Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

106 viewsTimeliness of Filing BP 22 Cases

Timeliness of Filing BP 22 Cases

Uploaded by

Concepcion CejanoThis document outlines the timeliness requirements and elements of a crime for filing a BP 22 case in the Philippines. A BP 22 case involves issuing a check that is subsequently dishonored by the drawee bank within 90 days of presentment due to insufficient funds or a closed/stopped account. The drawer must receive notice of dishonor, usually via registered mail, and fail to pay within 5 days of receiving notice. To be guilty of a BP 22 crime, the drawer must have issued the check knowing there were insufficient funds and the bank dishonored it for the stated reasons.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Miami-Dade County Clerk Criminal JusticeDocument1 pageMiami-Dade County Clerk Criminal Justicem j100% (2)

- Pakyaw Contract Agreement 2021 1Document1 pagePakyaw Contract Agreement 2021 1MC MirandaNo ratings yet

- Declaration of Actual Use FormDocument1 pageDeclaration of Actual Use FormCari Mangalindan MacaalayNo ratings yet

- Unit Two (Land Reform in The Philippines) : (Public Act 4054)Document6 pagesUnit Two (Land Reform in The Philippines) : (Public Act 4054)JamesBuensalidoDellavaNo ratings yet

- Compromise Agreement Re Compromise AgreementDocument3 pagesCompromise Agreement Re Compromise AgreementKathleen CastroNo ratings yet

- Equitable Mortgage - No Criminal Liability and Sub MeterDocument3 pagesEquitable Mortgage - No Criminal Liability and Sub Meterjohn kristoffer cananesNo ratings yet

- Sec Green Lane FormDocument8 pagesSec Green Lane FormZena E. SugatainNo ratings yet

- MCF 21.4 Motion To Quash SubpoenaDocument2 pagesMCF 21.4 Motion To Quash SubpoenapolbisenteNo ratings yet

- Tax Treaty Forms 0901 SeriesDocument16 pagesTax Treaty Forms 0901 SeriesgoldagigiNo ratings yet

- BSP Memorandum No. M 2018 017Document12 pagesBSP Memorandum No. M 2018 017Maya Julieta Catacutan-Estabillo100% (1)

- Criminological Research 2Document3 pagesCriminological Research 2mark patalinghugNo ratings yet

- People V AbellaDocument2 pagesPeople V AbellaChupsNo ratings yet

- BIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed CorporationDocument4 pagesBIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed Corporationliz kawiNo ratings yet

- 2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFDocument191 pages2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFRamon PamosoNo ratings yet

- Baneko Ne: Serurrel PilipinasDocument16 pagesBaneko Ne: Serurrel PilipinasEselito C. RuizNo ratings yet

- Spa Lto San IsidroDocument2 pagesSpa Lto San IsidroBar2012No ratings yet

- BSP Guideline On Registration-Of-Foreign-InvestmentsDocument6 pagesBSP Guideline On Registration-Of-Foreign-InvestmentsmtscoNo ratings yet

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- NFCC Computation 2Document1 pageNFCC Computation 2Claudio OlaritaNo ratings yet

- Rmo 07-06Document9 pagesRmo 07-06Printet08No ratings yet

- Grave Threats - Aguilar vs. ZamucoDocument4 pagesGrave Threats - Aguilar vs. ZamucoIzobelle PulgoNo ratings yet

- G.R. No. 226590, April 23, 2018 Shirley T. Lim, Mary T. Limleon and Jimmy T. Lim, Petitioners, V. People of THE PHILIPPINES, Respondent. DecisionDocument4 pagesG.R. No. 226590, April 23, 2018 Shirley T. Lim, Mary T. Limleon and Jimmy T. Lim, Petitioners, V. People of THE PHILIPPINES, Respondent. DecisionVanessa MallariNo ratings yet

- Verification and Certification SampleDocument1 pageVerification and Certification SamplealexredroseNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Release Waiver and Quitclaim: AME OF Mployee Osition ATE OFDocument2 pagesRelease Waiver and Quitclaim: AME OF Mployee Osition ATE OFEmil A. MolinaNo ratings yet

