Professional Documents

Culture Documents

Derewala Industries 6mar2020

Derewala Industries 6mar2020

Uploaded by

Mukul SoniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derewala Industries 6mar2020

Derewala Industries 6mar2020

Uploaded by

Mukul SoniCopyright:

Available Formats

RATING RATIONALE

06 Mar 2020

Derewala Industries Ltd

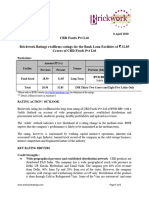

Brickwork Ratings reaffirms the ratings for the Bank Loan Facilities of Rs. 159 Crs of

Derewala Industries Ltd.

Particulars

Previously

Amount rated Previous Rating

Facility** Rated Amount Tenure Rating Assigned*

(Rs. in Crs) (Feb 2020)

(Rs. in Crs)

Fund 33 159 Long BWR BBB- BWR BBB-

Based Term Stable Stable

Reaffirmation

Total 33 159* INR One Hundred Fifty Nine Crores Only

*Please refer to BWR website www.brickworkratings.com/ for definition of the ratings

** Details of Bank facilities is provided in Annexure-I

RATING ACTION / OUTLOOK

Brickwork ratings has reaffirmed the Long term rating of BWR BBB- with a stable outlook.

The ratings draw comfort from the exclusive experience of the promoters in jewellery business,

moderate debt protection metrics and comfortable gearing ratio, presence of a natural hedge

against price volatility, favourable receivable level and competitive edge from integrated

production setup. The rating is, however, constrained by working capital intensive operations

due to high level of inventory, exposure to raw material price volatility, competition from

various players and inherent risk associated with nature of business.

The outlook of the company is stable as the company has been able to sustain the revenues and

profitability in FY 19.

KEY RATING DRIVERS

Credit Strengths:

● Exclusive experience of the Promoters – The Derewala Group, promoted by Mr.

Pramod Agrawal, started its business in 1986 through a proprietorship firm called

Derewala Jewellery Manufacturing Company. He is the Chairman of Indian Institute of

www.brickworkratings.com Page 1of 6

Gem and Jewellery, Jaipur (a project of GJEPC). He is also a Chairman of Gem and

Jewellery Export Promotion Council (GJEPC) at all India level, Board of Director of All

India Gems and Jewellery Trade Federation (GJF) and Executive Member of Jewellers

Association, Jaipur. Also, Mr. Pramod Agrawal has a total experience of more than 30

years. Mr. Yoginder Garg, Director of company, looking after sales and marketing

distribution networks across India offering new and exciting jewelry at incredible prices

having experience of 26 years.

● Moderate Debt protection metrics - The entity has comfortable debt protection metrics

as ISCR and DSCR stood at 1.38x and 1.37x respectively in FY19 which reflects the

ability of the company for timely repayment of debt. The entity does not have long term

borrowings from Banks and financial institutions.

● Comfortable Gearing Ratio - The Gearing Ratio (i.e TOL:TNW) of the company was

recorded at a comfortable level of 2.28x in FY19 improved from 2.47x in FY18. Overall

debt of the company has declined from Rs. 211 Crs in FY 18 to Rs. 159 Crs as on date.

Further, company has provided declaration stating that before the end of March 2020,

company will further reduce the loan by another Rs. 6 Crs

● Natural Hedge for Gold prices - The funding of gold is through Gold Loan facility from

State Bank of India which provides natural hedge against price and forex volatilities.

Company purchases the Gold from the State Bank of India and manufactures the product

as per requirements of customers. On the date of sale to customers, the same rate is

charged by the Bank for its purchases. SBI Gold loan is to be repaid within 180 days

from the date of purchase.

● Comfortable conversion cycle - The company has been able to maintain a receivable of

19 days which is adequate for the jewellery industry.

Credit Risks:

● Highly fragmented nature of Industry: The gems and jewellery industry is highly

fragmented and unorganised. The larger domestic players and export oriented units are

entering the organised domestic retail segment at the cost of the unorganised segment.

Over the last couple of years, the share of organised players has been expanding, with

major growth being observed in metropolitan areas.

