Professional Documents

Culture Documents

Nio Apr 25 Argus Research

Nio Apr 25 Argus Research

Uploaded by

Les SangaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nio Apr 25 Argus Research

Nio Apr 25 Argus Research

Uploaded by

Les SangaCopyright:

Available Formats

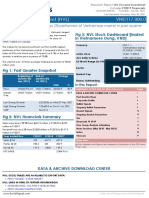

® TORONTO-DOMINION BANK

(NYS:TD)

Report Date: April 28, 2021

Over the past year, TD shares are up

52.7%, versus a gain of 30.1% for the

broader market. The 52 week trading

range is $37.62 to $69.06. The Argus A6

target price is $75 representing a 9.4% gain

from the current level.

Toronto-Dominion is one of Canada's two largest banks and operates three business segments: Canadian retail banking, U.S. retail banking, and wholesale banking.

Growth Analysis GAAP Data Growth Rates Argus Rating: BUY

2016 2017 2018 2019 2020 1-Year 3-Year 5-Year Rating Since: 01/29/20

Revenue (B) 25.9 27.8 29.0 30.9 Nil Nil Nil Nil

Gross Margin Nil Nil Nil Nil Nil Nil Nil Nil Current Price: $68.54

Operating Income Nil Nil Nil Nil Nil Nil Nil Nil Target Price: $75.00

Interest Expense (B) 5.1 7.0 10.7 13.7 Nil Nil Nil Nil

Market Cap: $124.6 billion

Pre Tax Income (B) 8.1 9.6 10.4 10.1 Nil Nil Nil Nil

Net Income (B) 6.7 8.1 8.5 8.9 Nil Nil Nil Nil Dividend: $3.16

EPS 3.56 4.26 4.53 4.75 Nil Nil Nil Nil Yield: 4.6%

Dividend/Share 1.65 1.82 1.97 2.20 Nil Nil Nil Nil

Shares Outstanding (B) 1.4 1.4 1.4 1.4 Nil Nil Nil Nil Beta: 0.78

Market Cap (B) 64.3 81.7 76.9 79.2 Nil Nil Nil Nil Sector: Financials

Book Value (B) 37.27 39.29 41.47 47.42 Nil Nil Nil Nil

Industry: Diversified Banks

Financial Condition GAAP Data Growth Rates

2016 2017 2018 2019 2020 1-Year 3-Year 5-Year Argus A6 Sub-component Scores

Cash / Short Term Inv. (B) 43.9 42.8 26.7 23.1 Nil Nil Nil Nil

Current Assets Nil Nil Nil Nil Nil Nil Nil Nil H Hi gh M Medi um L Low

Current Liabilities Nil Nil Nil Nil Nil Nil Nil Nil

Working Capital Nil Nil Nil Nil Nil Nil Nil Nil H Indus try

Short-Term Debt Nil Nil Nil Nil Nil Nil Nil Nil Earnings revisions, analyst conviction, performance and

Long Term Debt (B) 31.5 29.7 27.2 28.8 Nil Nil Nil Nil historical industry weighting.

Total Debt (B) 31.5 29.7 27.2 28.8 Nil Nil Nil Nil H Ma na gement

Shareholders Equity (B) 55.3 57.5 59.5 66.6 Nil Nil Nil Nil Consistency of growth & financial strength.

Ratio Analysis Trend H Sa fety

2016 2017 2018 2019 2020 1-Year 3-Year 5-Year Liquidity, dividend yield, market cap, debt leverage and

Operating Margin Nil Nil Nil Nil Nil Nil Nil Nil stock price beta.

Net Margin 26% 28% 29% 28% 27% Lower Lower Higher H Fi na nci a l Strength

ROE 13% 15% 15% 15% 14% Lower Lower Lower Balance sheet debt and liquidity ratios.

ROA 1% 1% 1% 1% 1% Lower Lower Lower Growth

H

Current Ratio Nil Nil Nil Nil Nil Nil Nil Nil

Normalized earnings estimates and sales trends.

Interest Coverage Nil Nil Nil Nil Nil Nil Nil Nil

Dividend Payout Ratio 46% 43% 43% 46% Nil Nil Nil Nil M Va l ue

L-T Debt/Equity 61% 55% 49% 46% 52% Higher Lower Lower Price/earnings, price/sales ratios, trend lines, and DCF

Total Debt/Total Cap 36% 34% 31% 30% 33% Higher Lower Lower valuation.