- Sec Cert (MTPP)Document2 pagesSec Cert (MTPP)jcgodinez1987No ratings yet

- Final Pay COE Demand LetterDocument2 pagesFinal Pay COE Demand LetterMartin SandersonNo ratings yet

- Letter For PCSD Re Issuance Vvof SEP Clearance - 2022 - 03 - 21Document4 pagesLetter For PCSD Re Issuance Vvof SEP Clearance - 2022 - 03 - 21Georjalyn Joy Quiachon (Jaja)No ratings yet

- Affidavit of Driver Other Than The Registered OwnerDocument1 pageAffidavit of Driver Other Than The Registered OwnerMitz FranciscoNo ratings yet

- Retainer AgreementDocument2 pagesRetainer AgreementJson Galvez100% (1)

- Sample Contract of LeaseDocument3 pagesSample Contract of LeaseRosalie Alvior AranggaNo ratings yet

- Is Foreign Equity Possible in The Philippine Book Publishing Industry?Document12 pagesIs Foreign Equity Possible in The Philippine Book Publishing Industry?Ed Sabalvoro MPANo ratings yet

- National Commission On Indigenous PeoplesDocument2 pagesNational Commission On Indigenous PeoplesReginald BuduhanNo ratings yet

- Leave Form TemplateDocument5 pagesLeave Form TemplateBill VillonNo ratings yet

- Motin For Execution. JavierDocument2 pagesMotin For Execution. JavieredcelquibenNo ratings yet

- Affidavit Occupancy-CambonggaDocument1 pageAffidavit Occupancy-CambonggaSheena ArakainNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Sample Problem Oblicon-1Document8 pagesSample Problem Oblicon-1mariannedriz22No ratings yet

- Itr Affidavit of LossDocument1 pageItr Affidavit of LossartNo ratings yet

- CommodatumDocument3 pagesCommodatumGuineaMaeEugarolfNo ratings yet

- TRAVEL RECORDS Form Revised PDFDocument2 pagesTRAVEL RECORDS Form Revised PDFMonNo ratings yet

- Demand Letter SampleDocument3 pagesDemand Letter Sampleken adamsNo ratings yet

- EODocument13 pagesEOAnonymous 1lYUUy5TNo ratings yet

- Undertaking AritanaDocument1 pageUndertaking AritanaLhess RamosNo ratings yet

- Letter of ConformityDocument1 pageLetter of ConformityAlfred FranciscoNo ratings yet

- AFFIDAVIT OF Two Disinterested PersomnDocument2 pagesAFFIDAVIT OF Two Disinterested PersomnWillnard LaoNo ratings yet

- Subscrition Contract TemplateDocument2 pagesSubscrition Contract Templateejay nielNo ratings yet

- Rule 10 - Admin Offenses and PenaltiesDocument44 pagesRule 10 - Admin Offenses and PenaltiesGeramer Vere DuratoNo ratings yet

- Ltom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentDocument2 pagesLtom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentMarivic EspiaNo ratings yet

- SC Decision On Party-ListDocument7 pagesSC Decision On Party-ListSunStar Philippine NewsNo ratings yet

- Checklist Aep PM-NCR-03-F 01-R 04Document1 pageChecklist Aep PM-NCR-03-F 01-R 04KAYE VIENNANo ratings yet

- Subic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationDocument1 pageSubic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationInquiry PVMNo ratings yet

- EDITED ALICE Motion Correction To Amend Final OrderDocument3 pagesEDITED ALICE Motion Correction To Amend Final OrderJenifer PaglinawanNo ratings yet

- Special Leave Benefit For Women Employees - GuidelinesDocument5 pagesSpecial Leave Benefit For Women Employees - GuidelinesMellie MorcozoNo ratings yet

- Promissory Note: Name of Lender Name of BorrowerDocument2 pagesPromissory Note: Name of Lender Name of BorrowerPatrick BacongalloNo ratings yet

- NCIP en Banc Resolution 145 S. 2009Document2 pagesNCIP en Banc Resolution 145 S. 2009Ernest Aton100% (1)

- Compromise Agreement Estimada MTCDocument4 pagesCompromise Agreement Estimada MTCHazel GavilangaNo ratings yet

