Professional Documents

Culture Documents

Economic Resilience in Sub-Saharan Africa An Analysis of The Determinants

Economic Resilience in Sub-Saharan Africa An Analysis of The Determinants

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Resilience in Sub-Saharan Africa An Analysis of The Determinants

Economic Resilience in Sub-Saharan Africa An Analysis of The Determinants

Copyright:

Available Formats

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Economic Resilience in Sub-Saharan Africa :

An Analysis of the Determinants

Willy NOUMESSI FODJOU Armand Gilbert NOULA Juliette MEVAMBA-CHEKEM

University of Dschang, Cameroon University of Dschang, Cameroon University of Dschang, Cameroon

Abstract:- This paper examines the macroeconomic oil shocks of 1973 and 1979 and more recently the oil price

factors related to economic structure and institutions that crash of 2014 are illustrations of this. In addition, economic

are most important for economic resilience in order to growth prospects can also be derailed by climate hazards

guide future policy actions. This is done through affecting growth performance in agricultural countries in

econometric analysis by assessing the absorptive capacity particular. This situation is observed in the case of countries

of common shocks for sub-Saharan African countries. with crops that are highly dependent on rainfall. Other shocks

The results suggest that factors related to economic have internal origins. These include unsustainable fiscal

structure appear to be the most important. These include policies that put pressure on public finances and structural

exchange rates, terms of trade, trade openness, foreign and institutional weaknesses that exacerbate fluctuations in

direct investment and financial development. Institutional economic activity.

factors such as government stability and reduced social

conflict increase the absorptive capacity to shocks. These One way to tackle this problem is economic resilience.

findings reiterate the need to identify and vigorously Indeed, the latter has been the subject of renewed interest in

pursue macroeconomic policies and structural reforms. economics in the aftermath of the Great Recession of 2008,

which has led to a renewed interest in the study of shocks, but

Keywords:- Economic Resilience, Generalized Methods of has reoriented the debate towards the capacity of economies

Moments, Shocs, Structural Factors, Sub-Saharan Africa. to recover from shocks (Sanchez, 2016). Indeed, the Great

Recession and its uneven consequences within and across

I. INTRODUCTION countries have posed new challenges to policy-making and, in

particular, to the design and adoption of policies that can help

For several decades, the world economy, and more different economies bounce back from the deep crisis and

specifically that of developing countries, has been support inclusive growth (Lagarde, 2017). In this sense, the

experiencing a great deal of turbulence caused by fluctuations unevenly distributed effects of the crisis across countries have

in the international economic situation, which have often had been the source of a wealth of research in an effort to

an impact on their economic development to varying degrees. understand these differences and explore the recovery paths

The intertwining of several factors has often been at the that underpin economic resilience (Brigulio et al. 2006 ;

origin of such a situation. Indeed, in an economic context Duval and Vogel, 2008 ; Briguglio et al. 2009 ; Pendall et al.

marked by trade liberalisation and economic integration 2010 ; Kose and Prasad, 2010 ; Guillaumont, 2009;

promoting greater global competitiveness, exposure factors Antosiewicz and Lewandowski, 2014; Ngouhouo and

have increased beyond those linked to multiple threads of Nchofoung, 2021). These studies cover different realities

history and culture. Among the factors of uncertainty, the ranging from many European countries to some developing

interconnection between countries through technology and countries, as well as at different levels of analysis (Bergeijk et

capital transfer, trade, financial markets, and advances in al. 2017).

information and communication technologies are the most

observed sources of vulnerability. This interdependence has In recent years, the focus on the design and

favoured the proliferation of deep shocks and crises with development of economic policies capable of maintaining an

sinister and perverse consequences on economic economy's output at its potential in the face of shocks has

performance. An illustration can be seen in the great financial increased the scope of economic resilience analysis. In this

crisis of 2008 which originated in the United States and sense, studies have first relied on theoretical design to define

spread to the global economy with negative repercussions on operational measures for empirical analysis. In this respect,

the real economy. two groups of measures seem to emerge. The first have

focused on its measurement through composite indicators

On the other hand, the abundance of natural resources in (Brigulio et al. 2009; Advantage West Midlands, 2010;

most developing countries, such as those in sub-Saharan Ngouhouo and Nchofoung, 2021). This measure is based on

Africa, has led to high exposure to international price economic factors capturing macroeconomic stability and

fluctuations, especially with their low diversification (IMF, market efficiency and socio-political factors capturing good

2016). Similarly, countries with a high dependence on political governance and social development. The second

imports of essential commodities are at the mercy of group focuses solely on the behaviour of macroeconomic

unpredictable changes in world prices of these products. The aggregates that contribute to macroeconomic and financial

IJISRT21JUN1006 www.ijisrt.com 796

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

stability such as economic growth and the output gap characteristics. Finally, it is also important to recognize that

(Sondermann, 2018; Jolles et al. 2018). On the other hand, the potential for success of structural reforms is not the same

some authors have used these measures to try to assess the in all areas, as some structural characteristics are linked to the

resilience of economies (Dhwane and Jeske, 2006; degree of economic development and only change over the

Antosiewicz and Lewandowski, 2014; Duval and Vogel, long term.

2008; Elbourne et al. 2008; Hassan and Othman, 2015;

Abdullah and Hassan, 2018). It turns out that countries with To fill this gap, this paper aims to provide a better

an advanced stage of development and integration into the understanding of the determinants of economic resilience.

global economy are often more resilient (Kose and Prasad, The explanatory factors of resilience may be a combination of

2010). However, despite these theoretical and empirical several economic, social and institutional factors. This article

achievements, several aspects have not yet been explored, contributes to the existing literature on the determinants of

particularly in the context of developing countries such as economic resilience.

those in sub-Saharan Africa.

The remainder of the paper is organised into three

Furthermore, the differences in resilience observed sections, including the methodological approach, the results

between countries and regions, as revealed by the studies and the conclusion.

mentioned above, pave the way for research into a new field

of analysis in order to understand the factors that explain II. METHODOLOGY

these differences. This calls for more research, particularly

into the factors that determine the economic resilience of a In order to identify the determinants of economic

given country or area. In this sense, few studies have been resilience in sub-Sahara african countries, we start, with some

conducted, but those that do exist have focused on structural differences, from Sondermann's (2018) modelling strategy

(Duval et al., 2007; Duval and Vogel, 2008; Martin et al., based itself on the static seminal approach of Canova et al.

2016; Sondermann, 2018) and institutional factors (2012) to specify resilience in Sub-Saharan African countries.

(Gianmoena and Rios, 2018; Jolles et al., 2018). To the best

of our knowledge, these studies have focused on European A. Model specification

and OECD countries. Following Sondermann (2018) and Jolles et al. (2018),

we consider a dynamic panel output gap equation to explain

However, there is relatively little work on sub-Saharan the determinants of economic resilience defined in terms of

Africa. With the exception of the notable work of Adom the shock absorbing capacity of each country (measured by

(2016) and Ngouhouo and Nchofoung (2021) on assessing the the joint shock response coefficient in equation 1). The choice

state of economic resilience. For the few who have looked at of this model is justified by the fact that it takes into account

the effects of shocks, most have limited themselves to the the individual and temporal dimension. Unlike the study by

sources of fluctuations and their impacts on the economy Duval and Vogel (2008) which analyses the role of structural

(Hoffmaister et al., 1998; Sissoko and Dibooglu, 2006; policies in explaining economic resilience in OECD countries

Rasaki and Malikane, 2015). According to these authors, the and the study by Jolles et al. (2018) which identifies the

main sources of output fluctuations are external and relate to determinants of resilience in the Euro zone, this article re-

changes in the terms of trade, primary commodity prices and examines these determinants in SSA countries. The aim is to

world interest rates. In addition, the analysis in terms of identify the conventional (economic structure-related) and

resilience to the effects of these shocks has often been taken unconventional (institutional) factors that affect the

into account in the study of convergence and heterogeneity absorptive capacity of an economy, according to the equation

between countries (Bah, 2015). In addition, by taking into below.

