Professional Documents

Culture Documents

01 Activity 1

01 Activity 1

Uploaded by

Justine Mae QuintosOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 Activity 1

01 Activity 1

Uploaded by

Justine Mae QuintosCopyright:

Available Formats

01 Activity 1

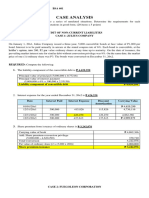

Jeremiah Corporation has provided the following information on intangible assets as follows:

a. A patent was purchased from Isaiah Company for P5,000,000 on January 1, 20x1. On the acquisition

date, the patent was estimated to have a useful life of 10 years. The patent had a net book value of

P5,000,000 when Isaiah sold it to Jeremiah.

b. On February 2, 20x2, a franchise was purchased from Daniel Company for P2,160,000. The contract

that runs for 20 years provides that 5%of revenue from the franchise must be paid to Daniel. Revenue

from the franchise for 20x2 was P8,000,000.

c. Jeremiah incurred the following research and development costs in 20x2:

Materials and equipment P462,000

Personnel 657,000

Indirect costs 329,000

Total P1,448,000

Because of the recent events, Jeremiah, on January 1, 20x2, estimates that the remaining useful life of

the patent purchased on January 1, 20x1, is only five (5) years from January 1, 20x2.

1. On December 31, 20x2, the carrying value of the patent should be ______________

Acquisition cost of the patent P5,000,000

Less: Amortization

20X1 (P5,000,000/10 years) P500,000

20X2(P5,000,000 – 500,000

=P4,500,000/ 5 years) P900,000 (1,400,000)

Carrying value of patent, 20X2 P3,600,000

2. The unamortized cost of the franchise at December 31, 20x2 should be ____________

Acquisition cost of franchise P2,160,000

Less: Amortization (P2,160,000/20 years x 11/12) (99,000)

Carrying value of franchise, 20X2 P2,061,000

3. How much should be charged against Jeremiah’s income for the year ended December 31,

20x2?

Amortization of patent P900,000

Amortization of franchise 99,000

Payment to franchise (P8,000,000 x 5%) 400,000

Research and development cost 1,448,000

Charges against 20X2 income P2,847,000

You might also like

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- Reviewer Financial AccountingDocument21 pagesReviewer Financial Accountingjingyuu kim67% (3)

- Audit of Prepayment and Intangible Asset: Problem 6-1Document42 pagesAudit of Prepayment and Intangible Asset: Problem 6-1Un knownNo ratings yet

- Property, Plant and Equipment: Chapter 23 AnswerDocument34 pagesProperty, Plant and Equipment: Chapter 23 AnswerYuuNeko08No ratings yet

- P2 - Installment Sales, O2018 AUFDocument5 pagesP2 - Installment Sales, O2018 AUFedsNo ratings yet

- Assessment Tasks 6Document4 pagesAssessment Tasks 6hahahahaNo ratings yet

- 01 Activity 1Document2 pages01 Activity 1Emperor SavageNo ratings yet

- 02 Task Performance 1Document4 pages02 Task Performance 1Justine Mae QuintosNo ratings yet

- Topic 1: Conceptual FrameworkDocument16 pagesTopic 1: Conceptual FrameworkHuỳnh Như PhạmNo ratings yet

- TP A&aDocument7 pagesTP A&aJennie Ann ModeracionNo ratings yet

- Topic 2 - PPE - Eng - ExerciseDocument4 pagesTopic 2 - PPE - Eng - Exercisehuynhgiade1805No ratings yet

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- Ppe ProblemsDocument8 pagesPpe ProblemsPeter Elijah AntonioNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- CPAR - AP Solutions 1st PB-BATCH 91Document5 pagesCPAR - AP Solutions 1st PB-BATCH 91Allyson VillalobosNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaan50% (2)

- 2 - A. Problems - Property Plant and EquipmentDocument59 pages2 - A. Problems - Property Plant and EquipmentsbibandiganNo ratings yet

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Document11 pagesChapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Jan OleteNo ratings yet

