Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

53 viewsMahusay - Bsa211 - Module 2 Self Exercises

Mahusay - Bsa211 - Module 2 Self Exercises

Uploaded by

Jeth MahusayThis document contains a review exercise for an auditing and assurance principles module on audit planning and internal control consideration. It includes 10 multiple choice questions related to audit planning procedures, evaluating internal controls, control environment and assessing control risk. The questions cover topics like obtaining an understanding of a client's control environment, evaluating existing internal controls, analytical procedures used in audit planning and assessing aspects of a client's internal control system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Mahusay - Acc319 - Module 1 Major OutputDocument4 pagesMahusay - Acc319 - Module 1 Major OutputJeth MahusayNo ratings yet

- Prelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearDocument10 pagesPrelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearJeremae Ann Ceriaco100% (1)

- 5890 Take Home Test 2Document10 pages5890 Take Home Test 2biwithse7enNo ratings yet

- CH 1 Quiz With AnswersDocument7 pagesCH 1 Quiz With AnswersBeverly Ann Caparoso100% (3)

- Major Assessment - Current Liab-MahusayDocument5 pagesMajor Assessment - Current Liab-MahusayJeth Mahusay100% (1)

- Future of AnalysisDocument6 pagesFuture of AnalysisJohn SolórzanoNo ratings yet

- Amit Black Book Financial Analysis of Idbi BankDocument81 pagesAmit Black Book Financial Analysis of Idbi Bankamit100% (1)

- At Aud001Document4 pagesAt Aud001KathleenNo ratings yet

- At Aud001Document4 pagesAt Aud001Missy Rose LegaraNo ratings yet

- Quiz - Understanding The Entity and Its EnvironmentDocument4 pagesQuiz - Understanding The Entity and Its EnvironmentKathleenNo ratings yet

- Assurance Principles Midterm QuizDocument5 pagesAssurance Principles Midterm Quizjovelyn labordoNo ratings yet

- Aud TheoDocument7 pagesAud TheoRalph MindaroNo ratings yet

- Line Item: Basic Concepts of Internal Control CparDocument35 pagesLine Item: Basic Concepts of Internal Control CparrexNo ratings yet

- CH 11Document4 pagesCH 11Ariana GrandeNo ratings yet

- Risk Assessment AuditDocument9 pagesRisk Assessment Auditrandom17341No ratings yet

- ICPA Audit Planning HandoutDocument4 pagesICPA Audit Planning Handoutmichelle angela maramagNo ratings yet

- Homework in Internal ControlDocument7 pagesHomework in Internal ControlAdam SmithNo ratings yet

- Aldersgate College Espinoza, Danielle Audrey MDocument6 pagesAldersgate College Espinoza, Danielle Audrey MddddddaaaaeeeeNo ratings yet

- Audit PlanningDocument14 pagesAudit PlanningkristineNo ratings yet

- 6 Internal Control AKDocument9 pages6 Internal Control AKMinie KimNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsReymark MutiaNo ratings yet

- Exercise - Overview of The Financial Statement Audit ProcessDocument4 pagesExercise - Overview of The Financial Statement Audit ProcessAlyssa RacasaNo ratings yet

- AT - Material4 Audit Planning-2Document10 pagesAT - Material4 Audit Planning-2Zach RiversNo ratings yet

- RESA AT PreWeek (B43)Document7 pagesRESA AT PreWeek (B43)MellaniNo ratings yet

- CH 11 P1Document4 pagesCH 11 P1GlaizzaNo ratings yet

- AT Preweek (B44)Document7 pagesAT Preweek (B44)Haydy AntonioNo ratings yet

- A12 Quiz3Document8 pagesA12 Quiz3Irish Gracielle Dela CruzNo ratings yet

- DocDocument3 pagesDocMarvine MagaddatuNo ratings yet

- Quizzer 2Document6 pagesQuizzer 2Patrick BacongalloNo ratings yet

- Internal Control - DrillDocument10 pagesInternal Control - DrillTeofel John Alvizo Pantaleon100% (1)

- Auditing in A CIS Environment V1Document27 pagesAuditing in A CIS Environment V1alexissosing.cpaNo ratings yet

- PGB B2Document9 pagesPGB B2Mark ButayaNo ratings yet

- Audit Theory Midterm PDFDocument8 pagesAudit Theory Midterm PDFJuly LumantasNo ratings yet

- Considerations of Internal Control Psa-Based QuestionsDocument28 pagesConsiderations of Internal Control Psa-Based QuestionsNoro75% (4)

- AP 01 Overview of Audit Process AdUDocument5 pagesAP 01 Overview of Audit Process AdUziNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Weakness.": Knowledge Necessary For Audit PlanningDocument9 pagesWeakness.": Knowledge Necessary For Audit Planningkris mNo ratings yet