account regional integration, a study by Ehrhart and Jacolin,

(2012) tries to highlight the mitigating capacity by showing yit St X it St X it Di it (1)

how the economies of the franc zone could contain the effects

of price shocks. Similarly, other authors highlight economic

resilience by examining the dynamics of the behaviour of Where, yit represents the output gap, St common

economies following internal and external shocks within a shocks, and X it the set of variables explaining the behaviour

monetary union (Coulibaly and Gnimassoun, 2013).

of the output gap following a common shock. The interaction

There is therefore a renewed interest in the lack of in- action between these factors and common shocks ( St X it )

depth studies on economic resilience in the context of indicates the absorption of the effects of shocks on the output

developing countries in SSA. Given the heterogeneity among gap, with i and t indicating country and time specificities

countries in the region, the effects of shocks may vary from respectively.

country to country, as may adjustment and recovery. Thus, in

order to guide structural reforms, it seems necessary to In reality, each economy is subject to both idiosyncratic

identify the more detailed structural characteristics of and common shocks. In addition, shocks can be of different

countries that can contribute to their ability to withstand the nature, such as productivity shocks, confidence shocks or

impact of adverse shocks. Similarly, in order to prioritise preference shocks. It is important to note that shocks are not

between different structural reforms, it is necessary to assess directly observable and have to be estimated.

the impact of a wide range of structural and institutional

IJISRT21JUN1006 www.ijisrt.com 797

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Focusing on unobserved shocks is interesting for two B. Variable specification and justification

reasons : i) it highlights how country-specific factors shape The annual data collected for this study are extracted

the effects of common shocks on output gaps, which is the from the World Bank database (WDI, 2018) for structural

primary aim of this study ; ii) it is a structural approach given variables, and from the ICGR database (2019) for

the wide variety of shocks that actually occur, some of which institutional variables. They cover the period 1995-2017 for

would be difficult to capture in the econometric framework 25 SSA countries3. Several structural and institutional

adopted here. However, this modelling choice also has its variables are defined to examine their capacity to absorb

limitations. In particular, the omission of idiosyncratic shocks shocks and increase economic resilience

and the failure to distinguish between supply and demand Output gap : This is the percentage difference between

shocks increases the risk of omitted variable bias in the actual output and potential output. It is used as a measure

econometric estimates. Another potential source of estimation of economic resilience in this study following Duval and

bias is that output gap estimates are subject to measurement Vogel (2008) and Jolles et al, (2018). Its determination is

error. imperative and the problem of method choice arises.

The choice of the measurement of the output gap

Determining common shocks There are several possible methods for estimating output

There are several methods for estimating common gaps4, such as the Hodrick-Prescott (HP) and Baxter-King

shocks but we retain the structural method developed by (BK) filters or the OECD methodology which derives

Sondermann (2018) following the approach of Canova et al. potential output from a production function approach.

(2011). This method advocates a VAR (Vector Most characteristics of business cycles are robust to all

Autoregressive) approach to extract common shocks over the these methodological choices (see Duval et al., 2007, for a

period from 1995 to 2017. It is composed of three variables: detailed analysis). The analysis below is therefore based

real GDP, the consumer price index (CPI) and the money on a single method for assessing economic resilience, the

supply (M2). Indeed, the analysis of the evolution of the Hodrick-Prescott (HP) gap measure. To this end, a

asymmetry of economic shocks reveals the presence of strong Hodrick Prescott (HP)5 filter is used to decompose the

asymmetries of supply shocks, inflationary shocks and series into trend and cyclical components to isolate the

monetary shocks. These shocks have specific effects on trend, which is then defined as potential output, by solving

macroeconomic variables. Generally speaking, a positive the following program :

supply shock leads to an increase in production, thus a

decrease in the price level. A positive demand shock does not T

affect long-run output, but does lead to a change in aggregate Min (ln Yt ln Yt * ) 2

demand. Finally, a monetary shock has no long-term effect on t 1

output and real balances. On the other hand, it has a Under restraint,

significant impact on all variables in the short run. Thus, the

three-variable VAR estimated at level1 with the number of T 1

lags determined by the Akaike and BIC2 criteria is written : (ln Y

t 1

*

t 1 ln Yt * ln Yt * ln Yt *1 ) 2

yt yt

We rewrite :

Xt A L X t i t X t pt and t pt T T 1 2

mt Min (ln Yt ln Yt ) (ln Y ln Yt ) (ln Yt ln Y )

* 2 *

t 1

* * *

t 1

mt t 1 t 2

*

Where Yt is the observed GDP at constant prices, Yt

is the trend or potential GDP at constant prices is a number

The residuals are obtained using the Choleski

decomposition. Having GDP first (with t the time index)

implies that the unpredictable part of GDP is due mainly to chosen to be small as a minimisation threshold, is a

pure GDP shocks. For prices (𝑝 the unpredictable part is due

to GDP and price shocks only, and so on. For money (𝑚) the 3

Anglola, Burkina Faso, Cameroon, Ivoiry Coast, Congo,

interpretation of a money demand type relationship is DRC, Guinea, Botswana, Gabon, Ghana, Gambia, Kenya,

consistent with a final monetary classification. The series on Malawi, Mali, Mozambique, Madagascar, Niger, Nigeria,

the error term from the VAR specification is then used as a Sierra Leone, Senegal, South Africa, Tanzania, Togo,

common (unobserved) shock. The graph in the appendice Ouganda, Zimbabwe.

shows the estimation of the common shocks. 4

The output gap is the percentage difference between actual

and potential output. While actual output can be observed

with some precision, potential output is unobservable and

must be inferred from the available data.

5

The Hodrick-Prescott (HP) filter isolates a stochastic trend

1

For the extraction of shocks from a VAR model, the by introducing a trade-off between obtaining a good match

stationarity properties of the variables are no longer relevant with the actual series and a high degree of smoothing of the

since the estimation of the VAR coefficients will be trend series. The stochastic trend is assumed to measure

consistent even if there are unit roots (Canova, 2007) potential output, and the residual is the business cycle

2

Let Bayesian information criterion component of the output gap.

IJISRT21JUN1006 www.ijisrt.com 798

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

parameter that determines the smoothness of the underlying - Trade openness : The resilience of an economy also

trend. Low values of produce a trend close to real GDP, depends on the degree of integration with the global

while high values create an underlying trend converging to a economy. The openness of an economy is measured by

linear trend. Therefore, also determines the length of the the ratio of imports and exports to GDP. It takes into

account that more open economies tend to be more

cycle. Low values of will only identify high frequency vulnerable to the loss of access to external finance. Thus,

cycles and include long cycles in the trend, while higher lower levels of restrictions on external trade transactions

values of will produce longer cycles and tend to give a tend to increase a country's ability to respond to a shock.

higher value to the output gap. In line with most of the This variable suggests that economies with high levels of

literature, is set to 100 for annual observations. external trade are more resilient. The expected sign of the

coefficient of this variable in interaction with shocks is

Generally, the different methods can be grouped into negative.

two categories, statistical and economic. Statistical methods - Economic diversification : The Diversification Index

implicitly assume that GDP corresponds to a long-term variable was calculated from the main export products of

equilibrium component plus short-term disturbances around each country. Several indicators of economic

this trend. They decompose between the trend and the cycle diversification exist in the literature. The most widely

to isolate the trend, which is then defined as potential output. used are : i) the Ogive index which measures the deviation

Economic methods derive an estimate of potential output from an equitable distribution of employment across all

from economic supply relationships, including the sectors, ii) the normalised Herfindahl-Hirschman index

