Professional Documents

Culture Documents

Commercial Real Estate - Case Study Apr 2020

Commercial Real Estate - Case Study Apr 2020

Uploaded by

alim shaikhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commercial Real Estate - Case Study Apr 2020

Commercial Real Estate - Case Study Apr 2020

Uploaded by

alim shaikhCopyright:

Available Formats

Case Study

Tristar Infra Ltd. owns a Business Park located at prime CBD area. This Business Park has 6 lakh sq ft of

commercial space available for rent. The promoters are now looking to exit from their investment in this

Business Park. They are ready to sell their equity stake (45 Crs equity shares) to any prospective bidder at

₹20 per share, thereby valuing the Business Park at ₹900 Crs.

White Rock Plc, a Real Estate fund, is interested in acquiring the equity stake in this Business Park.

However before deciding on the acquisition (at ₹20 per share), the fund will like to carry out their financial

due diligence. Below are the commercial details of the Business Park;

Available space = 6,00,000 sq ft

Financial Year Expected Occupancy ratio

2020-21 80%

2021-22 85%

2022-23 90%

2023-24 92%

2024-25 95%

2025-26 95%

2026-27 98%

2027-28 98%

2028-29 98%

Proposed Rent Structure

Financial Year monthly Rent (₹ per sq ft)

2020-21 160

2021-22 160

2022-23 8% increase over previous year

2023-24 180

2024-25 180

2025-26 10% increase over previous year

2026-27 220

2027-28 220

2028-29 10% increase over previous year

From Year 2029-30 Assume 4% growth in Rent

Operational cost estimates

Property Other Insurance

Maintenance Tax (₹ per operational Cost Premium (for Collection loss ( for

Year

Cost (₹ per sq. sq. ft. per (₹ per sq. ft. per the year ₹ in the year)

ft. per month) month) month) Crs)

0.1% of gross rent

2020-21 15 4 12 1

collection

Inflation

6% 4% 5% 10%

estimates

White Rock Plc has adopted accounting policy of providing 10% depreciation (SLM).

Applicable tax rate is 30%.

The White Rock Plc intend to invest in this business park with equity funding. The cost of equity is 16% for

the White Rock Plc. You are required to;

Find out NPV of the project

Assuming White Rock Plc go ahead with this investment, what will be the likely value of their

equity in year 2029-30.

You might also like

- Rental Lease Move in Move Out Inspection BLANK FORMDocument5 pagesRental Lease Move in Move Out Inspection BLANK FORMTrinity GibbsNo ratings yet

- F09 FIN4410 Topic 7Document7 pagesF09 FIN4410 Topic 7Mustafa Aziz100% (1)

- 4 Quadrant ModelDocument3 pages4 Quadrant ModelJJ LatifNo ratings yet

- Valuation ReportDocument84 pagesValuation Reportalim shaikhNo ratings yet

- REPE Case 02 45 Milk Street Investment RecommendationDocument20 pagesREPE Case 02 45 Milk Street Investment RecommendationziuziNo ratings yet

- Ch02 P14 Build A Model AnswerDocument4 pagesCh02 P14 Build A Model Answersiefbadawy1No ratings yet

- The PA I-78I-81 Logistics CorridorDocument20 pagesThe PA I-78I-81 Logistics CorridorAnonymous Feglbx5No ratings yet

- Betaworks Shareholder Letter 2012Document32 pagesBetaworks Shareholder Letter 2012Erin GriffithNo ratings yet

- CalculationsManual4.05 NA (S CURVE)Document38 pagesCalculationsManual4.05 NA (S CURVE)Teodoro Miguel Carlos IsraelNo ratings yet

- Private Equity Real Estate Fundraising Report 2010Document1 pagePrivate Equity Real Estate Fundraising Report 2010http://besthedgefund.blogspot.comNo ratings yet

- Microsoft Word - Zoning Calc Handout - 01-07-10Document7 pagesMicrosoft Word - Zoning Calc Handout - 01-07-10balaNo ratings yet

- DamodaranDocument49 pagesDamodaranSukanta ChatterjeeNo ratings yet

- New Teacher S Companion Practical Wisdom For Succeeding in The ClassroomDocument47 pagesNew Teacher S Companion Practical Wisdom For Succeeding in The Classroomsarikeisarawak100% (1)

- Kansas Property Management Agreement PDFDocument5 pagesKansas Property Management Agreement PDFDrake MontgomeryNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- 01 23 19 Catalina IM Catalina Entitlement Fund PDFDocument52 pages01 23 19 Catalina IM Catalina Entitlement Fund PDFDavid MendezNo ratings yet

- RE 01 12 Simple Multifamily Acquisition SolutionsDocument3 pagesRE 01 12 Simple Multifamily Acquisition SolutionsAnonymous bf1cFDuepPNo ratings yet

