Professional Documents

Culture Documents

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Uploaded by

Fong Kah YanCopyright:

Available Formats

You might also like

- Advanced Diagnostics Ford Manual-FordDocument55 pagesAdvanced Diagnostics Ford Manual-FordAnonymous 8To07bJFa71% (7)

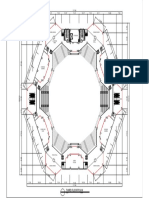

- Fourth Floor Esport ArenaDocument1 pageFourth Floor Esport ArenaJaniel Sazon SerranoNo ratings yet

- Third Floor Esport ArenaDocument1 pageThird Floor Esport ArenaJaniel Sazon Serrano0% (2)

- A211-12 - Architectural Level 01 Brickwork Detail Plan - North WallDocument1 pageA211-12 - Architectural Level 01 Brickwork Detail Plan - North WallJavier Enrique Diaz ChacinNo ratings yet

- Sanjib Ji2Document1 pageSanjib Ji2ashokNo ratings yet

- DDC Guyana, Riser Spanner Joint 27.56 TonDocument1 pageDDC Guyana, Riser Spanner Joint 27.56 TonGreg BiddleNo ratings yet

- Marathon Electric - 184TTFBD6006 - DrawingDocument1 pageMarathon Electric - 184TTFBD6006 - DrawingJonalou ArominNo ratings yet

- Iit PlanDocument1 pageIit Planronakchavan1990No ratings yet

- Recommended Setting Maximum Setting: Current Revision ApprovedDocument1 pageRecommended Setting Maximum Setting: Current Revision Approvedtecnicomineria14060No ratings yet

- GuruFocus Report 0P0000BK9ADocument14 pagesGuruFocus Report 0P0000BK9AcarminatNo ratings yet

- Vermi PlanDocument1 pageVermi Planmanilesnarf5No ratings yet

- A1 Etch or Scribe "B-9675" IN SHEET: RevisionsDocument1 pageA1 Etch or Scribe "B-9675" IN SHEET: RevisionsI CNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Detailed Pert-CPMDocument1 pageDetailed Pert-CPMIsabellaPeriginaNo ratings yet

- POCLLBPR - V2 - BUT Premium - Commercial Live Goals - UK - 2020Document1 pagePOCLLBPR - V2 - BUT Premium - Commercial Live Goals - UK - 2020amamùra maamar100% (1)

- ÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileDocument1 pageÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileSagarNo ratings yet

- A-6 - Floor FinishesDocument1 pageA-6 - Floor FinishesfelixNo ratings yet

- Planta Electrica Transformador: JM-5 JM-8 JM-11Document1 pagePlanta Electrica Transformador: JM-5 JM-8 JM-11DosSantos GroupNo ratings yet

- Ir Reference Document 2007 Sartorius Stedim Biotech PDFDocument161 pagesIr Reference Document 2007 Sartorius Stedim Biotech PDFBrian VasquezNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Air Conditioning Solution Profile: Global Operations DivisionDocument10 pagesAir Conditioning Solution Profile: Global Operations DivisionAmer Lobrio BantuasNo ratings yet

- Rafter - 1: Schedule of SlabDocument1 pageRafter - 1: Schedule of Slabrogelio sorianoNo ratings yet

- FasbruyerDocument2 pagesFasbruyerFelipe SepulvedaNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Lokesh SuranaNo ratings yet

- Cartobase 9-14-2-2Document1 pageCartobase 9-14-2-2RicardoNo ratings yet

- CM100RX-24A NDocument8 pagesCM100RX-24A NLITMAS TECHNOLOGYNo ratings yet

- PROYECTO FINAL DE CAD-Layout1Document1 pagePROYECTO FINAL DE CAD-Layout1Joss Adhelyn Cordova CastilloNo ratings yet

- PARCIAL DE CAD - CORDOVA-ModelDocument1 pagePARCIAL DE CAD - CORDOVA-ModelJoss Adhelyn Cordova CastilloNo ratings yet

- PARCIAL DE CAD - CORDOVA-Layout1Document1 pagePARCIAL DE CAD - CORDOVA-Layout1Joss Adhelyn Cordova CastilloNo ratings yet

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Document2 pagesATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- CP Arq 01 Planta Bind-ChactunDocument1 pageCP Arq 01 Planta Bind-ChactunPoncho HernandezNo ratings yet

- Factsheet NiftyMidSmallITAndTelecomDocument2 pagesFactsheet NiftyMidSmallITAndTelecomAvinash BaldiNo ratings yet

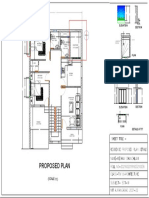

- Addition Alteration 2Document1 pageAddition Alteration 2Kscsiddhant KscsiddhantNo ratings yet

- Corte Longitudinal Corte Transversal: A C D F BDocument1 pageCorte Longitudinal Corte Transversal: A C D F BLaura Newsotty HerreraNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Izmir Main ProposalDocument19 pagesIzmir Main ProposalJoellaaaNo ratings yet

- Company Overview: Initial Report May 6th, 2008Document24 pagesCompany Overview: Initial Report May 6th, 2008beacon-docsNo ratings yet

- B.1 C.1 E.1 F.1 G A 7: 10F Unit 1003 Tycoon Center, Pearl Drive ST., Ortigas Center, Pasig City 1605Document1 pageB.1 C.1 E.1 F.1 G A 7: 10F Unit 1003 Tycoon Center, Pearl Drive ST., Ortigas Center, Pasig City 1605Royce PaladaNo ratings yet

- Aehr Test SystemsDocument1 pageAehr Test SystemsYS FongNo ratings yet

- Denah Gedung DM 15 No. 110 Rev6Document3 pagesDenah Gedung DM 15 No. 110 Rev6Wijaya GultomNo ratings yet

- Arquitectonico PaDocument1 pageArquitectonico PaPedro MárquezNo ratings yet

- Factsheet Nifty 100 EW IndexDocument2 pagesFactsheet Nifty 100 EW IndexAnkit JoshiNo ratings yet

- PJU Tiang Listrik Tahap 1 Grand Hill PDFDocument2 pagesPJU Tiang Listrik Tahap 1 Grand Hill PDFpuji dpNo ratings yet

- DAY Investor: Thursday, May 24, 2018Document167 pagesDAY Investor: Thursday, May 24, 2018RaduNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- Model ESG AdaptiveDocument2 pagesModel ESG AdaptiveSteven SmithNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Voltages / Loading: Inactive Out of Calculation De-EnergizedDocument1 pageVoltages / Loading: Inactive Out of Calculation De-EnergizedAnish PoudelNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50Sunil ChawdaNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Joza XDDocument1 pageJoza XDRicardo AmadorNo ratings yet

- Arquitectura 1Document1 pageArquitectura 1lalalallalalaaluuuNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Devi Prasad BeheraNo ratings yet

- Planta Arquitectonica Apt - 1001Document1 pagePlanta Arquitectonica Apt - 1001Maria Alejandra VivancoNo ratings yet

- AffinHwang - AME IPO ICDocument15 pagesAffinHwang - AME IPO ICFong Kah YanNo ratings yet