- Spa Bir Tin Application S1Document3 pagesSpa Bir Tin Application S1Meralu PagueNo ratings yet

- Pacquiao v. MilabaoDocument26 pagesPacquiao v. Milabaoaudreydql5No ratings yet

- Erc Res. No. 9 (2020)Document52 pagesErc Res. No. 9 (2020)Raine Buenaventura-EleazarNo ratings yet

- Board Resolution - Windor Homes SubdDocument2 pagesBoard Resolution - Windor Homes SubdBobby VisitacionNo ratings yet

- Actreg 3 Batas Pambansa Bilang 22 (Bouncing Checks Law)Document16 pagesActreg 3 Batas Pambansa Bilang 22 (Bouncing Checks Law)nuggsNo ratings yet

- Of Contracting The ObligationDocument3 pagesOf Contracting The ObligationAaron ViloriaNo ratings yet

- Motion For Leave of Court To Take Deposition of WitnessDocument3 pagesMotion For Leave of Court To Take Deposition of WitnessConcepcion Cejano100% (1)

- Motion For Leave To Fule Amended ComplaintDocument3 pagesMotion For Leave To Fule Amended ComplaintConcepcion CejanoNo ratings yet

- Marital Guide QuestionsDocument1 pageMarital Guide QuestionsConcepcion CejanoNo ratings yet

- Supplemental Judicial AffidavitDocument4 pagesSupplemental Judicial AffidavitConcepcion CejanoNo ratings yet

- Motion For Leave To Serve Summons by PublicationDocument3 pagesMotion For Leave To Serve Summons by PublicationConcepcion CejanoNo ratings yet

- Motion To Investigate Collusion and Chnage of AddressDocument3 pagesMotion To Investigate Collusion and Chnage of AddressConcepcion CejanoNo ratings yet

- Municipal Circuit Trial CourtDocument2 pagesMunicipal Circuit Trial CourtConcepcion CejanoNo ratings yet

- Notice of Submission and ManifestationDocument3 pagesNotice of Submission and ManifestationConcepcion CejanoNo ratings yet

- Motion To Dismiss Based On Demurrer To EvidenceDocument5 pagesMotion To Dismiss Based On Demurrer To EvidenceConcepcion CejanoNo ratings yet

- Motion To Quash Unjust VexationDocument14 pagesMotion To Quash Unjust VexationConcepcion CejanoNo ratings yet

- Motion To Quash InformationDocument7 pagesMotion To Quash InformationConcepcion CejanoNo ratings yet

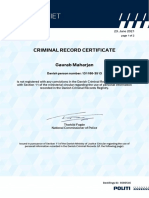

- Criminal Record Certificate: Gaurab MaharjanDocument2 pagesCriminal Record Certificate: Gaurab MaharjanGaurab MaharjanNo ratings yet

- USA V Therese Borgerding (Affidavit)Document9 pagesUSA V Therese Borgerding (Affidavit)File 411No ratings yet

- Romblon State University Institute of Criminal Justice EducationDocument4 pagesRomblon State University Institute of Criminal Justice EducationdominiqueNo ratings yet

- MurderDocument6 pagesMurderROHAN JOHNSONNo ratings yet

- People Vs CA and Eladio Tangan G.R. No. 103613 - 105830, 352 Scra 599 PDFDocument9 pagesPeople Vs CA and Eladio Tangan G.R. No. 103613 - 105830, 352 Scra 599 PDFjharen lladaNo ratings yet

- Definition of TDocument23 pagesDefinition of TA BermudezNo ratings yet

- SPL DigestsDocument29 pagesSPL DigestsDeeej cartalNo ratings yet

- Aim High TB2 Answer KeyDocument7 pagesAim High TB2 Answer KeygunelNo ratings yet

- Crim Law OutlineDocument73 pagesCrim Law OutlineStephanie HaroNo ratings yet

- We Should All Be FeministDocument14 pagesWe Should All Be FeministASPIRANT CSSNo ratings yet

- Mukesh AoreDocument188 pagesMukesh AorekpandiyarajanNo ratings yet

- 9781542034296Document274 pages9781542034296allisonfranke92No ratings yet

- People vs. EscarlosDocument2 pagesPeople vs. EscarlosKate VanessaNo ratings yet