'equilibrium' value of the various components. Unlike (HHI) which allows for an assessment of the degree of

statistical methods, economic approaches base their diversification/concentration of trade and iii) the

assumptions on economic theory. However, it should be aggregate specialisation index (close to the Herfindahl-

noted that statistical filtering methods in general (the HP and Hirschman index). There is no empirical evidence of a

Baxter-King (BK) methods) are criticised for not being hierarchy concerning these three measures. Therefore, our

model-based. To address this criticism, different approaches study is limited to the Hirschman index which

have been developed to determine the potential output of an corresponds to the sum of all squared shares of each

economy. For example, the OECD has introduced an product in total national exports, and can be expressed as

alternative model-based method that takes into account a follows :

production function that includes capital, job creation, factor

N

HHI ( xi / X ) 2

productivity and wages that do not accelerate unemployment

(Duval and Vogel, 2008). Claus (2003) also proposes an

i 1

approach based on a model involving a SVAR (Structural

vector autoregressive), in his assessment of potential output

in New Zealand. Beyond this criticism, commonly used Where xi is the nominal value of domestic exports of

filtering methods have statistical weaknesses. It is well product i, X is the nominal value of all domestic exports of

known, for example, that the HP method creates biases due to the country and N is the total number of export products. Its

the unsatisfactory treatment of parameter observations in a level of concentration depends on both the number of

sample, but this is the approach used in this work. products (or the number of markets) and the distribution of

- Terms of trade : The terms of trade are the ratio, for a shares that these products represent. This index takes values

given product, between the price index of exports and that between 0 and 1. Values close to 0 indicate perfect

of imports, expressed in the same base year. A 1% diversification and a maximum of 1 represents perfect

improvement in the terms of trade means that the growth concentration of exports, either in a single product, or to a

in the price of exports is 1% higher than the growth in the single destination country.

price of imports. It also means a deterioration in price - Foreign direct investment : In the literature, authors

competitiveness. Conversely, a decrease in the terms of generally use the stock of FDI (Daude and Stein, 2007)

trade means an improvement in price competitiveness. and the FDI to GDP ratio (Dje, 2007) to capture FDI. In

This ratio can be calculated per product, for a set of this paper, we re-examine the determinants of economic

products or globally. An improvement in the terms of resilience in SSA. This region makes very little foreign

trade is likely to reduce the importance of shocks and investment, which is why we use the FDI/GDP ratio,

increase the absorption capacity. This variable comes which represents the share of FDI inflows to SSA

from the WDI database (2018). In interaction with shocks, countries in GDP, in order to take into account the size of

its expected sign is negative. each economy.

- The exchange rate : A low real exchange rate makes it - Official Development Assistance (ODA): This is measured

possible to increase exports by competitiveness effect, by the ratio of official development assistance to GDP for

their development loosens the external constraint and each country in the sample. This variable represents the

makes it possible to import capital not produced locally, contribution of international donors from the North to

which supports growth. Conversely, a high real exchange improving the living conditions of people in the South.

rate favours the traditional sector for developing countries. Both theoretical and empirical literature has shown that

The coefficient associated with this variable must be this variable is positively related to economic resilience.

negative. This variable is taken from WDI (2018). The expected

sign of the associated coefficient is negative.

IJISRT21JUN1006 www.ijisrt.com 799

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

- Government expenditure : This generally refers to total economics, especially in macroeconomics and finance, this

government expenditure and its financial operations. In method seems relevant to the analysis of the determinants of

the literature they are often considered as automatic economic resilience. It has the advantage of identifying

stabilisers in case of shocks, necessary in the recovery of unobservable effects for cross-sectional data. It controls for

fiscal policy (Hijzen et al., 2017). This indicator is the presence of unobservable heterogeneity, and provides

expressed as a percentage of gross domestic product. more robust estimators (Greene and Schlacther, 2005). The

- Financial development : In financial liberalisation system GMM estimator controls for unobserved country-

theories, financial development has gained considerable specific effects and potential endogeneity of explanatory

prominence worldwide. It reflects the abandonment of variables. There are several reasons for choosing the

policies of financial repression, deemed harmful to generalized method of moments (GMM) according to Asongu

growth, and the adoption of a policy of financial and De Moor (2017). First, the dependent variables must be

liberalisation. They show the need to remove restrictions persistent. Second, the estimation strategy takes into account

on interest rates, thereby encouraging savings and the endogeneity of all regressors. Third, cross-country

increasing the amount of financial resources available for variation is not eliminated with the estimation approach.

investment. It would be an important factor in absorbing Finally, the system GMM technique corrects for the small

shocks. One measure of financial development is the sample bias inherent in the difference estimator.

amount of bank credit allocated to the private sector,

expressed as a percentage of GDP. III. RESULTS AND DISCUSSION

- Institutions : Rodrick (1999) and Acemoglu et al (2003)

suggest that good quality institutions (stability of Table 1 below presents the results of the estimation of

government, rule of law, absence of social conflict and the basic model (equation 1.) by the GMMs on dynamic

corruption) are conducive to greater resilience. This is panels. The aim is to identify the conventional and non-

because external shocks to growth are more important the conventional factors that can explain economic resilience

more latent social conflicts are in an economy and the through their capacity to absorb common shocks. Overall, the

weaker its institutions for conflict management. model seems significant because, in accordance with the

principles of use of GMMs in a system, the AR (2) and

Given the specification of output gaps and the Hansen statistics are insignificant, thus validating the

interaction between variables and common shocks in a panel hypothesis of second-order non-correlation of the residuals

model, we use the generalized methods of moments (GMM) between the instruments and the absence of over-

proposed by Blondell and Bond (1998). Widely used in identification of restrictions.

Table 1: Estimation of the economic resilience determinants equation

(1) (2) (3) (4) (5) (6) (7) (8) (9)

(11) (10)

0.891**

L.gdp_gap 1.349*** 0.264*** 1.154*** 1.168*** 1.264*** 1.444*** 0.986*** 0.819*** 1.763*** 0.889*** *

(0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000)

1.7827** 0.996**

SHOC 7.251** 3.787*** * 6.429*** 3.938** 1.930*** 1.875*** 0.886*** 6.045*** 1.286*** *

(0.014) (0.007) (0.000) (0.006) (0.014) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000)

Structurals

factors

TOT*SHOCS -1.185*

(0.093)

RATE*SHOC -0.464**

(0.046)

DIVER*SHO

CS 0.390***

(0.000)

TRADE*SHO

CS -1.143**

(0.043)

Macroecono

mics factors

DEP*SHOCS -0.114

(0.129)

-

FDI*SHOCS 0.333***

(0.001)

CREDIT*SH -

OCS 0.0216**

IJISRT21JUN1006 www.ijisrt.com 800

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

*

(0.000)

APD*SHOCS 0.0718**

(0.045)

Institutionals

factors

Govstab*SHO -

CS 0.560***

(0.000)

Conflict*SHO

CS -0.031

(0.154)

Demo*SHOC

S 0.102

(0.203)

- - - - - - - - -

- 0.000435 0.0012** 0.00182* 0.00171* 0.00112* 0.00116* 0.00122* - 0.0012** 0.00152

Constant 0.00144* ** * ** ** * ** ** 0.0021** * ***

(0.075) (0.047) (0.001) (0.000) (0.000) (0.011) (0.007) (0.010) (0.000) (0.000) (0.006)

Country fixed

effet Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Observations 485 485 485 485 485 460 484 484 485 485 485

