Professional Documents

Culture Documents

Procedures For MV Owners

Procedures For MV Owners

Uploaded by

Toni - Ann Irving0 ratings0% found this document useful (0 votes)

51 views2 pagesTo transfer a motor vehicle, the buyer and seller must visit the Tax Office with several key documents, including the Certificate of Title, Registration Certificate, valid insurance in the buyer's name, and valid identification. The documents are checked and if in order, the transfer is completed on the reverse side of the Title in front of the Collector of Taxes. The buyer then pays the transfer fee and collects a receipt.

Original Description:

Original Title

Procedures for Mv Owners

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTo transfer a motor vehicle, the buyer and seller must visit the Tax Office with several key documents, including the Certificate of Title, Registration Certificate, valid insurance in the buyer's name, and valid identification. The documents are checked and if in order, the transfer is completed on the reverse side of the Title in front of the Collector of Taxes. The buyer then pays the transfer fee and collects a receipt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

51 views2 pagesProcedures For MV Owners

Procedures For MV Owners

Uploaded by

Toni - Ann IrvingTo transfer a motor vehicle, the buyer and seller must visit the Tax Office with several key documents, including the Certificate of Title, Registration Certificate, valid insurance in the buyer's name, and valid identification. The documents are checked and if in order, the transfer is completed on the reverse side of the Title in front of the Collector of Taxes. The buyer then pays the transfer fee and collects a receipt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

What documents should I have 1 The transferee (buyer), if already in

when Transferring a Motor Vehicle? possession of registration plates,

should submit to the Tax Office the

1 Certificate of Title relevant receipt/documents

for verification. This should be done

1 Registration Certificate before attaching the registration plates

to the vehicle purchased.

1 Valid Insurance cover note in buyer’s name

N.B. Remember Registration Plates are not

1 Valid Identification (e.g. Passport, transferable from person to person and each

Driver’s Licence) pair of plates can only be assigned from one

vehicle to another by the Collector of Taxes.

1 Valid Certificate of Fitness

How do I obtain a Certificate of Title?

1 Letter of authorization along with the

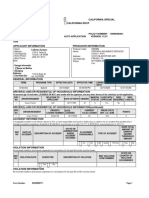

1 Complete the form - ”Application for Motor

company’s stamp if application is for

a company. Vehicle Transaction (s) - MVO1”

1 Submit your Certificate of Fitness,

1 If a lien is attached to the vehicle,

Registration Certificate and Insurance

the discharge of lien is needed.

Certificate or Cover Note.

NB. Taxpayer Registration Number

1 Pay required fee

(TRN) is required to complete the form

How do I transfer a Motor Vehicle? 1 Collect Title in approximately three (3)

months.

1 Both parties (seller and buyer) should

visit at the Tax Office with the NOTE

necessary documents- (See list under This brochure is only a Guide.

previous question) It is NOT a substitute for the

Road Traffic Act and other relevant

1 Documents are checked, if in order, Legislation

the transfer is done on the reverse

side of the Title in the presence of For more information

the Collector of Taxes. Call:1- 888 – TAX– HELP (829– 4357)

1- 888 – GO – JA- TAX (465 – 2829)

1 The transferee ( buyer) pays transfer fee Email:taxhelp@taj.gov.jm

Website: www.jamaicatax.gov.jm/

and collects receipt.

www.jamaicatax- online.gov.jm

Facebook:www.facebook.com/jamaicatax

1 The Transferee (buyer) pays the Twitter:@jamaicatax or

required GCT (second sales tax) on Visit any tax office nearest you

vehicles, which are 8 years old and

under, based on the cc rating or A publication of

Tax Administration Jamaica

cwt/ kilo rating. JUNE 2011

1 Letter of authorization along with What documents do I need to

the company stamp if application is Renew my Motor Vehicle Licence?

for a company

1 Expired Motor Vehicle Registration

1 Private Import - Original and Copy Certificate

of Import Licence

1 Valid Certificate of Fitness

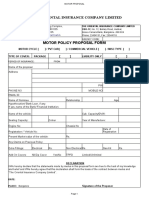

How do I Register and License a 1 Valid Insurance Certificate or Cover

New Motor Vehicle? Note

Why should I license my NB. * Taxpayer Registration Number

Motor Vehicle? (TRN) is required to complete

The Road Traffic Act and Regula- 1 Complete Application form for new the form

tions require that any Motor Vehicle or Registration Plates, Registration,

Trailer be registered and licensed Licence and Title (forms obtain * For renewal of P.P.V. or

before it is used on any public road. able at the Tax Office) and online C.C. Motor Vehicle Licence

@ www.jamaicatax.gov.jm the Road Licence or letter from

What Documents do I need to Transport Authority is needed.

