Professional Documents

Culture Documents

Regulatory Reform of Indonesian Payment System

Regulatory Reform of Indonesian Payment System

Uploaded by

KHUSUS DRIVEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Regulatory Reform of Indonesian Payment System

Regulatory Reform of Indonesian Payment System

Uploaded by

KHUSUS DRIVECopyright:

Available Formats

REGULATORY REFORM OF INDONESIAN PAYMENT SYSTEM

Bank Indonesia is initiating Regulatory Reform on Payment System with the issuance of Bank Indonesia

Regulation (PBI) No. 22/23/PBI/2020 regarding the Payment System, effective July 1, 2021.

1 2

Why is Bank Indonesia conducting regulatory What is the objective of payment

reform on payment system? system regulatory reform in Indonesia?

The development of Digital

Indonesia Payment Regulatory Restructuring the payment system

System Blueprint

Economy and Finance

2025 Reform industry and providing a legal umbrella

that covers end-to-end payment system

ecosystem.

Integrated regulatory,

1 Business model complexity licensing, supervisory and

Accommodating the development of

and risks; reporting function Strike a balance between digital economy and finance.

optimizing innovations and

2 Complex and rigid

regulations; and maintaining stability as well Strengthening and simplifying existing

as national interest regulations.

3 Global regulatory

transformation in digital.

3 What are the salient provisions of the regulatory reform?

Transitional Provisions

1 RP 2

RP a. LICENSING REQUIREMENTS, INCLUDING INITIAL CAPITAL

Existing licensed Payment 2-year period to meet the

System Service Providers (PJSP) new requirements.

Strengthening access policy Strengthening supervision

through reclassification and and assessment through the

access policy mechanism using classification of payment Applicats shall meet the licensing

activity-based approach, system providers, including License applicants at the time

Bank Indonesia Regulation (PBI) requirements under Bank Indonesia

provision of license based on the introduction of the new Regulation (PBI) concerning the

categories of activities payment system capital concerning the Payment System

becomes effective payment system.

(bundling), and the amendment requirements.

of minimum paid up capital

requirements. b. SHAREHOLDINGS AND CONTROLLING ASPECTS

4

3 Existing licensed Payment System Service Providers (PJSP)

Integrated payment system Grandfathering (non-retroactive)

data and/or information Providing there are no changes in the composition of foreign

Strengthening the sandbox management. ownership and/or control undertaken by a foreign entity unless

function of payment system in accordance with BI policy or a follow-up supervisory action

technology innovation.

5 c. APPLICATION FOR APPROVAL

Entities that have submitted or in the process of approval for activities and

products development and/or cooperations at the time the Bank Indonesia

Regulation (PBI) concerning the Payment System becomes effective are

Strengthening the institutional required to meet the requirements in accordance with the

aspects of ownership and Bank Indonesia Regulation.

controlling.

d. SRO APPOINTMENT

Entities appointed as self-regulatory organization (SRO) prior to enforcement

of Bank Indonesia Regulation (PBI) concerning the Payment System are

appointed as SRO as stipulated in the Bank Indonesia Regulation.

Regulations in full, scan:

Promulgation of the Bank Indonesia Regulation (PBI) concerning the

Payment System will be followed by the issuance of implementing

regulations to support the regulatory reform.

100 Upon enactment of the Bank Indonesia Regulation (PBI), all regulations

.00

0 in the area of payment system issued by Bank Indonesia shall remain

effective providing there are no contradictories with the Bank Indonesia

Regulation concerning the Payment System.

www.bi.go.id BankIndonesiaChannel BankIndonesiaOfficial bank_indonesia bank_indonesia Contact Center 131

You might also like

- Bank Peserta BI-RTGSDocument4 pagesBank Peserta BI-RTGSdanyep uripNo ratings yet

- GBI-Keynote For 7th IFA International Conference - 6 Oct 2021 - FinalDocument23 pagesGBI-Keynote For 7th IFA International Conference - 6 Oct 2021 - FinalMd Enamul HasanNo ratings yet

- India FintechLatestDocument15 pagesIndia FintechLateststudyu256No ratings yet

- RBI RegulationsDocument2 pagesRBI RegulationsDEEPSHIKA P 1850346No ratings yet

- Payment and Settlement Act PDFDocument11 pagesPayment and Settlement Act PDFRebanta SarkarNo ratings yet

- Attachment PAYMENT AND SETTLEMENT SYSTEM ACT 2007 Lyst8740Document10 pagesAttachment PAYMENT AND SETTLEMENT SYSTEM ACT 2007 Lyst8740Vaishali SinghNo ratings yet

- Audit of Banks PDFDocument52 pagesAudit of Banks PDFParmila Rawat0% (1)

- 67410bos54195 cp9Document63 pages67410bos54195 cp9erbhaskarsoni2000No ratings yet

