Professional Documents

Culture Documents

V'Smar T Academy: Advance Ruling

V'Smar T Academy: Advance Ruling

Uploaded by

vipul jainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

V'Smar T Academy: Advance Ruling

V'Smar T Academy: Advance Ruling

Uploaded by

vipul jainCopyright:

Available Formats

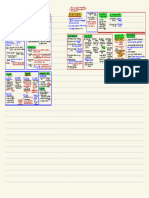

“advance ruling” means a decision provided by the AAR or

Advance Ruling

y

Sec 95 the AAAR to an applicant on matters or on questions specified

in relation to the supply of goods or

m

services or both being undertaken or proposed to be

undertaken by the applicant

Sec 96 State Govt. [Every State]

CA Vishal Bhattad

Application (ARA-1)

Authority

of Adv. Ruling

Difference

d e

Refer the case

Sec 99

App. Authority

of Adv. Ruling

Difference

cannot be

a

(AAR) (AAAR) proceeded

Fees 5000 is opinion Sec 100 Appeal is opinion further

c

Sec 98 ARA-02 30 days

TM TM + TM TM

(Central ) (State ) (Central ) (State )

A

30 days

TM = Technical Member After Examining

OR Furnish Applicant is

fees

Applicant Admitted Rejected Forward 10,000

t

relevant Application Material It shall be deemed

* Note 1 records not satisfied

Opp of

r

Sec 95 placed by Sec 100 than no advance

* Application shall hearing Applicants or Ruling can be

a

Reg. P not be admitted ARA-03 Appeal

Copy of AR

desirous Question raised in obtained by Authority issued in respect

to concern

application is already 30 days + 30 days

to obtain Reg. officer Opp. of being of given question

m

pending or decide in (No Fees)

heard after giving opp. of

any proceeding of an

S y

applicant Officers are being haired

Concerned Advance Ruling

Sec 97

Questions of Advance Ruling

V ’ officer

In writting

not satisfied Sec 101

order of

m within 90 days from

e

(a) classification of any goods or services or both within 90 days from Advance Ruling the date of filing

(b) applicability of a notification the date of Application as AAAR appeal

(c)

(d)

(e)

determination of time and value of supply

admissibility of input tax credit

determination of the liability to pay tax Copy of AR

Copy of AR to

Jurisdictional

Concerned Juriditional

Officer

a

Officer

d think fit

c

officer

(f) whether applicant is required to be registered Sent to

applicant Important Note :- Ruling given by AAR & AAAR

(g) whether any particular thing is a supply of goods or services Confirming original Modifying

Note:- On following matter advance Ruling not available

1. Determination of POS

t A will be applicable only within the Jurisdiction of

concerned State or UT

order of AAR

Copy of AR shall be sent to the

order of AAR

r

2. Procedural aspects like E-Way Bill, Return, Documents etc. Ü Applicant Ü the concerned officer

Ü the Jurisdictional Officer Ü to the AAR

102:-Rectification of advance ruling

m

103:- Applicability of advance ruling

a Jurisdictional

officer

104:- Advance ruling to be void in 105:- Powers of Authority and Appellate 106:- Procedure of Authority and Appellate

S

Ü Rectify any error apparent on the certain circumstances. Authority Authority

’

Ü Advance Ruling by AAR/AAAR is Ü AR is void- ab-initio if it obtained by

face of record ÜAAR/AAAR have all powers of a civil court ÜThe Authority or the Appellate Authority

binding on fraud or suppression of material facts

Ü Error noticed by Own/concened under code of civil procedure 1908 for

shall, subject to the provisions of this

V

a) on the applicant who had sought it or mispresentation of facts

officers/ Jurisdictional officers ØDiscovery & Inspection enforcing the

/Applicant b) concerned officers or Jurisdictional Ü All provisions of this act/rule are attendance of any person & ÜChapter, have power to regulate its own

Officer applicable as if such AR had never examination him on both compelling of

Ü Rectification is allowed within procedure.