Valuation Analysis Trend Vicker's Institutional & Insider Holdings

2016 2017 2018 2019 2020 1-Year 3-Year 5-Year

13F Non Mutual Funds

Price - Year End 45.38 56.85 55.46 57.07 44.23 Lower Lower Higher

52-Week High 54.59 65.24 79.36 77.74 76.72 Lower Higher Higher 13F Mutual Funds

52-Week Low 34.04 44.54 54.88 48.31 33.83 Lower Lower Lower 13F Total: 715.3m

P/E High 15.3 15.3 17.5 16.4 Nil Nil Nil Nil Insider

P/E Low 9.6 10.4 12.1 10.2 Nil Nil Nil Nil

Other Mutual Funds

P/S High 4.1 4.4 5.1 4.6 Nil Nil Nil Nil

Other

P/S Low 2.5 3.0 3.5 2.9 Nil Nil Nil Nil

Outstanding: 1,818.6m

P/B High 2.1 2.3 2.7 2.3 Nil Nil Nil Nil

P/B Low 1.3 1.6 1.8 1.4 Nil Nil Nil Nil The financial information in the tables to the left is proprietary to Morningstar

Yield High 3.02% 2.79% 2.48% 2.82% Nil Nil Nil Nil and/or its content providers; may not be copied or distributed; and is not

warranted to be accurate, complete or timely. Neither Morningstar nor its

Yield Low 4.84% 4.09% 3.58% 4.54% Nil Nil Nil Nil content providers are responsible for any damages or losses arising from any use

of this information. © 2017 Morningstar, Inc. All Rights Reserved.

Return 11% 25% -2% 3% -22% Lower Lower Nil

© 2021 Argus Res ea rch Compa ny ARGUS A6 Report

®

Diversified Banks

Peer Comparison Table: Financials .

Market Cap 5-yr EPS Current FY 1-yr EPS

Ticker Company Price($) Net Margin Argus Rating

(Millions $) Growth Rate P/E Growth Rate

C CITIGROUP INC 73.01 152,349.97 -13% 8.20 13% -41% BUY

RY ROYAL BANK OF CANADA 95.07 135,424.80 Nil Nil 24% Nil BUY

TD TORONTO-DOMINION BANK 68.54 124,646.56 Nil Nil 27% Nil BUY

USB US BANCORP 58.82 88,381.40 -3% 15.48 20% -26% HOLD

TFC TRUIST FINANCIAL CORP 58.89 79,197.92 20% 13.58 18% -17% BUY

Peer Average 116,000.1 1% 7 21% -17%

Our rating on the Financial Services sector is Over-Weight. With market optimism rising ● we believe dividends will be maintained unless lockdowns are reimposed and the

on positive vaccine developments and the new administration in Washington, interest economy falters.

rates have started to move higher at the long end of the yield curve. We expect banks ● Meanwhile, credit quality, which often tracks the employment picture (i.e., higher

to benefit from wider net interest margins and lower loan-loss provisions as the unemployment translates to a diminished ability to repay loans) is likely to be the biggest

economy normalizes, and insurance companies to generate higher income in their wildcard for earnings. Banks recorded sharply higher loss provisions in the first half of

investment portfolios. 2020, bracing for delinquencies from home loan, credit card and business customers who

have lost their sources of income.

The sector accounts for 11.3% of the S&P 500, down from 16.3% following the exclusion ● Top Stock Pick: JPMorgan Chase

of REIT stocks. Over the past five years, the weighting has ranged from 9% to 17%. We

think the sector should account for 12%-13% of diversified portfolios. The Financial Insurance

sector is outperforming the market thus far in 2021, with a gain of 15.4%. It

underperformed in 2020, with a loss of 4.1%, and slightly outperformed in 2019, with a ● Life insurance companies will likely see weak investment returns in the near term as they

gain of 29.2%. reinvest their bond portfolios at lower interest rates. Life insurance stocks have also

dropped since the end of February 2020 on coronavirus fears.

The projected P/E ratio on 2021 earnings is 16, below the market multiple of 23. As for ● Property-Casualty (P&C) insurers continue to manage their combined ratios, with the

earnings expectations, analysts now expect earnings to rise 12.6% in both 2021 and premier operators keeping costs at 82%-85% of total revenue. We are optimistic about

2022 after falling 24.8% in 2020 and rising 39.0% in 2019. Yields are slightly above the P&C insurers based on expectations for high single-digit growth and improvement in

market average. Dividends and share repurchases also remain subject to regulatory ROE. Additionally, P&C insurers are not as sensitive to interest rate movements, as their

approval for large banks deemed too-big-to-fail. investment horizons are shorter than those of life insurers.

