Professional Documents

Culture Documents

Anf 5B

Anf 5B

Uploaded by

Akash KediaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anf 5B

Anf 5B

Uploaded by

Akash KediaCopyright:

Available Formats

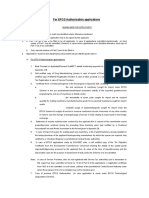

ANF- 5B

Application Form for Redemption of EPCG Authorization /Issuance of Post Export EPCG Duty

Credit Scrip)

(Please see the guidelines before filing the application)

1. Applicant Details

a. IEC Number Branch Code

b. Name

c. Address

2. EPCG Authorization No. and Date Duty Saved Amount Duty Saved Amount utilized

allowed

(including indigenously procured CG)

3. Installation Certificate No. and Date

4. Export Product Details

a. Export product/services allowed as per the EPCG

Authorization

b. Alternate Product/Services (if permitted) name & ITC(HS) code

5. Export Obligation Period

a. Date of expiry of initial EOP

b. Extended EOP date

c. Actual EO completion date

6. Average Export Obligation imposed* EO as per actual duty saved amount

In Indian Rs. In Indian Rs. In US$

* In case of fulfilment of EO by alternate product, Average EO of alternate product should also be given.

7. Details of Physical Exports/Deemed Exports made/Services rendered for fulfilment of specific EO

Sl. Products Details of FOB (in FFE)/FOR value

No. Exported/ Shipping

Supplied/Servic Bill/Voucher/Inv

es Rendered oice/CT3/ARE3/

with ITC(HS) Lorry Receipt/

Code Railway Receipt

etc.

Same No. Date Direct Third Deemed By Group Other Total

Product/Services Exports Party Exports Company (R&D

Exports Services/

-------------------- Royalty)

Alternative

Product/Services

8. I/We further declare that I/we have made exports as under for maintenance of Average Export Obligation:

Financial Year Average to be maintained Average maintained

Declaration/Undertaking

I/We hereby declare/certify that:

1. I/We have updated my/our profile in ANF -1.

2. The particulars and the statements made in this application are true and correct to the best of my/our

knowledge and belief and nothing has been concealed or withheld therefrom. If anything is found incorrect

or false it will render me/us liable for any penal action or other consequences as may be prescribed in law

or otherwise warranted.

3. None of the Partners(s)/Director(s)/ Trustee/ Karta/ Proprietor of the firm/company has come under the

adverse notice of DGFT or is in the caution list of RBI.

4. None of the Partners(s)/Director(s)/ Trustee/ Karta/ Proprietor of the firm/company, as the case may be,

is/are a Proprietor/Partner/Director/Karta/Trustee in any other firm/Company which has come under the

adverse notice of DGFT or is in the caution list of RBI, to the best of my knowledge.

5. Neither the Registered Office of the company /Head Office of the firm nor any of its Branch

Office(s)/Unit(s)/Division(s) has been declared a defaulter or has otherwise been made ineligible for

undertaking import/export under any of the provisions of the Policy.

6. I/we have not exported items on the SCOMET list for which permission has not been taken.

7. I am authorized to verify and sign this declaration as per Paragraph 9.06 of the Foreign Trade Policy.

Place Signature of the Applicant

Date Name

Designation

Official Address

Telephone/Mobile

Residential Address

Email-id

8. All physical exports made as shown in item No. 7 and 8 above are in freely convertible currency.

(Signature with Seal of the Chartered Accountant / Cost Accountant / Company Secretary)

Guidelines for Applicants

1. Application must be accompanied by the certificate in Appendix 5C duly signed by Chartered Accountant /

Cost Accountant / Company Secretary.

You might also like

- NUR 205-Week 5 Pre Class Assignment WI 21Document6 pagesNUR 205-Week 5 Pre Class Assignment WI 21Oliver Namyalo100% (3)

- Project Report in JSWDocument44 pagesProject Report in JSWmohd arif khan73% (15)

- ZTE H298A Admin ManualDocument19 pagesZTE H298A Admin Manualjosefm665699No ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- Sub Section VIDocument9 pagesSub Section VIdvnambNo ratings yet

- Anf 4fDocument4 pagesAnf 4fAjaiKumarNo ratings yet

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Document4 pagesANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88No ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- Application Form For Import Certificate Under IndoDocument4 pagesApplication Form For Import Certificate Under Indoakashaggarwal88No ratings yet

- Anf 1BDocument11 pagesAnf 1Bdkhatri01No ratings yet

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghNo ratings yet

- EPCG License RequirementsDocument14 pagesEPCG License RequirementsAmit AshishNo ratings yet

- Anf 2CDocument3 pagesAnf 2CBaljeet SinghNo ratings yet

- Application Form For Export of SCOMET ItemsDocument4 pagesApplication Form For Export of SCOMET Itemsakashaggarwal88No ratings yet