- Final Exam AUD002Document6 pagesFinal Exam AUD002KathleenNo ratings yet

- 7 Auditing and Assurance - Questions and AnswerDocument2 pages7 Auditing and Assurance - Questions and AnswerAlliah Tandog100% (1)

- AUDITTHEODocument13 pagesAUDITTHEOAlisonNo ratings yet

- Audit - Mock Board Examination - Sy2019-20Document15 pagesAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNo ratings yet

- Consideration of Internal ControlDocument4 pagesConsideration of Internal ControlMary Grace SalcedoNo ratings yet

- Nature of Internal Control: Multiple Choice QuestionsDocument11 pagesNature of Internal Control: Multiple Choice QuestionsJamaica David100% (1)

- Consideration of Internal ControlDocument6 pagesConsideration of Internal Controlinto the unknownNo ratings yet

- Quiz On Overview of Audit ProcessDocument14 pagesQuiz On Overview of Audit ProcessZtrick 1234No ratings yet

- Aud Plan 123Document7 pagesAud Plan 123Mary GarciaNo ratings yet

- Chapter 7: Audit PlanningDocument7 pagesChapter 7: Audit PlanningAngela RamosNo ratings yet

- AT Quizzer 8 - Risk Assessment and Materiality 2SAY2122Document9 pagesAT Quizzer 8 - Risk Assessment and Materiality 2SAY2122lyndon delfinNo ratings yet

- Activity - Risk Assessment Part III - Internal Control SystemDocument6 pagesActivity - Risk Assessment Part III - Internal Control SystemGia Sarah Barillo BandolaNo ratings yet

- Iat22 M2Document8 pagesIat22 M2Kristine Lirose BordeosNo ratings yet

- Audit Planning QuizletDocument32 pagesAudit Planning QuizletMinie KimNo ratings yet

- ASR Quizzer 6 - Planning and Risk AssessmenttDocument18 pagesASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeNo ratings yet

- Midterm Act 2Document4 pagesMidterm Act 2MikNo ratings yet

- Material No. 1Document6 pagesMaterial No. 1Jen AnchetaNo ratings yet

- Internal ControlDocument6 pagesInternal ControlAlissaNo ratings yet

- Chapter 8 Audit Planning Flashcards - QuizletDocument97 pagesChapter 8 Audit Planning Flashcards - Quizletglt0No ratings yet

- Acp 102 FTDocument7 pagesAcp 102 FTLyca SorianoNo ratings yet

- Auditing Theory2011Document18 pagesAuditing Theory2011Justine Ann GalabayoNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Ac10 Chap 56Document30 pagesAc10 Chap 56SVPSNo ratings yet

- Intro To IA Quiz 1Document16 pagesIntro To IA Quiz 1Jao FloresNo ratings yet

- AT 05 Auditor - S Response To Assessed RiskDocument4 pagesAT 05 Auditor - S Response To Assessed RiskjeromyNo ratings yet

- Pre-Assessment Test For Auditing TheoryDocument13 pagesPre-Assessment Test For Auditing TheoryPrecious mae BarrientosNo ratings yet

- Mahusay Acc3112 Major Output 2Document2 pagesMahusay Acc3112 Major Output 2Jeth Mahusay100% (1)

- Law11 - Module 4 - Mahusay, Jeth A.Document4 pagesLaw11 - Module 4 - Mahusay, Jeth A.Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 3Document5 pagesMahusay Acc227 Module 3Jeth MahusayNo ratings yet

- Mahusay Module 4 - Acc4115Document4 pagesMahusay Module 4 - Acc4115Jeth MahusayNo ratings yet

- Mahusay Acc3112 Major Output 3Document4 pagesMahusay Acc3112 Major Output 3Jeth MahusayNo ratings yet

- Mahusay Acc3112 Major Output 1Document4 pagesMahusay Acc3112 Major Output 1Jeth MahusayNo ratings yet

- Acc 227 Intermediate Accounting 2 CSGDocument58 pagesAcc 227 Intermediate Accounting 2 CSGJeth MahusayNo ratings yet

- Mahusay Module 1 - Acc4115Document1 pageMahusay Module 1 - Acc4115Jeth MahusayNo ratings yet

- Mahusay Module 2 - Acc4115Document5 pagesMahusay Module 2 - Acc4115Jeth MahusayNo ratings yet

- Mahusay-Pe2 Lesson 4Document2 pagesMahusay-Pe2 Lesson 4Jeth MahusayNo ratings yet

- Mahusay - G - Ai, PortfolioDocument15 pagesMahusay - G - Ai, PortfolioJeth MahusayNo ratings yet

- Mahusay-Pe2 Lesson 3Document1 pageMahusay-Pe2 Lesson 3Jeth MahusayNo ratings yet

- Mahusay Law211 Articles of CooperationDocument10 pagesMahusay Law211 Articles of CooperationJeth MahusayNo ratings yet