AR(1) 0.043 0.007 0.003 0.003 0.004 0.004 0.0153 0.008 0.004 0.007

AR(2) 0.162 0.056 0.320 0.172 0.090 0.057 0.085 0.398 0.255 0.252 0.206

sargan 0.843 0.405 0.193 0.575 0.538 0.159 0.426 0.0673 0.124 0.149 0.307

hansen 0.799 0.0598 0.380 0.837 0.523 0.402 0.585 0.848 0.239 0.893 0.609

Note: * p<0.1 ** p<0.05 *** p<0.01. Student's tally in brackets

TOT : terms of trade ; RATE : real interest rate ; DIVERS : economic diversification ; TRADE : economic openness ; DEP :

Govment expenditure ; FDI :foreign direct investment ; CREDIT : domestic investment APD : offocial development aid ;

Govstab :govment stability ; cinflict :internal conflict ; demo : democratie

Overall, when examining the resilience factors, it negative and significant sign. This suggests that the exchange

emerges that conventional factors, particularly those linked to rate is a shock absorber. Indeed, according to the literature

economic structure, favour economic resilience. Indeed, the (Collins and Razin, 1997 for example), small variations or a

absorption measured in terms of the interaction of the factor fall in real exchange rates allow for an increase in exports

considered with the common shocks is manifested by a through a competitiveness effect, their development loosens

negative sign for the interaction variable, thus translating the the external constraint and allows for the import of capital not

capacity of the factor to absorb shocks. produced locally, which favours growth. Conversely, high

real exchange rates favour the traditional sector for

As for the factors related to economic structure, the developing countries. The existence of monetary unions for

coefficient on the terms of trade is negative and significant. most SSA countries favours a certain stability of exchange

This indicates that the higher its value (i.e. when there is an rates, which constitutes a factor of absorption in the face of

appreciation or improvement in the terms of trade), the shocks.

narrower the output gap in the face of a common shock. That

is, actual output tends towards potential output. Thus, the Similarly, the coefficient of trade openness is negative

appreciation of the terms of trade, due to the increase in and significant. This negative sign of the estimate of the

exports, is a factor in the absorption of common shocks. interaction of trade openness and common shocks shows that

When they represent the most important source of economic high openness to international trade increases absorption of

fluctuations in SSA (Haffmaister et al., 1998; Sissoko and shocks by reducing the output gap, as it allows the economy

Dibooglu, 2006), their improvement is likely to reduce to benefit more from a recovery in export markets. Indeed, a

fluctuations and thus contribute to economic resilience. This high degree of trade openness is explained by an increase in

result is in fact consistent with terms-of-trade theory, trading partners and therefore an increase in exports, which

particularly for Africa (Deaton and Miller, 1996), according creates a surplus in the balance of trade necessary to maintain

to which higher relative export prices allow for greater the economy's trend in the face of shocks. Briguglio et al

purchases of production inputs and investments in (2009) showed that some small island states such as

productivity-enhancing measures, such as more efficient Singapore, which are intrinsically vulnerable to external

production technologies. shocks, were able to resist external shocks and maintain their

level of development precisely because of their trade

We also find that the coefficient associated with the openness, which favours a high concentration of exports ; as

exchange rate variable in interaction with shocks has a did Jolles et al. (2018).

IJISRT21JUN1006 www.ijisrt.com 801

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

capacity that determines the rapid recovery of an economy

However, diversification in interaction with common from a negative shock is enhanced when the economy has

shocks has a positive and significant coefficient. This reflects discretionary instruments that it can use to counter the effects

a low shock absorption capacity for the latter. Indeed, one of of negative shocks, such as a strong fiscal position, which

the main characteristics of SSA countries is the low means that policymakers can use public spending to counter

diversification of their exports, which is not able to mitigate the effects of negative shocks (Briguglio et al., 2009)

the impact of shocks. It is generally accepted that diversified

economies are likely to be more resilient to shocks. With regard to institutions, the general view nowadays

is that institutions modulate and shape long-run economic

For macroeconomic factors, we find that FDI and growth trajectories defining and delimiting the context that

financial development interact with shocks with significant agents in the economic system operate in, mainly through the

coefficients and negative signs. Thus, it appears that capital definition of incentives to behave in a certain way (Acemoglu

inflows in the form of FDI, when used effectively (i.e. in the et al. 2003, 2005). Two of these unconventional determinants

presence of good institutions), increase investment, allowing are identified in these estimates (government stability and

recipient firms to better withstand shocks, thus contributing to internal conflict). Indeed, the coefficient associated with these

economic resilience. variables interacting with common shocks are significant and

show positive signs contrary to expectations. This suggests

Furthermore, financial development appears to be an that institutions are not conducive to absorbing shocks.

important factor in absorbing shocks. Indeed, the significance Generally, government institutions have always been weak,

of the coefficient associated with financial development (in with mostly corrupt and inefficient bureaucracies (Collier and

terms of credit granted to the private sector) shows the Gunning, 1999). The significance observed for these

capacity of the financial sector to direct capital towards variables reflects efforts to improve the quality of institutions,

highly profitable investments. This increases the shock which individually are still weak to respond effectively to

absorption necessary for financial stability and economic negative shocks. The interaction with other factors could be

growth. This result is in line with the literature on the subject an important factor for economic resilience.

(Levine, 1997)

Sensitivity testing

However, while public expenditure is an important In order to test the sensitivity of our results, we change

element of fiscal policy, particularly in terms of automatic our dependent variable, namely the output gap, by real GDP.

stabilisers in the event of shocks, it is marginal in helping to Indeed, following the logic of Canoval et al. (2012) and

absorb shocks in SSA countries. This can be explained by the sondermann (2018), resilience can be approximated by real

pro-cyclical tendency of fiscal policy in most SSA countries GDP, as the focus is on the occurrence of shocks. In this

and does not constitute a resilience factor in this respect. Yet respect, the impact of shocks is materialised by extreme

it is widely accepted in the literature that public spending, fluctuations in GDP. Thus the results obtained from the GDP

when used effectively, can contribute to economic stability regressions are contained in Table 2 below. Overall, the

(Besley and Persson, 2014). Moreover, the absorptive results do not change but they do vary significantly.

Table 2 : Estimation of equation (1) with GDP as the dependent variable

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

L.GDP 0.994*** 0.963*** 0.998*** 0.988*** 0.996*** 0.991*** 0.993*** 1.022*** 1.002*** 0.985*** 1.000***

(0.003) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.000) (0.00351)

SHOC 7.353*** 4.912*** 1.546*** 10.36*** 4.333*** 1.796*** 1.996*** 0.827*** 3.625*** 8.606*** 1.593***

(0.007) (0.00) (0.000) (0.001) (0.002) (0.000) (0.000) (0.000) (0.000) (0.020) (0.220)

Structural factors

TOT*SHO

CS -1.274**

(0.039)

RATE*SH -

OC 0.482***

(0.000)

Diver*SHO

CS 0.262***

(0.002)

TRADE*S -

HOCS 2.100***

(0.004)

Macroeconmics

factors

DEP*SHOCS -0.146**

IJISRT21JUN1006 www.ijisrt.com 802

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

(0.026)

-

FDI*SHOCS 0.348***

(0.000)

-

CREDIT*SHO 0.0221**

CS *

(0.000)

APD*SHOCS 0.151***

(0.000)

Institutionals factors

Govstab*SHO -

CS 0.217***

(0.004)

Conflict*SHO

CS -0.898**

(0.039)

Demo*SHOC

S -0.00442

(0.0615)

-

Constant 0.170* 0.898*** 0.0802** 0.331*** 0.148** 0.256** 0.209* 0.465*** 0.00449* 0.380 0.0334

(0.099) (0.000) (0.054) (0.005) (0.038) (0.041) (0.059) (0.002) (0.096) (0.319) (0.0816)

Country fixed

effect Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Observations 485 485 485 485 485 460 484 484 485 485 485

