Professional Documents

Culture Documents

Company Law Sample Paper

Company Law Sample Paper

Uploaded by

Abhinay KumarCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Procedure To Procure A Digital Certificate:: Subscription Form PDFDocument3 pagesProcedure To Procure A Digital Certificate:: Subscription Form PDFAbhinay KumarNo ratings yet

- Digit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesDocument2 pagesDigit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesAbhinay KumarNo ratings yet

- Divisions of Icsa Name of Institute Email Id & Website Contact NumberDocument1 pageDivisions of Icsa Name of Institute Email Id & Website Contact NumberAbhinay KumarNo ratings yet

- Corporate Law Study Guide: The Chartered Governance Institute of Canada International Qualifying ProgramDocument14 pagesCorporate Law Study Guide: The Chartered Governance Institute of Canada International Qualifying ProgramAbhinay KumarNo ratings yet

- Corporate Governance Syllabus CDN 2020Document10 pagesCorporate Governance Syllabus CDN 2020Abhinay KumarNo ratings yet

- Company Law Sample Mark SchemeDocument17 pagesCompany Law Sample Mark SchemeAbhinay KumarNo ratings yet

- Business Corporations Act: Revised Statutes of Alberta 2000 Chapter B-9Document240 pagesBusiness Corporations Act: Revised Statutes of Alberta 2000 Chapter B-9Abhinay KumarNo ratings yet

- Debt Funding in IndiaDocument54 pagesDebt Funding in IndiaAbhinay KumarNo ratings yet

- Accounting and Inventory Management Simplified For Your Ecommerce BusinessDocument33 pagesAccounting and Inventory Management Simplified For Your Ecommerce BusinessAbhinay KumarNo ratings yet

- Total Unit To Be Accounted For 90Document6 pagesTotal Unit To Be Accounted For 90Harsh KSNo ratings yet

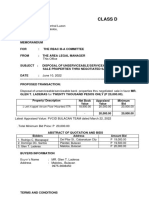

- Class D: Property/ Description Net Book Value Appraised Value Minimum BidDocument4 pagesClass D: Property/ Description Net Book Value Appraised Value Minimum BidRay Anne Denise GoNo ratings yet

- International Trade - Assignment 3Document11 pagesInternational Trade - Assignment 3phuc buiNo ratings yet

- Construction Claims: Published By: Badr Abd El KhalekDocument17 pagesConstruction Claims: Published By: Badr Abd El KhalekAbderrahmane AbderrahmaniNo ratings yet

- Globalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política deDocument15 pagesGlobalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política demichxel psNo ratings yet

- UNOPS - Esourcing - Vendor Guide - v1.7 - EN GDocument46 pagesUNOPS - Esourcing - Vendor Guide - v1.7 - EN GDawitNo ratings yet

- Software Services VDocument1 pageSoftware Services Vwalid elalaouiNo ratings yet

- Business Studies DefinationDocument11 pagesBusiness Studies DefinationAnurag SharmaNo ratings yet

- Emerging Concepts in Cost and ManagementDocument2 pagesEmerging Concepts in Cost and ManagementRavi SinghNo ratings yet

- 7 Roles of Entrepreneurship in Economic Development of A CountryDocument2 pages7 Roles of Entrepreneurship in Economic Development of A CountryDianNo ratings yet

- PDF 24Document208 pagesPDF 24LalithaNo ratings yet

- Tenderdocumentphase 1Document66 pagesTenderdocumentphase 1ashwin tripathiNo ratings yet

- 1b Evolution MGT TheoryDocument22 pages1b Evolution MGT TheoryDheeraj100% (1)

- Building Customer Satisfaction PDFDocument14 pagesBuilding Customer Satisfaction PDFSaurav MedhiNo ratings yet

- Dagmar ModelDocument7 pagesDagmar ModelDheerendra Singh88% (8)

- 2Cr Smart ProtectDocument4 pages2Cr Smart Protectvamsi krishna bayyarapuNo ratings yet

- Managerial Economics ECON 1Document26 pagesManagerial Economics ECON 1Micaela EncinasNo ratings yet

- Project Report On ICICI Bank by GAURAV NARANGDocument100 pagesProject Report On ICICI Bank by GAURAV NARANGmania1b2c376% (50)

- MODULE 3 - BankingDocument5 pagesMODULE 3 - BankingKeiko KēkoNo ratings yet

- Marketing StrategyDocument7 pagesMarketing StrategyBibiNo ratings yet

- Defining Free Cash Flow Top-Down ApproachDocument2 pagesDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- Unit 5: Performance Management: Assignment Task - 02Document6 pagesUnit 5: Performance Management: Assignment Task - 02Salwa SarfarazNo ratings yet