Ü Order inoperative if law, facts or been given books of account & other records

6 month from the date of order

circumstances supporting the original Ü Opportunities of being heard required ÜEvery proceeding before AAR/AAAR shall

Ü If tax enhanced or ITC reduced on

AR have changed be deemed to be a Judical proceeding

rectification opportunity of being

heard given

You might also like

- Admin Exam AnswerDocument15 pagesAdmin Exam Answeralexsarah123100% (11)

- PeopleDJT DecOrderExtrajudicialDocument4 pagesPeopleDJT DecOrderExtrajudicialAaron Parnas100% (4)

- HIRA For Stores ActivityDocument5 pagesHIRA For Stores ActivityRohit Singh100% (22)

- User Manual IRISDocument243 pagesUser Manual IRISZubair Mohammed100% (2)

- Norv Eisenberg Letter To Gov PatDocument2 pagesNorv Eisenberg Letter To Gov Patzachariastaxes100% (1)

- International Institutional LawDocument1,310 pagesInternational Institutional LawEdmund Khovey100% (2)

- MDP 39015021692390 112 1683635293Document1 pageMDP 39015021692390 112 1683635293melinia WulanNo ratings yet

- Chemical KineticsDocument2 pagesChemical KineticsMelvin SotoNo ratings yet

- AST Test SheetDocument1 pageAST Test SheetCorey RochkinNo ratings yet

- Contraet.:1: ReviewedDocument1 pageContraet.:1: ReviewedlujoflosaNo ratings yet

- The Law of DemandDocument5 pagesThe Law of DemandVidushi salariaNo ratings yet

- Limited: PrivateDocument2 pagesLimited: Privated69451559No ratings yet

- NR'S MVDC Solution: 10Kv Jiangdong MVDC For Optimizing Distribution NetworkDocument2 pagesNR'S MVDC Solution: 10Kv Jiangdong MVDC For Optimizing Distribution NetworkMoshNo ratings yet

- Eco NotesDocument7 pagesEco NotesVicky KumarNo ratings yet

- 1Document26 pages1Bhavani LakamanaNo ratings yet

- Interpretation of StatuteDocument5 pagesInterpretation of Statuteanshumanpanda135No ratings yet

- Hazard-Identification Dec 2015Document22 pagesHazard-Identification Dec 2015Dumitru EninNo ratings yet

- General Clauses Act - 3 Pages - CA Amit MahajanDocument6 pagesGeneral Clauses Act - 3 Pages - CA Amit Mahajanmadhav023000No ratings yet

- Auditoromermancnc: A, FPQDocument6 pagesAuditoromermancnc: A, FPQApeksha ChilwalNo ratings yet

- 4MRecording SheetDocument1 page4MRecording SheetYATHISH BABUNo ratings yet

- Material Damage: Insured InsurerDocument3 pagesMaterial Damage: Insured InsurerArun SinghNo ratings yet

- Chapter 2 Formulation and Verification of Accounting TheoryDocument1 pageChapter 2 Formulation and Verification of Accounting Theoryammar beatlesNo ratings yet

- Peripherals (Sedition, Reservation)Document1 pagePeripherals (Sedition, Reservation)Kesava KumarNo ratings yet

- Cardan Dianteiro AmarokDocument12 pagesCardan Dianteiro AmarokCaverrna CapitãoNo ratings yet

- Manual Equipo Sonido RcaDocument31 pagesManual Equipo Sonido RcaCampo Elias QNo ratings yet

- ISO 16232 Contamination Analysis: VHX Series Digital MicroscopeDocument2 pagesISO 16232 Contamination Analysis: VHX Series Digital Microscopelil10zinNo ratings yet

- 6 Professional AppointmentsDocument18 pages6 Professional Appointmentsilyas hussainNo ratings yet

- Maturity-Form-2 (2)Document1 pageMaturity-Form-2 (2)saeed.sos.121No ratings yet

- 2nd Live Webinar - WhiteboardDocument1 page2nd Live Webinar - WhiteboardAsnifah AlinorNo ratings yet

- Request For Approval-I - I A1: MJ-RA-230109-RA-007Document1 pageRequest For Approval-I - I A1: MJ-RA-230109-RA-007Arie PratamaNo ratings yet