- Mahusay - G-Ai Module 3Document8 pagesMahusay - G-Ai Module 3Jeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 4 Major OutputDocument3 pagesMahusay - Acc319 - Module 4 Major OutputJeth Mahusay100% (3)

- Mahusay Acc227 Module 1Document12 pagesMahusay Acc227 Module 1Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 2Document9 pagesMahusay Acc227 Module 2Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Document3 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Jeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 3 Major OutputDocument4 pagesMahusay - Acc319 - Module 3 Major OutputJeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 2 Major OutputDocument2 pagesMahusay - Acc319 - Module 2 Major OutputJeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 1 Self ExerciseDocument2 pagesMahusay - Acc319 - Module 1 Self ExerciseJeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Formation of PartnershipDocument4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Formation of PartnershipJeth MahusayNo ratings yet

- One Person CorporationDocument3 pagesOne Person CorporationJeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 4Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 4Jeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Jeth MahusayNo ratings yet

- Mahusay Law211 Articles of IncorporationDocument4 pagesMahusay Law211 Articles of IncorporationJeth MahusayNo ratings yet

- Mahusay Law211 Articles of PartnershipDocument2 pagesMahusay Law211 Articles of PartnershipJeth MahusayNo ratings yet

- Green Building Valuation ReportDocument12 pagesGreen Building Valuation ReportLTE002No ratings yet

- Bda 1Document28 pagesBda 1Ikhsan WijayaNo ratings yet

- Enhancing Reading Culture Among School Learners in Kitagata Sub-County School Sheema District A Multifaceted ApproachDocument7 pagesEnhancing Reading Culture Among School Learners in Kitagata Sub-County School Sheema District A Multifaceted ApproachKIU PUBLICATION AND EXTENSIONNo ratings yet

- An Approach To Case Analysis What Is A Case Study?Document8 pagesAn Approach To Case Analysis What Is A Case Study?Ankur JainNo ratings yet

- Organizing References by Using MendeleyDocument49 pagesOrganizing References by Using MendeleyHaniff ShaufilNo ratings yet

- Admas University Bishoftu Campus: Course Title-Resarch Methods in Accounting and Finance Title: Group Assignment IiiDocument9 pagesAdmas University Bishoftu Campus: Course Title-Resarch Methods in Accounting and Finance Title: Group Assignment IiiSolomon GirmaNo ratings yet

- Napoleon Hill - Gandeste Si Devii BogatDocument16 pagesNapoleon Hill - Gandeste Si Devii BogatDenisa H. StroeNo ratings yet

- Iconies 2018 Uin Maliki MalangDocument10 pagesIconies 2018 Uin Maliki MalangAgungNo ratings yet

- Trinidad and Tobago Market StudyDocument75 pagesTrinidad and Tobago Market StudyKeriann LNo ratings yet

- Data Analysis Algorithms For Revenue AssuranceDocument16 pagesData Analysis Algorithms For Revenue AssuranceHenry WishlyNo ratings yet

- Descriptive Vs Inferential StatisticsDocument11 pagesDescriptive Vs Inferential Statisticsyashar2500No ratings yet

- DENSITASDocument3 pagesDENSITASGunNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasEden Dela CruzNo ratings yet

- Ec571-Panel DataDocument33 pagesEc571-Panel DataFadil YmNo ratings yet

- Quantitative ResearchDocument28 pagesQuantitative ResearchCarlo Joseph CarzaNo ratings yet

- Juma Ally Final-MSc. PPM-dissertationDocument84 pagesJuma Ally Final-MSc. PPM-dissertationJuma AllyNo ratings yet

- Elisson Et Al., 1985 Construction of An Infant Neurological InternationalDocument8 pagesElisson Et Al., 1985 Construction of An Infant Neurological InternationalSantiago Gonzalez ArdilaNo ratings yet

- Stat ExcelDocument12 pagesStat ExcelNoli BencaloNo ratings yet

- Research 2: Ms. Mariecor C. BalberDocument31 pagesResearch 2: Ms. Mariecor C. BalberMariecorNo ratings yet

- Exploring My Cultural Understanding of Physiotherapy in A Different CultureDocument41 pagesExploring My Cultural Understanding of Physiotherapy in A Different Culturegoody12foodsNo ratings yet

- Measures of Variability For Ungrouped DataDocument16 pagesMeasures of Variability For Ungrouped DataSharonNo ratings yet

- YMS Chapter 1: Exploring Data AP Statistics at LSHS Mr. MoleskyDocument2 pagesYMS Chapter 1: Exploring Data AP Statistics at LSHS Mr. MoleskyInTerp0ol100% (4)

- Data SPSS Kak Ela Persen InhibisiDocument11 pagesData SPSS Kak Ela Persen InhibisiAgustia AmlizaNo ratings yet

- Phys230 Course OutlineDocument4 pagesPhys230 Course OutlinechaciNo ratings yet

- Posselt Lipson - 2016 - JCSDDocument18 pagesPosselt Lipson - 2016 - JCSDGray LagolosNo ratings yet