- Sop Post Market SurveillanceDocument3 pagesSop Post Market SurveillanceVenkatesh Venkatesh100% (1)

- The Marketing Environment of A Company Is Composed of The PeopleDocument4 pagesThe Marketing Environment of A Company Is Composed of The PeopleLegends FunanzaNo ratings yet

- Financial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument37 pagesFinancial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- CSR.M3 Module 3 Communication and TransparencyDocument25 pagesCSR.M3 Module 3 Communication and Transparencyidris ekrem gülerNo ratings yet

- NL Jan17Document28 pagesNL Jan17varaprasad_ganjiNo ratings yet

- DOP Trial GuidelineDocument8 pagesDOP Trial Guidelinetoewin zawNo ratings yet

- APLL Franchise ProposalDocument13 pagesAPLL Franchise ProposalncitindiaNo ratings yet

- Process - Cost Spoilage PDFDocument5 pagesProcess - Cost Spoilage PDFJayne Carly CabardoNo ratings yet

Company Law Sample Paper

Company Law Sample Paper

Uploaded by

Abhinay KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Law Sample Paper

Company Law Sample Paper

Uploaded by

Abhinay KumarCopyright:

Available Formats

Please complete this box:

Candidate number: as indicated on your admission slip

Desk number:

Number of continuation sheets attached:

If you are using a calculator, please enter the make and model number:

Make (company name): Model number:

ICSA Qualifying Programme

Company Law

Sample assessment material 2019

Time allowed: 3 hours (plus 15 minutes reading time)

Do not open this examination paper until the presiding officer or an invigilator tells you to.

You must not take this paper out of the examination room.

The examination paper contains 12 questions of which you must attempt 11. You must attempt all 8

questions in Section A and 3 questions in Section B.

Section A contains 25 marks and Section B contains 75 marks. There are 100 marks available in total

for the paper.

You may continue your answers on the continuation sheets at the back of the booklet if necessary.

Separate answer sheets are available from the invigilator.

Note: Unless otherwise specified, you should assume that an Act or an organisation referred to in the

questions is a UK Act or organisation.

Where questions refer to the Articles of Association, you should assume the relevant Model Articles

apply, as prescribed under the Companies Act 2006.

© ICSA 2019 Page 1 of 9

© ICSA 2019 Page 2 of 9

Section A

Answer all the questions in this section.

1. Which of the following actions does not generally require the approval of a company’s members?

(Tick one box only)

A. A change to the articles of association

B. Creation of a floating charge

C. A three-year service contract

D. A loan to a director of £100,000

(1 mark)

2. Can the directors of a private limited company refuse to register a transfer of shares? Explain your

answer.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

(2 marks)

3. Define when a person has information as an insider under s.57 of the Criminal Justice Act 1993.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

(2 marks)

4. All public companies are required to prepare a directors’ remuneration report.

Is this true or false?

(Tick one box only)

True

False

(1 mark)

© ICSA 2019 Page 3 of 9

5. List the three steps a private company would need to take in order to re-register as a public

company.

i _______________________________________________________________________

_______________________________________________________________________

ii _______________________________________________________________________

_______________________________________________________________________

iii _______________________________________________________________________

_______________________________________________________________________

(3 marks)

6. Outline who may inspect the register of members, and explain the procedure which must be

followed when an inspection request is made.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

(5 marks)

© ICSA 2019 Page 4 of 9

7. Explain when the Court can exercise its discretion to make an order for winding up under the “just

and equitable” jurisdiction in s.122(1)(g) of the Insolvency Act 1986.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

(5 marks)

8. Explain what a disqualification order made under s.1(1) of the Company Directors Disqualification

Act 1986 is, and its potential effects.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

(6 marks)

_________________________________________________________________________________

TOTAL FOR SECTION A = 25 MARKS

© ICSA 2019 Page 5 of 9

Section B

Answer three questions only.

[This has been produced for sample purposes, adequate spacing for answers will be included in

the examinations.]

9. Swan Limited (Swan) was incorporated in 2013. The company manufactures and sells

environmentally friendly cleaning products. Since its incorporation, Swan has struggled financially

and has never made a profit.

Swan has issued 1,000 ordinary shares with a nominal value of £1 each. Alina and Mary, the

company’s two directors, each hold 200 shares. Shaun, a businessman, owns 100 shares. The

remaining 500 shares are held by Alina and Mary’s friends and family members.