- Developing For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITDocument73 pagesDeveloping For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITmarks2muchNo ratings yet

- Sodo Arena Proposal Seattle Duwamish Manufacturing and Industrial Center Land Use and Planning IssuesDocument26 pagesSodo Arena Proposal Seattle Duwamish Manufacturing and Industrial Center Land Use and Planning IssuesMatt DriscollNo ratings yet

- MezzanineDocument14 pagesMezzaninevirtualatallNo ratings yet

- Babson Capital Mezz Middle Market WPDocument8 pagesBabson Capital Mezz Middle Market WPrhapsody1447No ratings yet

- Mezzanine CapitalDocument8 pagesMezzanine CapitalDhananjay SharmaNo ratings yet

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- REITs and InvITsDocument17 pagesREITs and InvITsSai YvstNo ratings yet

- REITs (Public + Private)Document81 pagesREITs (Public + Private)Chris CarmenNo ratings yet

- Basics of REITDocument9 pagesBasics of REITRoyce ZhanNo ratings yet

- Rethink Zoning OrdinanceDocument400 pagesRethink Zoning OrdinanceThe UrbanistNo ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- ChelseaFund - TermSheet - May 10-VMADocument2 pagesChelseaFund - TermSheet - May 10-VMAMarius AngaraNo ratings yet

- Partnership PresentationDocument128 pagesPartnership Presentationparv dalalNo ratings yet

- Land Bank FeasibilityDocument80 pagesLand Bank Feasibilitymehdi940No ratings yet

- InVEMA13 - Real Estate ValuationDocument9 pagesInVEMA13 - Real Estate ValuationDaniel ValerianoNo ratings yet

- Best Practices For Transportation Management PDFDocument8 pagesBest Practices For Transportation Management PDFAbner LlenosNo ratings yet

- Mapletree Commercial Trust Annual Report 2015-16Document160 pagesMapletree Commercial Trust Annual Report 2015-16Sassy TanNo ratings yet

- Corporate Real Estate Asset Management PaperDocument19 pagesCorporate Real Estate Asset Management PaperZX LeeNo ratings yet

- LS - Real Estate and Portfolio TheoryDocument31 pagesLS - Real Estate and Portfolio TheoryTanmoy ChakrabortyNo ratings yet

- PERE - Private Equity Real EstateDocument1 pagePERE - Private Equity Real EstatePereNo ratings yet

- Lbo ReportDocument9 pagesLbo ReportNikhilesh MoreNo ratings yet

- Park Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %Document10 pagesPark Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %merag76668No ratings yet

- The Journey Is The Reward: Changing Oakland'S Dynamic DistrictsDocument3 pagesThe Journey Is The Reward: Changing Oakland'S Dynamic DistrictsOaklandCBDs100% (1)

- Glacier Funding V CDO Term SheetDocument2 pagesGlacier Funding V CDO Term Sheetthe_akinitiNo ratings yet

- How Do Investment Banks Value Initial Public Offerings (Ipos) ?Document32 pagesHow Do Investment Banks Value Initial Public Offerings (Ipos) ?mumssrNo ratings yet

- Guidelines For Real Estate Research and Case Study Analysis: January 2016Document129 pagesGuidelines For Real Estate Research and Case Study Analysis: January 2016dzun nurwinasNo ratings yet

- Case1 - LEK Vs PWCDocument26 pagesCase1 - LEK Vs PWCmayolgalloNo ratings yet

- Private Debt The Rise of An Asset ClassDocument4 pagesPrivate Debt The Rise of An Asset ClassCarlos VelasquezNo ratings yet

- Single Tenant Triple Net Lease Dunkin Donuts For SaleDocument12 pagesSingle Tenant Triple Net Lease Dunkin Donuts For SalenetleaseNo ratings yet

- Commercial Real Estate Valuation Model1Document6 pagesCommercial Real Estate Valuation Model1Sajib JahanNo ratings yet

- Tax Equity Financing and Asset RotationDocument38 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- REPE Case 03 Sao Paulo Opportunistic Pre Sold Condos SlidesDocument18 pagesREPE Case 03 Sao Paulo Opportunistic Pre Sold Condos SlidesBrado DelgadoNo ratings yet

- Commercial Real Estate Valuation Model1Document2 pagesCommercial Real Estate Valuation Model1cjsb99No ratings yet

- Financial Model - 225 East 13th Street, New YorkDocument13 pagesFinancial Model - 225 East 13th Street, New YorkAliHaidar85100% (2)

- Factors Affecting Capitalization Rate of US Real EstateDocument36 pagesFactors Affecting Capitalization Rate of US Real Estatevharish88No ratings yet

- Investment Proposal (Project) Application Form: C Ompany ProfileDocument3 pagesInvestment Proposal (Project) Application Form: C Ompany ProfilenabawiNo ratings yet