- Pbi 230621 enDocument199 pagesPbi 230621 enGerald de BrittoNo ratings yet

- Audit of BanksDocument59 pagesAudit of Bankskaran kapadiaNo ratings yet

- Niti-Parichay #31: Rbi' New Framework On Outsourcing For PsoDocument4 pagesNiti-Parichay #31: Rbi' New Framework On Outsourcing For PsoSUCHETA ROUT MBA 2021-23 (Kolkata)No ratings yet

- National Payment Systems Vision Strategy 2023 2027Document40 pagesNational Payment Systems Vision Strategy 2023 2027Dale MoongaNo ratings yet

- 5 March 2024 - Progress in NEFT and RTGS - Finance 360Document16 pages5 March 2024 - Progress in NEFT and RTGS - Finance 360Aravind k sNo ratings yet

- The Philippine Payment and Settlement System: Payments and Settlements OfficeDocument17 pagesThe Philippine Payment and Settlement System: Payments and Settlements OfficePrachi SaxenaNo ratings yet

- Payment Systems in India: Reserve Bank of IndiaDocument16 pagesPayment Systems in India: Reserve Bank of IndiaRahul BadaniNo ratings yet

- Icici Bank Ir 2022 FinancialDocument177 pagesIcici Bank Ir 2022 FinancialGreat VivekanandaNo ratings yet

- MEMORANDUM No. M-2021 - : Trisd@bsp - Gov.phDocument8 pagesMEMORANDUM No. M-2021 - : Trisd@bsp - Gov.phOgie FermoNo ratings yet

- Bofia 2020 ReviewDocument10 pagesBofia 2020 ReviewIdiaro Kolawole AbdulrasaqNo ratings yet

- Business Line ArticleDocument24 pagesBusiness Line ArticleRaj KishoreNo ratings yet

- Omkar ConclusionDocument2 pagesOmkar ConclusionezekielNo ratings yet

- ConclusionDocument2 pagesConclusionezekiel50% (2)

- Commercial Bank of Ethiopia Customers AcDocument132 pagesCommercial Bank of Ethiopia Customers Acdro land100% (2)

- Fintech Newsletter Recent Legal Developments and Market Updates From India Eight of August Twenty ThreeDocument11 pagesFintech Newsletter Recent Legal Developments and Market Updates From India Eight of August Twenty ThreeVibhu SinghNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument12 pagesEY Tax Alert: Malaysian DevelopmentsdanNo ratings yet

- 02.the Importance of Liquidity Management - Indian ContextDocument5 pages02.the Importance of Liquidity Management - Indian ContextAjeet SinghNo ratings yet

- CBDT Issues Thresholds For Triggering Significant Economic Presence in IndiaDocument5 pagesCBDT Issues Thresholds For Triggering Significant Economic Presence in IndiaZOYA ZAFAR SIDDIQUINo ratings yet

- Rate Regulated ActivitiesDocument66 pagesRate Regulated ActivitiesamolrNo ratings yet

- RBI Circulars December 2023Document12 pagesRBI Circulars December 2023mounikaNo ratings yet

- Amendments in Ind AS Based On MCA Circular - Summary Notes - Bhavik ChokshiDocument21 pagesAmendments in Ind AS Based On MCA Circular - Summary Notes - Bhavik Chokshitax SollutionsNo ratings yet

- 16 Dec 2023 - Major Decisions in Financial Sector - Finance CADocument10 pages16 Dec 2023 - Major Decisions in Financial Sector - Finance CAAravind k sNo ratings yet

- Understanding The Implications of The IBBIs CIRP Amendment Regulations 2023Document3 pagesUnderstanding The Implications of The IBBIs CIRP Amendment Regulations 2023Astik Dubey ADNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument6 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsGlen JavellanaNo ratings yet

- VisionDocument 03032020Document31 pagesVisionDocument 03032020Ayush SrivastavaNo ratings yet

- Pay - UK Faster Payments Service Principles October 2021Document26 pagesPay - UK Faster Payments Service Principles October 2021Vijay ChavanNo ratings yet

- Notification Dated February 29Document4 pagesNotification Dated February 29divya guptaNo ratings yet

- AuditChain Whitepaper-V1Document10 pagesAuditChain Whitepaper-V1Jonathan GillNo ratings yet

- Overview of The New Payments ArchitectureDocument3 pagesOverview of The New Payments ArchitectureJagadeesh RatnalaNo ratings yet

- Briefing Report: Standing Committee On AppropriationDocument16 pagesBriefing Report: Standing Committee On AppropriationIta NurjanahNo ratings yet

- FIAKS APAC Payment Systems 1658580657Document79 pagesFIAKS APAC Payment Systems 1658580657imshwetaNo ratings yet

- (IJCST-V7I1P9) :A. Indhumathi, S. JambunathanDocument4 pages(IJCST-V7I1P9) :A. Indhumathi, S. JambunathanEighthSenseGroupNo ratings yet

- Regulatory Compliance Is A Data Management Game 0Document12 pagesRegulatory Compliance Is A Data Management Game 0P MandalNo ratings yet

