Professional Documents

Culture Documents

House Property - Summary (PY 2020-21 AY 2021-22)

House Property - Summary (PY 2020-21 AY 2021-22)

Uploaded by

Aruna RajappaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

House Property - Summary (PY 2020-21 AY 2021-22)

House Property - Summary (PY 2020-21 AY 2021-22)

Uploaded by

Aruna RajappaCopyright:

Available Formats

4.

150 INCOME TAX LAW

LET US RECAPITULATE

Section Contents

22 Basis of Charge

The annual value of any property comprising of buildings or lands

appurtenant thereto, of which the assessee is the owner, is

chargeable to tax under the head “Income from house property”.

(i) Property should consist of any buildings or lands

appurtenant thereto

Income from letting out of vacant land is, however, taxable

under the head “Income from other sources” or “Profits and

gains from business or profession”, as the case may be.

(ii) Assessee must be the owner of the property

(iii) The property may be used for any purpose, but it should not

be used by the owner for the purpose of any business or

profession carried on by him, the profit of which is

chargeable to tax.

Further, the income earned by an assessee engaged in the

business of letting out of properties on rent would be taxable

as business income.

(iv) Property held as stock-in-trade etc.

Annual value of house property will be charged under the

head “Income from house property”, where it is held by the

assessee as stock-in-trade of a business also.

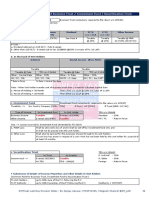

23(1) Annual Value of let-out property

Annual value is the amount arrived after deducting the municipal

taxes actually paid by the owner during the previous year from the

Gross Annual Value (GAV). The GAV of Let-out property would be

determined in the following manner:

© The Institute of Chartered Accountants of India

INCOME FROM HOUSE PROPERTY 4.151

Step 1: Compare fair rent with municipal value

whichever is higher

Step 2: Compare step 1 value with standard rent

whichever is lower is the Expected Rent

Compare the Expected rent determined

Step 3 above with actual rent

Actual rent > Actual rent <

Expected Rent Expected Rent

Actual rent < Actual rent <

Actual rent Expected Expected Rent

is GAV Rent because because of any

of vacancy other reason

Expected Rent

is GAV

23(2) Annual Value of self-occupied property

Where the property is self-occupied for own residence or unoccupied

throughout the previous year owing to his employment, business or

profession carried on at any other place and residing at that other

place in a building not belonging to him, its Annual Value will be Nil,

provided no other benefit is derived by the owner from such property.

An assessee can claim benefit of Nil Annual Value in respect of one or

two residential house properties self-occupied by him.

© The Institute of Chartered Accountants of India

4.152 INCOME TAX LAW

23(4) Annual Value of deemed to be let-out property

If more than two properties are so self-occupied/unoccupied, the

assessee may claim benefit of Nil annual value in respect of any two

properties at his option. The other property(s) would be deemed to

be let out, in respect of which Expected Rent would be the GAV.

23(5) Annual value where the property held as stock-in-trade etc.

Where property consisting of any buildings or lands appurtenant

thereto is held as stock-in-trade and the whole or any part of the

property is not let out during the whole or any part of the previous

year, the annual value of such property or part of the property for the

period upto 2 years from the end of the financial year in which

certificate of completion of construction of the property is obtained

from the competent authority shall be taken as “Nil”.

24 Deductions from Annual Value

1. 30% of Annual Value [Section 24(a)]

2. Interest on borrowed capital [Section 24(b)]: Interest payable on

loans borrowed for the purpose of acquisition, construction,

repairs, renewal or reconstruction can be claimed as deduction.

Pre-construction interest: Interest for the period prior to the

previous year in which property is acquired or construction is

completed.

Pre-construction interest is allowable as deduction in 5 equal

installments from the previous year of completion of construction or

acquisition.

(a) Let out property: Whole of the amount of interest on borrowed

capital payable during the previous year and apportioned pre-

construction interest without any ceiling limit would be allowed

as deduction.

(b) Self-occupied property:

(i) Loan taken on or after 1.4.99: Interest on loan taken for acquisition

or construction of house on or after 1.4.99, where such construction

is completed within 5 years from the end of the financial year in

which capital was borrowed, aggregate interest paid or payable for

one or two self-occupied properties subject to a maximum of

` 2,00,000 (including apportioned pre-construction interest).