- Property Valuation and Appraisal U.S. Information Systems and Recommendations For PolandDocument51 pagesProperty Valuation and Appraisal U.S. Information Systems and Recommendations For PolandRobert JohnNo ratings yet

- Merger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryDocument14 pagesMerger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryOtunba Olowolafe MichaelNo ratings yet

- KKRDocument2 pagesKKRMihai StoicaNo ratings yet

- Custom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Document37 pagesCustom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Jonathan D SmithNo ratings yet

- Poland Investor GuideDocument32 pagesPoland Investor GuidearifnezamiNo ratings yet

- N1591 2019-20 - Sample Exam QuestionsDocument11 pagesN1591 2019-20 - Sample Exam QuestionsMandeep SNo ratings yet

- Project Management – an Artificial Intelligent (Ai) ApproachFrom EverandProject Management – an Artificial Intelligent (Ai) ApproachNo ratings yet

- WaterSlideTowerFinishes Brochure DigitalDocument29 pagesWaterSlideTowerFinishes Brochure Digitalalim shaikhNo ratings yet

- NPV Irr CaseDocument22 pagesNPV Irr Casealim shaikhNo ratings yet

- 2015 Park Recreation Open Space Master PlanDocument196 pages2015 Park Recreation Open Space Master Planalim shaikhNo ratings yet

- Casinos in Goa: The Challenge Ahead Is To Implement Sustainable Strategies To Minimize Their Ill-EffectsDocument8 pagesCasinos in Goa: The Challenge Ahead Is To Implement Sustainable Strategies To Minimize Their Ill-Effectsalim shaikhNo ratings yet

- Gddpga - 4 - 1Document27 pagesGddpga - 4 - 1alim shaikhNo ratings yet

- The Only Listed Gaming and Hospitality Company in IndiaDocument23 pagesThe Only Listed Gaming and Hospitality Company in Indiaalim shaikhNo ratings yet

- DNA of Theme Park HotelsDocument11 pagesDNA of Theme Park Hotelsalim shaikhNo ratings yet

- A Revenue Management Model For Casino Table Games: Michael Chen, Henry Tsai, and Shiang-Lih Chen MccainDocument10 pagesA Revenue Management Model For Casino Table Games: Michael Chen, Henry Tsai, and Shiang-Lih Chen Mccainalim shaikhNo ratings yet

- WaterRides-Brochure 2021 DigitalDocument15 pagesWaterRides-Brochure 2021 Digitalalim shaikhNo ratings yet

- Analytical Case Study of Casino and Resort: Wei Lin, PH.D William SchmarzoDocument40 pagesAnalytical Case Study of Casino and Resort: Wei Lin, PH.D William Schmarzoalim shaikhNo ratings yet

- M3 PN200352 Casino NI 43 101 PEA FinalDocument328 pagesM3 PN200352 Casino NI 43 101 PEA Finalalim shaikhNo ratings yet

- Extraordinary: Government of GoaDocument5 pagesExtraordinary: Government of Goaalim shaikhNo ratings yet

- 4874-Article Text-16268-1-10-20210429Document10 pages4874-Article Text-16268-1-10-20210429alim shaikhNo ratings yet

- Titan: 87 - Limited Relationship Ring P Fort 400 001 DCS-CRD India PlazaDocument37 pagesTitan: 87 - Limited Relationship Ring P Fort 400 001 DCS-CRD India Plazaalim shaikhNo ratings yet

- Nevada Gaming Revenue - A Comparative Analysis of Slots and TablesDocument11 pagesNevada Gaming Revenue - A Comparative Analysis of Slots and Tablesalim shaikhNo ratings yet

- Evaluating Mergers and Divestitures: A Casino Case StudyDocument46 pagesEvaluating Mergers and Divestitures: A Casino Case Studyalim shaikhNo ratings yet

- Can REIT Address Expectations of Indian Real Estate Investors?Document7 pagesCan REIT Address Expectations of Indian Real Estate Investors?alim shaikhNo ratings yet

- Valuation of CasinoDocument11 pagesValuation of Casinoalim shaikhNo ratings yet

- How Well Do Investment Trusts Perform in India?: Test Engineering and Management May 2021Document7 pagesHow Well Do Investment Trusts Perform in India?: Test Engineering and Management May 2021alim shaikhNo ratings yet

- Reit - Ideal Working Model For Indian ContextDocument18 pagesReit - Ideal Working Model For Indian Contextalim shaikhNo ratings yet

- State Secretary: Fax:: Commissioner: /E-Mail: Comm-Gsec - Goa@nic - inDocument1 pageState Secretary: Fax:: Commissioner: /E-Mail: Comm-Gsec - Goa@nic - inalim shaikhNo ratings yet