- Economic Survey 2020 21 Vol 1 Summary 7Document2 pagesEconomic Survey 2020 21 Vol 1 Summary 7Ullas UdayNo ratings yet

- Jio 2021Document53 pagesJio 2021Shuhaib MukkolyNo ratings yet

- Payment Industry Go To Market-DeloitteDocument7 pagesPayment Industry Go To Market-DeloitteMegha PantNo ratings yet

- Navigating The National Payment Systems in Digital EraDocument12 pagesNavigating The National Payment Systems in Digital EraFikky Chandra SilabanNo ratings yet

- Real Time Gross Settlement System (RTGS) - An Overview: Information TechnologyDocument6 pagesReal Time Gross Settlement System (RTGS) - An Overview: Information TechnologyReetesh ChandraNo ratings yet

- Inter Psak 25Document28 pagesInter Psak 25vincent alvinNo ratings yet

- Businesscontinuitysips 2006 enDocument13 pagesBusinesscontinuitysips 2006 enkpferreirNo ratings yet

- Payment Banks: Digital Revolution in Indian Banking SystemDocument7 pagesPayment Banks: Digital Revolution in Indian Banking SystemResearch SolutionsNo ratings yet

- Transparency in Extractive Industries: EITI and BeyondDocument16 pagesTransparency in Extractive Industries: EITI and Beyondby21No ratings yet

- Resumen Activos y Pasivos RegulatoriosDocument54 pagesResumen Activos y Pasivos RegulatorioscarlsoNo ratings yet

- Getpdf 4Document49 pagesGetpdf 4WilliamNo ratings yet

- Regulatory Updates - Financial Messaging and Cloud Based ServicesDocument5 pagesRegulatory Updates - Financial Messaging and Cloud Based Servicesdivya guptaNo ratings yet

- Law in Transition 2020 English Fintech RegulationDocument6 pagesLaw in Transition 2020 English Fintech RegulationValentina PérezNo ratings yet

- Cloud Computing: Helping Financial Institutions Leverage The Cloud To Improve IT EfficiencyDocument15 pagesCloud Computing: Helping Financial Institutions Leverage The Cloud To Improve IT EfficiencyIBMBankingNo ratings yet

- FIC - Union Budget 2021Document3 pagesFIC - Union Budget 2021Alakriti SinhaNo ratings yet

- PR689DLDocument17 pagesPR689DLDirector Bal JyotiNo ratings yet

- RBI Framework On Micro Finance LoansDocument5 pagesRBI Framework On Micro Finance LoansPun PNo ratings yet

- April 2024 Monthly PDFDocument97 pagesApril 2024 Monthly PDFktryktnr4pNo ratings yet

- Inputs On The ABS-CBN News Channel On The Money Guide QuestionsDocument5 pagesInputs On The ABS-CBN News Channel On The Money Guide QuestionsRea Rosario G. MaliteNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Public Office, Private Interests: Accountability through Income and Asset DisclosureFrom EverandPublic Office, Private Interests: Accountability through Income and Asset DisclosureNo ratings yet

- Islamic Finance AssignmentDocument20 pagesIslamic Finance AssignmentHewNo ratings yet

- Profil Komisaris enDocument7 pagesProfil Komisaris enPutu HerdyNo ratings yet

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- Ojk & Bi: by Nabella Septi I Duanty RahayuDocument31 pagesOjk & Bi: by Nabella Septi I Duanty RahayuNabell IndraswariNo ratings yet

- Top Corruptor in Indonesia During 2008-2010: Naomee Grace Monica (240210100027)Document15 pagesTop Corruptor in Indonesia During 2008-2010: Naomee Grace Monica (240210100027)Lilis SulastriNo ratings yet

- Financial Services Authority (OJK) & Banking Regulations UpdateDocument7 pagesFinancial Services Authority (OJK) & Banking Regulations Update라이언똥구녕No ratings yet

- CBDC-2022 Bank of IndonesiaDocument65 pagesCBDC-2022 Bank of IndonesiaDai Dong Dao PhapNo ratings yet

- Tugas 1 Bahasa Inggris Niaga Jenita ApriliaDocument3 pagesTugas 1 Bahasa Inggris Niaga Jenita Apriliajenita apriliaNo ratings yet

- M 24Document20 pagesM 24Mul YadiNo ratings yet

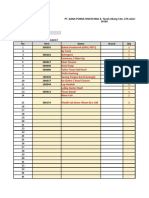

- Template PB HK Bulanan TerbaruDocument40 pagesTemplate PB HK Bulanan TerbaruTrio HadiNo ratings yet

- Financial Market in Indonesia-2Document13 pagesFinancial Market in Indonesia-2005Silviana MSBisdigANo ratings yet

- G20 Finance Track Side Events: February 14th-19th, 2022 Jakarta Convention Center Jakarta, IndonesiaDocument21 pagesG20 Finance Track Side Events: February 14th-19th, 2022 Jakarta Convention Center Jakarta, IndonesiaMentari YoomiNo ratings yet