● P&C stocks also declined on coronavirus fears, as they may be responsible for business

Key Sector Trends interruption proceeds. However, the fears are for the most part unfounded as most

insurers wrote clauses exempting themselves from disease-related losses after the SARS

outbreak in 2003. Recent rulings in a number of states have sided with insurance

Banking companies.

● The coronavirus has significantly impacted many sources of revenue for banks, ● P&C companies have been hurt by an increase in catastrophe losses, including claims

from reduced loan growth as companies and individuals put off purchases, to related to wildfires in California, hurricanes, and social unrest. Additionally, lower pricing

narrower interest margins after the Fed cut rates to zero, to lower fee-based income for insurance premiums and low returns on investment portfolios have weighed on

as activity slows. results.

● We believe the Fed has done an admirable job in shoring up the fixed-income and ● Top Stock Pick: Allstate

mortgage-securities markets, offering much needed liquidity. We also note that the

banking industry is in a much better capital position than during the financial crisis of

2008-2009. While the largest seven banks have all suspended buyback activity to

conserve capital,

© 2021 Argus Res ea rch Compa ny ARGUS A6 Report

®

Argus A6 Quantitative Universe RATING DISTRIBUTION SECTOR

Our A6 Quantitative Universe includes more than 1,500 companies that are diversified across all asset

classes and industry sectors. Ratings for these companies are derived through a proprietary algorithm we

have designed and tested so that the ratings are based on our fundamental Six-Point System. Our A6

Quantitative Ratings include sub-ratings for each of the six factors.

The A6 algorithm is designed to capture and analyze financial trends for each company under coverage.

Companies are measured against their historical record, peer group, and the broad market. For each

covered company, the A6 algorithm generates a subrating for growth, financial strength, industry

outlook, management, risk/safety and valuation. These scores are totaled and provide an overall rating

for each company. The A6 algorithm rates stocks on growth based on normalized earnings estimates and

sales trends, among other factors. Our financial strength ranking is based primarily on balance sheet

debt and liquidity ratios. For risk, we factor in liquidity, dividend yield, market cap, debt leverage and MARKET CAP DISTRIBUTION

stock price beta. Our valuation subrating includes factors such as price/earnings and price/sales ratios,

trend lines, and discounted cash flow valuations. Ratings are reviewed weekly. Data sources for the A6 ALL STOCKS

reports include Argus estimates, Vickers Stock Research, Bloomberg and Thomson Reuters, among

others.

Large Cap

Argus Research Disclaimer Mid Cap

Small Cap

Argus Research Co. (ARC) is an independent investment research provider whose parent company, Argus

Investors' Counsel, Inc. (AIC), is registered with the U.S. Securities and Exchange Commission. Argus

Investors' Counsel is a subsidiary of The Argus Research Group, Inc. Neither The Argus Research Group

nor any affiliate is a member of the FINRA or the SIPC. Argus Research is not a registered broker dealer ARGUS FUNDAMENTAL ARGUS A6 (QUANT)

and does not have investment banking operations. The Argus trademark, service mark and logo are the UNIVERSE UNIVERSE

intellectual property of The Argus Research Group, Inc. The information contained in this research report

is produced and copyrighted by Argus Research Co., and any unauthorized use, duplication, redistribution

or disclosure is prohibited by law and can result in prosecution. The content of this report may be derived

from Argus research reports, notes, or analyses. The opinions and information contained herein have

been obtained or derived from sources believed to be reliable, but Argus makes no representation as to

their timeliness, accuracy or completeness or for their fitness for any particular purpose. In addition, this

content is not prepared subject to Canadian disclosure requirements. This report is not an offer to sell or a

solicitation of an offer to buy any security. The information and material presented in this report are for

general information only and do not specifically address individual investment objectives, financial CURRENT RATING DISTRIBUTION

situations or the particular needs of any specific person who may receive this report. Investing in any

security or investment strategies discussed may not be suitable for you and it is recommended that you

consult an independent investment advisor. Nothing in this report constitutes individual investment, legal

or tax advice. Argus may issue or may have issued other reports that are inconsistent with or may reach

different conclusions than those represented in this report, and all opinions are reflective of judgments

made on the original date of publication. Argus is under no obligation to ensure that other reports are

brought to the attention of any recipient of this report. Argus shall accept no liability for any loss arising

from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue

of their receipt of this material. Investments involve risk and an investor may incur either profits or

losses. Past performance should not be taken as an indication or guarantee of future performance. Argus

has provided independent research since 1934. Argus officers, employees, agents and/or affiliates may

have positions in stocks discussed in this report. No Argus officers, employees, agents and/or affiliates

may serve as officers or directors of covered companies, or may own more than one percent of a

covered company's stock. Argus Investors' Counsel (AIC), a portfolio management business based in Stamford, Connecticut, is a customer of Argus Research Co. (ARC), based in New