● Inherent risk associated with business - There are inherent risks associated with the

jewellery industry like governmental regulations such as hallmarking, imposition of

custom duty and demonetisation in FY17, and the Goods and Services Tax in FY18.

Also, the major risk associated with business is the ever changing taste and preference of

customers relating to the designs of jewellery.

● High working capital requirements- The Company has highly

working-capital-intensive operations and maintains large inventory which may impact the

profitability in case of price volatility.

www.brickworkratings.com Page 2of 6

ANALYTICAL APPROACH AND APPLICABLE RATING CRITERIA

For arriving at its ratings, BWR has applied its rating methodology as debited in the Rating

Criteria detailed below ( hyperlinks provided at the end of this rationale).

RATING SENSITIVITIES

Going forward, the ability of the firm to improve its scale of operations by improving its

profitability margins and efficiently manage its liquidity would remain the key rating

sensitivities.

Positive: The rating outlook may be revised to 'Positive' in case the revenues and profit show

sustained improvement backed by healthy liquidity.

Negative: The rating outlook may be revised to 'Negative' in case revenues of the company

substantially deteriorates from current level. Rating may also be adversely affected in case of

adequate deterioration in gearing and coverage ratios.

LIQUIDITY POSITION (ADEQUATE)

Company has a Fund Based facility of Rs. 159 crs and its average utilisation of the fund-based

limits is 80% over the 6 months ended Feb 2020. Company has cash accruals(PAT +DEP) of Rs

5.96 Cr in FY19 improved from Rs. 5.07 Crs in FY18 whereas CPLTD in FY19 was almost

negligible. Company has free cash and cash equivalents of Rs. 7.93 Crs as on 31 Dec 2019.

COMPANY PROFILE

Derewala Group has been promoted by Mr. Pramod Agrawal who started the jewellery business

in 1986 as a proprietorship concern. In 2003, this was converted into a partnership concern in the

name of Derewala Jewellery Industries. They converted the partnership concern to a company

renamed as Derewala Industries Ltd. in 2014 having its worldwide distribution from its base in

Jaipur, the jewellery hub of India. Derewala creates jewellery that is both exquisite and

exclusive, employs passionate designers, brilliant engineers, master craftsmen, and uses state of

the art technology. Derewala’s expertise caters to retailers, manufacturers and wholesalers

worldwide. Its silver jewellery portfolio includes rings, pendants, bracelets and beaded

jewellery, among others. These are supplied to wholesalers and direct marketing companies in

the US, the UK, Sweden, Germany and France. The gold jewellery includes chains, mesh,

stamped and gold flick products that are supplied to wholesalers as well as reputed retailers in

India.

www.brickworkratings.com Page 3of 6

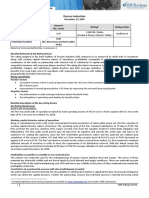

KEY FINANCIAL INDICATORS (in INR Cr)

Key Parameters Units FY18 FY19 9MFY20

Result Type Audited Audited Provisional

Total Operating Income Cr 378.37 380.24 272.56

OPBDIT Cr 23.39 20.73 18.31

PAT Cr 0.71 1.62 3.90

TNW Cr 85.64 87.66 92.97

TOL/TNW Times 2.47 2.28 2.07

Current Ratio Times 1.22 1.24 1.28

KEY COVENANTS OF THE INSTRUMENT/FACILITY RATED: NA

NON-COOPERATION WITH PREVIOUS RATING AGENCY, IF ANY : NA

RATING HISTORY

Current Rating (2020)

Facility Rating History

Tenu Amount 2020

Rating 2019 2018 2017

re (Rs. Crs) ( Feb)

BWR BBB- BWR BBB-

Fund Based - Long - - -

159 (Stable)

Cash Credit Term (Stable)