© The Institute of Chartered Accountants of India

INCOME FROM HOUSE PROPERTY 4.153

(ii) Loan taken before 1.4.99: In case of loan for acquisition or

construction taken prior to 1.4.99 or loan taken for repair,

renovation or reconstruction at any point of time, aggregate

interest paid or payable for one or two self-occupied properties

subject to a maximum of ` 30,000 (including apportioned pre-

construction interest).

Note - Total amount of interest deduction under (i) and (i) in

respect of one or two self-occupied properties owned by the

assessee cannot exceed ` 2,00,000.

25 Inadmissible deductions

Interest chargeable under this Act which is payable outside India shall

not be deducted if –

(a) tax has not been paid or deducted from such interest and

(b) in respect of which there is no person in India who may be treated

as an agent

25A Taxability of recovery of unrealised rent & arrears of rent received

(i) Taxable in the year of receipt/ realisation

(ii) Deduction@30% of rent received/ realised

(iii) Taxable even if assessee is not the owner of the property in the

financial year of receipt/ realization

26 Co-owned property

(i) Self-occupied property: The annual value of the property of each

co-owner will be Nil and each co-owner shall be entitled to a

deduction of ` 30,000 / ` 2,00,000, as the case may be, on account

of interest on borrowed capital.

However, aggregate deduction of interest to each co-owner in

respect of co-owned self-occupied property and any other self-

occupied house property, if any, cannot exceed ` 30,000/

` 2,00,000, as the case may be.

(ii) Let-out property: The income from such property shall be

computed as if the property is owned by one owner and thereafter

the income so computed shall be apportioned amongst each co-

owner as per their specific share.

© The Institute of Chartered Accountants of India

4.154 INCOME TAX LAW

27 Deemed Ownership: The following persons, though not legal owners

of a property, are deemed to be the owners:

(i) Transferor of the property, where the property is transferred to

the spouse or to minor child except minor married daughter,

without adequate consideration

(ii) Holder of an impartible estate

(iii) Member of a co-operative society etc.

(iv) Person in possession of a property

(v) Person having right in a property for a period not less than 12

years

Other important points

(i) The Actual rent received/receivable should not include any amount of

rent which is not capable of being realized i.e., unrealized rent while

determining gross annual value in case let-out property, provided the

conditions specified in Rule 4 are satisfied.

Note - The income-tax returns, however, permit deduction of unrealized

rent from gross annual value. If this view is taken, the unrealized rent

should be deducted only after computing gross annual value.

(ii) If a portion of a property is let-out and a portion is self-occupied, then,

the income will be computed separately for let out and self occupied

portion.

© The Institute of Chartered Accountants of India

You might also like

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument35 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- 56465bos45796cp4u2 PDFDocument49 pages56465bos45796cp4u2 PDFNarendra VasavanNo ratings yet

- Unit - 2: Income From House Property: After Studying This Chapter, You Would Be Able ToDocument47 pagesUnit - 2: Income From House Property: After Studying This Chapter, You Would Be Able Toadityaraj purohitNo ratings yet

- 62289bos50449 Mod1 cp5Document41 pages62289bos50449 Mod1 cp5monicabhat96No ratings yet

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument40 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToManoj GNo ratings yet

- Heads of Income: Unit - 2: Income From House PropertyDocument40 pagesHeads of Income: Unit - 2: Income From House PropertyMaheswar SethiNo ratings yet

- Income From House Property: After Studying This Chapter, You Would Be Able ToDocument38 pagesIncome From House Property: After Studying This Chapter, You Would Be Able ToAnkitaNo ratings yet

- Income From HP PDFDocument14 pagesIncome From HP PDFNanda NanduNo ratings yet

- Chapter 5 Income From House PropertyDocument19 pagesChapter 5 Income From House PropertysagarNo ratings yet

- HP and PGBP PDFDocument106 pagesHP and PGBP PDFRavi YadavNo ratings yet

- Income From House PropertyDocument9 pagesIncome From House PropertySukritiNo ratings yet

- Chapter 5 Income From House Property PMDocument14 pagesChapter 5 Income From House Property PMMohammad Yusuf NabeelNo ratings yet