AR(1) 0.0132 0.014 0.011 0.006 0.002 0.003 0.004 0.008 0.008 0.022 0.006

AR(2) 0.155 0.127 0.244 0.247 0.087 0.226 0.098 0.314 0.215 0.354 0.141

sargan 0.220 0.213 0.200 0.828 0.101 0.456 0.529 0.176 0.747 0.267 0.444

hansen 0.521 0.210 0.249 0.853 0.237 0.375 0.245 0.783 0.338 0.220 0.301

Note: * p<0.1 ** p<0.05 *** p<0.01. Student's tally in brackets

Source: Author’s calculations based on World Bank (WDI), International Country Risk Guide (ICRG)

Table 2 shows that the determinants of resilience conventional determinants was identified (government

identified above are almost the same when considering GDP stability).

as a proxy for economic resilience. However, the effect of

government stability stands out as a resilience factor, In view of these results, several recommendations can

particularly in terms of absorbing the effects of shocks. be made to increase resilience in SSA countries. First,

Moreover, the reduction of internal conflicts facilitates the advocate a counter-cyclical fiscal policy to mitigate the

absorption of shocks and thus increases economic resilience effects of shocks and strengthen the governance process in

in the same way as public spending. All this shows that our African countries to improve the means of transfers between

results are robust. countries. And secondly, to encourage better management of

official development assistance through transparency. Thus,

IV. CONCLUSION all these measures could lead not only to strengthening

economic resilience in SSA countries, but also increase the

The purpose of this paper was to re-examine the region's development potential.

determinants of economic resilience in Sub-Saharan Africa.

Most of the work on economic resilience has focused on REFERENCES

analysing its consequences. Curiously, it has failed to address

the question of why some countries are more resilient than [1]. Acemoglu, D., S. Johnson and J. A. Robinson (2005),

others and vice versa. This has led to an interest in ‘Institutions as a Fundamental Cause of Long_Run

understanding the factors that even cause resilience. Growth,’ in: Aghion, P. and S. N. Durlauf ﴾eds.﴿,

Addressing this concern would lead to more appropriate Handbook of Economic Growth, Volume 1A.

policy recommendations. By applying the method of [2]. Antsiewicz. M., and Lewandowski. P. (2014) « What if

generalized moments in a system to our model, our results you were German?- DSGE approach to the Great

suggest that conventional determinants explain resilience in Recession on labour markets », IBS Working Paper

Sub-Saharan Africa (terms of trade, exchange rate, trade #01/2014.

openness, foreign direct investment, financial development). [3]. Arellano M, Bover O. (1995), “Another look at the

Beyond these conventional determinants, one of the non- instrumental variable estimation of error components

models”. J Econom 68(1):29–51

IJISRT21JUN1006 www.ijisrt.com 803

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[4]. Bah M S (2015) ‘Real convergence in West African Economics and Agribusiness, School of Economics,

Economic and Monetary Union (WAEMU)’, Finance and Banking, UUM COB.

Economics Letters, 135, 19-23. [17]. Hijzen, A., A. Kappeler, M. Pak and C. Schwellnus

[5]. PA, Brakman S, Marrewijk C (2017) Heterogeneous (2017), ‘Labour market resilience: The role of structural

economic resilience and the great recession’s world and macroeconomic policies’, in OECD Employment

trade collapse. Pap Reg Sci 96(1):3–12 Outlook 2017.

[6]. Briguglio, L., G. Cordina, N. Farrugia and S. Vella [18]. Hoffmaister A. W., Roldos J. E. and Wickham P.(1998)

(2009), ‘Economic vulnerability and resilience: : "Macroeconomic fluctuations in Sub-Saharan Africa",

concepts and measurements’, Oxford Development IMF Staff Paper, 45, 132-161

Studies, Vol. 37, No. 3, pp. 229-247. [19]. IMF (2016), ‘A Macroeconomic Perspective on

[7]. Canova, F., L. Coutinho and Z. Kontolemis (2012), Resilience’, Note for G20 meeting.

‘Measuring the macroeconomic resilience of industrial [20]. Jolles M. and E. Meyermans (2018), ‘Economic

sectors in the EU and assessing the role of product resilience, the Single Market and EMU: a self-

market regulations’, European Economy Occasional reinforcing interaction’, Quarterly Report on the Euro

Papers 112 Area, Vol. 17, No. 1, pp. 7.22.

[8]. Coulibaly Issiaka and B. Gnimassoun, (2013), [21]. Kose. A. and Prasad. E. (2010) « Resilience of

« Optimality of a monetary union: New evidence from Emerging Market Economies to Economic and

exchange rate misalignments in West Africa », Financial Developments in Advanced Economies »

Economic Modelling 32 (2013) 463–482 European Commission, DirectorateGeneral for

[9]. Deaton, A. and Miller, R.I. (1996), “International Economic and Financial Affairs, B-1049 Brussels.

Commodity Prices, Macroeconomic Performance and [22]. Lagarde C (2017) Building a more resilient and

Policies in Sub-Saharan Africa,” Journal of African inclusive global economy. IMF, Washington

Economies 5, Supplement, 99-191 [23]. Ngouhouo I. and Nchofoung T. N., (2021), « Economic

[10]. Dhawan. R. and Jeske. K. (2006) « How Resilient Is the Resilience in Sub-Saharan Africa: Evidence from

Modern Economy to Energy Price Shocks? », Economic Composite Indicators », Journal of the Knowledge

Review Third Quarter 2006. Economy

[11]. Duval, R. and L. Vogel (2008), ‘Economic resilience to [24]. Pendall. R., Kathryn. F., Margaret. C. (2010) «

shocks: The role of structural policies’, OECD Journal: Resilience and Regions: Building Understanding of the

Economic Studies, Vol. 2008 (1), pp. 1-38 Metaphor » Cambridge Journal of Regions, Economy

[12]. Ehrhard H. et Jacolin L. (2012), « L’impact de la crise and Society 3: 1-14.

de la zone euro sur la zone franc: analyse des canaux de [25]. Rasaki M.,G. and Malikane C.(2015) : "Macroeconomic

transmission », Political Science. shocks and fluctuations in African economies",

[13]. Elbourne A., D. Lanser, B. Smid and M. Vromans Economic Systems, 39, pp.553-696, Décembre 2015.

(2008), ‘Macroeconomic resilience in a DSGE model’, [26]. Sánchez Caldera A., M. Rasmussen and O. Röhn

CPB Discussion Paper No. 96. (2016), 'Economic Resilience: What Role for Policies?',

[14]. Gianmoena L. and Vicente Rios (2018), « The Journal of International Commerce, Economics and

Determinants of Resilience in European Regions During Policy, Vol. 7, No. 2 pp. 1-44.

the Great Recession: a Bayesian Model Averaging [27]. Sissoko Y. and Dibooglu S.(2006) : "The exchange rate

App », Discussion Paper n. 235 system and macroeconomic fluctuations in Sub-Saharan

[15]. Guillaumont, P. (2009) « An economic vulnerability Africa", Ecconomic Systems, volume 30, pp.141-156.

index: Its design and use for international development [28]. Sondermann, D. (2018), ‘Towards more resilient

policy. » Oxford Development Studies, 37(3), 193 – economies: The role of well-functioning economic

228. structures’, Journal of Policy Modeling, Vol. 40, No. 1,

[16]. Hassan. S. and Othman. Z. (2015) « The Effect of pp 97-117.