- Baldur's Gate The Struggles of StelmaneDocument18 pagesBaldur's Gate The Struggles of StelmaneVitor Hugo100% (1)

- Life sb5 U09 WordlistDocument8 pagesLife sb5 U09 WordlistKarime PadillaNo ratings yet

- Chapter 6 SOCIOLOGICAL THEORIS OF CRIME CAUSATIONDocument8 pagesChapter 6 SOCIOLOGICAL THEORIS OF CRIME CAUSATIONPauline GalanNo ratings yet

- Gangstalking - 07-05-2023 Aggregate of My Posts From The Past WeekDocument15 pagesGangstalking - 07-05-2023 Aggregate of My Posts From The Past WeekEmmanuel Isaiah Smith100% (1)

- RulebookDocument18 pagesRulebookCarlos ViamonteNo ratings yet

- Supreme Court: Hipolito Magsalin, For Appellants. Office of The Solicitor-General Araneta, For AppelleeDocument2 pagesSupreme Court: Hipolito Magsalin, For Appellants. Office of The Solicitor-General Araneta, For AppelleeAlvin GULOYNo ratings yet

- Notes LEA 2.3Document41 pagesNotes LEA 2.3JabbarNo ratings yet

- G.R. No. L-2043 - People vs. Carillo 85 Phil. 611 635Document8 pagesG.R. No. L-2043 - People vs. Carillo 85 Phil. 611 635HugeNo ratings yet

- Background Verification Form (BVF) : Personal InformationDocument2 pagesBackground Verification Form (BVF) : Personal InformationMarshall0% (1)

- 24 Go Vs CADocument2 pages24 Go Vs CAKLNo ratings yet

- CybercrimeDocument3 pagesCybercrimeAzucena Ramírez SaavedraNo ratings yet

- Non-Correctional AdministrationDocument8 pagesNon-Correctional AdministrationCatherine AcedoNo ratings yet

- Criminal Law Ii Digests Compilation 2020Document108 pagesCriminal Law Ii Digests Compilation 2020dnzrck100% (4)

- Crimes and Criminals: MurderDocument1 pageCrimes and Criminals: MurderJorge Zambrano Goyeneche100% (1)

Timeliness of Filing BP 22 Cases

Timeliness of Filing BP 22 Cases

Uploaded by

Concepcion Cejano0 ratings0% found this document useful (0 votes)

106 views2 pagesThis document outlines the timeliness requirements and elements of a crime for filing a BP 22 case in the Philippines. A BP 22 case involves issuing a check that is subsequently dishonored by the drawee bank within 90 days of presentment due to insufficient funds or a closed/stopped account. The drawer must receive notice of dishonor, usually via registered mail, and fail to pay within 5 days of receiving notice. To be guilty of a BP 22 crime, the drawer must have issued the check knowing there were insufficient funds and the bank dishonored it for the stated reasons.

Original Description:

Original Title

Timeliness of filing BP 22 cases

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the timeliness requirements and elements of a crime for filing a BP 22 case in the Philippines. A BP 22 case involves issuing a check that is subsequently dishonored by the drawee bank within 90 days of presentment due to insufficient funds or a closed/stopped account. The drawer must receive notice of dishonor, usually via registered mail, and fail to pay within 5 days of receiving notice. To be guilty of a BP 22 crime, the drawer must have issued the check knowing there were insufficient funds and the bank dishonored it for the stated reasons.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

106 views2 pagesTimeliness of Filing BP 22 Cases

Timeliness of Filing BP 22 Cases

Uploaded by

Concepcion CejanoThis document outlines the timeliness requirements and elements of a crime for filing a BP 22 case in the Philippines. A BP 22 case involves issuing a check that is subsequently dishonored by the drawee bank within 90 days of presentment due to insufficient funds or a closed/stopped account. The drawer must receive notice of dishonor, usually via registered mail, and fail to pay within 5 days of receiving notice. To be guilty of a BP 22 crime, the drawer must have issued the check knowing there were insufficient funds and the bank dishonored it for the stated reasons.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Timeliness of filing BP 22 cases:

1. When the check is presented for payment, and within 90 days from date of

presentment was subsequently dishonored by the drawee bank for reason of DAIF

(Drawn Against Insufficient Fund) or Account Closed or Stop Payment for no

valid reason;

2. Notice of Dishonor should be provided to the Drawer; can be in the form of a

demand letter showing a copy of the dishonored check/s, and must be received by

the drawer or the signatory of the check;

3. Despite receipt of notice of dishonor, failed to pay the amount of the check or

make arrangement for full payment of the same within five (5) banking days after

receiving said notice.