- Bursa Malaysia (BURSA MK) : Regional Morning NotesDocument5 pagesBursa Malaysia (BURSA MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Electronics Manufacturing Services - Malaysia: Regional Morning NotesDocument4 pagesElectronics Manufacturing Services - Malaysia: Regional Morning NotesFong Kah YanNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Ata Ims (Aib MK) : Regional Morning NotesDocument5 pagesAta Ims (Aib MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Duopharma Biotech (DBB MK) : MalaysiaDocument16 pagesDuopharma Biotech (DBB MK) : MalaysiaFong Kah YanNo ratings yet

- Inari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyDocument3 pagesInari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyFong Kah YanNo ratings yet

- Rubber Gloves - Malaysia: Regional Morning NotesDocument5 pagesRubber Gloves - Malaysia: Regional Morning NotesFong Kah YanNo ratings yet

- Household Responsibility System. The System Can Be Divided Into 3Document4 pagesHousehold Responsibility System. The System Can Be Divided Into 3Fong Kah YanNo ratings yet

- Alpha Picks: Catching The Late Ray of Sunshine: Regional Morning NotesDocument5 pagesAlpha Picks: Catching The Late Ray of Sunshine: Regional Morning NotesFong Kah YanNo ratings yet

- Verantis BlowerDocument14 pagesVerantis BlowerTaniadi SuriaNo ratings yet

- Globaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDocument7 pagesGlobaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDyaji Charles BalaNo ratings yet

- 91%-UGRD-IT6210 Quantitative Methods or Quantitative (Same Title)Document14 pages91%-UGRD-IT6210 Quantitative Methods or Quantitative (Same Title)michael sevillaNo ratings yet

- Affidavit of DenialDocument1 pageAffidavit of Denialkillua111445100% (1)

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- SHS Perforated Materials vs. Manuel DiazDocument3 pagesSHS Perforated Materials vs. Manuel DiazRJ PasNo ratings yet

- Application To Pay Filing Fee in InstallmentsDocument2 pagesApplication To Pay Filing Fee in InstallmentsNatalie RowlandNo ratings yet

- MobileBill 1025537183Document6 pagesMobileBill 1025537183Rohit BhambhaniNo ratings yet

- TDS - Rheobuild 1100Document3 pagesTDS - Rheobuild 1100Alexi ALfred H. Tago100% (1)

- Microtig 185 DaDocument40 pagesMicrotig 185 DaCONTROLES PHILLMATNo ratings yet

- Sebial Vs SebialDocument4 pagesSebial Vs SebialNC BergoniaNo ratings yet

- Reviewer UcspDocument5 pagesReviewer UcspMayzie jayce CastañedaNo ratings yet

- Swithmail V 2.0: Usage and General How-ToDocument6 pagesSwithmail V 2.0: Usage and General How-ToDaniel AraújoNo ratings yet

- The Psychological ContractDocument5 pagesThe Psychological Contractანი გორგოძეNo ratings yet

- Dates Time School RoutineDocument85 pagesDates Time School RoutineCristina BariNo ratings yet

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- 129 Bba-206Document3 pages129 Bba-206Ghanshyam SharmaNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- Management of Cybersecurity in Medical Devices - Diec 2020Document13 pagesManagement of Cybersecurity in Medical Devices - Diec 2020Haris Hamidovic100% (1)

- Sankalp Research Paper 2023Document22 pagesSankalp Research Paper 2023Shivansh SinghNo ratings yet

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdNo ratings yet

- Tata PowerDocument9 pagesTata PowerAnkita SinghNo ratings yet

- Kec 553a Lab Manual DSP 20-21Document62 pagesKec 553a Lab Manual DSP 20-21sachinyadavv13No ratings yet

- Sample Offer LettersDocument4 pagesSample Offer LettersAvinash KumarNo ratings yet

- Functional Properties and Health Benefits of Bioactive Peptides Derived From Spirulina: A ReviewDocument19 pagesFunctional Properties and Health Benefits of Bioactive Peptides Derived From Spirulina: A ReviewOrlando Torres CastilloNo ratings yet

- URS R404aDocument1 pageURS R404aironiteNo ratings yet

- Sports Economics 2017 1st Edition Berri Solutions ManualDocument8 pagesSports Economics 2017 1st Edition Berri Solutions Manualbrendabrownipnmktbzas100% (10)

- Sample Resignation LetterDocument4 pagesSample Resignation Letterriduanrashid100% (1)

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Uploaded by

Fong Kah YanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Alpha Picks: Adding Sea LTD and Comfortdelgro, Remove Singtel

Uploaded by

Fong Kah YanCopyright:

Available Formats

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

STRATEGY – SINGAPORE KEY RECOMMENDATIONS

Company Rec ------ Price (S$) ------ Up/(down)

Alpha Picks: Adding Sea Ltd and ComfortDelGro, Ascendas Reit BUY

3 Jun 21 Target

2.92 3.82

to TP (%)

30.8

remove Singtel ComfortDelGro

Far East HTrust

BUY

BUY

1.67

0.595

1.95

0.71

16.8

19.3

Our Alpha Picks portfolio narrowly beat the STI in May with a 1.5% mom decline vs the Food Empire BUY 0.915 1.30 42.1

G.H.Y Culture BUY 0.71 1.18 66.2

latter’s 1.7% mom decline. For June, we add one newly-initiated stock, Sea Ltd as well Hong Leong Asia BUY 0.975 1.38 41.5

as potential re-opening play ComfortDelGro, and remove Singtel. InnoTek BUY 0.96 1.20 25.0

OCBC BUY 12.42 15.50 24.8

WHAT’S NEW Sea Ltd * BUY 258.35 314.48 21.7

SGX BUY 10.39 12.35 18.9

• A narrow win in May. For the month of May, our Alpha Picks portfolio outperformed the SIA SELL 4.93 4.15 (15.8)

Yangzijiang BUY 1.49 1.76 18.1

STI by 0.2ppt, losing 1.5% mom vs the STI which fell 1.7%. Following the lead of global

Note: *US$

and regional markets, the STI dipped in mid-May to trough at 3,032 on 14 May only to Source: UOB Kay Hian

recover in the last week as MSCI Singapore Index revisions led to increased fund inflows.