Reaffirmation

Total 159 INR One Hundred Fifty Nine Crores Only

COMPLEXITY LEVELS OF THE INSTRUMENTS

For more information, visit www.brickworkratings.com/download/ComplexityLevels.pdf

www.brickworkratings.com Page 4of 6

Hyperlink/Reference to applicable Criteria

● General Criteria

● Approach to Financial Ratios

● Manufacturing Sector

● Short Term Debt

Analytical Contacts Investor and Media Relations

Neha Wahi

Primary Analyst

+011-23412232 Extn 114

nehawahi@brickworkratings.com Liena Thakur

Assistant Vice President - Corporate Communications

R K Sharma +91 84339 94686

Senior Director – Ratings liena.t@brickworkratings.com

+011-23412232 Extn 104

rksharma@brickworkratings.com

Derewala Industries Ltd

ANNEXURE I

Details of Bank Facilities rated by BWR

Sl. No. Name of the Type of Facilities Long Term Short Term Total

Bank (₹ Cr) (₹ Cr) (₹ Cr)

1 Kotak Export Packing -

25 25

MahindraBank Credit

2. State Bank of -

Cash Credit 14.50 14.50

India

3. State Bank of Cash Credit (Gold -

119.50 119.50

India Metal Loan)

TOTAL 159

INR One Hundred Fifty Nine Crores Only

www.brickworkratings.com Page 5of 6

For print and digital media The Rating Rationale is sent to you for the sole purpose of dissemination

through your print, digital or electronic media. While it may be used by you acknowledging credit to

BWR, please do not change the wordings in the rationale to avoid conveying a meaning different from

what was intended by BWR. BWR alone has the sole right of sharing (both direct and indirect) its

rationales for consideration or otherwise through any print or electronic or digital media.

About Brickwork Ratings :Brickwork Ratings (BWR), a SEBI registered Credit Rating Agency,

accredited by RBI and empaneled by NSIC, offers Bank Loan, NCD, Commercial Paper, MSME ratings

and grading services. NABARD has empaneled Brickwork for MFI and NGO grading. BWR is accredited

by IREDA & the Ministry of New and Renewable Energy (MNRE), Government of India. Brickwork

Ratings has Canara Bank, a leading public sector bank, as its promoter and strategic partner. BWR has its

corporate office in Bengaluru and a country-wide presence with its offices in Ahmedabad, Chandigarh,

Chennai, Hyderabad, Kolkata, Mumbai and New Delhi along with representatives in 150+ locations.

DISCLAIMER Brickwork Ratings (BWR) has assigned the rating based on the information obtained

from the issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable

steps to avoid any data distortion; however, it does not examine the precision or completeness of the

information obtained. And hence, the information in this report is presented “as is” without any express or

implied warranty of any kind. BWR does not make any representation in respect to the truth or accuracy

of any such information. The rating assigned by BWR should be treated as an opinion rather than a

recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses

incurred by users from any use of this report or its contents. BWR has the right to change, suspend or

withdraw the ratings at any time for any reasons

www.brickworkratings.com Page 6of 6

You might also like

- Saregama Carvaan Songlist 1.0Document122 pagesSaregama Carvaan Songlist 1.0funterweb100% (1)

- History of Public Health Nursing in The PhilippinesDocument6 pagesHistory of Public Health Nursing in The PhilippinesClaudette Kyle Cornelio100% (1)

- Facility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)Document4 pagesFacility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)ShamNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Satya Stone Exports-01!24!2020Document4 pagesSatya Stone Exports-01!24!2020vasfee.7172No ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Haryana Steel Mongers 18june2019Document5 pagesHaryana Steel Mongers 18june2019partoshsingh746No ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Entertainment-City-Jan 2019 BRICKWORKDocument6 pagesEntertainment-City-Jan 2019 BRICKWORKPuneet367No ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- PR - Sri Anagha - Refineries - 23 - 09 - 2020Document6 pagesPR - Sri Anagha - Refineries - 23 - 09 - 2020Jayshreeben DobariyaNo ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- PR Globe Textiles 19jul23Document6 pagesPR Globe Textiles 19jul23solanki.prabhuNo ratings yet

- Y-Wildcraft-India-18Oct 2022Document8 pagesY-Wildcraft-India-18Oct 2022PratyushNo ratings yet

- Parasakti - IndRa - Dec 2022 - BBB+Document5 pagesParasakti - IndRa - Dec 2022 - BBB+SaranNo ratings yet