ELEMENTS OF THE CRIME/VIOLATION OF BP22:

1. The person draws or issues any check for account or for value;

2. He has knowledge at the time of issue, that he does not have sufficient funds with

the drawee bank; and

3. Drawee bank dishonors the check due to DAIF or account closed or stop payment

for no valid reason.

- There is presumption of knowledge if the check is dishonored within 90 days

from the date of the check;

- There is also presumption of knowledge of insufficiency of funds, if drawer

fails to pay within five (5) days from the receipt of notice of dishonor.

- The Notice of Dishonor can be sent either by registered mail or personal

service.

- If by registered mail, the ff are the requisites:

a. Registry /receipt;

b. Registry return card, which should be signed legibly by the drawer;

c. Affidavit executed by the person who mailed the notice of dishonor

detailing the circumstances of the mailing of the same.

BP 22 cases applies even in cases where dishonored checks are issued merely in

the form of a guarantee. The gravamen of the offense is the mere issuance of the

bouncing check regardless of the purpose why it was issued.

BP 22 cases are categorized as transitory or continuing crimes; thus, it can be

filed in any place where any of the elements of the offense occurred or where the

check is/was drawn, issued, delivered or dishonored.

The Complaint must be filed within four (4) years from dishonor, before the

office of the Public Prosecutor, and if there is probable cause, it is filed in the

MTC/MCTC.

Imprisonment for at least 30 days or a fine of at least double the amount of the

check but not to exceed 200K

If acquitted due to insufficiency of evidence, may still be held civilly liable

because civil liability is not automatically extinguished upon dismissal of the case

on the ground of failure to establish guilt beyond reasonable doubt.

Can be held liable for Estafa under Art. 315, 2-d, under deceit or fraud;

presumption of deceit exist upon proof that the drawer of the check failed to

deposit the amount within three (3) days from notice of dishonor.

You might also like

- Miami-Dade County Clerk Criminal JusticeDocument1 pageMiami-Dade County Clerk Criminal Justicem j100% (2)

- Pakyaw Contract Agreement 2021 1Document1 pagePakyaw Contract Agreement 2021 1MC MirandaNo ratings yet

- Declaration of Actual Use FormDocument1 pageDeclaration of Actual Use FormCari Mangalindan MacaalayNo ratings yet

- Unit Two (Land Reform in The Philippines) : (Public Act 4054)Document6 pagesUnit Two (Land Reform in The Philippines) : (Public Act 4054)JamesBuensalidoDellavaNo ratings yet

- Compromise Agreement Re Compromise AgreementDocument3 pagesCompromise Agreement Re Compromise AgreementKathleen CastroNo ratings yet

- Equitable Mortgage - No Criminal Liability and Sub MeterDocument3 pagesEquitable Mortgage - No Criminal Liability and Sub Meterjohn kristoffer cananesNo ratings yet

- Sec Green Lane FormDocument8 pagesSec Green Lane FormZena E. SugatainNo ratings yet

- MCF 21.4 Motion To Quash SubpoenaDocument2 pagesMCF 21.4 Motion To Quash SubpoenapolbisenteNo ratings yet

- Tax Treaty Forms 0901 SeriesDocument16 pagesTax Treaty Forms 0901 SeriesgoldagigiNo ratings yet

- BSP Memorandum No. M 2018 017Document12 pagesBSP Memorandum No. M 2018 017Maya Julieta Catacutan-Estabillo100% (1)

- Criminological Research 2Document3 pagesCriminological Research 2mark patalinghugNo ratings yet