- Application For Duty Free Import Authorisation (DFIADocument9 pagesApplication For Duty Free Import Authorisation (DFIAakashaggarwal88No ratings yet

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- Application For Redemption / No Bond CertificateDocument4 pagesApplication For Redemption / No Bond Certificateakashaggarwal88100% (1)

- Export LicenseDocument3 pagesExport LicenseRoshaniNo ratings yet

- Application Form For Advance Authorisation (Including AdvanceDocument6 pagesApplication Form For Advance Authorisation (Including Advanceakashaggarwal88No ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- Application Form For End User Certificate UnderDocument4 pagesApplication Form For End User Certificate Underakashaggarwal88No ratings yet

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocument3 pagesForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNo ratings yet

- Licenta de ExportDocument6 pagesLicenta de Exportyonu7No ratings yet

- Direct Import Payment - RL 01.04.2016Document3 pagesDirect Import Payment - RL 01.04.2016Prakash PandeyNo ratings yet

- Aayat Niryat FormsDocument175 pagesAayat Niryat FormsSenthil MuruganNo ratings yet

- ANF 2G - NewDocument3 pagesANF 2G - Newdkhatri01No ratings yet

- Aayat Niryat FormsDocument179 pagesAayat Niryat FormsankitNo ratings yet

- Anf 1 Andanf 2 ADocument10 pagesAnf 1 Andanf 2 Atasneem89No ratings yet

- Anf 1aDocument3 pagesAnf 1adkhatri01No ratings yet

- ANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPDocument4 pagesANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPUtkarsh KhandelwalNo ratings yet

- 0993 HL AssociatesDocument5 pages0993 HL AssociatesYakshit JainNo ratings yet

- Application For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationDocument3 pagesApplication For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationPrashantNo ratings yet

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssuesrinivasNo ratings yet

- Impex DocumentsDocument32 pagesImpex DocumentsjananiNo ratings yet

- Advance Authorization SchemeDocument7 pagesAdvance Authorization SchemeJohn AnandNo ratings yet

- Circular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarDocument9 pagesCircular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarMarlinNo ratings yet

- Name: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessDocument6 pagesName: Golingan, Christian Jay R. Couse: BSBA 701 International Trade and BusinessChristian Jay GolinganNo ratings yet

- Appendix-6E Form of Legal Agreement For Eou/Ehtp/Stp/BtpDocument12 pagesAppendix-6E Form of Legal Agreement For Eou/Ehtp/Stp/BtpNITINNo ratings yet

- 0929 I P ElectronicsDocument5 pages0929 I P ElectronicsYakshit JainNo ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Nandish EthirajNo ratings yet

- ANF 3B Application For Served From IndiaDocument4 pagesANF 3B Application For Served From Indiaakashaggarwal88No ratings yet

- Handouts Basic Requirements For Registering Sole ProprietorDocument7 pagesHandouts Basic Requirements For Registering Sole ProprietorAinne Tan100% (1)

- Guidelines and Registration Form Local Vendor Post Contract Award Products or Services L2Document5 pagesGuidelines and Registration Form Local Vendor Post Contract Award Products or Services L2anitalee0705No ratings yet

- Export DocumentsDocument28 pagesExport DocumentsAmit PatelNo ratings yet

- CAPPFDR270315Document9 pagesCAPPFDR270315tharunsathyaNo ratings yet

- Pharmexcil Pharmaceutical Export Promotion Council (Set Up by Ministry of Commerce & Industry, Govt., of India)Document6 pagesPharmexcil Pharmaceutical Export Promotion Council (Set Up by Ministry of Commerce & Industry, Govt., of India)Neha ThakkarNo ratings yet

- App. Form SPRS Form 3.8.2018-1Document20 pagesApp. Form SPRS Form 3.8.2018-1Harshit BaheriaNo ratings yet

- Checklist For Partnership ConcernDocument9 pagesChecklist For Partnership Concernm3788999No ratings yet

- X Checklist - IECDocument4 pagesX Checklist - IECadministratorNo ratings yet

- Procedure For Claiming of Shares From IEPFDocument5 pagesProcedure For Claiming of Shares From IEPF15986No ratings yet

- Checklist - Listing - of - CP-BSE (26 Nov 2019)Document5 pagesChecklist - Listing - of - CP-BSE (26 Nov 2019)HimanshiNo ratings yet

- Cmo 3-2015Document33 pagesCmo 3-2015Angel FerreraNo ratings yet

- Meity - Approved Exemption Application Format-RevisedDocument8 pagesMeity - Approved Exemption Application Format-Revisedsantosh sanasNo ratings yet

- GOODDDDocument12 pagesGOODDDPeeyush JainNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- BPCL Documents To Be UploadedDocument2 pagesBPCL Documents To Be UploadedinfoNo ratings yet

