Professional Documents

Culture Documents

Solution Case 1

Solution Case 1

Uploaded by

Ario LintangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution Case 1

Solution Case 1

Uploaded by

Ario LintangCopyright:

Available Formats

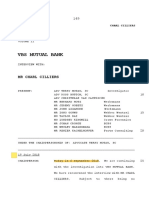

Solution Case 1

(a) Component Depreciation Expense

Building structure €5,400,000 ÷ 60 = € 90,000

Building engineering 2,400,000 ÷ 30 = 80,000

Building external works 900,000 ÷ 30 = 30,000

€200,000

(b) Building Engineering........................................ 2,600,000

Accumulated Depreciation

(€2,400,000 X 20/30)....................................... 1,600,000

Loss on Disposal of Plant Assets.................... 800,000

Building Engineering............................. 2,400,000

Cash...................................................... 2,600,000

Solution Case 2

(a) December 31, 2015

Loss on Impairment.......................................... 500,000

Accumulated Depreciation––Equipment..... 500,000

Cost.......................................... €7,000,000

Accumulated Depreciation....... (1,500,000)

Carrying amount...................... 5,500,000

Fair value less cost of disposal (5,000,000)

Loss on impairment.................. € 500,000

(b) December 31, 2016

Depreciation Expense.......................................... 1,250,000

Accumulated Depreciation––Equipment........ 1,250,000

New carrying amount.................. €5,000,000

Useful life.................................... ÷ 4 years

Depreciation per year................. €1,250,000

(c) Accumulated Depreciation––Equipment.............. 1,500,000

Recovery of Impairment Loss......................... 1500,000

Solution Case 3

(a) January 1, 2014

Equipment........................................................................ 60,000

Cash........................................................................... 60,000

December 31, 2014

Depreciation Expense....................................................... 10,000

Accumulated Depreciation––Equipment..................... 10,000

(b) December 31, 2015

Depreciation Expense........................................................ 10,000

Accumulated Depreciation––Equipment...................... 10,000

Accumulated Depreciation––Equipment............................. 20,000

Loss on Impairment............................................................. 5,000

Equipment (€60,000 – €35,000).................................... 25,000

(c) Depreciation expense––2016: (€60,000 – €25,000) ÷ 4 = €8,750

Solution Case 4

(a) Sum-of-the-Years'-Digits 2014 2015

Accumulated Depreciation $ 345,000 $ 966,000

Book Value 1,815,000 1,194,000

Depreciation Expense 345,000 621,000

Double-Declining Balance

Accumulated Depreciation $ 432,000 $1,123,200

Book Value 1,728,000 1,036,800

Depreciation Expense 432,000 691,200

(b) Cost $2,160,000

Depreciation (621,000)

Residual (120,000)

$1,419,000 × 1/2 = $709,500, 2016 depreciation

You might also like

- Name: Ahmed Idris Abaker K Customer No: 2812095 Account Type: Saving Account Currency: SDG Issue Date: 19-03-2023Document17 pagesName: Ahmed Idris Abaker K Customer No: 2812095 Account Type: Saving Account Currency: SDG Issue Date: 19-03-2023Ahmed EdrisNo ratings yet

- Your Automatic Payments Schedule: PO Box 3199 Winston Salem, NC 27102-3199Document4 pagesYour Automatic Payments Schedule: PO Box 3199 Winston Salem, NC 27102-3199Yenny VidalNo ratings yet

- Theoretical Foundations of Corporate FinanceFrom EverandTheoretical Foundations of Corporate FinanceRating: 5 out of 5 stars5/5 (1)

- Banking DictionaryDocument188 pagesBanking DictionaryRanjan Shetty100% (1)

- Jawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500Document2 pagesJawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500Anisa Siti WahyuniNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Chapter 22 Tutorial SolutionsDocument12 pagesChapter 22 Tutorial SolutionsShareceNo ratings yet

- PR Week 10Document8 pagesPR Week 10Rifda AmaliaNo ratings yet

- CH9 SolutionsDocument11 pagesCH9 SolutionsGhadeer MohammedNo ratings yet

- Depn Ch11IDocument3 pagesDepn Ch11Isamia.aliNo ratings yet

- (15-16) Solution For Chapter 9Document9 pages(15-16) Solution For Chapter 9poisonlresourcesNo ratings yet