- MRF Limited - R - 30112020Document7 pagesMRF Limited - R - 30112020deepal patilNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- Jyoti CNC Automation 24dec2019Document7 pagesJyoti CNC Automation 24dec2019Puneet367No ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- Gna Gears LimitedDocument7 pagesGna Gears Limitedankityad129No ratings yet

- Y-Wildcraft-India-18Oct 2022Document8 pagesY-Wildcraft-India-18Oct 2022PratyushNo ratings yet

- PR Faridabad Steel 24jan23Document6 pagesPR Faridabad Steel 24jan23partoshsingh746No ratings yet

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocument7 pagesEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- Asquare Food Beverages 27dec2018Document6 pagesAsquare Food Beverages 27dec2018Tanmay GuptaNo ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- AKR Industries 19mar2020Document8 pagesAKR Industries 19mar2020Karthikeyan RK Swamy100% (1)

- Global BuildconDocument6 pagesGlobal Buildconprasad.patilNo ratings yet

- Magnolia Martinique - R - 03082017Document7 pagesMagnolia Martinique - R - 03082017Bhavin SagarNo ratings yet

- Jainam Cables (India) Private Limited: Summary of Rated InstrumentsDocument6 pagesJainam Cables (India) Private Limited: Summary of Rated InstrumentspunamNo ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- KH Exports India Private Limited: Summary of Rating ActionDocument7 pagesKH Exports India Private Limited: Summary of Rating ActionMohammed sameh RNo ratings yet

- Suprajit Engineering LimitedDocument6 pagesSuprajit Engineering LimitedHarinath ReddyNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Ginni Filaments Limited-09!07!2020Document4 pagesGinni Filaments Limited-09!07!2020Saurabh AgarwalNo ratings yet

- Bata India Limited: Summary of Rating ActionDocument6 pagesBata India Limited: Summary of Rating ActionDhrubajyoti DattaNo ratings yet

- Gokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating ActionDocument6 pagesGokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating Actionabhi MestriNo ratings yet

- Pankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Document3 pagesPankaj Jewellers BankLoan - 18.35Cr Rationale 20jul2017Techno Gamerz And EntertainerNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Kanchan India BL 20mar2019Document7 pagesKanchan India BL 20mar2019aaravNo ratings yet

- Neelkanth Salt Chem India Private LimitedDocument5 pagesNeelkanth Salt Chem India Private LimitedcharananwarNo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Why Indicators: Overbought: A Technical Condition That Occurs When There HasDocument13 pagesWhy Indicators: Overbought: A Technical Condition That Occurs When There HasMukul SoniNo ratings yet

- What Is The 'Volume Weighted Average Price - VWAP'Document5 pagesWhat Is The 'Volume Weighted Average Price - VWAP'Mukul SoniNo ratings yet

- Range BarsDocument8 pagesRange BarsMukul SoniNo ratings yet

- Rule Book 1Document112 pagesRule Book 1Mukul SoniNo ratings yet

- Options Theory For Professional TradingDocument134 pagesOptions Theory For Professional TradingVibhats VibhorNo ratings yet

- Complete CMF Form Jan2014Document4 pagesComplete CMF Form Jan2014Mukul SoniNo ratings yet

- How To Use Cycles: Lesson 9Document5 pagesHow To Use Cycles: Lesson 9Mukul SoniNo ratings yet

- 13 B 2 NDocument7 pages13 B 2 NRay Ramilo100% (1)

- Complete Research Ch1 5Document57 pagesComplete Research Ch1 5Angelie Regie J EstorqueNo ratings yet

- Product Demo Feedback FormDocument1 pageProduct Demo Feedback FormVarunSharmaNo ratings yet

- Dynamic Modeling of PMSMDocument10 pagesDynamic Modeling of PMSMHisham Magdi El DeebNo ratings yet

- Calculus III and IV - SodinDocument164 pagesCalculus III and IV - Sodintom-manor-1138No ratings yet

- A Bad Workman Always Blames His ToolsDocument6 pagesA Bad Workman Always Blames His ToolsTimothy BrownNo ratings yet