CHANGE IN SHARE PRICE

With the Singapore Government potentially relaxing Phase 2 (Heightened Alert)

Company Rec** May 21 To-date*

restrictions in mid-Jun 21, there appears to be upside to some re-opening plays. (% mom) (%)

Ascendas Reit BUY (5.8) (3.0)

• Banks and industrials outperformed but industrial and hospitality trusts were a Far East HTrust BUY (7.1) 21.4

drag. Only three companies in our portfolio showed a positive return for May: Yangzijiang Food Empire BUY (2.1) 34.6

G.H.Y Culture BUY (0.7) (1.4)

(+4.9% mom), OCBC (+1.3% mom) and Innotek (+0.5% mom). On the negative side, Far Hong Leong Asia BUY (4.3) (4.4)

East Hospitality Trust (-7.1% mom) and Ascendas REIT (-5.8%) were key drags on the InnoTek BUY 0.5 45.5

OCBC BUY 1.3 23.0

portfolio for the month. SGX BUY (1.1) (0.4)

SingTel BUY (3.6) 2.6

• Adding Sea Ltd and ComfortDelGro. We add newly initiated Sea Ltd to our Alpha Picks SIA SELL (1.6) 11.5

as we like the Tencent-backed company’s position as it is one of Southeast Asia’s largest Yangzijiang BUY 4.9 47.5

FSSTI (1.7)

internet companies, and is making inroads into Latin America. Its strong position in the * Share price change since stock was selected as alpha pick

digital entertainment market could be augmented by digital banking growth opportunities Source: UOB Kay Hian

in the near to medium term. We also add ComfortDelGro as we expect a recovery in land

PORTFOLIO RETURNS

transport ridership as Singapore appears to be on track to relax COVID-19 stay-home 2020 1Q21

restrictions. FSSTI return -11.8 11.3

Alpha Picks Return

• We remove Singtel from the portfolio as we do not see meaningful upside for the - Price-weighted 0.0 5.9

- Market cap-weighted -1.3 7.0

company post its disappointing FY21 results that were below our and street estimates. In - Equal-weighted 3.9 8.6

addition, the company guided for 60-80% dividend payout ratio for FY22 vs expectations Assumptions for the 3 methodologies:

for a 100% payout ratio. 1) Price-weighted: Assuming same number of shares for each stock;

a higher share price will have a higher weighting.

ANALYSTS’ TOP ALPHA* PICKS 2) Market cap-weighted: Weighting based on the market cap at

inception date; a higher market cap will have a higher weighting.

Analyst Company Rec Performance# Catalyst 3) Equal-weighted: Assuming same investment amount for each

Jonathan Koh Ascendas REIT BUY -3.0 Resiliency from business parks and logistics stock; every stock will have the same weighting.

segments Source: UOB Kay Hian

Lucas Teng ComfortDelGro BUY - Reopening play with potential unlocking of value in PORTFOLIO RETURNS IN THE PAST 12 MONTHS

Australia (WE OUTPERFORMED FSSTI 7 OUT OF 12 MONTHS)

Jonathan Koh Far East BUY 21.4 Recovery in occupancy, ADR and RevPAR in 2022 (%)

Hospitality Trust 20

Clement Ho Food Empire BUY 34.6 Stronger-than-expected recovery in volume

consumption 15

Lucas Teng/ John G.H.Y Culture & BUY -1.4 Resumption of concerts; contract wins for drama 10

Cheong Media productions; M&A; wider analyst coverage

John Cheong Hong Leong Asia BUY -4.4 Established track record; strong recovery for 5

building materials segment

0

John Cheong InnoTek BUY 45.5 Better-than-expected results; higher dividends

Jonathan Koh OCBC BUY 23.0 OCBC’s dividend yield improving from 4.8% for -5

2021F to 5.4% for 2022F Jun Jul Aug Sep Oct Nov Dec 2021 Feb Mar Apr May

Clement Ho Sea Ltd BUY - One of SE Asia’s largest internet companies with

digital banking growth opportunities

FSSTI Alpha Picks Portfolio

Lucas Teng SGX BUY -0.4 Multi-asset exchange supports a resilient revenue Source: Bloomberg, UOB Kay Hian

stream

Ajith K SIA SELL 11.5 Trading at high valuations ANALYST(S)

Adrian Loh Yangzijiang BUY 47.5 Continued new order wins, strong 1H results

Singapore Research

* Denotes a timeframe of 1-3 months and not UOBKH’s usual 12-month investment horizon for stock recommendation +65 6535 6868

# Share price change since stock was selected as Alpha Pick

Source: UOB Kay Hian

research@uobkayhian.com

Refer to last page for important disclosures. 1

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

Sea Limited – BUY (Clement Ho)

• One of Southeast Asia’s largest internet companies. Backed by Tencent of China,

Sea operates the market-leading Garena and Shopee in Southeast Asia and Taiwan, and

is making inroads into Latin America.

• Digital financial services to be next engine of growth. Branded as SeaMoney, it is

licensed to offer electronic money services in Vietnam, Thailand, Indonesia, the

Philippines and Malaysia. This segment has expanded beyond e-wallet service to include

consumer lending, which is a natural extension of its e-commerce business.

• Expanded digital entertainment business to maintain competitiveness. Recent

investments show that Sea is seeking to expand and enhance its self-developed hit game

Free Fire as a long-term strategy to maintain profitability (by saving on licensing fees).

• On 31 May 21, we initiated coverage on the stock with a BUY rating. We value the

company at US$314.48/share, implying 93x 2021F adjusted operating earnings. The high

multiple is in line with the PEG multiples of comparable industry peers, supported by

Sea’s 5-year adjusted operating profit CAGR of 50.9% over 2020-25.

Share Price Catalysts

• Earlier-than-expected reduction in cash burn

• Further market share gains for Shopee in their operating regions

• Timeline: 3-6 months.

ComfortDelgro – BUY (Lucas Teng)

• Looking forward to recovery. Barring another big cluster of COVID-19 cases, the

authorities are on track to bringing the local outbreak under control, which will likely see a

relaxation of COVID-19 restrictions in mid-Jun 21. Preparations for the new normal,

including expanded vaccinations and testing, could also see the return of land transport

activities at a faster rate compared with the lifting of the circuit breaker in 2020. A

recovery in 2H21 could mitigate a possible short-term impact for CD in 2Q21.

• Value unlocking in Australia. The group also recently announced that it is exploring

various options to unlock value of its assets in Australia (including a partial sale of assets

or an IPO), where it is one of the largest privately-owned bus operators. The group’s total

investment in Australia is S$1.17b to date.

• Limited downside risk. 1Q21 saw overseas buses picking up traction, in the UK and

Australia. We are less concerned with Australia operations regarding potential outbreaks,

given resilient public transport contracts have kept revenue steady in 2020 (only down

3% yoy) despite COVID-19 restrictions. UK operations will likely continue to see a

recovery given the high vaccination rates (60% with at least 1 dose), while we opine that

London’s public transport funding will continue to be place

Share Price Catalysts

• Lifting of COVID-19 stay-home restrictions in Singapore, unlocking of value in Australia

business, regulatory changes for Downtown Line financing.

• Timeline: 3-6 months.

Singapore Exchange – BUY (Lucas Teng)

• Volatility and hedging needs remain. Trading volume for Singapore Exchange (SGX)

remains elevated with 3QFY21 cash equities’ daily average value (DAV) traded of

S$1.52b almost 50% higher compared with FY19 levels. May 21 trading velocity has

likely edged up mom given the changes to the MSCI Singapore Index. The group also

has a wide range of liquid derivative products in key asset classes such as equities,

currencies and commodities, which assure customer stickiness.

Refer to last page for important disclosures. 2

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

• MSCI changes to boost derivatives volume; higher average fee per contract. The

coming changes for the MSCI Singapore Index could see higher volumes with the

addition of foreign listed entities. In addition, introductory fees for the FTSE Taiwan Index

will also be reduced from 3QFY21, raising average fee per contract.

• Below peers’ valuation. SGX currently trades at 24x FY22F PE, below peers’ average

multiple of 28.0x. New initiatives (eg SPACs, secondary listings) could potentially rerate

SGX to trade closer towards its developed markets counterparts of similar size (eg ASX,

Japan Exchange Group).