Register and License a New

Motor Vehicle? 1 Pay required fees and collect What should I do when I

appropriate receipts. Purchase a Second - Hand Vehicle?

1 Valid Certificate of Fitness 1 Collect Title in approximately three 1 Ensure that the engine and chassis

(3) months.. numbers on the relevant documents

1 Valid Insurance Certificate or agree with the engine and chassis

Cover Note numbers on the vehicle.

N.B. Keep Title in a safe place as

1 Receipt and Invoice from you will not be able to transfer your 1 Ensure that there is a Title for the

Motor Car Dealer vehicle without it. vehicle to be purchased.

1 Copy of original Import Entry Keep your registration plate receipt

(C78) signed by Customs and in a safe place. You will need it if

two photocopies you are to transfer your plates to

another vehicle at a later date.

1 Identification, e.g. Passport or

Driver’s Licence Motor Vehicles may be licensed for

six or twelve months.

NB. Taxpayer Registration Number

(TRN) is required to complete the

form.

You might also like

- Talor Gooch LIV Player Agreement Pt. 2 REDACTEDDocument32 pagesTalor Gooch LIV Player Agreement Pt. 2 REDACTEDRyan BallengeeNo ratings yet

- Company Leased Vehicle PolicyDocument5 pagesCompany Leased Vehicle PolicyGunjan Sharma100% (2)

- Certificate of RegistrationDocument30 pagesCertificate of RegistrationJanber Engell Gabriel TanudraNo ratings yet

- Checklist Polish Employment NewDocument1 pageChecklist Polish Employment NewRehman AB100% (3)

- Registration of Ownership TranferDocument6 pagesRegistration of Ownership TranferIronHeart MulaaferNo ratings yet

- Step 1:: Determine Your EligibilityDocument1 pageStep 1:: Determine Your EligibilityAnyia ArcherNo ratings yet

- Vehicle RegistrationDocument11 pagesVehicle RegistrationClash OfclansNo ratings yet

- F1276 CFDDocument2 pagesF1276 CFDinfo.brisbanea1trailersNo ratings yet

- F3523 CFDDocument2 pagesF3523 CFDAdam Scott MillerNo ratings yet

- FDM Vol. 2 (2nd Edition)Document93 pagesFDM Vol. 2 (2nd Edition)DRR100% (1)

- Affidavit of NonliabilityDocument3 pagesAffidavit of Nonliabilityzia_ghiasiNo ratings yet

- Affidavit of Non LiabilityDocument3 pagesAffidavit of Non LiabilityJAMES DOUGLAS JRNo ratings yet

- Acceptance Form May 2012Document8 pagesAcceptance Form May 2012Ridah SolomonNo ratings yet

- Sri Lanka Tax CarDocument9 pagesSri Lanka Tax CardasdreadfefaNo ratings yet

- Car Ownership Transfer in The PhilippinesDocument8 pagesCar Ownership Transfer in The PhilippinesKian Beltran100% (1)

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransfershiviariNo ratings yet

- Resident Parking Permit - Guidance NotesDocument4 pagesResident Parking Permit - Guidance NotesEnglandKorfballNo ratings yet

- ActivityDocument5 pagesActivitymmmcylleNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferYhr YhNo ratings yet

- MV Validation and TransferDocument4 pagesMV Validation and TransferIsaac DanNo ratings yet

- Resident Parking PermitDocument4 pagesResident Parking PermitIondontuNo ratings yet

- Step by Step Guideline For Claims ProcessingDocument3 pagesStep by Step Guideline For Claims ProcessingJewelyn C. Espares-CioconNo ratings yet

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferChristopher RusliNo ratings yet

- Public Insufficient Evidence ChecklistDocument1 pagePublic Insufficient Evidence ChecklistLaura FrekiNo ratings yet

- Private Hire Birmingham City CouncilDocument16 pagesPrivate Hire Birmingham City Councilhassanzk.pakNo ratings yet

- Bulk Fuel Terms and ConditionsDocument25 pagesBulk Fuel Terms and ConditionsMark ReinhardtNo ratings yet

- Customer Application Form - Token: Date-Appt IDDocument3 pagesCustomer Application Form - Token: Date-Appt IDRamasubramanian KRNo ratings yet

- Transfer of Ownership of Private MVsDocument2 pagesTransfer of Ownership of Private MVsjon-jon anchetaNo ratings yet