- CAP873Document2 pagesCAP873NIdhi100% (1)

- Tutorial 8Document3 pagesTutorial 8Robert OoNo ratings yet

- Web Anal YticsDocument213 pagesWeb Anal YticsAditya KumarNo ratings yet

Mahusay - Bsa211 - Module 2 Self Exercises

Mahusay - Bsa211 - Module 2 Self Exercises

Uploaded by

Jeth Mahusay100%(1)100% found this document useful (1 vote)

53 views6 pagesThis document contains a review exercise for an auditing and assurance principles module on audit planning and internal control consideration. It includes 10 multiple choice questions related to audit planning procedures, evaluating internal controls, control environment and assessing control risk. The questions cover topics like obtaining an understanding of a client's control environment, evaluating existing internal controls, analytical procedures used in audit planning and assessing aspects of a client's internal control system.

Original Description:

Original Title

MAHUSAY - BSA211 - MODULE 2 SELF EXERCISES

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a review exercise for an auditing and assurance principles module on audit planning and internal control consideration. It includes 10 multiple choice questions related to audit planning procedures, evaluating internal controls, control environment and assessing control risk. The questions cover topics like obtaining an understanding of a client's control environment, evaluating existing internal controls, analytical procedures used in audit planning and assessing aspects of a client's internal control system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

53 views6 pagesMahusay - Bsa211 - Module 2 Self Exercises

Mahusay - Bsa211 - Module 2 Self Exercises

Uploaded by

Jeth MahusayThis document contains a review exercise for an auditing and assurance principles module on audit planning and internal control consideration. It includes 10 multiple choice questions related to audit planning procedures, evaluating internal controls, control environment and assessing control risk. The questions cover topics like obtaining an understanding of a client's control environment, evaluating existing internal controls, analytical procedures used in audit planning and assessing aspects of a client's internal control system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

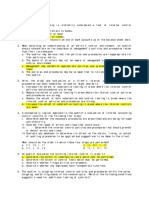

Name: Mahusay, Jeth A.

Date: December, 2020

Year: BSA-3 Instructor:Ms. Anna Mae Magbanua, CPA

Subject: Auditing and Assurance Principle

Module 2: AUDIT PHASE 1

Lesson 4: Audit Planning

Learning Activity:

Review Exercises

1. When obtaining an understanding of an entity's control environment,

an auditor should concentrate on the substance of management's policies

and procedures rather than their form because

a. The auditor may believe that the policies and procedures are

inappropriate for that particular entity

b. The board of directors may not be aware of management's

attitude toward the control environment

c. Management may establish appropriate policies and procedures

but not act on them

d. The policies and procedures may be so weak that no reliance is

contemplated by the auditor

2. After studying and evaluating a client's existing internal control, an

auditor has concluded that the policies and procedures are well designed

and functioning as intended. Under these circumstances, the auditor

would most likely

a. Perform further control tests to the extent outlined in the audit

program

b. Determine the control policies and procedures that should

prevent or detect errors and fraud

c. Set detection risk at a higher level than would be set under

conditions of weak internal control

d. Set detection risk at a lower level than would be set under

conditions of weak internal control

3. An auditor evaluates the existing internal control in order to

a. Determine the extent of substantive tests which must be

performed

b. Determine the extent of control tests which must be performed

c. Ascertain whether irregularities are probable

d. Ascertain whether any employees have incompatible functions

4. Which of the following procedures would an auditor most likely

perform in planning a financial statement audit?

a. Inquiring of the client's legal counsel concerning

pending litigation

b. Comparing the financial statements to anticipated results

c. Examining computer generated exception reports to verify the

effectiveness of internal controls

d. Searching for unauthorized transactions that may aid in

detecting unrecorded liabilities

5. Analytical procedures used in planning an audit should focus on

a. Reducing the scope of tests of controls and substantive tests

b. Providing assurance that potential material misstatements will be

identified

c. Enhancing the auditor's understanding of the client's business

d. Assessing the adequacy of the available evidential matter

6. Analytical procedures, which means the analysis of significant ratios

and trends including the resulting investigation of fluctuations

and relationships that are inconsistent with other relevant information or

which deviate from predicted amounts are not required to be applied

a. At the planning stage of the audit

b. Overall review stage of the audit

c. As substantive procedures

d. None of the above

7. Which of the following statements is correct concerning analytical

procedures?

a. Analytical procedures usually involve comparisons of ratios

developed from recorded amounts to assertions developed by

management

b. Analytical procedures used in planning an audit generally use

data aggregated at a high level

c. Analytical procedures can replace tests of controls in gathering

evidence to support the assessed level of control risk

d. Analytical procedures are more efficient, but not more effective,

than tests of details and transactions

8. Which of the following is an effective audit planning and control

procedures that helps prevent misunderstandings and inefficient use of

audit personnel?