- People V AbellaDocument2 pagesPeople V AbellaChupsNo ratings yet

- BIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed CorporationDocument4 pagesBIR Ruling No. 010-02 - 30 Day Period For Filing of Short Period Return by Absorbed Corporationliz kawiNo ratings yet

- 2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFDocument191 pages2017 REVISED PASIG REVENUE CODE-min202019 - 05745 PDFRamon PamosoNo ratings yet

- Baneko Ne: Serurrel PilipinasDocument16 pagesBaneko Ne: Serurrel PilipinasEselito C. RuizNo ratings yet

- Spa Lto San IsidroDocument2 pagesSpa Lto San IsidroBar2012No ratings yet

- BSP Guideline On Registration-Of-Foreign-InvestmentsDocument6 pagesBSP Guideline On Registration-Of-Foreign-InvestmentsmtscoNo ratings yet

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- NFCC Computation 2Document1 pageNFCC Computation 2Claudio OlaritaNo ratings yet

- Rmo 07-06Document9 pagesRmo 07-06Printet08No ratings yet

- Grave Threats - Aguilar vs. ZamucoDocument4 pagesGrave Threats - Aguilar vs. ZamucoIzobelle PulgoNo ratings yet

- G.R. No. 226590, April 23, 2018 Shirley T. Lim, Mary T. Limleon and Jimmy T. Lim, Petitioners, V. People of THE PHILIPPINES, Respondent. DecisionDocument4 pagesG.R. No. 226590, April 23, 2018 Shirley T. Lim, Mary T. Limleon and Jimmy T. Lim, Petitioners, V. People of THE PHILIPPINES, Respondent. DecisionVanessa MallariNo ratings yet

- Verification and Certification SampleDocument1 pageVerification and Certification SamplealexredroseNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Release Waiver and Quitclaim: AME OF Mployee Osition ATE OFDocument2 pagesRelease Waiver and Quitclaim: AME OF Mployee Osition ATE OFEmil A. MolinaNo ratings yet

- Sec Cert (MTPP)Document2 pagesSec Cert (MTPP)jcgodinez1987No ratings yet

- Final Pay COE Demand LetterDocument2 pagesFinal Pay COE Demand LetterMartin SandersonNo ratings yet

- Letter For PCSD Re Issuance Vvof SEP Clearance - 2022 - 03 - 21Document4 pagesLetter For PCSD Re Issuance Vvof SEP Clearance - 2022 - 03 - 21Georjalyn Joy Quiachon (Jaja)No ratings yet

- Affidavit of Driver Other Than The Registered OwnerDocument1 pageAffidavit of Driver Other Than The Registered OwnerMitz FranciscoNo ratings yet

- Retainer AgreementDocument2 pagesRetainer AgreementJson Galvez100% (1)

- Sample Contract of LeaseDocument3 pagesSample Contract of LeaseRosalie Alvior AranggaNo ratings yet

- Is Foreign Equity Possible in The Philippine Book Publishing Industry?Document12 pagesIs Foreign Equity Possible in The Philippine Book Publishing Industry?Ed Sabalvoro MPANo ratings yet

- National Commission On Indigenous PeoplesDocument2 pagesNational Commission On Indigenous PeoplesReginald BuduhanNo ratings yet

- Leave Form TemplateDocument5 pagesLeave Form TemplateBill VillonNo ratings yet

- Motin For Execution. JavierDocument2 pagesMotin For Execution. JavieredcelquibenNo ratings yet

- Affidavit Occupancy-CambonggaDocument1 pageAffidavit Occupancy-CambonggaSheena ArakainNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Sample Problem Oblicon-1Document8 pagesSample Problem Oblicon-1mariannedriz22No ratings yet

- Itr Affidavit of LossDocument1 pageItr Affidavit of LossartNo ratings yet

- CommodatumDocument3 pagesCommodatumGuineaMaeEugarolfNo ratings yet

- TRAVEL RECORDS Form Revised PDFDocument2 pagesTRAVEL RECORDS Form Revised PDFMonNo ratings yet

- Demand Letter SampleDocument3 pagesDemand Letter Sampleken adamsNo ratings yet

- EODocument13 pagesEOAnonymous 1lYUUy5TNo ratings yet

- Undertaking AritanaDocument1 pageUndertaking AritanaLhess RamosNo ratings yet

- Letter of ConformityDocument1 pageLetter of ConformityAlfred FranciscoNo ratings yet

- AFFIDAVIT OF Two Disinterested PersomnDocument2 pagesAFFIDAVIT OF Two Disinterested PersomnWillnard LaoNo ratings yet

- Subscrition Contract TemplateDocument2 pagesSubscrition Contract Templateejay nielNo ratings yet

- Rule 10 - Admin Offenses and PenaltiesDocument44 pagesRule 10 - Admin Offenses and PenaltiesGeramer Vere DuratoNo ratings yet

- Ltom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentDocument2 pagesLtom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentMarivic EspiaNo ratings yet

- SC Decision On Party-ListDocument7 pagesSC Decision On Party-ListSunStar Philippine NewsNo ratings yet

- Checklist Aep PM-NCR-03-F 01-R 04Document1 pageChecklist Aep PM-NCR-03-F 01-R 04KAYE VIENNANo ratings yet

- Subic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationDocument1 pageSubic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationInquiry PVMNo ratings yet

- EDITED ALICE Motion Correction To Amend Final OrderDocument3 pagesEDITED ALICE Motion Correction To Amend Final OrderJenifer PaglinawanNo ratings yet

- Special Leave Benefit For Women Employees - GuidelinesDocument5 pagesSpecial Leave Benefit For Women Employees - GuidelinesMellie MorcozoNo ratings yet

- Promissory Note: Name of Lender Name of BorrowerDocument2 pagesPromissory Note: Name of Lender Name of BorrowerPatrick BacongalloNo ratings yet

- NCIP en Banc Resolution 145 S. 2009Document2 pagesNCIP en Banc Resolution 145 S. 2009Ernest Aton100% (1)

- Compromise Agreement Estimada MTCDocument4 pagesCompromise Agreement Estimada MTCHazel GavilangaNo ratings yet

- Spa Bir Tin Application S1Document3 pagesSpa Bir Tin Application S1Meralu PagueNo ratings yet

- Pacquiao v. MilabaoDocument26 pagesPacquiao v. Milabaoaudreydql5No ratings yet

- Erc Res. No. 9 (2020)Document52 pagesErc Res. No. 9 (2020)Raine Buenaventura-EleazarNo ratings yet

- Board Resolution - Windor Homes SubdDocument2 pagesBoard Resolution - Windor Homes SubdBobby VisitacionNo ratings yet

- Actreg 3 Batas Pambansa Bilang 22 (Bouncing Checks Law)Document16 pagesActreg 3 Batas Pambansa Bilang 22 (Bouncing Checks Law)nuggsNo ratings yet

- Of Contracting The ObligationDocument3 pagesOf Contracting The ObligationAaron ViloriaNo ratings yet

- Motion For Leave of Court To Take Deposition of WitnessDocument3 pagesMotion For Leave of Court To Take Deposition of WitnessConcepcion Cejano100% (1)

- Motion For Leave To Fule Amended ComplaintDocument3 pagesMotion For Leave To Fule Amended ComplaintConcepcion CejanoNo ratings yet

- Marital Guide QuestionsDocument1 pageMarital Guide QuestionsConcepcion CejanoNo ratings yet

- Supplemental Judicial AffidavitDocument4 pagesSupplemental Judicial AffidavitConcepcion CejanoNo ratings yet

- Motion For Leave To Serve Summons by PublicationDocument3 pagesMotion For Leave To Serve Summons by PublicationConcepcion CejanoNo ratings yet

- Motion To Investigate Collusion and Chnage of AddressDocument3 pagesMotion To Investigate Collusion and Chnage of AddressConcepcion CejanoNo ratings yet

- Municipal Circuit Trial CourtDocument2 pagesMunicipal Circuit Trial CourtConcepcion CejanoNo ratings yet

- Notice of Submission and ManifestationDocument3 pagesNotice of Submission and ManifestationConcepcion CejanoNo ratings yet