Share Price Catalysts

• M&As, secondary listings of foreign listed entities, longer-than-expected period of trading

volatility.

• Timeline: 3-6 months.

Hong Leong Asia – BUY (John Cheong)

• Established track record and strong recovery for building materials segment. Hong

Leong Asia (HLA) has been listed in the SGX since 1998 and is part of Hong Leong

Group conglomerate, one of the largest globalised corporations in Asia. HLA started as a

building materials supplier before venturing into the diesel engine segment. HLA’s

building materials unit is one of the largest integrated players in Singapore, providing

ready-mix concrete and precast concrete elements for public housing construction. Its

subsidiary, Tasek, is the fourth-largest cement producer in Malaysia. We expect the

earnings of the building materials segment to grow by 55% yoy for 2021, driven by better

sales volume as well as better ASPs for precast and ready-mix concretes as construction

activity resumes.

• Diesel engine segment to benefit from accelerating demand due to a new product

version. HLA’s 44.7%-owned subsidiary, China Yuchai International Ltd (CYD US;

UNRATED) is the second-largest engine manufacturer in China. It manufactures and

sells engines for trucks, buses passenger vehicles, industrial equipment and agricultural

applications. Despite major disruptions due to COVID-19, China Yuchai recorded a

14.4% yoy increase in the number of engine units, as a result of the growth in China’s

agriculture segment. We expect China Yuchai’s 2021 earnings to grow by 17% yoy, as

the growth momentum should continue in 2021 from greater buying activity in National

VI(a) compliant diesel engines before its full implementation on 1 Jul 21.

• New energy solutions could drive long-term growth, formed partnership on 2 Jun 2021

to develop EV. To tap on the EV market in the longer term, China Yuchai is developing

alternative new energy solutions in new generation hybrid power, integrated electric

bridge and fuel cell system. On 2 Jun 21, China Yuchai formed a partnership with

Guangxi Shenlong Automobile Manufacturing to develop new energy vehicles based

upon China Yuchai's four new energy powertrain systems including the ISG power

generation powertrain (YC IE-Power), e-CVT power-split hybrid powertrain (YC e-CVT),

integrated electric drive axel powertrain (YC e-Axel), and a fuel cell system (YC FCS).

Both parties will also leverage each other's supply chains and distribution networks,

especially in international markets, with a focus on entering Southeast Asian markets.

• Expect robust growth in 2021; restructuring completed for loss-making segment.

Given the strong growth for both the building materials segment and China Yuchai, we

expect HLA’s earnings growth to grow 52% yoy for 2021. The disposal of the loss-making

air-conditioning business, expected to complete in 1H21, will also provide a further

earnings lift and allow management to concentrate on the profitable segments.

• Attractive valuation given the strong upcycle of both key segments. Our target price of

S$1.38 is pegged to 12x 2022F PE, 1SD above HLA’s historical five-year average. We

think current valuations of 9x 2022F PE for HLA are attractive, given that both its key

segments will ride on an industry uptrend.

Refer to last page for important disclosures. 3

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

Share Price Catalysts

• Earnings surprise due to better-than-expected engine sales and building materials sales.

• Better-than-expected dividend.

• Value-unlocking activity of China Yuchai International Ltd (CYD US; UNRATED).

G.H.Y Culture & Media Holding – BUY (Lucas Teng, John Cheong)

• Stellar maiden results. 2020 core earnings surged strongly by 244% yoy. Revenue of

S$127.1m was up 93% yoy while gross margin was 44% (+15ppt) as the group noted

strong demand for its drama series. In 2020, GHY had six drama series sold and

completed, while two dramas and one online short drama series were in production as at

31 Dec 20.

• Pipeline with larger scale projects, higher episode count. GHY has another 13

dramas and one film series to be produced and released progressively through 2021-22.

Management also noted that potential drama series produced in 2021 are larger-scale

projects with higher episode count, which will contribute to sustainable growth and

earnings resilience

• Share purchases and potential M&As. GHY CEO Guo Jingyu recently purchased

approximately 0.66m shares at S$0.75/share, accumulating almost 1.74m shares since

the company’s listing. In addition, the group also has net cash of S$105m and is

positioned for growth with potential M&As.

• Valuations still attractive. GHY currently trades at 13x 2021F PE, below peers’ average

of 20x 2021F PE, while exhibiting stronger earnings growth.

Share Price Catalysts

• Events: Resumption of concerts, contract wins for the production of drama series, M&As,

wider analyst coverage

• Timeline: 3-6 months.

InnoTek – BUY (John Cheong)

• Positive outlook from venturing into the EV and parts assembly business. In the

outlook statement of InnoTek’s recent 2020 Annual Report dated 13 Apr 21, InnoTek

highlighted that its China auto division is experiencing great change, with a clear shift

towards electric vehicles (EV). InnoTek’s precision metal components division also serves

EV manufacturers. However, as the industry evolves holistically towards charging stations

and infrastructure support, InnoTek will seek to deepen its value proposition with existing

and develop new customers. This means moving beyond single-part manufacturing to

parts assembly. InnoTek has secured initial orders of the latter and expect orders to

increase as it establishes its foothold within the segment.

• Set to benefit from a strong recovery in China’s auto sales China has successfully

contained the COVID-19 outbreak, and this has led to a surge in passenger vehicle (PV)

sales back to pre-COVID-19 levels. CAAM estimates March auto sales at 2.38m units, up

67% yoy and 64% mom, and 1Q21 PV sales should reach 6.34m units, up 73% yoy.

InnoTek, which has large exposure to China’s automobile market (historically accounted

for >30% of annual revenue), is set to benefit.

• New CEO’s successful restructuring initiatives and strong major shareholder

backing. InnoTek’s new CEO and Non-Independent Director Lou Yiliang (who joined at

end-15) had implemented several restructuring initiatives to boost profitability, including

an incentive scheme which rewards employees based on units produced per day and

production yield. As a result, InnoTek managed to turn from a net annual loss of S$16.3m

in 2015 to decade-high annual net profits of S$20.2m/S$16.7m in 2018/19 respectively.

Meanwhile, its gross margins have also increased from 6.5% in 2015 to 24.6% in 2020.

As such, InnoTek has become more resilient during economic downturns due to the

Refer to last page for important disclosures. 4

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

initiatives. The track record of its major shareholder, the Chandaria family which is

involved in the founding of Venture Corporation (Venture), has been underappreciated by

the market. Mr Neal Chandaria has been the Chairman since 2017 to date, which are

InnoTek’s most profitable years.

• Attractive valuation and balance sheet loaded with cash. Trading at 2022F 9.2x PE

(5x ex-cash 2021F PE), we opine this is unjustified as InnoTek has the third-best net

margins and net cash position among similar Singapore peers. Coupled with the lowest

P/B ratio, we believe InnoTek should be trading at a valuation nearer or on a par with its

Singapore peers at 2022F PE of 12.0x. As of end-20, InnoTek had a net cash position of

S$92m, up S$72m (+28% yoy) vs the level as at end-19, forming around 40% of its

current market capitalisation.