- Ktqte1-N2 - 2 9-3 3Document6 pagesKtqte1-N2 - 2 9-3 3Trần Thanh SơnNo ratings yet

- CPAR 92 AUD-1st PB SolDocument3 pagesCPAR 92 AUD-1st PB SolEmmanuel TeoNo ratings yet

- Chapter 5 Audit of PPEDocument29 pagesChapter 5 Audit of PPELyka Mae Palarca IrangNo ratings yet

- BAC1634 - Tutorial 3 QDocument6 pagesBAC1634 - Tutorial 3 QLee Hau SenNo ratings yet

- Gabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuDocument3 pagesGabriel Jay M. Mendoza OCTOBER 3, 2016 At3A - Advone Ms. Janine AbuGJ MendozaNo ratings yet

- Investment PropertyDocument14 pagesInvestment PropertyJerome BaluseroNo ratings yet

- Situation 8 11Document8 pagesSituation 8 11GuinevereNo ratings yet

- Chapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Document13 pagesChapter 26 Acctg For Derivatives Hedging Transactions Part 3 Afar Part 2Kathrina Roxas100% (1)

- Applied TopicsDocument5 pagesApplied TopicsMarjorieNo ratings yet

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Sol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsDocument11 pagesSol. Man. Chapter 12 Acctg For Derivatives Hedging Transactions Part 2 Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- IA 3 ReviewDocument34 pagesIA 3 ReviewHell LuciNo ratings yet

- Acai Chapter 17 QuestionnairesDocument5 pagesAcai Chapter 17 QuestionnairesKathleenCusipagNo ratings yet

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- Audit of PpeDocument35 pagesAudit of Ppelordaiztrand50% (2)

- Auditing First Preboard SolutionsDocument2 pagesAuditing First Preboard SolutionslorenzNo ratings yet

- Batch 19 2nd Preboard (P1)Document10 pagesBatch 19 2nd Preboard (P1)Jericho PedragosaNo ratings yet

- Far Progress Test 3 QPDocument6 pagesFar Progress Test 3 QPmarumoranyiNo ratings yet

- Diagnostic Examination For PPE (11over20)Document11 pagesDiagnostic Examination For PPE (11over20)Sunny MoreNo ratings yet

- Adjusting Entries AssignmentDocument4 pagesAdjusting Entries AssignmentJynilou PinoteNo ratings yet

- Problems Audit of Property Plant and Equipmentdocx PresentDocument10 pagesProblems Audit of Property Plant and Equipmentdocx PresentDominic RomeroNo ratings yet

- Q1-Review On Fa3Document4 pagesQ1-Review On Fa3Santos Gigantoca Jr.No ratings yet

- Problem XDocument30 pagesProblem XLove FreddyNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Auditing ProblemsDocument17 pagesAuditing ProblemsMakiri Sajili II50% (2)

- AFAR - Revenue Recognition 2019Document4 pagesAFAR - Revenue Recognition 2019Joanna Rose DeciarNo ratings yet

- Audit of Financial Statement PresentationDocument7 pagesAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: Problem 1 - Investment in AssociateDocument5 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: Problem 1 - Investment in AssociateCarlo ParasNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- BISC - FR.F7 - Past Exam - Sep - Dec 2023Document8 pagesBISC - FR.F7 - Past Exam - Sep - Dec 2023lihubruhNo ratings yet

- ACT1104-Final Period Quiz No. 6 With AnswerDocument12 pagesACT1104-Final Period Quiz No. 6 With AnswerPj Dela VegaNo ratings yet

- Audit of Investments - 2Document6 pagesAudit of Investments - 2Hasmin Saripada AmpatuaNo ratings yet

- Purchases, Cash Basis P 2,850,000Document2 pagesPurchases, Cash Basis P 2,850,000Dummy GoogleNo ratings yet

- Auditing Problems Test Banks - PPE Part 1Document4 pagesAuditing Problems Test Banks - PPE Part 1Alliah Mae ArbastoNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet