Professional Documents

Culture Documents

Full-Time Equivalent Employee Calculator Using 2017 Data To Determine 2018 Status

Full-Time Equivalent Employee Calculator Using 2017 Data To Determine 2018 Status

Uploaded by

yoseptianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Full-Time Equivalent Employee Calculator Using 2017 Data To Determine 2018 Status

Full-Time Equivalent Employee Calculator Using 2017 Data To Determine 2018 Status

Uploaded by

yoseptianCopyright:

Available Formats

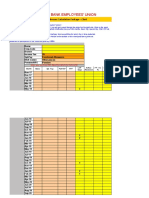

Full-time Equivalent Employee Calculator

Using 2017 Data to Determine 2018 Status

For each month during 2017, insert the numbers below, in the blue shaded areas.

For future months, you will need to enter estimated numbers.

Only include W-2 employees who work in the United States.

Do not include leased employees, sole proprietors, partners of a partnership, or 2%+ shareholders in an S-Corp.

Do not include seasonal employees who worked for you less than 3 months during the year.

IF YOUR COMPANY HAS COMMON OWNERSHIP WITH ANY OTHER COMPANY OR COMPANIES, CONTACT YOUR TAX ATTORNEY FOR ADDITIONAL GUIDANCE.

FULL-TIME EMPLOYEES PART-TIME HOURS FTE EMPLOYEES RESULTS

Number of employees who For those not captured under This is your monthly full-time

worked 30+ hours per week OR FT, number of total hours equivalent employee number For 2018, your company must use your

130+ hours per month worked by all your PT'ers (cap under the ACA law entire year's average to determine if you

at 120 per PT'er) must "pay or play".

January-16

If your average is under 50 (shaded in

February-16 pink) your company will not be required

to "pay or play" in 2018.

March-16

April-16

May-16

June-16

July-16

August-16

September-16

October-16

Full 12 month

November-16

average

December-16 Jan - Dec average:

1) If you use estimated numbers for any months, you must recalculate using actual figures prior to finalizing your "pay or play" determination. If your company is then at 50+

FIE you must offer coverage by 4/1/2018.

2) This calculator is provided for assistance purposes only. GHB Insurance does not determine whether companies are required to "pay or play". This liability is held solely by

the employer. It is recommended that employers review this information with their CPA, tax atorney, or other legal counsel.

You might also like

- Nutrition and Diet Therapy, 6th Ed (2015)Document697 pagesNutrition and Diet Therapy, 6th Ed (2015)Neomorpheous90100% (2)

- Performance Based Share Option Plan On January 1 2016 Rhine CompanyDocument1 pagePerformance Based Share Option Plan On January 1 2016 Rhine CompanyLet's Talk With HassanNo ratings yet

- 05 Social Security How Work Affects Your Benefits En-05-10069Document10 pages05 Social Security How Work Affects Your Benefits En-05-10069api-309082881No ratings yet

- Uniform and Property Receipt TemplateDocument1 pageUniform and Property Receipt TemplateannanaqviNo ratings yet

- Cash Runway Forecast: Click HereDocument3 pagesCash Runway Forecast: Click HereRyan YoungrenNo ratings yet

- Worksheet Partnership Fundamental 2Document3 pagesWorksheet Partnership Fundamental 2Harsh ShahNo ratings yet

- Aarm PSX Lesson 5Document14 pagesAarm PSX Lesson 5mahboob_qayyumNo ratings yet

- Calculating Gratuity For The Employees No Longer Covered Below The Gratuity ActDocument1 pageCalculating Gratuity For The Employees No Longer Covered Below The Gratuity ActTanisha SharmaNo ratings yet

- Crisis 6Document3 pagesCrisis 6Suthan SelvarajNo ratings yet

- Cash Flow Forecast Start Up LoansDocument7 pagesCash Flow Forecast Start Up LoansLinda TNo ratings yet

- Karur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDocument10 pagesKarur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDeepa ManianNo ratings yet

- Assume The Same Facts For ABC Corporation As in P14 5: Unlock Answers Here Solutiondone - OnlineDocument1 pageAssume The Same Facts For ABC Corporation As in P14 5: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Fundamental Analysis: by Investorguide StaffDocument4 pagesFundamental Analysis: by Investorguide StaffsimmishwetaNo ratings yet

- Forecast Revenue and CostDocument21 pagesForecast Revenue and CostRose RepuestoNo ratings yet

- There Are Two Types of TaxDocument13 pagesThere Are Two Types of TaxSahil NegiNo ratings yet

- Module 7Document3 pagesModule 7Rica Niña LetranNo ratings yet

- CDJ Page2 PDFDocument8 pagesCDJ Page2 PDFThúy Vy NguyễnNo ratings yet

- CDJ Page2 PDFDocument8 pagesCDJ Page2 PDFThúy Vy NguyễnNo ratings yet

- Navigating Through CSU-Xpress 1.ppsxDocument20 pagesNavigating Through CSU-Xpress 1.ppsxAnonymous 8cpUZONo ratings yet

- FM NotesDocument1 pageFM Notesyor7724No ratings yet

- For 2016 Raphael Frame Company Prepared The Sales Budget ThatDocument1 pageFor 2016 Raphael Frame Company Prepared The Sales Budget ThatMuhammad ShahidNo ratings yet

- Course Title: Fundamentals of Banking: Assignment No: 01 Course Code: BNK-201Document11 pagesCourse Title: Fundamentals of Banking: Assignment No: 01 Course Code: BNK-201TAWHID ARMANNo ratings yet

- M2L3.9 Home AssignmentDocument1 pageM2L3.9 Home Assignmentmart roel salamancaNo ratings yet

- Clean and Professional Company Profile PresentationDocument10 pagesClean and Professional Company Profile PresentationAzriel Varrand kNo ratings yet

- MMPV & MMRVDocument4 pagesMMPV & MMRVJp PrabakarNo ratings yet

- Jobspeak Report Feb 2016Document12 pagesJobspeak Report Feb 2016Sandip ChandaNo ratings yet

- DocumentDocument15 pagesDocumentharryreturnNo ratings yet

- FORECASTING-REVENUES Week13Document17 pagesFORECASTING-REVENUES Week13Honey Grace Dela CernaNo ratings yet

- Fundamental AnalysisDocument7 pagesFundamental AnalysisArpit JainNo ratings yet

- Google Adsense-When Do I Get Paid Using Google Adsense-177Document1 pageGoogle Adsense-When Do I Get Paid Using Google Adsense-177Rafael Lima DinizNo ratings yet

- Stock Valuation MethodsDocument5 pagesStock Valuation MethodsgoodthoughtsNo ratings yet

- ACC04 - Quiz09 - Chap25-26 - BSA 3-1tDocument7 pagesACC04 - Quiz09 - Chap25-26 - BSA 3-1tMaketh.ManNo ratings yet

- 07 - Inquiry For The Deadline of Submission of TIMTADocument2 pages07 - Inquiry For The Deadline of Submission of TIMTAAhyz DyNo ratings yet

- Key Performance Indicators: Data Collection TemplateDocument11 pagesKey Performance Indicators: Data Collection Templaterahul2barweNo ratings yet

- Finance Docs To Be Submitted by New JoineesDocument1 pageFinance Docs To Be Submitted by New Joineescybersharath cybersharathNo ratings yet

- The Accounting Records of Tama Co Show The Following Assets: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Accounting Records of Tama Co Show The Following Assets: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- If You Start Using The Spreadsheet Mid-Year Time Off Award Donate Annual LeaveDocument35 pagesIf You Start Using The Spreadsheet Mid-Year Time Off Award Donate Annual LeavejavedkaleemNo ratings yet

- Prashant'S Commerce Academy Fundamentals of PartnershipDocument3 pagesPrashant'S Commerce Academy Fundamentals of PartnershipMuskan TilokaniNo ratings yet

- Engineering-PPT Format) : Labor Should Be Less Than 30 Percent of The RevenueDocument2 pagesEngineering-PPT Format) : Labor Should Be Less Than 30 Percent of The RevenueAnita SinghNo ratings yet