Share Price Catalysts

• Better-than-expected demand from automobile segments and winning of more EV

customers.

• Potential takeover target given its attractive ex-cash multiple.

• Better-than-expected dividend.

Food Empire – BUY (Clement Ho)

• Daily share buy-back underlines confidence in business outlook. Since the start of

the buy-back mandate on 23 Apr 20, a total of 3,483,600 shares has been purchased,

forming approximately 0.65% of its outstanding shares. This was mainly carried out in

4Q20 and Jan 21 where Food Empire bought back a total of around 3.0m shares for a

consideration of approximately S$2.0m, potentially signalling a strong confidence in its

2021 business outlook.

• Compelling valuation. Food Empire trades at an undemanding valuation of 11x 2021F

PE, a significant discount to peers’ average of approximately 25x 2021F PE despite its

growing presence in the Vietnam market and leading position in its core markets in

Eastern Europe.

• 2020 earnings growth amid COVID-19 pandemic reflects resilient product offering

and strong brand equity. Given the low price, relatively inelastic and consumer-staple

nature of its products, Food Empire is likely to be more resilient and sheltered from an

economic slowdown, in our view. Additionally, we highlight that in spite of the weaker

ruble against the US dollar, the group has managed to mitigate some of the adverse

impact on bottom-line through ASP hikes and cost management. We were encouraged

by the group’s core earnings (ex foreign exchange) growth in 2020 at 14% yoy despite

stringent lockdowns in 2Q20. We believe this is a testament to its strong brand equity in

its core markets that was developed over many years.

Share Price Catalysts

• Events: Stronger-than-expected recovery in volume consumption and improvement in

operating leverage.

• Potential takeover target given its attractive valuation and distribution network.

• Timeline: 3-6 months.

Singapore Airlines – SELL (Ajith K)

• Post our downgrade on SIA, the stock price has declined to S$4.41, just 1 S cent

away from our prior fair value of S$4.40. After the company’s announcement of its full-

year results and S$6.2b in Mandatory Convertible Bonds (MCB), we lowered our fair

value further to S$4.15 to factor in the MCB dilution. This effectively values SIA at 1.0x

FY22/FY23’s average book value.

• We have already factored in a recovery. In valuing SIA, we have already factored in

travel recovery in 4QFY22 (calendar 1Q22), whilst for the whole of FY22, we assume

Refer to last page for important disclosures. 5

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

that: a) pax traffic rises by 310% yoy, and b) that pax load factor improves from 13.4% in

FY21 to 25% in FY22. In the near term, SIA's stock price could rebound further due to

positive sentiments towards border re-openings; however we believe that the stock could

gradually decline towards our fair value.

Share Price Catalysts

• Events: Global vaccination by 3Q21.

• Timeline: 3-6 months.

Overseas - Chinese Banking Corporation – BUY (Jonathan Koh)

• New CEO, but unchanged focus to expand in Greater Bay Area. Ms Helen Wong is a

competent leader with a strong track record, having led HSBC’s Greater China

operations, which is the largest profit centre of HSBC. New CEO Helen Wong

emphasised focus on organic growth from: a) capturing investment and trade flows

between ASEAN and Greater China, b) retail wealth management, c) sustainable finance,

and d) accelerated growth in digitalisation.

• Maintain guidance. Management has upgraded its guidance to mid-to-high single-digit

loan growth for 2021 (2020: +0.5%). NIM is expected to stabilise at 1.50-1.55%.

Management expects credit costs to be at the lower end of guidance of 100-130bp over

the 2-year period (2020: 67bp).

• Further reduction of loan relief programmes. Exposure to loans under moratorium

dropped by 10.5% from S$5.7b (2.1% of total loans) in Jan 21 to S$5.1b (1.9% of total

loans) in Mar 21. 92% of the loans under moratorium are secured by collateral. Most

customers indicated they do not require additional assistance.

• Paying sustainable dividends. OCBC’s CET-1 CAR improved 0.3ppt qoq to 15.5% in

1Q21. OCBC estimated that by maintaining dividend payout at 40-50%, it would be able

to support growth in risk-weighted assets of 7-8% per year without impeding CET-1 CAR.

Management emphasised that dividend policy must be progressive and sustainable. As

such, we expect OCBC to gradually increase recurrent regular dividends. Having a high

CET-1 CAR also helped OCBC weather unexpected economic shocks, which has been

aptly demonstrated amid the COVID-19 pandemic.

Share Price Catalyst

• Events: OCBC’s dividend yield improving from 4% for 2021 to 4.5% for 2022.

• Timeline: 6-12 months.

Ascendas REIT – BUY (Jonathan Koh)

• Positive rental reversion driven by Singapore and the US. AREIT achieved positive

rental reversion of 3% in 1Q21, driven by business & science parks (+2.8%) and logistics

& distribution centres (+5.6%) in Singapore and business parks (+6.2%) in the US.

• More acquisitions are forthcoming in 2021. AREIT secured accretive acquisitions

worth S$1.4b in Singapore, Australia and the US in 2020 (completed S$973m in 2020

and S$535m to be completed over the next two years). It has an optimal asset mix 60:40

between Singapore and overseas markets. Having expanded overseas at a frantic pace

over the past five years (investment mandate extended to overseas properties in Aug 15),

AREIT could refocus on expanding within Singapore in 2021.

• Potential acquisitions from sponsor CapitaLand include Ascent at Science Park I

(GFA: 555,030sf) and Galaxis (75% stake) at one-north (GFA: 742,050sf). Key tenants at

Ascent are Johnson & Johnson, Dyson, Merck and Prestige Biopharma. Key tenants at

Galaxis are Canon, Sea Ltd, Oracle and Avaloq.

• Data centres add a new engine for growth and expansion. AREIT has completed the

acquisition of 11 data centres located across the UK (four), Netherlands (three), France

(three) and Switzerland (one) from vendor Digital Realty Trust for S$905m in Mar 21. The

Refer to last page for important disclosures. 6

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

acquisition of 11 data centres in Europe has injected a new dimension for growth. There

is room for asset enhancements for the 11 data centres via: a) repositioning some

powered shell data centres into co-location data centres, and b) converting ancillary office

spaces into data halls. Over the longer term, management intends to build scale for data

centres in Singapore and Europe, focusing on core and shell data centres.

Share Price Catalysts

• Events: a) Resiliency from business parks and logistic segments; b) contributions from

development projects and AEIs.

• Timeline: 6-12 months.

Yangzijiang Shipbuilding – BUY (Adrian Loh)

• 1Q21 NPAT and margins stronger than expected. Yangzijiang (YZJ) reported an 89%

yoy increase in 1Q21 NPAT at Rmb780m (26% of our full-year estimate) which was

driven by a 10ppt increase in gross profit margins and an 18ppt increase in net margins.

We were not perturbed by revenues that declined 25% yoy to Rmb2.62b due to lower

shipbuilding activities as shipbuilding margins expanded to 14.7% vs 8.4% in 1Q20 which

was affected by COVID-19. During the analyst briefing, management reiterated its belief

that its revenues will trough in 1Q21 and should increase from 2Q21 onwards.