- Chapter 5Document9 pagesChapter 5CA Mohit SharmaNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument21 pagesIncome From House Property: Section/Rule Subject Matterphanidhar varanasiNo ratings yet

- Tax ProjectDocument12 pagesTax ProjectUtkarsh SinghNo ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Tax HandoutDocument6 pagesTax Handoutshekharsuhani5No ratings yet

- Income From House Property-6Document9 pagesIncome From House Property-6s4sahithNo ratings yet

- Study Note: 8 Income From House Property: 8.1 Basis of Charge (Section 22)Document19 pagesStudy Note: 8 Income From House Property: 8.1 Basis of Charge (Section 22)T.S.G RamaraoNo ratings yet

- Income From House PropertyDocument8 pagesIncome From House Propertysuruchiba2049No ratings yet

- Income From House PropertyDocument31 pagesIncome From House PropertyAarti SainiNo ratings yet

- Income From House Property: Chapter - 4 Unit - 3Document24 pagesIncome From House Property: Chapter - 4 Unit - 3srinidhivrNo ratings yet

- 07 Income From Property (50 59)Document11 pages07 Income From Property (50 59)jafferyasim100% (2)

- II. Income Under The House Properties :: Basis of Charge Section 22Document4 pagesII. Income Under The House Properties :: Basis of Charge Section 22Akash Singh RajputNo ratings yet

- A Case Study: House Property Under Income Tax, Wealth Tax and FEMADocument8 pagesA Case Study: House Property Under Income Tax, Wealth Tax and FEMAManoj Nikumbh MKNo ratings yet

- Short Notes of House PropertyDocument3 pagesShort Notes of House PropertyutsavNo ratings yet

- Income Tax: House PropertyDocument6 pagesIncome Tax: House PropertyAshika Khanna 1911165No ratings yet

- Chapter-4b Income From House Property PDFDocument6 pagesChapter-4b Income From House Property PDFBrinda RNo ratings yet

- Income From House Property 12th July 23Document39 pagesIncome From House Property 12th July 23Ashish KumarNo ratings yet

- S021 - Haroon Shaik DIT AssignmentDocument10 pagesS021 - Haroon Shaik DIT AssignmentHaroonNo ratings yet

- Income From House Property - ManishaDocument14 pagesIncome From House Property - ManishaManisha HirawatNo ratings yet

- ITA Ded On Personal Loan For PropertyDocument5 pagesITA Ded On Personal Loan For PropertyNsgNo ratings yet

- Income From House PropertyDocument23 pagesIncome From House PropertySahil14JNo ratings yet

- Income From House PropertyDocument15 pagesIncome From House PropertyMansi DabasNo ratings yet

- Income From House PropertyDocument7 pagesIncome From House PropertyDivya KakranNo ratings yet

- Income From House Propert Notes (Chapterof ICSI) PDFDocument28 pagesIncome From House Propert Notes (Chapterof ICSI) PDFSHIVAM AGRAHARINo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Income From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiDocument40 pagesIncome From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiRAKESH KUMAR GOUTAMNo ratings yet

- Ch. 6Document11 pagesCh. 6Ali nawazNo ratings yet

- House PropertyDocument7 pagesHouse Propertyatul.maurya0290No ratings yet

- Income From House PropertyDocument74 pagesIncome From House PropertyHarshit YNo ratings yet

- Final PPT of Income From House PropertyDocument33 pagesFinal PPT of Income From House PropertyAzhar Ali100% (1)

- Notes of Income From House PropertyDocument12 pagesNotes of Income From House PropertyKomal MenghaniNo ratings yet

- House Property-Income TaxDocument26 pagesHouse Property-Income TaxSwetaNo ratings yet

- Incomefromhouse Property JeevithaDocument22 pagesIncomefromhouse Property Jeevitharyanraj008No ratings yet

- House Property IncomeDocument4 pagesHouse Property IncomeOnkar BandichhodeNo ratings yet

- Computation of Income From House PropertDocument20 pagesComputation of Income From House PropertSIDDHART BHANSALINo ratings yet

- Income From House PropertyDocument6 pagesIncome From House Propertypardeep bainsNo ratings yet

