Professional Documents

Culture Documents

Sutherland Global Services Philippines, Inc. - Philippine Branch

Sutherland Global Services Philippines, Inc. - Philippine Branch

Uploaded by

Jonathan Diane SasisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sutherland Global Services Philippines, Inc. - Philippine Branch

Sutherland Global Services Philippines, Inc. - Philippine Branch

Uploaded by

Jonathan Diane SasisCopyright:

Available Formats

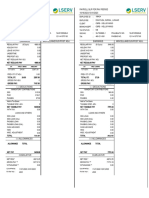

Sutherland Global Services Philippines, Inc.

– Philippine Branch

Payroll Period: July 05, 2018 to July 20, 2018

Employee ID: PH016054

Employee Name: GAMBOA, MARIE KRISTINE, CASAL

Designation: MANAGER-ACCOUNT

Department: TMO -DETROIT

Location: PHILPLANS CORPO

Tax Status: ME

Description Taxable Non-Taxable Inputs

Basic Salary 33,804.44 0.00

Description Days/Hours

Basic Pay 11 33,804.44 0.00 HR

Overtime Pay 0.00 0.00

Description Days/Hours

Allowance 615.00 5,000.00

Description

WELLNESS ALLOWANCE 615.00 0.00 HR

MEAL ALLOWANCE 0.00 1,250.00 HR

RICE ALLOWANCE 0.00 2,500.00 HR

TRANSPORTATION

LAUNDRY ALLOWANCE 0.00 1,250.00 HR

COMMUNICATION

Adjustments 0.00 0.00

Description Days/Hours

Deduction Before Tax 0.00 0.00

Description Days Hours

Gross Earnings 34,419.44 5,000.00

Statutory Deductions -1,231.30 0.00

Description

SSS -581.30 0.00 Finance

PhilHealth -550.00 0.00 Finance

PagIBIG -100.00 0.00 Finance

Net Earnings Before Tax 33,188.14 5,000.00

Witholding Tax -5,827.11 0.00

Net Earnings After Tax 27,361.03 5,000.00

Other Deductions 0.00 0.00

Net Pay 27,361.03 5,000.00

Total Net Pay 32,361.03

Tax Computation

TAXABLE PERIOD 13TH BASIC TAXABLE ABSENCES/TARDY/UT OVERTIME SSS/PAGIBIG/PHIC TAXABLE WTAX

INCOME MONTH ALLOWANCES

PAY/SLCONV. AND OTHER

INCOME

YTD BASIC JANUARY 0.00 433,311.46 33,041.69 0.00 0.00 -7,387.80 458,965.35 74,036.70

NET OF 15 TO

STATUTORY JULY 15

DEDUCTIONS

CURRENT JULY EOM 0.00 33,804.44 615.00 0.00 0.00 -1,231.30 33,188.14 0.00

BASIC NET OF

STATUTORY

DEDUCTIONS

SICK LEAVE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

CONVERSION

FORECAST Remaining 0.00 338,044.40 3,075.00 0.00 0.00 -6,156.50 334,962.90 0.00

Payroll

Periods

PREVIOUS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

EMPLOYER

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL 0.00 805,160.30 36,731.69 0.00 0.00 -14,775.60 827,116.39 74,036.70

TAXABLE

INCOME (YTD

ACTUAL +

CURRENT

ACTUAL +

FORECAST)

PRODUCTIVITY INCENTIVES AND BENEFITS CURRENT YTD TOTAL

MEAL 0.00 1,489.00 1,489.00

PROGRAM INCENTIVE 0.00 0.00 0.00

VPP/PIP 0.00 15,702.71 15,702.71

TOTAL PRODUCTIVITY INCENTIVES BENEFITS 0.00 17,191.71 17,191.71

LESS 10K CAP FOR DE MINIMIS FOR PRODUCTIVITY INCENTIVES 10,000.00

TAXABLE INCOME - NET OF 10K 7,191.71

13TH MONTH PAY 67,608.88

TOTAL 74,800.59

LESS 90K CAP FOR NON TAXABLE INCOME 90,000.00

TAXABLE INCOME - NET OF 90K 0.00

ANNUALIZATION CALCULATION

GROSS TAXABLE COMPENSATION 827,116.39

LESS PERSONAL EXEMPTION 0.00

NET TAXABLE INCOME 827,116.39

VARIABLE TAX

827,116.39 - 800,000.00 x 30% 8,134.92

FIXED TAX 130,000.00

ANNUAL TAX DUE 138,134.92

Less: YTD ACTUAL TAX WITHHELD 74,036.70

REMAINING ANNUAL TAX DUE 64,098.22

TAX ON INCENTIVES/OTHERS 0.00

REMAINING ANNUAL TAX DUE SPREAD OVER REMAINING PAYROLL PERIODS (64,098.22 - 0.00)/11 5,827.11

TOTAL TAX FOR CURRENT PAYROLL PERIOD 5,827.11

This is a computer generated Payslip and does not require signature

You might also like

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Payslip May2017 SF396Document1 pagePayslip May2017 SF396abhilash H100% (1)

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Folk Violin SongbookDocument19 pagesFolk Violin SongbookTyler Swinn100% (1)

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument2 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNo ratings yet

- Sre Malinao Q1 2023Document6 pagesSre Malinao Q1 2023Paolo IcangNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- UntitledDocument4 pagesUntitledAnn LiNo ratings yet

- Miscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post AdjDocument1 pageMiscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post Adjnicole.dimayuga3No ratings yet