York. Argus Investors' Counsel pays Argus Research Co. for research used in the management of the AIC core equity strategy and model portfolio and UIT products, and has the same

access to Argus Research Co. reports as other customers. However, clients and prospective clients should note that Argus Investors' Counsel and Argus Research Co., as units of The

Argus Research Group, have certain employees in common, including those with both research and portfolio management responsibilities, and that Argus Research Co. employees

participate in the management and marketing of the AIC core equity strategy and UIT and model portfolio products.

© 2021 Argus Res ea rch Compa ny ARGUS A6 Report

You might also like

- Champion CattlefarmsDocument24 pagesChampion Cattlefarmsshaniah1475% (4)

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Delfi DBSDocument14 pagesDelfi DBSquang caoNo ratings yet

- Fibonacci Queen Fib NotesDocument6 pagesFibonacci Queen Fib NotesLes Sanga0% (1)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- BCA BrochureDocument15 pagesBCA BrochurejitenparekhNo ratings yet

- NRDS Trade ReportDocument3 pagesNRDS Trade Report2thnzkcssjNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- High Management Efficiency Poor Growth in Long Term Net SalesDocument18 pagesHigh Management Efficiency Poor Growth in Long Term Net SalesAbdul SamadNo ratings yet

- DAO - BBNI - Mei 2021Document12 pagesDAO - BBNI - Mei 2021amujogja2022No ratings yet

- Lesson 4.2Document4 pagesLesson 4.2crisjay ramosNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- FS AnalysisDocument51 pagesFS AnalysisJecelyn PaganaNo ratings yet

- No Va Land Investment (NVL) VND117,000.0: Fig 3: NVL Stock Dashboard (Traded in Vietnamese Dong, VND)Document27 pagesNo Va Land Investment (NVL) VND117,000.0: Fig 3: NVL Stock Dashboard (Traded in Vietnamese Dong, VND)DIDINo ratings yet

- Annual Report SIB 2019-20Document189 pagesAnnual Report SIB 2019-20SREE RAMNo ratings yet

- Zacks Small-Cap Research: Corecivic, IncDocument8 pagesZacks Small-Cap Research: Corecivic, IncKarim LahrichiNo ratings yet

- Dick's - Equity Valuation and AnalysisDocument135 pagesDick's - Equity Valuation and AnalysisnpapadokostasNo ratings yet

- Aptus Housing Finance LTD: SubscribeDocument5 pagesAptus Housing Finance LTD: SubscribeupsahuNo ratings yet

- RoyalBankofCanadaTSXRY PublicCompanyDocument1 pageRoyalBankofCanadaTSXRY PublicCompanyGDoingThings YTNo ratings yet

- 1 956 1 BOBAnalystPresentationQ4FY20Document71 pages1 956 1 BOBAnalystPresentationQ4FY20SannihithNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- Indusind Q2FY23 RU LKPDocument12 pagesIndusind Q2FY23 RU LKPPramukNo ratings yet

- Ruffer Investment Company LimitedDocument19 pagesRuffer Investment Company LimitedForkLogNo ratings yet

- MR D.I.Y. Group (M) (MRDIY MK) : Shopping For A Great BargainDocument18 pagesMR D.I.Y. Group (M) (MRDIY MK) : Shopping For A Great BargainMohd ShahrirNo ratings yet

- The Presentation Materials 3Q22Document36 pagesThe Presentation Materials 3Q22ZerohedgeNo ratings yet

- Lesson 9 - Analysis of Financial StatementDocument26 pagesLesson 9 - Analysis of Financial StatementJannah FrancineNo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- The Presentation MaterialsDocument28 pagesThe Presentation MaterialsValter SilveiraNo ratings yet

- Q223 EarningsDocument24 pagesQ223 Earningsdinesh suresh KadamNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- 02 Quiz 1 Managerial AcctgDocument3 pages02 Quiz 1 Managerial AcctgRalph Louise PoncianoNo ratings yet