- Titan Earnings Call Transcript Q3 FY'22Document17 pagesTitan Earnings Call Transcript Q3 FY'22alim shaikhNo ratings yet

- Measuring Performance Efficiency of Listed Real Estate Investment Trust (REITS) in Sub-Sahara AfricaDocument11 pagesMeasuring Performance Efficiency of Listed Real Estate Investment Trust (REITS) in Sub-Sahara Africaalim shaikhNo ratings yet

- Kasturi K: One Stop Hi-Tech Health Care CentreDocument20 pagesKasturi K: One Stop Hi-Tech Health Care Centrealim shaikhNo ratings yet

- India: On The Reit' Path: Sweta Ananthanarayanan and Shreyas NarlaDocument23 pagesIndia: On The Reit' Path: Sweta Ananthanarayanan and Shreyas Narlaalim shaikhNo ratings yet

- The Historical Development of Hospitality in Makkah: International Journal of Engineering and Technology August 2018Document6 pagesThe Historical Development of Hospitality in Makkah: International Journal of Engineering and Technology August 2018alim shaikhNo ratings yet

- Private & Confidential: VVVVVVDocument171 pagesPrivate & Confidential: VVVVVValim shaikhNo ratings yet

- The Second Tallest Building in The WorldDocument177 pagesThe Second Tallest Building in The Worldalim shaikhNo ratings yet

- ObliCon Diploma Paculdo V RegaladoDocument2 pagesObliCon Diploma Paculdo V RegaladoTrinca DiplomaNo ratings yet

- Effect of Flooding On Property Value A Case Study of Isheri North, Isheri, Lagos StateDocument7 pagesEffect of Flooding On Property Value A Case Study of Isheri North, Isheri, Lagos Statefagbemi KayodeNo ratings yet

- ESPN - Flash Report 2022 - 06 - NL - January 2022Document2 pagesESPN - Flash Report 2022 - 06 - NL - January 2022jihaneNo ratings yet

- Melencio v. Dy Tiao LayDocument10 pagesMelencio v. Dy Tiao LayEdu RiparipNo ratings yet

- Prioritized Vs Accelerated ExaminationDocument6 pagesPrioritized Vs Accelerated ExaminationSchneider Rothman IP Law GroupNo ratings yet

- Rent AgreementRANJANADEVIDocument3 pagesRent AgreementRANJANADEVIAdvocate Arun Kumar GargNo ratings yet

- Grade 7 EMS NotesDocument6 pagesGrade 7 EMS NoteshayleyNo ratings yet

- Car Rental Business Plan PDFDocument46 pagesCar Rental Business Plan PDFjesicalarson123No ratings yet

- The Sindh Rented Premises Ordinance 1979Document10 pagesThe Sindh Rented Premises Ordinance 1979king100% (2)

- JLL India Office Update Q1 2021Document18 pagesJLL India Office Update Q1 2021jatin girotraNo ratings yet

- 10 Chapter 5Document61 pages10 Chapter 5Pratiyush KumarNo ratings yet

- CBRE North America CapRate 2014H1 MasterDocument49 pagesCBRE North America CapRate 2014H1 Mastercubsfan936No ratings yet

- Wsu Ncaa 2020Document79 pagesWsu Ncaa 2020Matt BrownNo ratings yet

- BUSANA1 Chapter 2 Part 1Document42 pagesBUSANA1 Chapter 2 Part 1senior highNo ratings yet

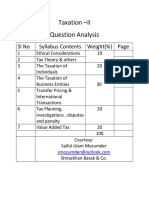

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- Income From House PropertyDocument22 pagesIncome From House PropertytukuNo ratings yet

- Tabel EkotekDocument44 pagesTabel EkotekAkbar AgudaNo ratings yet

- The Commercial Observer - May 11, 2010Document55 pagesThe Commercial Observer - May 11, 2010Jesse CostelloNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- Commercial Lease AgreementDocument9 pagesCommercial Lease Agreementapi-568505563No ratings yet

- Simple Contract of Lease Sample PhilippinesDocument8 pagesSimple Contract of Lease Sample Philippinesanjie williamNo ratings yet

- OriginalDocument2 pagesOriginalCindhy Borja FactoranNo ratings yet

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telNo ratings yet

- Psychological Empowerment in The WorkplaceDocument24 pagesPsychological Empowerment in The WorkplaceAndhika Putra KresnanditoNo ratings yet

- Lease ContractDocument2 pagesLease ContractAtty. Ed Mark BaroyNo ratings yet

- Professional Practice: B.Arch. V YearDocument12 pagesProfessional Practice: B.Arch. V YearMohammad AnasNo ratings yet

- Asian TransmissionDocument22 pagesAsian TransmissionHannah SyNo ratings yet