- Assigment Principle of Accounting 2 Natural ResourceDocument10 pagesAssigment Principle of Accounting 2 Natural ResourceKasihNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- Brief Exercises Chapter 10 - SolutionsDocument5 pagesBrief Exercises Chapter 10 - Solutionssarahthai0705No ratings yet

- Model Solution: Solution To The Question No. 1 (B) Required (I)Document4 pagesModel Solution: Solution To The Question No. 1 (B) Required (I)HossainNo ratings yet

- FR222. IFA IL I Solution CMA January 2022 ExaminationDocument8 pagesFR222. IFA IL I Solution CMA January 2022 Examinationtdebnath_3No ratings yet

- Statement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEDocument12 pagesStatement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEJamie Rose AragonesNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- Bài tập C5Document16 pagesBài tập C5Khanh LêNo ratings yet

- 0 - AE 17 ProblemsDocument3 pages0 - AE 17 ProblemsMajoy BantocNo ratings yet

- Homework Lec4Document9 pagesHomework Lec4Tran Do QuynNo ratings yet

- Chapter 9 Assigned Question SOLUTIONSDocument31 pagesChapter 9 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- Solution To P23.5 and P24.1Document5 pagesSolution To P23.5 and P24.1Fiyo DarmawanNo ratings yet

- CH 12Document8 pagesCH 12Sree Mathi SuntheriNo ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument5 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aYamateNo ratings yet

- (IFA 13) - Rendy Filiang - 1402210324Document10 pages(IFA 13) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- BE Chap 10Document4 pagesBE Chap 10TIÊN NGUYỄN LÊ MỸNo ratings yet

- (W4) ANS - PPE Subsequent MeasurementDocument3 pages(W4) ANS - PPE Subsequent MeasurementMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- Process Costing Test Bank SOLUTION PDFDocument7 pagesProcess Costing Test Bank SOLUTION PDFAshNor RandyNo ratings yet

- Fix Asset Intangible AssetDocument7 pagesFix Asset Intangible AssetMichelleNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (15)

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (34)

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- Pup-Ppe5-Src 2-1Document15 pagesPup-Ppe5-Src 2-1Jerome BaluseroNo ratings yet

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Practice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalDocument2 pagesPractice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalKaren Joyce SinsayNo ratings yet

- Worksheet 4Document6 pagesWorksheet 4Sneha KumariNo ratings yet

- Financial Accounting Solution ch14Document23 pagesFinancial Accounting Solution ch14hw cNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Practice Exam Chapters 1-5 (1) Solutions: Problem IDocument5 pagesPractice Exam Chapters 1-5 (1) Solutions: Problem IAtif RehmanNo ratings yet

- Latihan Soal Week 8Document6 pagesLatihan Soal Week 8Natasya Prashta WidyadhariNo ratings yet

- Tutorial 01 - SolutionsDocument4 pagesTutorial 01 - Solutionsraygains23No ratings yet

- 2009-12-06 064119 StarkeyDocument5 pages2009-12-06 064119 StarkeyAnne KatNo ratings yet

- Chapter 1 2 SolutionsDocument10 pagesChapter 1 2 SolutionsShiv AchariNo ratings yet

- Chapter 9-1Document5 pagesChapter 9-1jou20220354No ratings yet

- Akuntansi Keuangan 1: Depreciation, Impairment and DepletionDocument11 pagesAkuntansi Keuangan 1: Depreciation, Impairment and DepletionHamka RivaiNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1Document7 pagesFIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1AdindaNo ratings yet

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- Tugas Kelompok Ke-3 Week 8: Flexible BudgetDocument4 pagesTugas Kelompok Ke-3 Week 8: Flexible BudgetArkan HafidzNo ratings yet

- AF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Document12 pagesAF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Shadow IpNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- Model Solution: Solution To The Question No. 1Document9 pagesModel Solution: Solution To The Question No. 1HossainNo ratings yet

- Questions Chapter 1 (Continued) : Weygandt, Accounting Principles, 12/e, Solutions Manual (For Instructor Use Only)Document2 pagesQuestions Chapter 1 (Continued) : Weygandt, Accounting Principles, 12/e, Solutions Manual (For Instructor Use Only)xanax_1984No ratings yet