Shaun believes that Alina and Mary have done a poor job of managing the company. He also

believes that with a new board, the company could become profitable. He therefore starts buying

shares from the other shareholders with a view to amassing enough shares to vote Alina and Mary

out of office. When Alina and Mary discover his plan, they issue 400 new ordinary shares and sell

them to Timothy. The effects of the issue are to dilute the holdings of the existing shareholders and

also to raise much needed capital.

In order to convince shareholders the directors can manage the company successfully, Alina

suggests that a dividend is paid at a rate of 5p per share. Mary has some doubts about this idea,

but she goes along with it. Timothy agrees it is a good idea, and the dividend is declared and paid.

Evaluate the appropriateness of Alina and Mary’s actions, including any further implications they

may have.

[Total for Question 9 = 25 marks]

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

© ICSA 2019 Page 6 of 9

10. (a) Discuss the significance of corporate personality and the circumstances in which the Court

has historically ‘pierced the veil of corporate personality’. Refer to case law in your answer.

(10 marks)

(b) The Supreme Court considered the question of ‘piercing the veil’ in Prest v Petrodel [2013]

UKSC 34. Evaluate the Supreme Court’s decision and its implications.

(15 marks)

[Total for Question 10 = 25 marks]

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

© ICSA 2019 Page 7 of 9

11. James and Michael are the only directors of Food for Thought Ltd (FFT), a catering company

incorporated in 2010. James and Michael hold 60% and 30% of the company’s shares

respectively. Their friend Mercy is the only other member with 10% of the company’s shares.

James is the company’s Finance Director.

In 2018, and without informing Michael and Mercy, James transferred £20,000 from FFT’s bank

account to Avocado Ltd (Avocado), which specialises in providing catering for weddings and

parties. James also knowingly passed on some of FFT’s confidential information including its client

list to Avocado.

Mercy has since discovered that the shares in Avocado are wholly owned by James’s daughter,

Rose, who is also its only director. Mercy now wishes to bring a derivative claim to recover FFT’s

loss.

James tells Mercy that he plans to ratify his actions at FFT’s next general meeting.

Discuss:

(a) Whether Mercy has grounds to bring a successful derivative claim and how likely such a

claim would be to succeed.

(17 marks)

(b) Whether ratification of James' actions is possible and what effect it might have.

(8 marks)

[Total for Question 11 = 25 marks]

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

© ICSA 2019 Page 8 of 9

12. Desi and Ethan run a software development business together. In 2015 they incorporated DE

Software Limited (DE). Desi and Ethan were the only shareholders with 500 £1 ordinary shares

each. They were also the company’s only directors.

DE has been experiencing financial difficulties for the past two years. In January 2018, the

company’s auditor informed Desi and Ethan that it was inevitable the company would go into

insolvent liquidation. Desi and Ethan decided to continue trading in the hope that their situation

would improve. Unfortunately, the company continued to lose money and in April 2019, DE was

wound up.

Fenella has been appointed as the company’s liquidator. Fenella has learned that:

(i) in September 2018, the company repaid an unsecured loan of £10,000 to Ethan, which he

had made to the company earlier in the year;

(ii) the company has an unpaid tax bill of £25,000; and

(iii) the company’s staff have not been paid for several months, resulting in around £50,000 in

unpaid wages.

Fenella has also learned that the company’s remaining assets total £70,000. Her expenses for

acting as liquidator will be £5,000.

Discuss the course of action that Fenella needs to undertake. In your answer, include an

explanation of how assets might be distributed. Use the figures provided above.

[Total for Question 12 = 25 marks]

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

__________________________________________________________________________

TOTAL FOR SECTION B = 75 MARKS

TOTAL FOR PAPER = 100 MARKS

END

The scenarios included here are entirely fictional. Any resemblance of the information in the scenarios

to real persons or organisations, actual or perceived, is purely coincidental.

© ICSA 2019 Page 9 of 9

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Procedure To Procure A Digital Certificate:: Subscription Form PDFDocument3 pagesProcedure To Procure A Digital Certificate:: Subscription Form PDFAbhinay KumarNo ratings yet

- Digit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesDocument2 pagesDigit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesAbhinay KumarNo ratings yet

- Divisions of Icsa Name of Institute Email Id & Website Contact NumberDocument1 pageDivisions of Icsa Name of Institute Email Id & Website Contact NumberAbhinay KumarNo ratings yet

- Corporate Law Study Guide: The Chartered Governance Institute of Canada International Qualifying ProgramDocument14 pagesCorporate Law Study Guide: The Chartered Governance Institute of Canada International Qualifying ProgramAbhinay KumarNo ratings yet

- Corporate Governance Syllabus CDN 2020Document10 pagesCorporate Governance Syllabus CDN 2020Abhinay KumarNo ratings yet

