Professional Documents

Culture Documents

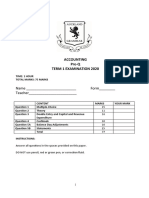

Accounting Notes

Accounting Notes

Uploaded by

Rafael Marco ManubayCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Creative Writing ExemplarDocument1 pageCreative Writing ExemplarRafael Marco ManubayNo ratings yet

- Once by The Pacific Analysis by MeDocument1 pageOnce by The Pacific Analysis by MeRafael Marco ManubayNo ratings yet

- Pre-Q Term 1 School Exam 2020Document14 pagesPre-Q Term 1 School Exam 2020Rafael Marco ManubayNo ratings yet

- 5 Physics Light Test Name: For The Multiple Choice Questions CIRCLE The Letter of The BEST Answer 1Document11 pages5 Physics Light Test Name: For The Multiple Choice Questions CIRCLE The Letter of The BEST Answer 1Rafael Marco ManubayNo ratings yet

- No. 4-37 Page 146Document6 pagesNo. 4-37 Page 146Nemalai VitalNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Unit-I Supply Chain Management: Dr.P.Nivetha Assistant Professor Department of Management StudiesDocument34 pagesUnit-I Supply Chain Management: Dr.P.Nivetha Assistant Professor Department of Management Studiesshahina begumNo ratings yet

- Lifelines of National EconomyDocument6 pagesLifelines of National EconomyjeffreyNo ratings yet

- GST 121 Indigenous Trade and Economic Development of NigeriaDocument12 pagesGST 121 Indigenous Trade and Economic Development of Nigeriajamesamelia3435No ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- Ritesh Agarwal - WikipediaDocument30 pagesRitesh Agarwal - Wikipediapproject345No ratings yet

- W11 Module 9-Aggregate and Operations SchedulingDocument11 pagesW11 Module 9-Aggregate and Operations SchedulingDanica VetuzNo ratings yet

- CHP 6 Eko 2Document10 pagesCHP 6 Eko 2Golden Ting Chiong SiiNo ratings yet

- TorrentDocument8 pagesTorrentkaranbarmecha90No ratings yet

- John Njenga GathuraDocument2 pagesJohn Njenga GathuraJohn NjengaNo ratings yet

- Simple Agreement For Future Tokens - What Are TheyDocument7 pagesSimple Agreement For Future Tokens - What Are TheyellirafaeladvNo ratings yet

- Apr Final RecoDocument252 pagesApr Final RecoVivek PatilNo ratings yet

- Operations Management MCQs - Types of Production - MCQs ClubDocument7 pagesOperations Management MCQs - Types of Production - MCQs ClubPranoy SarkarNo ratings yet

- Introduction To Capital BudgetingDocument20 pagesIntroduction To Capital BudgetingMary R. R. PanesNo ratings yet

- Toothpaste Industry in IndiaDocument30 pagesToothpaste Industry in IndiaNaureen ShabnamNo ratings yet

- Efisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten JemberDocument12 pagesEfisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten Jemberashadi asriNo ratings yet

- IRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationDocument6 pagesIRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationVinay KalraNo ratings yet

- Evaluation of Change in Credit PolicyDocument5 pagesEvaluation of Change in Credit PolicyJhunorlando DisonoNo ratings yet

- Data Tiket Dan Hotel Share H-1Document4 pagesData Tiket Dan Hotel Share H-1Ahmad NursalimNo ratings yet

- WhichDocument17 pagesWhichanhtran.31231021988No ratings yet

- Book A Flight Southwest Airlines YupDocument1 pageBook A Flight Southwest Airlines YupDerek CostanzoNo ratings yet

- Serghei Merjan CVDocument11 pagesSerghei Merjan CVUNIMEDIANo ratings yet

- Municipal Council of Iloilo v. EvangelistaDocument4 pagesMunicipal Council of Iloilo v. EvangelistaJune Vincent Ferrer IIINo ratings yet

- Midterm PresentationDocument88 pagesMidterm PresentationRowell Ian Gana-anNo ratings yet

- Pricing Strategies: Marketing Starter: Chapter 11Document28 pagesPricing Strategies: Marketing Starter: Chapter 11muazNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- HinoDocument14 pagesHinoOmerSyedNo ratings yet

- Cash Flow Statement Example1Document3 pagesCash Flow Statement Example1ScribdJrNo ratings yet

- BAM 101 Introduction To Business Administration (Shakshi Shakshi)Document10 pagesBAM 101 Introduction To Business Administration (Shakshi Shakshi)shakshiNo ratings yet

Accounting Notes

Accounting Notes

Uploaded by

Rafael Marco ManubayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Notes

Accounting Notes

Uploaded by

Rafael Marco ManubayCopyright:

Available Formats

Main Concepts

Balance 1 Balance 2

b/d b/d

Accruals Concept - Profit is the difference

between revenues earned and the expenses Bank 3 Income ??????

incurred generating those revenues. Statement ?

Matching Concept - Only expenses and revenues

6

which relate to the current accounting period

should be matched against each other to Balance 4 Balance 5

calculate profit. c/d c/d

1 - Prepayment made at the end of last year

1. Accrued expenses / other payables 2 - Accrued expense at the end of last year

This is when we still owe money and should have 3 - The amount paid this year for the expense

paid during the financial year when the 4 - Accrued expense at the end of this year

transaction occurred. 5 - Prepayment made at the end of this year

The amount owing is added / debited to the 6 - the amount we need to find

expense.