Economic Resilience on Private Investment in Selected

Malaysian Economic Sectors », Department of

IJISRT21JUN1006 www.ijisrt.com 804

Volume 6, Issue 6, June – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

APPENDICES

TABLE : DESCRIPTIVE STATISTICS

Variable Observations Mean Standard error Min Max

GAP 575 0.0001948 0.0397884 -0.29579 0.180347

TOT 575 115.9732 36.37841 21.3967 251.586

RATE 575 740.867 1222.707 0.00275 9125.74

TRADE 575 68.37082 30.0072 20.7225 277.798

DIVERS 575 0.1944377 .2066725 0.0022 0.859

DEP 575 5.05e+09 1.34e+10 0.622 8.70e+10

FDI 575 3.711711 5.658216 -8.58943 50.018

CREDIT 574 18.86224 26.14199 0.491388 160.125

APD 575 6.434519 5.963238 -.0846154 40.74074

Source : Authors

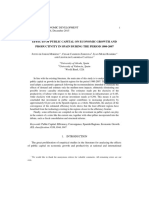

Graph : Common shocs

0.035

0.030

0.025

0.020

0.015

0.010

0.005

0.000

-0.005

-0.010

-0.015

-0.020

Source : Authors

[1]

IJISRT21JUN1006 www.ijisrt.com 805

You might also like

- Senyawa: Compound LyricismDocument51 pagesSenyawa: Compound LyricismMinor CompositionsNo ratings yet

- INSIDE THE CRIMINAL MIND, REVISED AND UPDATED EDITION (PAPERBACK) by STANTON SAMENOW - ExcerptDocument24 pagesINSIDE THE CRIMINAL MIND, REVISED AND UPDATED EDITION (PAPERBACK) by STANTON SAMENOW - ExcerptCrown Publishing Group65% (17)

- Admissions Offer LetterDocument4 pagesAdmissions Offer LetterMohammed Abraruddin100% (1)

- Using Nigem in Uncertain Times: Introduction and Overview of Nigem Arno Hantzsche, Marta Lopresto and Garry YoungDocument14 pagesUsing Nigem in Uncertain Times: Introduction and Overview of Nigem Arno Hantzsche, Marta Lopresto and Garry YoungeconstudentNo ratings yet

- CIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Document37 pagesCIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Dickson MusoniNo ratings yet

- An Empirical Test of Exogenous GrowthDocument33 pagesAn Empirical Test of Exogenous GrowthEduNo ratings yet

- Discussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringDocument10 pagesDiscussion Problems 1. You Plan To Retire 33 Years From Now. You Expect That You Will Live 27 Years After RetiringJape PreciaNo ratings yet

- Africa 2010-2020: Poverty Reduction Beyond The Global CrisisDocument14 pagesAfrica 2010-2020: Poverty Reduction Beyond The Global CrisisJohn WaweruNo ratings yet

- An Application of Panel Ardl in Analysin PDFDocument18 pagesAn Application of Panel Ardl in Analysin PDFShuchi GoelNo ratings yet

- Fiscal Policies in AseanDocument22 pagesFiscal Policies in AseanLCHNo ratings yet

- 05 - WD 2009 Linkages Between Financial Deepening, Trade OpennessDocument12 pages05 - WD 2009 Linkages Between Financial Deepening, Trade OpennessSatrio NugrohoNo ratings yet

- Policy Responses To The Global Financial Crisis What Did Emerging Economies Do DifferentlyDocument34 pagesPolicy Responses To The Global Financial Crisis What Did Emerging Economies Do DifferentlyremivictorinNo ratings yet

- Determinants of Economic Growth in Sub SDocument7 pagesDeterminants of Economic Growth in Sub SInnocent escoNo ratings yet

- Literature ReviewDocument12 pagesLiterature ReviewQamar VirkNo ratings yet

- Strategies Out of Global Recession in Emerging Markets: An Application For 2008 Global CrisisDocument20 pagesStrategies Out of Global Recession in Emerging Markets: An Application For 2008 Global CrisisLounceny CissokoNo ratings yet

- Managing Development - Globalization, Economic Restructuring and Social PolicyDocument14 pagesManaging Development - Globalization, Economic Restructuring and Social PolicysheenaNo ratings yet

- Financial Development and Economic Growth Nexus in The MENA CountriesDocument9 pagesFinancial Development and Economic Growth Nexus in The MENA CountriesHira HamidNo ratings yet

- Global Economic Crisis Research PapersDocument6 pagesGlobal Economic Crisis Research Papersmadywedykul2100% (1)

- Financial Development and Economic Complexity: The Role of Country StabilityDocument33 pagesFinancial Development and Economic Complexity: The Role of Country StabilityAubin DiffoNo ratings yet

- Is The Relationship Between Financial Development and Economic Growth Monotonic For Middle Income Countries?Document52 pagesIs The Relationship Between Financial Development and Economic Growth Monotonic For Middle Income Countries?z_12488109No ratings yet

- Re-Examining The Finance-Growth Nexus: Structural Break, Threshold Cointegration and Causality Evidence From The EcowasDocument23 pagesRe-Examining The Finance-Growth Nexus: Structural Break, Threshold Cointegration and Causality Evidence From The EcowasHelali KamelNo ratings yet

- Mehta Rao SonaliDocument31 pagesMehta Rao SonaliSonia HasNo ratings yet

- Wa0101.Document23 pagesWa0101.Qamar VirkNo ratings yet

- Journal of International Money and Finance: Makram El-Shagi, Camélia TurcuDocument5 pagesJournal of International Money and Finance: Makram El-Shagi, Camélia TurcuNadia Cenat CenutNo ratings yet

- Economic Growth, Financial Development, and Trade Openness of Leading Countries in ASEANDocument9 pagesEconomic Growth, Financial Development, and Trade Openness of Leading Countries in ASEANItz TangNo ratings yet

- Causal Nexus Between Innovation, Financial Development, and Economic Growth: The Case of OECD CountriesDocument32 pagesCausal Nexus Between Innovation, Financial Development, and Economic Growth: The Case of OECD Countriesusmanshaukat311No ratings yet

- Research Paper On Global Economic CrisisDocument7 pagesResearch Paper On Global Economic Crisisukefbfvkg100% (1)

- The Impact of Monetary Policy and Its LaDocument13 pagesThe Impact of Monetary Policy and Its Laibrahim javedNo ratings yet

- Lingkungan Makro 1Document20 pagesLingkungan Makro 1Skamil GhifariNo ratings yet

- 1spillovers and Connectedness in Foreign Exchange Markets 2023Document9 pages1spillovers and Connectedness in Foreign Exchange Markets 2023Belidet GirmaNo ratings yet

- 38 SSApanel ARDLDocument19 pages38 SSApanel ARDLFarhan DaudNo ratings yet

- 295 2017-AgriceconDocument9 pages295 2017-AgriceconYaniNo ratings yet

- Economic Growth Modelling in Africa: An Application of Bayesian Model AveragingDocument13 pagesEconomic Growth Modelling in Africa: An Application of Bayesian Model AveragingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 6 - ch.1 - Putting Long Term Sustainable Growth in PerspectiveDocument24 pages6 - ch.1 - Putting Long Term Sustainable Growth in PerspectiveomjrNo ratings yet

- Economic Determinants of Corporate Capital Structure: The Case of Tunisian FirmsDocument7 pagesEconomic Determinants of Corporate Capital Structure: The Case of Tunisian FirmsMissaoui IbtissemNo ratings yet

- Immunity of SACCOs in Times of Economic UpturnsDocument49 pagesImmunity of SACCOs in Times of Economic UpturnsdennisNo ratings yet

- 1findev, Instq, GrowthDocument7 pages1findev, Instq, GrowthJoel ChineduNo ratings yet

- Jed05 2015 0010 CCDocument23 pagesJed05 2015 0010 CCEncarna HABA MARTINo ratings yet

- Macroeconomic Determinants of Stock Market Development in GhanaDocument16 pagesMacroeconomic Determinants of Stock Market Development in GhanaJEAN PIERRE RIVERA HUANUCONo ratings yet

- Economic Liberalizatio EditedDocument18 pagesEconomic Liberalizatio Editedngolodedan2No ratings yet