- Towing and Storage Lien: Statutory Requirements of KRS 376.275, KRS 424.130 & OAG 66-369Document1 pageTowing and Storage Lien: Statutory Requirements of KRS 376.275, KRS 424.130 & OAG 66-369rajaramghoshNo ratings yet

- Vehicle Registration Transfer Application: Information SheetDocument5 pagesVehicle Registration Transfer Application: Information SheetMatt CarltonNo ratings yet

- DD 1Document2 pagesDD 1Rebecca CooperNo ratings yet

- HCV Application Form v04Document4 pagesHCV Application Form v04unixninetyeightNo ratings yet

- 925821-DnD 5e AdventureLogsheetDocument2 pages925821-DnD 5e AdventureLogsheetEthanNo ratings yet

- RC Transfer ProcessDocument2 pagesRC Transfer Processguiness_joe9154No ratings yet

- Mechanic's Lien Foreclosure: Vehicle InformationDocument2 pagesMechanic's Lien Foreclosure: Vehicle InformationToshiba userNo ratings yet

- ONE - motoRING - De-Register A VehicleDocument2 pagesONE - motoRING - De-Register A VehicleAung Kyaw OoNo ratings yet

- Information Sheet: The Acquirer (New Registered Operator) MustDocument5 pagesInformation Sheet: The Acquirer (New Registered Operator) MustRosebelle AbainzaNo ratings yet

- Vehicle Registration Transfer ApplicationDocument5 pagesVehicle Registration Transfer Applicationshrestharabin086No ratings yet

- Importer Terms and Agreement Form Rev01Document7 pagesImporter Terms and Agreement Form Rev01Simbi PierreNo ratings yet

- How To Apply For Driving LicenceDocument8 pagesHow To Apply For Driving Licencemahaboob bashaNo ratings yet

- Canada Tax - Certificate of ExemptionDocument1 pageCanada Tax - Certificate of ExemptionGennadiy GatorNo ratings yet

- Jafza Companies Termination: CR/TS/003/2013Document11 pagesJafza Companies Termination: CR/TS/003/2013Yogesh GuptaNo ratings yet

- Import Foreign Used Car To T&TDocument5 pagesImport Foreign Used Car To T&TShekinah FergusonNo ratings yet

- F3520 CFDDocument5 pagesF3520 CFDPhillip NguyenNo ratings yet

- Terms Conditions inDocument8 pagesTerms Conditions inShashwat KanoongoNo ratings yet

- LBU F VL MR9 Vehicle TransferDocument6 pagesLBU F VL MR9 Vehicle TransferGordon Bruce100% (1)

- App Ideas V2 0414Document57 pagesApp Ideas V2 0414Nguyễn HoàngNo ratings yet

- Power of Attorney (Natural Person Only)Document4 pagesPower of Attorney (Natural Person Only)jonkipperNo ratings yet

- MV Registration VehicleDocument3 pagesMV Registration VehicleKhak UsNo ratings yet

- F3520 CFDDocument5 pagesF3520 CFDLaura ČupićNo ratings yet

- JotejDocument4 pagesJotejfaiz bugtiNo ratings yet

- Checklist - LTO - Transferring Ownership of Private Motor Vehicles and MotorcyclesDocument2 pagesChecklist - LTO - Transferring Ownership of Private Motor Vehicles and MotorcyclesLRMNo ratings yet

- Motor Vehicle Registration InfoDocument3 pagesMotor Vehicle Registration InfoGivengift LilungweNo ratings yet

- Vehicle Registration in AustraliaDocument8 pagesVehicle Registration in AustraliaInarNo ratings yet

- Updated Resident Parking Permit Application Form 2023 24Document4 pagesUpdated Resident Parking Permit Application Form 2023 24tamtworkemailsNo ratings yet

- SVG ConcessionDocument16 pagesSVG ConcessionShanica Paul-RichardsNo ratings yet

- Form 28Document2 pagesForm 28anandshubhamsudhirkumarNo ratings yet

- Alarm A1Document2 pagesAlarm A1Bharathi ThiNo ratings yet

- GEORGIA MV Vehicles Titles ManualDocument144 pagesGEORGIA MV Vehicles Titles ManualDavid CarusoNo ratings yet

- Autosweep Rfid Subscription Personal Account: Enrollment TypeDocument2 pagesAutosweep Rfid Subscription Personal Account: Enrollment TypeMicrosoft OfficeNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Passive & Active TransportDocument31 pagesPassive & Active TransportToni - Ann IrvingNo ratings yet