- Royalty Purchase Agreement by and Between Arrowhead PharmaceuticalsDocument113 pagesRoyalty Purchase Agreement by and Between Arrowhead PharmaceuticalsRudolff MakagiansarNo ratings yet

- RG w210r Hse Observation 7 FebDocument2 pagesRG w210r Hse Observation 7 FebIhtisham UlhaqNo ratings yet

- Adobe Scan Apr 27, 2023Document1 pageAdobe Scan Apr 27, 2023Ratheesh RNo ratings yet

- Valuation of Goodwill PDFDocument17 pagesValuation of Goodwill PDFSanskriti SenNo ratings yet

- May 13Document48 pagesMay 13fijitimescanadaNo ratings yet

- March 4 2011Document48 pagesMarch 4 2011fijitimescanadaNo ratings yet

- Account Determination MM en AUDocument28 pagesAccount Determination MM en AURtaccaNo ratings yet

- Crain India 11-Apr-2024Document3 pagesCrain India 11-Apr-2024amitk397115No ratings yet

- Hira - HCCBDocument6 pagesHira - HCCBsrinu degalaNo ratings yet

- Chemical KineticsDocument65 pagesChemical KineticsPrithvi SinghNo ratings yet

- D618 Plastic ConditioningDocument4 pagesD618 Plastic ConditioningABHIJIT chowdhuryNo ratings yet

- Full Service University Placement in The US, UK and CanadaDocument4 pagesFull Service University Placement in The US, UK and Canadacengizarda1979No ratings yet

- L1 FrequencyResponseDocument8 pagesL1 FrequencyResponseCHAYANIN AKETANANUNNo ratings yet

- L1 FrequencyResponseDocument8 pagesL1 FrequencyResponseCHAYANIN AKETANANUNNo ratings yet

- HW11 (Aot)Document2 pagesHW11 (Aot)Sam BNo ratings yet

- Fiji Times Jan 7Document48 pagesFiji Times Jan 7fijitimescanadaNo ratings yet

- Fiji Times Nov26Document48 pagesFiji Times Nov26fijitimescanadaNo ratings yet

- 940 CallenegociobbDocument2 pages940 Callenegociobbabermudez4967No ratings yet

- Handle Handover Project To End UserDocument41 pagesHandle Handover Project To End UserSALAH HELLARANo ratings yet

- CT 100-201Document2 pagesCT 100-201emmanskiNo ratings yet

- Rock MechanicsDocument226 pagesRock MechanicsEngr. Zahid Ur RehmanNo ratings yet

- Chapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell PharmaDocument8 pagesChapter 1, Unit 2, Biostatistics and Research Methodology, B Pharmacy 8th Sem, Carewell Pharma60 Shriniwas RaipatwarNo ratings yet

- January 28Document48 pagesJanuary 28fijitimescanadaNo ratings yet

- Enclosure No. 2 To Deped Order No. 011, S. 2020: Office/School/Clc Workweek PlanDocument6 pagesEnclosure No. 2 To Deped Order No. 011, S. 2020: Office/School/Clc Workweek PlanJames D. MagpusaoNo ratings yet

- Cat Hydrovar en Web-1Document24 pagesCat Hydrovar en Web-1debora maryantiNo ratings yet

- Week 16Document2 pagesWeek 16mreviewplayNo ratings yet

- Siding MileageDocument8 pagesSiding MileagePawan KumarNo ratings yet

- Shutdown Activity Requested For Kiln AreaDocument3 pagesShutdown Activity Requested For Kiln AreaAbdullah BawazirNo ratings yet

- Some Linear Algebra (Solved) ExercisesDocument10 pagesSome Linear Algebra (Solved) Exercisesyoussefjoe264No ratings yet

- Adobe Scan Mar 01, 2024Document8 pagesAdobe Scan Mar 01, 2024waseerasul37No ratings yet

- QB - Indas 115 RevenueDocument26 pagesQB - Indas 115 Revenuevipul jainNo ratings yet

- Ind AS 109 - Summary Lecture - Board NotesDocument20 pagesInd AS 109 - Summary Lecture - Board Notesvipul jainNo ratings yet