- 10 IJEFI 10557 Srithilat OkeyDocument8 pages10 IJEFI 10557 Srithilat OkeySm HkmNo ratings yet

- Economic Modelling: Jamel JouiniDocument14 pagesEconomic Modelling: Jamel JouinihelenaNo ratings yet

- Economi Regional Et RsilienceDocument20 pagesEconomi Regional Et RsilienceLhoussayne Ben MoulaNo ratings yet

- The Effects of The Structural Adjustment Programs On Economic Growth in Sub Saharan Africa A Literature ReviewDocument12 pagesThe Effects of The Structural Adjustment Programs On Economic Growth in Sub Saharan Africa A Literature ReviewEditor IJTSRDNo ratings yet

- Rivera, Karen Diane C. - GS REPORTDocument18 pagesRivera, Karen Diane C. - GS REPORTKaren Diane Chua RiveraNo ratings yet

- 46 CCDocument13 pages46 CCRabaa DooriiNo ratings yet

- Samargandi 2015Document16 pagesSamargandi 2015dfsdfsdfNo ratings yet

- ArtCEPALReview102-12 10macrofordev15 05 11 CleanrevdocDocument40 pagesArtCEPALReview102-12 10macrofordev15 05 11 CleanrevdocKevin MurgaNo ratings yet

- J MSL 2019 8 037Document10 pagesJ MSL 2019 8 0375g55fnjhwtNo ratings yet

- The Impact of Banks and Stock Market Development On Economic Growth in South Africa - An ARDL-bounds Testing ApproachDocument17 pagesThe Impact of Banks and Stock Market Development On Economic Growth in South Africa - An ARDL-bounds Testing ApproachNokuthulaNo ratings yet

- Analysis of Structural Regression in Method Approach Detecting The Economic Crisis of Selected CountriesDocument11 pagesAnalysis of Structural Regression in Method Approach Detecting The Economic Crisis of Selected CountriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Journal of Development Economics: M. Ayhan Kose, Eswar S. Prasad, Marco E. TerronesDocument13 pagesJournal of Development Economics: M. Ayhan Kose, Eswar S. Prasad, Marco E. TerronesMeskini AnesNo ratings yet

- GlobalizationDocument13 pagesGlobalizationMeskini AnesNo ratings yet

- Food Policy: Luis Vinicio Losilla Solano, Bernhard Brümmer, Alejandra Engler, Verena OtterDocument10 pagesFood Policy: Luis Vinicio Losilla Solano, Bernhard Brümmer, Alejandra Engler, Verena OtterWilliams CastilloNo ratings yet

- Covid 19: Digesting A Bitter Cherry On An Over Baked CakeDocument20 pagesCovid 19: Digesting A Bitter Cherry On An Over Baked CakeVy NguyenNo ratings yet

- A Sectoral Analysis of Fiscal and Monetary Actions in NigeriaDocument22 pagesA Sectoral Analysis of Fiscal and Monetary Actions in NigeriaNiyi SeiduNo ratings yet

- Financial Sector Development and Economic Growth: Evidence From ZimbabweDocument12 pagesFinancial Sector Development and Economic Growth: Evidence From ZimbabweDhienna AyoeNo ratings yet

- MPRA Paper 112870Document46 pagesMPRA Paper 112870SAMEER QAMARNo ratings yet

- 413 Final DraftDocument16 pages413 Final DraftSabo Victor EmmanuelNo ratings yet

- Pradhan 2014Document19 pagesPradhan 2014Yulia KristiantyNo ratings yet

- Rode 12133Document18 pagesRode 12133AsniNo ratings yet

- How To Evaluate The Effects of IMF ConditionalityDocument45 pagesHow To Evaluate The Effects of IMF Conditionality34 กิตติศักดิ์ พิริยะธัญญากรมNo ratings yet

- Nexus Between Financial Innovation and Economic Growth in South Asia: Evidence From ARDL and Nonlinear ARDL ApproachesDocument19 pagesNexus Between Financial Innovation and Economic Growth in South Asia: Evidence From ARDL and Nonlinear ARDL ApproachesSobia MurtazaNo ratings yet

- A 65 669-676 Amended Research Article of Co - ANJUMDocument8 pagesA 65 669-676 Amended Research Article of Co - ANJUMshazia bilalNo ratings yet

- Industrial Policy in the Middle East and North Africa: Rethinking the Role of the StateFrom EverandIndustrial Policy in the Middle East and North Africa: Rethinking the Role of the StateNo ratings yet

- Design and Analysis of Various Formwork SystemsDocument6 pagesDesign and Analysis of Various Formwork SystemsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Reintegration of Dairy in Daily American Diets: A Biochemical and Nutritional PerspectiveDocument1 pageReintegration of Dairy in Daily American Diets: A Biochemical and Nutritional PerspectiveInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Nurturing Corporate Employee Emotional Wellbeing, Time Management and the Influence on FamilyDocument8 pagesNurturing Corporate Employee Emotional Wellbeing, Time Management and the Influence on FamilyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Occupational Injuries among Health Care Workers in Selected Hospitals in Ogbomosho, Oyo StateDocument6 pagesOccupational Injuries among Health Care Workers in Selected Hospitals in Ogbomosho, Oyo StateInternational Journal of Innovative Science and Research Technology100% (1)