- 11 Physics Graded WorkDocument1 page11 Physics Graded WorkToni - Ann IrvingNo ratings yet

- Displacement Time GraphDocument6 pagesDisplacement Time GraphToni - Ann IrvingNo ratings yet

- Light Rays and Rectilinear Propagation NotesDocument3 pagesLight Rays and Rectilinear Propagation NotesToni - Ann IrvingNo ratings yet

- Indicators and PH ScaleDocument3 pagesIndicators and PH ScaleToni - Ann IrvingNo ratings yet

- Disability Tax Credit Certificate: Protected BDocument6 pagesDisability Tax Credit Certificate: Protected BTrevor MarneyNo ratings yet

- Vipin PDFDocument7 pagesVipin PDFPiyush MishraNo ratings yet

- AC Chapter 9Document19 pagesAC Chapter 9Minh AnhNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Appointment LetterDocument9 pagesAppointment LetterRajesh RNo ratings yet

- Budget 2023 Tax GuideDocument2 pagesBudget 2023 Tax GuideMichele RivarolaNo ratings yet

- UMBC FRS ReportDocument79 pagesUMBC FRS ReportMatt BrownNo ratings yet

- Philamcare Health System vs. CA: FactsDocument8 pagesPhilamcare Health System vs. CA: FactsPaul EsparagozaNo ratings yet

- Pacific & Orient Insurance Co BHD: Premium Polisi (RM)Document2 pagesPacific & Orient Insurance Co BHD: Premium Polisi (RM)Mohamad HamidNo ratings yet

- 806 Dewberry HOADocument181 pages806 Dewberry HOAGopichand CHNo ratings yet

- I Am Sharing 'Sabrina Insurance' With YouDocument21 pagesI Am Sharing 'Sabrina Insurance' With Youhot mops & handy man100% (1)

- The Oriental Insurance Company Limited: Regional Office: 44/45, Leo Shopping ComplexDocument1 pageThe Oriental Insurance Company Limited: Regional Office: 44/45, Leo Shopping ComplexAnjanaya LamaniNo ratings yet

- PPN Network - Declaration FormDocument1 pagePPN Network - Declaration FormAnup SrivastavaNo ratings yet

- Philippine Deposit Insurance System R.A. No. 3591Document14 pagesPhilippine Deposit Insurance System R.A. No. 3591Chris ChanNo ratings yet

- PolicyDocument AspxDocument2 pagesPolicyDocument AspxdNo ratings yet

- Legal PersonalityDocument28 pagesLegal PersonalityalexanderdroushiotisNo ratings yet

- NHS FPX 6008 Assessment 2 Needs Analysis For ChangeDocument8 pagesNHS FPX 6008 Assessment 2 Needs Analysis For Changelilykevin075No ratings yet

- Secure Your Family's Goals With A Choice of Funds and BenefitsDocument9 pagesSecure Your Family's Goals With A Choice of Funds and BenefitsSainath MundheNo ratings yet

- MT 554 Insurance Principle Module 2Document6 pagesMT 554 Insurance Principle Module 2ksheerodshriNo ratings yet

- Your Pradhan Mantri Jeevan Jyoti Bima Yojana PolicyDocument3 pagesYour Pradhan Mantri Jeevan Jyoti Bima Yojana PolicymanitenkasiNo ratings yet

- 07 - Activity - 1RFLIB MACDocument2 pages07 - Activity - 1RFLIB MACh7t8gt5cnvNo ratings yet

- Final Examination in LAW 3033Document10 pagesFinal Examination in LAW 3033Mark Gelo WinchesterNo ratings yet

- HSU 392724 NL NL 0420 7Document24 pagesHSU 392724 NL NL 0420 7VivienNo ratings yet

- PCTE Group of Institutes, Ludhiana: BBA 3cDocument4 pagesPCTE Group of Institutes, Ludhiana: BBA 3cAman KarwalNo ratings yet

- Ae-26 Income Taxation Prelim ExaminationDocument8 pagesAe-26 Income Taxation Prelim ExaminationArlea AsenciNo ratings yet

- Mahavitaran Diary-2022Document200 pagesMahavitaran Diary-2022Jitendra JainNo ratings yet

- Egypt: Health Sector ReformDocument16 pagesEgypt: Health Sector Reformdevon2610No ratings yet

- CMBE2 Introductory Accounting For Non-Accountancy Students SyllabusDocument7 pagesCMBE2 Introductory Accounting For Non-Accountancy Students SyllabusEunice AmbrocioNo ratings yet