• New order win outlook. With slightly over US$4b in new orders garnered ytd in 2021,

we note that management is targeting US$5b in new orders which, in our view, should be

easily achieved. The company noted that its smallest Changbo yard (to be reactivated by

mid-21) will build the smaller 1,000-3,000TEU containerships while the Yangzi and Xinfu

yards will focus on the mid- and large-sized vessels. Our 2021 and 2022 new order win

expectations remain at US$5.5b and US$3.5b respectively.

• We believe that YZJ remains a compelling stock for this year as its valuations remain

undemanding, with 2021 EV/EBITDA and P/B multiples of 6.0x and 0.8x respectively, a

2022 PEG ratio of 0.31 and net cash of S$0.47/share (or 32% of its current share price).

Share Price Catalysts

• Events: New order wins; better returns on its debt investments portfolio; strong 1H21

results

• Timeline: 3-6 months

Far East Hospitality Trust – BUY (Jonathan Koh)

• Downside protection from high fixed rent component. FEHT is the most defensive

hospitality REITs. All FEHT hotels and serviced residences are under master lease

agreements with subsidiaries within sponsor Far East Organisation (FEO). The fixed rent

component from its master leases totalled S$67m per year, which is equivalent to 72% of

total gross revenue from its hotels and serviced residences in 2019 (pre-COVID-19).

These master leases run till 2032. Sponsor FEO owns 61% of FEHT and has a strong

balance sheet.

• Aligned to unitholders’ interest. From 1 Jan 20, base fee was reduced from 0.3% to

0.28% of deposited property. Performance fee was also reduced from 4.0% of NPI to

4.0% of annual distributable amount. The reduction in management fees demonstrates

that sponsor FEO is closely aligned to unitholders’ interest.

• Redeveloping Central Square. FEHT has received an outline advice from the Urban

Redevelopment Authority (URA) for the redevelopment of Central Square, which

comprises a serviced residence and commercial spaces, including office and retail units.

FEHT and City Developments (owner of the adjacent Central Mall) have jointly submitted

a proposal to redevelop Central Square and Central Mall under the strategic development

incentive scheme. The proposed integrated development will rejuvenate the precinct and

involves a potential rezoning and uplift in gross floor area (GFA).

Refer to last page for important disclosures. 7

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

• An opportunity to create value through capital re-cycling. Management will evaluate

opportunities to divest Central Square given the substantial disruption to income

contribution from the property during the redevelopment. Potential buyers include Far

East Organisation and City Developments, who could take over the entire redevelopment

project. The divestment, if it materialises, will help FEHT reap potential divestment gain

and deleverage as well.

• Our target price of S$0.71 is based on the dividend discount model (cost of equity:

7.0%, terminal growth: 1.8%). We expect distribution yield to recover to 5.5% in 2022 and

6.7% in 2023. FEHT trades at 0.74x 2021F P/B, representing a steep 26% discount

against NAV/share of S$0.79.

Share Price Catalyst

• Event: a) Downside protection from fixed rents embedded in master leases with sponsor

FEO, b) recovery in occupancy, average daily rate and RevPAR in 2022.

• Timeline: 6-12 months.

VALUATION

Price Target Upside Last -------------------- PE ------------------- Yield ROE Market Price/

Company Ticker Rec 3 Jun 21 Price To TP Year 2020 2021F 2022F 2021F 2021F Cap. NAV ps

(S$) (S$) (%) End (x) (x) (x) (%) (%) (S$m) (x)

Ascendas Reit AREIT SP BUY 2.92 3.82 30.8 12/20 20.6 18.9 18.0 5.3 6.8 11,740.9 1.3

ComfortDelGro CD SP BUY 1.67 1.95 16.8 12/20 58.6 15.4 16.7 3.0 0.0 3,619.6 1.4

Far East HTrust FEHT SP BUY 0.595 0.71 19.3 12/20 34.1 30.0 21.1 4.2 2.5 1,171.8 0.8

Food Empire FEH SP BUY 0.915 1.30 42.1 12/20 13.2 11.9 11.2 2.5 13.5 491.9 1.7

GHY Culture GHY SP BUY 0.71 1.18 66.2 12/20 17.1 12.1 12.0 2.5 34.9 762.4 4.8

Hong Leong Asia HLA SP BUY 0.975 1.38 41.5 12/20 15.6 10.3 8.5 1.6 7.8 729.1 0.8

InnoTek INNOT SP BUY 0.96 1.20 25.0 12/20 15.7 11.2 9.5 2.6 10.5 219.7 1.2

OCBC OCBC SP BUY 12.42 15.50 24.8 12/20 15.5 11.3 10.7 4.0 9.6 55,583.1 1.1

Sea Ltd (in US$) SE US BUY 258.35 314.48 21.7 12/20 n.a. n.a. n.a. 0.0 (91.0) 96,172.8 39.1

S'pore Exchange SGX SP BUY 10.39 12.35 18.9 6/20 23.6 24.1 23.6 3.1 35.6 11,109.3 8.8

SIA SIA SP SELL 4.93 4.15 (15.8) 3/21 n.a. n.a. 5.5 0.0 (4.2) 14,617.3 0.9

Yangzijiang YZJSGD SP BUY 1.49 1.76 18.1 12/20 11.6 9.7 7.8 3.7 8.7 5,734.3 0.8

Source: UOB Kay Hian

Refer to last page for important disclosures. 8

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

Disclosures/Disclaimers

This report is prepared by UOB Kay Hian Private Limited (“UOBKH”), which is a holder of a capital markets services licence and an

exempt financial adviser in Singapore.

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an

advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the

particular needs of any recipient hereof. Advice should be sought from a financial adviser regarding the suitability of the investment

product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this

report to any other person without the prior written consent of UOBKH. This report is not directed to or intended for distribution to or use by

any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as UOBKH may

determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to applicable law

or would subject UOBKH and its connected persons (as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any

registration, licensing or other requirements within such jurisdiction.

The information or views in the report (“Information”) has been obtained or derived from sources believed by UOBKH to be reliable.

However, UOBKH makes no representation as to the accuracy or completeness of such sources or the Information and UOBKH accepts

no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. UOBKH and its connected persons

may have issued other reports expressing views different from the Information and all views expressed in all reports of UOBKH and its

connected persons are subject to change without notice. UOBKH reserves the right to act upon or use the Information at any time,

including before its publication herein.

Except as otherwise indicated below, (1) UOBKH, its connected persons and its officers, employees and representatives may, to the

extent permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit

business from, the subject corporation(s) referred to in this report; (2) UOBKH, its connected persons and its officers, employees and

representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business

from, other persons in respect of dealings in the securities referred to in this report or other investments related thereto; (3) the officers,

employees and representatives of UOBKH may also serve on the board of directors or in trustee positions with the subject corporation(s)

referred to in this report. (All of the foregoing is hereafter referred to as the “Subject Business”); and (4) UOBKH may otherwise have an

interest (including a proprietary interest) in the subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in

the securities of the corporation(s) which are referred to in the content they respectively author or are otherwise responsible for.

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report was prepared by UOBKH, a company authorized, as noted above, to engage in securities activities in Singapore.