- Mhps-Ts Newsletter: MHPS Technical Services CorporationDocument24 pagesMhps-Ts Newsletter: MHPS Technical Services Corporationjonel.javierNo ratings yet

- How To Make Operational BudgetDocument11 pagesHow To Make Operational BudgetGregory KagoohaNo ratings yet

- 3in1tax Calculator With Form 16 V 14.2 FY 2019-20Document18 pages3in1tax Calculator With Form 16 V 14.2 FY 2019-20Nihit SandNo ratings yet

- Cash Flow Forecast Start Up LoansDocument7 pagesCash Flow Forecast Start Up LoansChimdesaNo ratings yet

- Active Form - 16 - Draft - CommunicationDocument2 pagesActive Form - 16 - Draft - Communicationsantam shomeNo ratings yet

- #Askthetaxwhiz: Top 10 Frequently Asked Tax Questions by StartupsDocument8 pages#Askthetaxwhiz: Top 10 Frequently Asked Tax Questions by StartupsHijabwear BizNo ratings yet

- Nominal Interest Rates vs. Real Interest Rates: DeflationDocument8 pagesNominal Interest Rates vs. Real Interest Rates: DeflationKr PrajapatNo ratings yet

- Higher Pension - SimulatorDocument8 pagesHigher Pension - SimulatorShashikant ChaudhariNo ratings yet

- What Is The Price-to-Sales (P/S) Ratio?Document4 pagesWhat Is The Price-to-Sales (P/S) Ratio?Jonhmark AniñonNo ratings yet

- Talal 14f-8944 Ratio AnalysisDocument4 pagesTalal 14f-8944 Ratio AnalysistalalNo ratings yet

- EA Flyer November2022 CLS GPCAHDocument1 pageEA Flyer November2022 CLS GPCAHDavid KebodeauxNo ratings yet

- Bahan Ajar Intercompany InventoryDocument16 pagesBahan Ajar Intercompany InventoryZachra MeirizaNo ratings yet

- 019 TPL5013 1540 1 PDFDocument1 page019 TPL5013 1540 1 PDFPradip Tapan BanerjeeNo ratings yet

- 2019 Top 3 Year-End TipsDocument3 pages2019 Top 3 Year-End TipsMichael CallahanNo ratings yet

- Appraisal Announcement 2009Document1 pageAppraisal Announcement 2009Ali BazlamitNo ratings yet

- Understand OMSY TCodeDocument2 pagesUnderstand OMSY TCodechanduNo ratings yet

- Forecasting Tool With Excel TrendlinesDocument12 pagesForecasting Tool With Excel TrendlinesAmit MaharNo ratings yet

- 2018 Year End Tax TipsDocument4 pages2018 Year End Tax TipsMichael CallahanNo ratings yet

- Attendance Record ExplanationDocument4 pagesAttendance Record ExplanationhhhtaNo ratings yet

- Exemplar Questions: TH THDocument9 pagesExemplar Questions: TH THAman KakkarNo ratings yet

- Tools of Fundamental AnalysisDocument7 pagesTools of Fundamental Analysisdverma1227No ratings yet

- Wacc Irr NPVDocument3 pagesWacc Irr NPVyoseptianNo ratings yet

- Financial LiteracyDocument27 pagesFinancial LiteracyyoseptianNo ratings yet

- Paper 1212121Document1 pagePaper 1212121yoseptianNo ratings yet

- 220823-MMUGM, Contoh PAPER-TOMDocument9 pages220823-MMUGM, Contoh PAPER-TOMyoseptianNo ratings yet

- Sustainability in Packaging: Inside The Minds of Global ConsumersDocument6 pagesSustainability in Packaging: Inside The Minds of Global ConsumersyoseptianNo ratings yet

- Toxicon: Case ReportDocument6 pagesToxicon: Case ReportBrando SaenzNo ratings yet

- Current Good Manufacturing Practices (CGMPS) Food CGMP Modernization - A Focus On Food Safety PDFDocument27 pagesCurrent Good Manufacturing Practices (CGMPS) Food CGMP Modernization - A Focus On Food Safety PDFaldi_dudulNo ratings yet