- Income Form House Property2016Document11 pagesIncome Form House Property2016Antora HoqueNo ratings yet

- House Property NotesDocument38 pagesHouse Property Notesshriram bhatNo ratings yet

- HUMTUM15 TH AugDocument2 pagesHUMTUM15 TH AugSushil_Pandey_4297No ratings yet

- Income From House PropertDocument6 pagesIncome From House PropertAkshi JainNo ratings yet

- House Property IncomeDocument21 pagesHouse Property IncomekhNo ratings yet

- Determination of Annual ValueDocument4 pagesDetermination of Annual ValueStudy AllyNo ratings yet

- Income From House PropertyDocument9 pagesIncome From House PropertyannnoyynnmussNo ratings yet

- (uploadMB - Com) 18 - House PropertyDocument22 pages(uploadMB - Com) 18 - House PropertyhariomnarayanNo ratings yet

- Income-From-House-Property-converted 1Document11 pagesIncome-From-House-Property-converted 1annnoyynnmussNo ratings yet

- Roles FamilyDocument40 pagesRoles FamilyAruna RajappaNo ratings yet

- Are Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustDocument2 pagesAre Important For Exam Purpose. This Question Bank and Questions Marked Important Herein Are JustAruna RajappaNo ratings yet

- 5 Ethics SampleDocument31 pages5 Ethics SampleAruna RajappaNo ratings yet

- SA 700 (R) Forming An Opinion and Reporting On Financial StatementsDocument22 pagesSA 700 (R) Forming An Opinion and Reporting On Financial StatementsAruna RajappaNo ratings yet

- Role of GenderDocument25 pagesRole of GenderAruna RajappaNo ratings yet

- Index: SA 200 - 299 SA 300 - 450 SA 500 - 580Document7 pagesIndex: SA 200 - 299 SA 300 - 450 SA 500 - 580Aruna Rajappa100% (1)

- Lecture 16 - Standards On Auditing (SA 300 and 315)Document8 pagesLecture 16 - Standards On Auditing (SA 300 and 315)Aruna RajappaNo ratings yet

- DT - One Page Summary - Business Trust, Inv Fund, Sec. TrustDocument1 pageDT - One Page Summary - Business Trust, Inv Fund, Sec. TrustAruna RajappaNo ratings yet

- DT - One Page Summary - Accreted Tax (Exit Tax)Document1 pageDT - One Page Summary - Accreted Tax (Exit Tax)Aruna RajappaNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Lecture 15 - Standards On Auditing (SA 260, 265 and 299Document6 pagesLecture 15 - Standards On Auditing (SA 260, 265 and 299Aruna RajappaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Lecture 21 - Standards On Auditing (SA 320 and 402) PDFDocument6 pagesLecture 21 - Standards On Auditing (SA 320 and 402) PDFAruna RajappaNo ratings yet

- Audit SA 51 Most Imp Phrases PDFDocument10 pagesAudit SA 51 Most Imp Phrases PDFAruna RajappaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Lecture 17 - Standards On Auditing (SA 330 and 450)Document6 pagesLecture 17 - Standards On Auditing (SA 330 and 450)Aruna RajappaNo ratings yet

- Lecture 10 - Standards On Auditing (SA 505, 510 and 520) PDFDocument8 pagesLecture 10 - Standards On Auditing (SA 505, 510 and 520) PDFAruna RajappaNo ratings yet

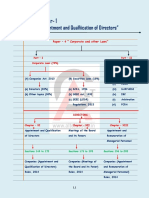

- Chapter - 1 "Appointment and Qualification of Directors": Lecture - 7Document4 pagesChapter - 1 "Appointment and Qualification of Directors": Lecture - 7Aruna RajappaNo ratings yet

- Chapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Document6 pagesChapter - 2 "Audit Strategy, Planning & Execution": Lecture - 18Aruna RajappaNo ratings yet

- Lecture 20 - Risk Assessment and Internal Control PDFDocument4 pagesLecture 20 - Risk Assessment and Internal Control PDFAruna RajappaNo ratings yet

- Chapter-1: "Appointment and Qualfiication of Directors"Document7 pagesChapter-1: "Appointment and Qualfiication of Directors"Aruna RajappaNo ratings yet