- Company Law Sample Mark SchemeDocument17 pagesCompany Law Sample Mark SchemeAbhinay KumarNo ratings yet

- Business Corporations Act: Revised Statutes of Alberta 2000 Chapter B-9Document240 pagesBusiness Corporations Act: Revised Statutes of Alberta 2000 Chapter B-9Abhinay KumarNo ratings yet

- Debt Funding in IndiaDocument54 pagesDebt Funding in IndiaAbhinay KumarNo ratings yet

- Accounting and Inventory Management Simplified For Your Ecommerce BusinessDocument33 pagesAccounting and Inventory Management Simplified For Your Ecommerce BusinessAbhinay KumarNo ratings yet

- Total Unit To Be Accounted For 90Document6 pagesTotal Unit To Be Accounted For 90Harsh KSNo ratings yet

- Class D: Property/ Description Net Book Value Appraised Value Minimum BidDocument4 pagesClass D: Property/ Description Net Book Value Appraised Value Minimum BidRay Anne Denise GoNo ratings yet

- International Trade - Assignment 3Document11 pagesInternational Trade - Assignment 3phuc buiNo ratings yet

- Construction Claims: Published By: Badr Abd El KhalekDocument17 pagesConstruction Claims: Published By: Badr Abd El KhalekAbderrahmane AbderrahmaniNo ratings yet

- Globalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política deDocument15 pagesGlobalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política demichxel psNo ratings yet

- UNOPS - Esourcing - Vendor Guide - v1.7 - EN GDocument46 pagesUNOPS - Esourcing - Vendor Guide - v1.7 - EN GDawitNo ratings yet

- Software Services VDocument1 pageSoftware Services Vwalid elalaouiNo ratings yet

- Business Studies DefinationDocument11 pagesBusiness Studies DefinationAnurag SharmaNo ratings yet

- Emerging Concepts in Cost and ManagementDocument2 pagesEmerging Concepts in Cost and ManagementRavi SinghNo ratings yet

- 7 Roles of Entrepreneurship in Economic Development of A CountryDocument2 pages7 Roles of Entrepreneurship in Economic Development of A CountryDianNo ratings yet

- PDF 24Document208 pagesPDF 24LalithaNo ratings yet

- Tenderdocumentphase 1Document66 pagesTenderdocumentphase 1ashwin tripathiNo ratings yet

- 1b Evolution MGT TheoryDocument22 pages1b Evolution MGT TheoryDheeraj100% (1)

- Building Customer Satisfaction PDFDocument14 pagesBuilding Customer Satisfaction PDFSaurav MedhiNo ratings yet

- Dagmar ModelDocument7 pagesDagmar ModelDheerendra Singh88% (8)

- 2Cr Smart ProtectDocument4 pages2Cr Smart Protectvamsi krishna bayyarapuNo ratings yet

- Managerial Economics ECON 1Document26 pagesManagerial Economics ECON 1Micaela EncinasNo ratings yet

- Project Report On ICICI Bank by GAURAV NARANGDocument100 pagesProject Report On ICICI Bank by GAURAV NARANGmania1b2c376% (50)

- MODULE 3 - BankingDocument5 pagesMODULE 3 - BankingKeiko KēkoNo ratings yet

- Marketing StrategyDocument7 pagesMarketing StrategyBibiNo ratings yet

- Defining Free Cash Flow Top-Down ApproachDocument2 pagesDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- Unit 5: Performance Management: Assignment Task - 02Document6 pagesUnit 5: Performance Management: Assignment Task - 02Salwa SarfarazNo ratings yet

- Sop Post Market SurveillanceDocument3 pagesSop Post Market SurveillanceVenkatesh Venkatesh100% (1)

- The Marketing Environment of A Company Is Composed of The PeopleDocument4 pagesThe Marketing Environment of A Company Is Composed of The PeopleLegends FunanzaNo ratings yet

- Financial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument37 pagesFinancial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- CSR.M3 Module 3 Communication and TransparencyDocument25 pagesCSR.M3 Module 3 Communication and Transparencyidris ekrem gülerNo ratings yet

- NL Jan17Document28 pagesNL Jan17varaprasad_ganjiNo ratings yet

- DOP Trial GuidelineDocument8 pagesDOP Trial Guidelinetoewin zawNo ratings yet

- APLL Franchise ProposalDocument13 pagesAPLL Franchise ProposalncitindiaNo ratings yet

- Process - Cost Spoilage PDFDocument5 pagesProcess - Cost Spoilage PDFJayne Carly CabardoNo ratings yet