- 1q23 Results PresentationDocument28 pages1q23 Results PresentationKumar SaketNo ratings yet

- Ibh Investor Presentation 0625311001637240357Document54 pagesIbh Investor Presentation 0625311001637240357viratNo ratings yet

- Draft 4Document19 pagesDraft 4Zarif TajwarNo ratings yet

- Case Submission On: Mellon Financial and The Bank of New YorkDocument3 pagesCase Submission On: Mellon Financial and The Bank of New Yorkneelakanta srikarNo ratings yet

- Siemens India: Thematically It Makes Sense But Valuations Don'tDocument9 pagesSiemens India: Thematically It Makes Sense But Valuations Don'tRaghvendra N DhootNo ratings yet

- CBA Full-Year ResultsDocument156 pagesCBA Full-Year ResultsTim MooreNo ratings yet

- AFD Practice Questions Mock (3399)Document7 pagesAFD Practice Questions Mock (3399)AbhiNo ratings yet

- 2024 q2 Earnings Results Presentation (1)Document15 pages2024 q2 Earnings Results Presentation (1)rborgesdossantos37No ratings yet

- CDSL 10 02 2021 HDFCDocument2 pagesCDSL 10 02 2021 HDFCJessy PadalaNo ratings yet

- IDBI Capital Century Plyboards Q4FY22 Result UpdateDocument10 pagesIDBI Capital Century Plyboards Q4FY22 Result UpdateTai TranNo ratings yet

- Chapter 2Document31 pagesChapter 2MunNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- MF Classic Value Investor Fact Sheet JhiDocument2 pagesMF Classic Value Investor Fact Sheet JhiJosé JoseNo ratings yet

- Full Financial Statement Analysis International Edition 13Th Edition Gibson Test Bank Online PDF All ChapterDocument50 pagesFull Financial Statement Analysis International Edition 13Th Edition Gibson Test Bank Online PDF All Chaptermcckytcght898100% (7)

- Morning - India 20210831 Mosl Mi PG010Document10 pagesMorning - India 20210831 Mosl Mi PG010vikalp123123No ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- BDL at 371.75 LIVE Share Price - Bharat Dynamics Stock News TodayDocument5 pagesBDL at 371.75 LIVE Share Price - Bharat Dynamics Stock News Todayqpyczn7fxdNo ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Morning Brief: JCI Index JCI MovementDocument8 pagesMorning Brief: JCI Index JCI MovementPutu Chantika Putri DhammayantiNo ratings yet

- Berger Paints Bangladesh Limited-PtdDocument15 pagesBerger Paints Bangladesh Limited-PtdnasirNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Investor Presentation Q2FY24Document18 pagesInvestor Presentation Q2FY24vishwasmaheshwari10No ratings yet

- Exhibit 99.1 - 9.30.22Document6 pagesExhibit 99.1 - 9.30.22Luis Miguel Vargas MarquinaNo ratings yet

- Wells Fargo - First-Quarter-2020-EarningsDocument40 pagesWells Fargo - First-Quarter-2020-EarningsAlexNo ratings yet

- Prince PipesDocument25 pagesPrince Pipeskiran.malukani26No ratings yet

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengNo ratings yet

- 4Q21 Earnings ReleaseDocument24 pages4Q21 Earnings ReleaseRichard May QuinteroNo ratings yet

- GS PresentationDocument14 pagesGS PresentationZerohedgeNo ratings yet

- Benzinga Pro Insider Report - Jan 1, 2023Document19 pagesBenzinga Pro Insider Report - Jan 1, 2023Les SangaNo ratings yet

- An Intro To Altcoin Market Cycles: Bitcoin Continues To Repeat HistoryDocument11 pagesAn Intro To Altcoin Market Cycles: Bitcoin Continues To Repeat HistoryLes SangaNo ratings yet

- Simpler Trading Risk Checklist-Risk ManagementDocument1 pageSimpler Trading Risk Checklist-Risk ManagementLes SangaNo ratings yet

- Founder's Letter - Annus Mirabilis For Animoca Brands and The Open Metaverse - by Yat Siu - Dec, 2021 - MediumDocument4 pagesFounder's Letter - Annus Mirabilis For Animoca Brands and The Open Metaverse - by Yat Siu - Dec, 2021 - MediumLes SangaNo ratings yet