The amount owing is a current liability.

Revenue ledger could look like this:

2. Prepayments / other receivables

This is when we have prepaid for the next

financial year. Balance 1 Balance 2

b/d b/d

The amount prepaid is subtracted / credited to the

expense. Income 6 bank 3

The amount prepaid is a current asset. statement ????????

3. Accrued revenue / other receivables Balance 4 Balance 5

c/d c/d

This is when we earned money but we still have

not received it yet.

The amount owing to us for the revenue earned 1 - Accrued income at the end of last year

must be added / credited to the revenue. 2 - Income received in advance at the end of last

The amount owing to us is a current asset. year

3 - The amount received this year for the revenue

4. Income in advance / other payables 4 - Income in advance at the end of this year

This is when we received too much money than 5 - Accrued income at the end of this year

we actually earned. 6 - the amount we need to find

The amount received in advance must be

subtracted / debited to the revenue.

The amount received in advance is a current

liability.

LATE EARLY

EXPENSE Accrued PrePayment

Expense (CL) (CA)

INCOME Accrued Income in

Income (CA) Advance (CL)

Expense ledger could look like this:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Creative Writing ExemplarDocument1 pageCreative Writing ExemplarRafael Marco ManubayNo ratings yet

- Once by The Pacific Analysis by MeDocument1 pageOnce by The Pacific Analysis by MeRafael Marco ManubayNo ratings yet

- Pre-Q Term 1 School Exam 2020Document14 pagesPre-Q Term 1 School Exam 2020Rafael Marco ManubayNo ratings yet

- 5 Physics Light Test Name: For The Multiple Choice Questions CIRCLE The Letter of The BEST Answer 1Document11 pages5 Physics Light Test Name: For The Multiple Choice Questions CIRCLE The Letter of The BEST Answer 1Rafael Marco ManubayNo ratings yet

- No. 4-37 Page 146Document6 pagesNo. 4-37 Page 146Nemalai VitalNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Unit-I Supply Chain Management: Dr.P.Nivetha Assistant Professor Department of Management StudiesDocument34 pagesUnit-I Supply Chain Management: Dr.P.Nivetha Assistant Professor Department of Management Studiesshahina begumNo ratings yet

- Lifelines of National EconomyDocument6 pagesLifelines of National EconomyjeffreyNo ratings yet

- GST 121 Indigenous Trade and Economic Development of NigeriaDocument12 pagesGST 121 Indigenous Trade and Economic Development of Nigeriajamesamelia3435No ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- Ritesh Agarwal - WikipediaDocument30 pagesRitesh Agarwal - Wikipediapproject345No ratings yet

- W11 Module 9-Aggregate and Operations SchedulingDocument11 pagesW11 Module 9-Aggregate and Operations SchedulingDanica VetuzNo ratings yet

- CHP 6 Eko 2Document10 pagesCHP 6 Eko 2Golden Ting Chiong SiiNo ratings yet

- TorrentDocument8 pagesTorrentkaranbarmecha90No ratings yet

- John Njenga GathuraDocument2 pagesJohn Njenga GathuraJohn NjengaNo ratings yet

- Simple Agreement For Future Tokens - What Are TheyDocument7 pagesSimple Agreement For Future Tokens - What Are TheyellirafaeladvNo ratings yet

- Apr Final RecoDocument252 pagesApr Final RecoVivek PatilNo ratings yet

- Operations Management MCQs - Types of Production - MCQs ClubDocument7 pagesOperations Management MCQs - Types of Production - MCQs ClubPranoy SarkarNo ratings yet

- Introduction To Capital BudgetingDocument20 pagesIntroduction To Capital BudgetingMary R. R. PanesNo ratings yet

- Toothpaste Industry in IndiaDocument30 pagesToothpaste Industry in IndiaNaureen ShabnamNo ratings yet

- Efisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten JemberDocument12 pagesEfisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten Jemberashadi asriNo ratings yet

- IRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationDocument6 pagesIRCTC IPO Description - IRCTC Limited (Indian Railway Catering and Tourism CorporationVinay KalraNo ratings yet

- Evaluation of Change in Credit PolicyDocument5 pagesEvaluation of Change in Credit PolicyJhunorlando DisonoNo ratings yet

- Data Tiket Dan Hotel Share H-1Document4 pagesData Tiket Dan Hotel Share H-1Ahmad NursalimNo ratings yet

- WhichDocument17 pagesWhichanhtran.31231021988No ratings yet

- Book A Flight Southwest Airlines YupDocument1 pageBook A Flight Southwest Airlines YupDerek CostanzoNo ratings yet

- Serghei Merjan CVDocument11 pagesSerghei Merjan CVUNIMEDIANo ratings yet

- Municipal Council of Iloilo v. EvangelistaDocument4 pagesMunicipal Council of Iloilo v. EvangelistaJune Vincent Ferrer IIINo ratings yet

- Midterm PresentationDocument88 pagesMidterm PresentationRowell Ian Gana-anNo ratings yet

- Pricing Strategies: Marketing Starter: Chapter 11Document28 pagesPricing Strategies: Marketing Starter: Chapter 11muazNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- HinoDocument14 pagesHinoOmerSyedNo ratings yet

- Cash Flow Statement Example1Document3 pagesCash Flow Statement Example1ScribdJrNo ratings yet

- BAM 101 Introduction To Business Administration (Shakshi Shakshi)Document10 pagesBAM 101 Introduction To Business Administration (Shakshi Shakshi)shakshiNo ratings yet