UOBKH is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of

research reports and the independence of research analysts. This research report is provided for distribution by UOBKH (whether directly

or through its US registered broker dealer affiliate named below) to “major U.S. institutional investors” in reliance on the exemption from

registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All US persons that

receive this document by way of distribution from or which they regard as being from UOBKH by their acceptance thereof represent and

agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on

the information provided in this research report should do so only through UOB Kay Hian (U.S.) Inc (“UOBKHUS”), a registered broker-

dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell

securities or related financial instruments through UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is

delivered to and intended to be received by a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry

Regulatory Authority (“FINRA”) and may not be an associated person of UOBKHUS and, therefore, may not be subject to applicable

restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Refer to last page for important disclosures. 9

R e g i o n a l M o r n i n g N o t e s Friday, 04 June 2021

Analyst Certification/Regulation AC

Each research analyst of UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect

his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by

him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of UOBKH or any other person, any of the Subject Business

involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any

compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any sales,

trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the compensation

received by each such research analyst is based upon various factors, including UOBKH’s total revenues, a portion of which are

generated from UOBKH’s business of dealing in securities.

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the

following table.

General This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or

located in any country or jurisdiction where the distribution, publication or use of this report would be contrary to

applicable law or regulation.

Hong Kong This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the

Securities and Futures Commission of Hong Kong. Neither the analyst(s) preparing this report nor his associate, has

trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the listed

corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under

Para. 16.5 of Code of Conduct with the listed corporation covered in this report. Where the report is distributed in Hong

Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong

Kong in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong

who is not a professional investor, or institutional investor, UOBKHHK accepts legal responsibility for the contents of the

analyses or reports only to the extent required by law.

Indonesia This report is distributed in Indonesia by PT UOB Kay Hian Sekuritas, which is regulated by Financial Services Authority

of Indonesia (“OJK”). Where the report is distributed in Indonesia and contains research analyses or reports from a

foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the relevant

foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the

recipients of the analyses or reports are to contact UOBKHM (and not the relevant foreign research house) in Malaysia,

at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as UOBKHM is the

registered person under CMSA to distribute any research analyses in Malaysia.

Singapore This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital

markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore.Where the

report is distributed in Singapore and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore

in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore

who is not an accredited investor, expert investor or institutional investor, UOBKH accepts legal responsibility for the

contents of the analyses or reports only to the extent required by law.

Thailand This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated

by the Securities and Exchange Commission of Thailand.

United This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning

Kingdom of the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in

the UK is intended only for institutional clients.

United This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S.

States of laws and regulations. It is being distributed in the U.S. by UOB Kay Hian (US) Inc, which accepts responsibility for its

America contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to in

(‘U.S.’) the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2021, UOB Kay Hian Pte Ltd. All rights reserved.

http://research.uobkayhian.com

RCB Regn. No. 197000447W

Refer to last page for important disclosures. 10

You might also like

- Advanced Diagnostics Ford Manual-FordDocument55 pagesAdvanced Diagnostics Ford Manual-FordAnonymous 8To07bJFa71% (7)

- Fourth Floor Esport ArenaDocument1 pageFourth Floor Esport ArenaJaniel Sazon SerranoNo ratings yet

- Third Floor Esport ArenaDocument1 pageThird Floor Esport ArenaJaniel Sazon Serrano0% (2)

- A211-12 - Architectural Level 01 Brickwork Detail Plan - North WallDocument1 pageA211-12 - Architectural Level 01 Brickwork Detail Plan - North WallJavier Enrique Diaz ChacinNo ratings yet

- Sanjib Ji2Document1 pageSanjib Ji2ashokNo ratings yet

- DDC Guyana, Riser Spanner Joint 27.56 TonDocument1 pageDDC Guyana, Riser Spanner Joint 27.56 TonGreg BiddleNo ratings yet

- Marathon Electric - 184TTFBD6006 - DrawingDocument1 pageMarathon Electric - 184TTFBD6006 - DrawingJonalou ArominNo ratings yet

- Iit PlanDocument1 pageIit Planronakchavan1990No ratings yet

- Recommended Setting Maximum Setting: Current Revision ApprovedDocument1 pageRecommended Setting Maximum Setting: Current Revision Approvedtecnicomineria14060No ratings yet

- GuruFocus Report 0P0000BK9ADocument14 pagesGuruFocus Report 0P0000BK9AcarminatNo ratings yet

- Vermi PlanDocument1 pageVermi Planmanilesnarf5No ratings yet

- A1 Etch or Scribe "B-9675" IN SHEET: RevisionsDocument1 pageA1 Etch or Scribe "B-9675" IN SHEET: RevisionsI CNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Detailed Pert-CPMDocument1 pageDetailed Pert-CPMIsabellaPeriginaNo ratings yet

- POCLLBPR - V2 - BUT Premium - Commercial Live Goals - UK - 2020Document1 pagePOCLLBPR - V2 - BUT Premium - Commercial Live Goals - UK - 2020amamùra maamar100% (1)

- ÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileDocument1 pageÉVÉ) BÉEÉÒ °ô (É®äJÉÉ: Budget ProfileSagarNo ratings yet

- A-6 - Floor FinishesDocument1 pageA-6 - Floor FinishesfelixNo ratings yet

- Planta Electrica Transformador: JM-5 JM-8 JM-11Document1 pagePlanta Electrica Transformador: JM-5 JM-8 JM-11DosSantos GroupNo ratings yet

- Ir Reference Document 2007 Sartorius Stedim Biotech PDFDocument161 pagesIr Reference Document 2007 Sartorius Stedim Biotech PDFBrian VasquezNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Air Conditioning Solution Profile: Global Operations DivisionDocument10 pagesAir Conditioning Solution Profile: Global Operations DivisionAmer Lobrio BantuasNo ratings yet

- Rafter - 1: Schedule of SlabDocument1 pageRafter - 1: Schedule of Slabrogelio sorianoNo ratings yet

- FasbruyerDocument2 pagesFasbruyerFelipe SepulvedaNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Lokesh SuranaNo ratings yet

- Cartobase 9-14-2-2Document1 pageCartobase 9-14-2-2RicardoNo ratings yet

- CM100RX-24A NDocument8 pagesCM100RX-24A NLITMAS TECHNOLOGYNo ratings yet

- PROYECTO FINAL DE CAD-Layout1Document1 pagePROYECTO FINAL DE CAD-Layout1Joss Adhelyn Cordova CastilloNo ratings yet

- PARCIAL DE CAD - CORDOVA-ModelDocument1 pagePARCIAL DE CAD - CORDOVA-ModelJoss Adhelyn Cordova CastilloNo ratings yet

- PARCIAL DE CAD - CORDOVA-Layout1Document1 pagePARCIAL DE CAD - CORDOVA-Layout1Joss Adhelyn Cordova CastilloNo ratings yet

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Document2 pagesATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- CP Arq 01 Planta Bind-ChactunDocument1 pageCP Arq 01 Planta Bind-ChactunPoncho HernandezNo ratings yet

- Factsheet NiftyMidSmallITAndTelecomDocument2 pagesFactsheet NiftyMidSmallITAndTelecomAvinash BaldiNo ratings yet

- Addition Alteration 2Document1 pageAddition Alteration 2Kscsiddhant KscsiddhantNo ratings yet