- Appraisal of Nursing Care Received and it’s Satisfaction: A Case Study of Admitted Patients in Afe Babalola Multisystem Hospital, Ado Ekiti, Ekiti StateDocument12 pagesAppraisal of Nursing Care Received and it’s Satisfaction: A Case Study of Admitted Patients in Afe Babalola Multisystem Hospital, Ado Ekiti, Ekiti StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluation of Lateral and Vertical Gingival Displacement Produced by Three Different Gingival Retraction Systems using Impression Scanning: An in-Vivo Original StudyDocument6 pagesEvaluation of Lateral and Vertical Gingival Displacement Produced by Three Different Gingival Retraction Systems using Impression Scanning: An in-Vivo Original StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Salivary Diagnostics in Oral and Systemic Diseases - A ReviewDocument5 pagesSalivary Diagnostics in Oral and Systemic Diseases - A ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Prevalence of Microorganisms in UTI and Antibiotic Sensitivity Pattern among Gram Negative Isolates: A Cohort StudyDocument4 pagesPrevalence of Microorganisms in UTI and Antibiotic Sensitivity Pattern among Gram Negative Isolates: A Cohort StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Biometric Security Systems Enhanced by AI: Exploring Concerns with AI Advancements in Facial Recognition and Other Biometric Systems have Security Implications and VulnerabilitiesDocument5 pagesBiometric Security Systems Enhanced by AI: Exploring Concerns with AI Advancements in Facial Recognition and Other Biometric Systems have Security Implications and VulnerabilitiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MSMEs and Rural Prosperity: A Study of their Influence in Indonesian Agriculture and Rural EconomyDocument6 pagesMSMEs and Rural Prosperity: A Study of their Influence in Indonesian Agriculture and Rural EconomyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Shift from Traditional to Modern Building Concepts and Designs in Ringim Town: A Comparative Study of Aesthetics, Values, Functions and DurabilityDocument9 pagesShift from Traditional to Modern Building Concepts and Designs in Ringim Town: A Comparative Study of Aesthetics, Values, Functions and DurabilityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fuzzy based Tie-Line and LFC of a Two-Area Interconnected SystemDocument6 pagesFuzzy based Tie-Line and LFC of a Two-Area Interconnected SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Explanatory Sequential Study of Public Elementary School Teachers on Deped Computerization Program (DCP)Document7 pagesAn Explanatory Sequential Study of Public Elementary School Teachers on Deped Computerization Program (DCP)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Dynamic Analysis of High-Rise Buildings for Various Irregularities with and without Floating ColumnDocument3 pagesDynamic Analysis of High-Rise Buildings for Various Irregularities with and without Floating ColumnInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- AI Robots in Various SectorDocument3 pagesAI Robots in Various SectorInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intrusion Detection and Prevention Systems for Ad-Hoc NetworksDocument8 pagesIntrusion Detection and Prevention Systems for Ad-Hoc NetworksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Geotechnical Assessment of Selected Lateritic Soils in Southwest Nigeria for Road Construction and Development of Artificial Neural Network Mathematical Based Model for Prediction of the California Bearing RatioDocument10 pagesGeotechnical Assessment of Selected Lateritic Soils in Southwest Nigeria for Road Construction and Development of Artificial Neural Network Mathematical Based Model for Prediction of the California Bearing RatioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effects of Liquid Density and Impeller Size with Volute Clearance on the Performance of Radial Blade Centrifugal Pumps: An Experimental ApproachDocument16 pagesThe Effects of Liquid Density and Impeller Size with Volute Clearance on the Performance of Radial Blade Centrifugal Pumps: An Experimental ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Novel Approach to Template Filling with Automatic Speech Recognition for Healthcare ProfessionalsDocument6 pagesA Novel Approach to Template Filling with Automatic Speech Recognition for Healthcare ProfessionalsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Innovative Mathematical Insights through Artificial Intelligence (AI): Analysing Ramanujan Series and the Relationship between e and π\piDocument8 pagesInnovative Mathematical Insights through Artificial Intelligence (AI): Analysing Ramanujan Series and the Relationship between e and π\piInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Integration of Information Communication Technology, Strategic Leadership and Academic Performance in Universities in North Kivu, Democratic Republic of CongoDocument7 pagesIntegration of Information Communication Technology, Strategic Leadership and Academic Performance in Universities in North Kivu, Democratic Republic of CongoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Importance of Early Intervention of Traumatic Cataract in ChildrenDocument5 pagesImportance of Early Intervention of Traumatic Cataract in ChildrenInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparison of JavaScript Frontend Frameworks - Angular, React, and VueDocument8 pagesComparison of JavaScript Frontend Frameworks - Angular, React, and VueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diode Laser Therapy for Drug Induced Gingival Enlaregement: A CaseReportDocument4 pagesDiode Laser Therapy for Drug Induced Gingival Enlaregement: A CaseReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Organizational Factors That Influence Information Security in Smes: A Case Study of Mogadishu, SomaliaDocument10 pagesOrganizational Factors That Influence Information Security in Smes: A Case Study of Mogadishu, SomaliaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Breaking Down Barriers To Inclusion: Stories of Grade Four Teachers in Maintream ClassroomsDocument14 pagesBreaking Down Barriers To Inclusion: Stories of Grade Four Teachers in Maintream ClassroomsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Occupational Safety: PPE Use and Hazard Experiences Among Welders in Valencia City, BukidnonDocument11 pagesOccupational Safety: PPE Use and Hazard Experiences Among Welders in Valencia City, BukidnonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of Factors Obstacling Construction Work in The Tojo Una-Una Islands RegionDocument9 pagesAnalysis of Factors Obstacling Construction Work in The Tojo Una-Una Islands RegionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of Artificial Intelligence On Employment Trends in The United States (US)Document5 pagesThe Influence of Artificial Intelligence On Employment Trends in The United States (US)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Disseminating The Real-World Importance of Conjunct Studies of Acculturation, Transculturation, and Deculturation Processes: Why This Can Be A Useful Technique To Analyze Real-World ObservationsDocument15 pagesDisseminating The Real-World Importance of Conjunct Studies of Acculturation, Transculturation, and Deculturation Processes: Why This Can Be A Useful Technique To Analyze Real-World ObservationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Corey and Oats inDocument3 pagesCorey and Oats inrealnatahanfNo ratings yet

- Quiz - Which Christlike Attribute Should You Work OnDocument4 pagesQuiz - Which Christlike Attribute Should You Work Ondiego.almeidNo ratings yet

- Chapter 7 The SouthlandDocument6 pagesChapter 7 The SouthlandJose RodriguezNo ratings yet

- Assignment #2 (The Philippines Past) RPHDocument6 pagesAssignment #2 (The Philippines Past) RPHCARL ADRIAN GUNDAYAONo ratings yet

- Basalom, Soror Jan19Document3 pagesBasalom, Soror Jan19Danica De GuzmanNo ratings yet

- Airtel Lalit CVDocument5 pagesAirtel Lalit CVRobbin BajpaiNo ratings yet

- Basics of Aircraft Market Analysis v1Document30 pagesBasics of Aircraft Market Analysis v1avianovaNo ratings yet

- Department of Defense - Joint Vision 2020 PDFDocument40 pagesDepartment of Defense - Joint Vision 2020 PDFPense Vie Sauvage100% (1)

- SectVI Specification V1of4 P1Document40 pagesSectVI Specification V1of4 P1Thristan Flora SelmaNo ratings yet

- KUTO VPN For Android - Download The APK From UptodownDocument1 pageKUTO VPN For Android - Download The APK From Uptodownjeccampos9No ratings yet

- Environmental Study Report - Fort York Pedestrian & Cycle BridgeDocument143 pagesEnvironmental Study Report - Fort York Pedestrian & Cycle BridgeReivax50No ratings yet

- Module - 3: Institutions Supporting EntrepreneursDocument47 pagesModule - 3: Institutions Supporting EntrepreneursChandan PNo ratings yet

- San Beda Redbook Previous Bar Questions and Answers PDFDocument786 pagesSan Beda Redbook Previous Bar Questions and Answers PDFMikee RañolaNo ratings yet

- Govt of Hongkong Special Admin Region vs. Olalia - Case DigestDocument1 pageGovt of Hongkong Special Admin Region vs. Olalia - Case DigestOnilyn MolinoNo ratings yet

- BCMSN Module 6 Lesson 3 WLAN Standards - EditedDocument50 pagesBCMSN Module 6 Lesson 3 WLAN Standards - EditedThiyagarajanNo ratings yet

- The Epiclesis For Reformed Eucharistic PrayerDocument26 pagesThe Epiclesis For Reformed Eucharistic PrayerBogdan Stefan AvramNo ratings yet

- 7 Dividend Valuation ModelDocument11 pages7 Dividend Valuation ModelDayaan ANo ratings yet

- Reardon v. DePuy Orthopaedics - ComplaintDocument22 pagesReardon v. DePuy Orthopaedics - ComplaintGeorge ConkNo ratings yet

- İngilizce Makaleler Ve Türkçeleri - 1Document10 pagesİngilizce Makaleler Ve Türkçeleri - 1Afife Sena100% (1)

- Gcu Student Teaching Evaluation of Performance Step Standard 1 Part II Part 1 - Signed-2Document5 pagesGcu Student Teaching Evaluation of Performance Step Standard 1 Part II Part 1 - Signed-2api-631448823No ratings yet

- Bba - Guidelines For Project Work - MewarDocument5 pagesBba - Guidelines For Project Work - MewarRahul MinochaNo ratings yet

- Conditionals: Sentence With ConditionsDocument3 pagesConditionals: Sentence With ConditionsSobuz RahmanNo ratings yet

- Symbiosis Law School, Pune: SUBJECT - Media and Entertainment Law Alternative Internal AssessmentDocument15 pagesSymbiosis Law School, Pune: SUBJECT - Media and Entertainment Law Alternative Internal AssessmentAditya KedariNo ratings yet

- Chong Wu Ling-Democratisation and Ethnic MinoritiesDocument350 pagesChong Wu Ling-Democratisation and Ethnic MinoritiesHariyadi SajaNo ratings yet

- 13 Stat x-150Document179 pages13 Stat x-150ncwazzyNo ratings yet