a. Make copies, for inclusion in the working papers, of those client

supporting documents examined by the auditor

b. Provide the client with copies of the audit programs to be used

during the audit

c. Arrange a preliminary conference with the client to discuss audit

objectives, fees, timing, and other information

d. Arrange to have the auditor prepare and post any necessary

adjusting or reclassification entries prior to final closing

9. Which of the following is an aspect of scheduling and controlling the

audit engagement?

a. Including in the audit program a column for estimated and actual

time

b. Performing audit work only after the client's books of account

have been closed for the period under examination

c. Writing a conclusion in individual working papers indicating how

the results of the audit will affect the auditor's report

d. Including in the engagement letter an estimate of the minimum

and maximum audit fee

10. Which of the following is an engagement attribute for an audit of

an entity that processes most of its financial data in electronic form

without any paper documentation?

a. Discrete phases of planning, interim, and year-end field work

b. Increased effort to search for evidence of management fraud

c. Performance of audit tests on a continuous basis

d. Increased emphasis on the completeness assertion

Lesson 5: Internal Control Consideration Introduction

Learning Activity:

Review Exercises

1. Which of the following is correct regarding internal control system?

a. Internal control system refers to all the policies and procedures

adopted by the auditor to assist in achieving management's

objective

b. A strong environment, by itself, ensure the effectiveness of the

internal control system

c. In the audit of financial statements, the auditor is only

concerned with those policies and procedures within the accounting

and internal control systems that are relevant to the financial

statements

d. The internal control system is confined to those matters which

relate directly to the functions of the accounting system

2. Which of the following is correct about internal control?

a. Accounting and internal control systems provide management

with conclusive evidence that objectives are reached

b. One of the inherent limitations of accounting and internal control

systems is the possibility that the procedures may become

inadequate due to changes in conditions, and compliance with

procedures may deteriorate

c. Most internal controls tend to be directed at non-routine

transactions

d. Management does not consider costs of the accounting and

internal control systems

3. Corporate directors, management, external auditors, and internal

auditors all play important roles in creating a proper control environment.

Top management is primarily responsible for

a. Establishing a proper environment and specifying overall internal

control

b. Reviewing the reliability and integrity of financial information and

the means used to collect and report such information

c. Ensuring that external and internal auditors adequately monitor

the control environment

d. Implementing and monitoring controls designed by the board of

directors

4. In an audit of financial statements, an auditor's primary consideration

regarding a control is whether it

a. Reflects management's philosophy and operating style

b. Affects management's financial statement assertions

c. Provides adequate safeguards over access to assets

d. Enhances management's decision-making processes

5. Effective internal control

a. Eliminates risk and potential loss to the organization

b. Cannot be circumvented by management

c. Is unaffected by changing circumstances and conditions

encountered by the organization

d. Reduces the need for management to review exception reports

on a day-to-day basis

6. Which of the following statements about internal control is correct?

a. Properly maintained internal controls reasonably assure that

collusion among employees cannot occur

b. Establishing and maintaining internal control is the

internal auditor’s responsibility

c. Exceptionally strong control allows the auditor to

eliminate substantive tests

d. The cost-benefit relationship should be considered in designing

internal control.

7. A proper understanding of the client's internal control is an integral

part of the audit planning process. The results of the understanding

a. Must be reported to the shareholders and the SEC

b. Bear no relationship to the extent of substantive testing to be

performed

c. Are not reported to client management

d. May be used as the basis for withdrawing from an

audit engagement

8. Audit evidence concerning segregation of duties ordinarily is best

obtained by

a. Performing tests of transactions that corroborate management's

financial statement assertions

b. Observing the employees as they apply specific controls

c. Obtaining a flowchart of activities performed by

available personnel

d. Developing audit objectives that reduce control risk

9. Based on a consideration of internal control completed at an interim

date, the auditor assessed control risk at a low level and performed

interim substantive tests. The records and procedures would most likely

be tested again at year-end if

a. Tests of controls were not performed by the internal auditor

during the remaining period

b. Internal control provides a basis for limiting the extent of

substantive testing

c. The auditor used nonstatistical sampling during the interim

period testing of controls

d. Inquiries and observations lead the auditor to believe that

conditions have changed

10. Although substantive tests may support the accuracy of

underlying records, these tests frequently provide no affirmative evidence

of segregation of duties because

a. Substantive tests rarely guarantee the accuracy of the records if

only a person who performs incompatible functions

b. The records may be accurate even though they are maintained

by a person who performs incompatible functions

c. Substantive tests relate to the entire period under audit, but

tests of controls ordinarily are confined to the period during which

the auditor is on the client's premises

d. Many computerized procedures leave no audit trail of who

performed them, so substantive tests may necessarily be limited to

inquiries and observation of office personnel

You might also like

- Mahusay - Acc319 - Module 1 Major OutputDocument4 pagesMahusay - Acc319 - Module 1 Major OutputJeth MahusayNo ratings yet

- Prelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearDocument10 pagesPrelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearJeremae Ann Ceriaco100% (1)

- 5890 Take Home Test 2Document10 pages5890 Take Home Test 2biwithse7enNo ratings yet

- CH 1 Quiz With AnswersDocument7 pagesCH 1 Quiz With AnswersBeverly Ann Caparoso100% (3)

- Major Assessment - Current Liab-MahusayDocument5 pagesMajor Assessment - Current Liab-MahusayJeth Mahusay100% (1)

- Future of AnalysisDocument6 pagesFuture of AnalysisJohn SolórzanoNo ratings yet

- Amit Black Book Financial Analysis of Idbi BankDocument81 pagesAmit Black Book Financial Analysis of Idbi Bankamit100% (1)

- At Aud001Document4 pagesAt Aud001KathleenNo ratings yet

- At Aud001Document4 pagesAt Aud001Missy Rose LegaraNo ratings yet

- Quiz - Understanding The Entity and Its EnvironmentDocument4 pagesQuiz - Understanding The Entity and Its EnvironmentKathleenNo ratings yet

- Assurance Principles Midterm QuizDocument5 pagesAssurance Principles Midterm Quizjovelyn labordoNo ratings yet

- Aud TheoDocument7 pagesAud TheoRalph MindaroNo ratings yet

- Line Item: Basic Concepts of Internal Control CparDocument35 pagesLine Item: Basic Concepts of Internal Control CparrexNo ratings yet

- CH 11Document4 pagesCH 11Ariana GrandeNo ratings yet

- Risk Assessment AuditDocument9 pagesRisk Assessment Auditrandom17341No ratings yet

- ICPA Audit Planning HandoutDocument4 pagesICPA Audit Planning Handoutmichelle angela maramagNo ratings yet

- Homework in Internal ControlDocument7 pagesHomework in Internal ControlAdam SmithNo ratings yet

- Aldersgate College Espinoza, Danielle Audrey MDocument6 pagesAldersgate College Espinoza, Danielle Audrey MddddddaaaaeeeeNo ratings yet

- Audit PlanningDocument14 pagesAudit PlanningkristineNo ratings yet

- 6 Internal Control AKDocument9 pages6 Internal Control AKMinie KimNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsReymark MutiaNo ratings yet

- Exercise - Overview of The Financial Statement Audit ProcessDocument4 pagesExercise - Overview of The Financial Statement Audit ProcessAlyssa RacasaNo ratings yet

- AT - Material4 Audit Planning-2Document10 pagesAT - Material4 Audit Planning-2Zach RiversNo ratings yet

- RESA AT PreWeek (B43)Document7 pagesRESA AT PreWeek (B43)MellaniNo ratings yet

- CH 11 P1Document4 pagesCH 11 P1GlaizzaNo ratings yet

- AT Preweek (B44)Document7 pagesAT Preweek (B44)Haydy AntonioNo ratings yet

- A12 Quiz3Document8 pagesA12 Quiz3Irish Gracielle Dela CruzNo ratings yet

- DocDocument3 pagesDocMarvine MagaddatuNo ratings yet

- Quizzer 2Document6 pagesQuizzer 2Patrick BacongalloNo ratings yet

- Internal Control - DrillDocument10 pagesInternal Control - DrillTeofel John Alvizo Pantaleon100% (1)

- Auditing in A CIS Environment V1Document27 pagesAuditing in A CIS Environment V1alexissosing.cpaNo ratings yet

- PGB B2Document9 pagesPGB B2Mark ButayaNo ratings yet

- Audit Theory Midterm PDFDocument8 pagesAudit Theory Midterm PDFJuly LumantasNo ratings yet

- Considerations of Internal Control Psa-Based QuestionsDocument28 pagesConsiderations of Internal Control Psa-Based QuestionsNoro75% (4)

- AP 01 Overview of Audit Process AdUDocument5 pagesAP 01 Overview of Audit Process AdUziNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- Weakness.": Knowledge Necessary For Audit PlanningDocument9 pagesWeakness.": Knowledge Necessary For Audit Planningkris mNo ratings yet

- Final Exam AUD002Document6 pagesFinal Exam AUD002KathleenNo ratings yet

- 7 Auditing and Assurance - Questions and AnswerDocument2 pages7 Auditing and Assurance - Questions and AnswerAlliah Tandog100% (1)

- AUDITTHEODocument13 pagesAUDITTHEOAlisonNo ratings yet

- Audit - Mock Board Examination - Sy2019-20Document15 pagesAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNo ratings yet

- Consideration of Internal ControlDocument4 pagesConsideration of Internal ControlMary Grace SalcedoNo ratings yet

- Nature of Internal Control: Multiple Choice QuestionsDocument11 pagesNature of Internal Control: Multiple Choice QuestionsJamaica David100% (1)