- Cabbash Vms BrochureDocument22 pagesCabbash Vms BrochureOghosa OsahenrhumwenNo ratings yet

- Volume Kerja English Year 4Document6 pagesVolume Kerja English Year 4kamiliamawaddahNo ratings yet

- Timeline Bendahara DesemberDocument2 pagesTimeline Bendahara DesemberSuci Ayu ChairunaNo ratings yet

- BiossDocument11 pagesBiossPriyanka SharmaNo ratings yet

- 72.61.00.045 26-MAR-2020 08-DEC-2021 Closed A319-100N, A320-200N, A321-200N, A321-200NX, A321-200NY 72-61 Iae LLC Pratt & Whitney TFU UpdateDocument9 pages72.61.00.045 26-MAR-2020 08-DEC-2021 Closed A319-100N, A320-200N, A321-200N, A321-200NX, A321-200NY 72-61 Iae LLC Pratt & Whitney TFU UpdatejivomirNo ratings yet

- HP System Management Homepage 6.0 User Guide: HP-UX, Linux, and Windows Operating SystemsDocument102 pagesHP System Management Homepage 6.0 User Guide: HP-UX, Linux, and Windows Operating SystemsFábio AndréNo ratings yet

- COT1-3rd HirarkiyaDocument49 pagesCOT1-3rd HirarkiyaRommel LasugasNo ratings yet

- The Mango Season Q&ADocument5 pagesThe Mango Season Q&Acamellight14No ratings yet

- A Discussion On Mahmood Ghaznavi The .IncridableDocument45 pagesA Discussion On Mahmood Ghaznavi The .IncridableMAHMOODOFGHAZNANo ratings yet

- Terms of Use: Thank You For Respecting My Work!Document11 pagesTerms of Use: Thank You For Respecting My Work!Tammy Reyes VélizNo ratings yet

- BGP (Border Gateway Protocol) - Port 179: Gateway Protocols (IGP's)Document32 pagesBGP (Border Gateway Protocol) - Port 179: Gateway Protocols (IGP's)Nitesh MulukNo ratings yet

- Class XII Applied Mathematics 2023-24 (K R Mangalam School)Document7 pagesClass XII Applied Mathematics 2023-24 (K R Mangalam School)GouriJayanNo ratings yet

- Aspirations of Peace and Nonviolence-Chandan-Sukumar-SenguptaDocument7 pagesAspirations of Peace and Nonviolence-Chandan-Sukumar-SenguptaSENGUPTA CHANDANNo ratings yet

- Printable Article Synthetic Materials Making Substances in The LabDocument2 pagesPrintable Article Synthetic Materials Making Substances in The LabJoshua BrewerNo ratings yet

- Nakshtra Swami and BhramanDocument12 pagesNakshtra Swami and Bhramansagar_m26100% (1)

- Resource Guide For New ChrosDocument23 pagesResource Guide For New Chroslane.a.mcfNo ratings yet

- UF - 455 - G Presentation Sheet 2011Document4 pagesUF - 455 - G Presentation Sheet 2011Carlos Perez TrujilloNo ratings yet

- FEG Token Litepaper v2.1Document15 pagesFEG Token Litepaper v2.1TelorNo ratings yet

- Transmission Structures and Foundations:: CourseDocument8 pagesTransmission Structures and Foundations:: CoursejulianobiancoNo ratings yet

- Nutrition Education Project Final VersionDocument16 pagesNutrition Education Project Final Versionapi-535168013No ratings yet

- 420 Economic Survey Chapter 11 Thalinomics IndiashastraDocument1 page420 Economic Survey Chapter 11 Thalinomics IndiashastraKarambir Singh DhayalNo ratings yet

- Jack Goldestone - THE PROBLEM OF THE EARLY MODERN WORLD - TEXT PDFDocument36 pagesJack Goldestone - THE PROBLEM OF THE EARLY MODERN WORLD - TEXT PDFBojanNo ratings yet

- Modeling & Simulation of Spherical Robot Configuration Using Solidworks & MatlabDocument3 pagesModeling & Simulation of Spherical Robot Configuration Using Solidworks & Matlabkarthi0% (1)