK172593 CHASSIS NO.: GP5-4009735Document1 pageBe Forward Co., LTD.: BK172593 CHASSIS NO.: GP5-4009735Sakarombe Ngonidzashe OwenNo ratings yet

- Motilal Discovery - Investment Idea: Varun BeveragesDocument5 pagesMotilal Discovery - Investment Idea: Varun Beveragesvikalp123123No ratings yet

- Banking Products and Operations - Unit 4Document57 pagesBanking Products and Operations - Unit 4Vaidyanathan RavichandranNo ratings yet

- Ae112 Lecture 1Document3 pagesAe112 Lecture 1eveNo ratings yet

- Cambridge O Level: Accounting 7707/11Document12 pagesCambridge O Level: Accounting 7707/11Jack KowmanNo ratings yet

- Domestic Markets & Monetary Management Department: ProvisionalDocument1 pageDomestic Markets & Monetary Management Department: ProvisionalIrfan KhanNo ratings yet

- Fiverr ProjectDocument12 pagesFiverr ProjectAryan ZiaNo ratings yet

- PDF SYBCom - F Div - Paper AFM IIIDocument16 pagesPDF SYBCom - F Div - Paper AFM IIIPushkar DereNo ratings yet

- 3 ZXM 4 DV1 P XTGGK 4 X816Document61 pages3 ZXM 4 DV1 P XTGGK 4 X816Sushant AnandNo ratings yet

- Leverage QuestionsDocument8 pagesLeverage QuestionsMidhun George VargheseNo ratings yet

- IRFC StockReport 20240214 1118Document12 pagesIRFC StockReport 20240214 1118Sashibhusan NayakNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- MQC00190DDocument5 pagesMQC00190DGaneshkumar AmbedkarNo ratings yet

- Bfi Questions FinalDocument4 pagesBfi Questions FinalChristian RellonNo ratings yet

- Chapter 08 - Use of BCBF Under Financial InclusionDocument7 pagesChapter 08 - Use of BCBF Under Financial Inclusionshubhram2014No ratings yet

- OCM 12 STD PaperDocument2 pagesOCM 12 STD PaperNafisa ShaikhNo ratings yet