- Policy For Take-Back ProgramDocument16 pagesPolicy For Take-Back ProgramShaswat SrivastavaNo ratings yet

- Grade 1 To 12 Daily Lesson LOG: I. ObjectivesDocument5 pagesGrade 1 To 12 Daily Lesson LOG: I. ObjectivesEdryl Piamonte UgpoNo ratings yet

- CanaisDocument5 pagesCanaissaiaziekNo ratings yet

- Valeroso v. People, G.R. No. 164815, February 22, 2008 (546 SCRA 450)Document11 pagesValeroso v. People, G.R. No. 164815, February 22, 2008 (546 SCRA 450)Philip Duvan FernandezNo ratings yet

- Suzhou Singapore International School: Area of Interaction: Product / Outcome: SpecificationsDocument36 pagesSuzhou Singapore International School: Area of Interaction: Product / Outcome: SpecificationsMatt RobergeNo ratings yet

- Pe 4Document5 pagesPe 4slide_poshNo ratings yet

- Safety Data Sheet Kerosene: NfpaDocument9 pagesSafety Data Sheet Kerosene: NfpaAliNo ratings yet

- Q Paper PracticalDocument2 pagesQ Paper PracticalSanjay L. RathodNo ratings yet

- Antiozonates: Rossari Biotech LTDDocument4 pagesAntiozonates: Rossari Biotech LTDEdward MenezesNo ratings yet

- Sardar JokesDocument5 pagesSardar JokesblpsimhaNo ratings yet

- Wealth Management AssignmentDocument2 pagesWealth Management AssignmentHimanshu BajajNo ratings yet

- Battery Soc Prediction JournalDocument12 pagesBattery Soc Prediction JournalketamencoNo ratings yet

- Biochem Lab NotesDocument26 pagesBiochem Lab NotesRicky Justin NgoNo ratings yet

- Entrepreneurship Summative Test Q1Document3 pagesEntrepreneurship Summative Test Q1urhenNo ratings yet

- Unit 11 Jurassic Park: Making The Film: (Write From The Textbook)Document3 pagesUnit 11 Jurassic Park: Making The Film: (Write From The Textbook)mohamed zoropNo ratings yet

- Adjusting Entries, Worksheet and FSDocument26 pagesAdjusting Entries, Worksheet and FSBianca RoswellNo ratings yet

- Aef2wb 34 35Document2 pagesAef2wb 34 35sigafile11No ratings yet

- Pressform Refractory PRINT Brochure PDFDocument44 pagesPressform Refractory PRINT Brochure PDFravikumarangNo ratings yet

- Love Marriage Vs Arranged Marriage EssayDocument8 pagesLove Marriage Vs Arranged Marriage Essayezmt6r5c100% (1)

- Renault 5 Buyers GuideDocument4 pagesRenault 5 Buyers Guider5gordini100% (2)

- Iygb Gce: Core Mathematics C2 Advanced SubsidiaryDocument5 pagesIygb Gce: Core Mathematics C2 Advanced SubsidiaryssmithNo ratings yet

- Python Interview QuestionsDocument2 pagesPython Interview Questionsriyaz husainNo ratings yet

- 305-1-Seepage Analysis Through Zoned Anisotropic Soil by Computer, Geoffrey TomlinDocument11 pages305-1-Seepage Analysis Through Zoned Anisotropic Soil by Computer, Geoffrey Tomlinد.م. محمد الطاهرNo ratings yet

- Imp For As400Document21 pagesImp For As400Dinesh ChaudhariNo ratings yet

- Examining The Relationship BetDocument24 pagesExamining The Relationship BetMariaNo ratings yet

- Ap4na1r4cmt ADocument6 pagesAp4na1r4cmt AMar GaoNo ratings yet

- FINAL EXAM 201820192 - Draf (270319)Document13 pagesFINAL EXAM 201820192 - Draf (270319)YuthishDheeranManiamNo ratings yet

- PQR Amp WPQ Standard Testing Parameter WorksheetDocument4 pagesPQR Amp WPQ Standard Testing Parameter WorksheetvinodNo ratings yet

- Apurba MazumdarDocument2 pagesApurba MazumdarDRIVECURENo ratings yet

- List of Companies Having SAPDocument2 pagesList of Companies Having SAPKrushikeshNo ratings yet