- Why REITs Outperform Stocks, and 3 Strong Buys in May 2019 - Seeking AlphaDocument10 pagesWhy REITs Outperform Stocks, and 3 Strong Buys in May 2019 - Seeking AlphaLes SangaNo ratings yet

- Divergence Cheat SheetDocument1 pageDivergence Cheat SheetLes SangaNo ratings yet

- Oversold StocksDocument10 pagesOversold StocksLes SangaNo ratings yet

- Drug Bug TableDocument1 pageDrug Bug TableLes SangaNo ratings yet

- Three Defensive Stocks That Will Keep Chugging Along - TopStockAnalystsDocument2 pagesThree Defensive Stocks That Will Keep Chugging Along - TopStockAnalystsLes SangaNo ratings yet

- BigTrends - High Impact Options Trading - Option Profits Through Superior Stock SelectionDocument29 pagesBigTrends - High Impact Options Trading - Option Profits Through Superior Stock SelectionLes SangaNo ratings yet

- Market Buzz: U.S. & Global MarketsDocument8 pagesMarket Buzz: U.S. & Global MarketsLes SangaNo ratings yet

- Ashoka Buildcon AR FY19Document252 pagesAshoka Buildcon AR FY19PratikNo ratings yet

- NSE and BSEDocument41 pagesNSE and BSEjatin akkiNo ratings yet

- Risk Based Audit ATLASDocument41 pagesRisk Based Audit ATLASVivi100% (1)

- Basel IV Crypto enDocument8 pagesBasel IV Crypto enMorgane FournelNo ratings yet

- Jesse Liver MoreDocument16 pagesJesse Liver Moreribeirolive100% (1)

- CISCO JunaYanoyan 06-20-2012Document3 pagesCISCO JunaYanoyan 06-20-2012Juna May YanoyanNo ratings yet

- Module 5 CFMADocument28 pagesModule 5 CFMAk 3117No ratings yet

- Introduction To Mutual Funds: What Is Mutual Fund? 2. What Are Different Types of Mutual Funds?Document2 pagesIntroduction To Mutual Funds: What Is Mutual Fund? 2. What Are Different Types of Mutual Funds?Rajeev BabuNo ratings yet

- Panlilio Vs Citi BankDocument2 pagesPanlilio Vs Citi BankRed HoodNo ratings yet

- 9193 CMSDocument2 pages9193 CMSRecordTrac - City of OaklandNo ratings yet

- For Correspondence To Bob: For Subscription and Renewal:: WEDNESDAY, MAY 20, 2009 052009 (6) - IFDocument41 pagesFor Correspondence To Bob: For Subscription and Renewal:: WEDNESDAY, MAY 20, 2009 052009 (6) - IF9roger95170100% (2)

- PRUretirement GrowthDocument32 pagesPRUretirement GrowthlongcyNo ratings yet

- Bus-101. ch-15Document21 pagesBus-101. ch-15Roynok Khan BadhonNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- Grade Control in MinesDocument5 pagesGrade Control in Minesa4agarwalNo ratings yet

- Conventions: Convention of DisclosureDocument5 pagesConventions: Convention of DisclosureAiswarya ShanmugamNo ratings yet

- Religare Securities ProjectDocument54 pagesReligare Securities ProjectKartikeya Mittal100% (1)

- Perception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CityDocument10 pagesPerception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CitySanjay KamathNo ratings yet

- Project Report On Mergers and AcquisitionsDocument48 pagesProject Report On Mergers and AcquisitionsAvtaar SinghNo ratings yet

- Misuse of Derivatives - FIs and LessonsDocument35 pagesMisuse of Derivatives - FIs and LessonsPrajjwol Bikram KhadkaNo ratings yet

- DSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)Document12 pagesDSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)sushilbajaj23No ratings yet

- NY Disclosure Form For Buyer and Seller BuyerDocument2 pagesNY Disclosure Form For Buyer and Seller BuyerPhillip KingNo ratings yet

- IFRS9 - July 2014 - Basis For ConclusionsDocument389 pagesIFRS9 - July 2014 - Basis For Conclusionsm7md.nagaNo ratings yet

- Vitsol Memorial For RESPONDENT-1Document29 pagesVitsol Memorial For RESPONDENT-1superman1996femaleNo ratings yet

- CA Inter ESOPDocument35 pagesCA Inter ESOPHarsh MundraNo ratings yet

- Financial Statement Analysis of Non Financial SectorDocument6 pagesFinancial Statement Analysis of Non Financial SectorTayyaub khalidNo ratings yet