- Weygandt Acctg Princ 9eDocument4 pagesWeygandt Acctg Princ 9e劉亮宏No ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Practice Exam Chapters 1-4 Solutions: Problem IDocument6 pagesPractice Exam Chapters 1-4 Solutions: Problem IJesse NgaliNo ratings yet

- Commerce: Research Paper Significance of The Indian Gold Loan MarketDocument2 pagesCommerce: Research Paper Significance of The Indian Gold Loan Marketjaymin2303No ratings yet

- AP - Personnel ServicesDocument5 pagesAP - Personnel ServicesTessieBCNo ratings yet

- Module 1 Financial Analysis and Reporting FM2Document10 pagesModule 1 Financial Analysis and Reporting FM2Christine Joy BieraNo ratings yet

- Transcription - Charl Cilliers (06.09.18)Document86 pagesTranscription - Charl Cilliers (06.09.18)Leila DouganNo ratings yet

- Statement 2022 9Document5 pagesStatement 2022 9wconceptouNo ratings yet

- WSS 9 Case Studies Blended FinanceDocument36 pagesWSS 9 Case Studies Blended FinanceAbdullahi Mohamed HusseinNo ratings yet

- Cash Flow StatementsDocument15 pagesCash Flow StatementsMaryjoy CuyosNo ratings yet

- SBR Examdoc S22-23Document6 pagesSBR Examdoc S22-23ndifrekeNo ratings yet

- FULL REPORT - Audit of Polk County, Tennessee For FY22Document229 pagesFULL REPORT - Audit of Polk County, Tennessee For FY22Dan Lehr100% (1)

- Frauds and Misuse of Plastic Cards: By-Anas KhatriDocument11 pagesFrauds and Misuse of Plastic Cards: By-Anas KhatriYash MuftiNo ratings yet

- Dr. Marasigan Journal EntriesDocument1 pageDr. Marasigan Journal EntriesNeilan Jay FloresNo ratings yet

- The Construction Industry Is Divided Into Two SectorsDocument12 pagesThe Construction Industry Is Divided Into Two SectorsJoseph FranciscoNo ratings yet

- Income Statement and Statement of Financial Position: Slide 4-1Document34 pagesIncome Statement and Statement of Financial Position: Slide 4-1Bich VietNo ratings yet

- Law Relating To Banking May 2015Document5 pagesLaw Relating To Banking May 2015Basilio MaliwangaNo ratings yet

- FM Updated Question Pack - FinalDocument46 pagesFM Updated Question Pack - FinalmuparuritNo ratings yet

- Account Statement 020222 010822Document143 pagesAccount Statement 020222 010822KumarNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- OpTransactionHistoryUX320 12 2023Document41 pagesOpTransactionHistoryUX320 12 2023Jamnas JamaludheenNo ratings yet

- India Non Judicial: Hundred RupeesDocument22 pagesIndia Non Judicial: Hundred RupeesParthasarathy SarathyNo ratings yet

- Rumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55Document2 pagesRumah Sakit Dr. Oen Kandang Sapi Solo: Surakarta 57128 Jl. Brigjend Katamso No.55yulius agus lingga pratomoNo ratings yet

- Acc 101 Financial Accounting and Reporting 1Document16 pagesAcc 101 Financial Accounting and Reporting 1cybell carandangNo ratings yet

- Rs-Cfa: Tally Accounting NotesDocument8 pagesRs-Cfa: Tally Accounting NotesJakir HusainNo ratings yet

- Invest On Memorial PlansDocument3 pagesInvest On Memorial Plansjeepneyko100% (1)

- SFM Formula BookDocument29 pagesSFM Formula BookAstikNo ratings yet

- RocketpreepayDocument5 pagesRocketpreepayMizanur RahmanNo ratings yet

- Fundamentals of Accountancy Las 3 4Document10 pagesFundamentals of Accountancy Las 3 4Mayjustine DacilloNo ratings yet

- Chapter 11 The Banking System and The Money Supply: Review QuestionsDocument5 pagesChapter 11 The Banking System and The Money Supply: Review QuestionsRo NaNo ratings yet