- Journal of The World Federation of OrthodontistsDocument6 pagesJournal of The World Federation of OrthodontistsJuan Carlos MeloNo ratings yet

- Research Problem Statement of The Problem and ObjectivesDocument5 pagesResearch Problem Statement of The Problem and ObjectivesDonabell RapiNo ratings yet

- SICK BUILDING SYNDROME.17512001.Galih PDFDocument15 pagesSICK BUILDING SYNDROME.17512001.Galih PDFRezandi Zaki RizqiullahNo ratings yet

- Gap Analysis ISO 8836 2019Document27 pagesGap Analysis ISO 8836 2019suman50% (2)

- The Facts On Tweens and Teens and Dating ViolenceDocument2 pagesThe Facts On Tweens and Teens and Dating ViolenceFilipaTorresCostaNo ratings yet

- For 'Best Practices in O&M Safety' PDFDocument153 pagesFor 'Best Practices in O&M Safety' PDFSachinGoyalNo ratings yet

- Time Me, Gentlemen! The Bravado and Bravery of Robert ListonDocument5 pagesTime Me, Gentlemen! The Bravado and Bravery of Robert ListonJonathan IsleyNo ratings yet

- Occlusal Splints and Temporomandibular Disorders: Why, When, How?Document5 pagesOcclusal Splints and Temporomandibular Disorders: Why, When, How?blogger bloggerNo ratings yet

- Proctology CatalogDocument6 pagesProctology CatalogArber LicajNo ratings yet

- Dairy Industries PDFDocument3 pagesDairy Industries PDFwakasensei99No ratings yet

- Shimul Tula Medicinal Qualities PaperDocument8 pagesShimul Tula Medicinal Qualities PapertojinboNo ratings yet

- Last Child in The Woods - Overview - Richard LouvDocument1 pageLast Child in The Woods - Overview - Richard LouvGengjiaqi CHANGNo ratings yet

- Normality and Pathology in A Biomedical Age (LSERO)Document25 pagesNormality and Pathology in A Biomedical Age (LSERO)Rodrigo Guerra ArrauNo ratings yet

- 16 - Development of Organisms and Continuity of Life: Candidates Should Be Able ToDocument3 pages16 - Development of Organisms and Continuity of Life: Candidates Should Be Able ToWeb BooksNo ratings yet

- Bleaching With Without ReservoirsDocument8 pagesBleaching With Without ReservoirsBasil AlNo ratings yet

- NASKAH SOAL 2022 InggrisDocument10 pagesNASKAH SOAL 2022 InggrisEnglish KamaseaNo ratings yet

- Efficacy of Computer Based Developmental Pediatric Screening (CBDPS)Document5 pagesEfficacy of Computer Based Developmental Pediatric Screening (CBDPS)RuchitaNo ratings yet

- Assessment of The EyesDocument32 pagesAssessment of The EyesArlyn MendenillaNo ratings yet

- Oky Final ReportDocument25 pagesOky Final Reportapi-573144944No ratings yet

- Fact Sheet: Biosafety and BiosecurityDocument1 pageFact Sheet: Biosafety and BiosecurityRALPH JAN T. RIONo ratings yet

- Artificial SkinDocument53 pagesArtificial SkincinthiamarnezNo ratings yet

- Mapeh 10Document5 pagesMapeh 10laczalj423No ratings yet

- KALBEDocument6 pagesKALBEAgness Noviita SariiNo ratings yet

- Assessment of Patients in Emergency DepartmentDocument22 pagesAssessment of Patients in Emergency DepartmentClaudine PadillonNo ratings yet

- October 25, 2013 Strathmore Times PDFDocument31 pagesOctober 25, 2013 Strathmore Times PDFStrathmore TimesNo ratings yet

- The Impact of Artificial Intelligence On HealthcareDocument2 pagesThe Impact of Artificial Intelligence On Healthcaremohammedezrouil100% (1)

- Miliaria-An Update: August 2017Document9 pagesMiliaria-An Update: August 2017Shafira TamaraNo ratings yet