- Corte Longitudinal Corte Transversal: A C D F BDocument1 pageCorte Longitudinal Corte Transversal: A C D F BLaura Newsotty HerreraNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Izmir Main ProposalDocument19 pagesIzmir Main ProposalJoellaaaNo ratings yet

- Company Overview: Initial Report May 6th, 2008Document24 pagesCompany Overview: Initial Report May 6th, 2008beacon-docsNo ratings yet

- B.1 C.1 E.1 F.1 G A 7: 10F Unit 1003 Tycoon Center, Pearl Drive ST., Ortigas Center, Pasig City 1605Document1 pageB.1 C.1 E.1 F.1 G A 7: 10F Unit 1003 Tycoon Center, Pearl Drive ST., Ortigas Center, Pasig City 1605Royce PaladaNo ratings yet

- Aehr Test SystemsDocument1 pageAehr Test SystemsYS FongNo ratings yet

- Denah Gedung DM 15 No. 110 Rev6Document3 pagesDenah Gedung DM 15 No. 110 Rev6Wijaya GultomNo ratings yet

- Arquitectonico PaDocument1 pageArquitectonico PaPedro MárquezNo ratings yet

- Factsheet Nifty 100 EW IndexDocument2 pagesFactsheet Nifty 100 EW IndexAnkit JoshiNo ratings yet

- PJU Tiang Listrik Tahap 1 Grand Hill PDFDocument2 pagesPJU Tiang Listrik Tahap 1 Grand Hill PDFpuji dpNo ratings yet

- DAY Investor: Thursday, May 24, 2018Document167 pagesDAY Investor: Thursday, May 24, 2018RaduNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- Model ESG AdaptiveDocument2 pagesModel ESG AdaptiveSteven SmithNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Voltages / Loading: Inactive Out of Calculation De-EnergizedDocument1 pageVoltages / Loading: Inactive Out of Calculation De-EnergizedAnish PoudelNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50Sunil ChawdaNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Joza XDDocument1 pageJoza XDRicardo AmadorNo ratings yet

- Arquitectura 1Document1 pageArquitectura 1lalalallalalaaluuuNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Devi Prasad BeheraNo ratings yet

- Planta Arquitectonica Apt - 1001Document1 pagePlanta Arquitectonica Apt - 1001Maria Alejandra VivancoNo ratings yet

- AffinHwang - AME IPO ICDocument15 pagesAffinHwang - AME IPO ICFong Kah YanNo ratings yet

- Bursa Malaysia (BURSA MK) : Regional Morning NotesDocument5 pagesBursa Malaysia (BURSA MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Electronics Manufacturing Services - Malaysia: Regional Morning NotesDocument4 pagesElectronics Manufacturing Services - Malaysia: Regional Morning NotesFong Kah YanNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Ata Ims (Aib MK) : Regional Morning NotesDocument5 pagesAta Ims (Aib MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Duopharma Biotech (DBB MK) : MalaysiaDocument16 pagesDuopharma Biotech (DBB MK) : MalaysiaFong Kah YanNo ratings yet

- Inari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyDocument3 pagesInari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyFong Kah YanNo ratings yet

- Rubber Gloves - Malaysia: Regional Morning NotesDocument5 pagesRubber Gloves - Malaysia: Regional Morning NotesFong Kah YanNo ratings yet

- Household Responsibility System. The System Can Be Divided Into 3Document4 pagesHousehold Responsibility System. The System Can Be Divided Into 3Fong Kah YanNo ratings yet

- Alpha Picks: Catching The Late Ray of Sunshine: Regional Morning NotesDocument5 pagesAlpha Picks: Catching The Late Ray of Sunshine: Regional Morning NotesFong Kah YanNo ratings yet

- Verantis BlowerDocument14 pagesVerantis BlowerTaniadi SuriaNo ratings yet

- Globaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDocument7 pagesGlobaltouch West Africa Limited A Case For Reinvestment Toward ProfitabilityDyaji Charles BalaNo ratings yet

- 91%-UGRD-IT6210 Quantitative Methods or Quantitative (Same Title)Document14 pages91%-UGRD-IT6210 Quantitative Methods or Quantitative (Same Title)michael sevillaNo ratings yet

- Affidavit of DenialDocument1 pageAffidavit of Denialkillua111445100% (1)

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- SHS Perforated Materials vs. Manuel DiazDocument3 pagesSHS Perforated Materials vs. Manuel DiazRJ PasNo ratings yet

- Application To Pay Filing Fee in InstallmentsDocument2 pagesApplication To Pay Filing Fee in InstallmentsNatalie RowlandNo ratings yet

- MobileBill 1025537183Document6 pagesMobileBill 1025537183Rohit BhambhaniNo ratings yet

- TDS - Rheobuild 1100Document3 pagesTDS - Rheobuild 1100Alexi ALfred H. Tago100% (1)

- Microtig 185 DaDocument40 pagesMicrotig 185 DaCONTROLES PHILLMATNo ratings yet

- Sebial Vs SebialDocument4 pagesSebial Vs SebialNC BergoniaNo ratings yet

- Reviewer UcspDocument5 pagesReviewer UcspMayzie jayce CastañedaNo ratings yet

- Swithmail V 2.0: Usage and General How-ToDocument6 pagesSwithmail V 2.0: Usage and General How-ToDaniel AraújoNo ratings yet

- The Psychological ContractDocument5 pagesThe Psychological Contractანი გორგოძეNo ratings yet

- Dates Time School RoutineDocument85 pagesDates Time School RoutineCristina BariNo ratings yet

- Responsible Leadership ReportDocument7 pagesResponsible Leadership ReportRNo ratings yet

- 129 Bba-206Document3 pages129 Bba-206Ghanshyam SharmaNo ratings yet

- IJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFDocument8 pagesIJAUD - Volume 2 - Issue 4 - Pages 11-18 PDFAli jeffreyNo ratings yet

- Management of Cybersecurity in Medical Devices - Diec 2020Document13 pagesManagement of Cybersecurity in Medical Devices - Diec 2020Haris Hamidovic100% (1)

- Sankalp Research Paper 2023Document22 pagesSankalp Research Paper 2023Shivansh SinghNo ratings yet

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdNo ratings yet

- Tata PowerDocument9 pagesTata PowerAnkita SinghNo ratings yet

- Kec 553a Lab Manual DSP 20-21Document62 pagesKec 553a Lab Manual DSP 20-21sachinyadavv13No ratings yet

- Sample Offer LettersDocument4 pagesSample Offer LettersAvinash KumarNo ratings yet

- Functional Properties and Health Benefits of Bioactive Peptides Derived From Spirulina: A ReviewDocument19 pagesFunctional Properties and Health Benefits of Bioactive Peptides Derived From Spirulina: A ReviewOrlando Torres CastilloNo ratings yet

- URS R404aDocument1 pageURS R404aironiteNo ratings yet

- Sports Economics 2017 1st Edition Berri Solutions ManualDocument8 pagesSports Economics 2017 1st Edition Berri Solutions Manualbrendabrownipnmktbzas100% (10)

- Sample Resignation LetterDocument4 pagesSample Resignation Letterriduanrashid100% (1)