- Consideration of Internal ControlDocument6 pagesConsideration of Internal Controlinto the unknownNo ratings yet

- Quiz On Overview of Audit ProcessDocument14 pagesQuiz On Overview of Audit ProcessZtrick 1234No ratings yet

- Aud Plan 123Document7 pagesAud Plan 123Mary GarciaNo ratings yet

- Chapter 7: Audit PlanningDocument7 pagesChapter 7: Audit PlanningAngela RamosNo ratings yet

- AT Quizzer 8 - Risk Assessment and Materiality 2SAY2122Document9 pagesAT Quizzer 8 - Risk Assessment and Materiality 2SAY2122lyndon delfinNo ratings yet

- Activity - Risk Assessment Part III - Internal Control SystemDocument6 pagesActivity - Risk Assessment Part III - Internal Control SystemGia Sarah Barillo BandolaNo ratings yet

- Iat22 M2Document8 pagesIat22 M2Kristine Lirose BordeosNo ratings yet

- Audit Planning QuizletDocument32 pagesAudit Planning QuizletMinie KimNo ratings yet

- ASR Quizzer 6 - Planning and Risk AssessmenttDocument18 pagesASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeNo ratings yet

- Midterm Act 2Document4 pagesMidterm Act 2MikNo ratings yet

- Material No. 1Document6 pagesMaterial No. 1Jen AnchetaNo ratings yet

- Internal ControlDocument6 pagesInternal ControlAlissaNo ratings yet

- Chapter 8 Audit Planning Flashcards - QuizletDocument97 pagesChapter 8 Audit Planning Flashcards - Quizletglt0No ratings yet

- Acp 102 FTDocument7 pagesAcp 102 FTLyca SorianoNo ratings yet

- Auditing Theory2011Document18 pagesAuditing Theory2011Justine Ann GalabayoNo ratings yet

- Audit Planning - Long QuizDocument15 pagesAudit Planning - Long QuizKathleenNo ratings yet

- Ac10 Chap 56Document30 pagesAc10 Chap 56SVPSNo ratings yet

- Intro To IA Quiz 1Document16 pagesIntro To IA Quiz 1Jao FloresNo ratings yet

- AT 05 Auditor - S Response To Assessed RiskDocument4 pagesAT 05 Auditor - S Response To Assessed RiskjeromyNo ratings yet

- Pre-Assessment Test For Auditing TheoryDocument13 pagesPre-Assessment Test For Auditing TheoryPrecious mae BarrientosNo ratings yet

- Mahusay Acc3112 Major Output 2Document2 pagesMahusay Acc3112 Major Output 2Jeth Mahusay100% (1)

- Law11 - Module 4 - Mahusay, Jeth A.Document4 pagesLaw11 - Module 4 - Mahusay, Jeth A.Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 3Document5 pagesMahusay Acc227 Module 3Jeth MahusayNo ratings yet

- Mahusay Module 4 - Acc4115Document4 pagesMahusay Module 4 - Acc4115Jeth MahusayNo ratings yet

- Mahusay Acc3112 Major Output 3Document4 pagesMahusay Acc3112 Major Output 3Jeth MahusayNo ratings yet

- Mahusay Acc3112 Major Output 1Document4 pagesMahusay Acc3112 Major Output 1Jeth MahusayNo ratings yet

- Acc 227 Intermediate Accounting 2 CSGDocument58 pagesAcc 227 Intermediate Accounting 2 CSGJeth MahusayNo ratings yet

- Mahusay Module 1 - Acc4115Document1 pageMahusay Module 1 - Acc4115Jeth MahusayNo ratings yet

- Mahusay Module 2 - Acc4115Document5 pagesMahusay Module 2 - Acc4115Jeth MahusayNo ratings yet

- Mahusay-Pe2 Lesson 4Document2 pagesMahusay-Pe2 Lesson 4Jeth MahusayNo ratings yet

- Mahusay - G - Ai, PortfolioDocument15 pagesMahusay - G - Ai, PortfolioJeth MahusayNo ratings yet

- Mahusay-Pe2 Lesson 3Document1 pageMahusay-Pe2 Lesson 3Jeth MahusayNo ratings yet

- Mahusay Law211 Articles of CooperationDocument10 pagesMahusay Law211 Articles of CooperationJeth MahusayNo ratings yet

- Mahusay - G-Ai Module 3Document8 pagesMahusay - G-Ai Module 3Jeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 4 Major OutputDocument3 pagesMahusay - Acc319 - Module 4 Major OutputJeth Mahusay100% (3)

- Mahusay Acc227 Module 1Document12 pagesMahusay Acc227 Module 1Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 2Document9 pagesMahusay Acc227 Module 2Jeth MahusayNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Document3 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 3Jeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 3 Major OutputDocument4 pagesMahusay - Acc319 - Module 3 Major OutputJeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 2 Major OutputDocument2 pagesMahusay - Acc319 - Module 2 Major OutputJeth MahusayNo ratings yet