- Nidhi CompanyDocument3 pagesNidhi Companyvipul jainNo ratings yet

- Is Audit of Erp SoftwareDocument24 pagesIs Audit of Erp Softwarevipul jainNo ratings yet

- Dr. Ram Manohar Lohia National Law University, Lucknow.: Project On Contract LawDocument11 pagesDr. Ram Manohar Lohia National Law University, Lucknow.: Project On Contract LawSwarnim PandeyNo ratings yet

- Parent's Guide To Provincial Code of ConductDocument5 pagesParent's Guide To Provincial Code of ConductCynthiaMcLeodSunNo ratings yet

- Criminal Law 2 Case Digest For Prosecutor Garciax27s ClassDocument244 pagesCriminal Law 2 Case Digest For Prosecutor Garciax27s Classmaria alpha sierra abiertasNo ratings yet

- Uber Eric Alexander vs. Rachel WhetstoneDocument10 pagesUber Eric Alexander vs. Rachel WhetstoneJulieB188No ratings yet

- Corpo Cases Week 5Document56 pagesCorpo Cases Week 5Cherlene TanNo ratings yet

- Petition For ReconsiderationDocument5 pagesPetition For ReconsiderationStatesman JournalNo ratings yet

- Guilty Until Proven InnocentDocument10 pagesGuilty Until Proven Innocentapi-356504737No ratings yet

- Press CouncilDocument2 pagesPress CouncilJesse JhangraNo ratings yet

- Digest - Azolla Farms vs. CADocument3 pagesDigest - Azolla Farms vs. CAairene_edano4678No ratings yet

- Acknowledgement: Asraf Uddin, Lecturer, Department of Law, Leading UniversityDocument7 pagesAcknowledgement: Asraf Uddin, Lecturer, Department of Law, Leading UniversityMazharul islamNo ratings yet

- What Are The Four Factors To Consider in Deciding Whether A Use of Copyrighted Material Is A Fair UseDocument3 pagesWhat Are The Four Factors To Consider in Deciding Whether A Use of Copyrighted Material Is A Fair UseBikesh DongolNo ratings yet

- English Translation of Vietnam's Declaration of IndependenceDocument3 pagesEnglish Translation of Vietnam's Declaration of IndependencePhạm Tiến DũngNo ratings yet

- Act 3135 (As Amended by Act 4118)Document6 pagesAct 3135 (As Amended by Act 4118)Joshua Janine LugtuNo ratings yet

- Drilon V LimDocument2 pagesDrilon V LimKrystel Hypa Magallanes100% (1)

- People vs. Lovedioro 250 SCRA 389Document16 pagesPeople vs. Lovedioro 250 SCRA 389Maricar VelascoNo ratings yet

- Right of Way AgreementDocument2 pagesRight of Way AgreementRamil F. De JesusNo ratings yet

- Role of Cbi in Combating CorruptionDocument2 pagesRole of Cbi in Combating CorruptionRichie Ghosh100% (1)

- Manzala vs. Commission On ElectionsDocument2 pagesManzala vs. Commission On ElectionsAnonymous 8SgE99No ratings yet

- Shaikh Zahid Mukhtar V State of MaharashtraDocument245 pagesShaikh Zahid Mukhtar V State of MaharashtraBar & BenchNo ratings yet

- Constitutional Law 1 - COURSE SYLLABUSDocument4 pagesConstitutional Law 1 - COURSE SYLLABUSArnold OniaNo ratings yet

- 2 Chemphil V CADocument4 pages2 Chemphil V CAGiancarlo Fernando0% (1)

- Mortgage and Pledge - Legal FormsDocument36 pagesMortgage and Pledge - Legal FormsRM MallorcaNo ratings yet

- 2 Prohibited Motions and PleadingsDocument2 pages2 Prohibited Motions and PleadingsR.A. GregorioNo ratings yet

- Sps Marcos Vs Heirs of BangiDocument1 pageSps Marcos Vs Heirs of BangiLamara Del RosarioNo ratings yet

- Casing Report - PNPDocument3 pagesCasing Report - PNPpopoNo ratings yet

- GO Vs CA Case DigestDocument19 pagesGO Vs CA Case DigestMarinel June PalerNo ratings yet