- Motion To Dismiss Based On Demurrer To EvidenceDocument5 pagesMotion To Dismiss Based On Demurrer To EvidenceConcepcion CejanoNo ratings yet

- Motion To Quash Unjust VexationDocument14 pagesMotion To Quash Unjust VexationConcepcion CejanoNo ratings yet

- Motion To Quash InformationDocument7 pagesMotion To Quash InformationConcepcion CejanoNo ratings yet

- Criminal Record Certificate: Gaurab MaharjanDocument2 pagesCriminal Record Certificate: Gaurab MaharjanGaurab MaharjanNo ratings yet

- USA V Therese Borgerding (Affidavit)Document9 pagesUSA V Therese Borgerding (Affidavit)File 411No ratings yet

- Romblon State University Institute of Criminal Justice EducationDocument4 pagesRomblon State University Institute of Criminal Justice EducationdominiqueNo ratings yet

- MurderDocument6 pagesMurderROHAN JOHNSONNo ratings yet

- People Vs CA and Eladio Tangan G.R. No. 103613 - 105830, 352 Scra 599 PDFDocument9 pagesPeople Vs CA and Eladio Tangan G.R. No. 103613 - 105830, 352 Scra 599 PDFjharen lladaNo ratings yet

- Definition of TDocument23 pagesDefinition of TA BermudezNo ratings yet

- SPL DigestsDocument29 pagesSPL DigestsDeeej cartalNo ratings yet

- Aim High TB2 Answer KeyDocument7 pagesAim High TB2 Answer KeygunelNo ratings yet

- Crim Law OutlineDocument73 pagesCrim Law OutlineStephanie HaroNo ratings yet

- We Should All Be FeministDocument14 pagesWe Should All Be FeministASPIRANT CSSNo ratings yet

- Mukesh AoreDocument188 pagesMukesh AorekpandiyarajanNo ratings yet

- 9781542034296Document274 pages9781542034296allisonfranke92No ratings yet

- People vs. EscarlosDocument2 pagesPeople vs. EscarlosKate VanessaNo ratings yet

- Baldur's Gate The Struggles of StelmaneDocument18 pagesBaldur's Gate The Struggles of StelmaneVitor Hugo100% (1)

- Life sb5 U09 WordlistDocument8 pagesLife sb5 U09 WordlistKarime PadillaNo ratings yet

- Chapter 6 SOCIOLOGICAL THEORIS OF CRIME CAUSATIONDocument8 pagesChapter 6 SOCIOLOGICAL THEORIS OF CRIME CAUSATIONPauline GalanNo ratings yet

- Gangstalking - 07-05-2023 Aggregate of My Posts From The Past WeekDocument15 pagesGangstalking - 07-05-2023 Aggregate of My Posts From The Past WeekEmmanuel Isaiah Smith100% (1)

- RulebookDocument18 pagesRulebookCarlos ViamonteNo ratings yet

- Supreme Court: Hipolito Magsalin, For Appellants. Office of The Solicitor-General Araneta, For AppelleeDocument2 pagesSupreme Court: Hipolito Magsalin, For Appellants. Office of The Solicitor-General Araneta, For AppelleeAlvin GULOYNo ratings yet

- Notes LEA 2.3Document41 pagesNotes LEA 2.3JabbarNo ratings yet

- G.R. No. L-2043 - People vs. Carillo 85 Phil. 611 635Document8 pagesG.R. No. L-2043 - People vs. Carillo 85 Phil. 611 635HugeNo ratings yet

- Background Verification Form (BVF) : Personal InformationDocument2 pagesBackground Verification Form (BVF) : Personal InformationMarshall0% (1)

- 24 Go Vs CADocument2 pages24 Go Vs CAKLNo ratings yet

- CybercrimeDocument3 pagesCybercrimeAzucena Ramírez SaavedraNo ratings yet

- Non-Correctional AdministrationDocument8 pagesNon-Correctional AdministrationCatherine AcedoNo ratings yet

- Criminal Law Ii Digests Compilation 2020Document108 pagesCriminal Law Ii Digests Compilation 2020dnzrck100% (4)

- Crimes and Criminals: MurderDocument1 pageCrimes and Criminals: MurderJorge Zambrano Goyeneche100% (1)