- FC GPRDocument15 pagesFC GPRAnant MishraNo ratings yet

- A Synopsis ON Study of Working of Foreign Exchange Market: Submitted By: Anant ChhajedDocument6 pagesA Synopsis ON Study of Working of Foreign Exchange Market: Submitted By: Anant ChhajedAnant ChhajedNo ratings yet

- Provisional Work Permit (PWP)Document1 pageProvisional Work Permit (PWP)Enika GarciaNo ratings yet

- Guidelines and Renewal Form Local Vendor R2Document4 pagesGuidelines and Renewal Form Local Vendor R2rajkiran_bNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Traditional Picnic Table: Step by Step InstructionsDocument3 pagesTraditional Picnic Table: Step by Step InstructionsMarco SilvaNo ratings yet

- 28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Document38 pages28/08/2016 1 Advanced Research Methodology... RU, Bangalore-64Ananthesh RaoNo ratings yet

- Reserach With QuestionnaireDocument54 pagesReserach With QuestionnaireMichell Ann AlvarezNo ratings yet

- Mohammed Ismail Borkar CVDocument3 pagesMohammed Ismail Borkar CVgourav GuptaNo ratings yet

- Pava 8191255 40Document2 pagesPava 8191255 40Ximena Gabriela Sotomayor-VelasquezNo ratings yet

- Order Crossover (OX) : Proposed by DavisDocument5 pagesOrder Crossover (OX) : Proposed by DavisOlivia brianneNo ratings yet

- Definition of InsuranceDocument6 pagesDefinition of InsuranceHARSH KUMARNo ratings yet

- Chapter 7: Mood Disorders and SuicideDocument41 pagesChapter 7: Mood Disorders and SuicideEsraRamosNo ratings yet

- Susy BrownDocument11 pagesSusy BrownAye Chan MoeNo ratings yet

- Practice Set in Inorganic ChemistryDocument3 pagesPractice Set in Inorganic ChemistryKalachuchiNo ratings yet

- The Scottish Country Dance BookDocument40 pagesThe Scottish Country Dance BookRory Corbett100% (1)

- The Effect of Social Verbal Physical and Cyberbullying Victimization On Academic PerformanceDocument22 pagesThe Effect of Social Verbal Physical and Cyberbullying Victimization On Academic PerformanceMark Dave Aborita MorcoNo ratings yet

- ER DiagramDocument49 pagesER DiagramsumipriyaaNo ratings yet

- Universal Grammar Approaches: in First Language AcquisitionDocument6 pagesUniversal Grammar Approaches: in First Language AcquisitionMark Vincent Z. PadillaNo ratings yet

- Chapter+4+Revision+notes - PDF ICT2621Document6 pagesChapter+4+Revision+notes - PDF ICT2621mmasalekNo ratings yet

- C. v. Raman - WikipediaDocument50 pagesC. v. Raman - Wikipedianagpalhiteshi132No ratings yet

- Exercises Past Simple To Be PDFDocument2 pagesExercises Past Simple To Be PDFGonzaloNo ratings yet

- CAPE Sociology Syllabus Pages DeletedDocument13 pagesCAPE Sociology Syllabus Pages DeletedDwayne ReidNo ratings yet

- Punjab State Power Corporation Limited. Be A Part of Punjab's Power Growth Recruitment For Assistant Lineman Against Cra 295/19Document2 pagesPunjab State Power Corporation Limited. Be A Part of Punjab's Power Growth Recruitment For Assistant Lineman Against Cra 295/19Amandeep SinghNo ratings yet

- Final For ReviewDocument39 pagesFinal For ReviewMichay CloradoNo ratings yet

- Political Economy of Uganda - Course OutlineDocument4 pagesPolitical Economy of Uganda - Course OutlineKISAKYE MOSESNo ratings yet

- Starting Up Notes (1-2-3-4) .Document2 pagesStarting Up Notes (1-2-3-4) .JHIMY PAREDESNo ratings yet

- Work-Life Balance Crafting During COVID-19Document21 pagesWork-Life Balance Crafting During COVID-19Sílvia PereiraNo ratings yet

- Risk Management in The Outdoors 1Document13 pagesRisk Management in The Outdoors 1api-278802103No ratings yet

- Tools and Techniques of Effective Second/Foreign Language TeachingDocument22 pagesTools and Techniques of Effective Second/Foreign Language TeachingalirioNo ratings yet

- Direction: Read The Following Statement Carefully. Encircle The Letter of The Correct AnswerDocument2 pagesDirection: Read The Following Statement Carefully. Encircle The Letter of The Correct AnswerKenji FujimaNo ratings yet

- Operating Systems: Chapter 3 - ProcessesDocument57 pagesOperating Systems: Chapter 3 - ProcessesM Fayez KhanNo ratings yet