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- OCTOBER 2021: PT. Shopee Internasional IndonesiaDocument1 pageOCTOBER 2021: PT. Shopee Internasional IndonesiaRifka FitrotuzzakiaNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedArul Mhmmd10No ratings yet

- 5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Document1 page5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Shreyash Sahay0% (1)

- Lalit Payslip LGDocument1 pageLalit Payslip LGLalit JainNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Specialist IDocument1 pageSpecialist Imyko joseph belloNo ratings yet

- Oct2022Document2 pagesOct2022Rishi KumarNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Payslip For The Month May-19: MilltecDocument1 pagePayslip For The Month May-19: MilltecRajen MudiNo ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- HRISPayslipDocument1 pageHRISPayslipJohn Carlo D. EngayNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocument5 pagesConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31No ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- PayslipDocument1 pagePayslipSahil shahNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Pay SlipDocument1 pagePay SlipericmebidNo ratings yet

- PayslipDocument1 pagePayslipTom KnobNo ratings yet

- Nov2023Document2 pagesNov2023ManiNo ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipHenry CagaNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- Iocl FebruaryDocument1 pageIocl FebruaryDipankar BarmanNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Document1 pageHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNo ratings yet

- FAR 4 - FebruaryDocument10 pagesFAR 4 - FebruaryCharles D. FloresNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Full Development of Annex A Exercise-J CardenasDocument17 pagesFull Development of Annex A Exercise-J CardenasBruno SamosNo ratings yet

- Zipatile ManualDocument16 pagesZipatile ManualdacrysNo ratings yet

- MonotropismQuestionnaire 230510Document5 pagesMonotropismQuestionnaire 230510Javiera AlarconNo ratings yet

- Readme CCRDocument51 pagesReadme CCRSesha SuryaNo ratings yet

- Cd00020086 Sensorless BLDC Motor Control and Bemf Sampling Methods With St7mc StmicroelectronicsDocument35 pagesCd00020086 Sensorless BLDC Motor Control and Bemf Sampling Methods With St7mc StmicroelectronicsmortezaNo ratings yet

- Lecture 5 PDFDocument8 pagesLecture 5 PDFMuhammad Hamza EjazNo ratings yet

- Depth of FocusDocument7 pagesDepth of FocusDr-Riya MondalNo ratings yet

- Ex Parte Petition 734100 7Document19 pagesEx Parte Petition 734100 7WXMINo ratings yet

- Practical Manual-Mass Commn PDFDocument36 pagesPractical Manual-Mass Commn PDFSSP GamerNo ratings yet

- Türkiye'deki Bazı Semi-Finish Grinding SistemleriDocument4 pagesTürkiye'deki Bazı Semi-Finish Grinding SistemleriTHAKARAR HARSHILNo ratings yet

- Brochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Document4 pagesBrochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Kaushal ParmarNo ratings yet

- Sikkim ENVIS-REPORT ON WED 2021Document25 pagesSikkim ENVIS-REPORT ON WED 2021CHANDER KUMAR MNo ratings yet

- Marble and Granite Tiles: Installation TipsDocument1 pageMarble and Granite Tiles: Installation Tipsandresboy123No ratings yet

- Waste Heat Boiler Deskbook PDFDocument423 pagesWaste Heat Boiler Deskbook PDFwei zhou100% (1)

- Piyumal PereraDocument1 pagePiyumal Pererays7mjwyqhsNo ratings yet

- CCC Question Paper 2017 With Answer PDF Online Test For Computer - Current Affairs Recruitment News TodayDocument6 pagesCCC Question Paper 2017 With Answer PDF Online Test For Computer - Current Affairs Recruitment News Todayjit19942007No ratings yet

- Organised By: Dr. Poonam S. TiwariDocument2 pagesOrganised By: Dr. Poonam S. Tiwarisayed kundumon100% (1)

- Jouney To Becoming A Surface Pattern DesignerDocument16 pagesJouney To Becoming A Surface Pattern Designerwhere is my mindNo ratings yet

- Production ManagementDocument26 pagesProduction Managementkevin punzalan100% (5)

- Velosi Insert 1Document4 pagesVelosi Insert 1api-3703379No ratings yet

- IMIL KYC + Sales TNCDocument5 pagesIMIL KYC + Sales TNCbanavaram1No ratings yet

- DissertationDocument54 pagesDissertationRakesh Insan100% (1)

- Vilathanakone LAVONGVILAY: Work Experience Contact InfoDocument1 pageVilathanakone LAVONGVILAY: Work Experience Contact InfoVilathanakone lavongvilayNo ratings yet

- A Comparative Study On Rigid and Flexible Pavement: A ReviewDocument6 pagesA Comparative Study On Rigid and Flexible Pavement: A Reviewpubg mobileNo ratings yet

- T5 B68 Craig Unger FDR - 5-21-04 Stull Email - Unger Saudi Flight Docs 616Document6 pagesT5 B68 Craig Unger FDR - 5-21-04 Stull Email - Unger Saudi Flight Docs 6169/11 Document ArchiveNo ratings yet

- Pink Floyd - LyricsDocument97 pagesPink Floyd - LyricsИван ВащенкоNo ratings yet

- Father Dowling Mysteries - Wikipedia2Document11 pagesFather Dowling Mysteries - Wikipedia2Vocal Samir0% (1)

- Parkin Econ SM CH30 GeDocument22 pagesParkin Econ SM CH30 GeMuri SetiawanNo ratings yet

- Car Radio Frame AndroidDocument23 pagesCar Radio Frame AndroidSopheak NGORNo ratings yet