- Mahusay - Acc319 - Module 1 Self ExerciseDocument2 pagesMahusay - Acc319 - Module 1 Self ExerciseJeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Formation of PartnershipDocument4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Formation of PartnershipJeth MahusayNo ratings yet

- One Person CorporationDocument3 pagesOne Person CorporationJeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 4Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 4Jeth MahusayNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Jeth MahusayNo ratings yet

- Mahusay Law211 Articles of IncorporationDocument4 pagesMahusay Law211 Articles of IncorporationJeth MahusayNo ratings yet

- Mahusay Law211 Articles of PartnershipDocument2 pagesMahusay Law211 Articles of PartnershipJeth MahusayNo ratings yet

- Green Building Valuation ReportDocument12 pagesGreen Building Valuation ReportLTE002No ratings yet

- Bda 1Document28 pagesBda 1Ikhsan WijayaNo ratings yet

- Enhancing Reading Culture Among School Learners in Kitagata Sub-County School Sheema District A Multifaceted ApproachDocument7 pagesEnhancing Reading Culture Among School Learners in Kitagata Sub-County School Sheema District A Multifaceted ApproachKIU PUBLICATION AND EXTENSIONNo ratings yet

- An Approach To Case Analysis What Is A Case Study?Document8 pagesAn Approach To Case Analysis What Is A Case Study?Ankur JainNo ratings yet

- Organizing References by Using MendeleyDocument49 pagesOrganizing References by Using MendeleyHaniff ShaufilNo ratings yet

- Admas University Bishoftu Campus: Course Title-Resarch Methods in Accounting and Finance Title: Group Assignment IiiDocument9 pagesAdmas University Bishoftu Campus: Course Title-Resarch Methods in Accounting and Finance Title: Group Assignment IiiSolomon GirmaNo ratings yet

- Napoleon Hill - Gandeste Si Devii BogatDocument16 pagesNapoleon Hill - Gandeste Si Devii BogatDenisa H. StroeNo ratings yet

- Iconies 2018 Uin Maliki MalangDocument10 pagesIconies 2018 Uin Maliki MalangAgungNo ratings yet

- Trinidad and Tobago Market StudyDocument75 pagesTrinidad and Tobago Market StudyKeriann LNo ratings yet

- Data Analysis Algorithms For Revenue AssuranceDocument16 pagesData Analysis Algorithms For Revenue AssuranceHenry WishlyNo ratings yet

- Descriptive Vs Inferential StatisticsDocument11 pagesDescriptive Vs Inferential Statisticsyashar2500No ratings yet

- DENSITASDocument3 pagesDENSITASGunNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasEden Dela CruzNo ratings yet

- Ec571-Panel DataDocument33 pagesEc571-Panel DataFadil YmNo ratings yet

- Quantitative ResearchDocument28 pagesQuantitative ResearchCarlo Joseph CarzaNo ratings yet

- Juma Ally Final-MSc. PPM-dissertationDocument84 pagesJuma Ally Final-MSc. PPM-dissertationJuma AllyNo ratings yet

- Elisson Et Al., 1985 Construction of An Infant Neurological InternationalDocument8 pagesElisson Et Al., 1985 Construction of An Infant Neurological InternationalSantiago Gonzalez ArdilaNo ratings yet

- Stat ExcelDocument12 pagesStat ExcelNoli BencaloNo ratings yet

- Research 2: Ms. Mariecor C. BalberDocument31 pagesResearch 2: Ms. Mariecor C. BalberMariecorNo ratings yet

- Exploring My Cultural Understanding of Physiotherapy in A Different CultureDocument41 pagesExploring My Cultural Understanding of Physiotherapy in A Different Culturegoody12foodsNo ratings yet

- Measures of Variability For Ungrouped DataDocument16 pagesMeasures of Variability For Ungrouped DataSharonNo ratings yet

- YMS Chapter 1: Exploring Data AP Statistics at LSHS Mr. MoleskyDocument2 pagesYMS Chapter 1: Exploring Data AP Statistics at LSHS Mr. MoleskyInTerp0ol100% (4)

- Data SPSS Kak Ela Persen InhibisiDocument11 pagesData SPSS Kak Ela Persen InhibisiAgustia AmlizaNo ratings yet

- Phys230 Course OutlineDocument4 pagesPhys230 Course OutlinechaciNo ratings yet

- Posselt Lipson - 2016 - JCSDDocument18 pagesPosselt Lipson - 2016 - JCSDGray LagolosNo ratings yet

- CAP873Document2 pagesCAP873NIdhi100% (1)

- Tutorial 8Document3 pagesTutorial 8Robert OoNo ratings yet

- Web Anal YticsDocument213 pagesWeb Anal YticsAditya KumarNo ratings yet